21 May 2018 Weekly Analysis

GCMAsia Weekly Report: May 21 – 25

Market Review (Forex): May 14 – 18

US dollar extended its bullish rally last Friday over the backdrop of higher anticipation towards the Federal Reserve to adopt aggressive measures in tightening their monetary policy. The dollar index rose 0.21% while peaking at fresh five-months high of 93.66 during late Friday trading.

Dollar has recovered extensively after bottoming out at 89.00 past few weeks ago due to recent positive progression in US economic performance when being compared to other nations. Over that backdrop, it has evoked bullish momentum on US Treasury yield which successfully breaches 3.000% threshold and peaking at 7-year’s high of 3.126%.

The rise in bond yields came along after recent economic data point towards higher inflationary pressure which catalyzed market speculation for the Federal Reserve to increase interest rate more rapidly to curb rising consumer prices. The Fed raised its rates in March and they are expected to raise rate twice more this year while some expecting for a third hike.

USD/JPY

Pair of USD/JPY remained unchanged at 110.77 during late Friday trading albeit recording a weekly gain of 1% last week.

EUR/USD

Euro extended losses by 0.20% to $1.1771 against the US dollar. The single common currency came under pressure amid higher political uncertainty in Italy after Five-Star movement and League reached a coalition agreement to govern the country which may jeopardize the country’s finances due to bulky spending proposals.

GBP/USD

Pair of GBP/USD dipped 0.34% while closing the week at $1.3470.

Market Review (Commodities): May 14 – 18

GOLD

Gold price received higher demand on last Friday following rising political uncertainty stemmed from the European Union albeit gains remained limited due to higher US bond yields. Price of the safe-haven asset extended gains by 0.17% while closing the week around $1,293.14 a troy ounce.

Despite the uptick, gold prices recorded an extensive loss of 1.60% as it struggled to pare its losses after US bond yields rallied sharply. Generally, rising bond yields will lead to a rise in the US dollar which may pressure gold prices due to higher opportunity cost to hold gold as an asset which does not pay any interest.

Crude Oil

Crude oil prices settled lower albeit recording a weekly gain following mixed signals from the global oil market. Price of the black commodity settled down 22 cents or 0.31% to $71.39 per barrel while recording a weekly gain of 0.46%.

Initially, crude oil price received some bullish uptick after United States pulled out from the nuclear agreement with Iran. The announcement which came last two weeks ago renewed market expectation for fresh sanctions to be enacted upon the oil producing country which could ease some pressure on global oversupply glut. The potential impact on global crude supplies from imminent US sanctions are yet to be known as Europe and China refused to support such restrictions.

However, concerns over rising US production continued to overshadow positive indication in the global market as analyst claims that rising output may jeopardize OPEC’s effort in rebalancing the global oil supply and demand levels. As such, Baker Hughes reported that the number of oil rigs in the US was unchanged at 844 but remained at its highest level since March 20th, 2015.

Weekly Outlook: May 21 – 25

For the week ahead, investors will be paying attention to the release of inflation data from the United Kingdom in order to gauge Bank of England’s next take on their monetary policy. Otherwise, investors will also keep an eye on FOMC meeting minutes scheduled to be released on Thursday to attain further signals with regards to future interest rate hikes.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: May 21 – 25

| Monday, May 21 |

Data N/A

Events CrudeOIL – OPEC Meeting

|

| Tuesday, May 22 |

Data GBP – CBI Industrial Trends Orders (May) CAD – Wholesale Sales (MoM) (Mar) CrudeOIL – API Weekly Crude Oil Stock

Events USD – FOMC Member Bostic Speaks USD – FOMC Member Harker Speaks USD – FOMC Member Kashkari Speaks

|

| Wednesday, May 23 |

Data EUR – German GDP (QoQ) (Q1) EUR – German Manufacturing PMI (May) EUR – Manufacturing PMI (May) EUR – Markit Composite PMI (May) EUR – Services PMI (May) GBP – CPI (YoY) (Apr) USD – New Home Sales (Apr) USD – Manufacturing PMI (May) USD – Markit Composite PMI (May) USD – Services PMI (May) CrudeOIL – Crude Oil Inventories CrudeOIL – Gasoline Inventories

Events N/A

|

| Thursday, May 24 |

Data EUR – German GDP (QoQ) (Q1) EUR – GfK German Consumer Climate (Jun) GBP – Retail Sales (MoM) (Apr) USD – Initial Jobless Claims USD – Existing Home Sales (Apr)

Events USD – FOMC Meeting Minutes GBP – Inflation Report Hearings

|

|

Friday, May 25

|

Data JPY – Tokyo Core CPI (YoY) (Mar) EUR – German Ifo Business Climate Index (May) GBP – GDP (QoQ) (Q1) USD – Core Durable Goods Orders (MoM) (Apr) USD – Michigan Consumer Sentiment (May) CrudeOIL – US Baker Hughes Oil Rig Count

Events USD – FOMC Member Harker Speaks USD – Fed Chair Powell Speaks USD – FOMC Member Bostic Speaks USD – FOMC Member Kaplan Speaks

|

Technical Weekly Outlook: May 21 – 25

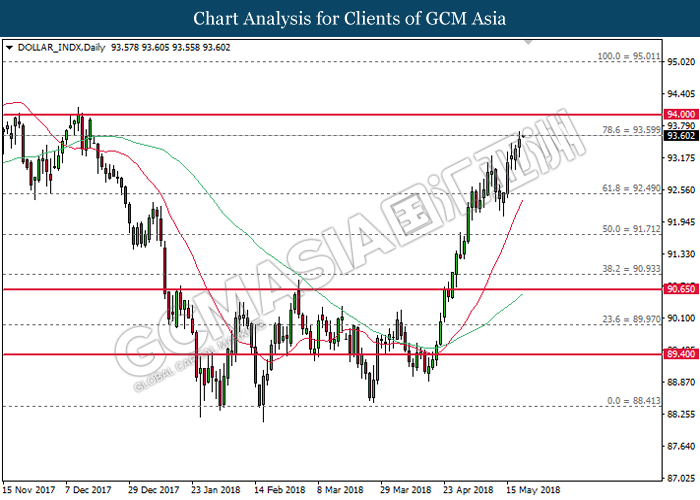

Dollar Index

DOLLAR_INDX, Daily: Dollar index extended gains following prior rebound and closure above the resistance level at 92.50. Both MA line which continues to expand upwards suggests the index to advance further up after breaking the target at 93.60.

Resistance level: 93.60, 94.00

Support level: 92.50, 91.70

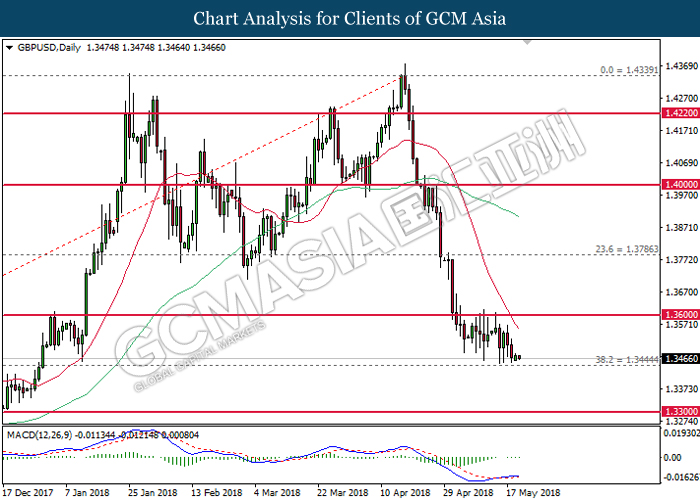

GBPUSD

GBPUSD, Daily: GBPUSD extended losses following prior retracement from the resistance level at 1.3600. MACD histogram which begins to form a downward signal suggests the pair to extend its prior losses in the event of a breakout from the support level of 1.3445.

Resistance level: 1.3600, 1.3785

Support level: 1.3445, 1.3300

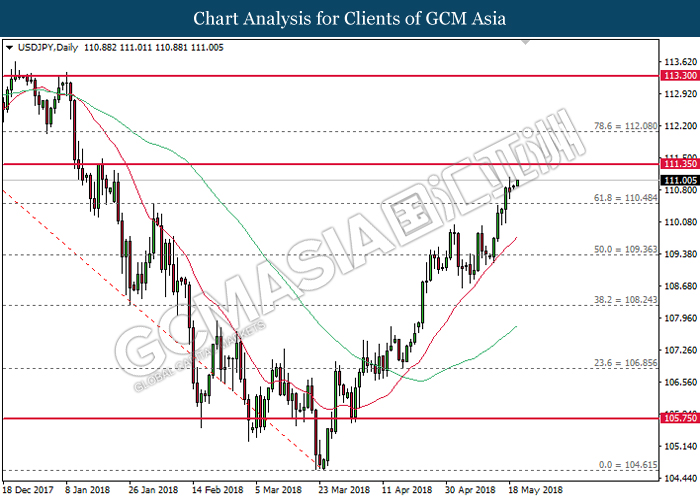

USDJPY

USDJPY, Daily: USDJPY advance further upwards following prior breakout from the resistance level at 110.50. Both MA line which continues to expand upwards suggests the pair to extend its gains towards the direction of resistance level near 111.35.

Resistance level: 111.35, 112.10

Support level: 110.50, 109.35

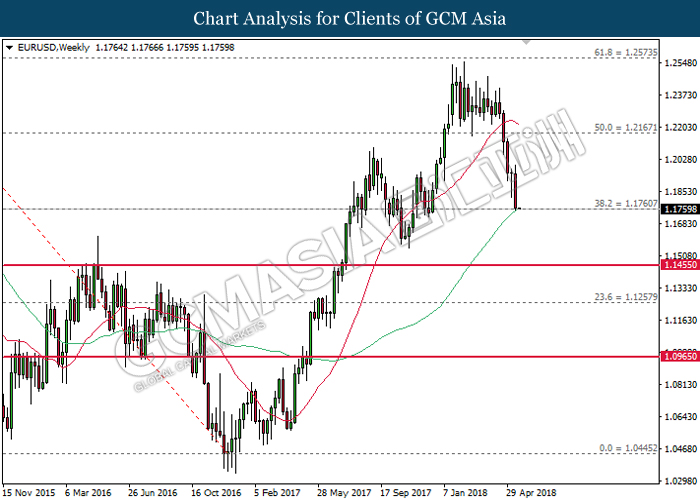

EURUSD

EURUSD, Weekly: EURUSD tumbled lower following prior closure below the 20-MA line (red). Recent price action suggests further bearish bias and thus a close below the 60-MA line (green) at 1.1760 would suggests the pair to extend its losses, towards next target at 1.1455 thereafter.

Resistance level: 1.2170, 1.2575

Support level: 1.1760, 1.1455

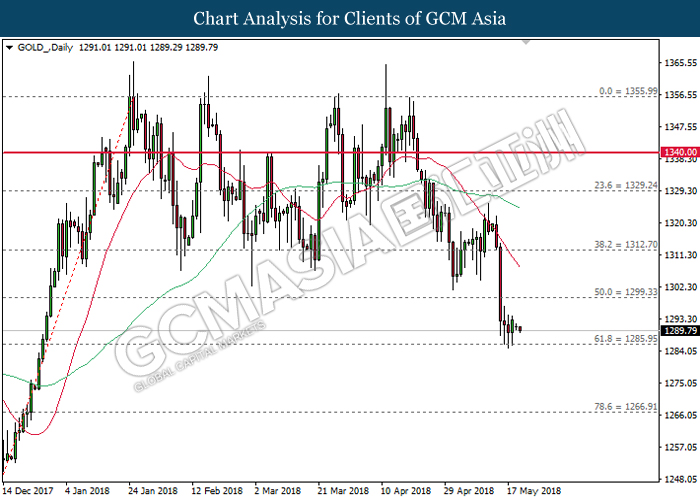

GOLD

GOLD_, Daily: Gold price advanced further down following prior closure below the support level of 1300.00. Both MA line which continues to expand downwards suggests the commodity price to extend its losses after closing below the support level of 1285.95.

Resistance level: 1300.00, 1312.70

Support level: 1285.95, 1266.90

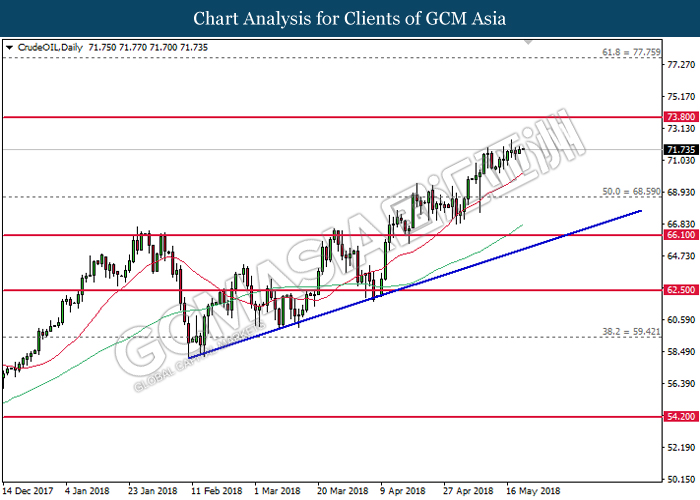

Crude Oil

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout from the resistance level of 68.60. Both MA lines which continues to expand upwards in tandem of current major trend suggests the commodity price to advance further upwards, towards the target of resistance level at 73.80.

Resistance level: 73.80, 77.75

Support level: 68.60, 66.10