20 September 2022 Morning Session Analysis

Unstoppable bulls in dollar market.

The dollar index, which gauges its value against a basket of six major currencies, was traded within a tight range ahead of a slew of central bank meetings this week, where the Federal Reserve’s will be the main focus of the market participants. At this juncture, the investors reckon that the Federal Reserve is likely to raise the interest rates at least by another 75-basis point in the upcoming meeting. Besides, it is getting more and more market players are seeing the Federal Reserve has reason to go for a hefty rate hike, said 100 basis point, whereby the recent economic data showed resilience in the US economy. With that, the bull in dollar market is unlikely to be topped in anytime soon. The Federal Reserve will hold a two days meeting starting from Wednesday, where the final decision of the interest rate adjustment would be announced on early Thursday, accompanied by some projections of inflation, economic growth and future path of interest rates from the Fed. As of writing, the dollar index dropped -0.16% to 109.60.

In the commodities market, the crude oil price rose by 0.25% to $85.75 per barrel after an internal document showed that the OPEC+ fell short from the oil production plan, outweighing the fears of slowing demand and hefty rate hikes. Besides, the gold prices appreciated by 0.10% to $1675.35 per troy ounce after the dollar index retreated from the recent high level.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

01:00 EUR ECB President Lagarde Speaks

(21st Sep)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Aug) | 1.685M | 1.610M | – |

| 20:30 | CAD – Core CPI (MoM) (Aug) | 0.5% | – | – |

Technical Analysis

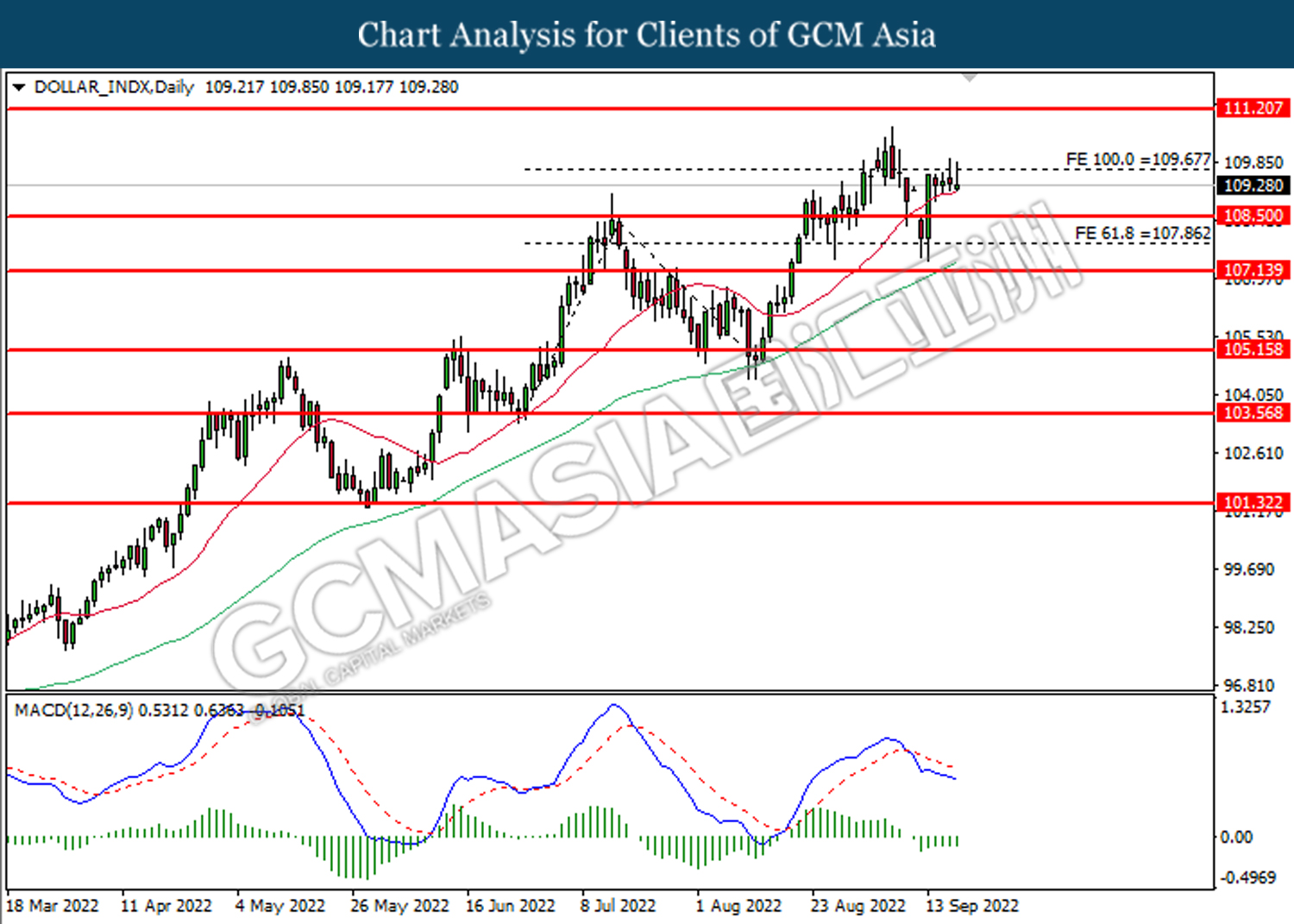

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

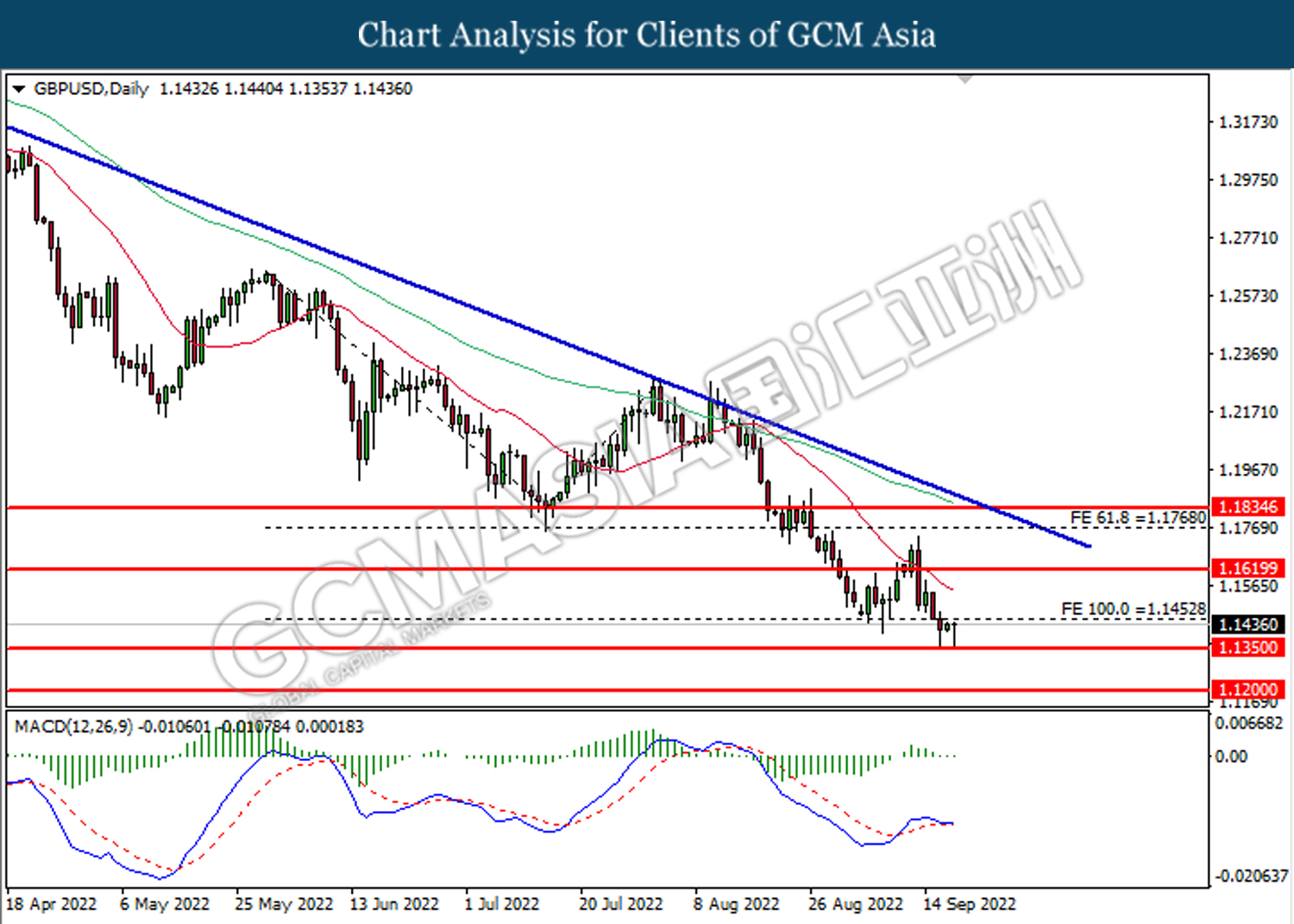

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1455. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1350.

Resistance level: 1.1455, 1.1620

Support level: 1.1350, 1.1200

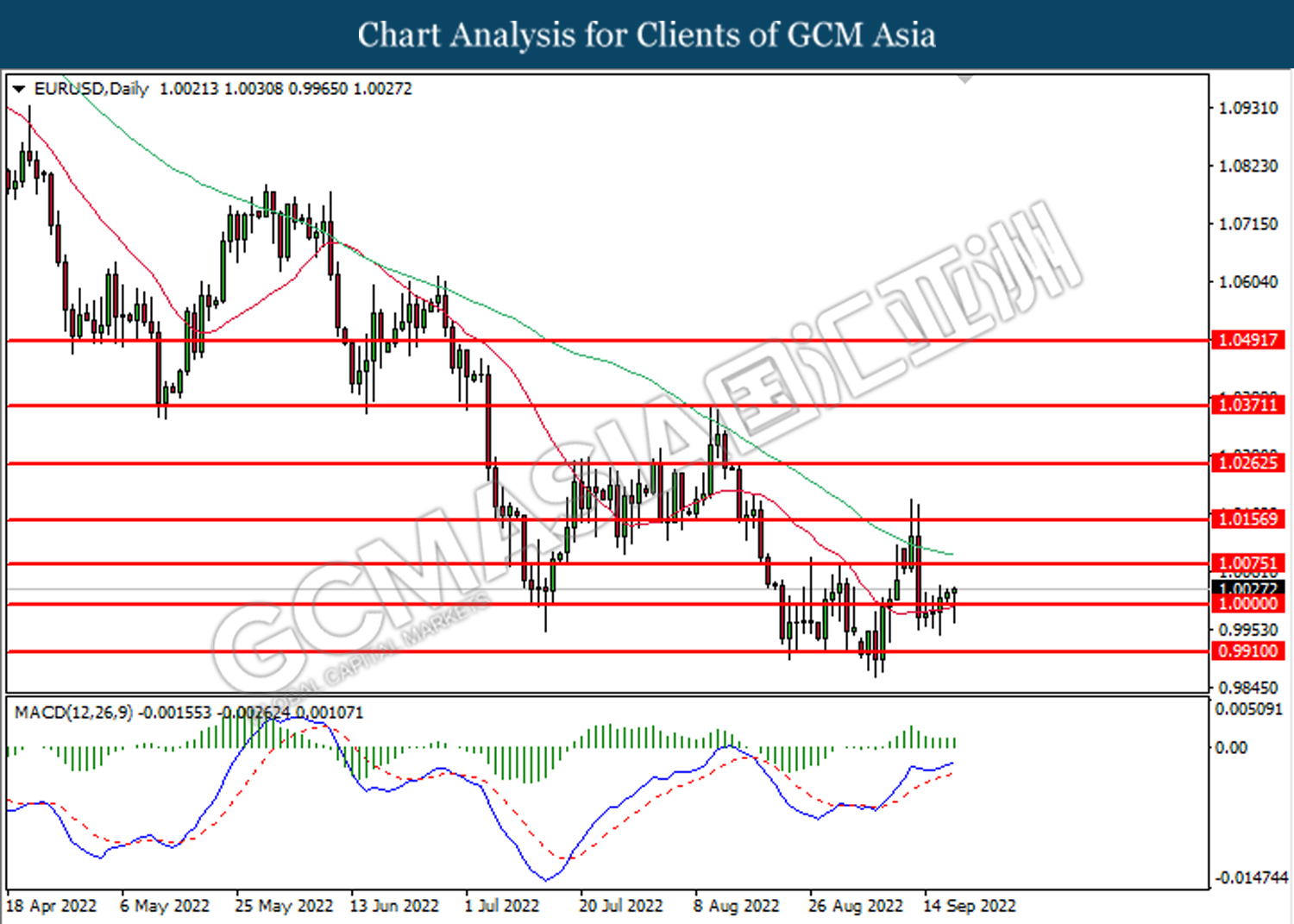

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0075.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9910

USDJPY, Daily: USDJPY was traded lower following prior retracement from the higher level. MACD which illustrated bearish momentum suggest the pair to extend its losses toward the support level at 141.50.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

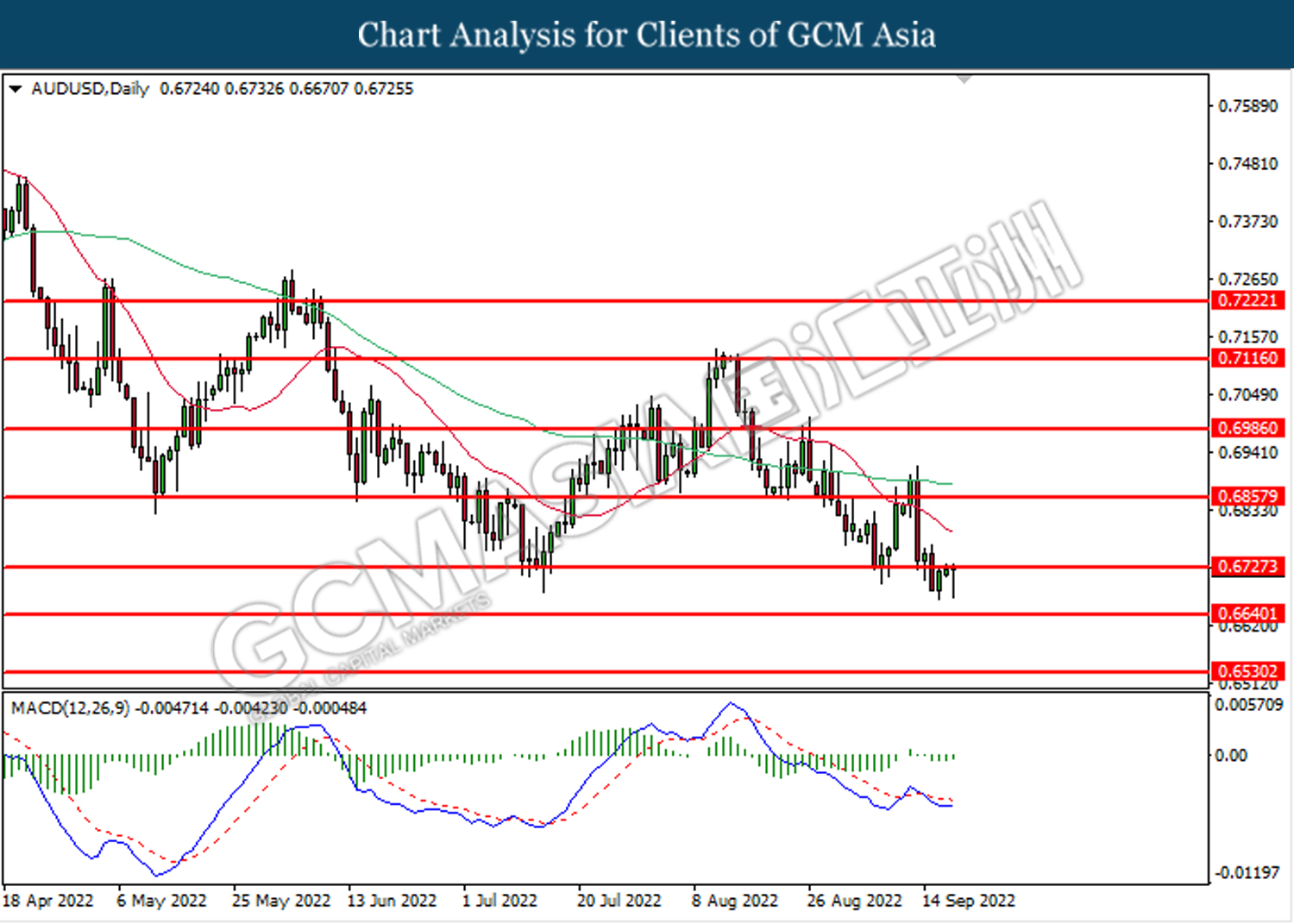

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

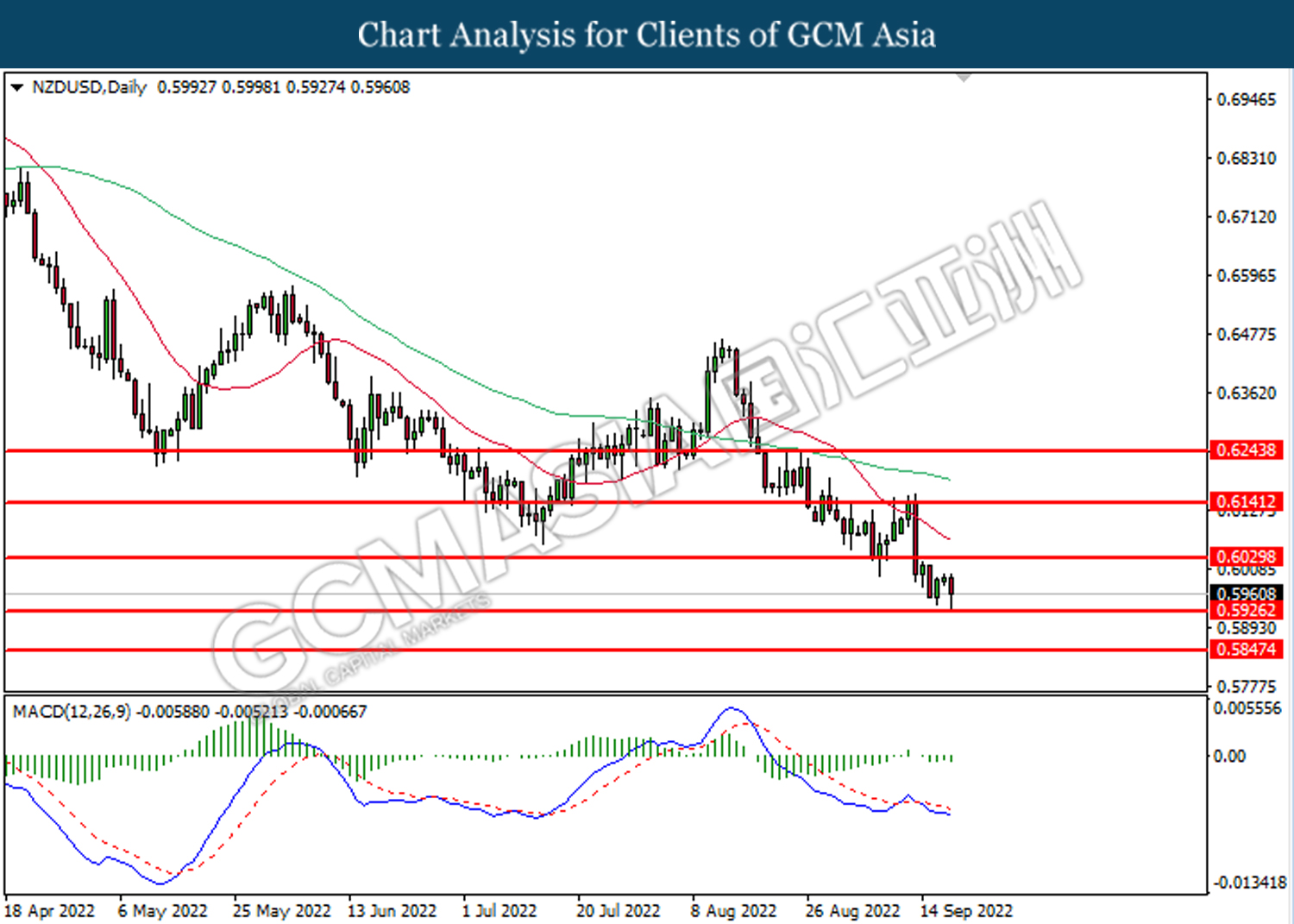

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.5925.

Resistance level: 0.6030, 0.6140

Support level: 0.5925, 0.5845

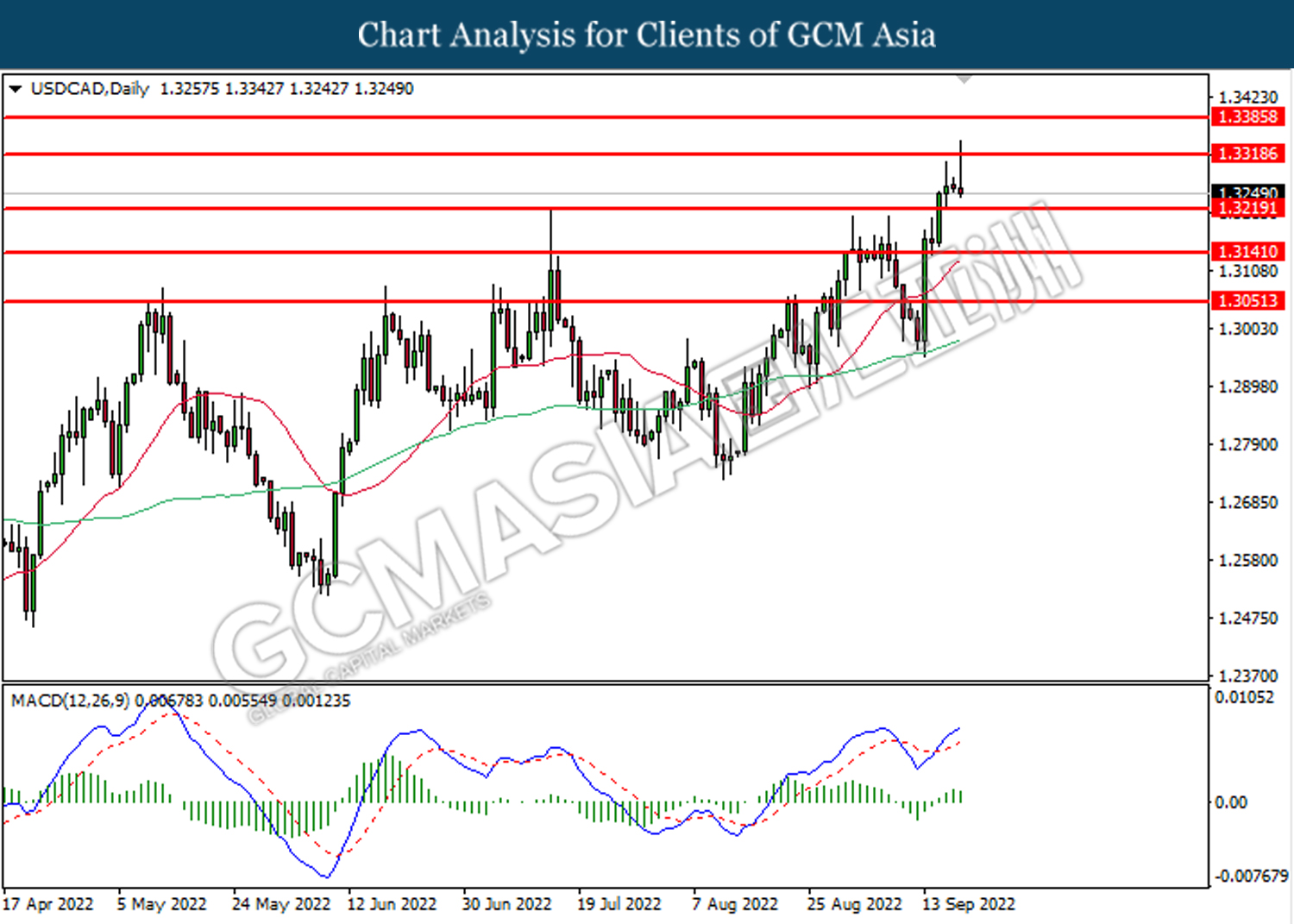

USDCAD, Daily: USDCAD was traded higher following prior retracement from the resistance level at 1.3320. MACD which illustrated diminishing bullish momentum suggests the pair to extend losses toward the support level at 1.3220.

Resistance level: 1.3320, 1.3385

Support level: 1.3220, 1.3140

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

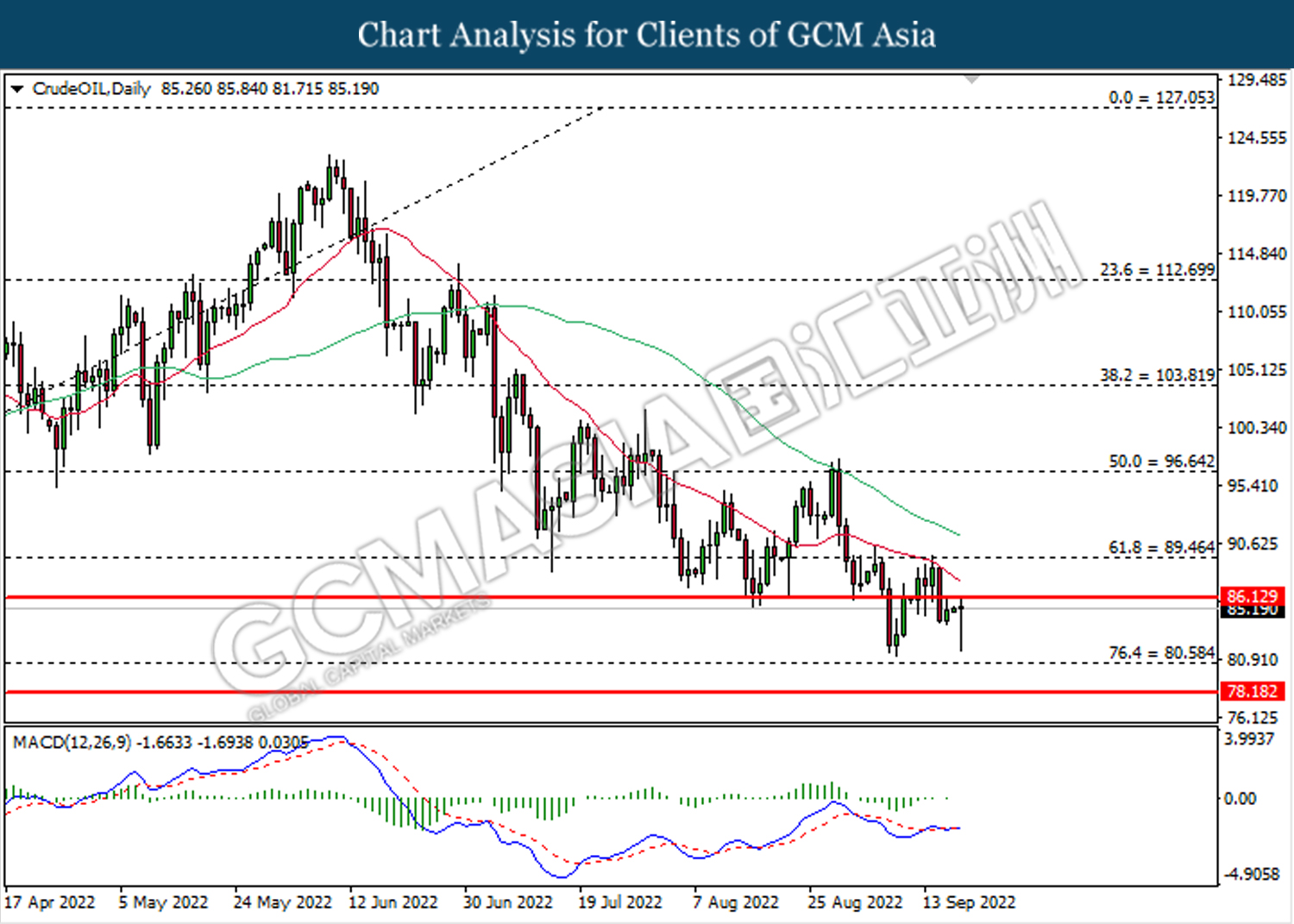

CrudeOIL, Daily: Crude oil price was traded higher while currently testing near the resistance level at 86.15. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 86.15, 89.45

Support level: 80.60, 78.20

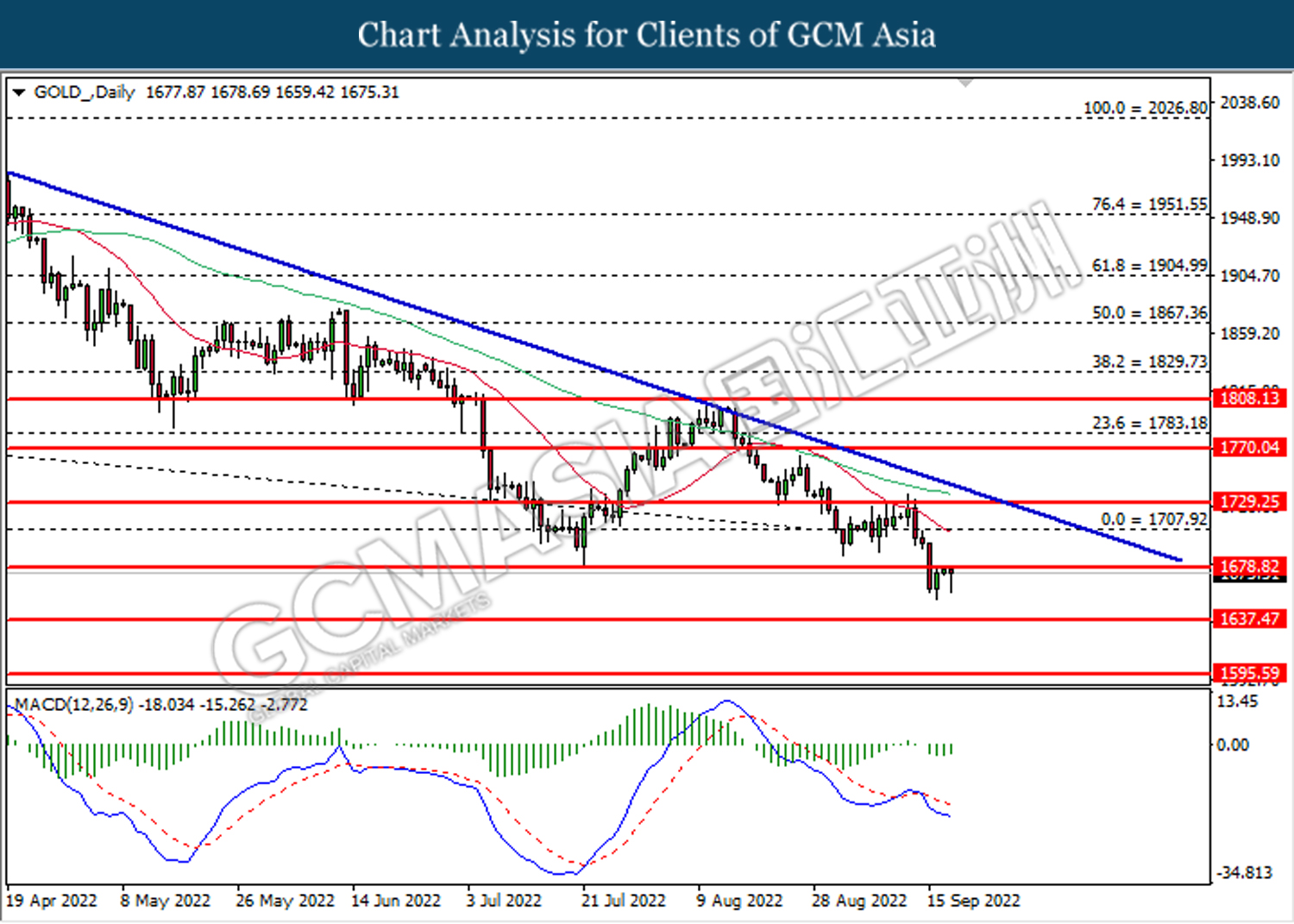

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1678.80. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1678.80, 1707.90

Support level: 1637.45, 1595.60