20 February 2019 Morning Session Analysis

Dollar falls ahead of Meeting Minutes, sterling gains.

Greenback measuring against a basket of six major currency pairs plunged by 0.39% to 96.30 ahead of FOMC Meeting Minutes. Dollar index was seen falling following optimism from trade talks as US President Donald Trump stated that negotiations with China is going well and that he is willing to extend the 1st March deadline in order to achieve a deal. As the global trade tensions are lifted from the market, riskier market sentiment was boosted as investors flee from safe-have dollar into risky markets such as pound and euro. Investors will now focus on the Meeting Minutes later today following the recent dovish statement from the central bank in January. In other news, pair of GBP/USD was traded flat at 1.3060 after surging to a 2-weeks high, supported by low unemployment rate and hopes that Prime Minister Theresa May will make progress in renegotiations on her Brexit deal with the EU. Besides that, trade talk optimism boosted investors risk appetite as they enter the pound market.

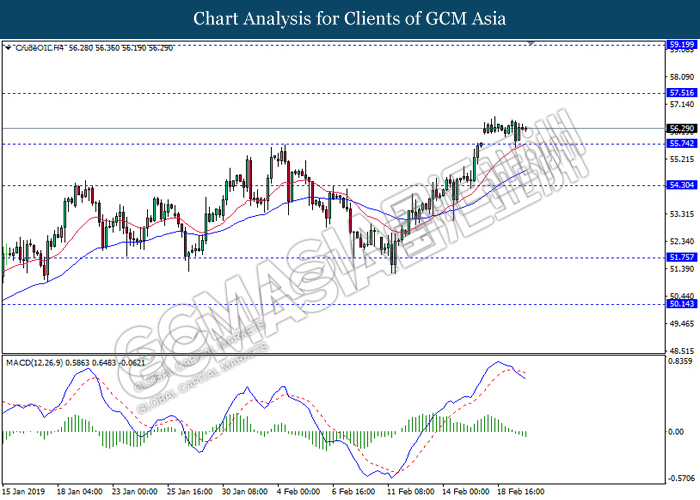

In the commodities market, crude oil price fell by 0.21% to $56.25 per barrel while holding its grounds near high levels, supported by OPEC’s production cut as well as sanctions on Iran and Venezuela exports on oil. However, the commodity was being pressured by growing production from US which the Energy Information Administration (EIA) stated on Tuesday are expected to keep rising. Likewise, gold price ticked higher by 0.01% to $1341.00 per troy ounce while furthering its upward momentum amid weakened dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

03:00 USD FOMC Meeting Minutes

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German PPI (MoM) (Jan) | -0.4% | -0.2% | – |

| 05:30 (21st) | CrudeOIL – API Weekly Crude Oil Stock | -0.998M | – | – |

Technical Analysis

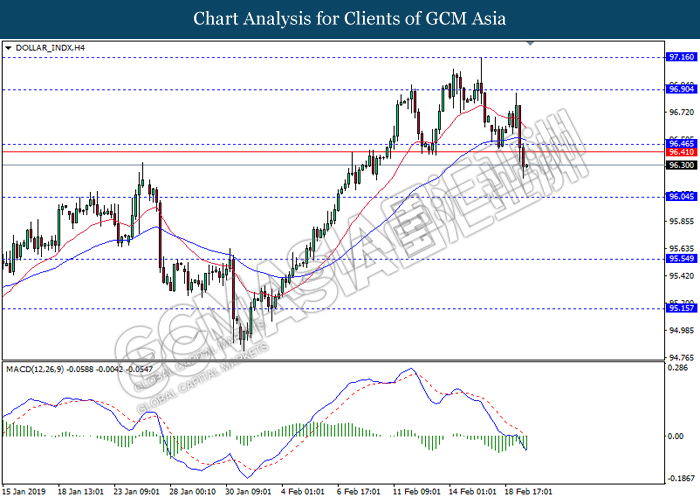

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level 96.45. MACD which indicate persistent bearish momentum suggest the dollar to extend its losses towards the support level 96.05.

Resistance level: 96.45, 96.90

Support level: 96.05, 95.55

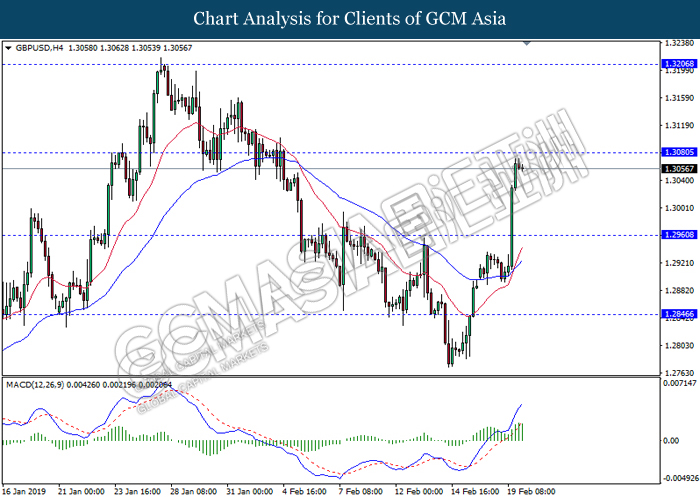

GBPUSD, H4: GBPUSD was traded higher following recent breakout above the previous resistance level 1.2960. However, MACD which illustrate diminishing bullish momentum suggest the pair to experience a short term technical correction towards the support level 1.2960.

Resistance level: 1.3080, 1.3205

Support level: 1.2960, 1.2845

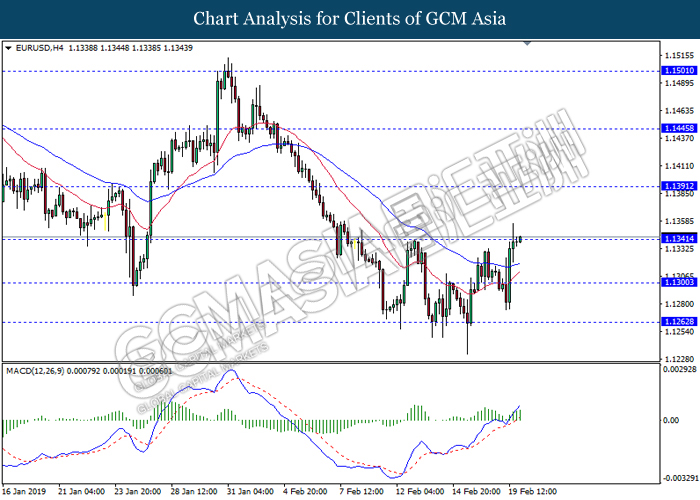

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level 1.1340. MACD which display persistent bullish momentum suggest the pair to extend its gain after it breaks above the resistance level.

Resistance level: 1.1390, 1.1445

Support level: 1.1340, 1.1300

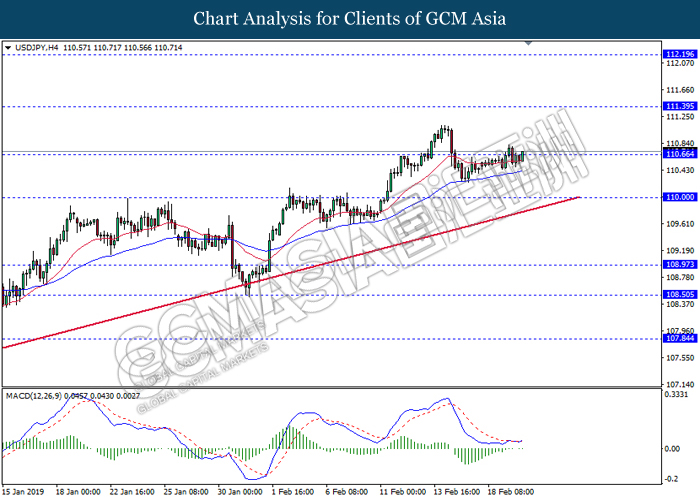

USDJPY, H4: USDJPY was traded higher while currently testing resistance level 110.65. MACD which illustrate bullish bias signal with the starting formation of golden cross suggest the pair to extend its gains after it successfully breaks above the resistance level.

Resistance level: 110.65, 111.40

Support level: 110.00, 108.95

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level 0.7155. MACD which illustrate diminishing bullish momentum suggest the pair to extend its bearish momentum after it breaks below the support level.

Resistance level: 0.7190, 0.7225

Support level: 0.7155, 0.7130

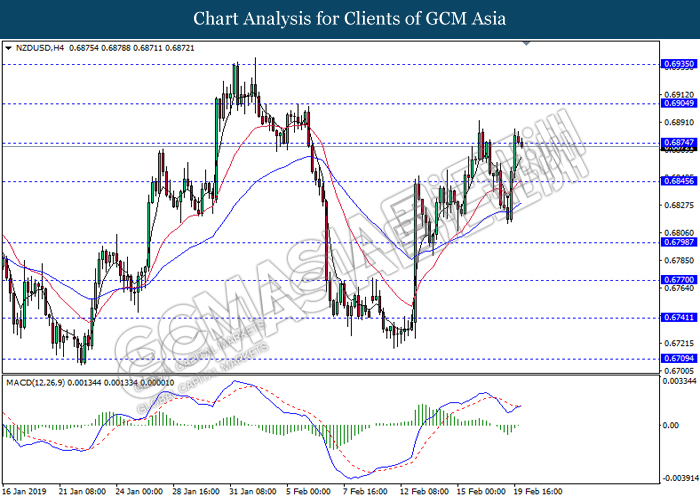

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6875.MACD which illustrate bullish bias suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.6875, 0.6905

Support level: 0.6845, 0.6800

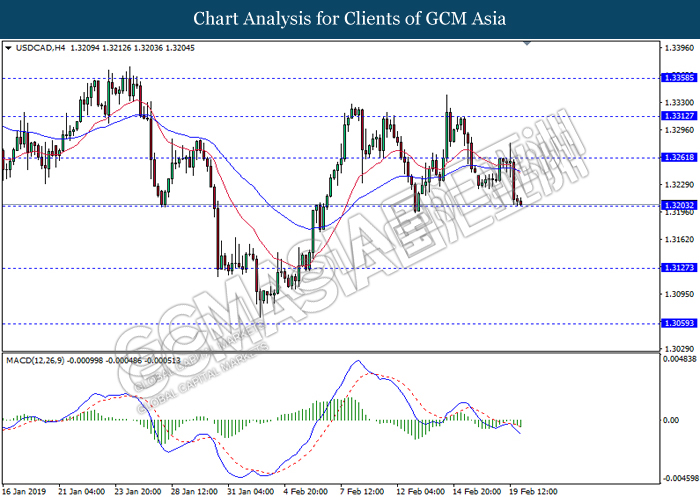

USDCAD, H4: USDCAD was traded lower while currently retest the support level 1.3205. MACD which illustrate persistent bearish momentum suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.3260, 1.3310

Support level: 1.3205, 1.3125

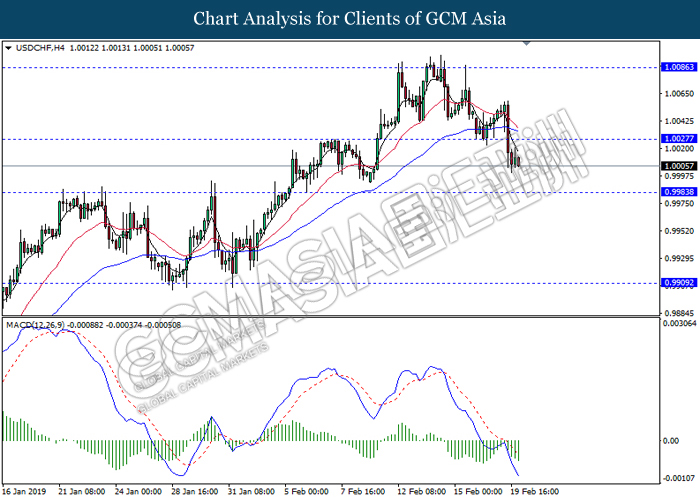

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level 1.0025. MACD which illustrate persistent bearish momentum suggest the pair to extend its losses towards the support level 0.9985.

Resistance level: 1.0025, 1.0085

Support level: 0.9985, 0.9910

CrudeOIL, H4: Crude oil price was traded flat after it breaks above the resistance level 55.75. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower as a short term technical correction towards the support level 55.75.

Resistance level: 57.50, 59.20

Support level: 55.75, 54.30

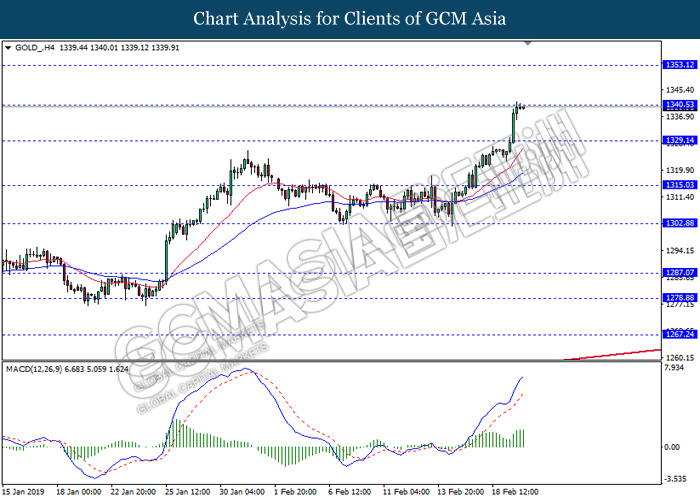

GOLD_, H4: Gold price was traded higher while currently testing the resistance level 1340.50. MACD which illustrate ongoing bullish momentum suggest the commodity to extend its gains after it break above the resistance level.

Resistance level: 1340.50, 1353.10

Support level: 1329.15, 1315.00