20 May 2022 Afternoon Session Analysis

Aussie surged following the announcement of easing lockdown policies from China.

The Chinese-proxy currencies such as Australia Dollar surged on yesterday following the Chinese authorities started to ease the lockdown restriction. According to CNBC, more Shanghai residents were allowed to go out to shop for groceries in nearly two months. The Shanghai had recorded no new infections outside quarantined areas for fifth day in a row. Economists expected that the economic activity would start to recover with business able to operate with workers living on site while authorities allow more to resume normal operations from the beginning of June. Nonetheless, the gains experienced by the Australia Dollar was limited by the downbeat economic data. According to Australian Bureau of Statistics, Australia Employment Change notched down significantly from the previous reading of 17.9K to 4.0K, missing the market forecast at 30K. As of writing, AUD/USD depreciated by 0.47% to 0.7015.

In the commodities market, the crude oil price depreciated by 0.79% to $108.55 per barrels as of writing amid downbeat data from US region had dialled down the market optimism toward the economic progression, dragging down the appeal for this black-commodity. On the other hand, the gold price retreated 0.12% to $1839.70 per troy ounces amid technical correction. Though, the overall trend for the gold yesterday remained bullish amid the depreciation of US Dollar following the released of negative economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Apr) | -1.4% | -0.2% | – |

Technical Analysis

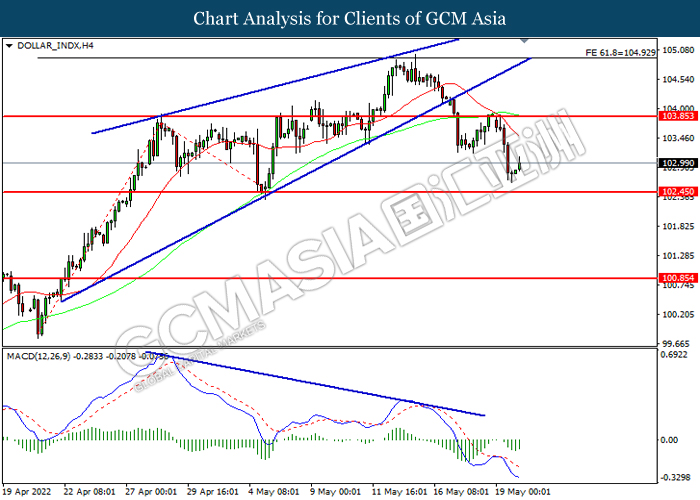

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 103.85, 104.95

Support level: 102.45, 100.85

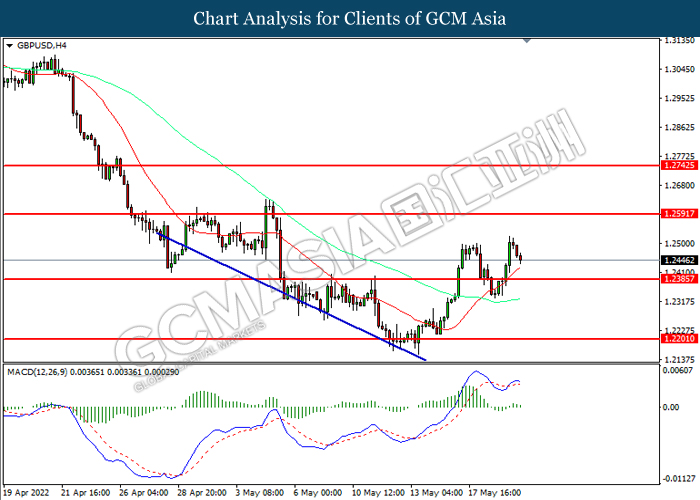

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2590, 1.2745

Support level: 1.2385, 1.2200

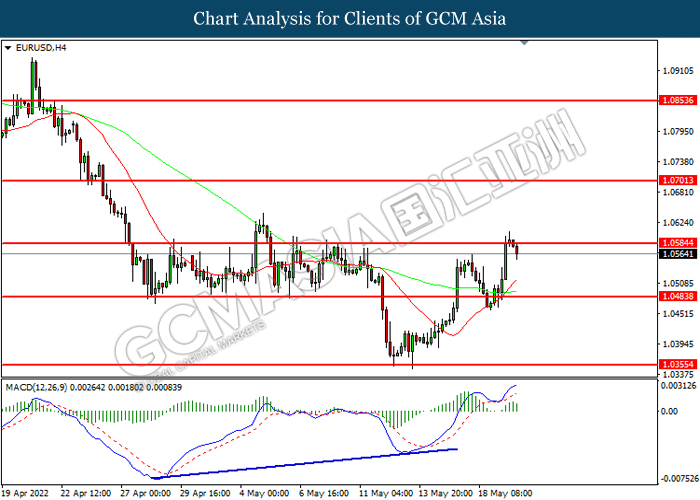

EURUSD, H4: EURUSD was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0585, 1.0700

Support level: 1.0485, 1.0355

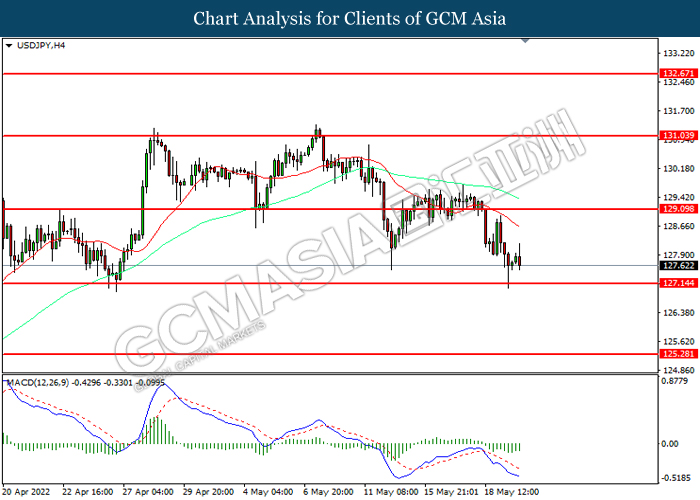

USDJPY, H4: USDJPY was traded within a range while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 129.10, 131.05

Support level: 127.15, 125.30

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its after breakout.

Resistance level: 0.7055, 0.7260

Support level: 0.6865, 0.6720

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout.

Resistance level: 0.6400, 0.6550

Support level: 0.6225, 0.6070

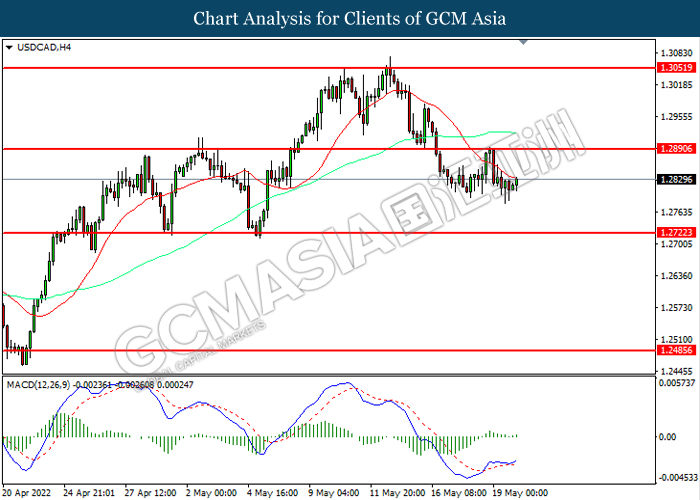

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2485

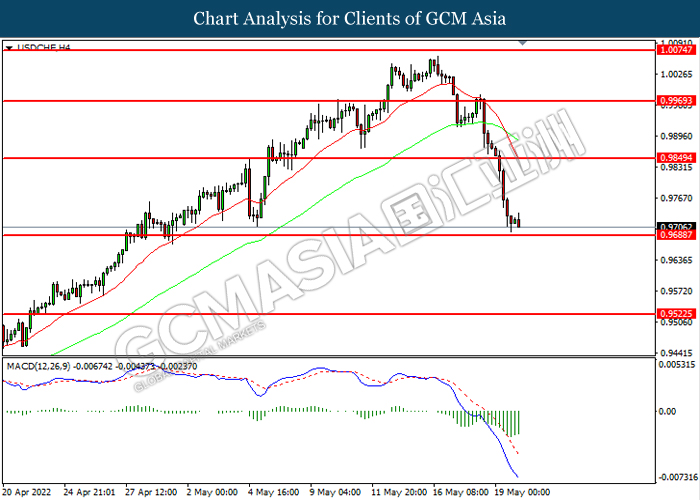

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9850, 0.9970

Support level: 0.9690, 0.9520

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 110.35, 113.05

Support level: 106.65, 104.05

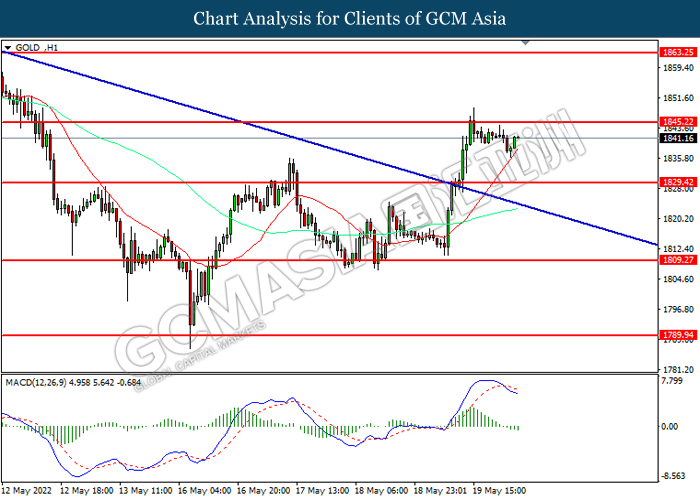

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated bearish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1845.20, 1863.25

Support level: 1829.40, 1809.25