21 November 2022 Morning Session Analysis

Dollar remains pressured as the pace of rate hike is likely to ease.

The dollar index, which gauges its value against a basket of six major currencies, hovered near its recent low level as the market participants are waiting for more economic data as well as comment from the Federal Reserve Chairman to gauge the further direction of Greenback. Over the past week, the US dollar net positioning turned net short for the first time since mid-July 2021. According to the Reuters and US Commodity Futures Trading Commission, the data showed that the value of the dollar positioning turned the table from a net long position of $2.36 billion to a net short position of $10.5 million for the week ended 15th November. With that, it is reflecting that the investors’ sentiment turned bearish on the dollar as the recent inflation figures, which including Consumer Price Index (CPI) and Producer Price Index (PPI), showed sign of easing, whereby it could urge the Federal Reserve to slowdown its pace on rising the interest rate. As of writing, the dollar index edged up 0.26% to 106.95.

In the commodities market, the crude oil price plunged by -1.99% to $77.55 per barrel amid market concern over the weakened demand in China. Besides, the gold prices edged down by -0.05% to $1750.85 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

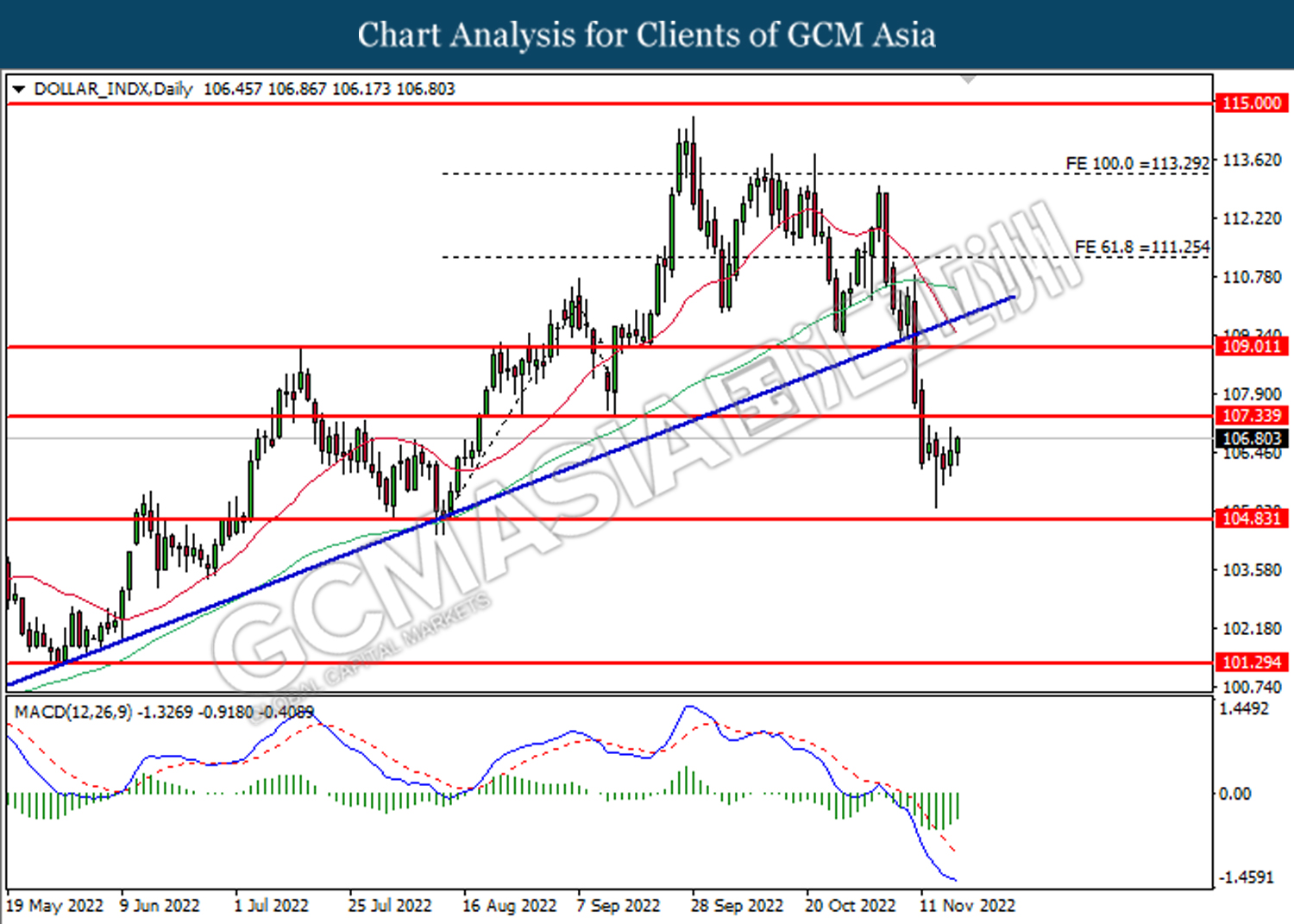

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.35.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

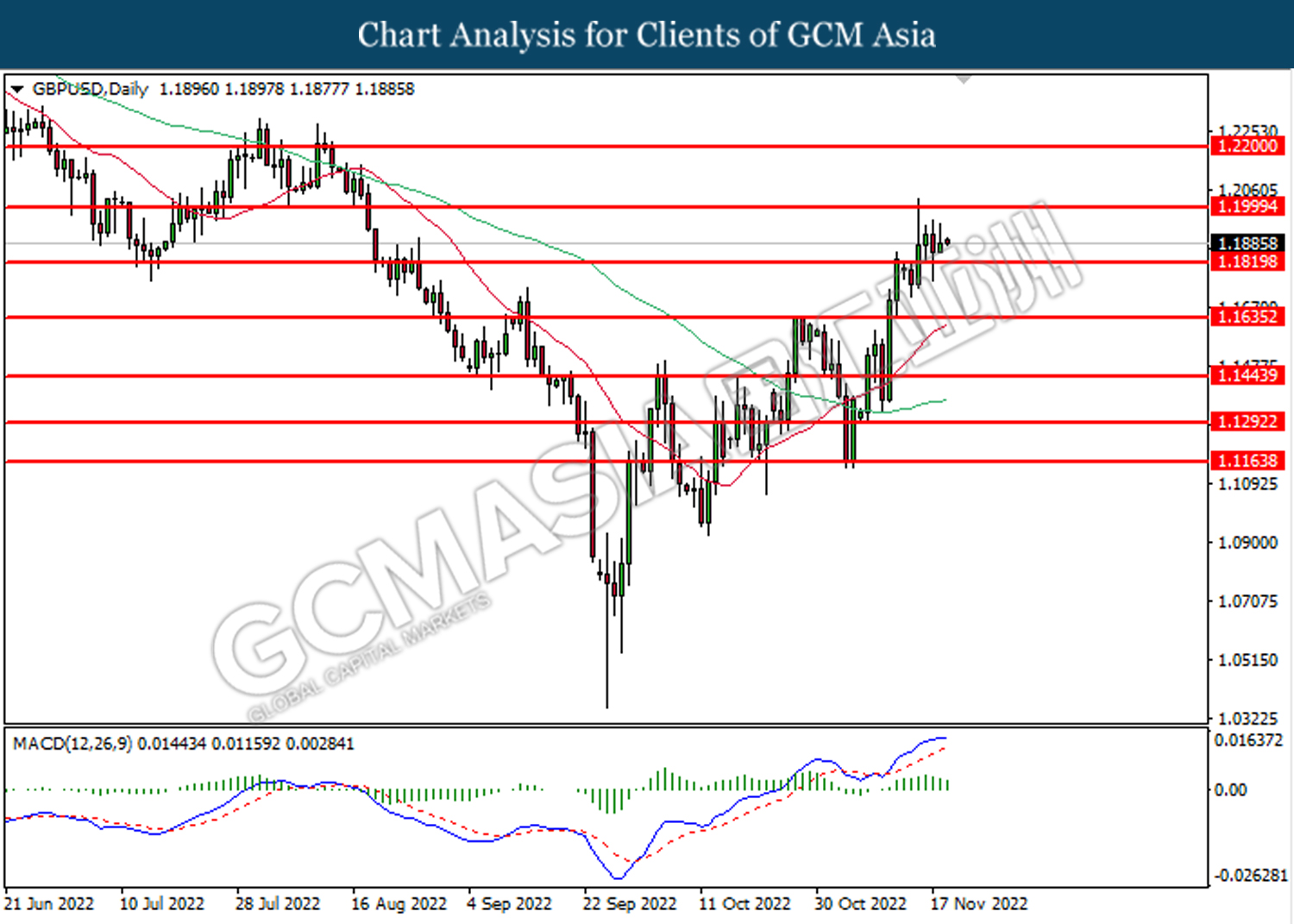

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1820. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2000.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

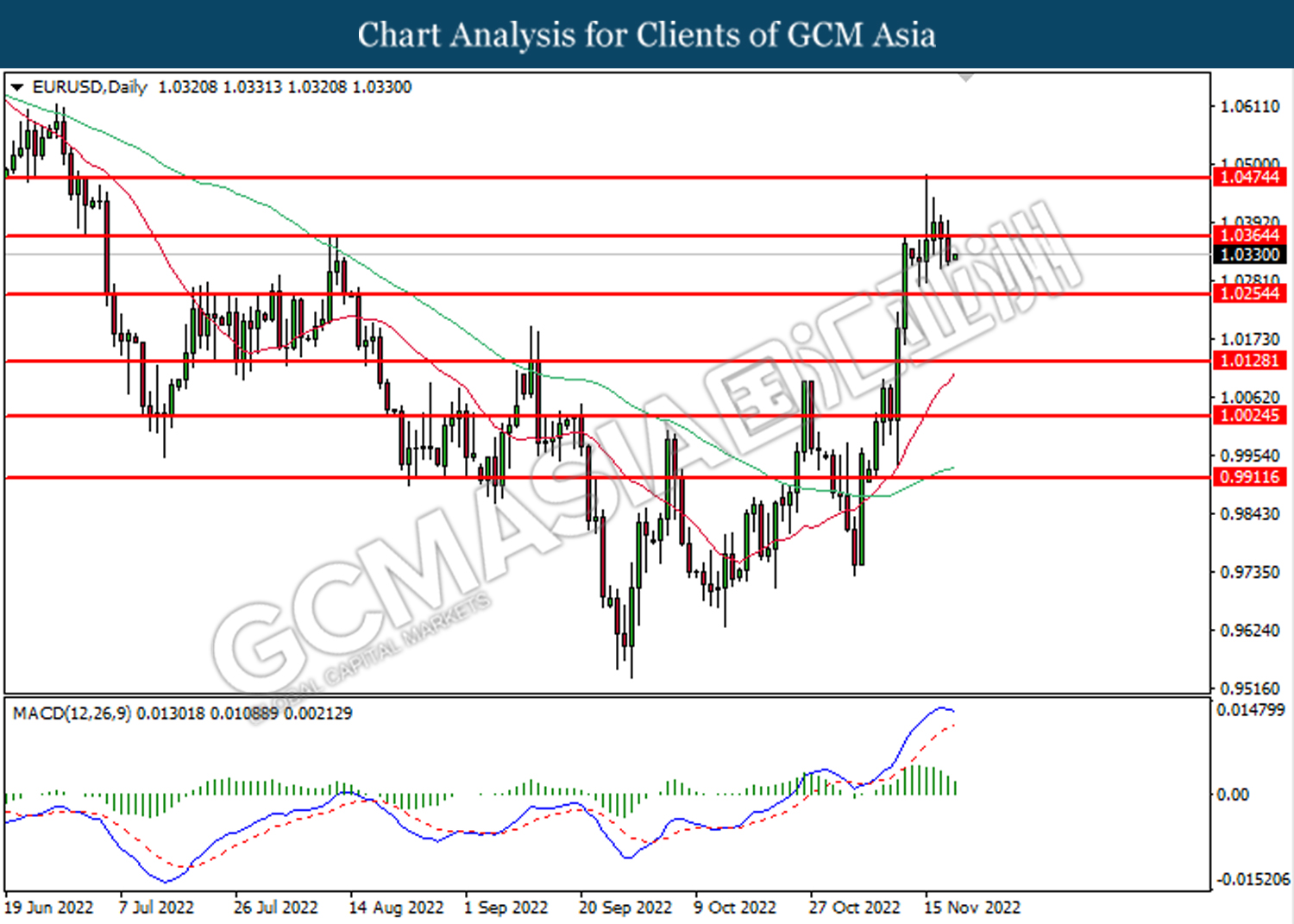

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0365. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0255.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

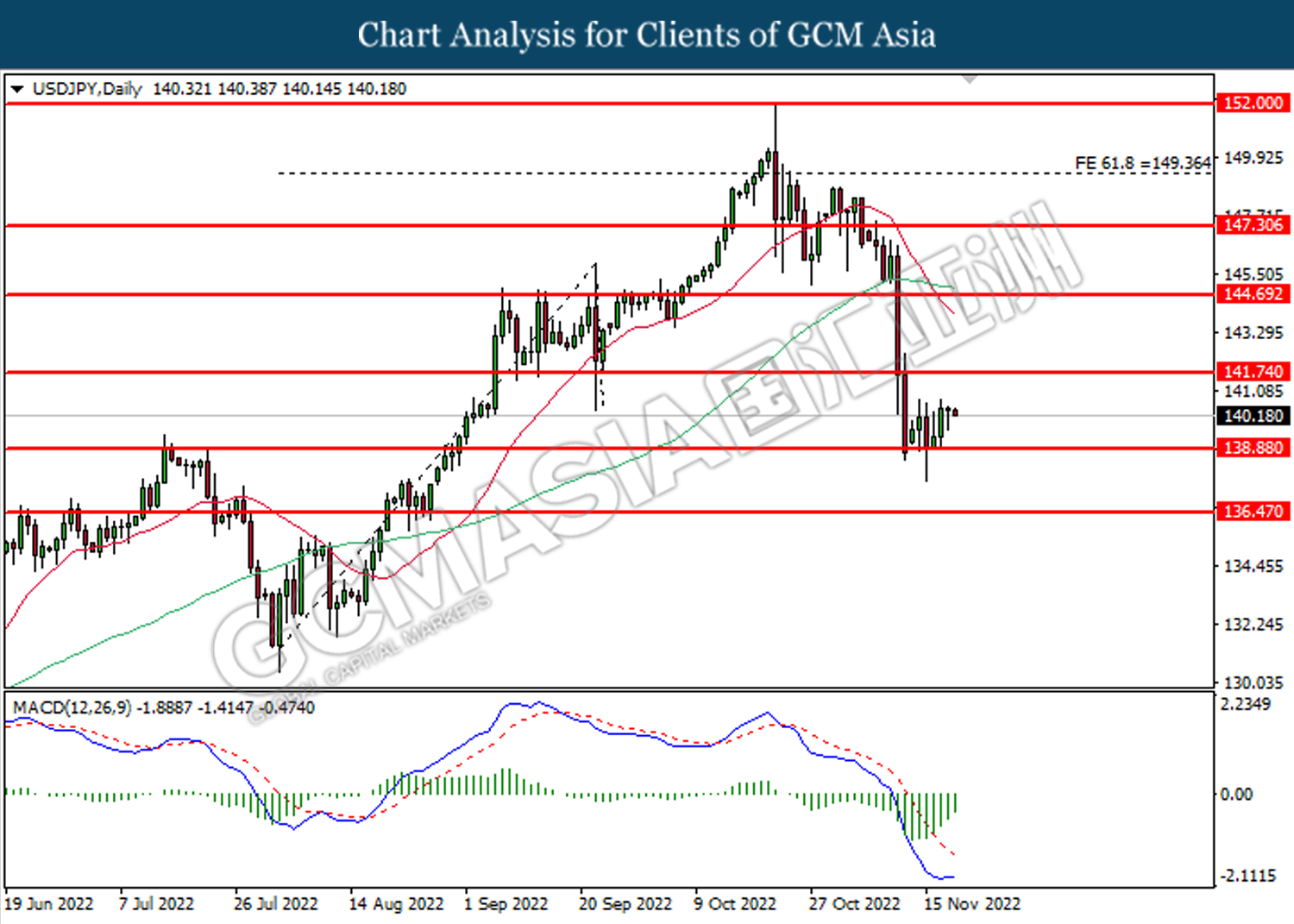

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 138.90. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 141.75.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

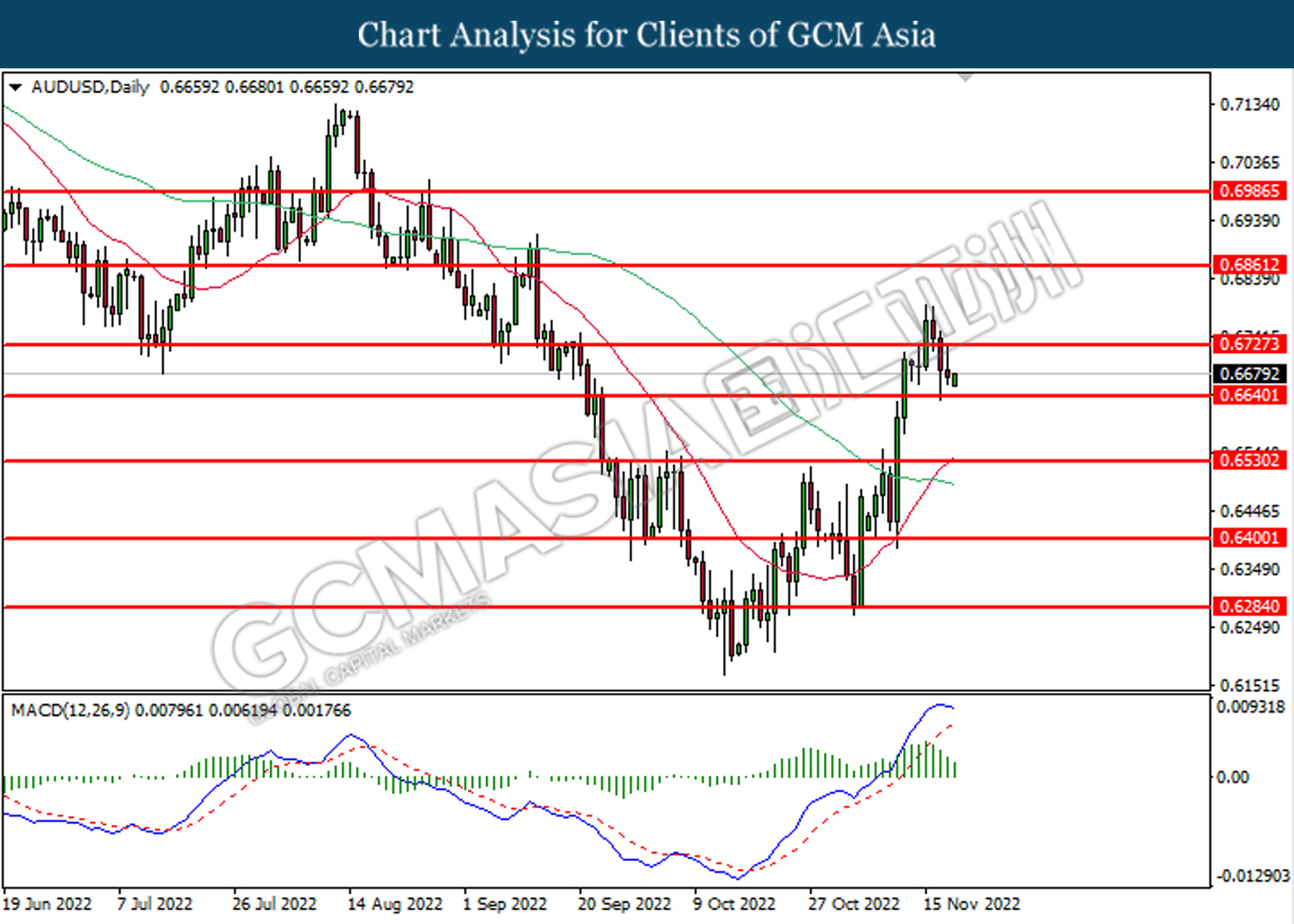

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6725. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

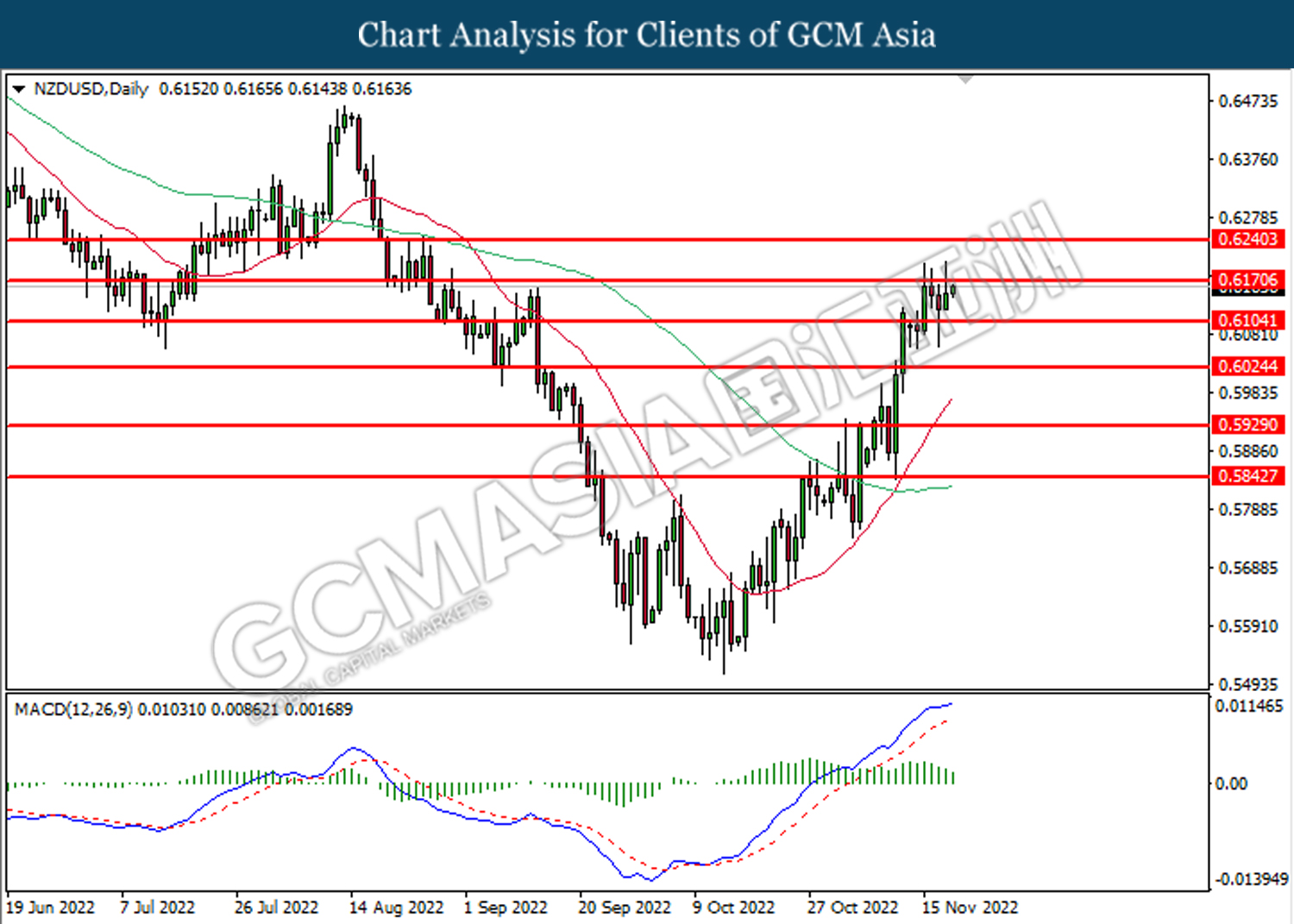

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6170. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6170, 0.6240

Support level: 0.6105, 0.6025

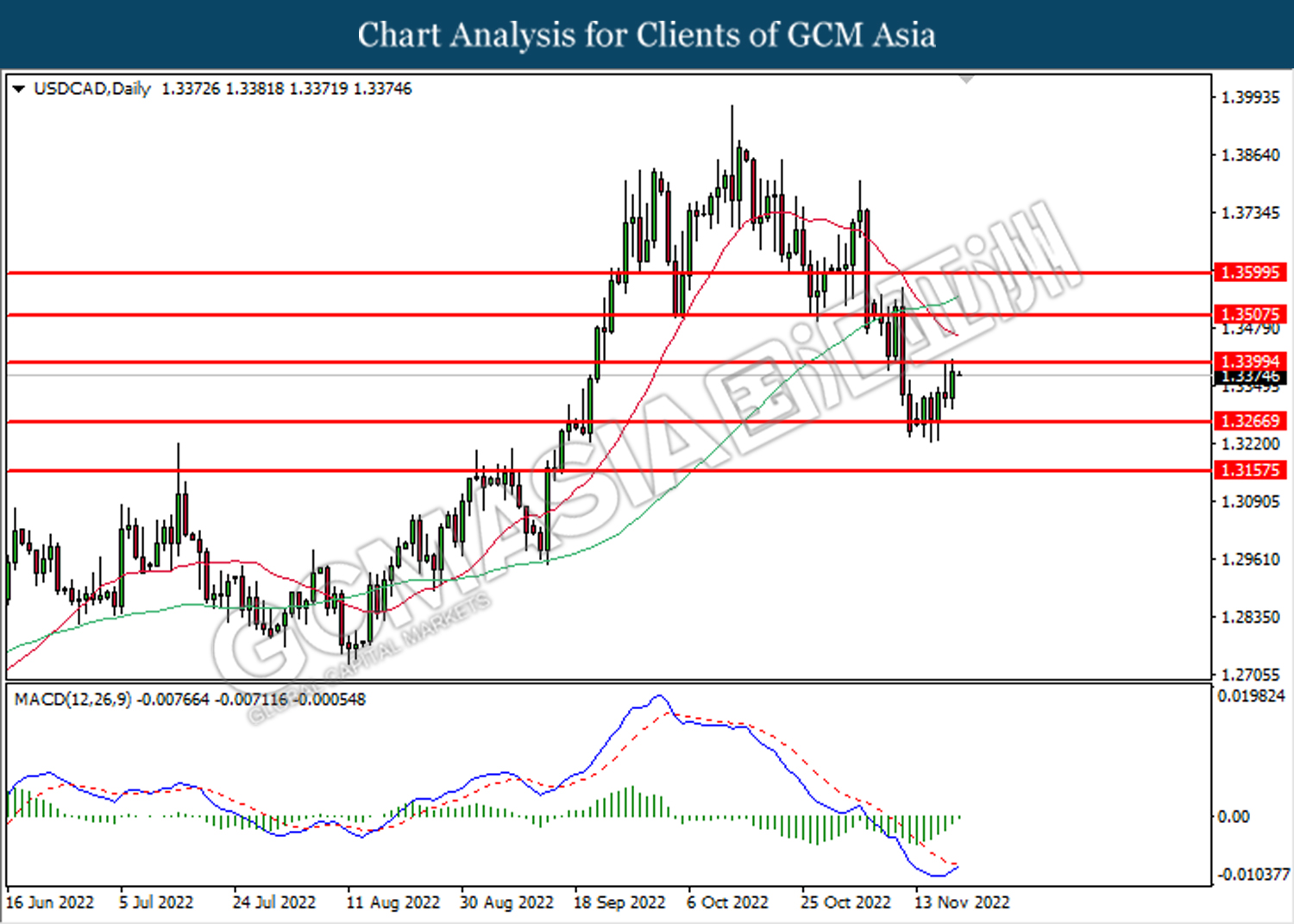

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3265. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3400.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

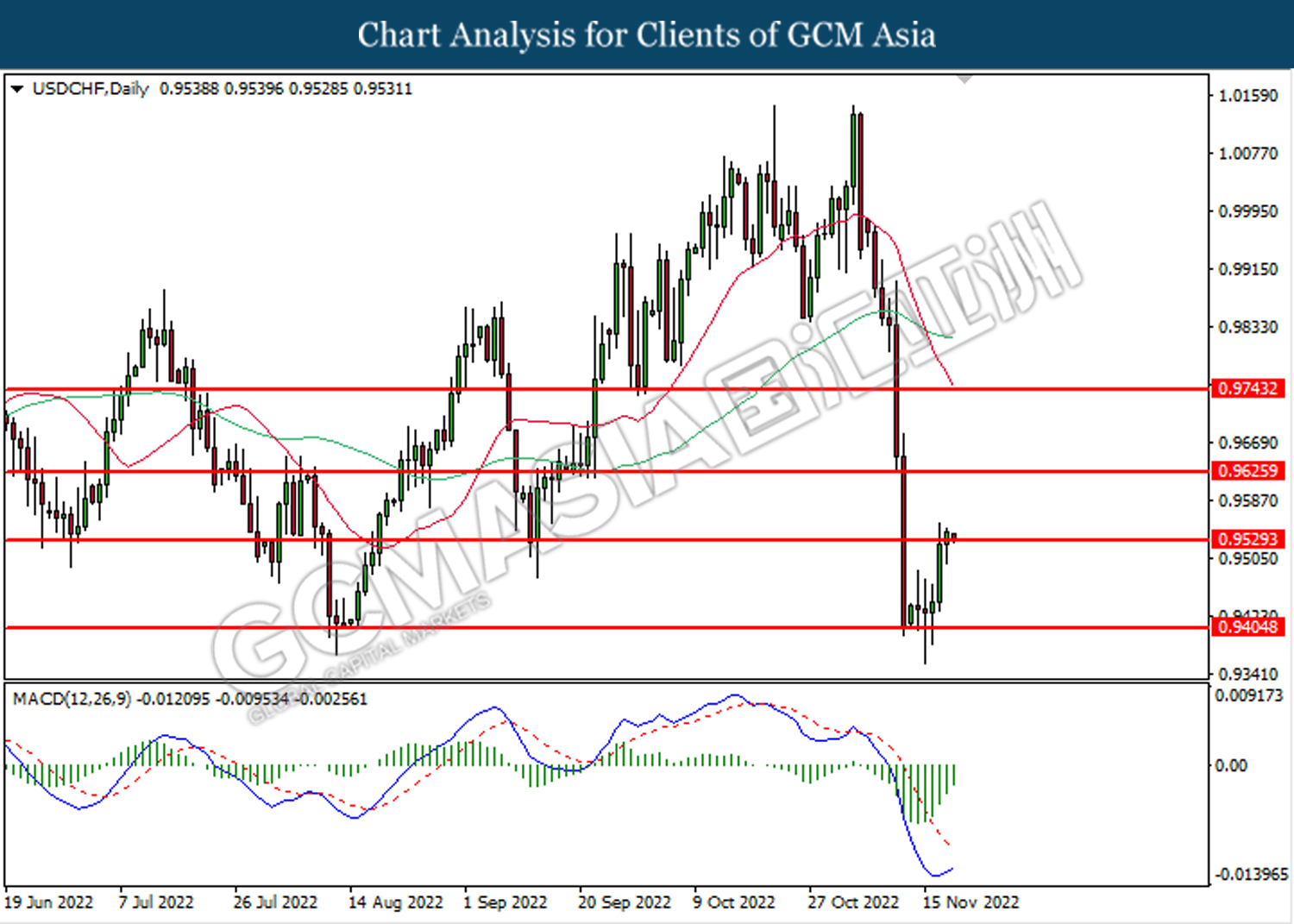

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9530. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9625.

Resistance level: 0.9625, 0.9745

Support level: 0.9530, 0.9405

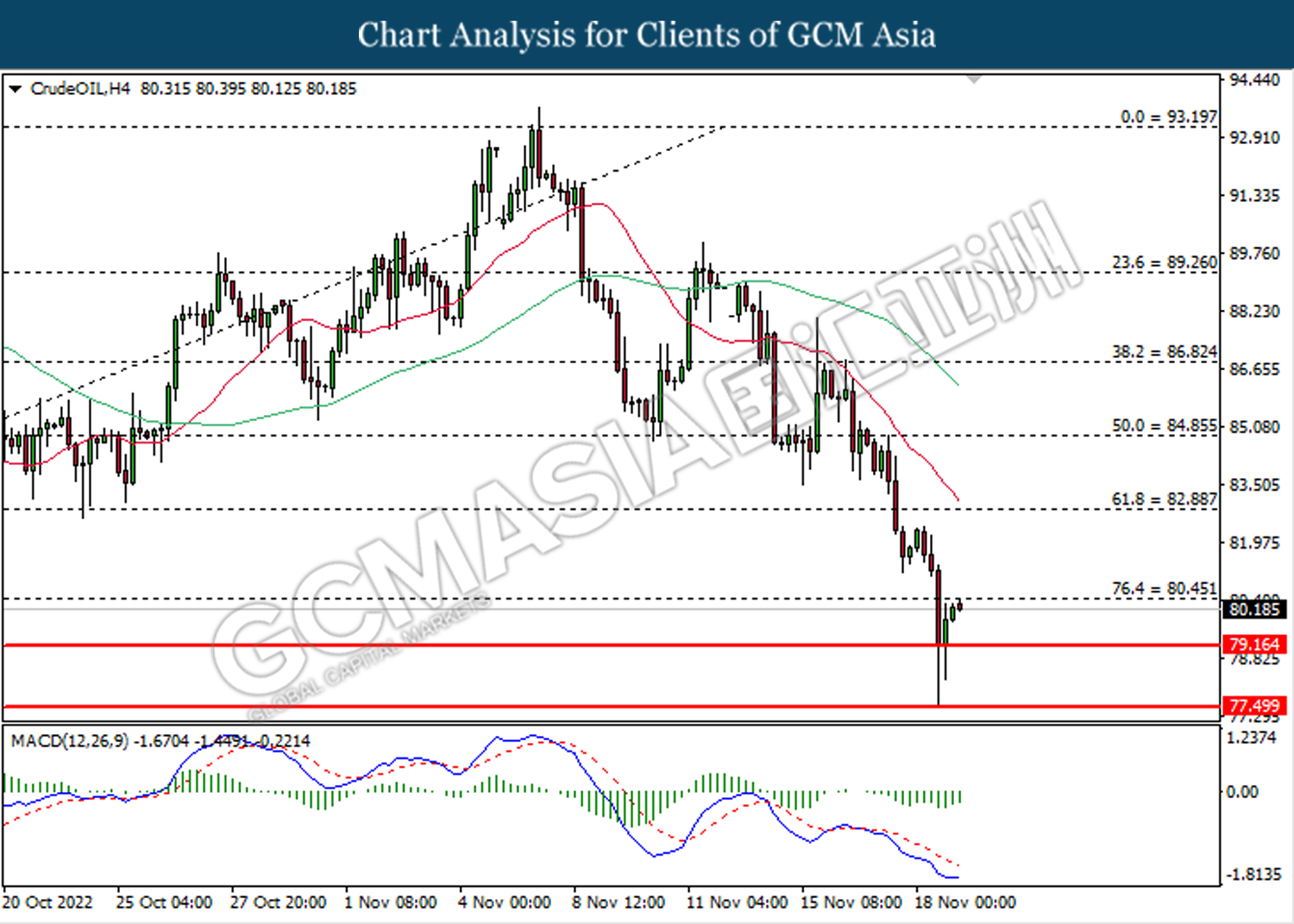

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from support level at 79.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 80.45.

Resistance level: 80.45, 82.90

Support level: 79.15, 77.50

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1766.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1726.15.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35