20 September 2022 Afternoon Session Analysis

Lockdown easing from China, sparked positive outlook toward Aussie.

The China proxy currency such as Australia Dollar rebounded from its lower level following Chinese authorities eased their Covid-19 lockdown in Chengdu. According to Reuters, the Chinese authorities claimed that the government departments, public transport services and companies were able to resume work on Monday, after shutting down on 1st September. The easing Covid-19 restriction would likely to spark positive prospect toward the China economy. Since China remained as Australia’s largest trading partner, the positive outlook for the Chinese economy would also enhance the demand for the Australia Dollar in future. On the other hand, the Japanese Yen is currently trading at 24-year lows, while the authorities have signaled to take action to stabilize the Japanese yen. Ahead of crucial Bank of Japan’s interest rate decision this week, investors would continue to scrutinize at whether Bank of Japan would shift from its current ultra-loose monetary policy. As of writing, AUD/USD appreciated by 0.01% to 0.6725 while USD/JPY depreciated by 0.07% to 143.10.

In the commodities market, the crude oil price surged 0.43% to $85.35 per barrel as of writing amid the easing of Covid-19 lockdown from Chinese authorities, which spurring bullish momentum on this black-commodity. On the other hand, the gold price depreciated by 0.03% to $1676.00 per troy ounces as of writing ahead of crucial FOMC meeting this week.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

01:00 EUR ECB President Lagarde Speaks

(21st Sep)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Aug) | 1.685M | 1.610M | – |

| 20:30 | CAD – Core CPI (MoM) (Aug) | 0.5% | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

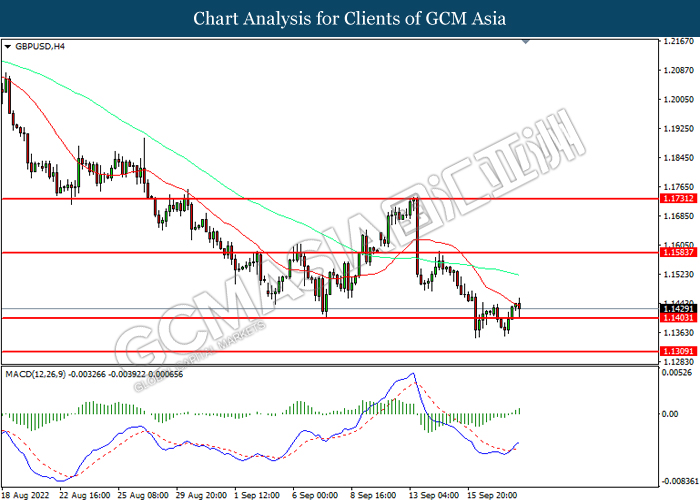

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1585, 1.1730

Support level: 1.1405, 1.1310

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0060, 1.0180

Support level: 0.9955, 0.9875

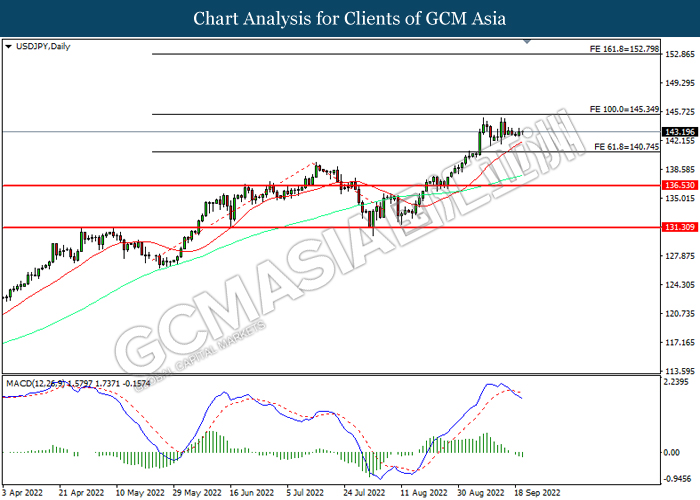

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

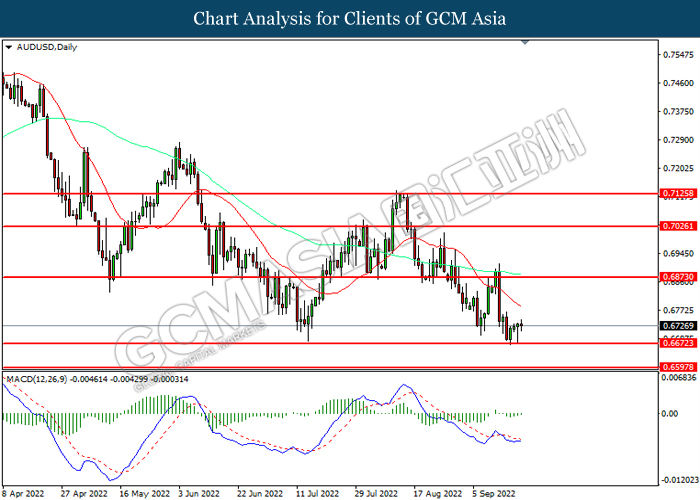

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6875, 0.7025

Support level: 0.6675, 0.6595

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6050, 0.6155

Support level: 0.5945, 0.5845

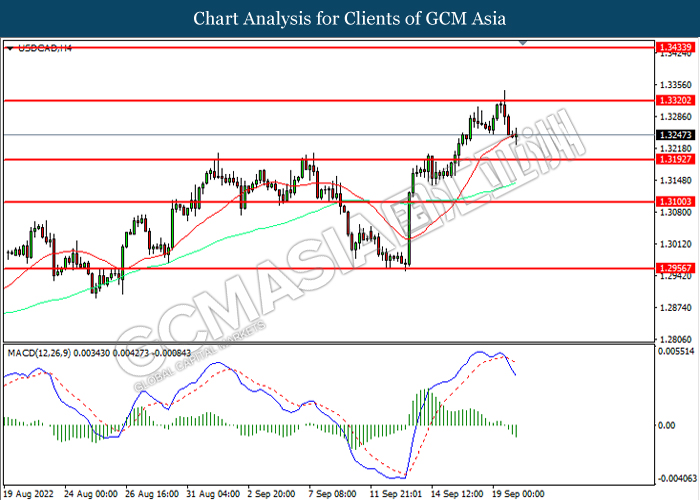

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.3320, 1.3435

Support level: 1.3195, 1.3100

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9740, 0.9855

Support level: 0.9635, 0.9515

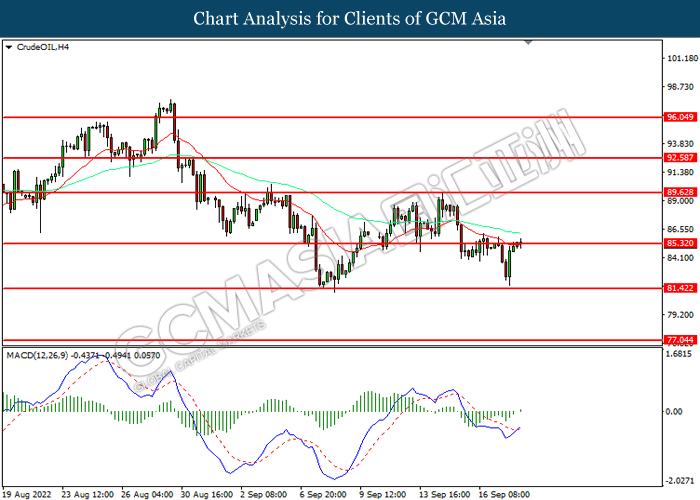

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 89.65, 92.60

Support level: 85.30, 81.40

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1680.00, 1693.65

Support level: 1656.10, 1642.20