20 February 2023 Afternoon Session Analysis

EUR rebounded amid economic condition improvement.

The EUR strengthened against USD as upbeat economic data from Eurozone boosted investor confidence. According to recent reports, Germany’s producer price index (PPI) hit -1.0%, which is above the expectation of -1.6%. At the same time, the French Consumer Price Index (CPI) stood at 0.4%, higher than the previous month’s readings of -0.1%. Both data showed the Eurozone economic conditions improved, boosting investor confidence. Simultaneously, the data also gives European Central Bank (ECB) more room for monetary policy tightening, as the current inflation figure is still far away from the ECB’s 2% target for inflation across the countries. As a result, the EUR experienced a wave of appreciation on Friday. Besides, the slip in the US dollar market also boosted the pair of EUR/USD amid investors waiting for more clear direction from Fed. The sentiment of the US dollar has remained weak in recent weeks, urging investors to shift their funds to riskier assets such as pounds, euros, and US stocks. As of writing, the EUR/USD depreciated by -0.05% to $1.0688.

In the commodities market, crude oil prices rebounded by 0.65% to $77.07 per barrel after a steep loss in the prior trading session amid rising supplies in the United States. Besides, gold prices appreciated by 0.08% to $1851.65 per troy ounce as the dollar index weakened.

Today’s Holiday Market Close

Time Market Event

All Day CAD Family Day

All Day USD Washington’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

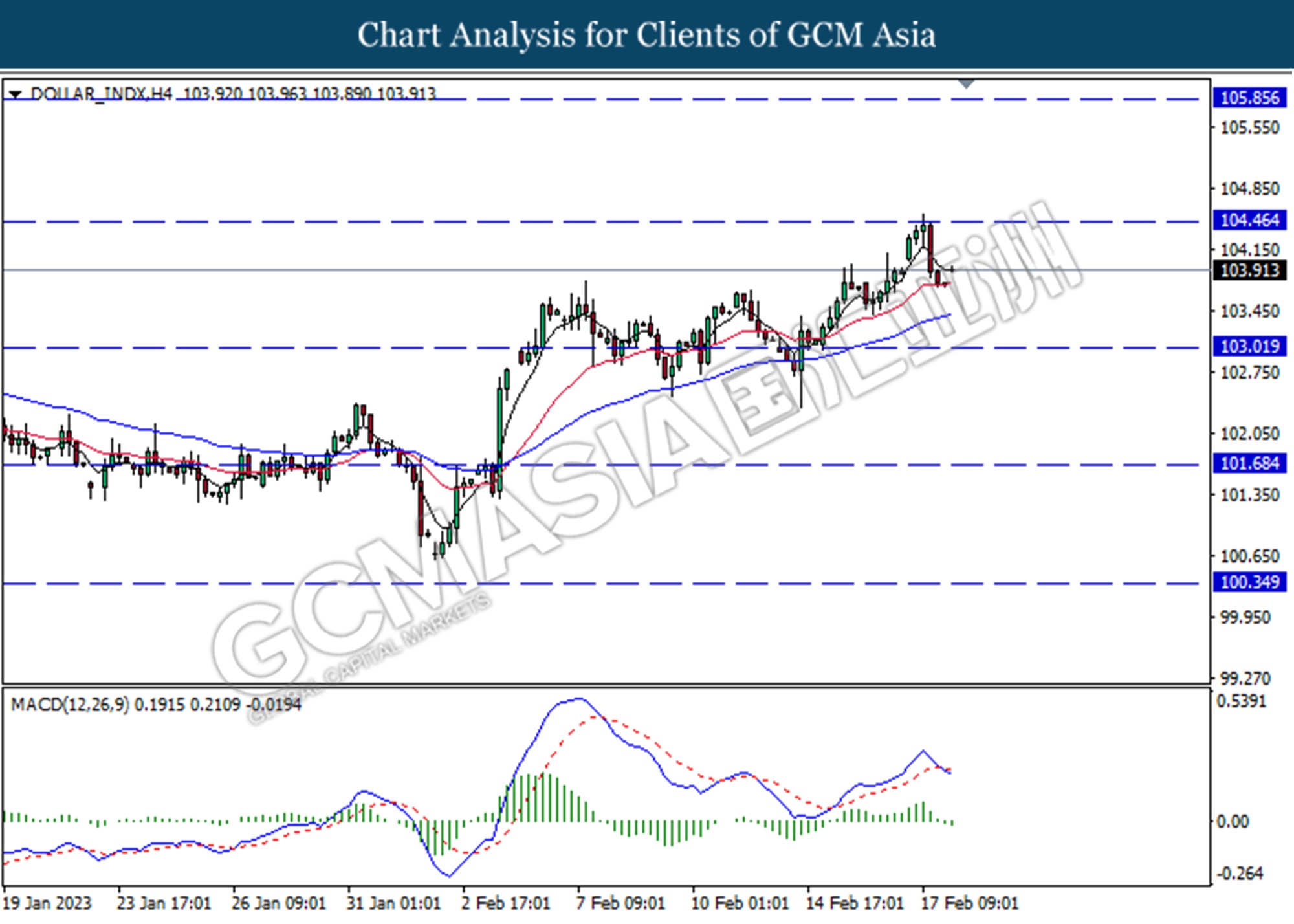

DOLLAR_INDX, H4: Dollar index was traded lower following a prior retracement from the resistance level at 104.45. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

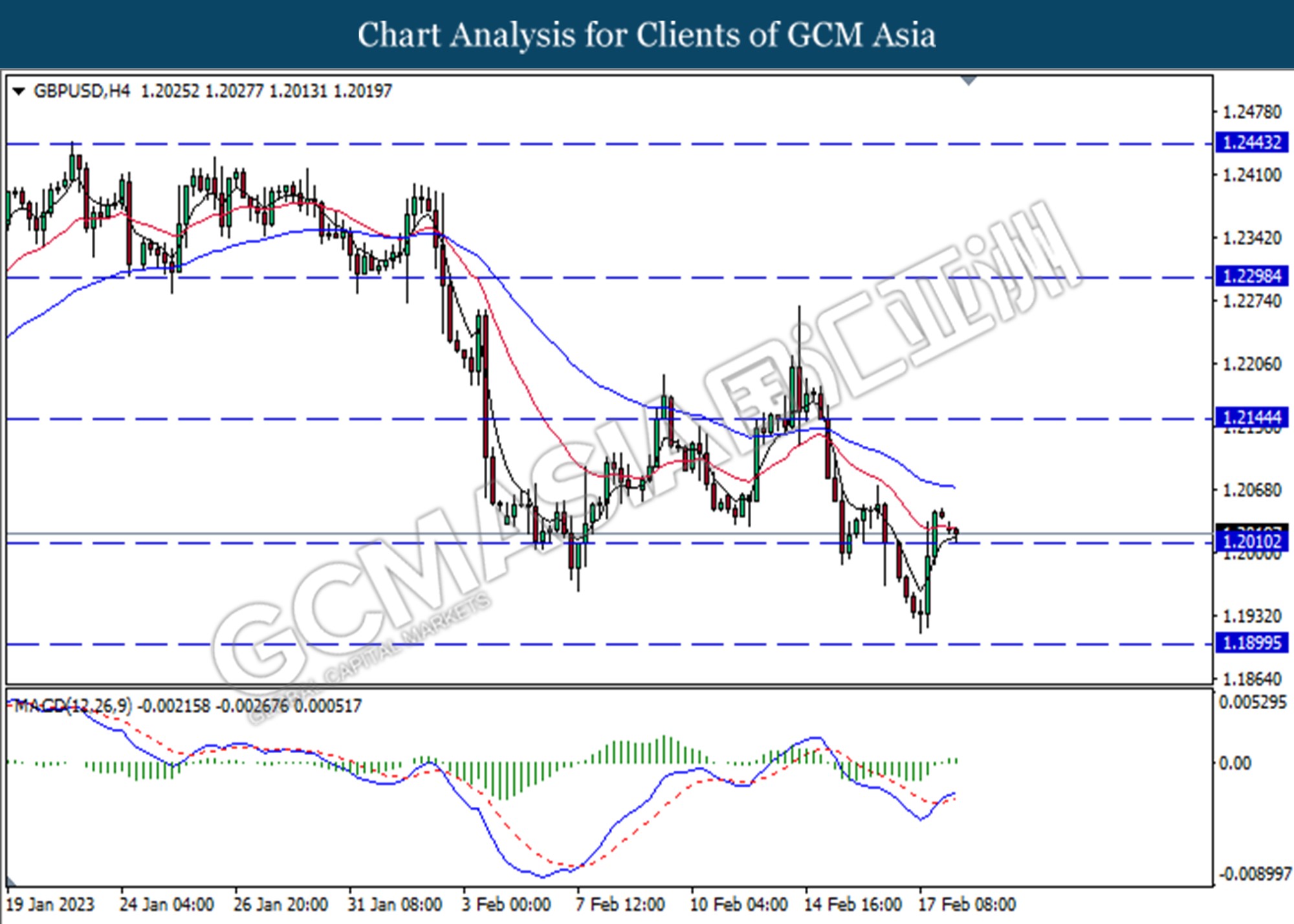

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2010. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses if successfully breaks below the support level.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded higher following the prior rebound from the support level at 1.0635. However, MACD which illustrated increasing bullish momentum suggests the pair undergo technical correction in the short-term.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0470

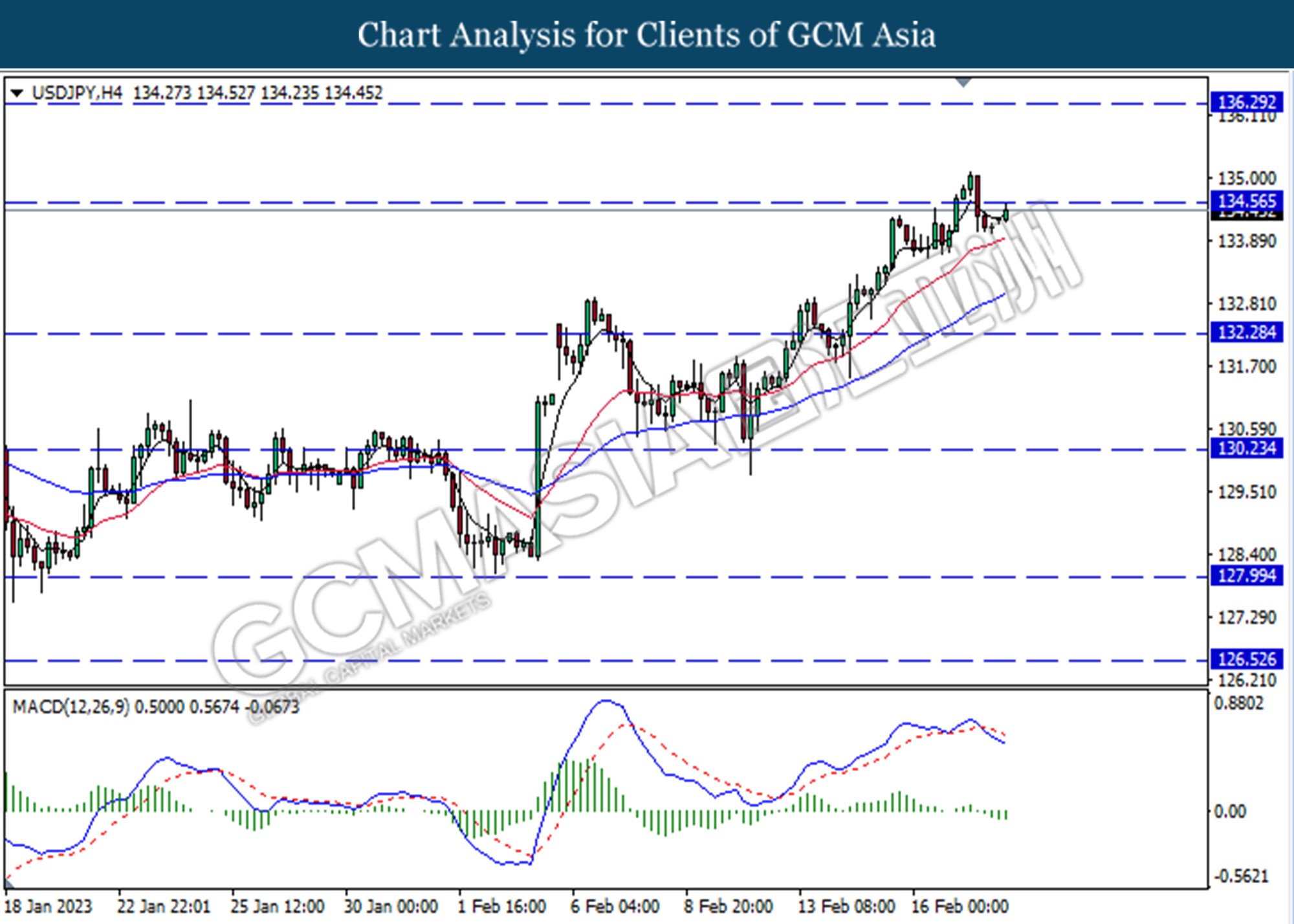

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 134.55. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

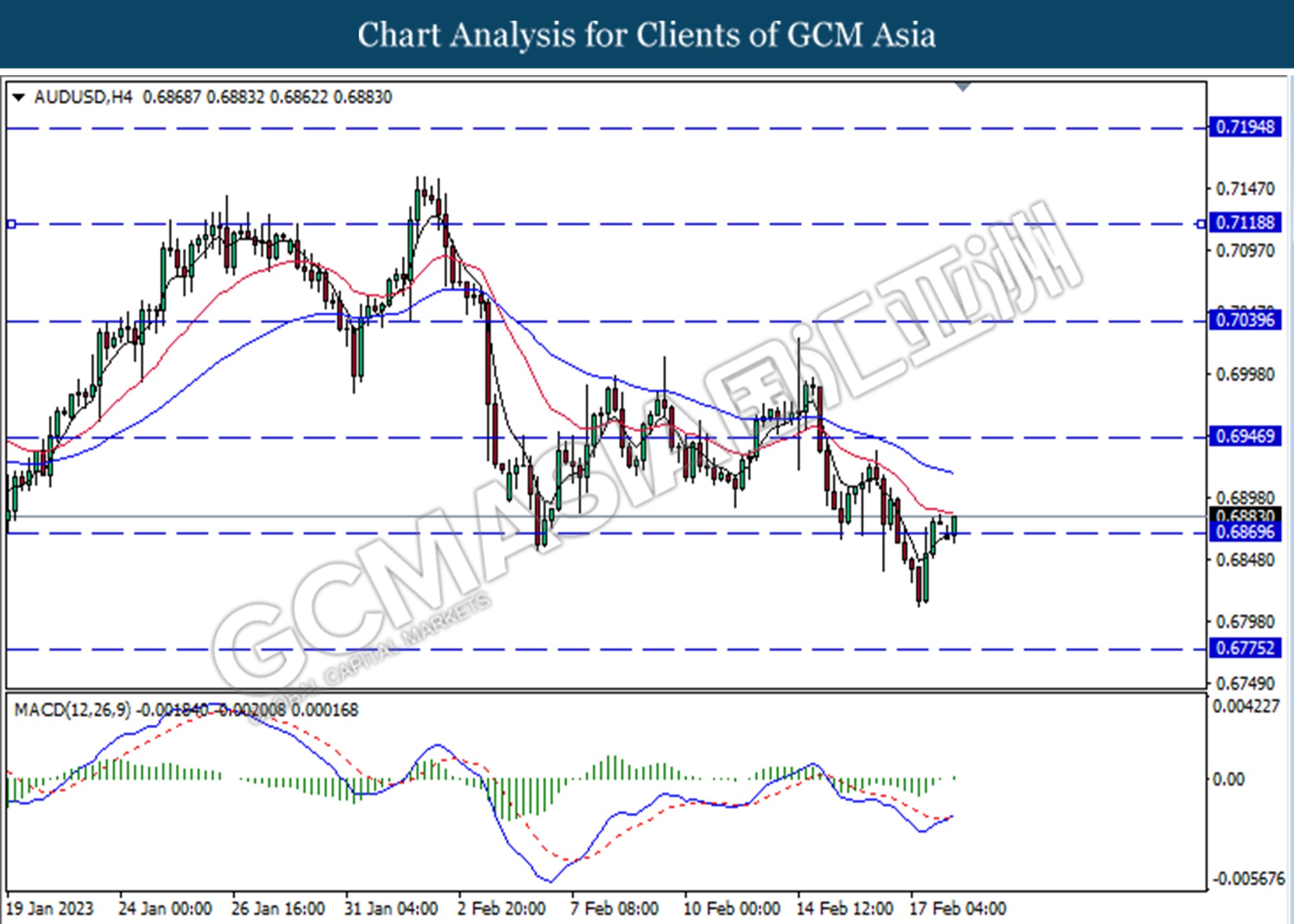

AUDUSD, H4: AUDUSD was traded higher following a prior break above the previous resistance level at 0.6870. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6945.

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

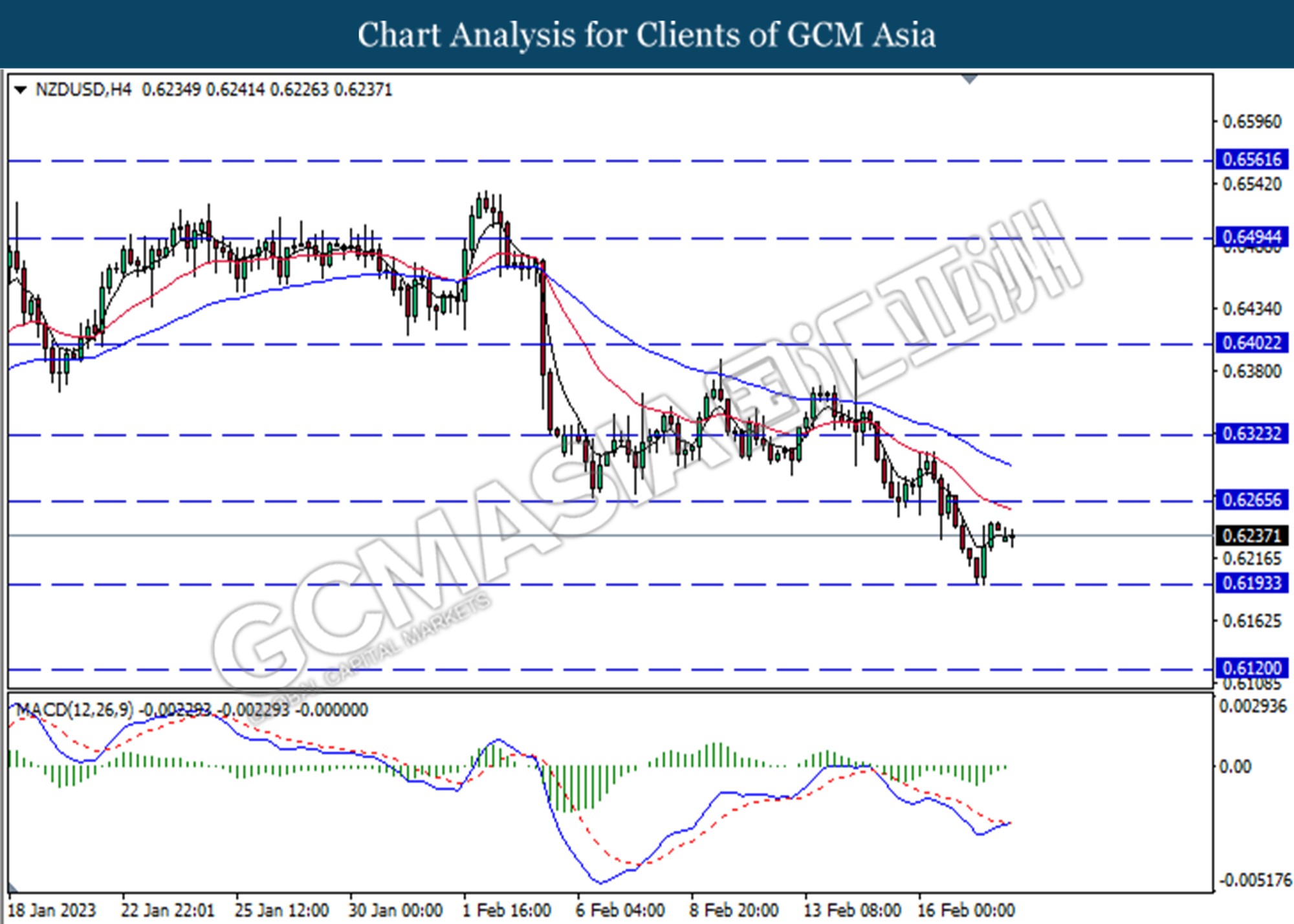

NZDUSD, H4: NZDUSD was traded lower following a retracement from a higher level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

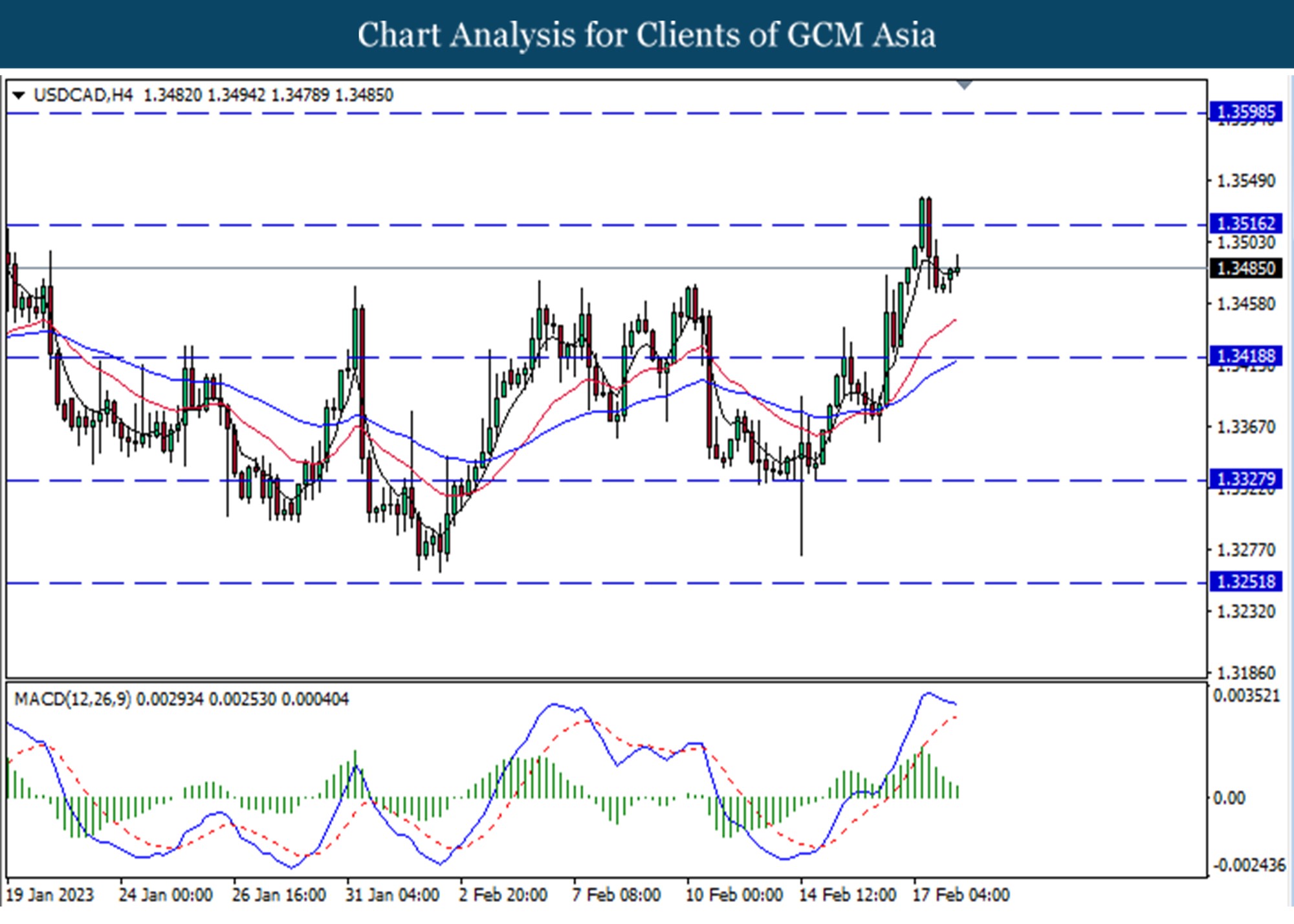

USDCAD, H4: USDCAD was traded higher following a rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

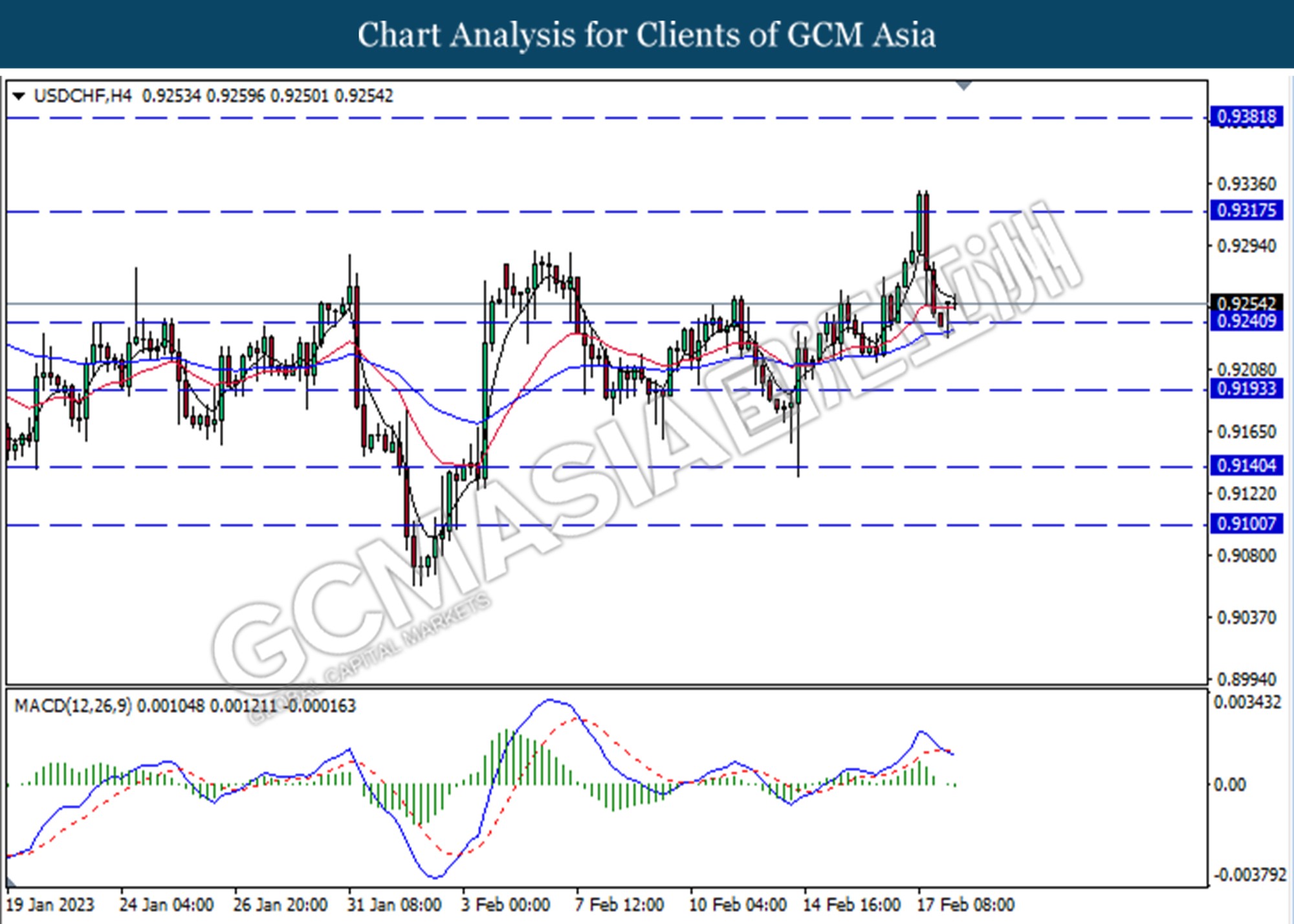

USDCHF, H4: USDCHF was traded higher following a prior rebound from the support level at 0.9240 However, MACD which illustrated bearish momentum suggests the pair to undergo technical correction in the short-term.

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

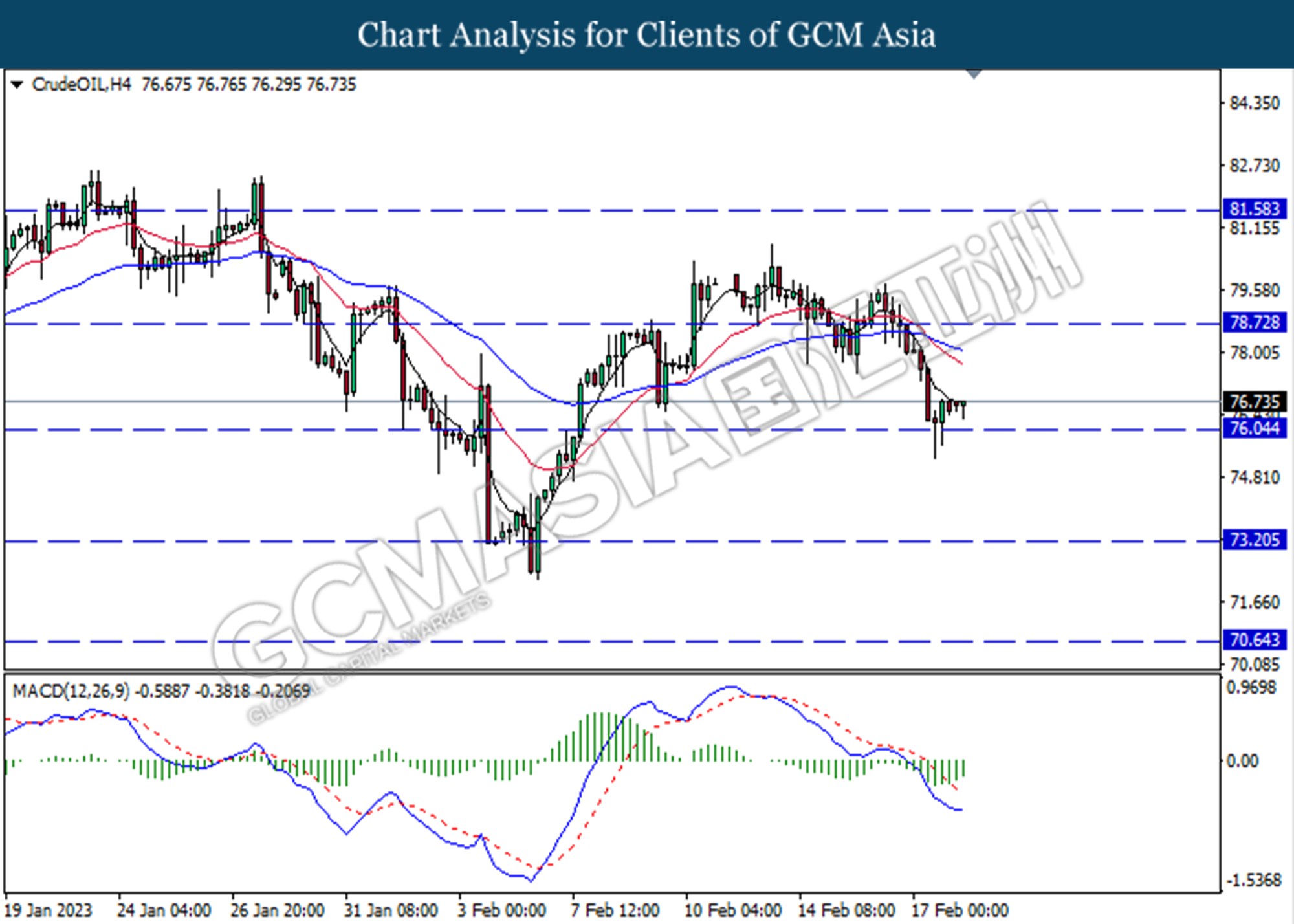

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 76.05. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical correction in the short term.

Resistance level: 78.75, 81.60

Support level: 76.05, 73.20

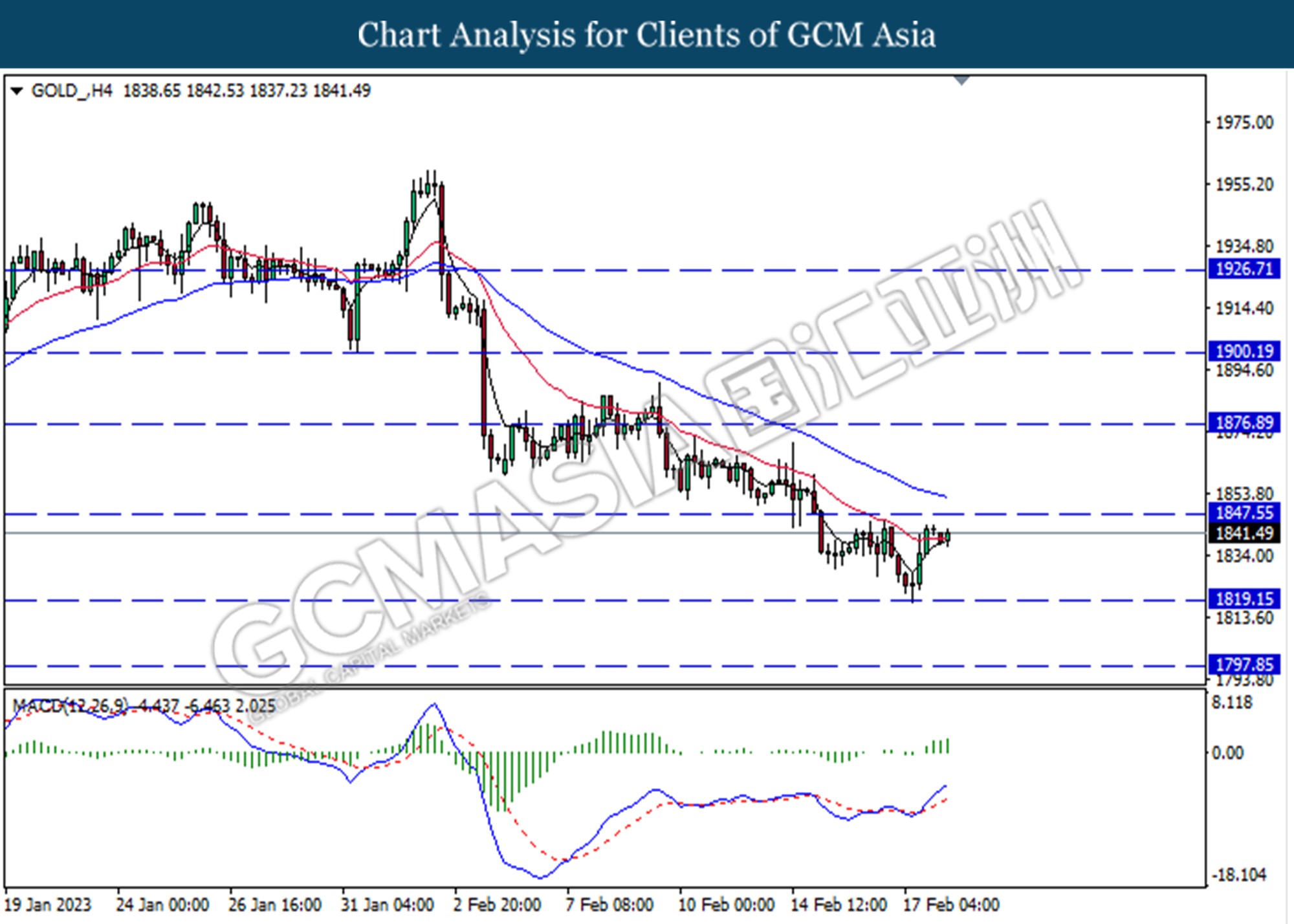

GOLD_, H4: Gold price was traded higher following a prior rebound from the support level at 1819.15. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 1847.55

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1797.85