21 June 2022 Morning Session Analysis

Euro eased after ECB’s member released its speech.

The EURUSD edged down on Monday after one of the European Central Bank (ECB) member appeared a speech. According to Reuters, European Central Bank chief economist Philip Lane had claimed on Monday that the record-high inflation in the euro zone could be fuelling “inflation psychology,” referring to the phenomenon of consumers and businesses adjusting their habits in anticipation of higher prices. He emphasized that once inflation psychology sets in, consumers would likely to bring forward their spending to beat the rise in prices while businesses start lifting their own prices as expecting higher costs, which causing the inflation keep soaring. Despite ECB would likely to implement contractionary monetary policy to lower down inflation risk, another comments of Philip Lane had prompted investors to shift their capitals toward other currencies. He mentioned that the rate hike increment in September still undecided, which dialed down the market optimism toward Euro. As of writing, EURUSD edged up by 0.09% to 1.0518.

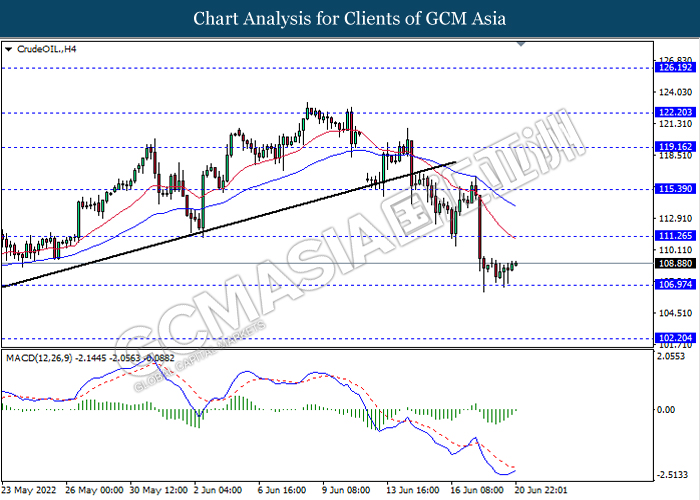

In the commodities market, crude oil price appreciated by 0.10% to $108.88 per barrel as of writing amid China’s crude oil imports from Russia soared 55% from a year earlier to a record level in May. On the other hand, gold price depreciated by 0.02% to $1840.30 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core Retail Sales (MoM) (Apr) | 2.4% | 0.6% | – |

| 22:00 | USD – Existing Home Sales (May) | 5.61M | 5.39M | – |

Technical Analysis

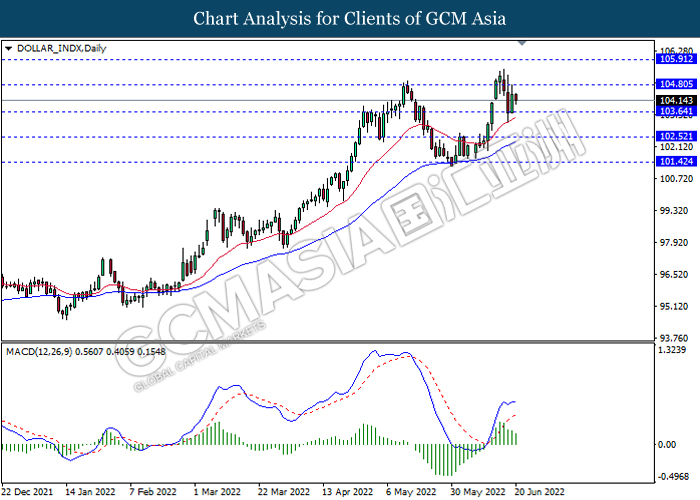

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

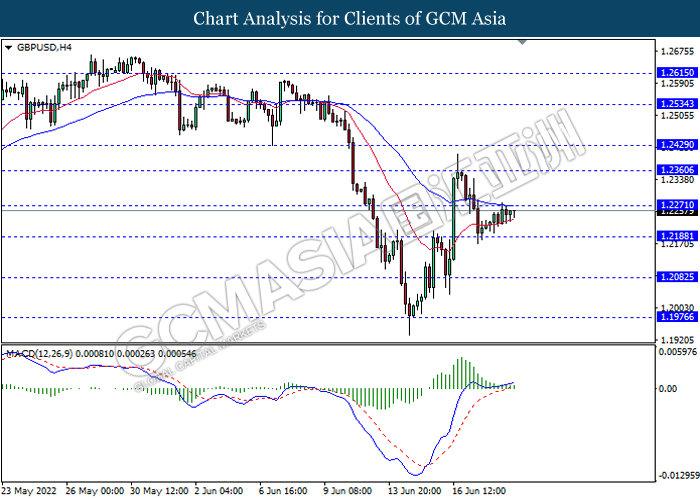

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2270, 1.2360

Support level: 1.2190, 1.2080

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0520, 1.0605

Support level: 1.0450, 1.0385

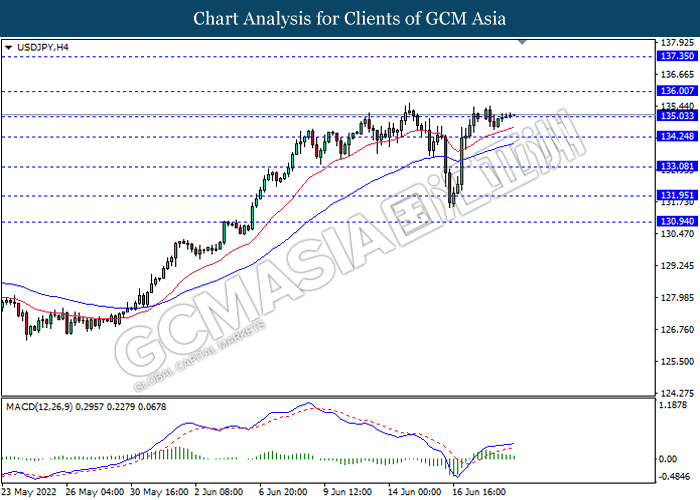

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 136.00, 137.35

Support level: 135.05, 134.25

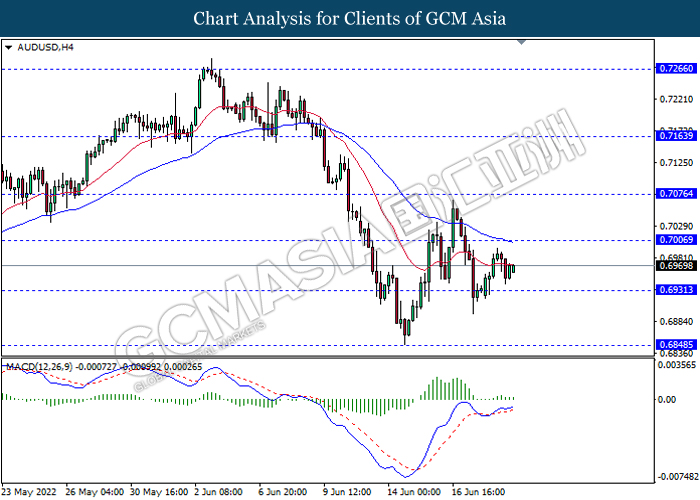

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

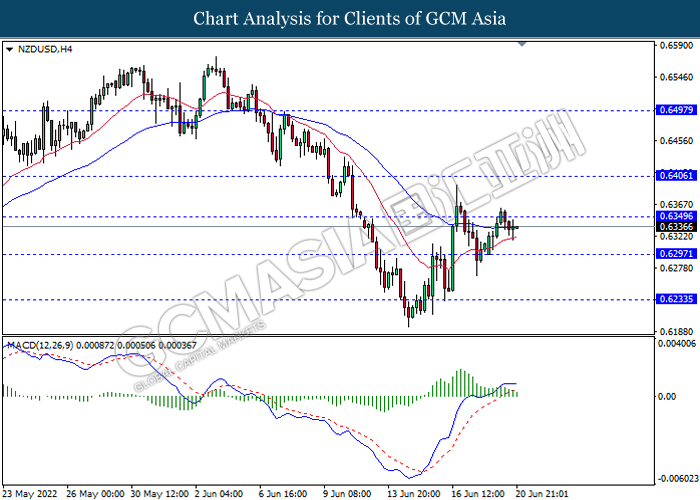

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6350, 0.6405

Support level: 0.6295, 0.6235

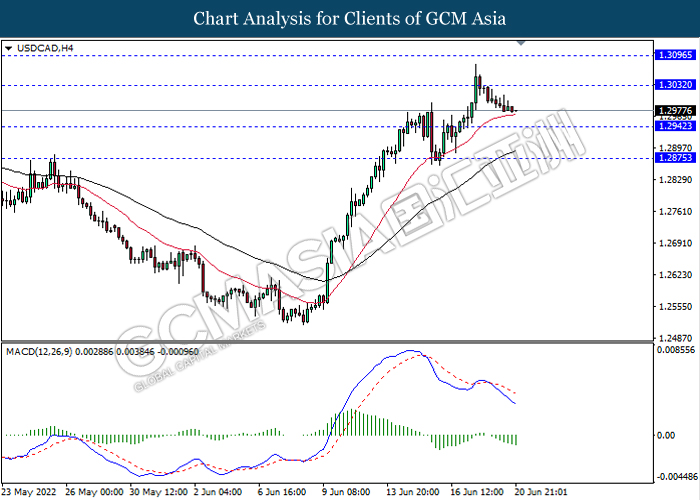

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3030, 1.3095

Support level: 1.2940, 1.2875

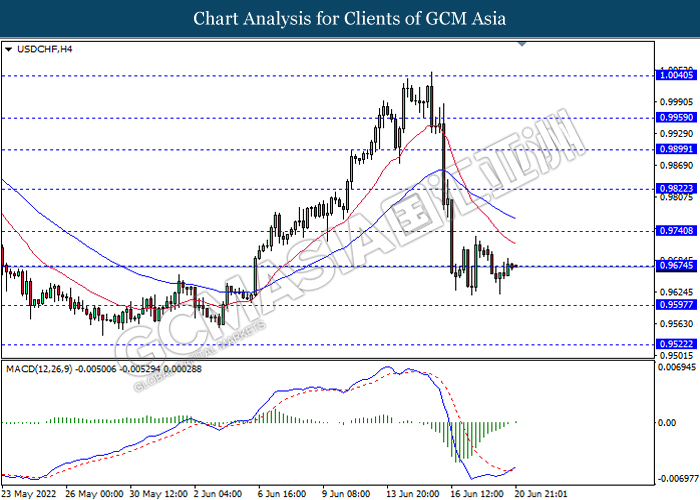

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 111.25, 115.40

Support level: 106.95, 102.20

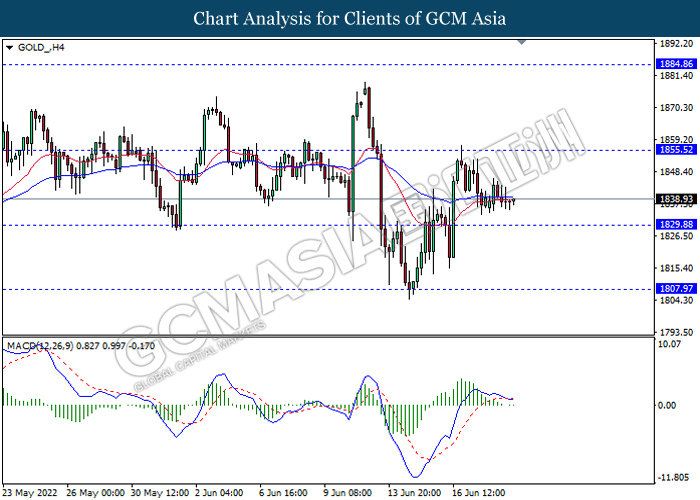

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1855.50, 1884.85

Support level: 1829.90, 1807.95