21 August 2018 Daily Analysis

Dollar fell amid Donald Trump criticize on rate hike.

The dollar index has continued its decline after the US President Donald Trump’s statement which criticizing the Fed to tighten monetary policy. According to the Reuters’s interview with the US President yesterday, Donald Trump has expressed his dissatisfaction with the Fed Chairman Jerome Powell in the interest rate hike plan. He has stated that the U.S. central bank could do more to assist him in stimulate the economy while at the same time he also accuses China and Europe of manipulating their respective currencies. The statement has sparked anxiety with the influence of US President Donald Trump in the Fed that could have led to a plan change in interest rate hikes. The dollar index has slipped 0.38% to 95.40 as of writing. Meanwhile, EURUSD has dropped 0.05% to 1.2736 following the turmoil in Turkey’s which is worsening. According to reports from Bloomberg, both credit rating agencies Standard & Poors, and Moodys have reduce Turkey’s sovereign credit rating on Friday due to the ongoing crisis in the country. In addition, market observers also remain focused on the developments after a report on shots was launched at the U.S. embassy. in the Turkish capital on Monday.

In the commodity market, crude oil prices have rose 0.08% to $ 65.26 a barrel following reports that China will remain it trading ties with Iran for crude oil. China has confirmed that the country is will continue to trade with Iran with the purchase of massive crude oil demand despite US efforts to persuade China to stop purchasing Iranian Oil. On the other hand, gold prices have risen by 0.24% to $ 1192.25 per troy ounce following the dollar weakness which is supported by the recovery of China Yuan amid new talks on trade between the US and China as well as statements from US President Donald Trump recently.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative CrudeOIL OPEC meeting

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20.30 | CAD – Wholesale Sales (MoM) (Jun) | 1.2% | 0.8% | – |

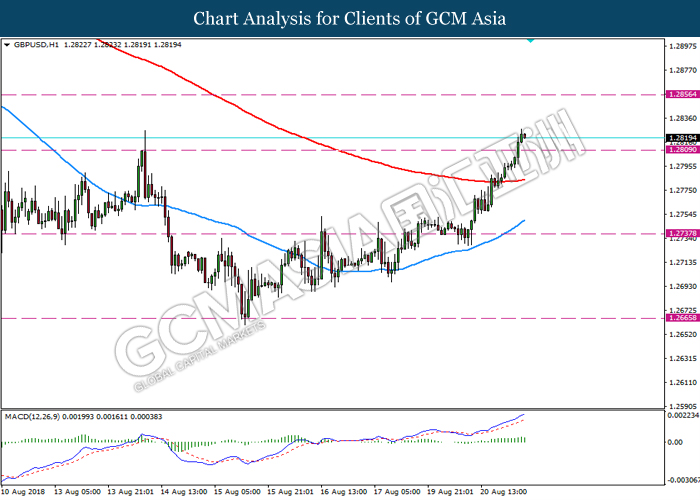

GBPUSD

GBPUSD, H1: GBPUSD was traded higher following recent breakout below the support level 1.2810. Recent price action and MACD which illustrate persistent bearish momentum suggest the pair to extend its gains towards the resistance level 1.2855.

Resistance level: 1.2855, 1.2905

Support level: 1.2810, 1.2735

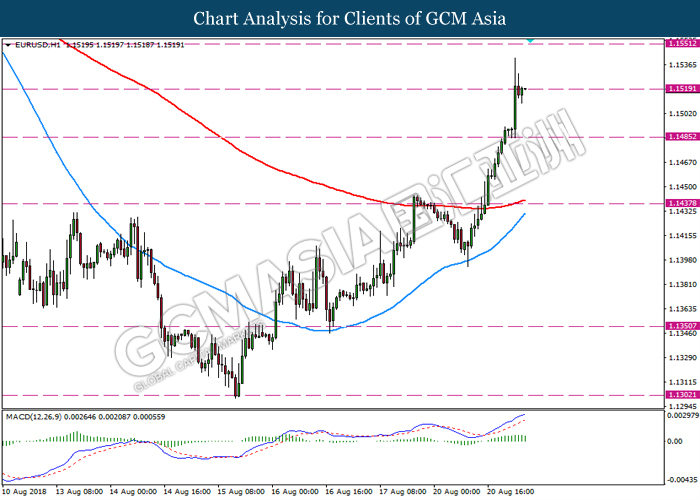

EURUSD

EURUSD, H1: EURUSD was traded higher while currently testing the resistance level 1.1520. Price action and MACD which indicates clear and ongoing bullish signal suggest the pair to extend its gains after it breaks above the resistance level 1.1520.

Resistance level: 1.1520, 1.1550

Support level: 1.1485, 1.1435

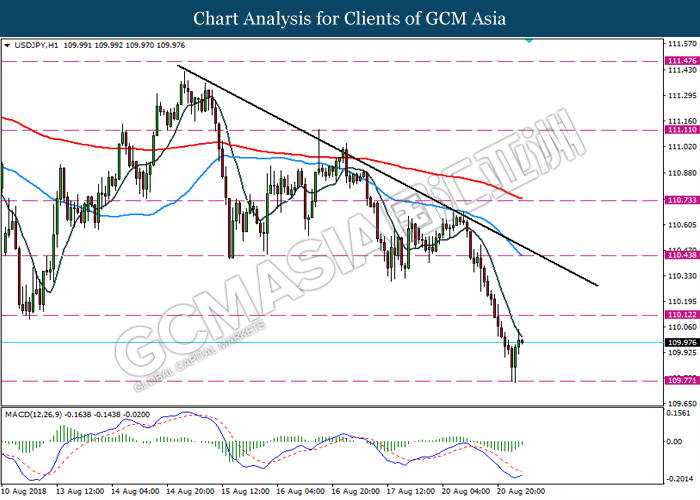

USDJPY

USDJPY, H1: USDJPY was traded higher following prior rebound from the support level 109.75. MACD which display diminished bearish signal suggest the pair to experience a technical correction towards the resistance level 110.10.

Resistance level: 110.10, 110.45

Support level: 109.75, 109.45

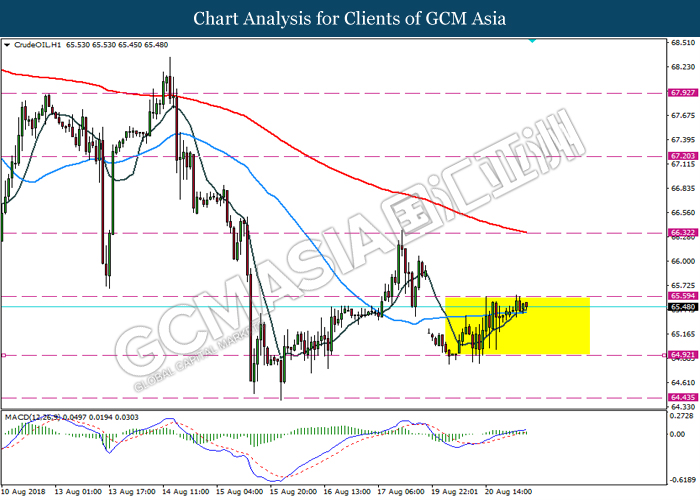

CrudeOIL

CrudeOIL, H1: The price of crude oil remains traded in a sideway channel while currently testing near the resistance level 65.60. Due to the lack of momentum in market and also lack of clear signal from MACD, it is suggested to wait until further signal appears such as breakout above the resistance level 65.60 or support level 64.90 before entering the market.

Resistance level: 65.60, 66.30

Support level: 64.90, 64.45

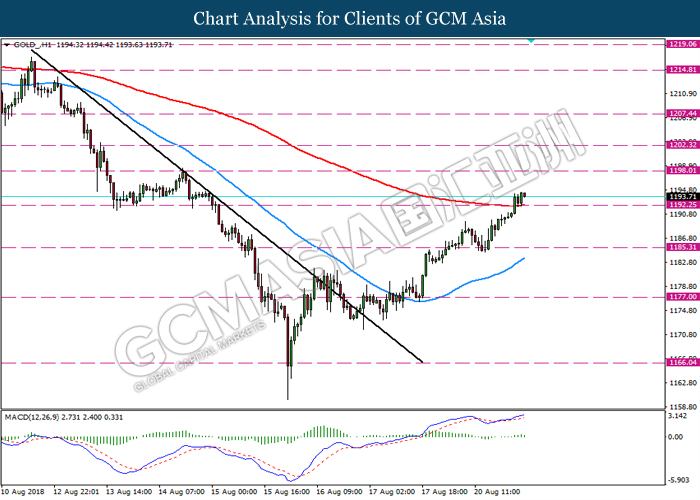

GOLD

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level 1192.00. Recent price action and MACD which illustrate ongoing bullish bias suggest the commodity to extend its gains towards the resistance level 1198.00

Resistance level: 1198.00, 1202.00

Support level: 1192.00, 1185.00