21 March 2022 Morning Session Analysis

US Dollar surged following Fed unleashed hawkish tone.

The Dollar Index which traded against a basket of six major currencies surged on last Friday over the backdrop of hawkish tone from Federal Reserve. According to Reuters, two of the Federal Reserve policymakers claimed that the central bank needs to take more aggressive steps to tame inflation following its reached 40-year highs. St. Louis Fed president James Bullard claimed that he is in favor of a half-point increase interest, while reiterating that Fed’s overnight lending rate to increase to more than 3% this year. Most of the policymakers had expressed their support for more aggressive action, with seven projecting rates to rise above 2% in year of 2022. Nonetheless, investors would continue to scrutinize the latest updates with regards of further crucial economic data as well monetary policy plan to receive further trading signal. As of writing, the Dollar Index surged 0.26% to 98.25.

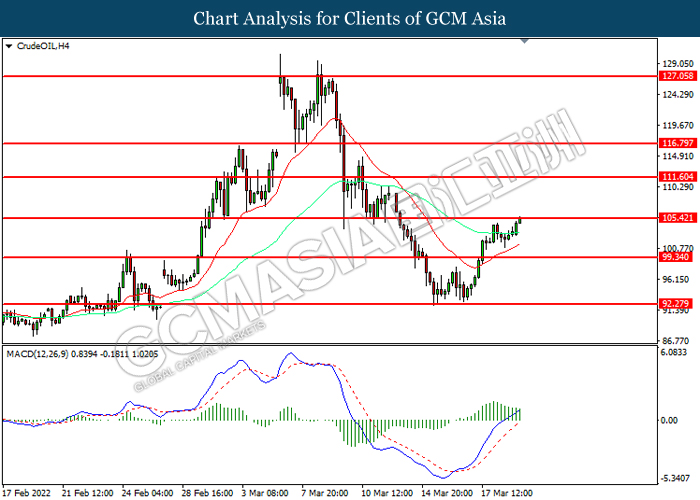

In the commodities market, the crude oil price appreciated by 1.20% to $105.45 per barrel as of writing amid rising tension between Russian-Ukraine continue to be spurring bullish momentum on the crude oil price. On the other hand, the gold price depreciated by 1.10% to $1921.30 per troy ounces as of writing amid hawkish expectation from Fed continue to drag down the appeal for inflation-hedging commodity such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 EUR ECB President Lagarde Speaks

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

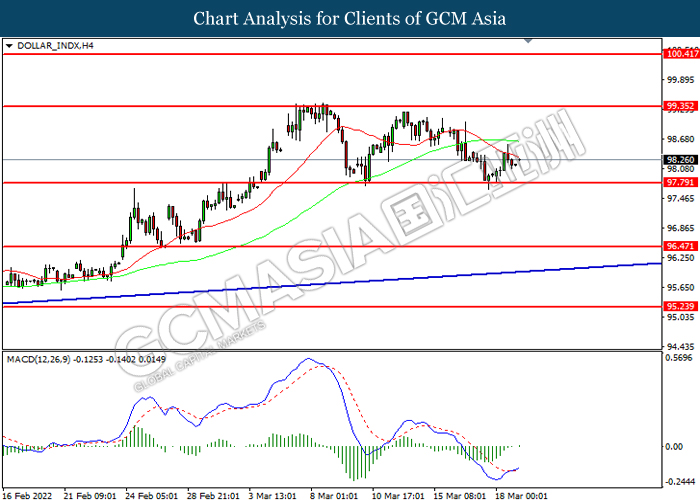

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

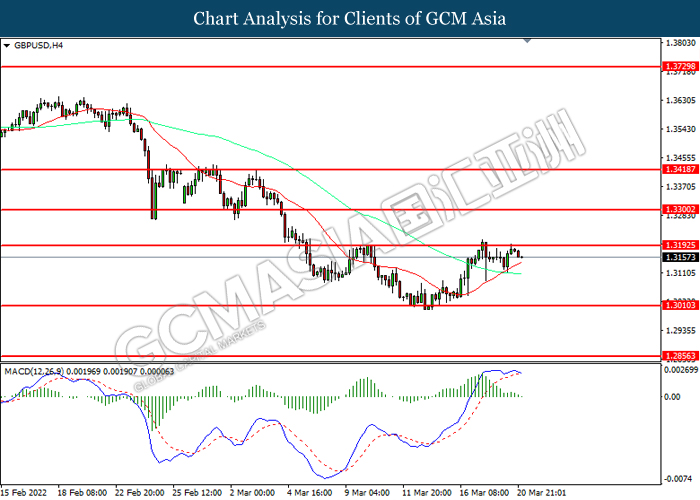

GBPUSD, H4: GBPUSD was traded higher while currently testing resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.3010, 1.2855

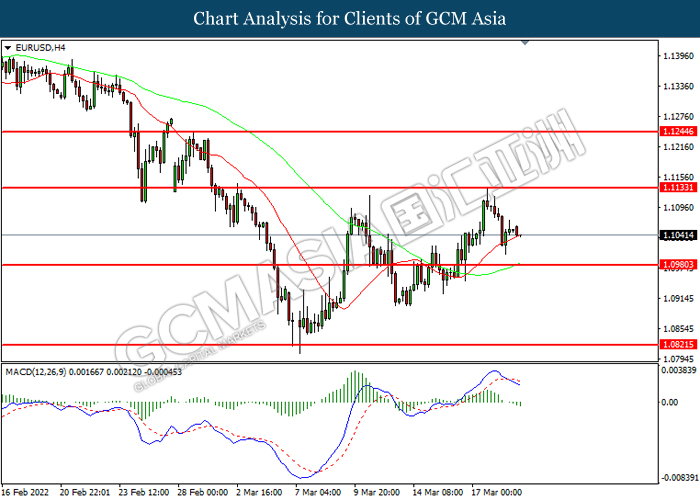

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 119.20, 120.50

Support level: 117.50, 116.25

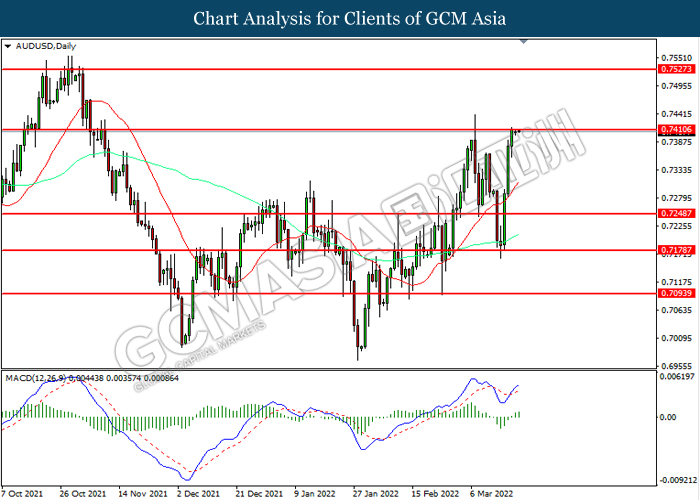

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

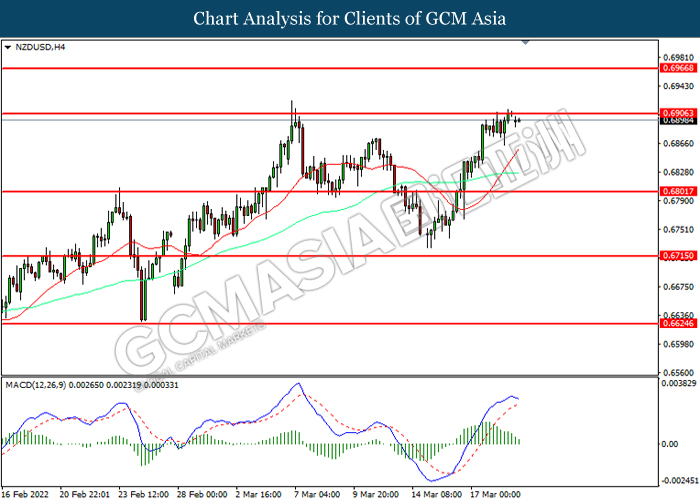

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6895. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6905, 0.6965

Support level: 0.6800, 0.6715

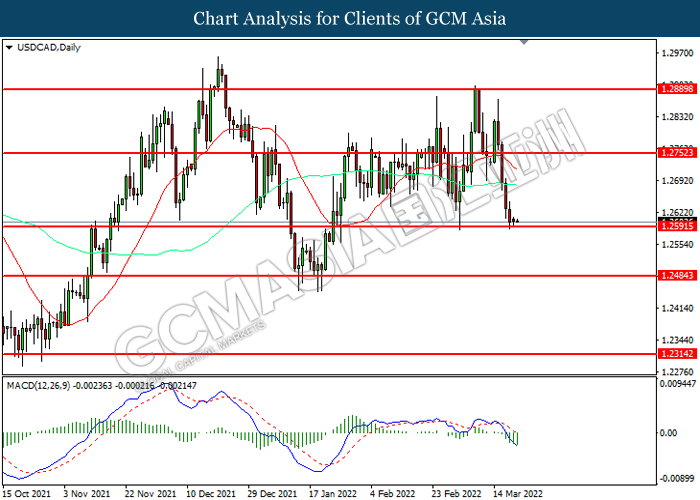

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2590, 1.2485

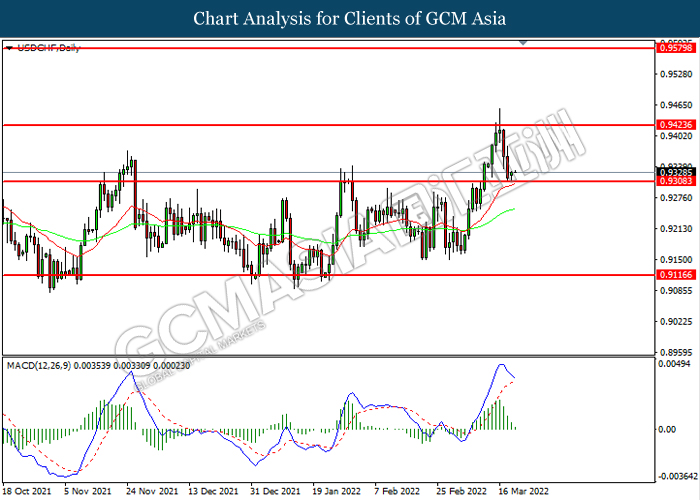

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 105.40, 111.60

Support level: 99.35, 92.30

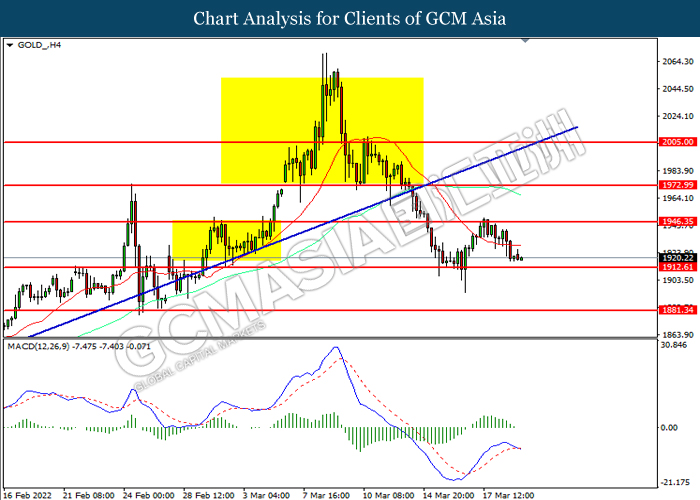

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35