21 July 2022 Afternoon Session Analysis

Japanese Yen remained weak following monetary policy decision.

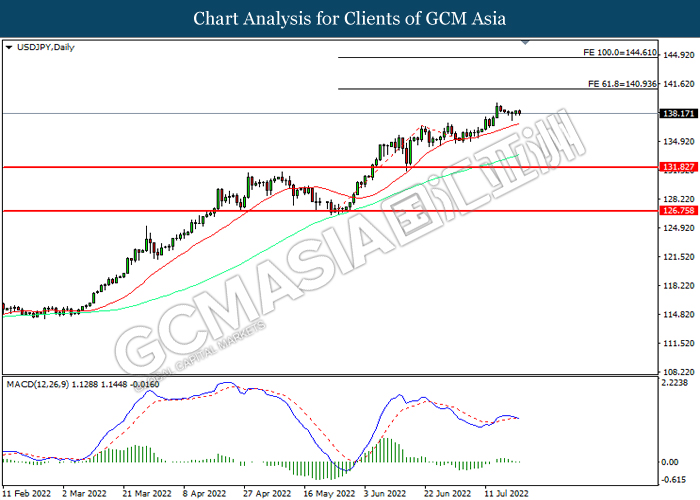

The overall market demand toward the Japanese Yen remained weak following the Bank of Japan maintain their easy monetary policy on Thursday, while it predicts more consumer inflation a higher commodity price worldwide. According to the latest monetary policy statement, the Japanese Central Bank decided to keep its monetary policy interest rate unchanged, controlling the 10-year yields to zero while short-term rates to minus 0.1% and promising to continue purchasing Japanese government bond without limit. Though, the losses experienced by the Japanese Yen was limited following the central bank increase the inflation forecast. the BoJ’s Monetary Policy Committee (MPC) predicted that the consumer inflation would rise 2.3% for the fiscal current year, increase from a 1.9% forecast three months ago. Rising inflation expectation would likely to prompt the central bank the increase their interest rate in future in order to stabilize the inflation risk. As of writing, USD/JPY appreciated by 0.01% to 138.20.

In the commodities market, the crude oil price retreated by 1.02% to $98.85 per barrel as of writing. The crude oil price slumped following the US gasoline inventories rose to 3.5-million-barrel last week, according to the government data, far higher than the market forecast at 71,000 barrels. On the other hand, the gold price depreciated by 0.21% to $1693.00 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Jul) | -0.50% | -0.25% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (Jul) | – | 0.25% | – |

| 20:30 | USD – Initial Jobless Claims | 244K | 240K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jul) | -3.3 | -2.5 | – |

Technical Analysis

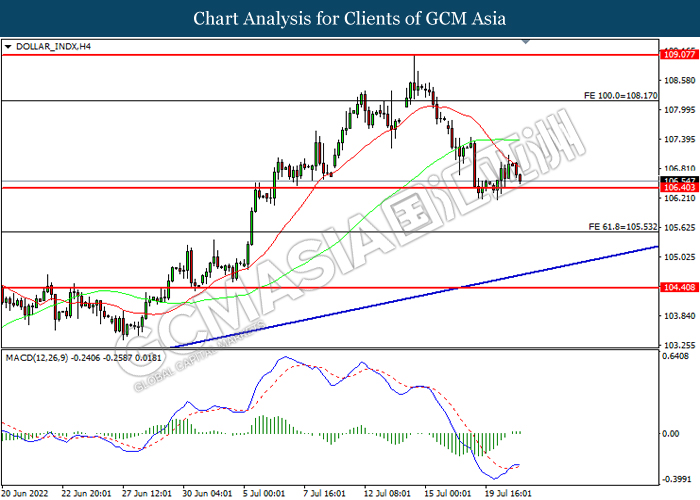

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 108.15, 109.05

Support level: 106.40, 105.55

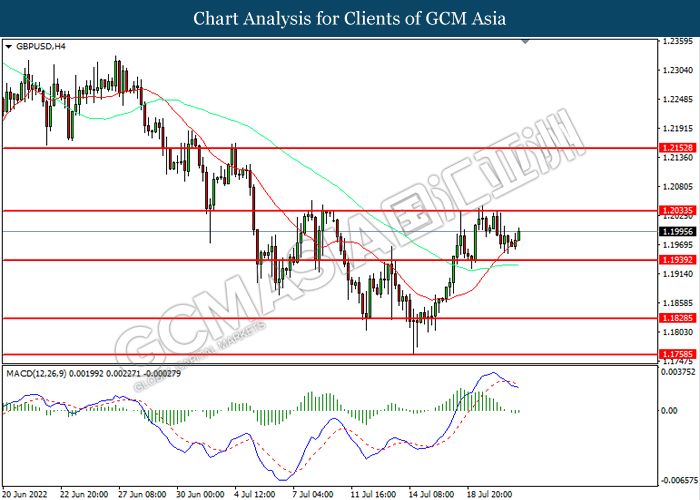

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2035, 1.2155

Support level: 1.1940, 1.1830

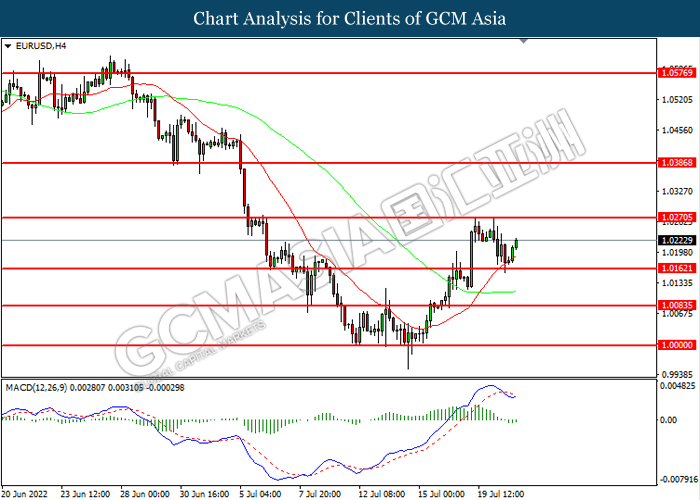

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its toward resistance level.

Resistance level: 1.0270, 1.0385

Support level: 1.0160, 1.0085

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 140.95, 144.60

Support level: 131.85, 126.75

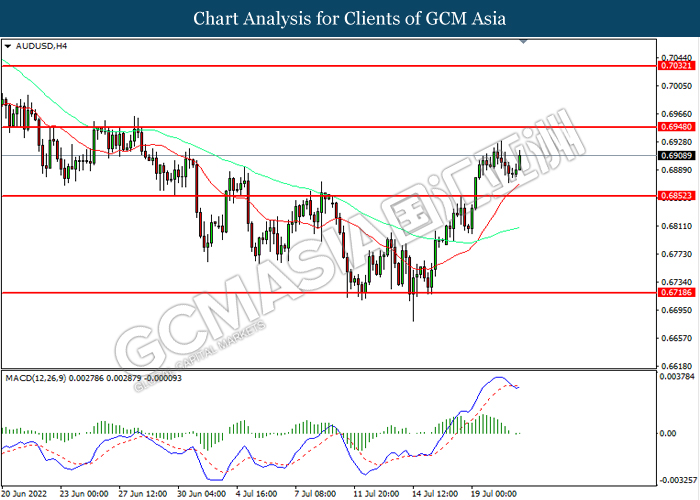

AUDUSD, H4: AUDUSD was traded higher following rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6950, 0.7030

Support level: 0.6850, 0.6720

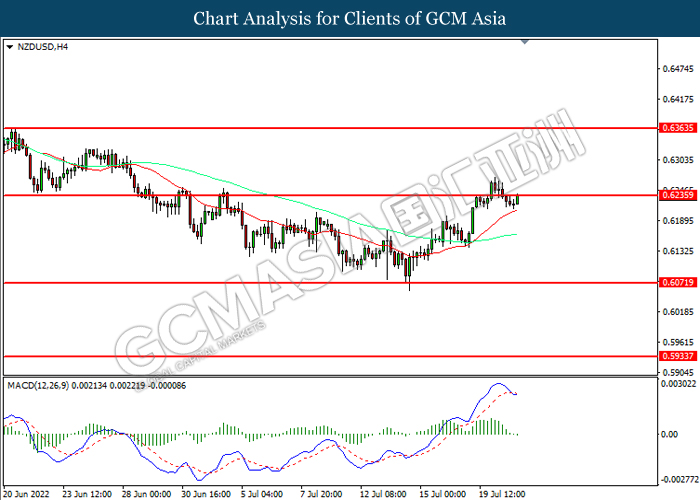

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6235, 0.6365

Support level: 0.6070, 0.5935

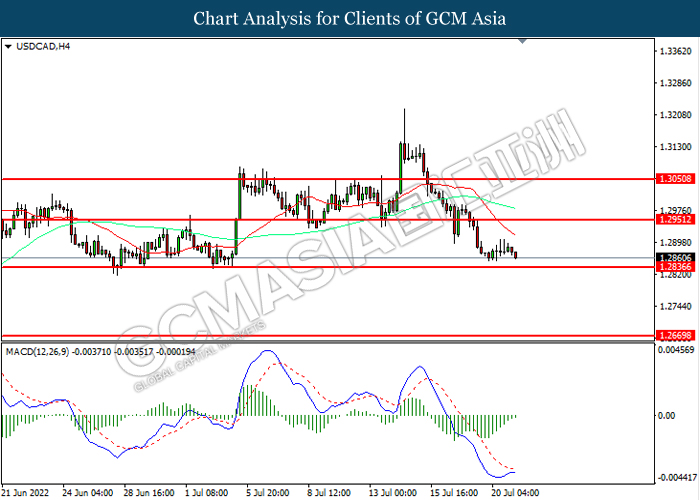

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2950, 1.3050

Support level: 1.2835, 1.2670

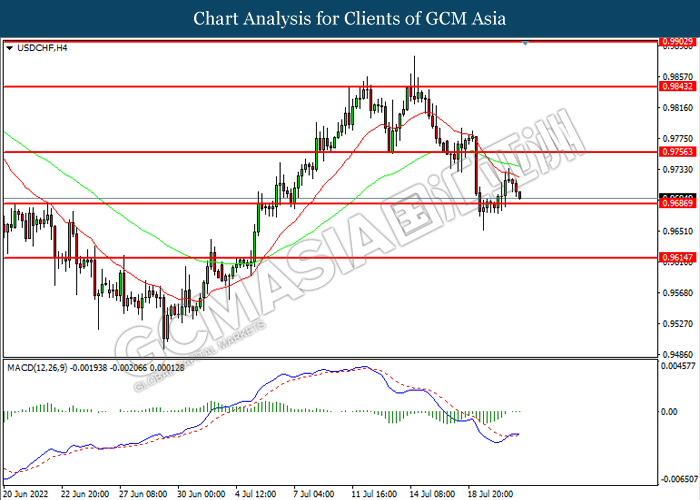

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9755, 0.9845

Support level: 0.9685, 0.9615

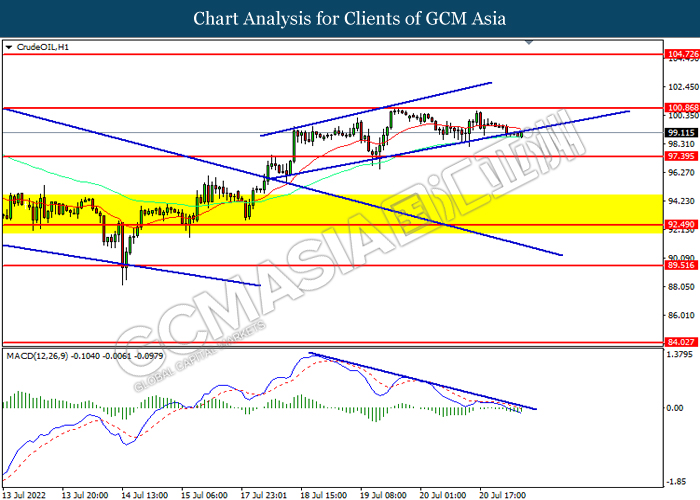

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 100.85, 104.75

Support level: 97.40, 92.50

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1702.60, 1725.00

Support level: 1680.00, 1666.85