21 November 2022 Afternoon Session Analysis

Aussie dived as China Covid-19 cases keep rising.

The AUD/USD, which widely traded by majority of investors dropped significantly on last week over the backdrop of surging Covid-19 cases in China. According to Reuters, Beijing residents were urged to stay at home on Monday, extending a request from the weekend as the city’s Covid-19 case number rose, with many business shut and school in area shifting classes online. Last week, new case numbers started to spike near April peaks as China battles outbreaks in cities across the country, from Zhengzhou in central Henan province to Guangzhou in the south and Chongqing in the southwest. In current situation, the aggressive lockdown move that reiterated by China government might be implemented again, which brought negative prospects toward economic progression in the China. As the trading partners with China, Australia economy would likely to be dragged down, which spurring bearish momentum on Aussie. As of writing, the AUD/USD depreciated by 0.34% to 0.6648.

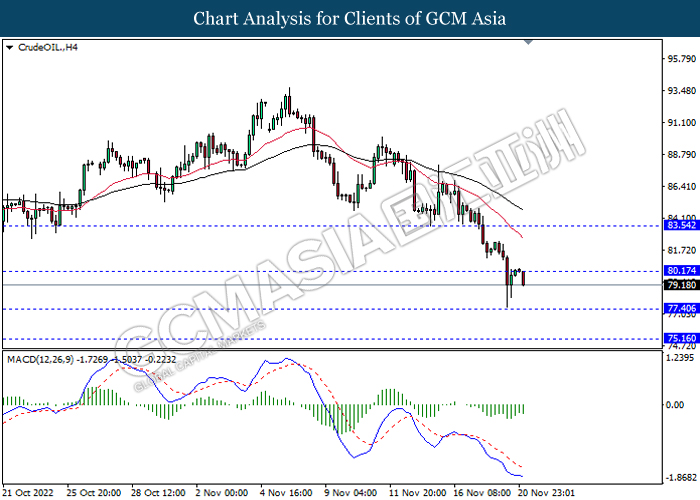

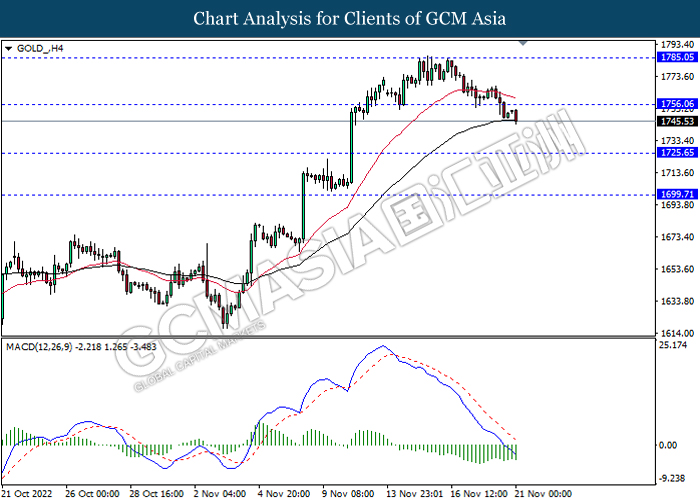

In the commodities market, the crude oil price slumped by 0.94% to $79.36 per barrel as of writing as the rising Covid-19 cases in China had weighed down the demand of this black commodity. On the other hand, the gold price eased by 0.43% to $1745.47 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

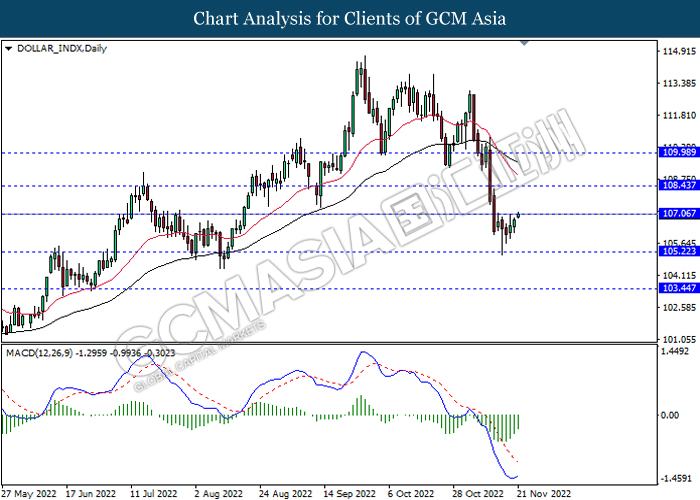

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains of successfully breakout the resistance level.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

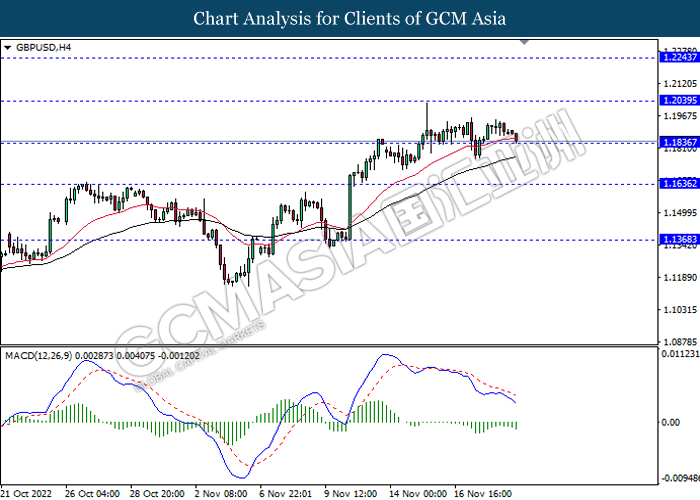

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

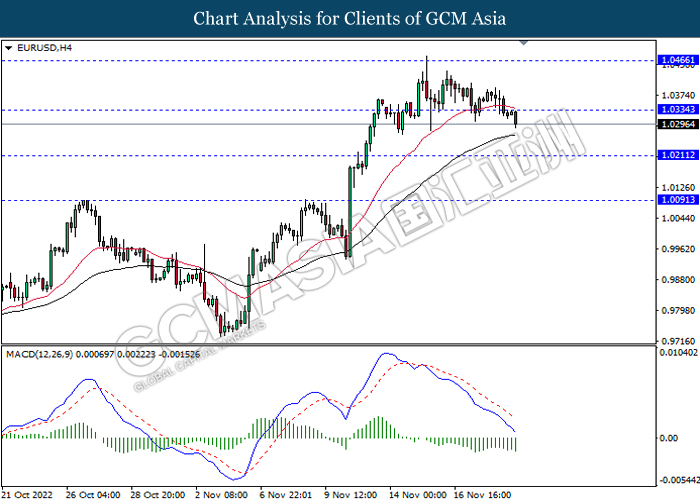

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0335, 1.0465

Support level: 1.0210, 1.0090

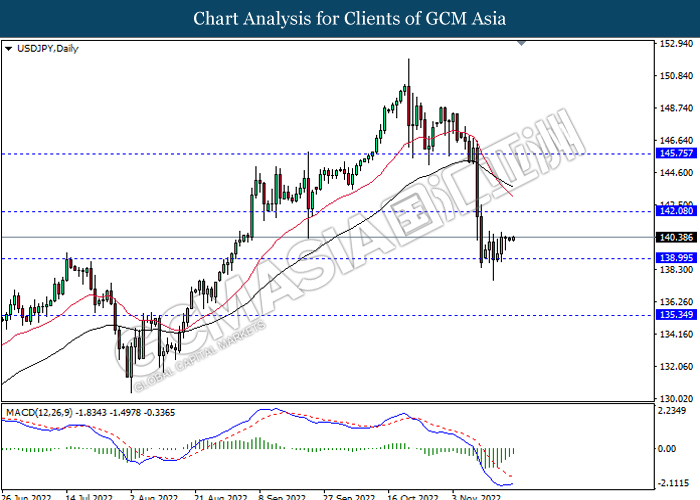

USDJPY, Daily: USDJPY was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

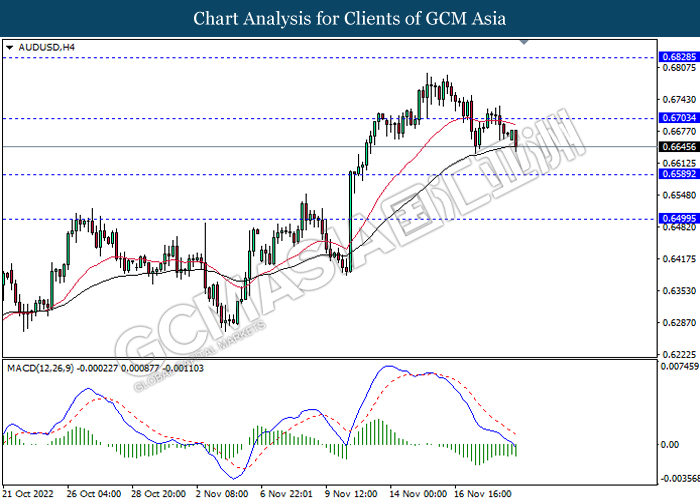

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

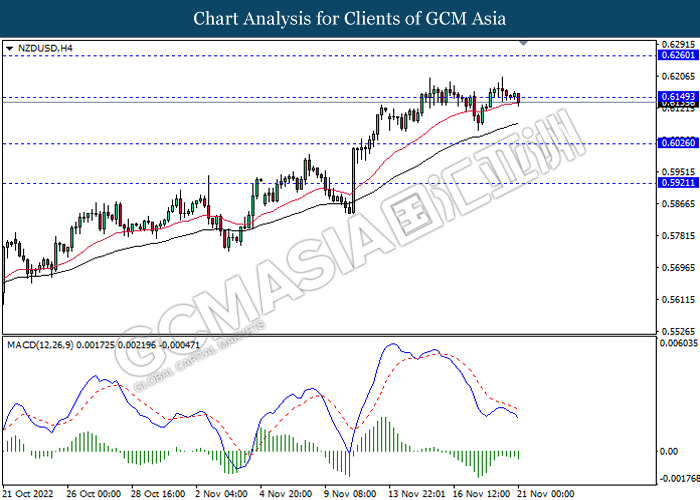

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

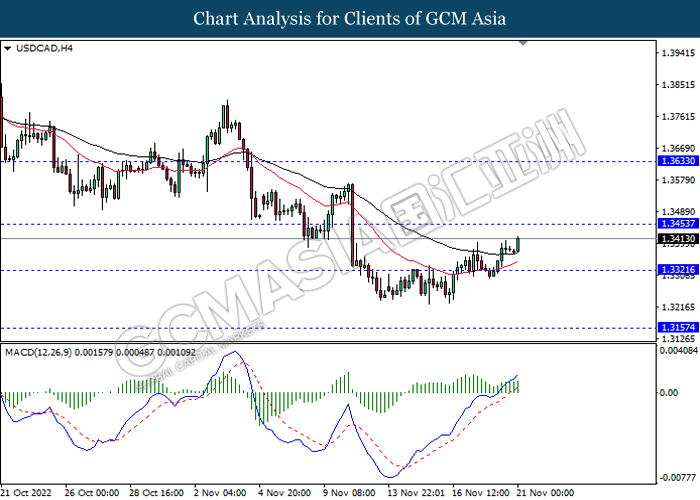

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

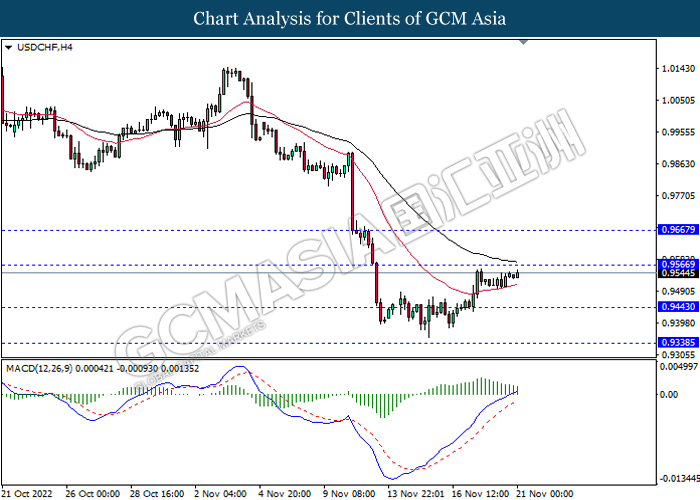

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9565, 0.9665

Support level: 0.9445, 0.9340

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 80.15, 83.55

Support level: 77.40, 75.15

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1756.05, 1785.05

Support level: 1725.65, 1699.70