21 June 2023 Morning Session Analysis

US Dollar surged ahead of Jerome Powell’s testimony.

The dollar index, which was traded against a basket of six major currencies, bounced off from the 6-week lows as investors are awaiting Federal Reserve Chairman Jerome Powell’s testimony before Congress later this week for clues on the outlook for monetary policy. Back at the Fed’s Press Conference last week, the Chairman of Fed Jerome Powell reiterated its hawkish stance regarding the monetary policy outlook, where he signalled more rate hikes may be coming later this year. Although Jerome Powell expressed optimism about the fight against inflation, he ruled out the possibility of cutting interest rates in a couple of years until inflation comes down significantly. With that, investors are eyeing the upcoming Jerome Powell’s speech if he will still maintain his view that the central bank is not done raising interest rates to keep inflation in check. On top of that, US Census Bureau posted stronger-than-expected housing data yesterday, triggering some buying momentum in the dollar market. According to the data, the US Building Permit was up from 1.147M to 1.491M, slightly higher than the consensus forecast at 1.425 M. As of writing, the dollar index ticked down -0.01% to 102.50.

In the commodities market, crude oil prices dropped by -0.02% to $70.75 per barrel as the strengthening of the US dollar weighed on the black commodity. Besides, the gold prices edged up by 0.12% to $1938.60 per troy ounce following the slight retracement of the US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (May) | 8.7% | 8.5% | – |

| 04:30

(22th) |

CrudeOIL – API Weekly Crude Oil Stock | 1.024M | – | – |

Technical Analysis

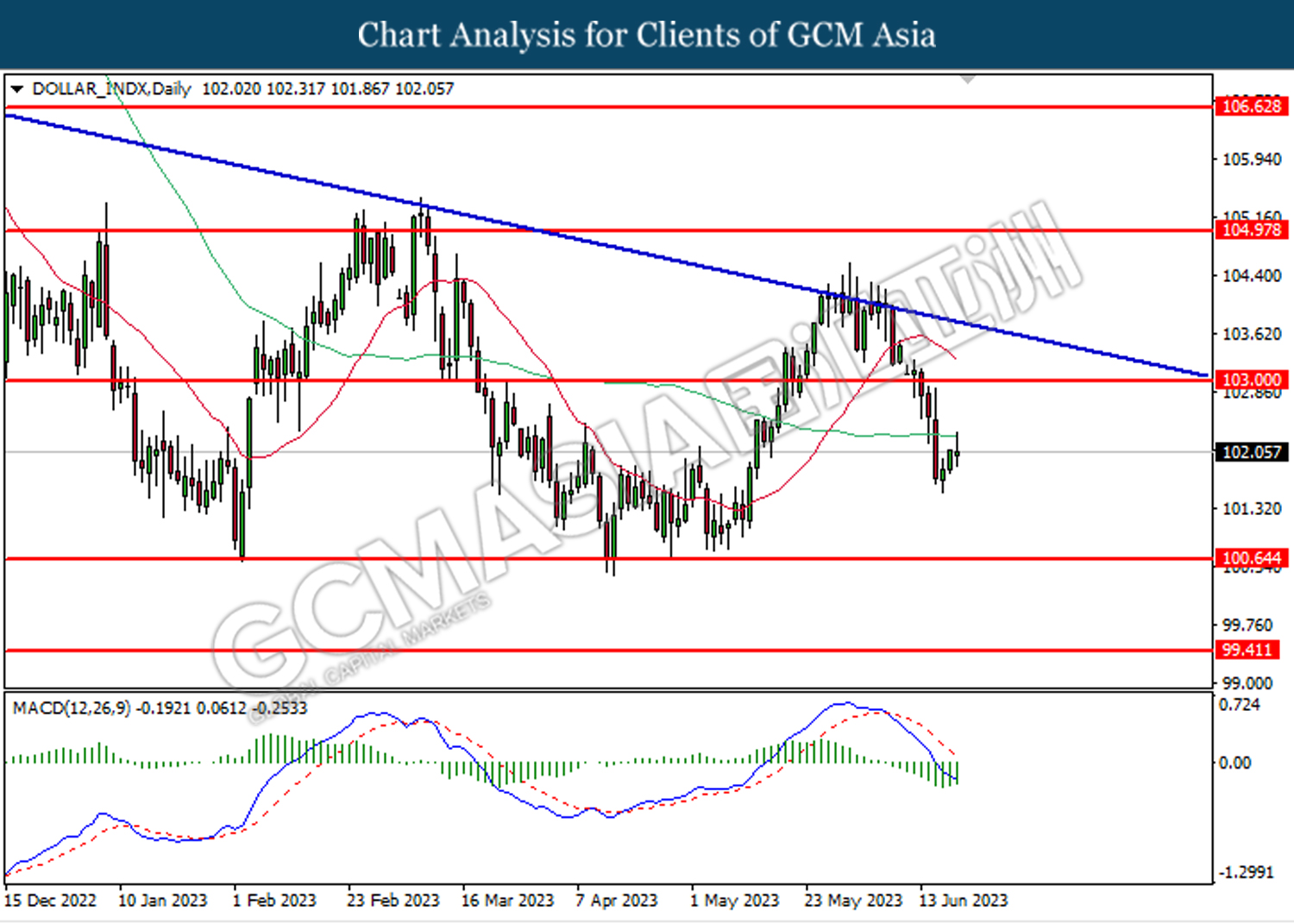

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

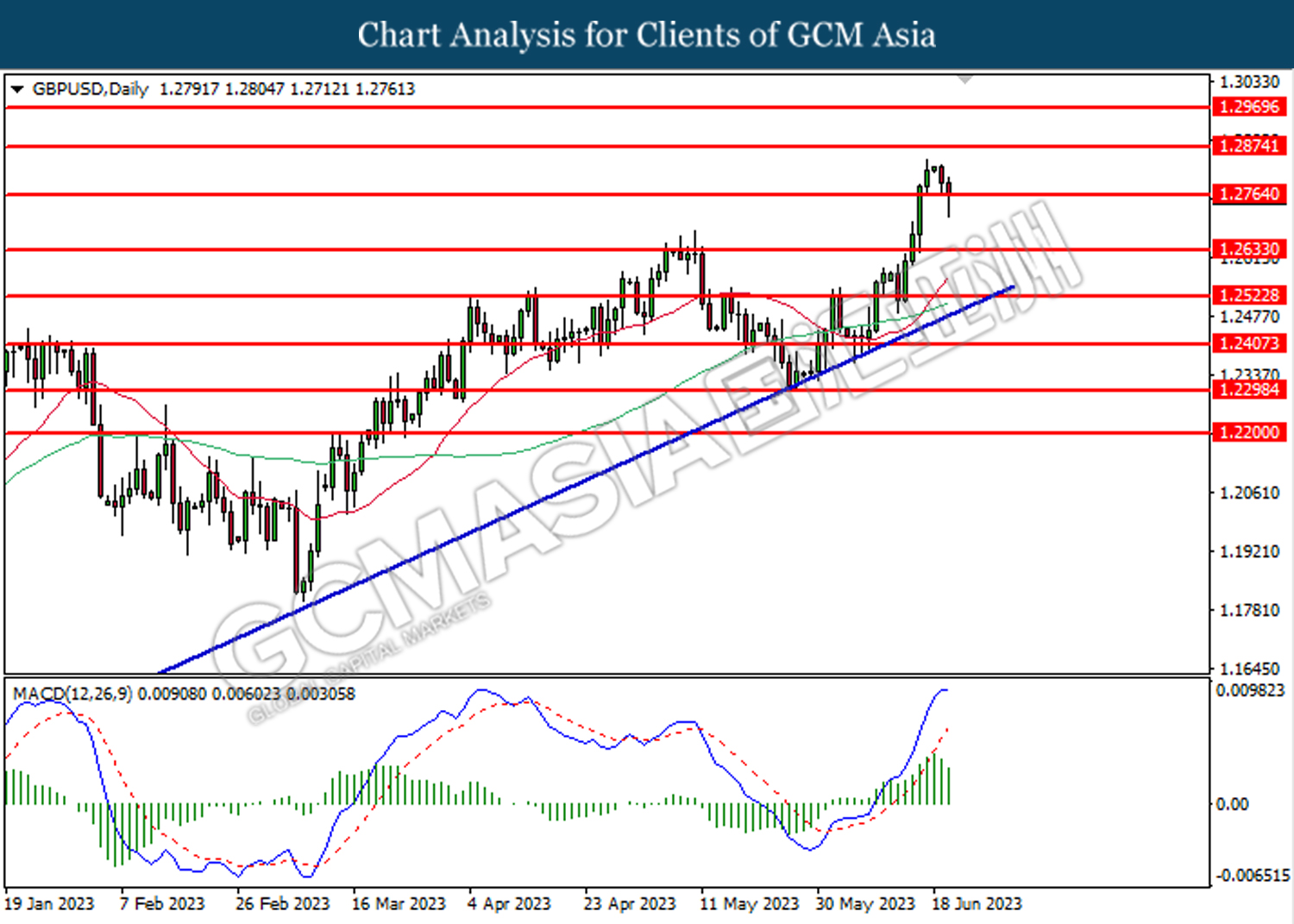

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2765. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2635, 1.2525

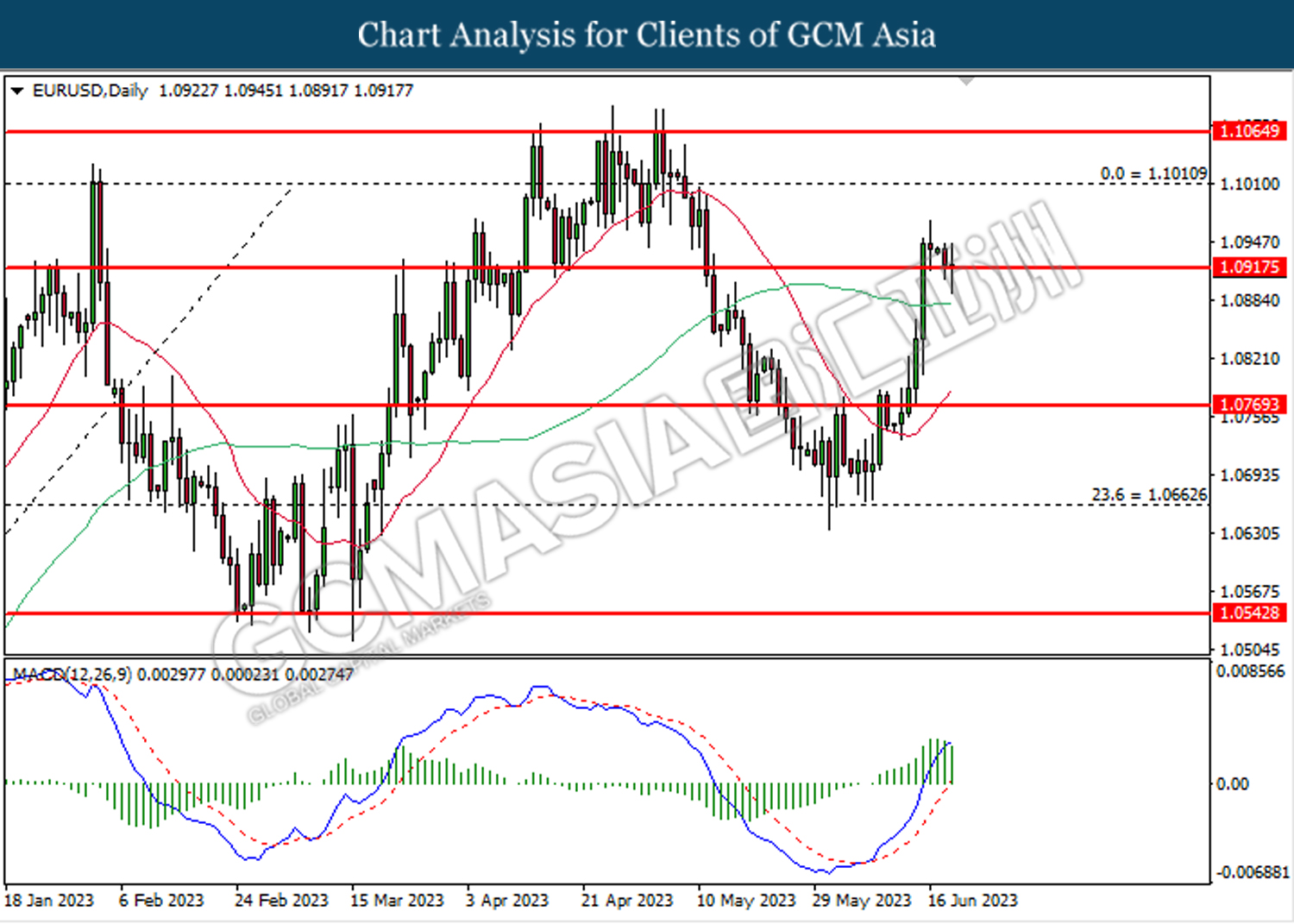

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

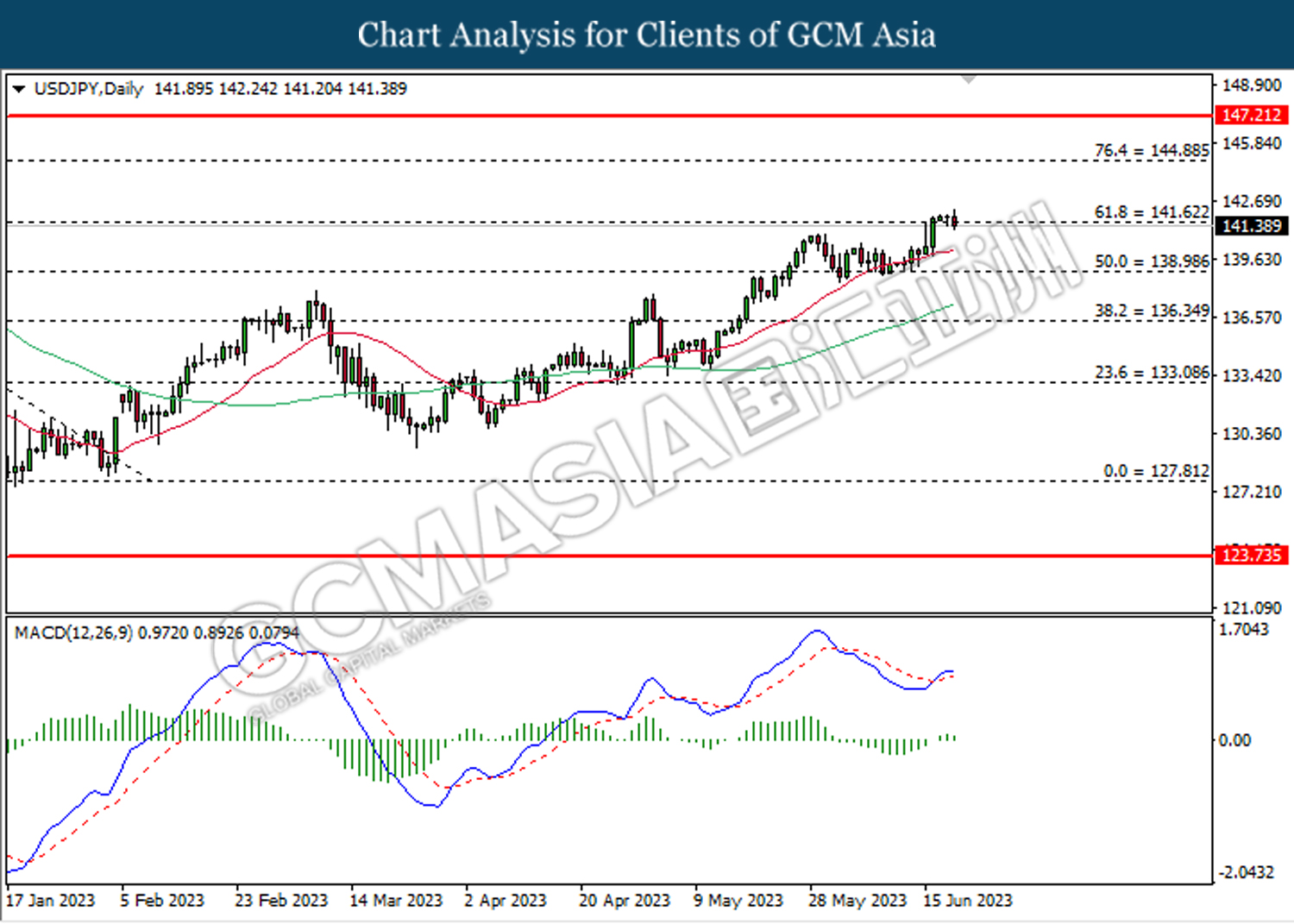

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

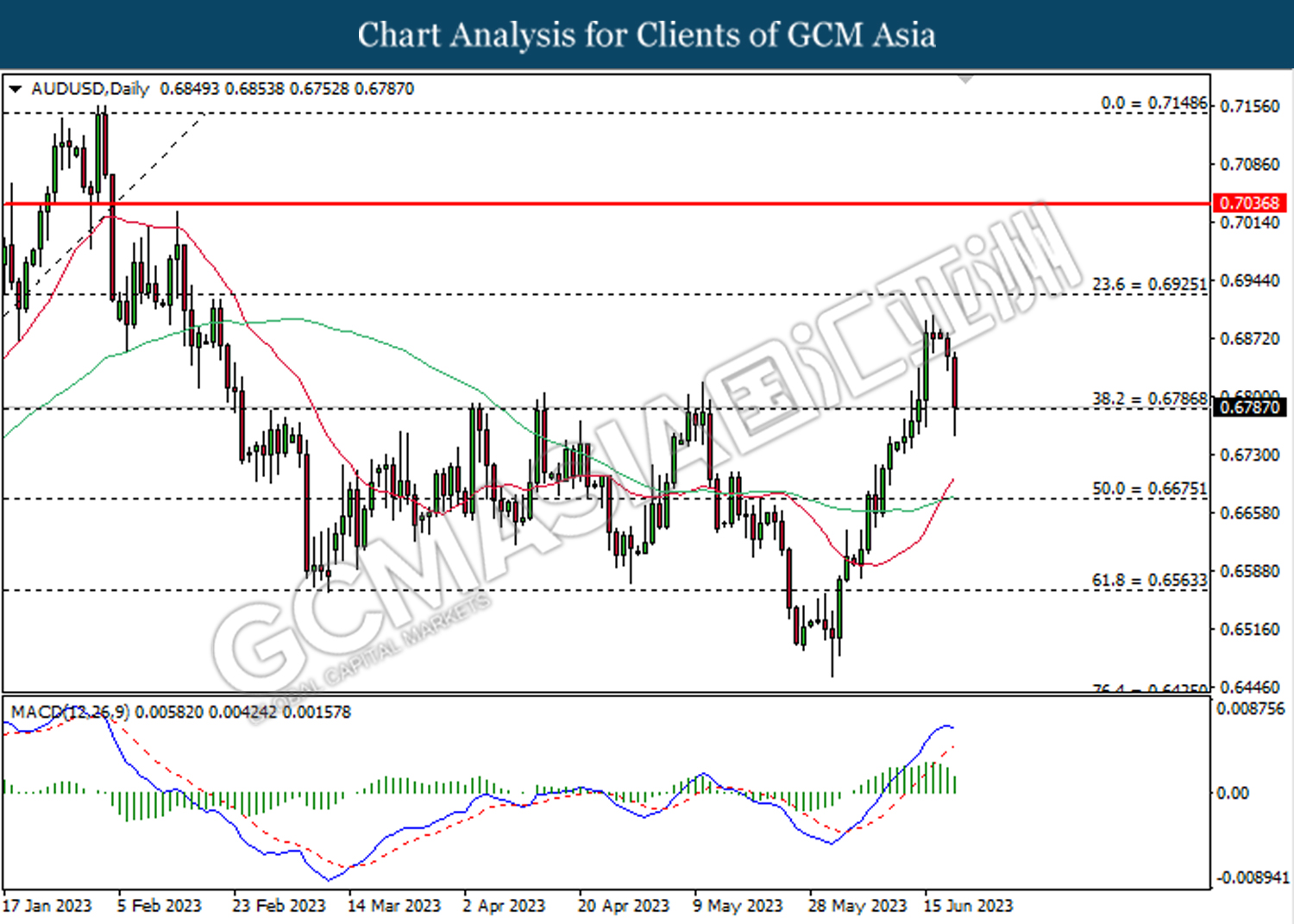

AUDUSD, Daily: AUDUSD was traded lower while currently testing support level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

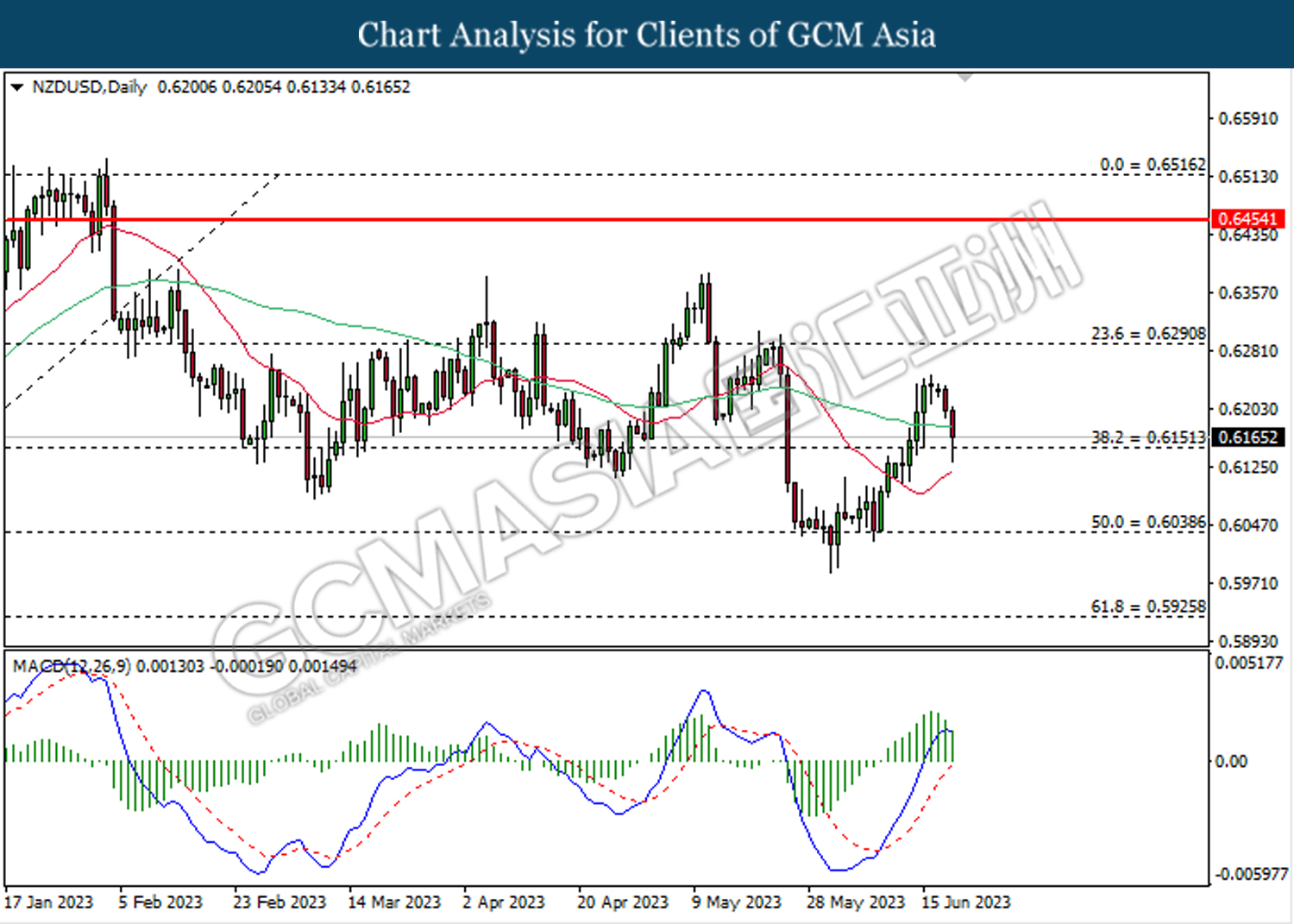

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

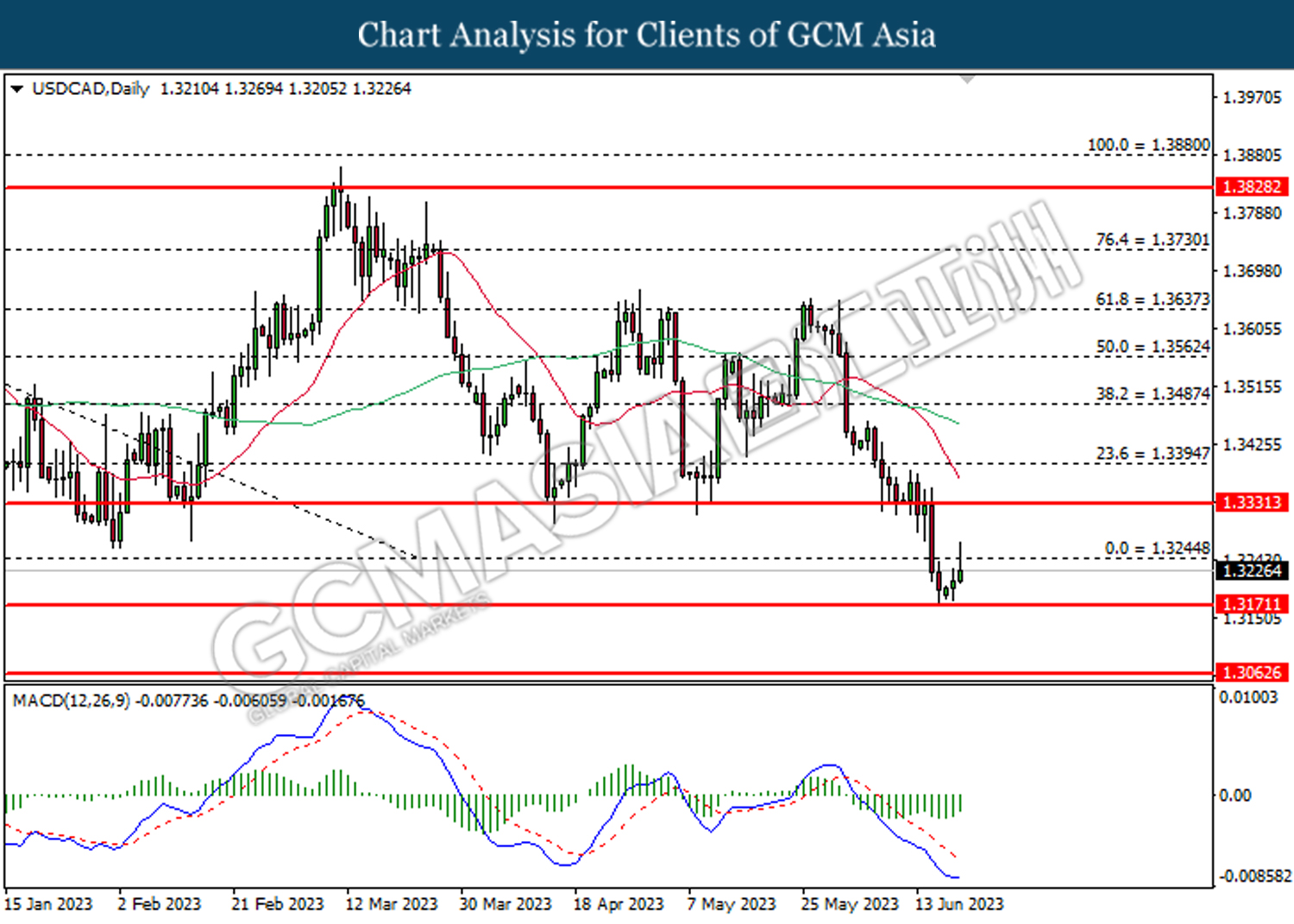

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3170. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3170, 1.3065

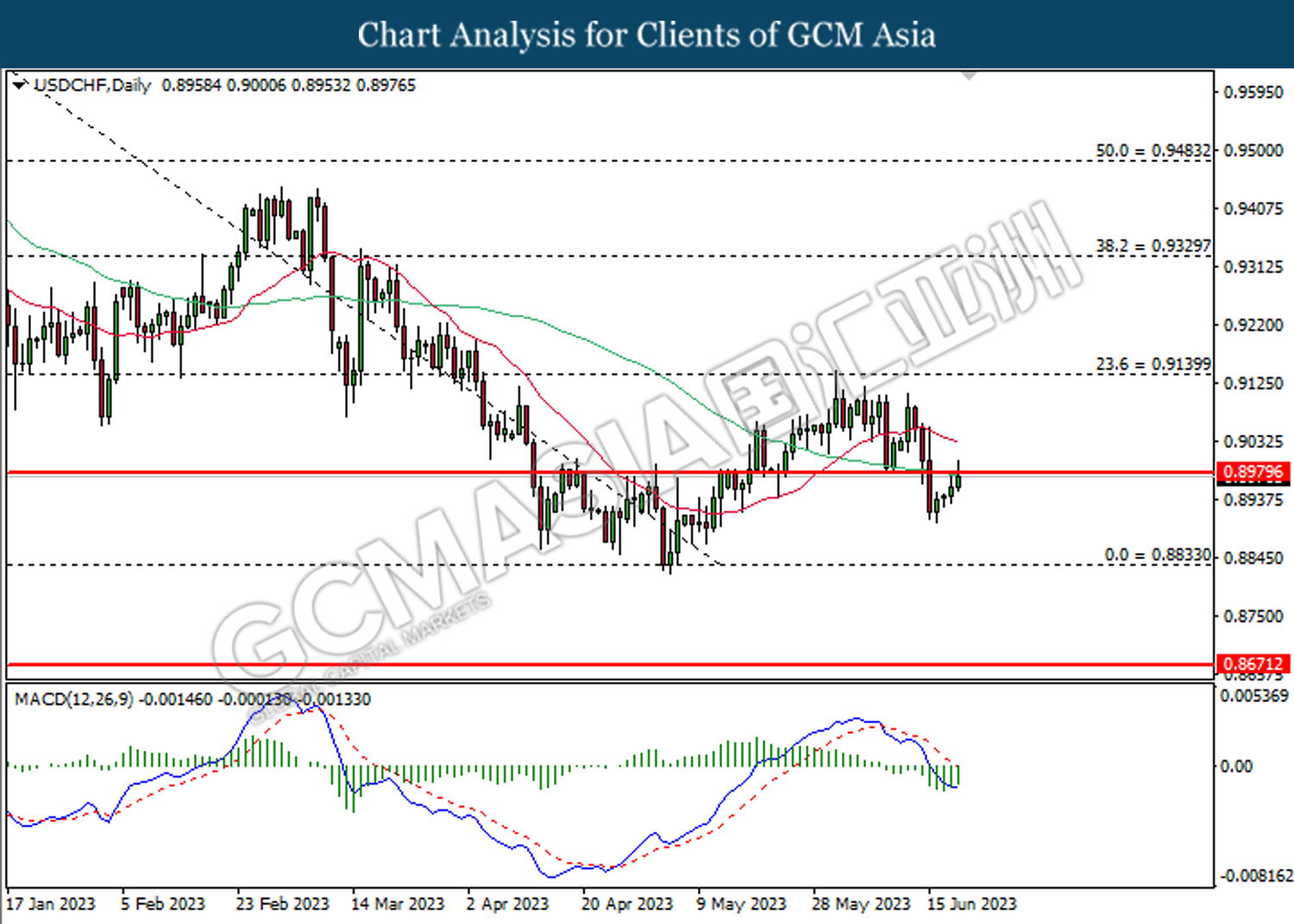

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8835, 0.8670

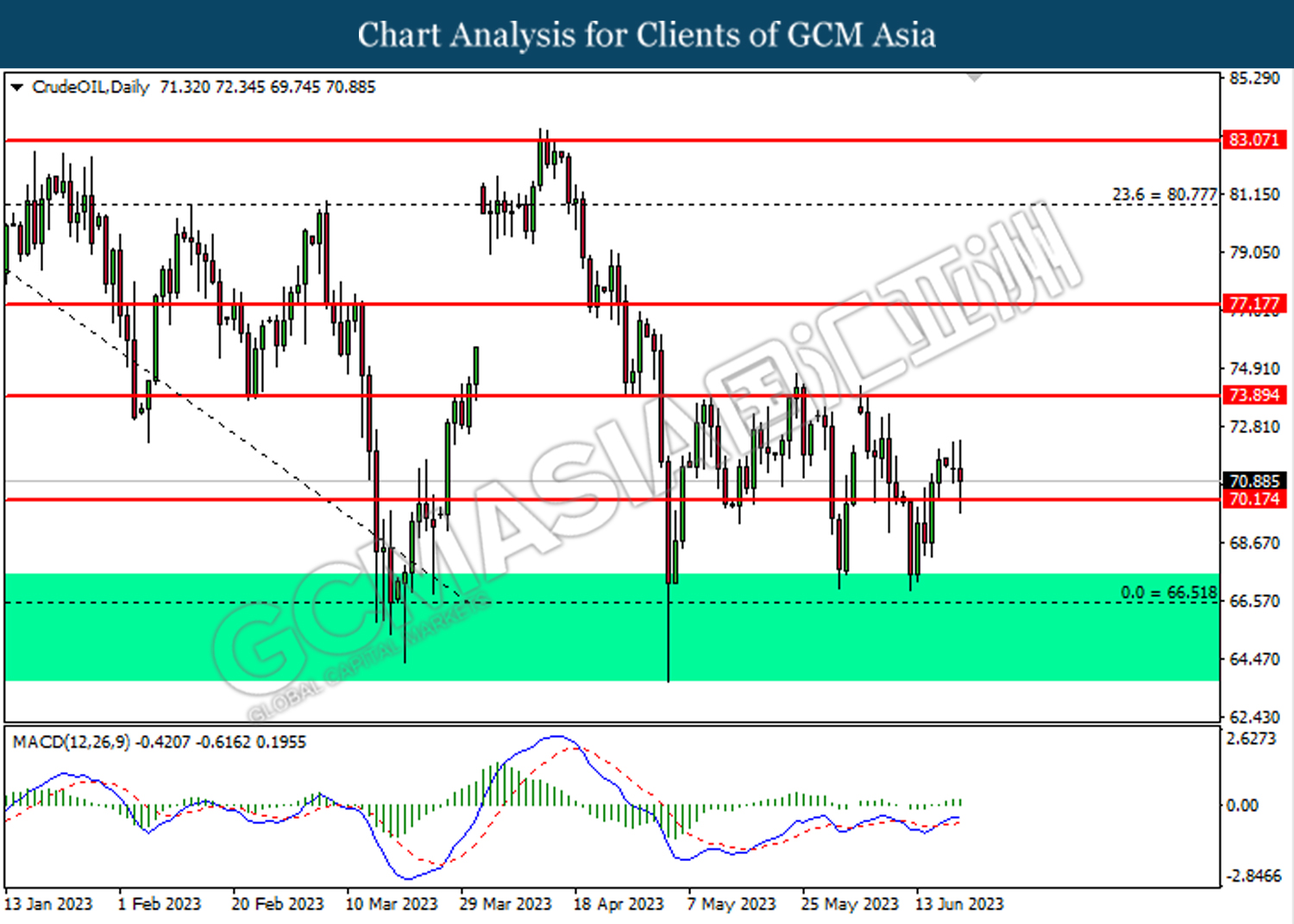

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

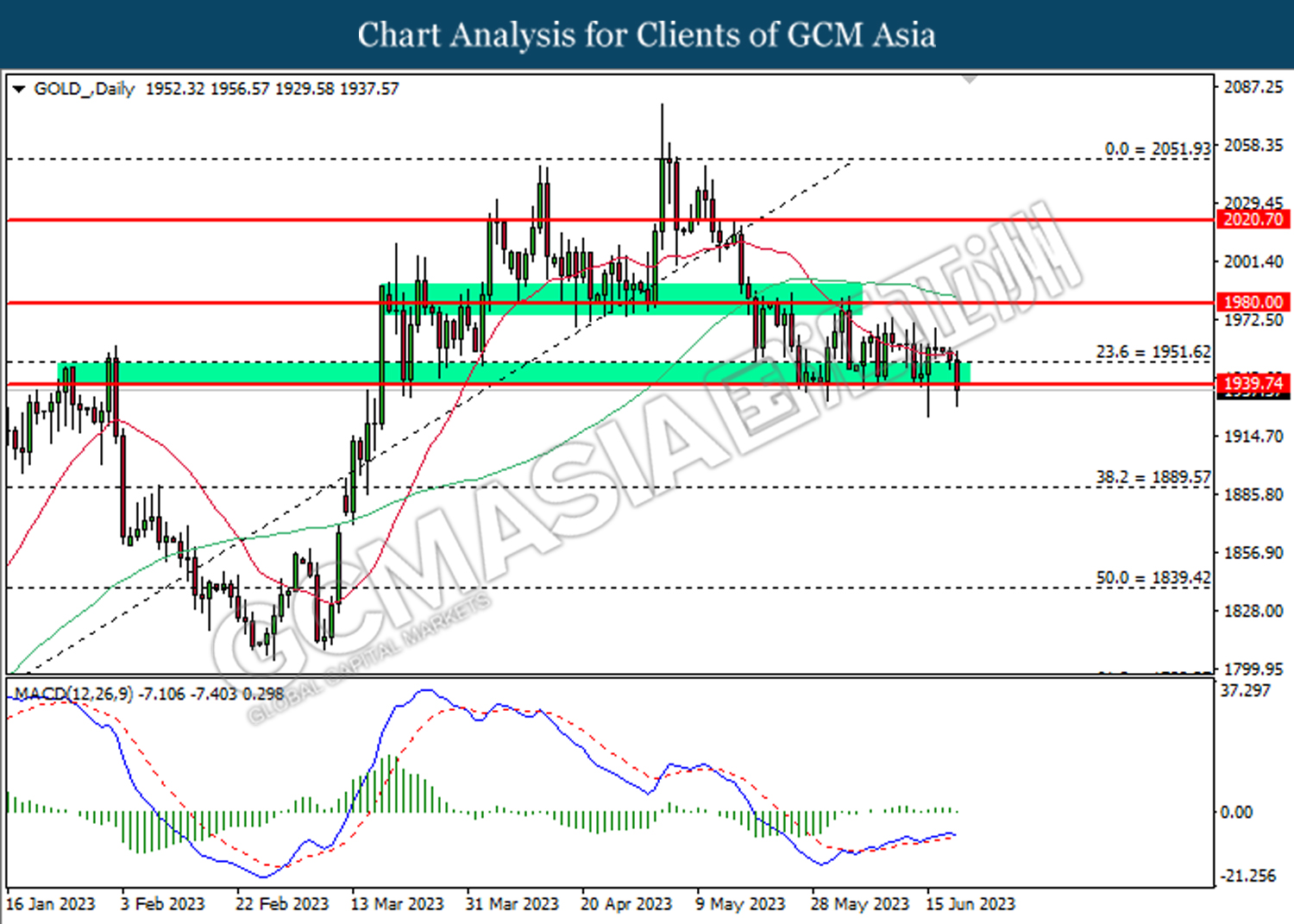

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1939.75. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1951.60, 1980.00

Support level: 1939.75, 1889.55