20 December 2022 Afternoon Session Analysis

Euro plunged as economic condition might be threatened further.

The EUR/USD, which widely traded by global investors lost its ground on yesterday following the rising possibilities of energy crisis face by European. According to CNBC, European Union (EU) agreed to implement a price cap on natural gas. French Energy Minister Agnes Pannier Runacher claimed on yesterday that the range of 160 to 200 euros [eur/MWh] is acceptable for France nation. The move is intended to shield consumers from the spiking gas price that driven by invasion of Russia-Ukraine. European natural gas price reached historic levels of around 350 euros per megawatt hour in August, whereas market participants were concerned about the bloc’s unity in fighting the energy crisis. However, the profits of gas sellers would likely to be deducted when the price cap was implemented, as well as gas-producing countries may not sell their gas to the EU. With that, it would likely to exacerbate the energy crisis issue in the Eurozone, which dragged down the value of Euro. As of writing, the EUR/USD edged up by 0.03% to 1.0614.

In the commodities market, the crude oil price appreciated by 0.78% to $75.97 per barrel as of writing over the price cap implementation from EU. On the other hand, the gold price rose by 0.18% to $1792.17 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Nov) | 1.512M | 1.485M | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Oct) | -0.7% | 1.4% | – |

Technical Analysis

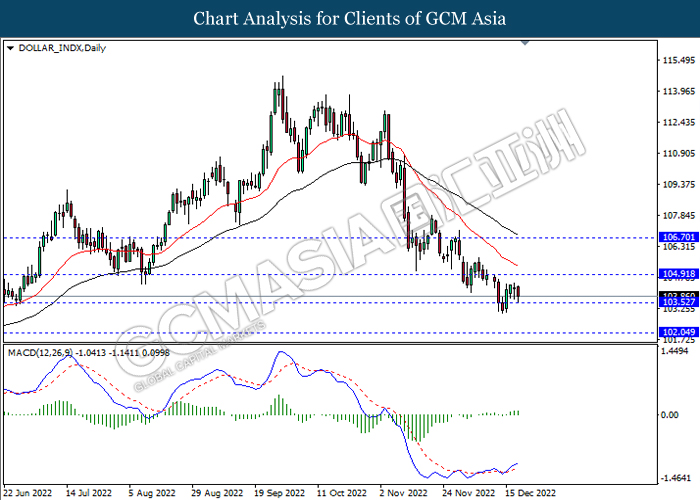

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

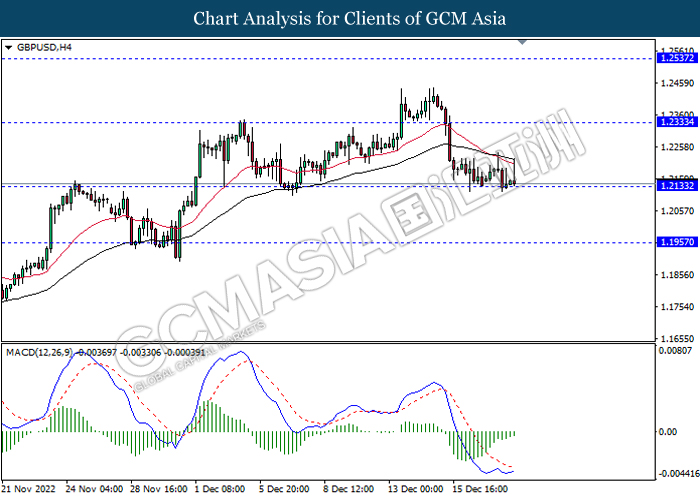

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

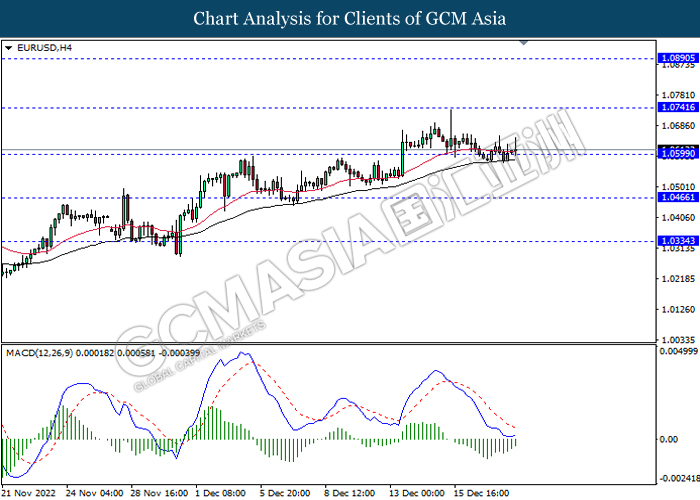

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

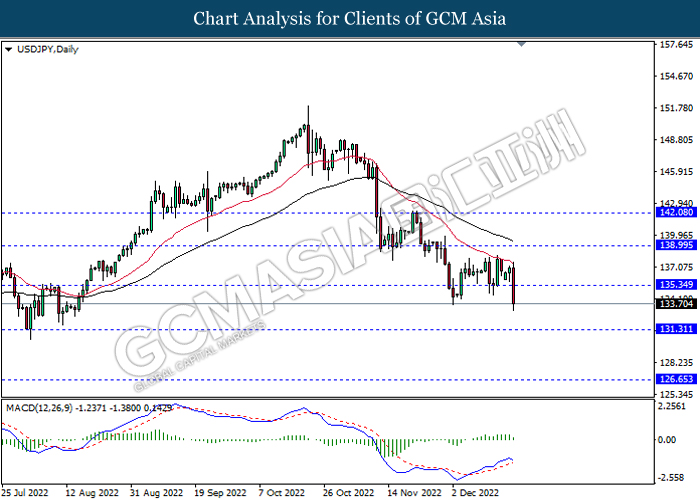

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 135.35, 139.00

Support level: 131.30, 126.65

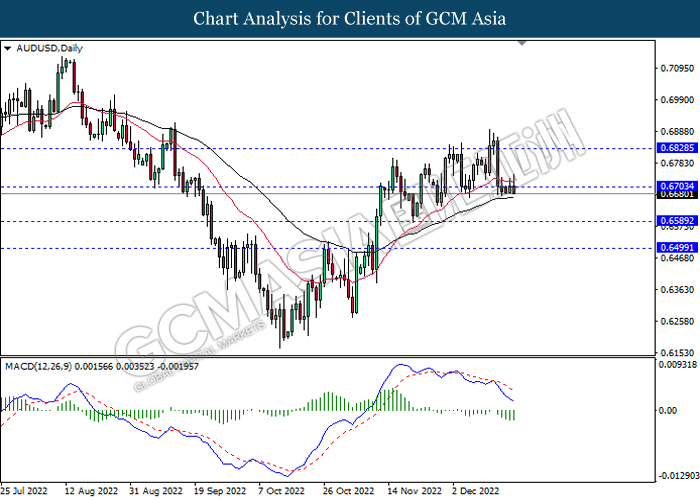

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

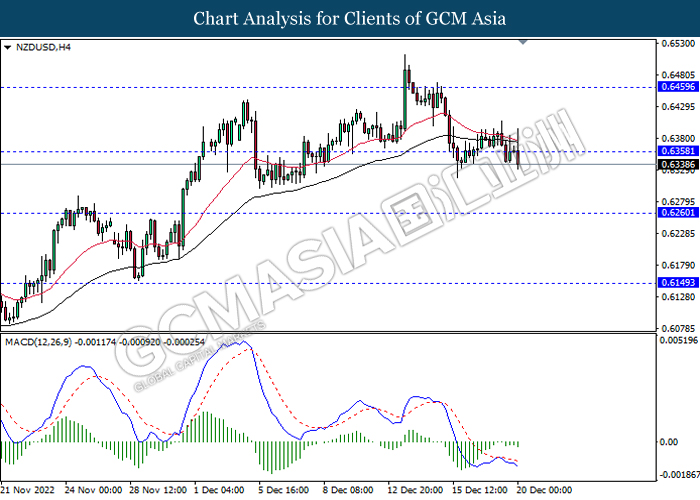

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

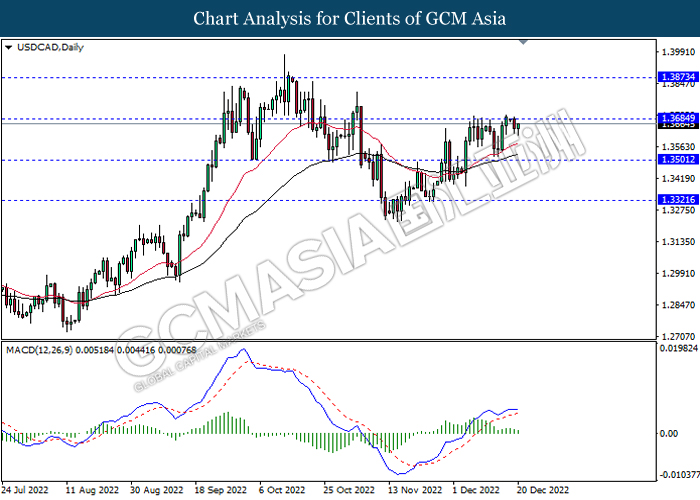

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

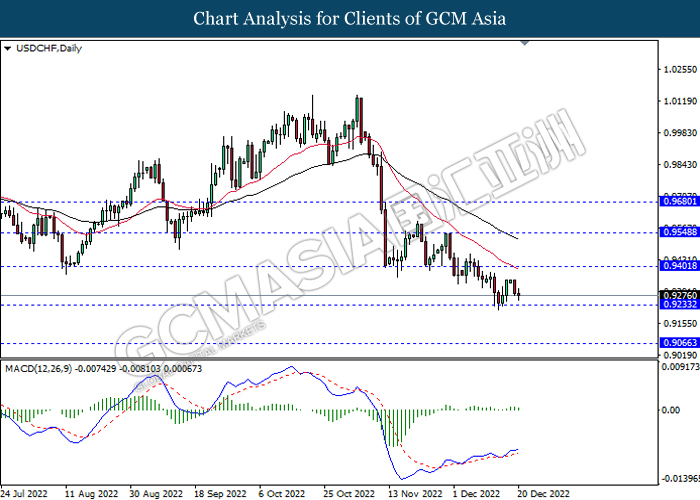

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

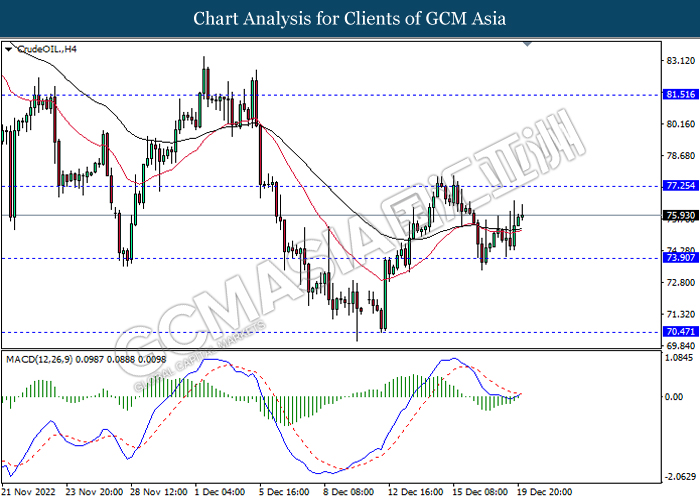

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

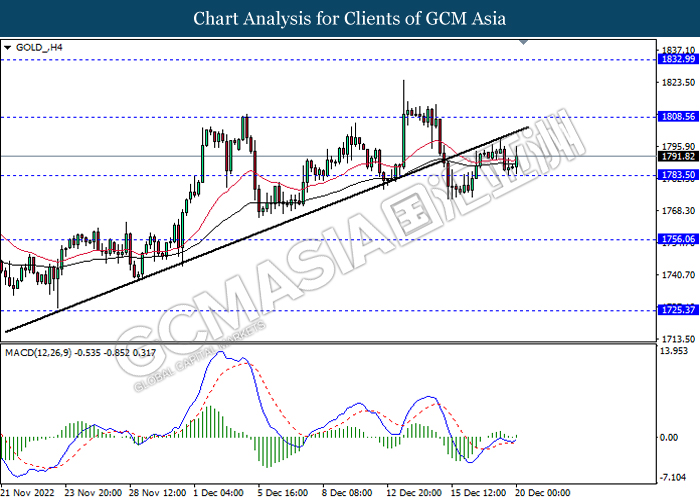

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05