20 August 2018 Weekly Analysis

GCMAsia Weekly Report: August 20 – 24

Market Review (Forex): August 13 – August 17

US Dollar

US Dollar has continued its downfall following the latest release of Michigan Consumer Sentiment Index which produce weak results. The dollar index has fall 0.53% while closing the price at 95.98 last week.

According to the University of Michigan which survey the personal confidence of consumers in economic activity, the index has proved the confidence among consumers for the month of August have dropped with the reading of 95.3 against market forecast of 98.0. Adding to the downward momentum in the greenback, the dollar upside potential has been limited by the recovery of Turkey and China Yuan which have bolstered most currency market against the dollar. To limit the Lira from falling, President Turkey Tayyip Erdogan has launch a economic action plan last week which have eased the market concern and made a recovery for Lira. In addition, the concerns around the US-China trade dispute has also been decreasing since Chinese officials announced a visit to the US in order to resume the trade talks.

Overall, the dollar strength has tumbled against it major rivals and the risk appetite for the dollar has decreased with the ongoing recovery of Turkey and also easing concerns with China and US renew trade talks that have continued to bolster the China Yuan and most markets against the dollar.

USD/JPY

USDJPY pair dropped 0.36% to 110.47 during late Friday trading session.

EUR/USD

EURUSD has slip 1.01% to 1.1407 against the US Dollar. With the macroeconomic release of CPI in eurozone that is in line with the expectations, the data have added more support to the EUR dollar in addition with the recovery of the Lira.

GBP/USD

GBPUSD has gained 0.28% to 1.2746 during late Friday New York session.

Market Review (Commodities): August 13 – August 17

Crude Oil

The price of crude oil rose on Friday as followed with US sanctions on Iranian oil which triggered concern for supply shortage last week. The commodity price has advance by 1.55% to $ 67.61 a barrel during last Friday’s session.

Last week, the price of crude oil has surged following with the International Energy Agency (IEA) on Friday raised its estimate of world oil demand growth next year to 1.5 million barrels a day (bpd) from 1.4 million bpd. Besides that, the IEA also warned that upcoming oil sanctions against Iran could bring turmoil to the market which the U.S. sanctions targeting Iranian oil are expected in early November and could increase the potential of a global energy supply shortage. Furthermore, the price remains to hold its gains as the Bakers Hughes data, a leading indicator which measure the drilling activity in US also increased by the number of 10 which the reading is 869, thus improve further risk appetite for the black oil.

Overall, the sentiment for the commodity was subjected towards bullish after it driven higher in the past few months as demand for oil outstrips supply.

GOLD

Gold prices was recently recovered amid dollar has gave up some of its earlier week gains amid recovery in Turkey and also a negative slew of economic data. The yellow metal price has closed the market last week by gaining 0.90% to $ 1,184.20 a troy ounce.

The gold price has rebound amid dollar that have been weakened by the latest release of economic data last Friday where a slumped data has hinted the lack of confidence among consumers in the current economy. In addition, China has recently confirmed to send a trade representative to refresh a new round trade talks for a better trade deal which have eased concerns.

Weekly Outlook: August 20 – 24

For the week ahead, investors will remain focus on the release of various economics data and also speeches, especially on Friday where Jerome Powell will make his first appearance as Fed chairman at the annual economic symposium in Jackson Hole. The conference will be closely monitored for clues to the monetary policy direction of some of the world’s most important central bank.

For crude oil traders, they will place their attention over inventories data which is scheduled to commence on Wednesday to obtain further signals with regards to their approach taken to tackle imminent supply shortage.

Highlighted economy data and events for the week: August 20 – 24

| Monday, August 20 |

Data EUR – German PPI (MoM) (Jul)

Events USD – FOMC Member Bostic Speaks AUD – RBA Governor Lowe Speaks AUD – RBA Meeting Minutes

|

| Tuesday, August 21 |

Data NZD – Retail Sales (QoQ) (Q2)

Events CrudeOIL – OPEC Meeting

|

| Wednesday, August 22 |

Data CAD – Retail Sales (MoM) (Jun) USD – Existing Home Sales (Jul) CrudeOIL – Crude Oil Inventories

Events GBP – Inflation Report Hearings USD – FOMC Meeting Minutes

|

| Thursday, August 23 |

Data EUR – German Manufacturing PMI (Aug) USD – New Home Sales (Jul)

Events EUR – ECB Publishes Account of Monetary Policy Meeting USD – Jackson Hole Synopsium

|

|

Friday, August 24

|

Data NZD – Trade Balance (MoM) (Jul) JPY – National CPI (MoM) EUR – German GDP (QoQ) (Q2) USD – Durable Goods Orders (MoM) (Jul)

Events USD – Fed Chair Powell Speaks

|

Technical Weekly Outlook: August 20 – August 24

Dollar Index

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level 96.6. MACD which display bearish momentum signal suggest the dollar to resume its technical correction towards the support level 95.00.

Resistance level: 96.60, 97.50

Support level: 95.00, 93.40

GBPUSD

GBPUSD, Daily: GBPUSD was traded lower following recent breakout below the previous support level 1.2785. Although MACD which display diminished bearish momentum with starting formation of golden cross, a breakout above the current resistance level 1.2785 is required to attain further confirmation.

Resistance level: 1.2785, 1.3005

Support level: 1.2600, 1.2385

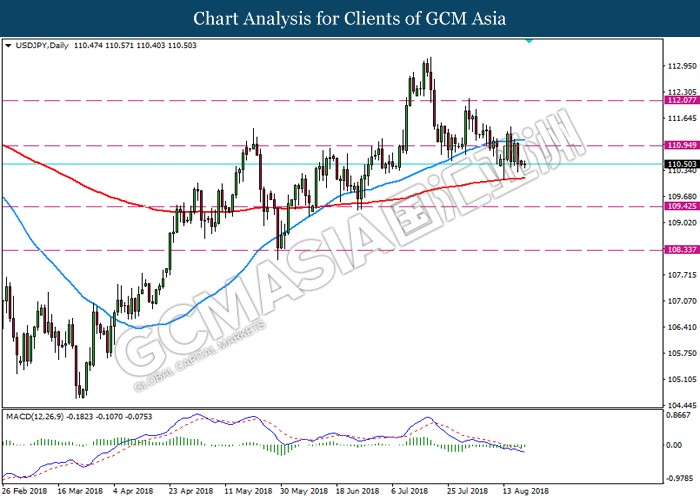

USDJPY

USDJPY, Daily: USDJPY was traded lower following recent breakout below the previous support level 110.95. Price action and MACD which illustrate persistent bearish momentum suggest the pair to extend its losses towards the support level 109.45.

Resistance level: 110.95, 112.05

Support level: 109.40, 108.30

EURUSD

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level 1.1315. Recent price action and MACD which illustrate bullish signal with starting formation of golden cross suggest the pair to extend its rebound towards the resistance level 1.1525.

Resistance level: 1.1525, 1.1760

Support level: 1.1315, 1.1105

GOLD

GOLD_, Daily: Gold price was traded lower following prior breakout from previous support level 1209.00. MACD which display bullish signal suggest the pair may experience a short-term technical correction towards back the current resistance level 1209.00 before it may resume its major trend.

Resistance level: 1209.05, 1295.00

Support level: 1130.00, 1053.00

Crude Oil

CrudeOIL, Daily: Crude oil price was traded lower while currently testing near the support level 64.20. Although MACD which illustrate ongoing bearish momentum, a breakout below the support level 64.20 is required to attain further confirmation.

Resistance level: 68.85, 72.55

Support level: 64.20, 59.75