21 December 2022 Afternoon Session Analysis

Canada Dollar jumped as nation spending increased.

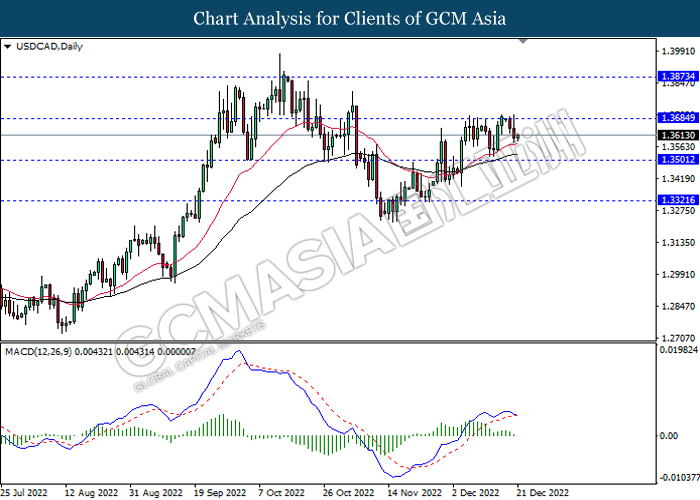

The USD/CAD, which widely traded by global investors slumped on yesterday after the upbeat economic data has been released. According to Statistics Canada, the Canada Core Retail Sales MoM for October notched up from the previous reading of -0.8% to 1.7%, exceeding the consensus expectation of 1.4%. The rising of consumer spending in Canada nation has brought positive prospects toward economic progression of the country, whereas attracting the eyes of investors. On the other hand, the EURUSD has recovered some lost ground throughout overnight trading session following the positive speech from European Central Bank (ECB) member. According to Bloomberg, ECB Governing Council member Francois Villeroy de Galhau claimed on Tuesday that the Eurozone economy would less likely to face a hard recession amid the implementation of rate hikes for tamping spiking inflation. Besides that, while easing the pace of rate hikes last week, the ECB has made clear that it has no intention of halting them any time soon. As of writing, the USDCAD edged down by 0.01% to 1.3609, while the EURUSD depreciated by 0.06% to 1.0615.

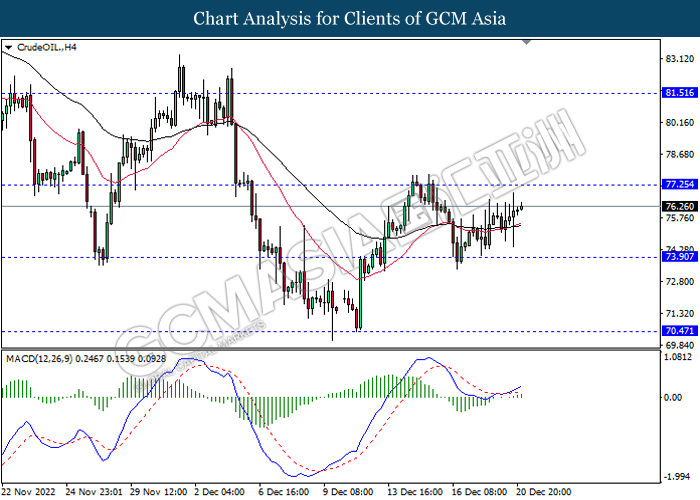

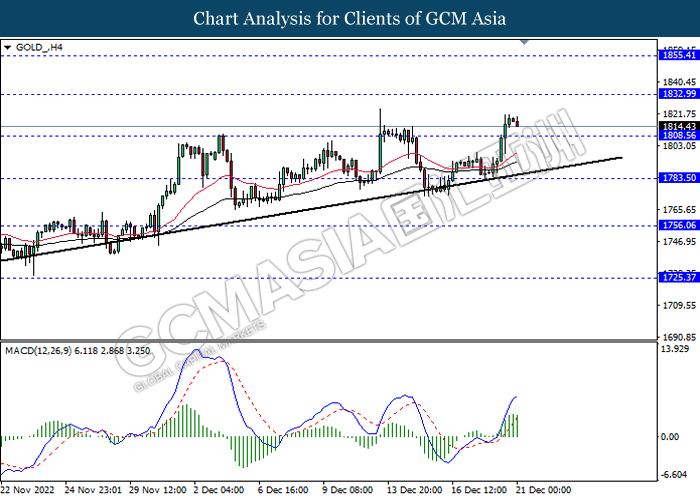

In the commodities market, the crude oil price rose by 0.25% to $76.41 per barrel as of writing following the China’s crude oil imports has increased by 17% in November from a year earlier. In addition, the gold price appreciated by 0.01% to $1815.15 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core CPI (MoM) (Nov) | 0.4% | – | – |

| 23:00 | USD – CB Consumer Confidence (Dec) | 100.2 | 101.0 | – |

| 23:00 | USD – Existing Home Sales (Nov) | 4.43M | 4.20M | – |

| 23:30 | CrudeOIL- Crude Oil Inventories | 10.231M | -1.657M | – |

Technical Analysis

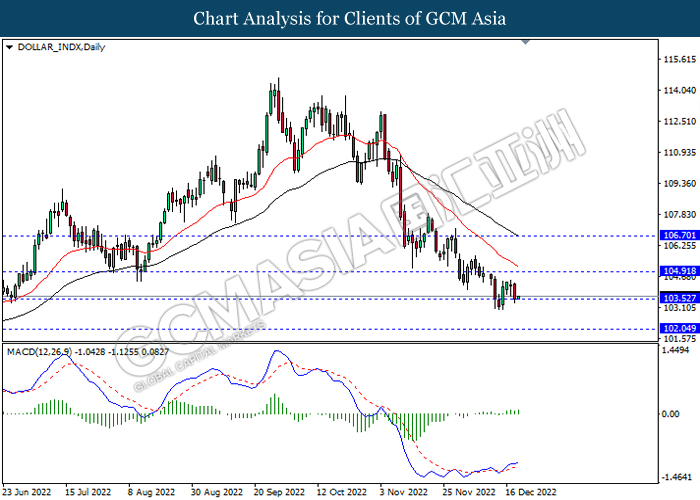

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

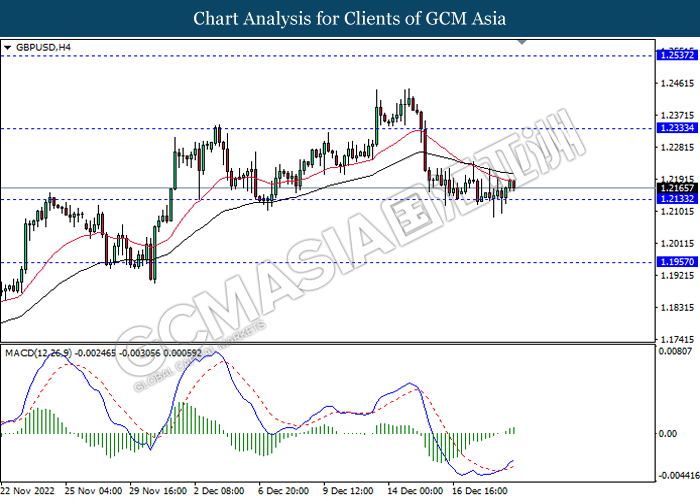

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

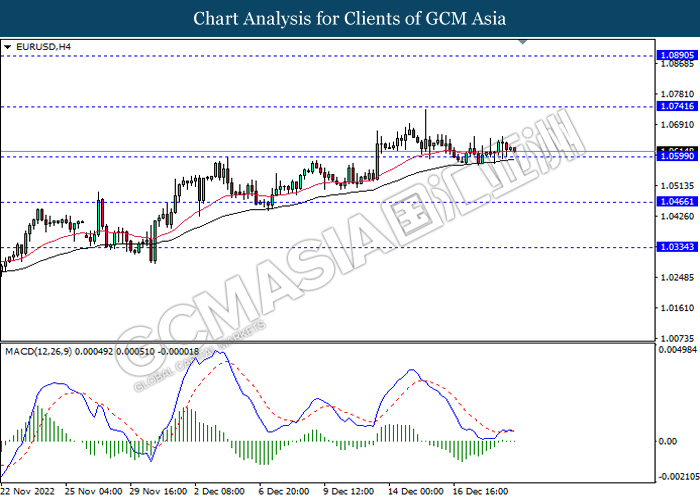

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

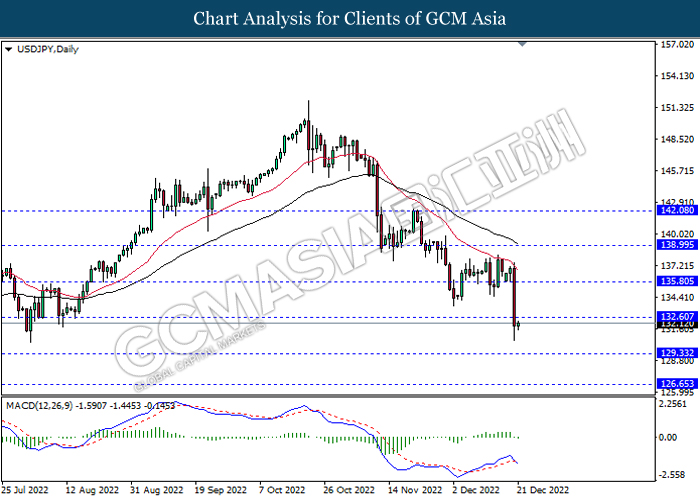

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

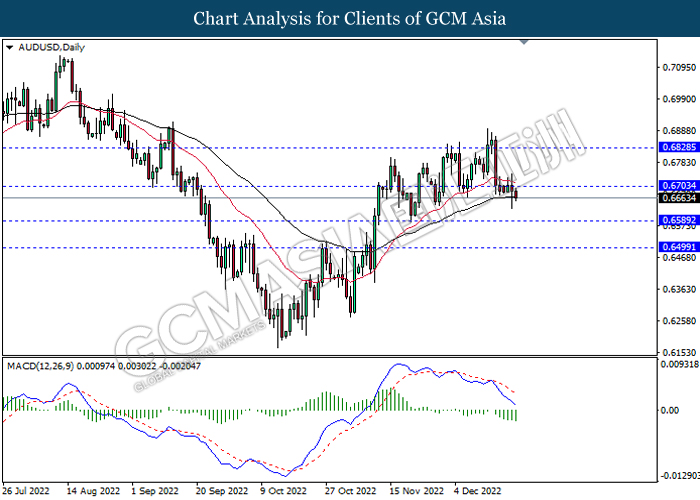

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

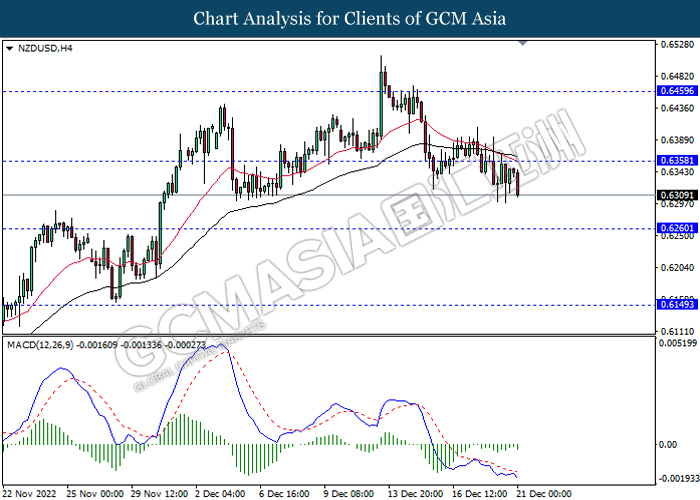

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

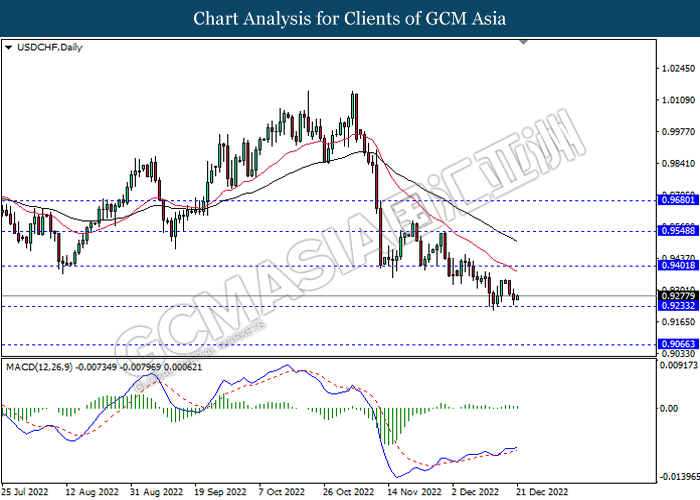

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1833.00, 1855.40

Support level: 1808.55, 1783.50