20 July 2022 Afternoon Session Analysis

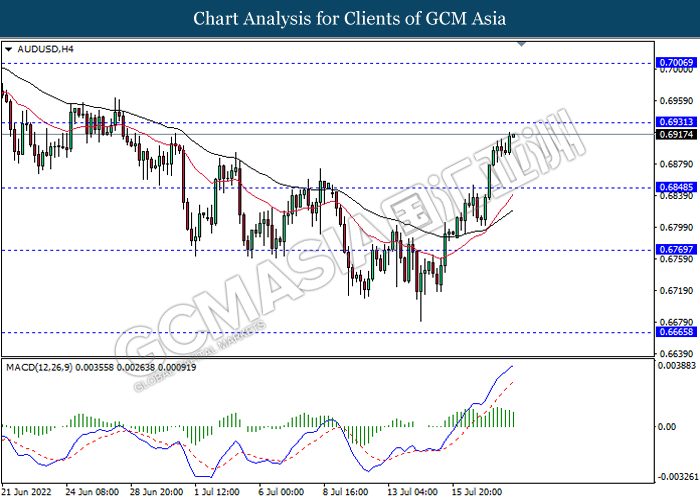

RBA targeted aggressive rate hikes, AUD/USD surged.

The AUD/USD was traded higher throughout the yesterday trading session amid the rising expectations of rate hike from Australia’s central bank. According to Reuters, Reserve Bank of Australia (RBA) Governor Philip Lowe appeared a speech at a business conference in Melbourne, said that the spiking inflation should not feed through to business and household expectations. He recommended that the rate increases could at least double from current low levels, which might need a rate hike from the current 1.35% to a neutral level of at least 2.5% in order to tackle inflation which reached to a 20-year peak of 5.1%. Few weeks ago, the RBA had raised its interest rate for three months consecutively while the market participants are predicting a further rate hike to 3.5% by the end of the year, which sparkling the appeal of the Australia Dollar. Besides, the Australia Dollar extended its gains over the slump of the US Dollar. As of writing, AUD/USD edged up by 0.06% to 0.6899.

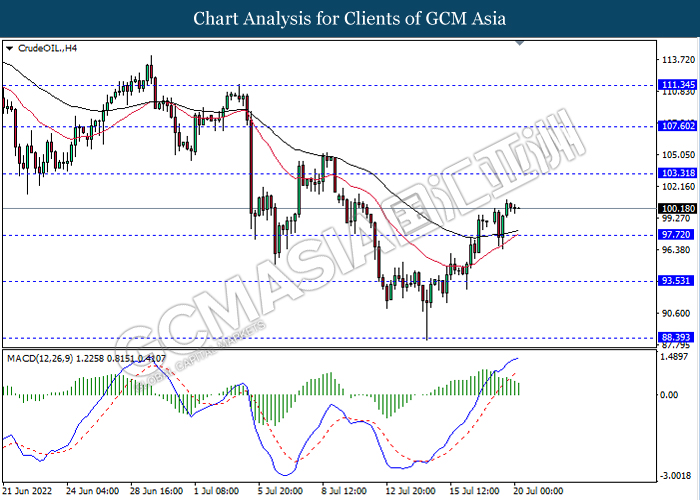

In the commodities market, crude oil price depreciated by 0.46% to $100.30 per barrel as of writing as the rising number of Covid-19 cases in China would hit world demand for oil. On the other hand, gold price depreciated by 0.13% to $1708.50 per troy ounce as of writing following the heightened expectations of rate hikes from major central banks.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Jun) | 9.1% | 9.2% | – |

| 20:30 | CAD – Core CPI (MoM) (Jun) | 0.8% | – | – |

| 22:00 | USD – Existing Home Sales (Jun) | 5.41M | 5.38M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.235M | -1.933M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.30, 108.80

Support level: 105.25, 103.65

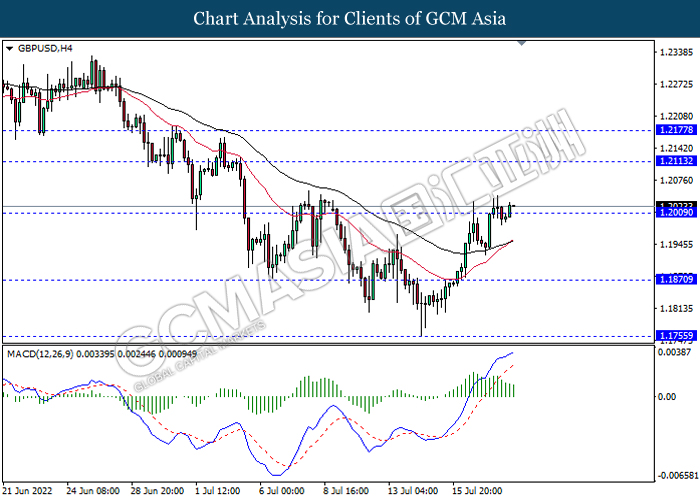

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2115, 1.2175

Support level: 1.2010, 1.1870

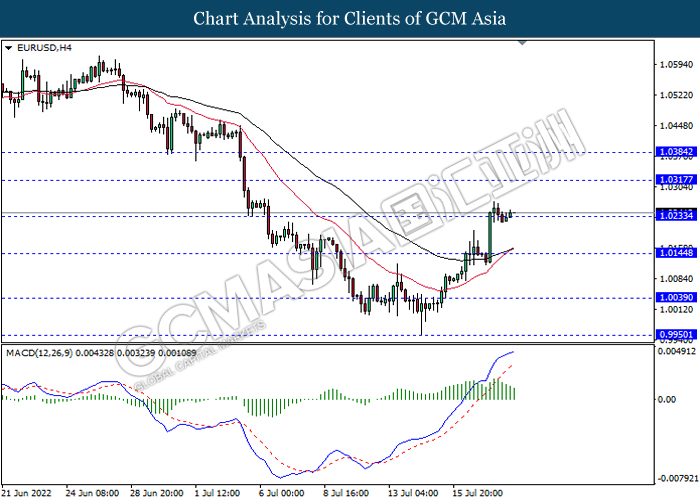

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0315, 1.0385

Support level: 1.0235, 1.0145

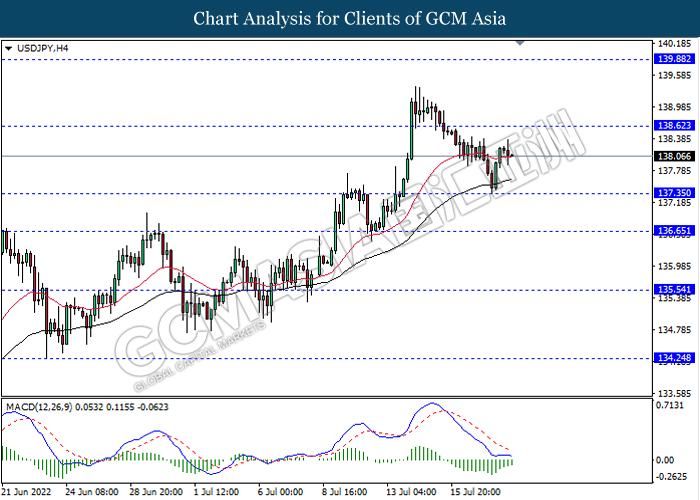

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 138.60, 139.90

Support level: 137.35, 136.65

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

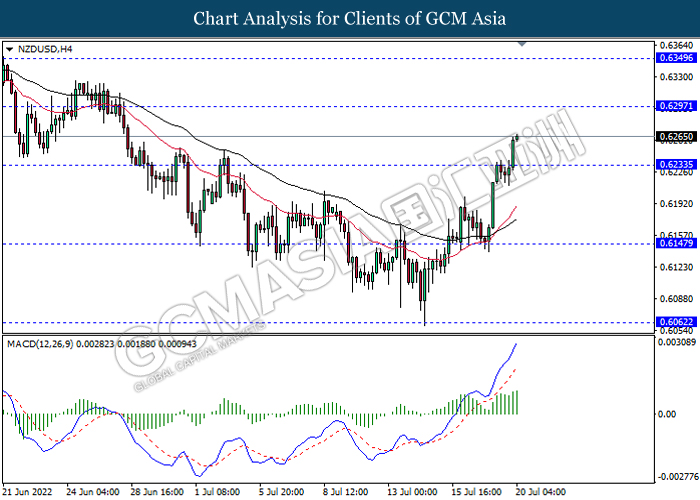

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6145

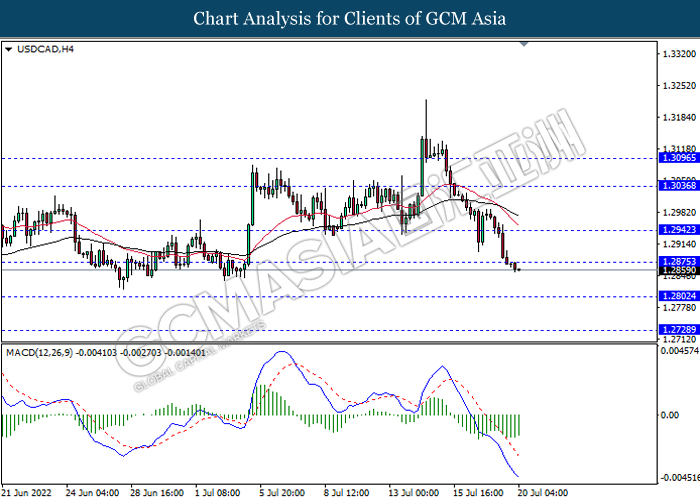

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

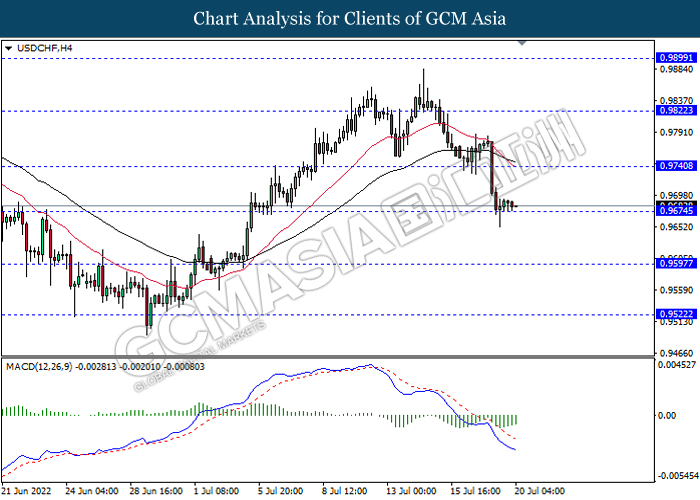

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

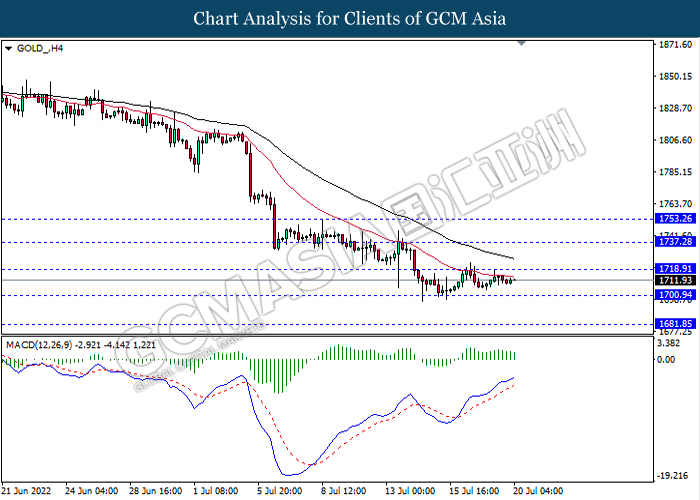

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85