20 August 2019 Afternoon Session Analysis

RBA meeting minutes dominate Aussie.

Aussie dollar was traded higher by the market participants following the release of upbeat RBA meeting minutes of its 7th August monetary policy meeting. The central bank has met the worldwide market expectation in keeping its interest rate unchanged at 1.00% while an extension of low interest rate period can be highly expected as RBA is still remained open toward further rate cut if needed. Despite escalation of trade war between US and China and global economy recession risks continue to haunt the Australia’s economy development, housing sector managed to turnaround from downside risks and stronger labor market scented the market sentiment of Aussie dollar while members are now seeing second quarter of Australia economy will be firmer. At the same time, Federal Reserve’s member Rosengren’s comment further extends the gains of AUD/USD as he revealed that they might take preventive measures such as quantitative easing if US economy still trapped by recession in next quarter. This comment had lifted up the market expectation of 0.25% rate cut from Fed to 96.2% from previous week 82.3%, according to Fed Rate Monitor Tool. During Asian trading session, AUD/USD spiked up 0.26% to 0.6780 while dollar index inched down 0.03% to $98.15.

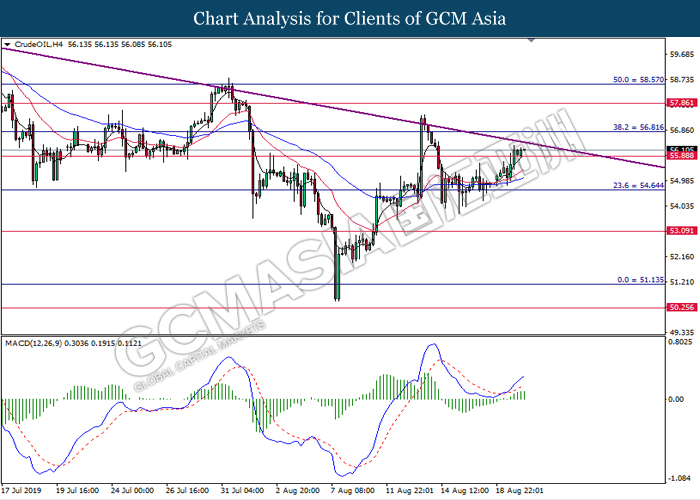

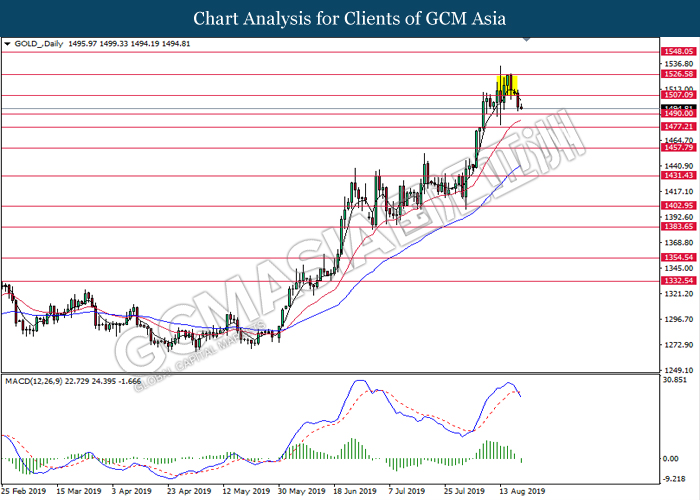

As for commodities market, crude oil price quoted up 0.07% to $56.15 per barrel amid Yemeni separatists attack on Saudi oilfield dragged up the market expectation of supply disruption in near term. Moreover, gold price ticked higher 0.06% to $1496.50 a troy ounce amid dollar’s weakening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 04:30

(21st) |

CrudeOIL – API Weekly Crude Oil Stock | -2.190M | – | – |

Technical Analysis

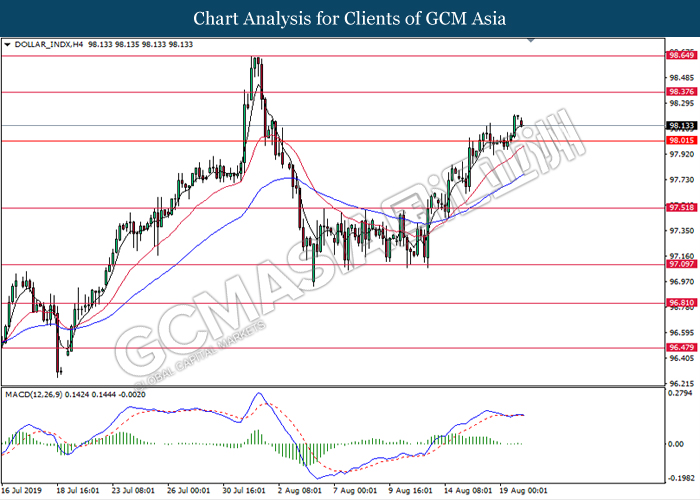

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from its top-level. MACD which display diminishing bullish momentum suggest index to extend its retracement towards the support level 98.00.

Resistance level: 98.40, 98.65

Support level: 98.00, 97.50

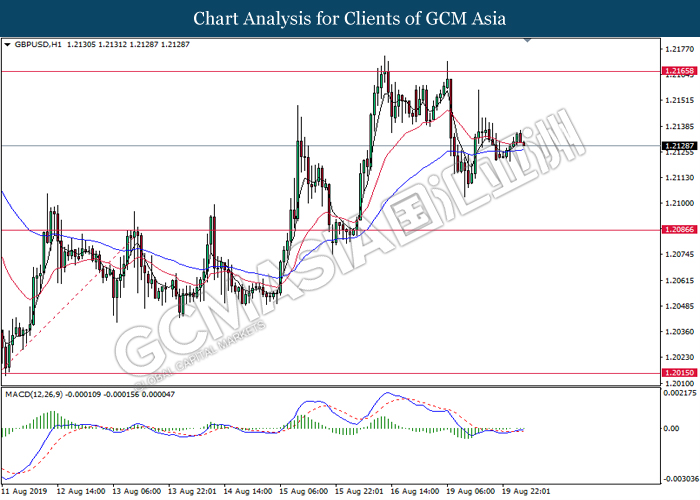

GBPUSD, H1: GBPUSD was traded lower following prior retracement from its top-level. However, due to lack of momentum and signal from the MACD, it is suggested to wait for further confirmation before entering the market.

Resistance level: 1.2165, 1.2220

Support level: 1.2085, 1.1980

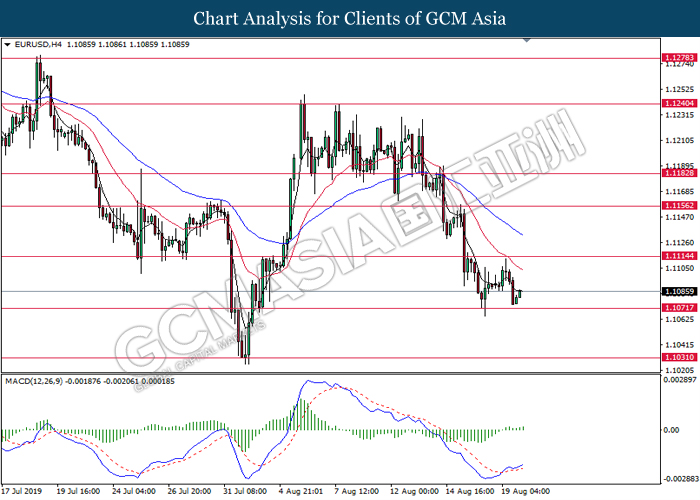

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level 1.1070. MACD which illustrate bullish momentum with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 1.1115.

Resistance level: 1.1115, 1.1155

Support level: 1.1070, 1.1030

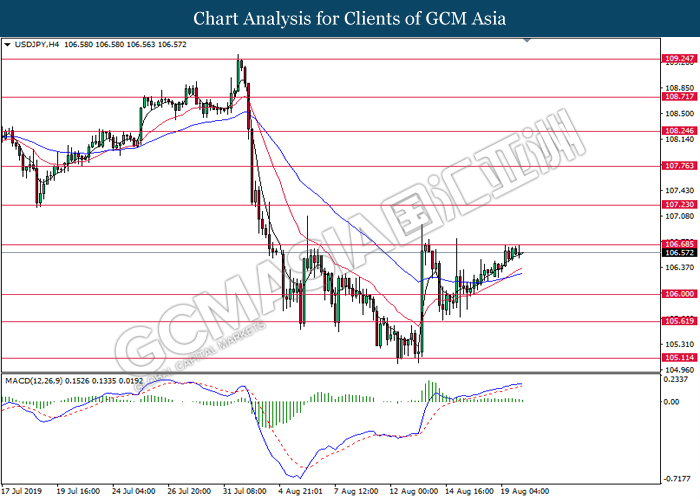

USDJPY, H4: USDJPY was traded higher while currently testing near the resistance level 106.70. However, MACD which display diminishing bullish momentum suggest the pair to undergo short-term technical correction and retrace towards the support level 106.00.

Resistance level: 106.70, 107.25

Support level: 106.00, 105.60

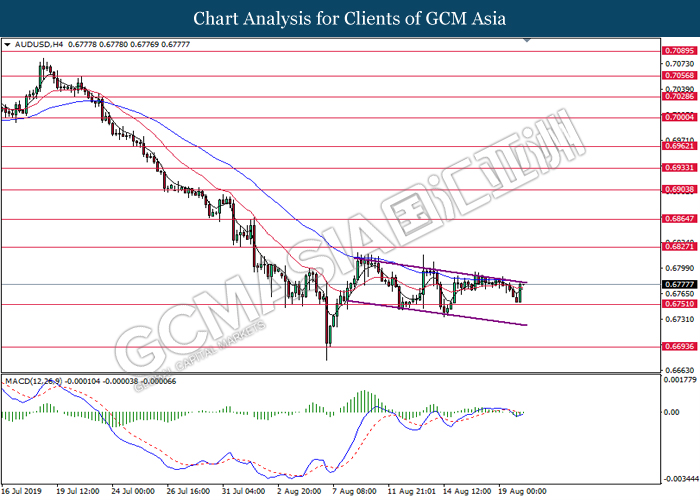

AUDUSD, H4: AUDUSD was traded higher while currently testing the top-level of its downward channel. MACD which illustrate bullish bias signal suggest the pair to extend its gains after successfully breaking above the downward channel.

Resistance level: 0.6825, 0.6865

Support level: 0.6750, 0.6695

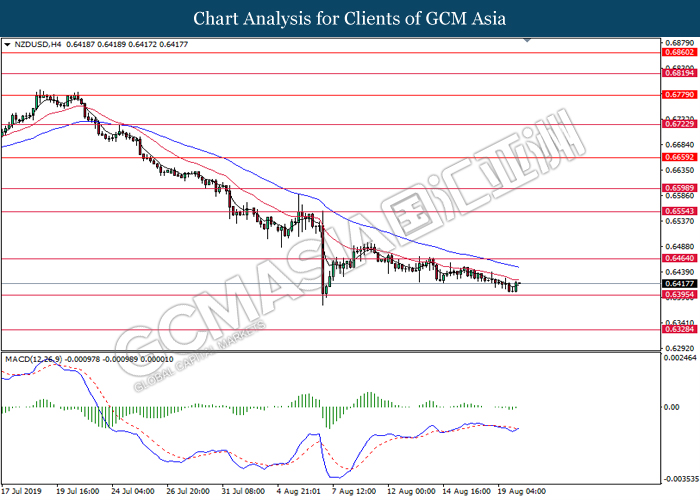

NZDUSD, H4: NZDUSD was traded higher following prior rebound from its support level 0.6395. MACD which display bullish bias signal suggest the pair to extend its rebound towards the resistance level 0.6465.

Resistance level: 0.6465, 0.6555

Support level: 0.6395, 0.6330

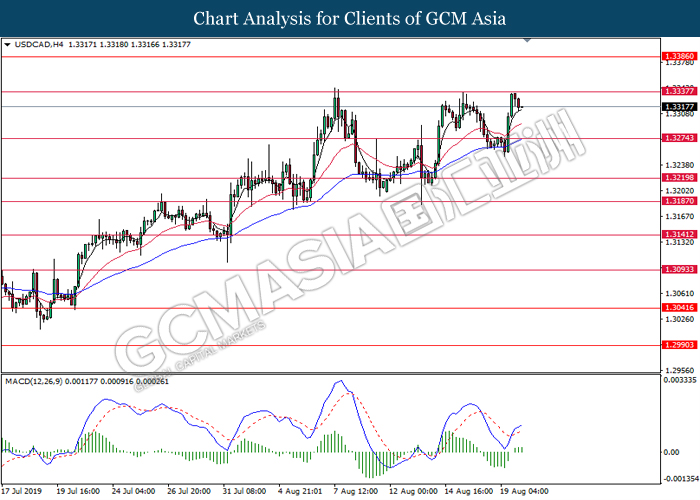

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.3340. MACD which display diminishing bullish momentum suggest the pair to extend its retracement towards the support level 1.3275.

Resistance level: 1.3340, 1.3385

Support level: 1.3275, 1.3220

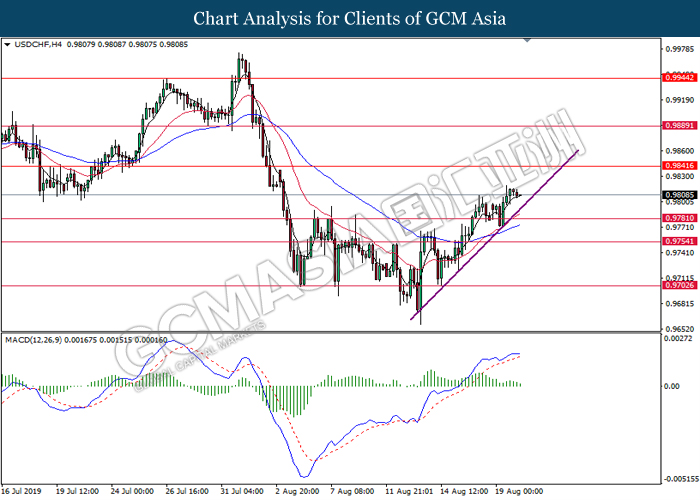

USDCHF, H4: USDCHF was traded lower following prior retracement from its top-level. MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracement towards the support level 0.9780.

Resistance level: 0.9840, 0.9890

Support level: 0.9780, 0.9755

CrudeOIL, H4: Crude oil price was traded higher while currently testing near the downward trendline. MACD which display bullish momentum suggest the commodity to extend its gains after successfully breaking above the downward trendline.

Resistance level: 56.80, 57.85

Support level: 55.90, 54.65

GOLD_, Daily: Gold price was traded lower while currently testing near the support level at 1490.00. MACD which display bearish momentum with the formation of death cross suggest the commodity to extend its losses after successfully breakout below the support level at 1490.00.

Resistance level: 1507.10, 1526.60

Support level: 1490.00, 1477.20