20 April 2023 Morning Session Analysis

Dollar regains its position but limited by Fed’s Beige Book.

The dollar index, which is traded against a basket of six major currencies, rebounded after hitting its lowest level since February. The following rebound in the dollar index came from Fed’s James Bullard issued a hawkish statement. In the communique, Bullard was recommended to raise for another half of a percentage point between 5.50% and 5.75% and to discount on recession talk. Bullard’s hawkish statement remarks boosted the 2 years treasury bond yields ticked up 4.5 basis points to 4.2480% and the dollar rebounded aftermath. Besides, the pair of USD/JPY shot above the 135 level after the Bank of Japan (BoJ) stated that it is unlikely to decide to change its curve control program. This means the BoJ is maintaining its ultra-loose monetary policy. Therefore, the Japanese Yen weakened in its position and the dollar strengthened. However, the gains of the dollar were limited after the Fed released the Beige Book report. The Beige Book report highlighted that the overall price levels rose appeared to be slowing and the labor market has become less constrained. With that, an expectation of a rate hike after the May minutes meeting is reduced. As of writing the dollar index edged up 0.19% to $101.645.

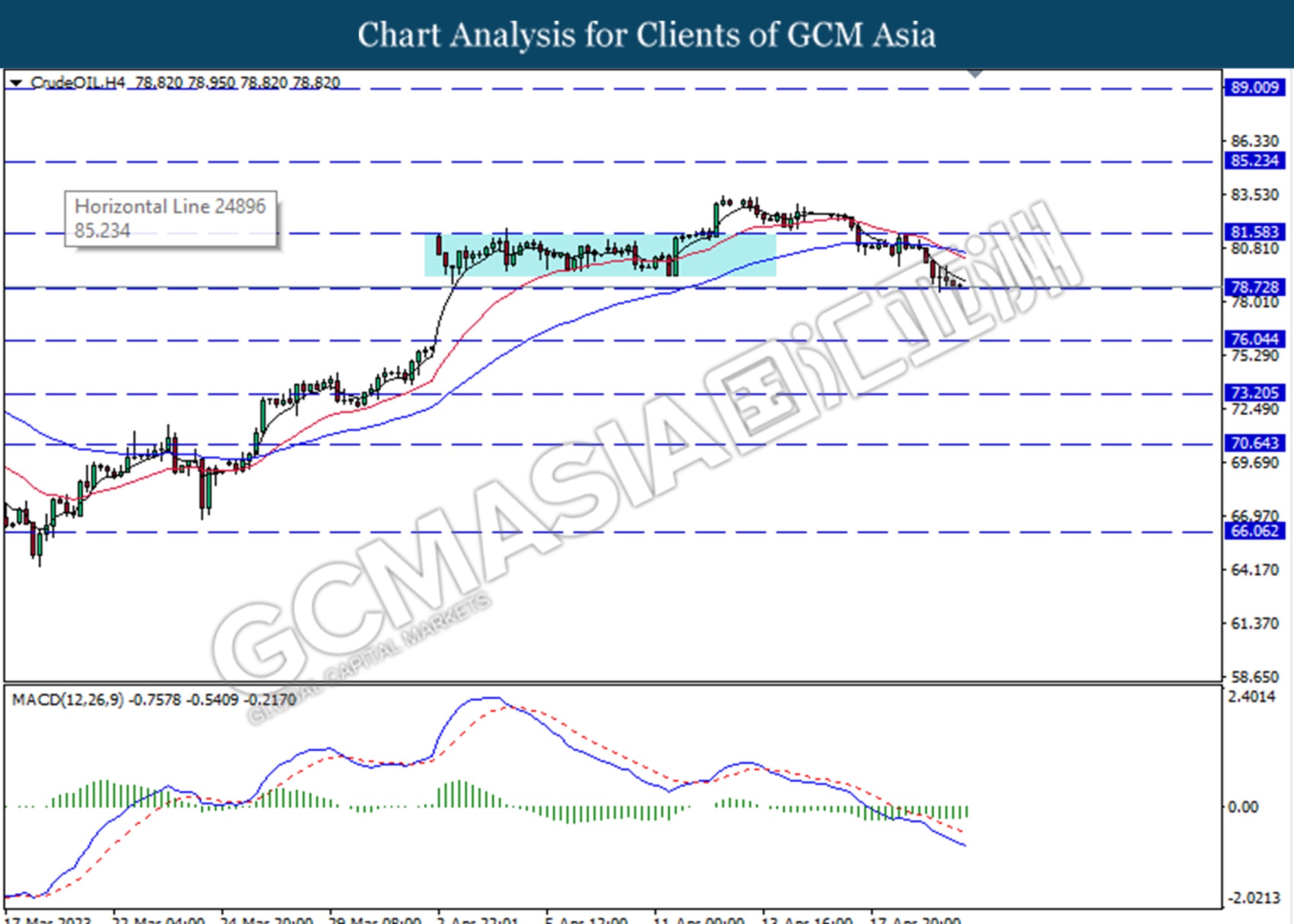

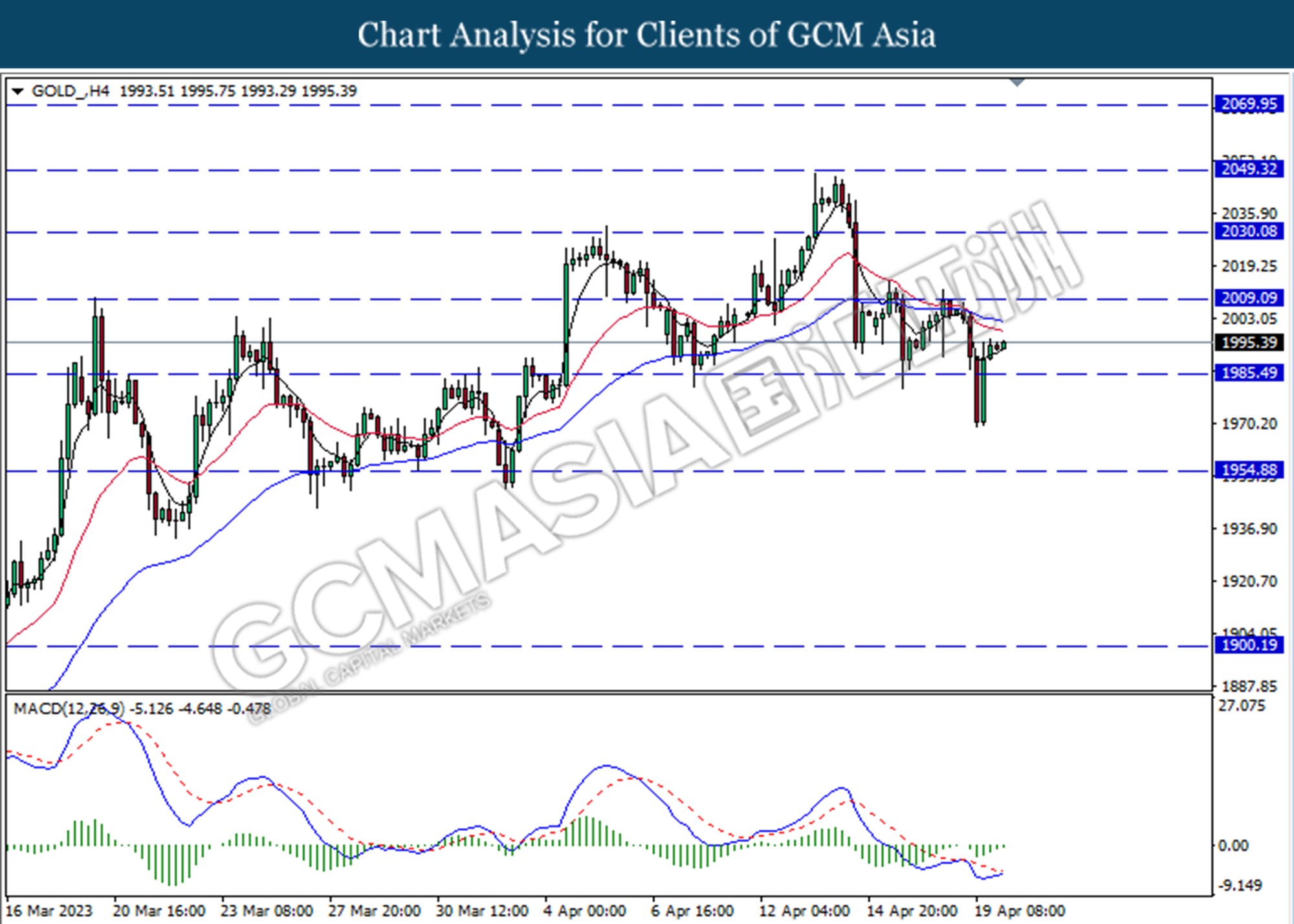

In the commodities market, crude oil prices edge lower by -0.45% to $78.88 per barrel as of writing. The crude oil price falls yesterday as recurring fears about Wall Street’s recession. Besides, gold prices depreciated -0.03% to $1994.16 per troy ounce as investors seek clarity on Fed hikes.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:15 | PBoC Loan Prime Rate | 3.65% | 3.655 | – |

| 20:30 | Initial Jobless Claims | 239k | 240k | – |

| 20:30 | Philadelphia Fed Manufacturing Index (Apr) | -23.2 | -20.0 | – |

| 22:00 | Existing Home Sales (Mar) | 4.58M | 4.50M | – |

Technical Analysis

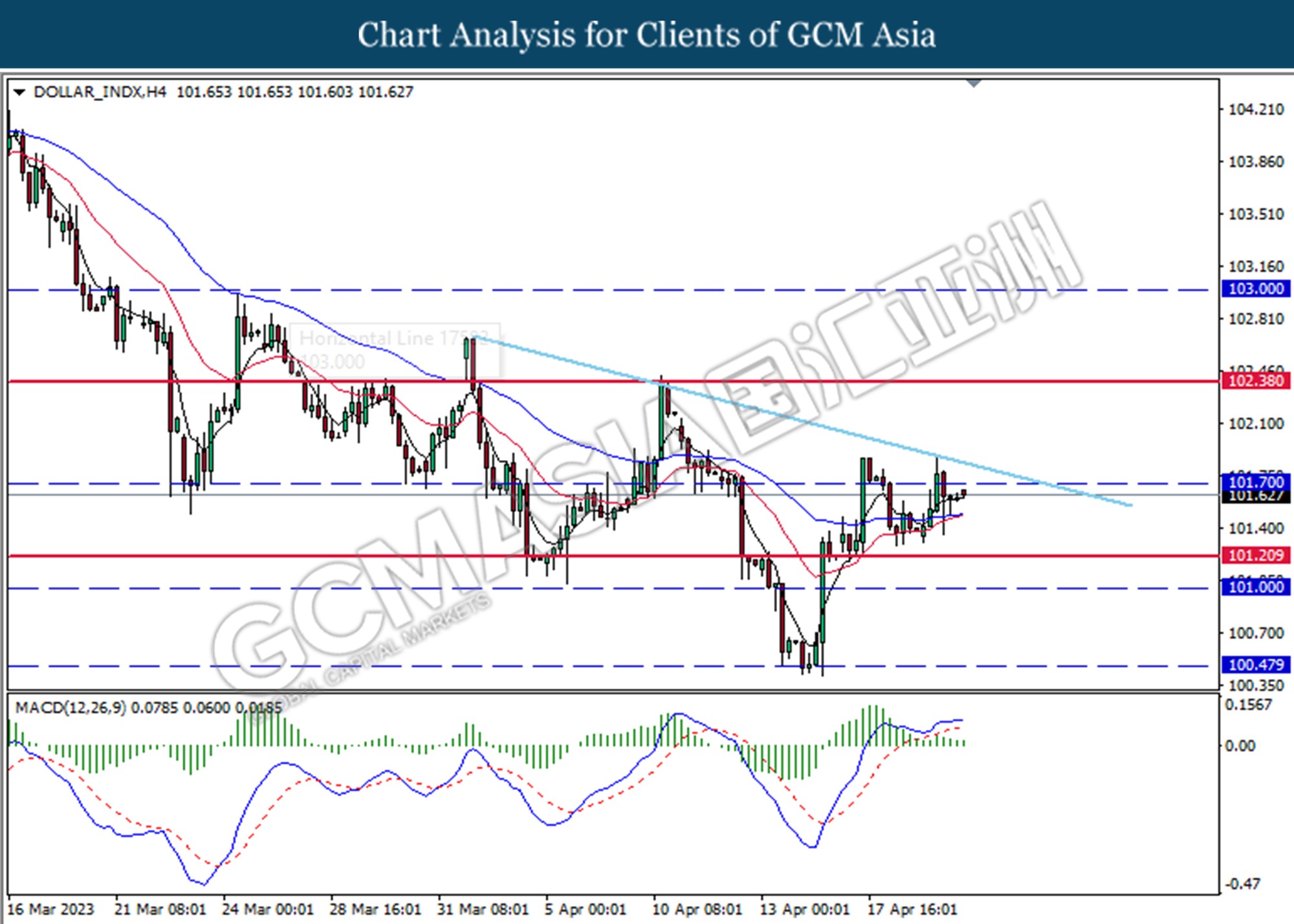

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 101.70 However, MACD which illustrated diminishing bullish momentum suggests the index to traded lower as technical correction.

Resistance level: 101.70, 102.40

Support level: 101.00, 100.50

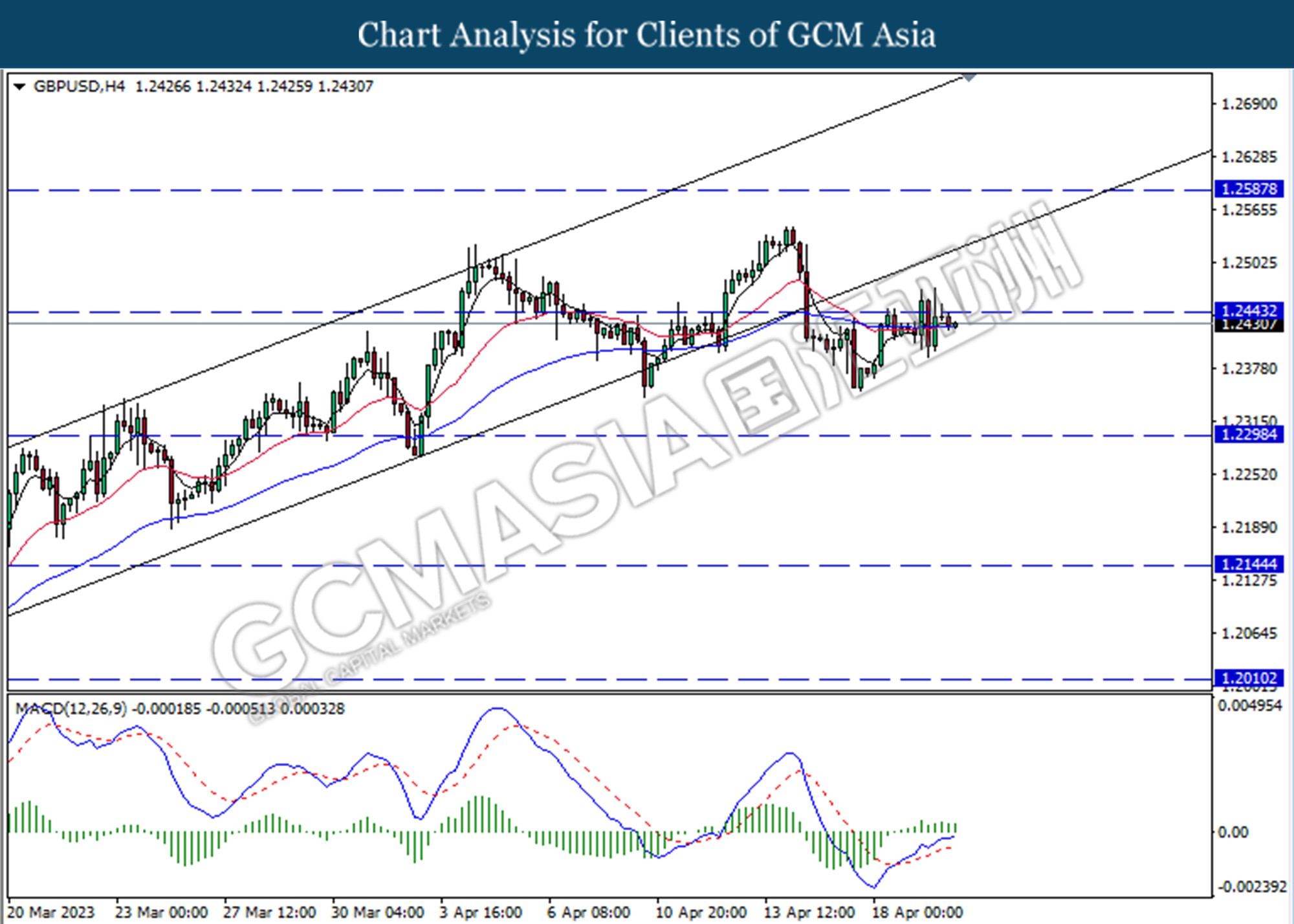

GBPUSD, H4: GBPUSD was traded lower following a prior break below from the previous support level at 1.2445. However, MACD which illustrated bullish momentum suggests the index to traded higher as technical correction.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

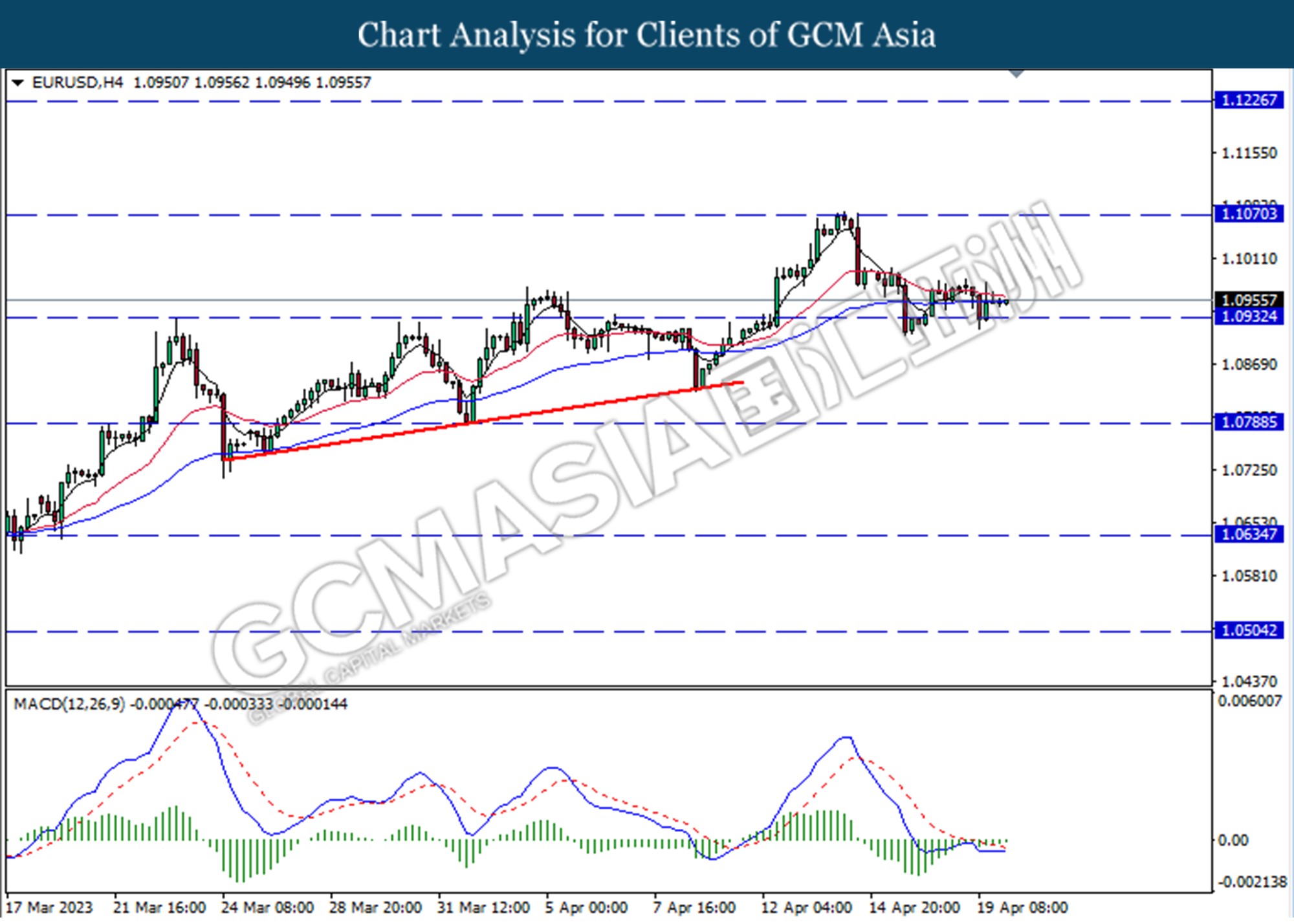

EURUSD, H4: EURUSD was higher following a prior rebound from the support level at 1.0930. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.1070.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

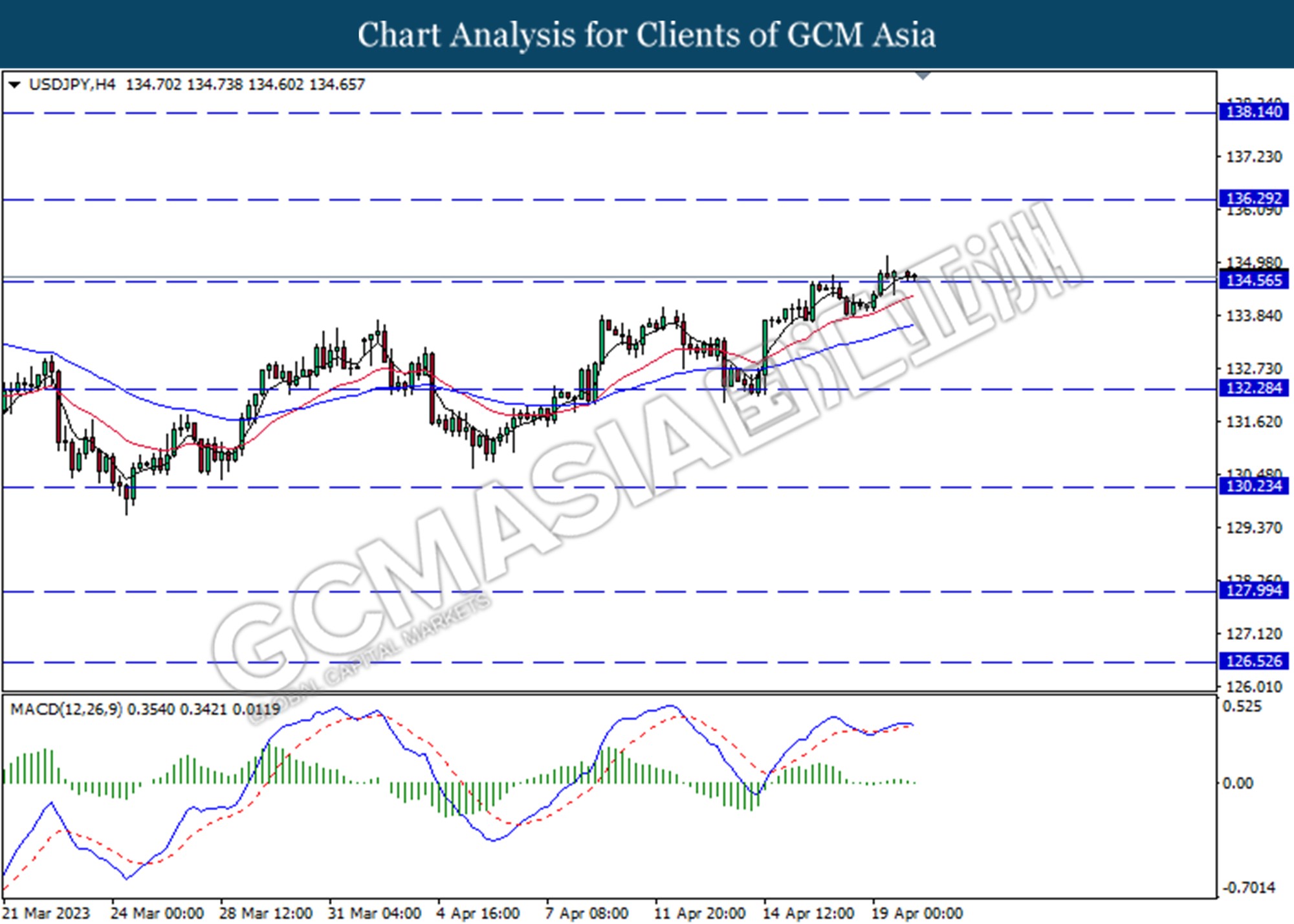

USDJPY, H4: USDJPY was traded lower while currently testing for the support level at 134.55. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses if successfully break below the support level.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

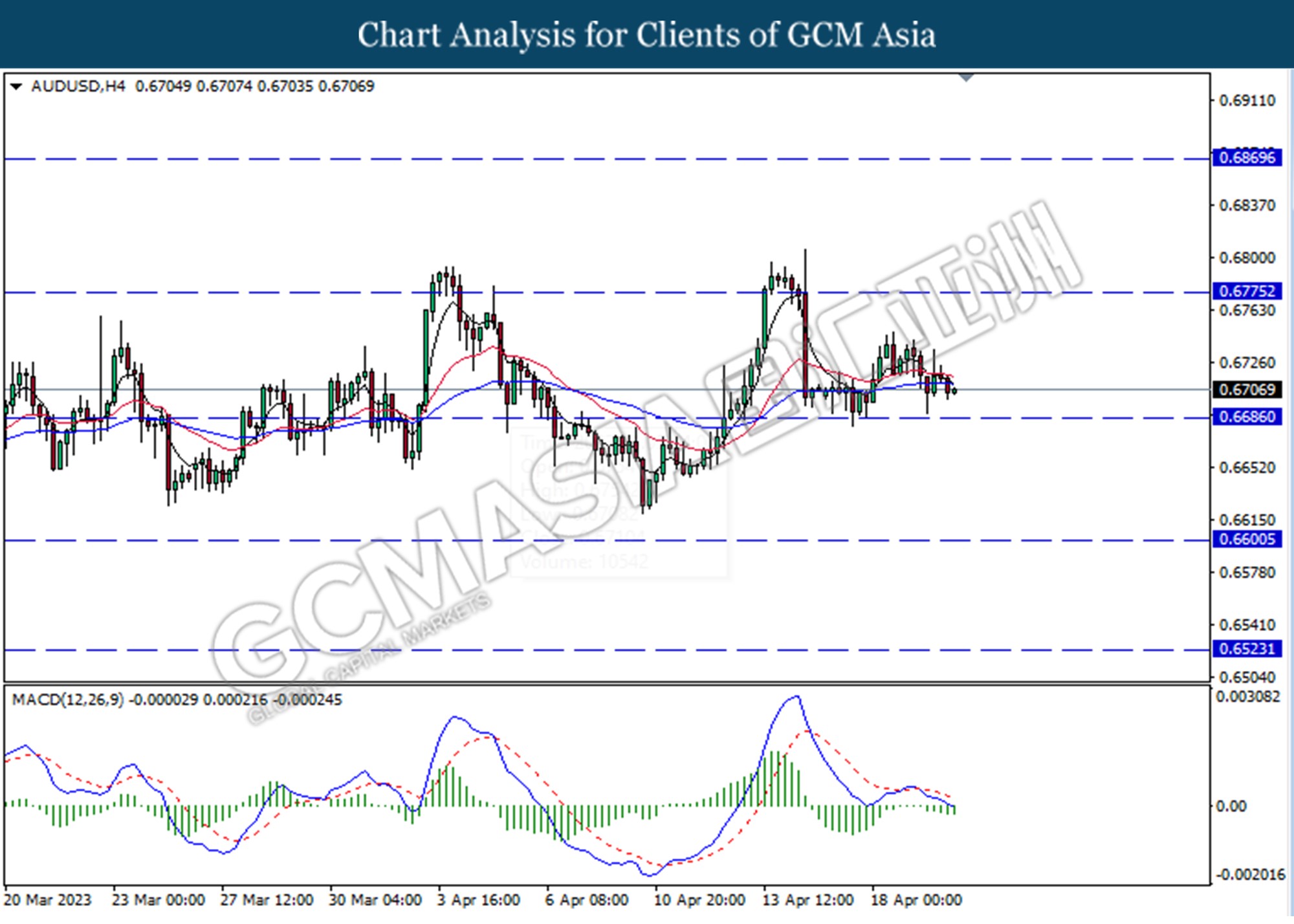

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6685.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

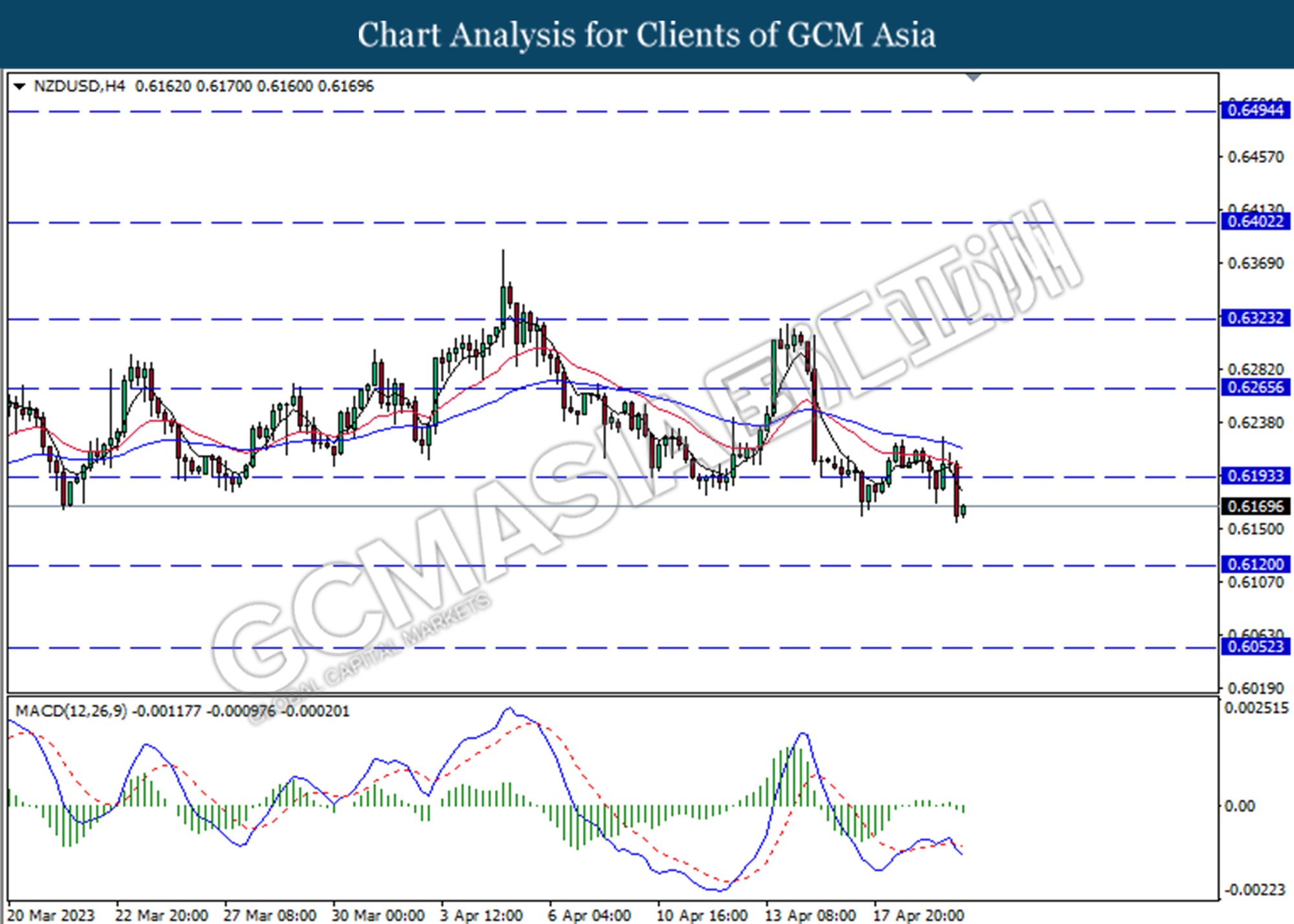

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6195. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 0.6120.

Resistance level: 0.6195, 0.6165

Support level: 0.6120, 0.6050

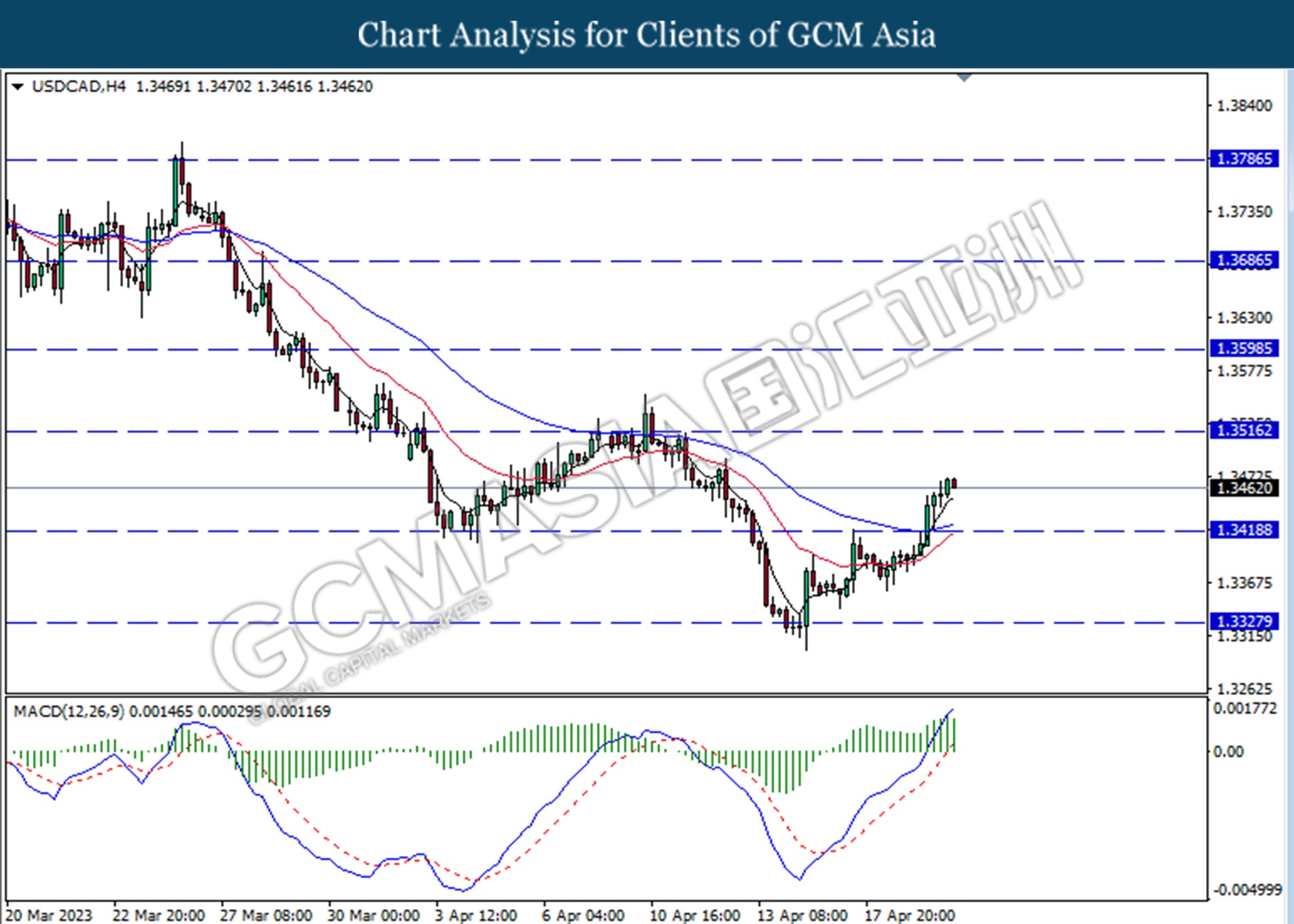

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3420. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3515.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

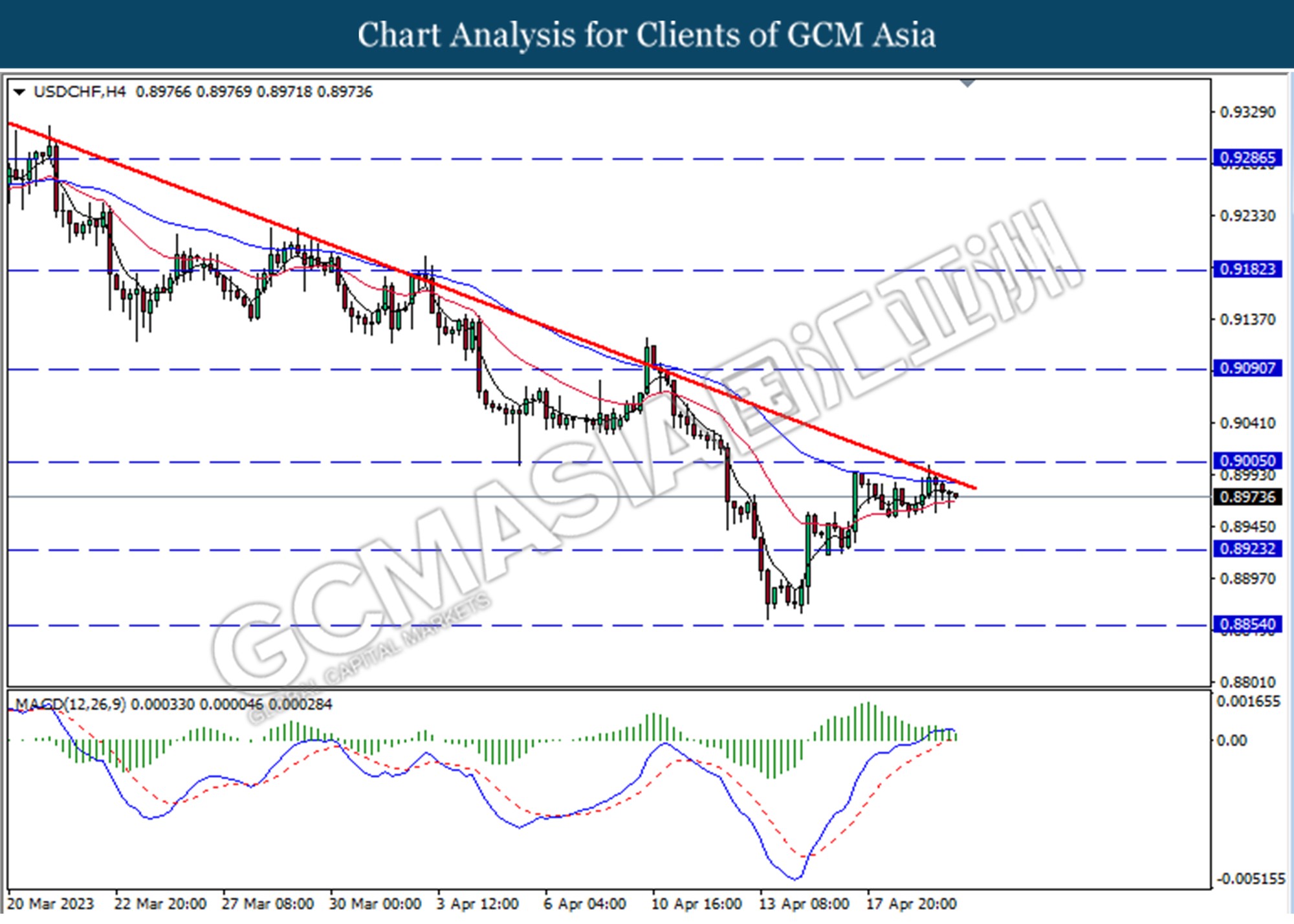

USDCHF, H4: USDCHF was traded lower following the prior retracement from the downward trend line. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.8925.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded lower while currently testing for the support level at 78.70. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully break below the support level.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

GOLD_, H4: Gold price was traded higher following the prior break above from the previous resistance level at 1985.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its gains toward the resistance level at 2009.10.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90