21 February 2023 Afternoon Session Analysis

The Aussie uptrend reversed as RBA loosen its monetary decision.

As one of the major currencies in the world, the Aussie dollar has experienced a tremendous sell-off in the recent trading session as the Reserve Bank of Australia (RBA) loosen its monetary policy decision. The board members decided to increase the interest rate target by 25bp to 3.35% as they expected the inflation has reached its peak last year December. The board members also argued that aggressively increasing the rate will lead to high prices and wages, which would cause higher inflation in persistent. In addition, a sharp drop in energy prices, due to lower energy demand in Europe following the winter weather, is expected to ease inflation. However, the bearish momentum of the Aussie dollar was offset by positive economic data. The unemployment rate in Australia was at its lowest level in nearly 50 years and thus, increased the space for further RBA tightening decisions. Some of the board members argued that the inflation in Australia remains high and still far away from the RBA’s target of 2% to 3%. The board agreed that further increases in the interest rate are needed to ensure that the inflation rate returns to its target. As of writing, the AUD/USD slipped by -0.20% to $0.6891.

In the commodity market, the crude oil price depreciated by -1.14% to $76.53 per barrel amid investors’ anticipation for more cues from Fed. Besides that, the gold price dropped by -0.17% to $1847.15 per troy ounce as of writing amid investors’ anticipates for more rate hikes for Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Feb) | 47.3 | 47.8 | – |

| 17:30 | GBP – Composite PMI | 48.5 | – | – |

| 17:30 | GBP – Manufacturing PMI | 47.0 | 47.5 | – |

| 17:30 | GBP – Services PMI | 48.7 | 49.2 | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Feb) | 16.9 | 22.0 | – |

| 21:30 | CAD – Core CPI (MoM) (Jan) | -0.3% | 0.2% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | -0.6% | -0.1% | – |

| 23:00 | USD – Existing Home Sales (Jan) | 4.02M | 4.10M | – |

Technical Analysis

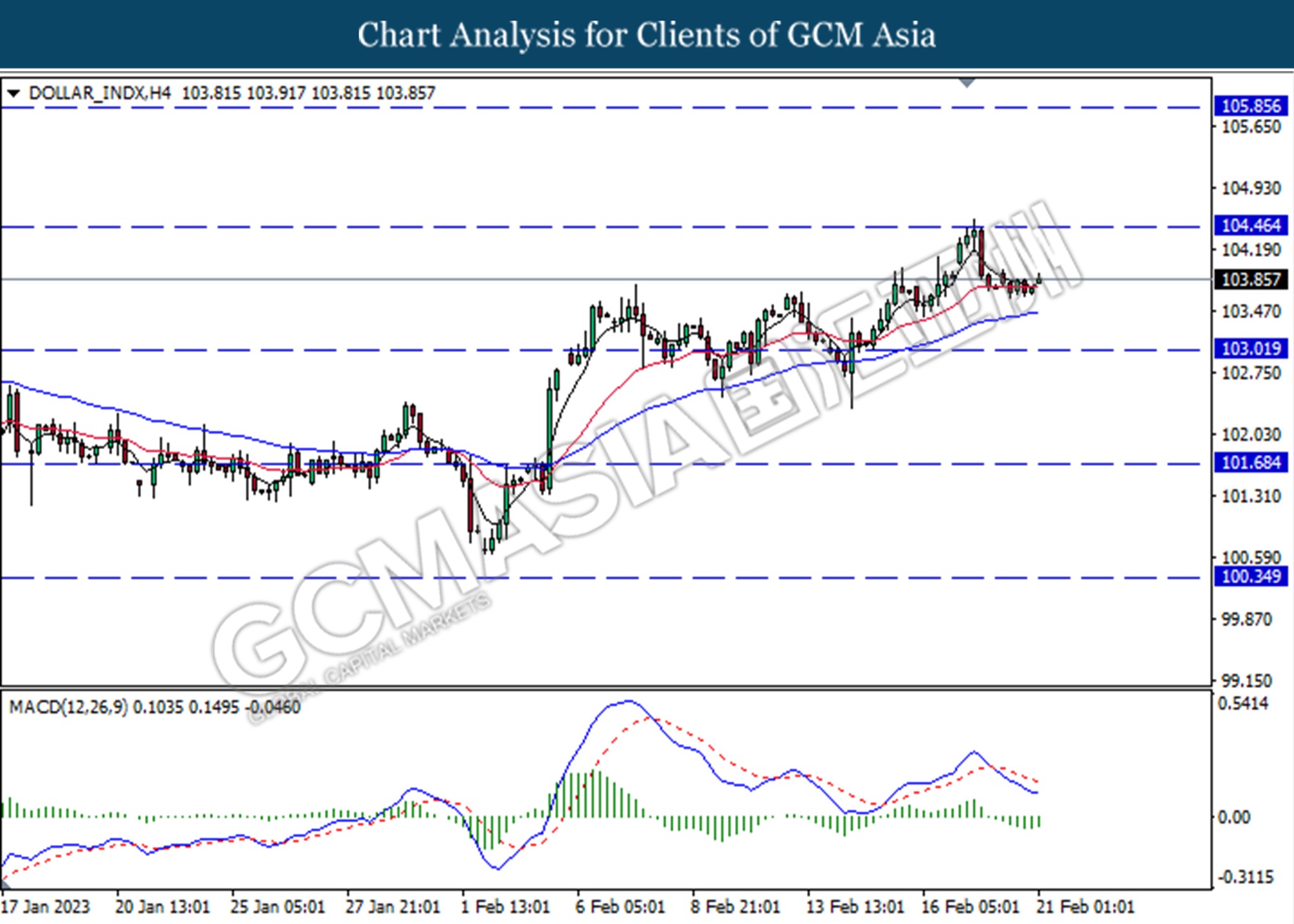

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the lowest level. MACD which illustrated decreasing bearish momentum suggests the index to extend its gain toward the resistance level at 104.45

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

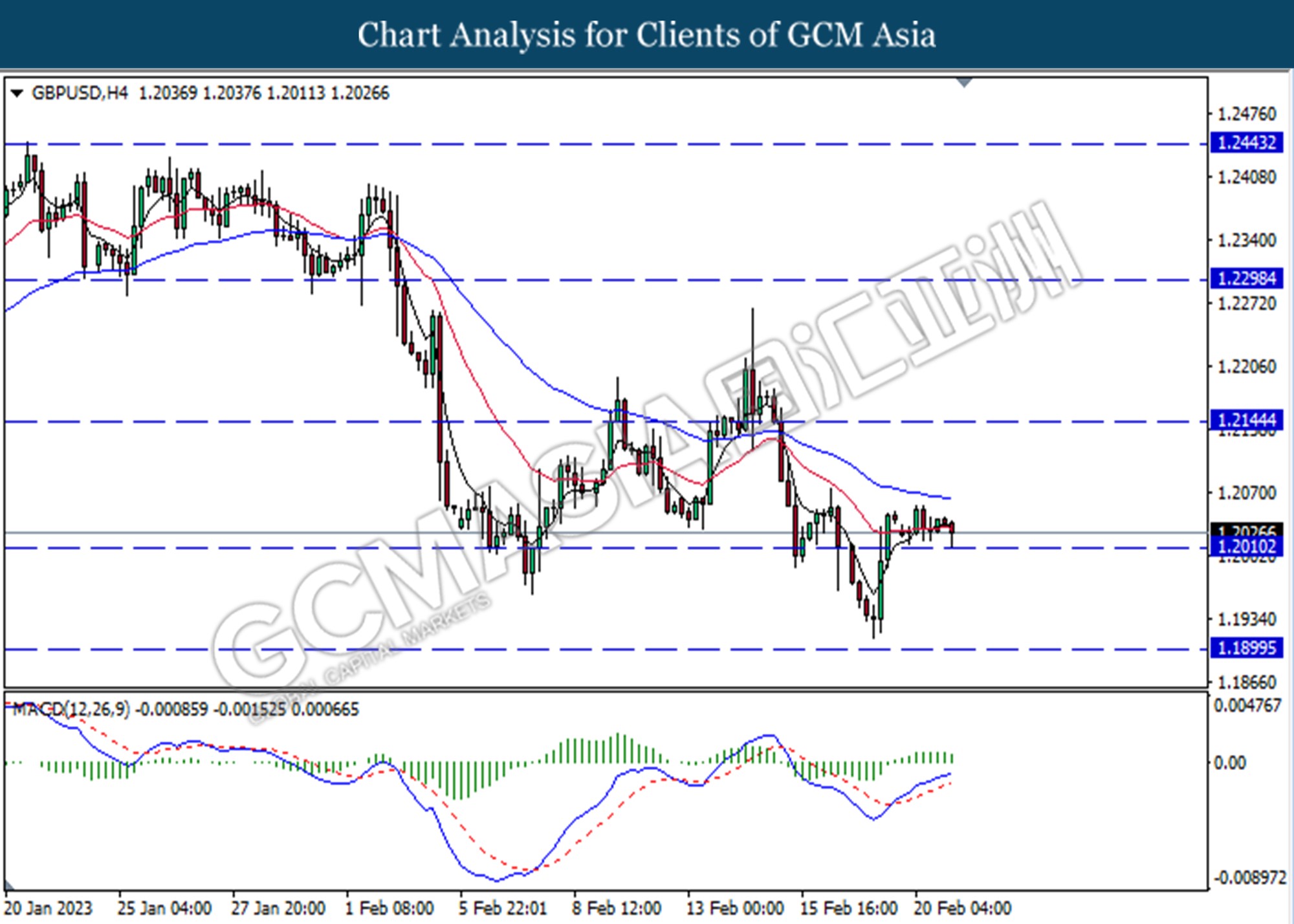

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2010. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses after it successfully breaks below the support level.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

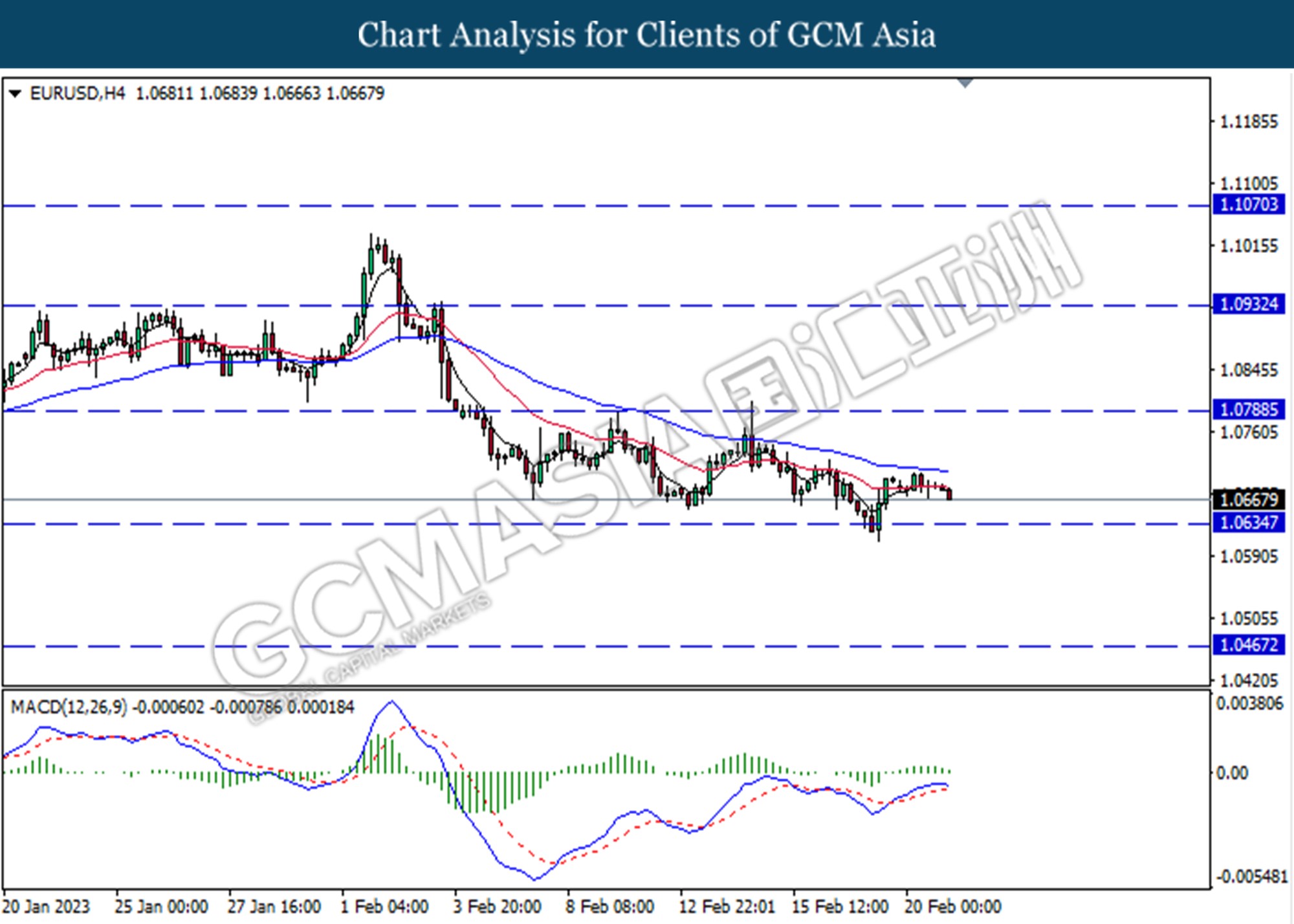

EURUSD, H4: EURUSD was traded lower following a prior retracement from a higher level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 1.0635.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0470

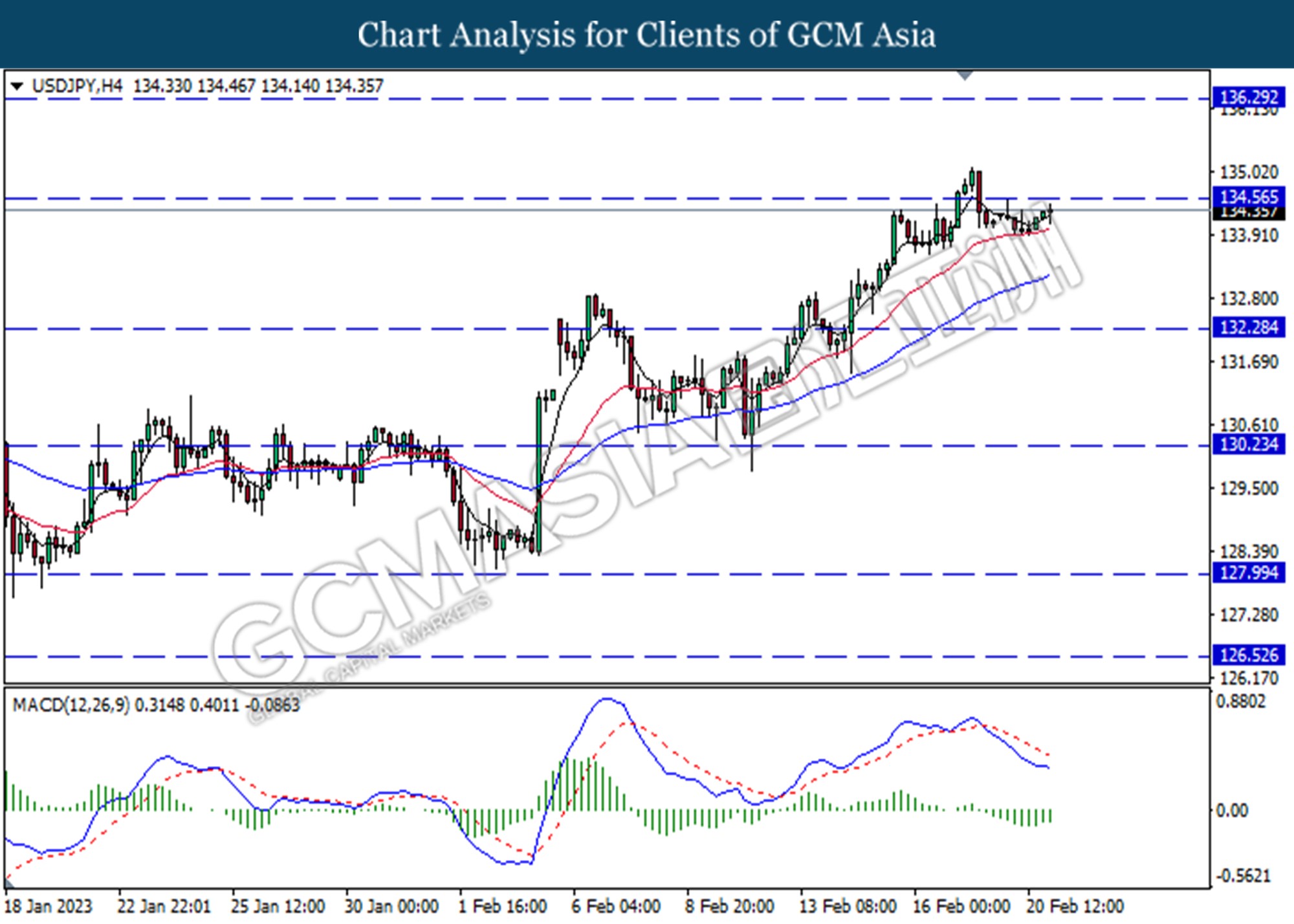

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lowest level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 134.55.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

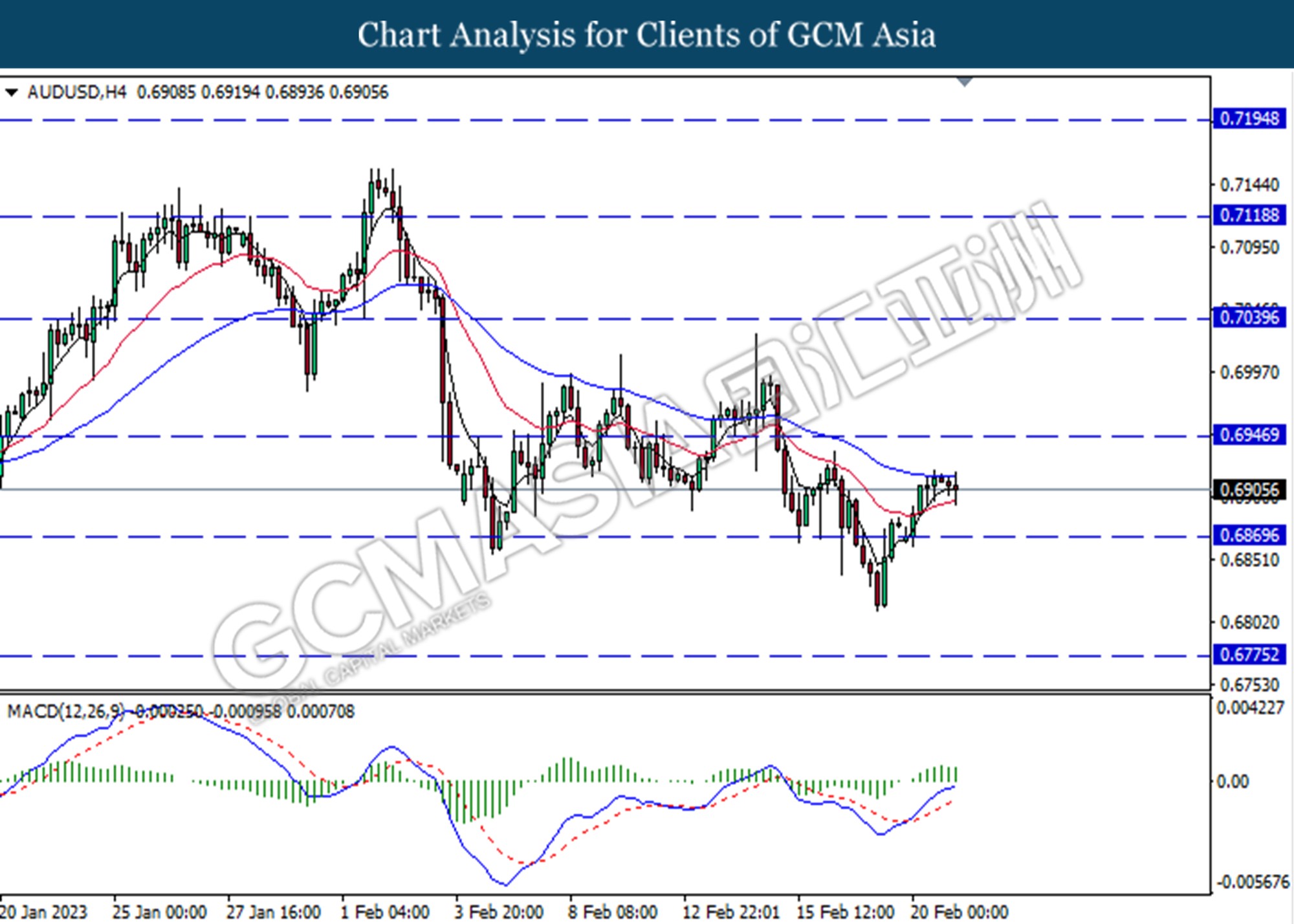

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from a higher level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6870.

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

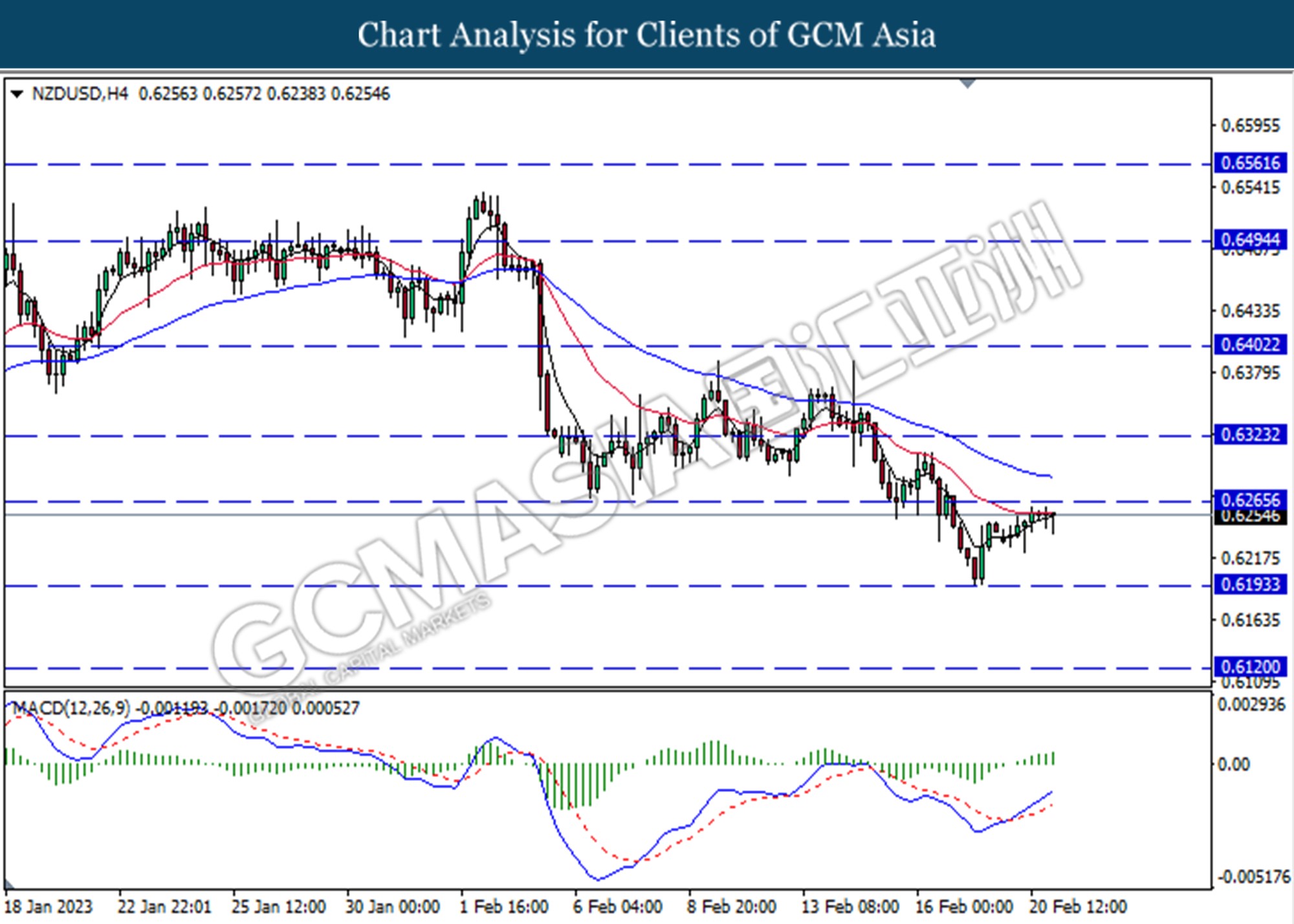

NZDUSD, H4: NZDUSD was traded lower following a prior retracement from a higher level. However, MACD which illustrated increasing bullish momentum suggests the pair to traded higher as a technical correction.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

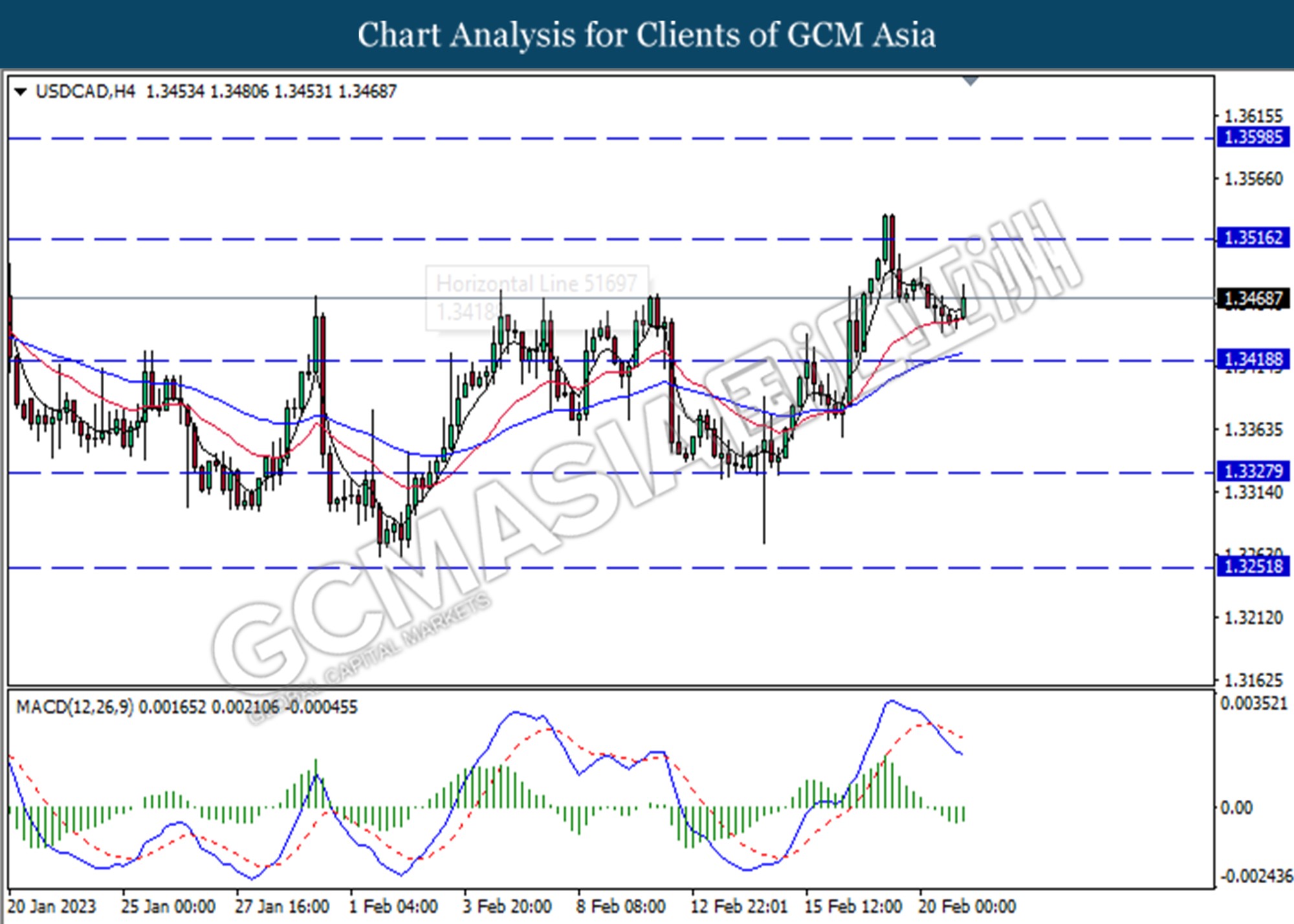

USDCAD, H4: USDCAD was traded higher following a prior rebound from the lowest level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3515.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

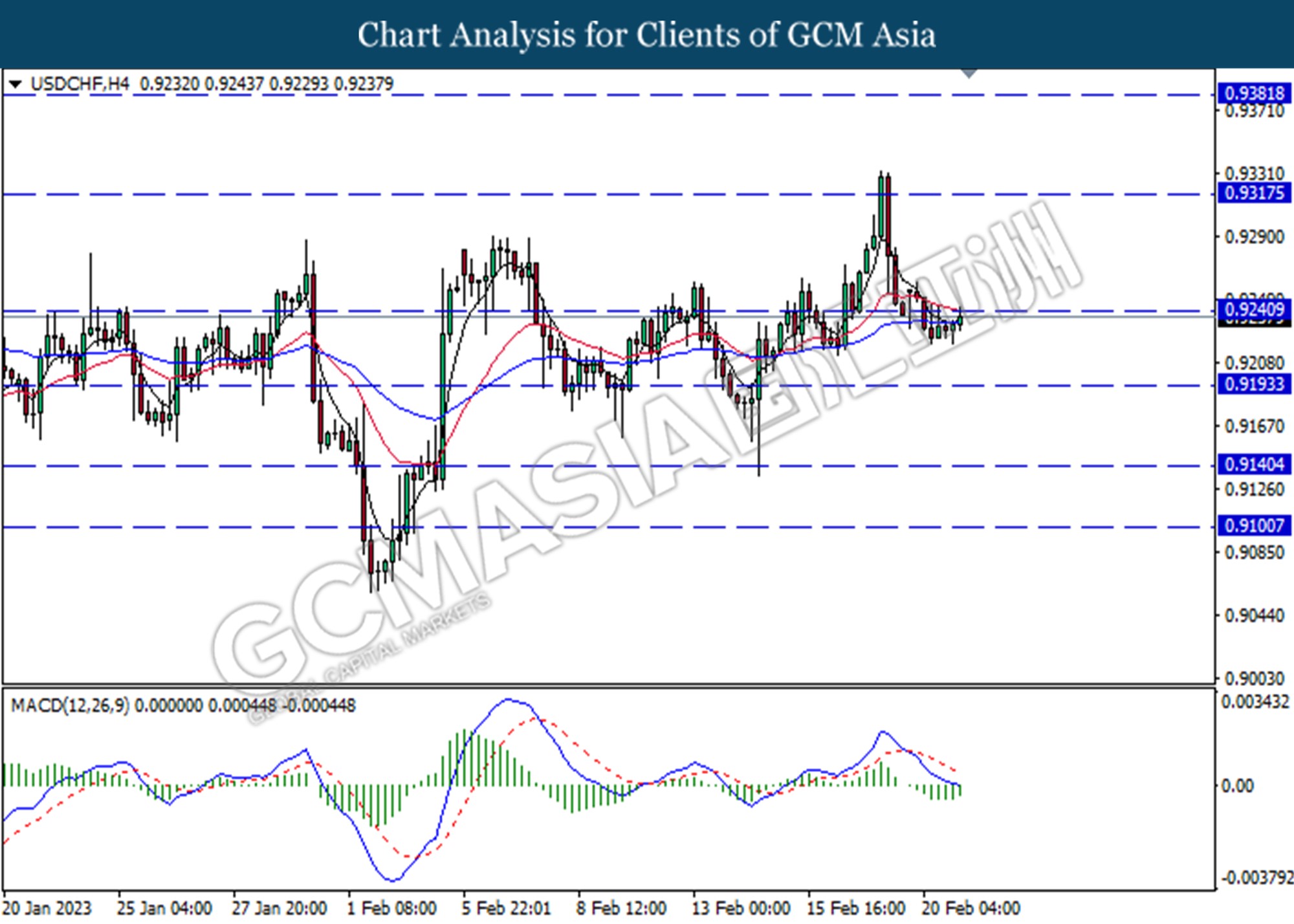

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9240. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains if successfully breakout above the resistance level.

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

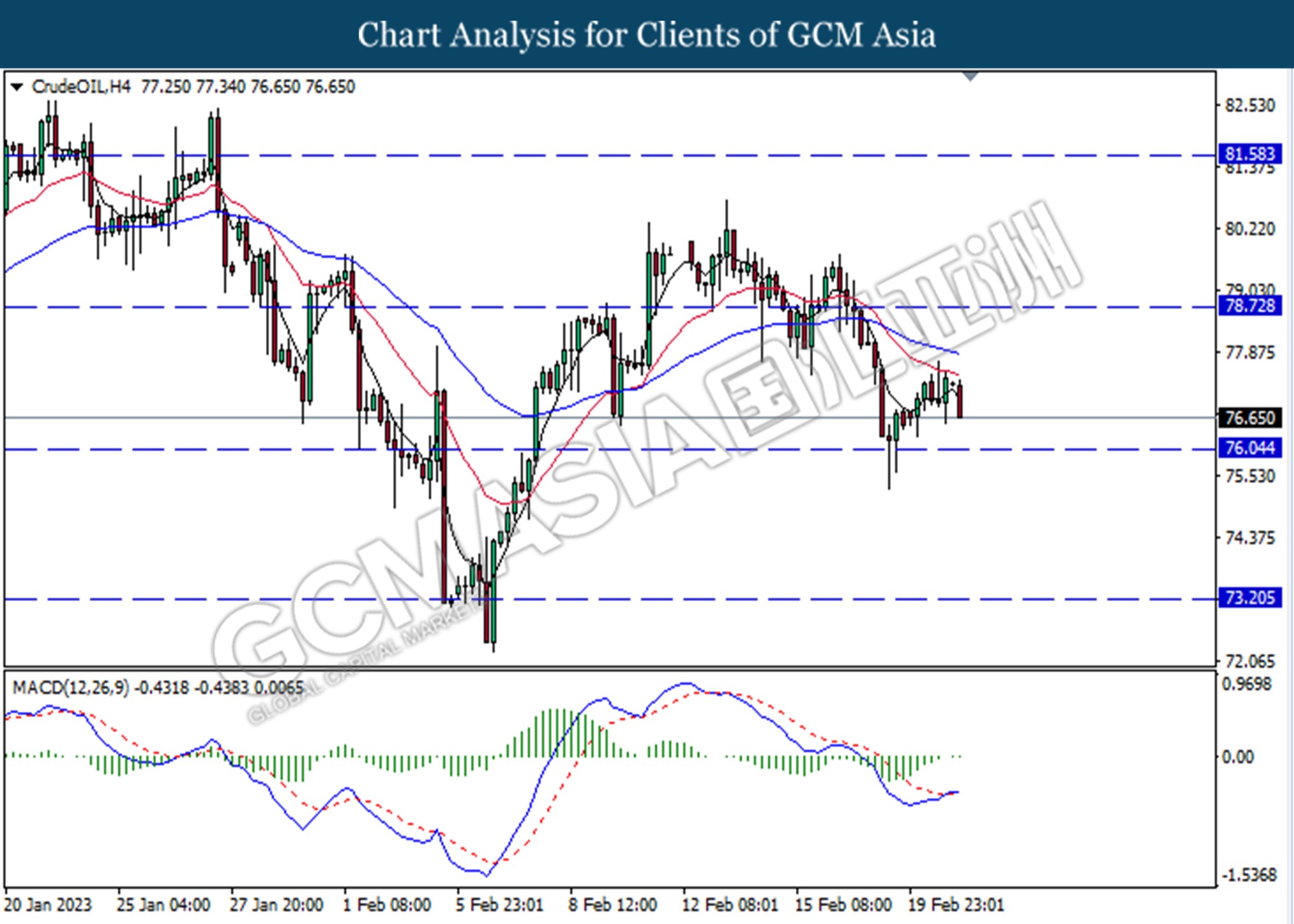

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from a higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 76.05.

Resistance level: 78.75, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded lower following a prior retracement from the resistance level at 1819.15. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45