21 August 2017 Weekly Analysis

GCMAsia Weekly Report: August 21 – 25

Market Review (Forex): August 14 – 18

U.S. Dollar

Greenback slipped against a basket of other major peers on Friday as US political uncertainty and growing doubts over the prospect for another rate hike continue to chips away investors’ confidence. The dollar index shed 0.3% during late Friday trading while last quoted at 93.36. For the week, the index has managed to record a gain of 0.43%.

Political uncertainty in the US remained as the main focus on Friday after US President Donald Trump told aides that he has decided to remove Steve Bannon from his post as chief White House Advisor. The latest twist in the Washington political saga has catalyzed growing concern over Trump’s ability to push through his pro-growth agenda such as fiscal spending and tax reforms.

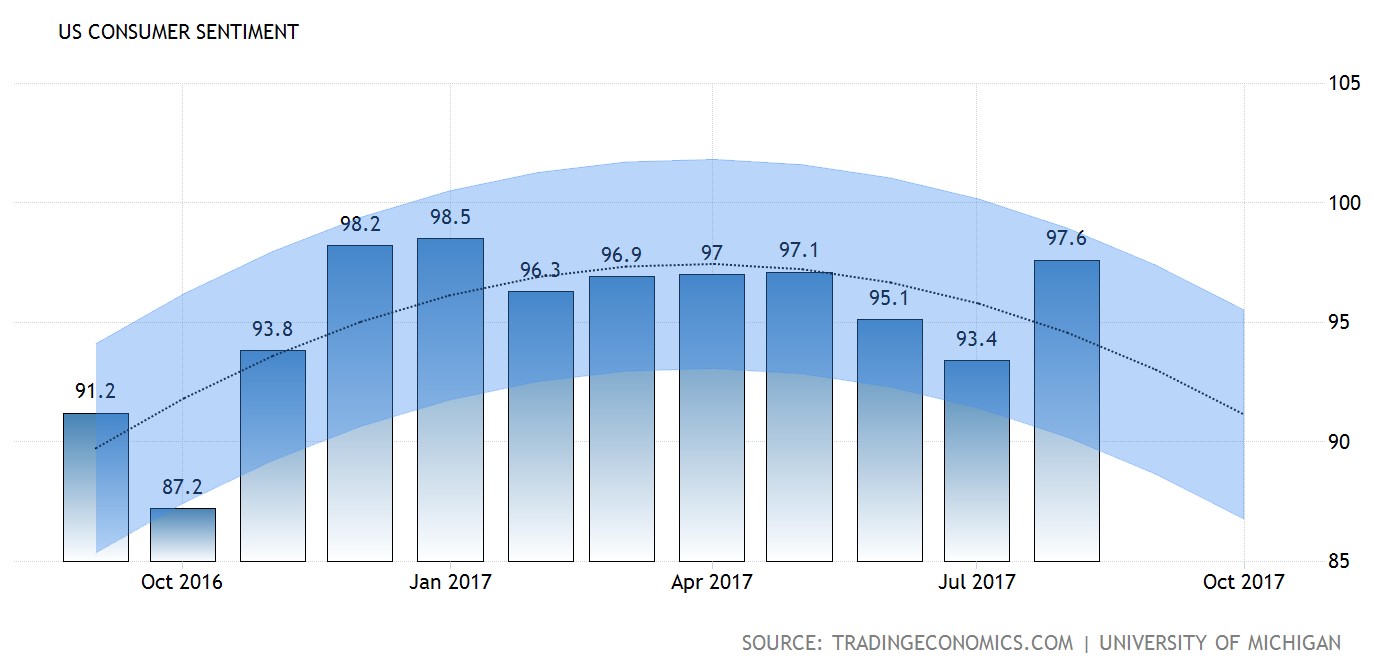

Otherwise, losses in greenback were capped after preliminary reading of consumer sentiment for the month of August exceed economist expectation which adds to a backdrop of recent upbeat economic docket. A survey conducted by The University of Michigan found that consumer sentiment rose to 97.6 in August, beating consensus forecast of 94.00.

US Consumer Sentiment

—– Forecast

US consumer sentiment rose to 97.6 in August, topping economist forecast of only 94.00.

USD/JPY

Pair of USD/JPY was down 0.36% to 109.18 during late Friday trading.

EUR/USD

Euro pushes higher against the dollar, appreciating more than 0.32% while closing at $1.1760.

GBP/USD

Pound sterling ticked up 0.08% while closing the week at $1.2878 against the US dollar.

Market Review (Commodities): August 14 – 18

GOLD

Gold prices retreats on Friday following prior surge to its highest level in nine months with the backdrop of US political uncertainty and terrorist attack in Spain. Its prices depreciate by 0.16% to $1,290.27 after peaking at a high of $1,306.90 earlier.

The demand for the precious metal subsides following reports of senior White House advisor Steve Bannon is dismissed of his post which is deemed as positive by investors for Trump’s administration agenda. However, its losses remained limited as greenback suffered from selling pressure due to greater uncertainty over Trump’s economic agenda and the timing of next interest rate hike.

Crude Oil

Oil prices was settled higher on Friday, skyrocketing more than 3% following reports of a unit shutdown in one of the largest oil refineries in the US and a fall in the number of active domestic oil drilling rigs. Its prices surged $1.42 or 3% and ended the week at $48.51 per barrel.

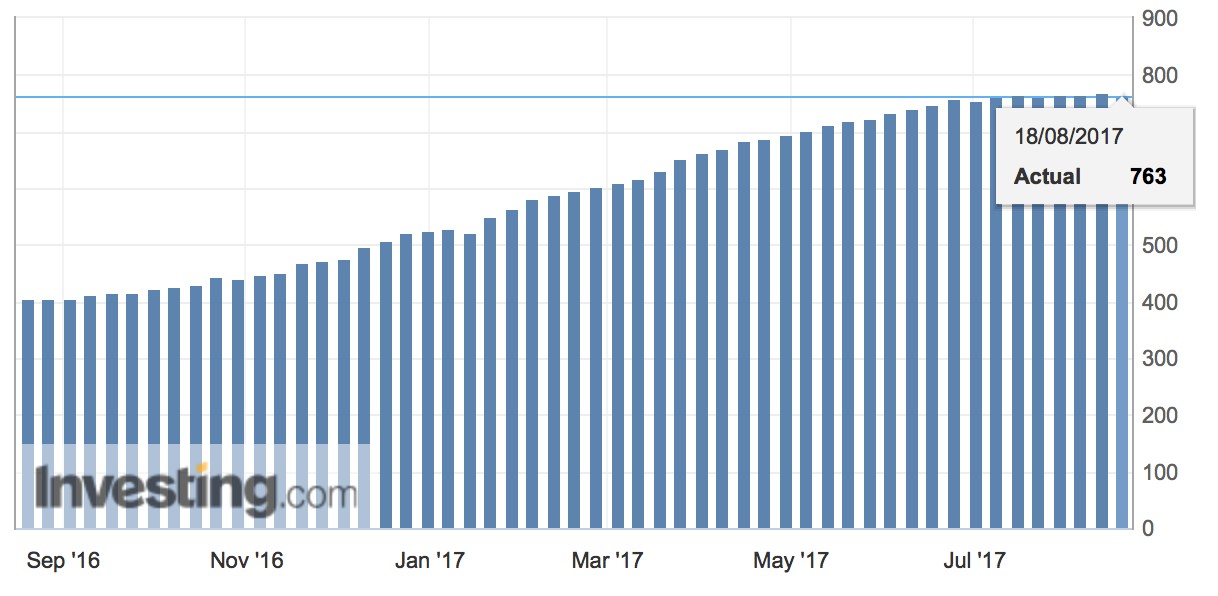

Traders pour into crude contracts after reports surfaced that a unit at Exxon Mobil’s Baytown, Texas refinery were shut down. The 584,000 barrels-a-day plant is the second largest oil refinery in the US. Likewise, US oilfield services firm Baker Hughes reported on Friday that the number of active oil drilling rigs fell by 5 while bringing the total count down to 763.

Despite Friday’s surge, its prices still ended the week with a loss of 31 cents or 0.6% due to ongoing concerns over rising oil outputs and OPEC’s ability to reduce global oversupply inventories. Previously, OPEC and 10 non-member producers has agreed to reduce daily production by 1.8 million barrels per day until March 2018 in hopes to reduce a global supply glut and rebalance the market. However, rising output from United States, Nigeria and Libya has offset such effort while raising doubts over OPEC’s ability to maintain such measures.

U.S. Baker Hughes Oil Rig Count

Active drilling rigs in the United States was down by 5 and the total count is currently at 763.

Weekly Outlook: August 21 – 25

For the week ahead, investors will be focusing on speeches by central bankers at the Federal Reserve’s annual central bank symposium in Jackson Hole, Wyoming. Likewise, they will also keep an eye on US economic docket which includes housing and durable goods data to gauge its impact on Fed’s policy while euro zone is bound to release their latest data on private sector activity.

Otherwise, oil traders will be looking forward for fresh weekly information on US stockpiles to gauge the strength of demand in the world’s largest oil consumer. In addition, remarks given by global oil producers will also be focused for evidence of their compliance towards the agreement to reduce their daily output.

Highlighted economy data and events for the week: August 21 – 25

| Monday, August 21 |

Data CAD – Wholesale Sales (MoM) (Jun)

Events N/A

|

| Tuesday, August 22 |

Data GBP – Public Sector Net Borrowing (Jul) EUR – German ZEW Economic Sentiment (Aug) GBP – CBI Industrial Trends Orders (Aug) CAD – Core Retail Sales (MoM) (Jun)

Events N/A

|

| Wednesday, August 23 |

Data CrudeOIL – API Weekly Crude Oil Stock EUR – German Manufacturing PMI USD – Manufacturing PMI (Aug) USD – Services PMI (Aug) USD – New Home Sales (Jul) CrudeOIL – Crude Oil Inventories

Events EUR – ECB President Draghi Speaks USD – FOMC Member Kaplan Speaks

|

| Thursday, August 24 |

Data GBP – GDP (QoQ) (Q2) USD – Initial Jobless Claims USD – Existing Home Sales (Jul)

Events USD – Jackson Hole Symposium

|

|

Friday, August 25

|

Data EUR – German GDP (QoQ) (Q2) EUR – German Ifo Business Climate Index (Aug) USD – Core Durable Goods Orders (MoM) (Jul) CrudeOIL – US Baker Hughes Oil Rig Count

Events USD – Jackson Hole Symposium USD – Fed Chair Yellen Speaks EUR – ECB President Draghi Speaks

|

Technical weekly outlook: August 21 – 25

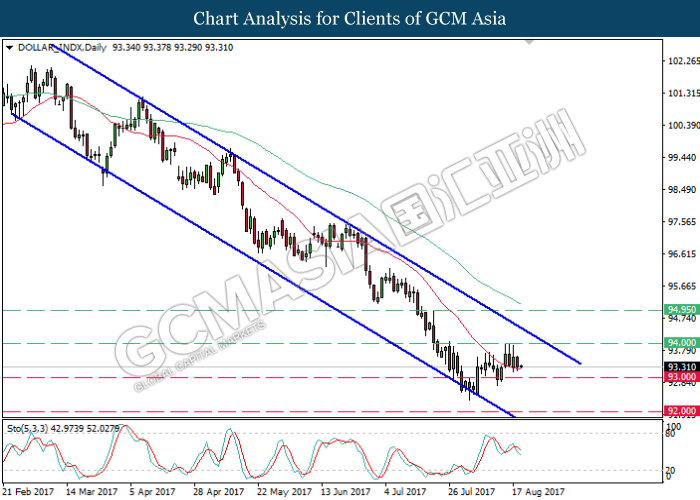

Dollar Index

DOLLAR_INDX, Daily: The dollar index remained traded within a downward channel recently retraced from the upper level of the channel. Stochastic Oscillator which illustrate a retracement signal suggests the dollar index advance further down after closing below the 20-MA line (red).

Resistance level: 94.00, 94.95

Support level: 93.00, 92.00

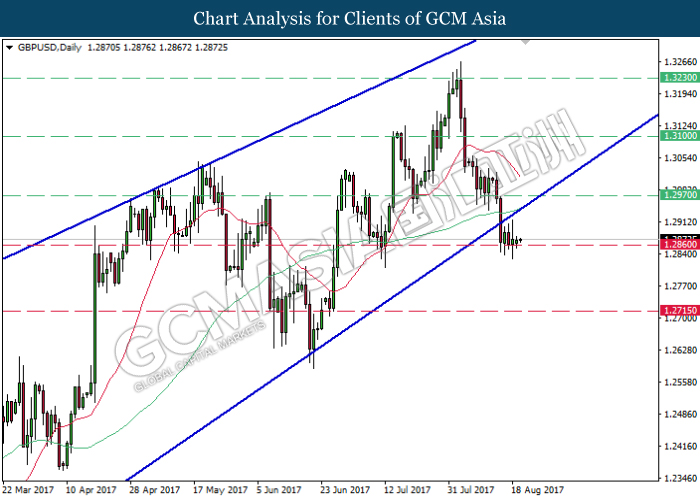

GBPUSD

GBPUSD, Daily: GBPUSD has recently broke out from the bottom level of upward wedge, signaling a change in trend direction to move further downwards. Both MA lines which continues to narrow downward suggests GBPUSD to extend its losses after closing below the support level of 1.2860.

Resistance level: 1.2970, 1.3100

Support level: 1.2860, 1.2715

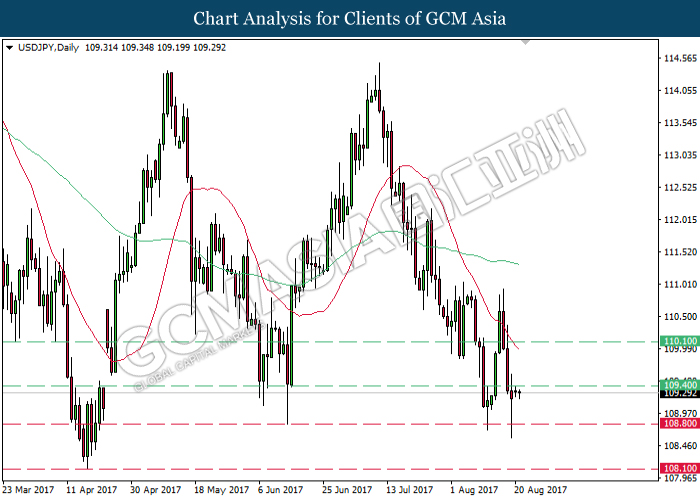

USDJPY

USDJPY, Daily: USDJPY were traded lower following prior retracement from the strong resistance level of 109.40. Both MA lines which continues to expand downwards suggests ongoing downside bias for USDJPY towards the target of support level at 108.80.

Resistance level: 109.40, 110.10

Support level: 108.80, 108.10

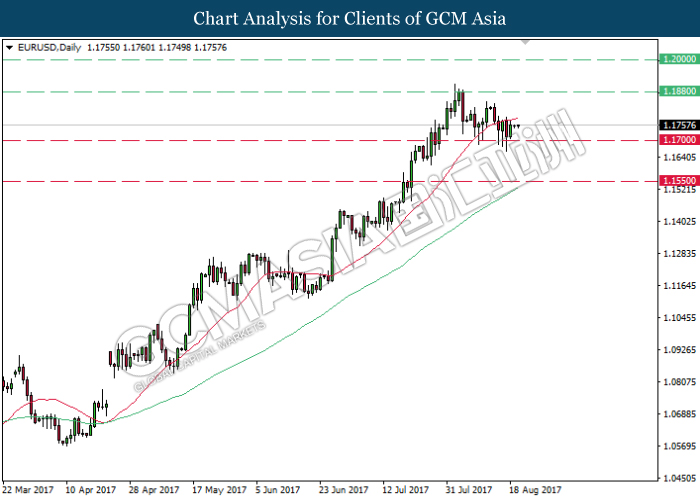

EURUSD

EURUSD, Daily: EURUSD was traded higher following prior rebound from the strong support level of 1.1700. Such price movement suggests further upside bias for EURUSD to advance further upwards after successfully closing above the 20-MA line (red).

Resistance level: 1.1880, 1.2000

Support level: 1.1700, 1.1550

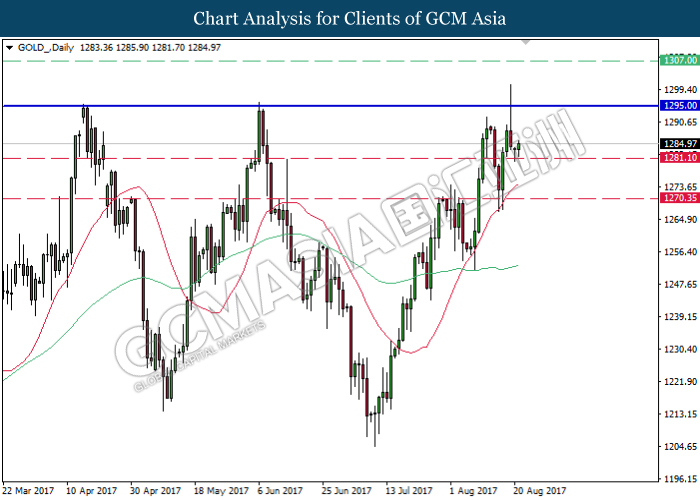

GOLD

GOLD_, Daily: Gold price was traded higher following prior rebound from the strong support level of 1281.10. Both MA lines which continues to expand upwards suggests gold price to move further up, towards the strong resistance level of 1295.00.

Resistance level: 1295.00, 1307.00

Support level: 1281.10, 1270.35

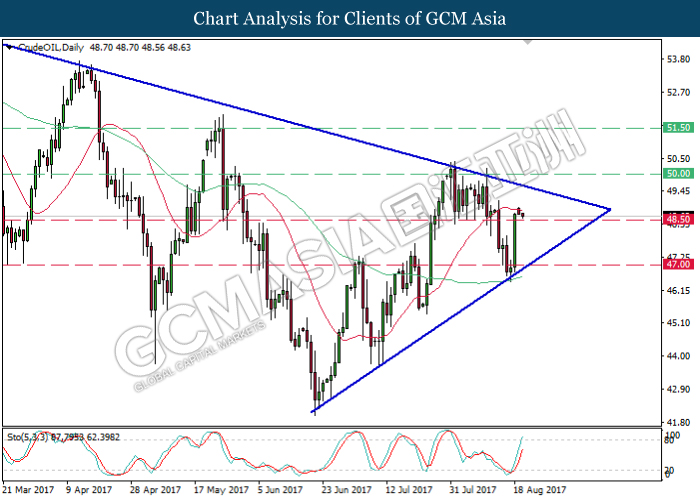

Crude Oil

CrudeOIL, Daily: Crude oil price remains traded within a narrowing triangle while recently retraced from the 20-MA line (red). Such price movement suggests its prices to be traded lower in short-term, towards the first target at 48.50. Otherwise, long-term trend direction could only be determined after a successful breakout from either side of the triangle.

Resistance level: 50.00, 51.50

Support level: 48.50, 47.00