21 October 2022 Morning Session Analysis

Pound jumped following the resignation of Liz Truss.

The Sterling pound, which is majorly traded by the global investors, surged as the British Prime Minister announced her resignation after a brief and chaotic tenure for six weeks. Yesterday, the UK Prime Minister Liz Truss delivered her resignation statement as her economic stimulus program sent shockwaves to the market, led to her party members loss their confidence in her after six weeks of appointment. Liz Truss also admitted that she cannot deliver the mandate on which she was elected by the Conservative Party. With that, she chose to resign as leader of the Conservative Party, but will still remain as prime minister until a successor has been chosen. During her tenure as the UK Prime Minister, she announced a massive package of tax cuts before unwinding most of it in the face of a market rout. At this point in time, a new conservative party leader will replace Liz Truss as new prime minister within a week, whereby no general election will be held soon. As of writing, the pair of GBP/USD dropped 0.03% to 1.1230.

In the commodities market, the crude oil price rose by 0.10% to $84.55 per barrel as China plans to ease the Covid-19 quarantine measures for visitors. However, the market fears over the high inflationary pressures around the world continues to weigh on the oil market outlook. Besides, the gold prices dropped -0.07% to $1627.10 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Sep) | -1.6% | -0.5% | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Aug) | -3.1% | 0.4% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 113.30.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

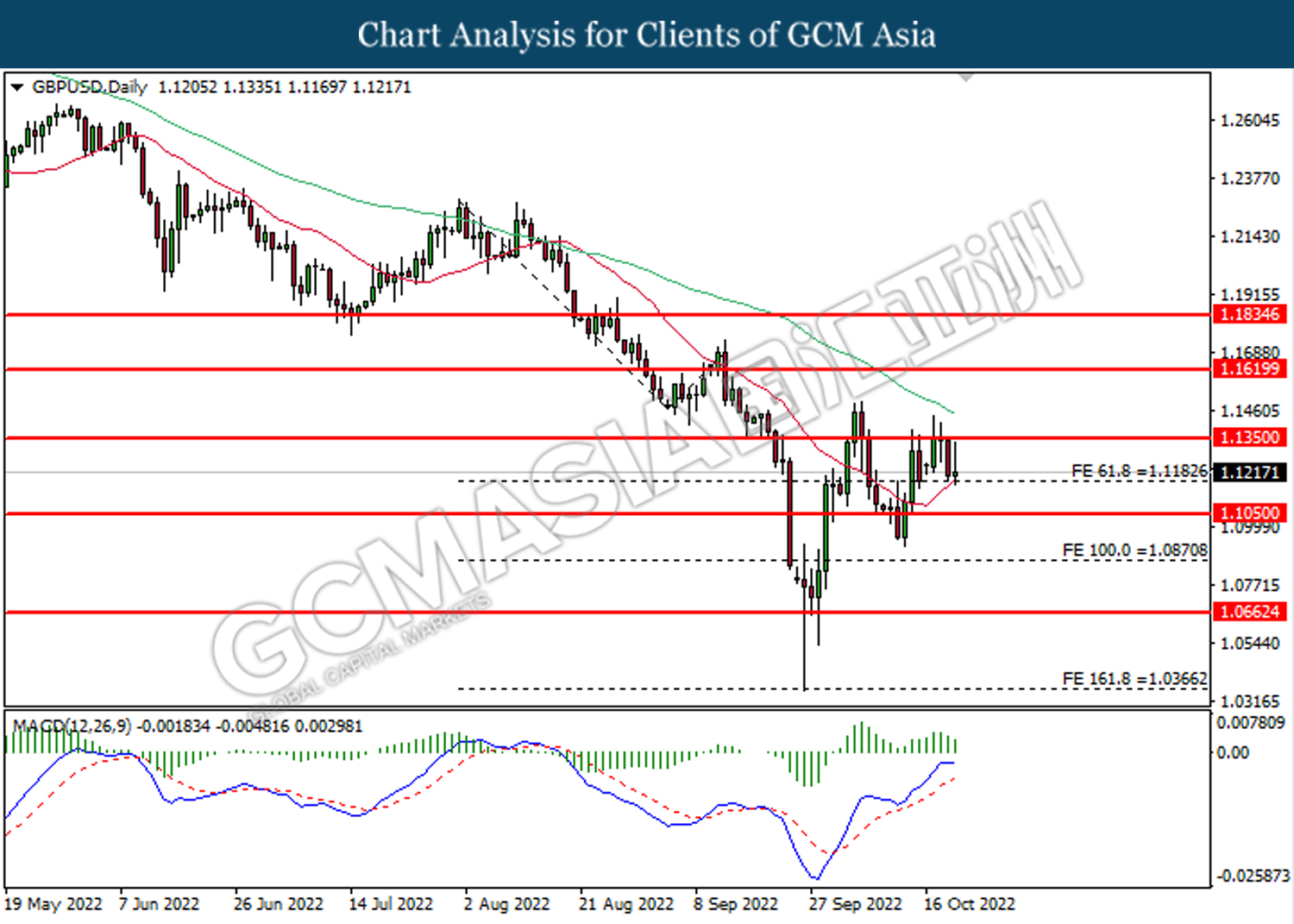

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1350. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1185.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 0.9830. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9685.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

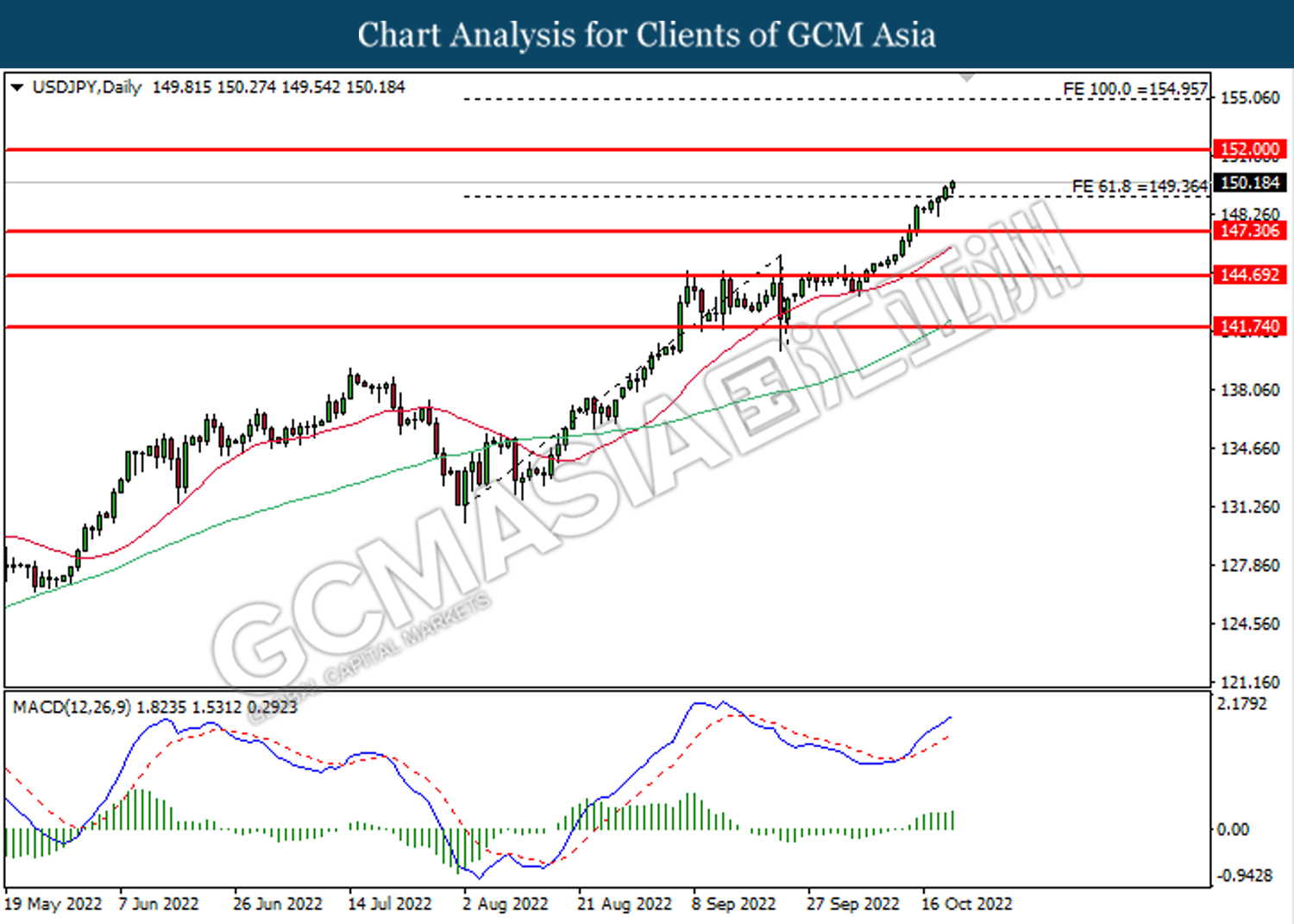

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 149.35. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 152.00.

Resistance level: 152.00, 154.95

Support level: 149.35, 147.30

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6285. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6285, 0.6430

Support level: 0.6165, 0.5990

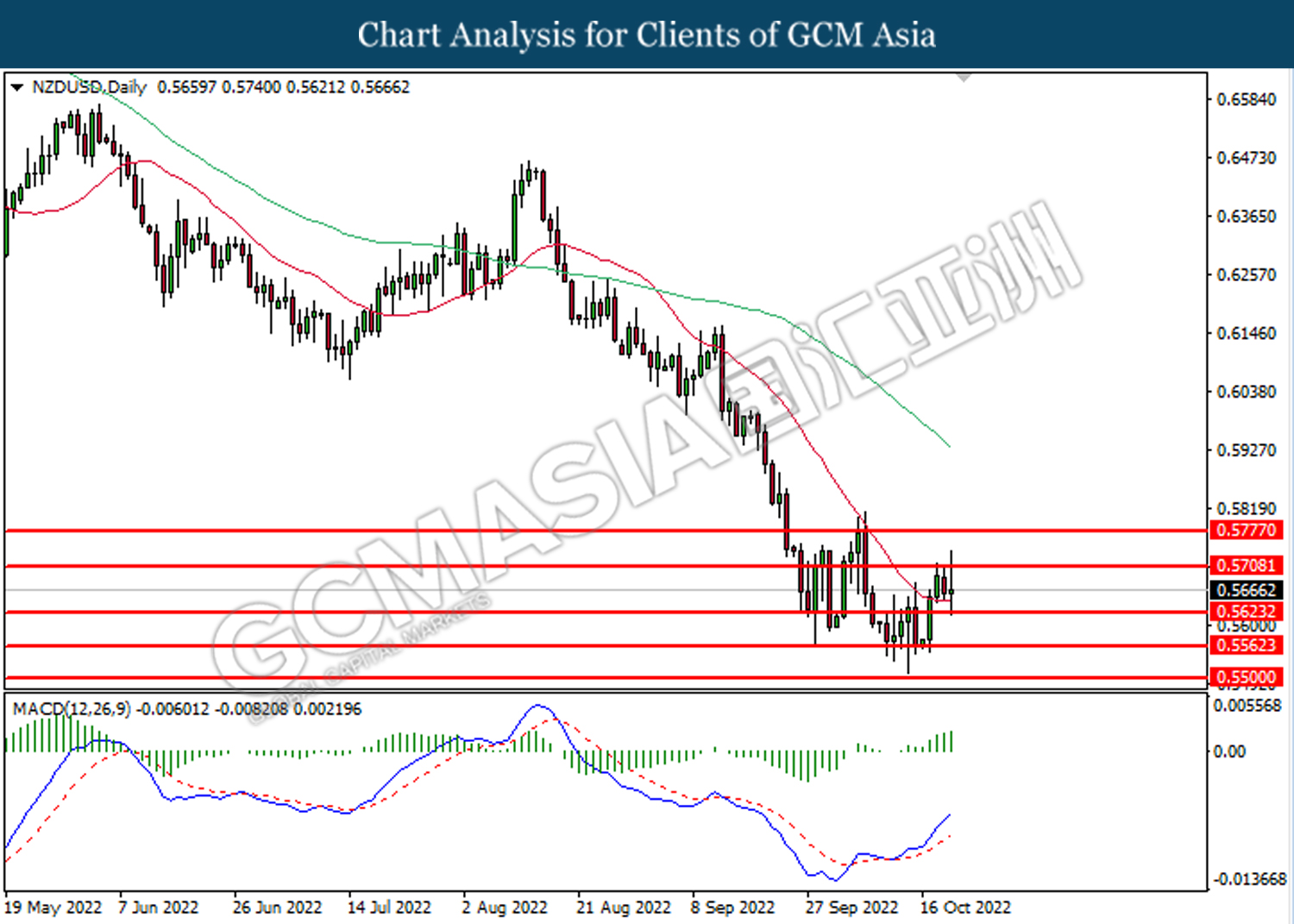

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.5710. However, MACD which illustrated bullish bias momentum suggest the pair to undergo short term technical correction.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5560

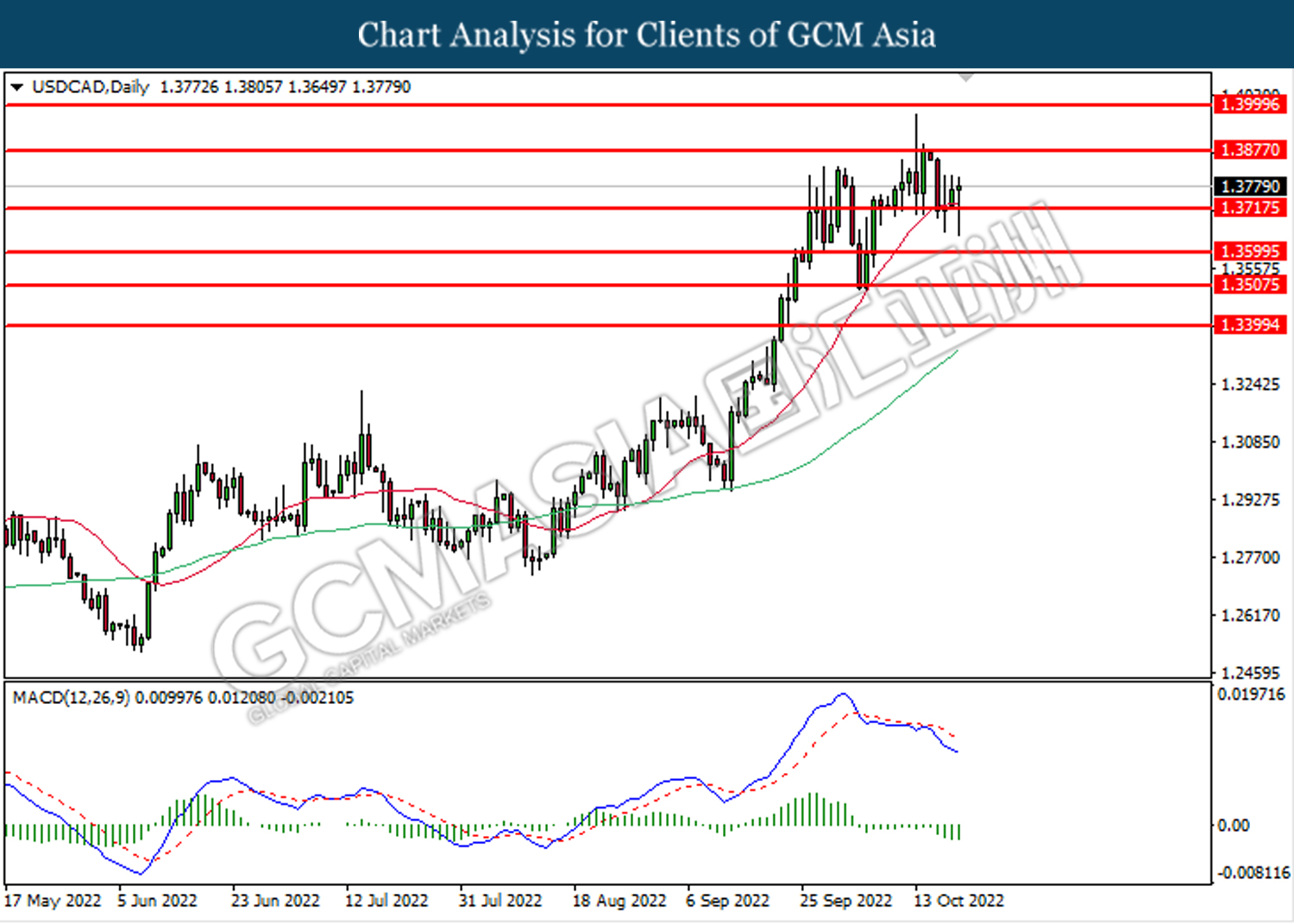

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3715. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical retracement in short term.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

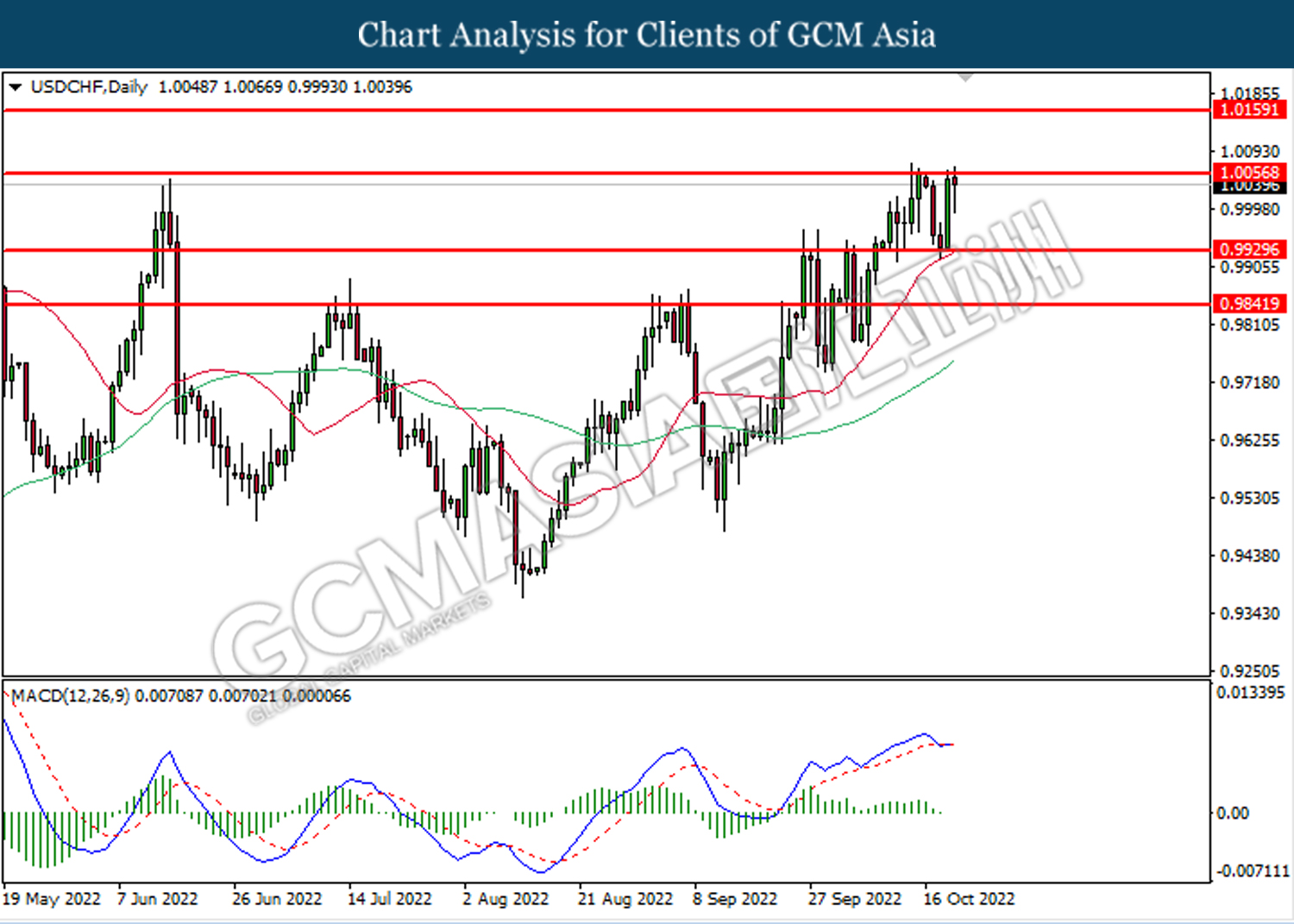

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 1.0055. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

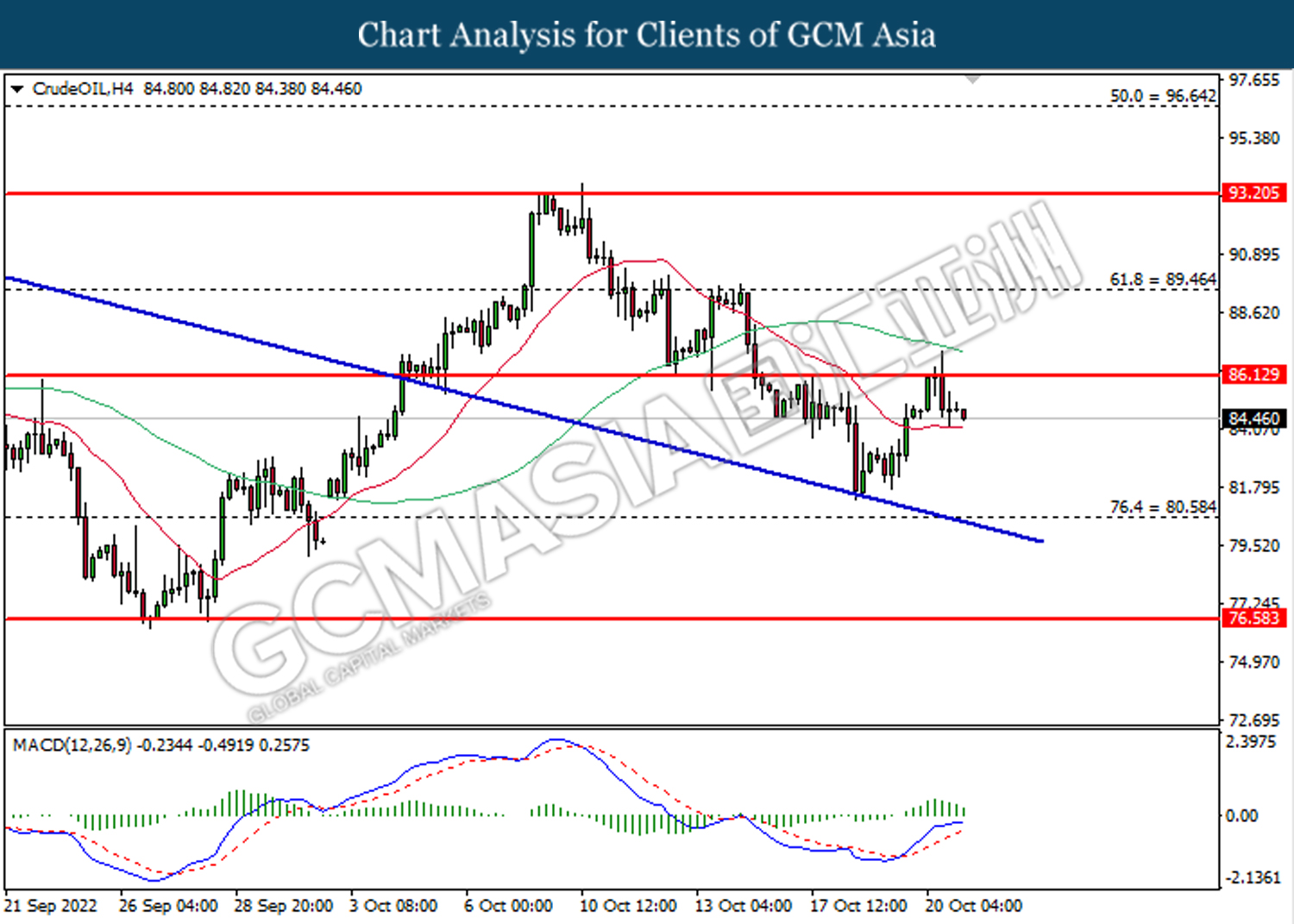

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 86.15. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

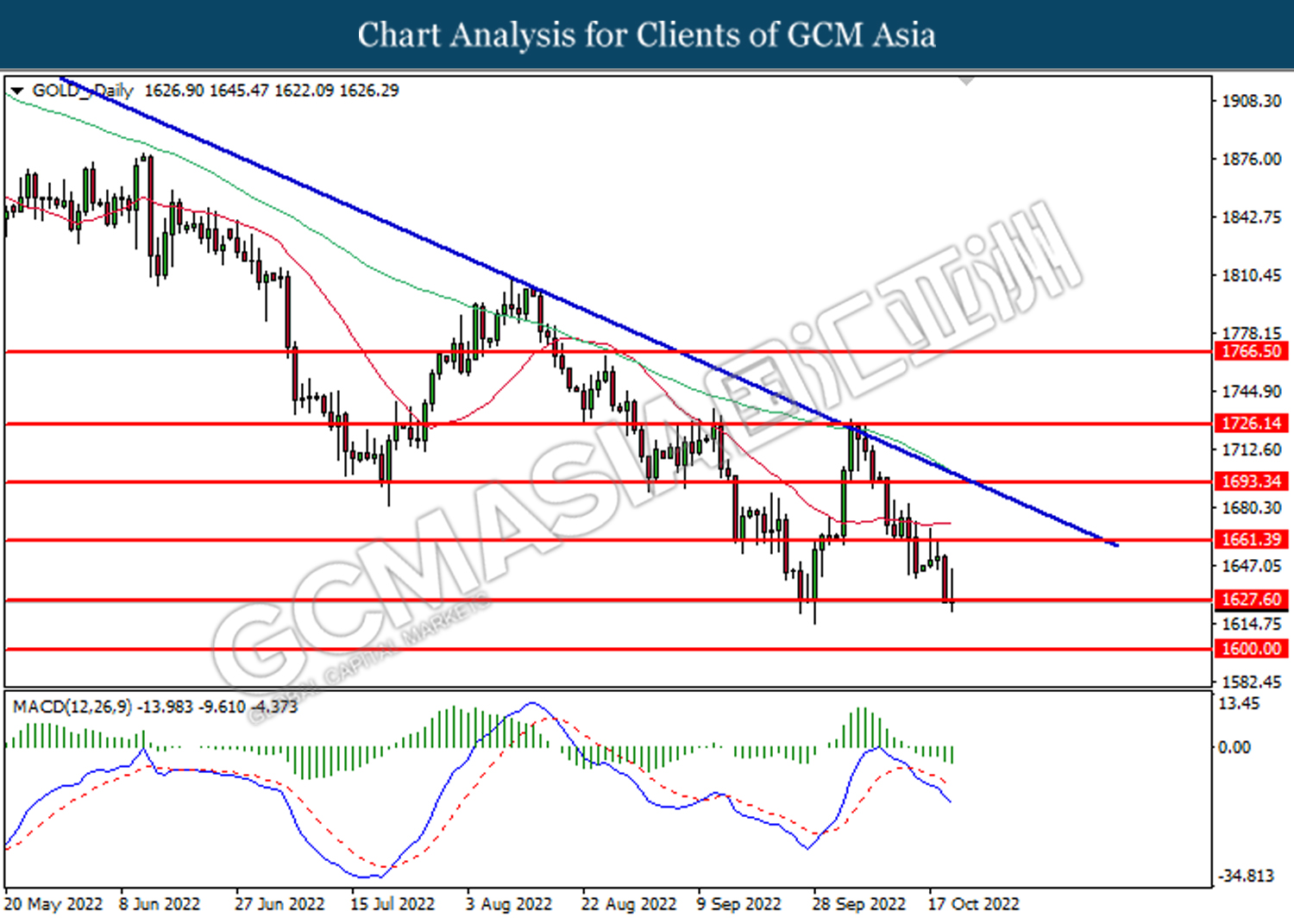

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1627.60. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00