21 February 2023 Morning Session Analysis

Movement of US Dollar slowed as market was lack of catalyst.

The Dollar Index which traded against a basket of six major currencies seesawed on Monday amid the low trading volume, with the US market close for Washington President’s birthday. After that, however, investors would start to focus on several crucial data and events. Prior to that, a series of economic data from the US has out-performed market expectation, which indicating that the US economy was not entering recession yet despite the aggressive rate hike implementation. On the other hand, the hawkish statement from Fed officials signaled there are still a long way to curb inflation, as well as the central bank has been suggested to raise further interest rate. Thus, the event and economic data such as FOMC Meeting Minutes, GDP and Core PCE Price Index would gather the attention of market participants. In addition, investors would continue to scrutinize the latest update with regards of Russia-Ukraine tensions. According to CNBC, the US President Joe Biden was meeting with Ukraine President Volodymyr Zelenskyy to reaffirm unwavering and unflagging commitment to Ukraine’s democracy, sovereignty, and territorial integrity. As of writing, the Dollar Index edged up by 0.01% to 103.78.

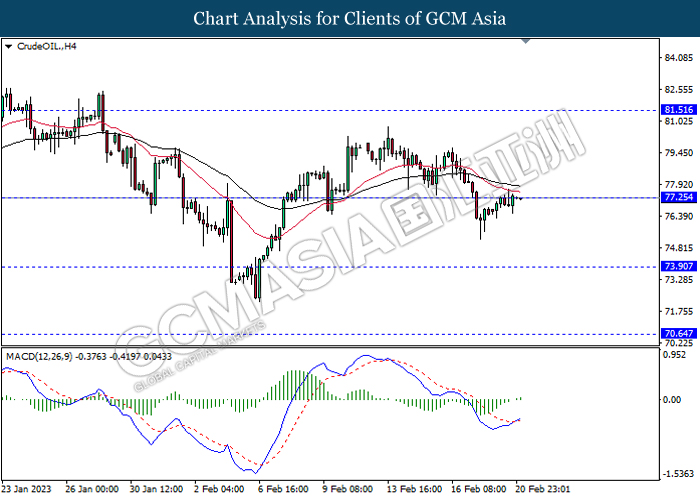

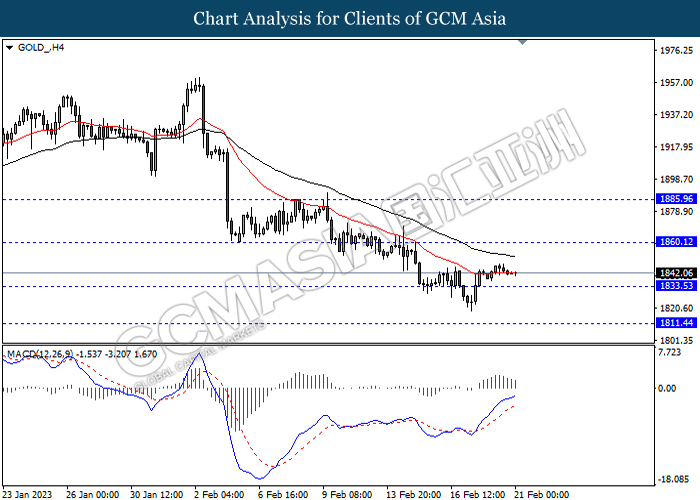

In the commodity market, the crude oil price depreciated by 0.14% to $77.27 per barrel as of writing following the rising concerns of hefty rate hike by Fed officials, which might lead a recession in the US. Besides that, the gold price dropped by 0.03% to $1840.72 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Feb) | 47.3 | 47.8 | – |

| 17:30 | GBP – Composite PMI | 48.5 | – | – |

| 17:30 | GBP – Manufacturing PMI | 47.0 | 47.5 | – |

| 17:30 | GBP – Services PMI | 48.7 | 49.2 | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Feb) | 16.9 | 22.0 | – |

| 21:30 | CAD – Core CPI (MoM) (Jan) | -0.3% | 0.2% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | -0.6% | -0.1% | – |

| 23:00 | USD – Existing Home Sales (Jan) | 4.02M | 4.10M | – |

Technical Analysis

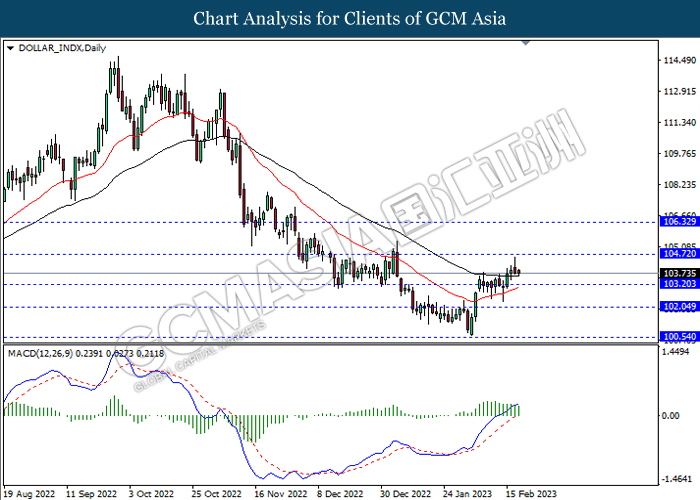

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

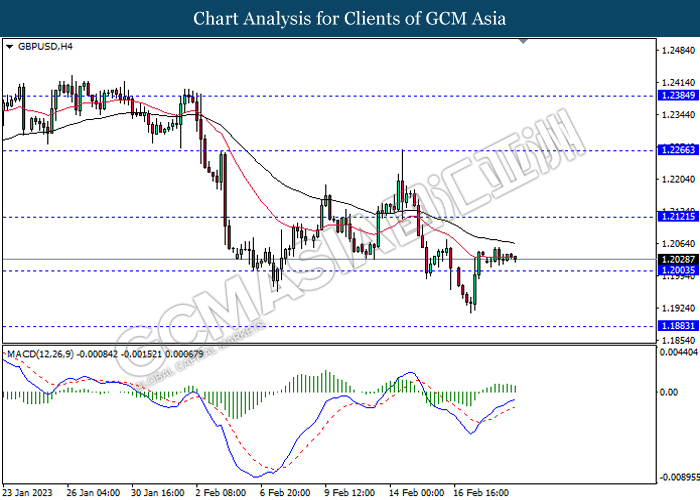

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

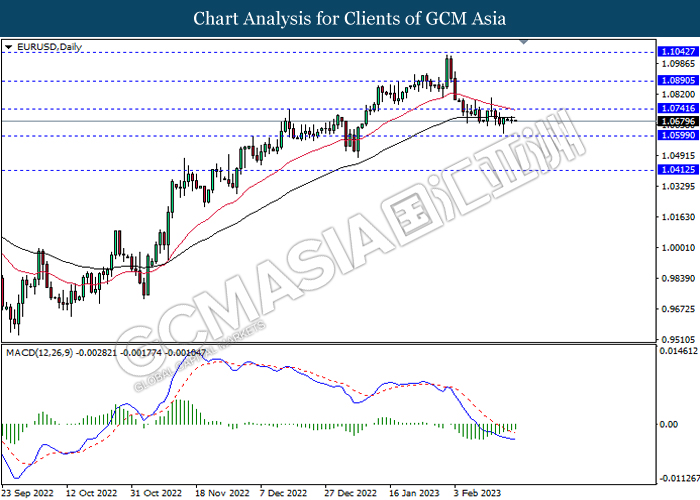

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

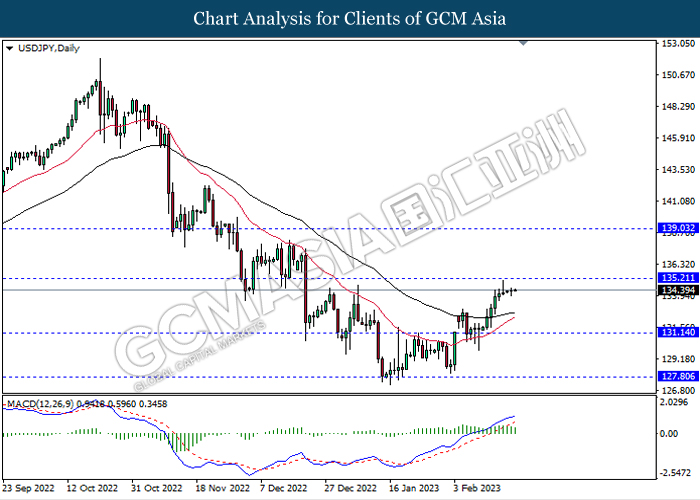

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

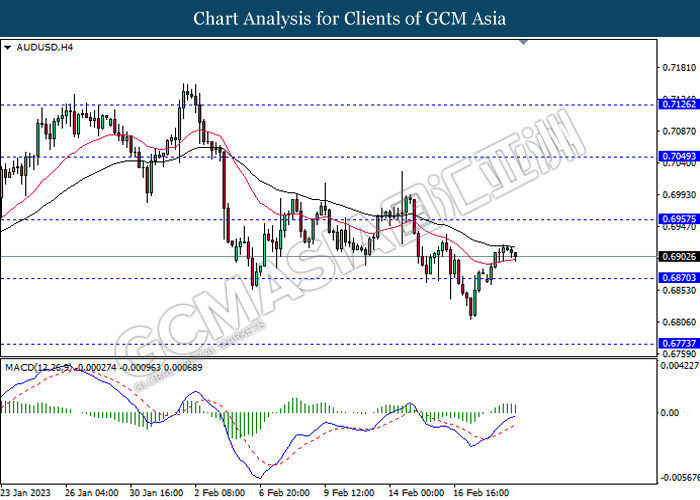

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6955, 0.7050

Support level: 0.6870, 0.6775

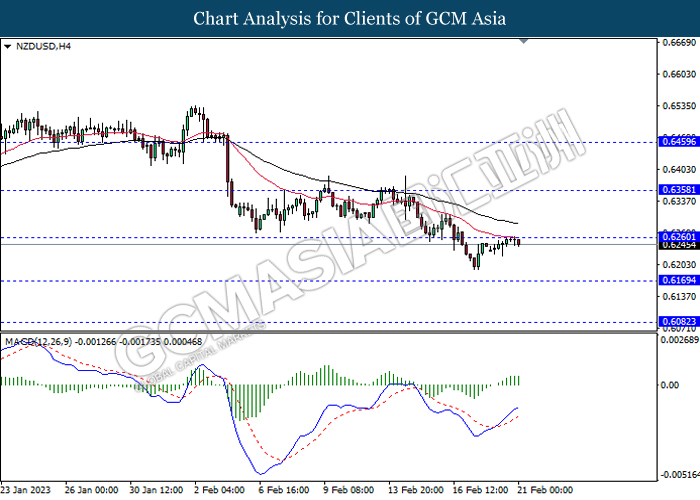

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

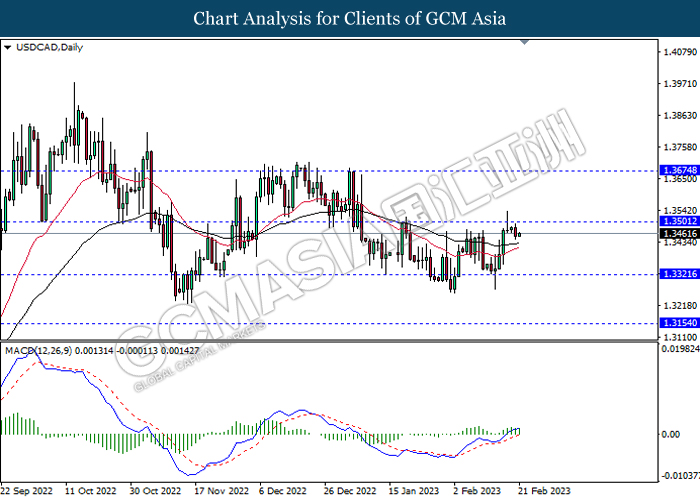

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

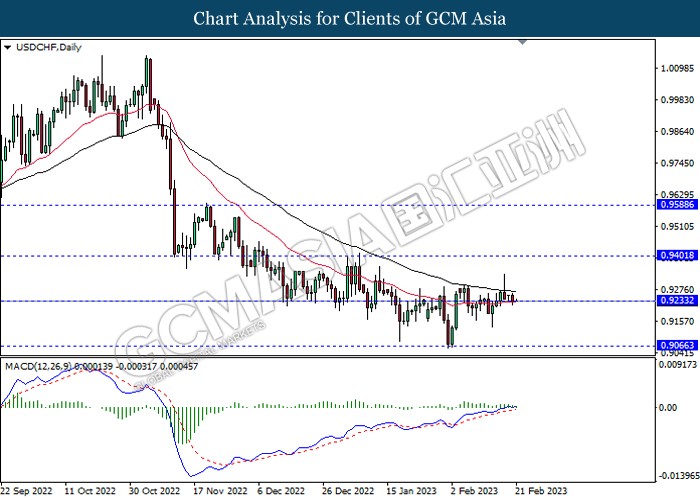

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45