21 February 2019 Morning Session Analysis

Dollar falls amid dovish Fed, bolstered by Brexit turmoil.

Dollar index measuring against a basket of six major currency pairs plunged near to its 96.00 level following the release of FOMC Meeting Minutes for January which carried a more dovish tone. In the minutes, Fed will use a more patient approach to its interest rates while policymakers expressed their willingness to end the balance sheet unwinding program later this year and keeping rate hikes on hold to further gauge the economy outlook for US. However, dollar’s fall was bolstered by political turmoil in the UK as three lawmakers defected from Prime Minister Theresa May’s Conservative Party. As May is set to renew talks with the EU this week to tackle the Irish backstop issue, lack of faith towards May caused three lawmakers to quit their position thus pressuring the currency. Investors now fear that if May is unable to obtain a better deal with the EU, UK will be forced to crash out of EU without a deal, possibly leading the economy into a recession stance. As of writing, dollar index was down by 0.01% to 96.35 while pair of GBP/USD was 0.03% to 1.3040

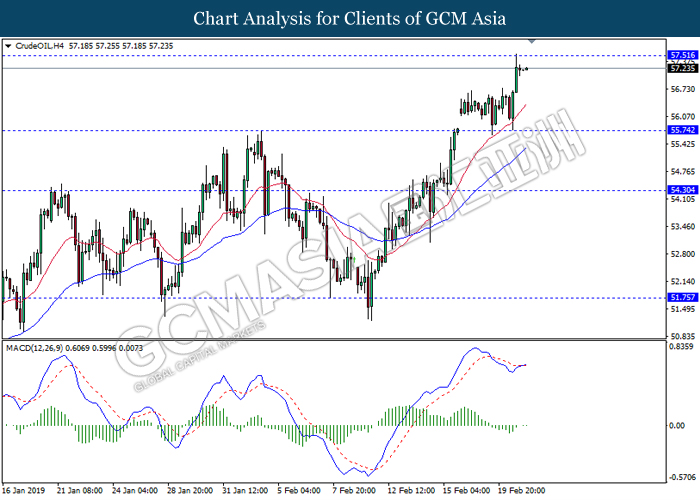

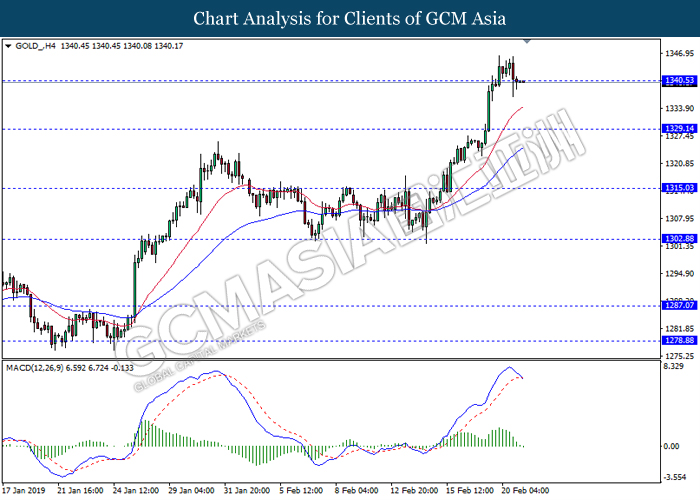

In the commodities market, crude oil price fell by 0.82% to $57.20 per barrel after reaching a new high in 2019. The fall on prices was caused by increasing inventories in the US as reported by American Petroleum Institute. However, current sentiment for oil market remained bullish as tensions from the trade war are slowly lifted from the market while investors expect both US and China to reach an agreement. On the other hand, OPEC’s production cut and sanctions on Iran and Venezuela oil continues to support oil prices. Gold prices on the other hand was gaining by 0.15% to $1340.45, supported by political turmoil in UK and dovish statement from the FOMC.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI | 49.7 | 50.0 | – |

| 17:00 | EUR – Markit Composite PMI (Feb) | 51.0 | 51.1 | – |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Dec) | -0.4% | 0.2% | – |

| 21:30 | USD – Initial Jobless Claims | 239K | 220K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Feb) | 17.0 | 15.6 | – |

| 22:45 | USD – Markit Composite PMI (Feb) | 54.4 | 55.1 | – |

| 23:00 | USD – Existing Home Sales (Jan) | 4.99M | 5.01M | – |

Technical Analysis

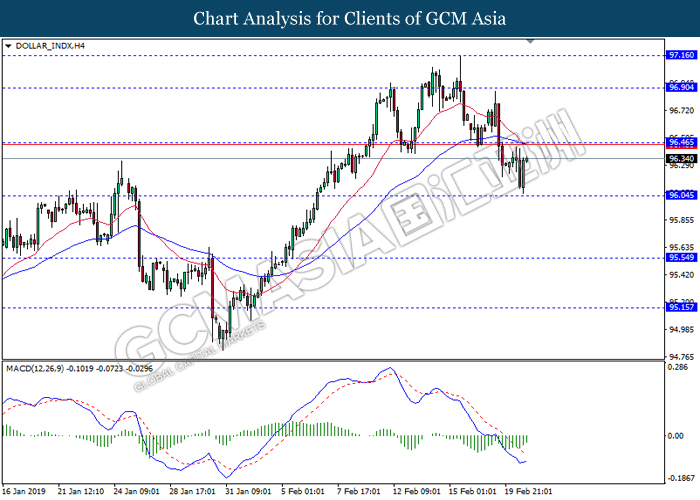

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level 96.05. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 96.45.

Resistance level: 96.45, 96.90

Support level: 96.05, 95.55

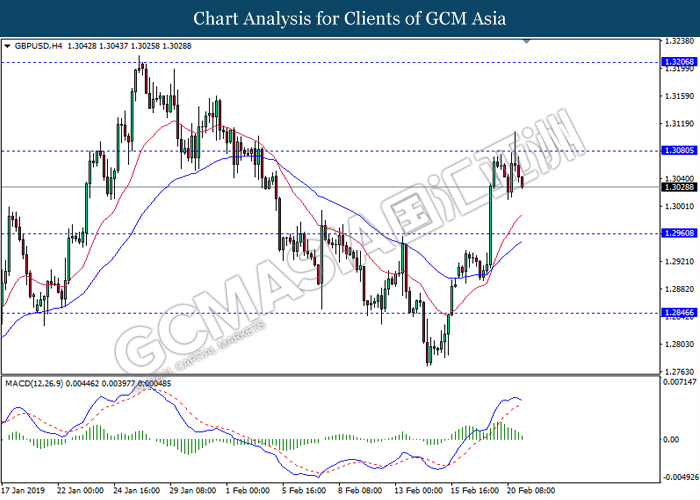

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level 1.3080. MACD which display bearish bias signal suggest the pair to extend its retracement towards the support level 1.2960.

Resistance level: 1.3080, 1.3205

Support level: 1.2960, 1.2845

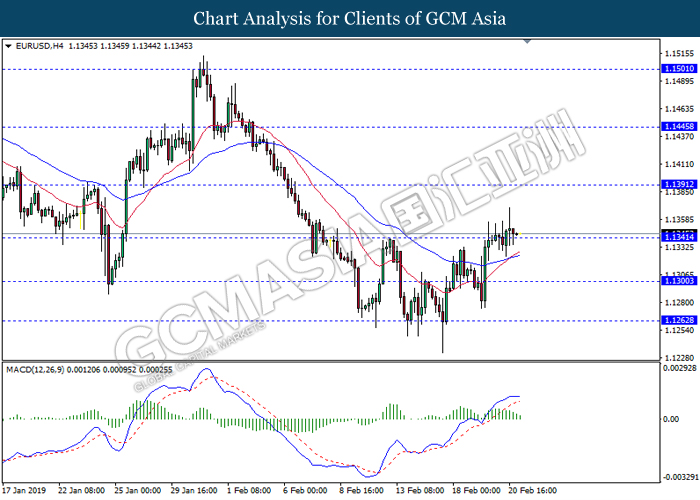

EURUSD, H4: EURUSD was traded flat after it breaks above the resistance level 1.1340. However, MACD which illustrate bearish bias signal suggest the pair to be traded lower when it breaks back below the support level 1.1340.

Resistance level: 1.1390, 1.1445

Support level: 1.1340, 1.1300

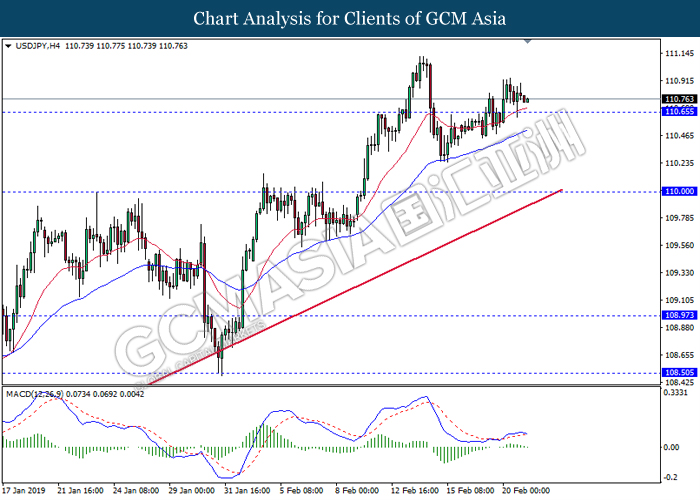

USDJPY, H4: USDJPY was traded flat following recent retracement from its high level. MACD which display diminishing bullish momentum suggest the pair to extend its retracement towards the support level 110.65.

Resistance level: 111.40, 112.20

Support level: 110.65, 110.00

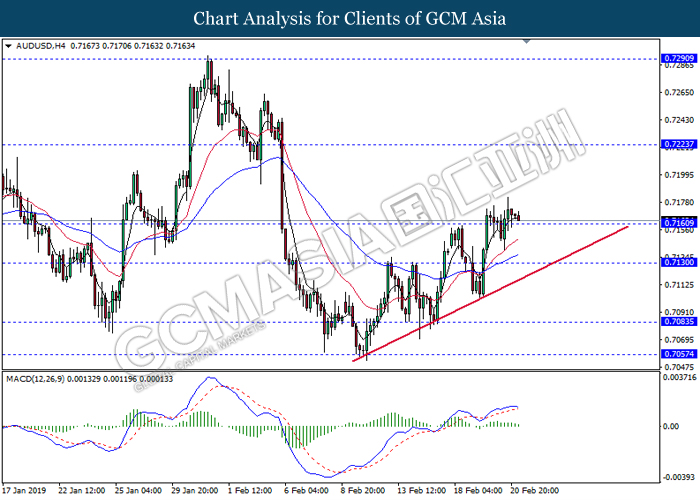

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level 0.7160. MACD which display bearish bias signal suggest the pair to extend its bearish momentum after it breaks below the support level.

Resistance level: 0.7225, 0.7290

Support level: 0.7160, 0.7130

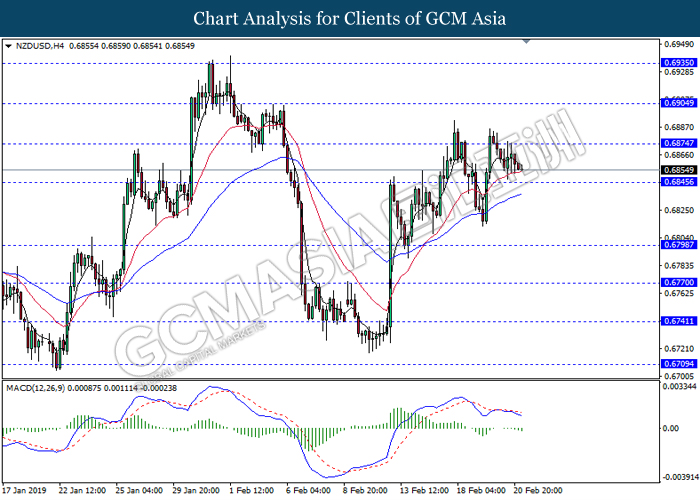

NZDUSD, H4: NZDUSD was traded lower following recent retracement from the resistance level 0.6875. MACD which illustrate bearish momentum with the formation of death cross suggest the pair to extend its retracement towards the support level 0.6845.

Resistance level: 0.6875, 0.6905

Support level: 0.6845, 0.6800

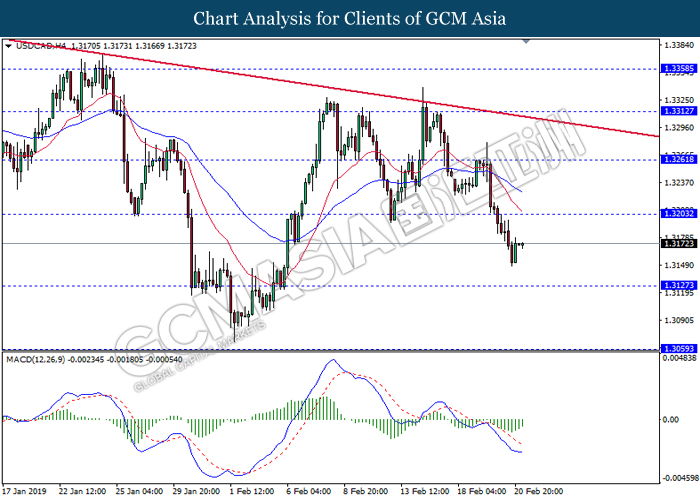

USDCAD, H4: USDCAD was traded higher following prior rebound from its low level. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.3205.

Resistance level: 1.3205, 1.3260

Support level: 1.3125, 1.3060

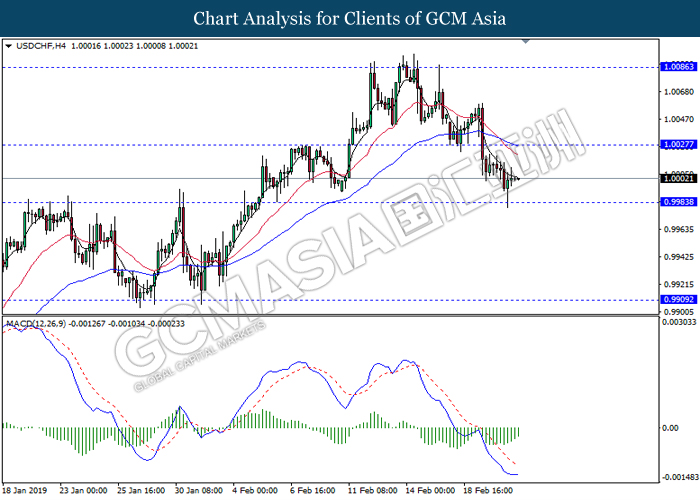

USDCHF, H4: USDCHF was traded higher following prior rebound from support level 0.9985. MACD which illustrate bullish bias signal suggest the pair to extend its rebound towards the resistance level 1.0025.

Resistance level: 1.0025, 1.0085

Support level: 0.9985, 0.9910

CrudeOIL, H4: Crude oil price was traded higher while currently testing near the resistance level 57.50. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower as a short term technical correction towards the support level 55.75

Resistance level: 57.50, 59.20

Support level: 55.75, 54.30

GOLD_, H4: Gold price was traded lower while currently testing the support level 1340.50. MACD which illustrate bearish momentum with the starting formation of death cross suggest the commodity to extend its bearish momentum after it breaks below the support level 1340.50.

Resistance level: 1353.10, 1364.95

Support level: 1340.50, 1329.15