21 December 2022 Morning Session Analysis

Greenback plunged as Yen surged on policy shift.

The dollar index, which traded against a basket of six major currencies, lost its ground while recording some losses during the previous trading session as the policy tweak from Bank of Japan (BoJ) boosted the appeal of Japanese Yen. In the BoJ meeting, the board of members agreed to maintain its policy settings broadly unchanged, leaving the short-term Japanese government bond yields at -0.1% and the 10-year yield at 0.00%. However, the BoJ made a surprise decision to let the 10-year yield to rise as high as 0.5% from a previous cap of 0.25%. The policy shift in adjusting the boundary deviation of long-term yield shocked the market participants, as it was a shift away from its long-running dovish stance of ultra-easing policy. On top of that, the dollar index received further bearish momentum after the US Census Bureau released a downbeat housing data yesterday. The US Building Permits dropped from the prior month reading of 1.512M to 1.342M, lower than the consensus forecast at 1.485M. As of writing, the pair of USD/JPY rebounded slightly by 0.05% to 131.75.

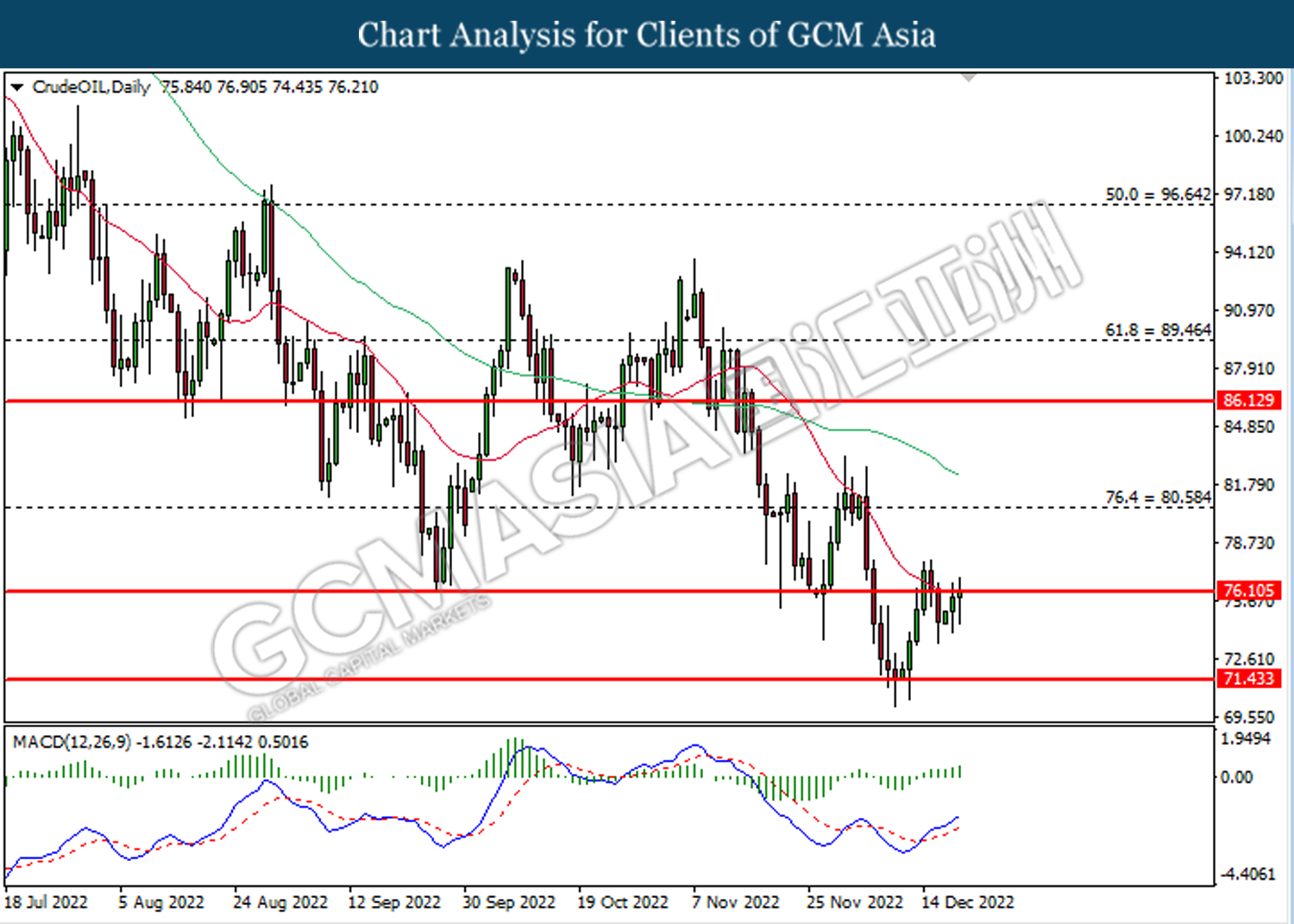

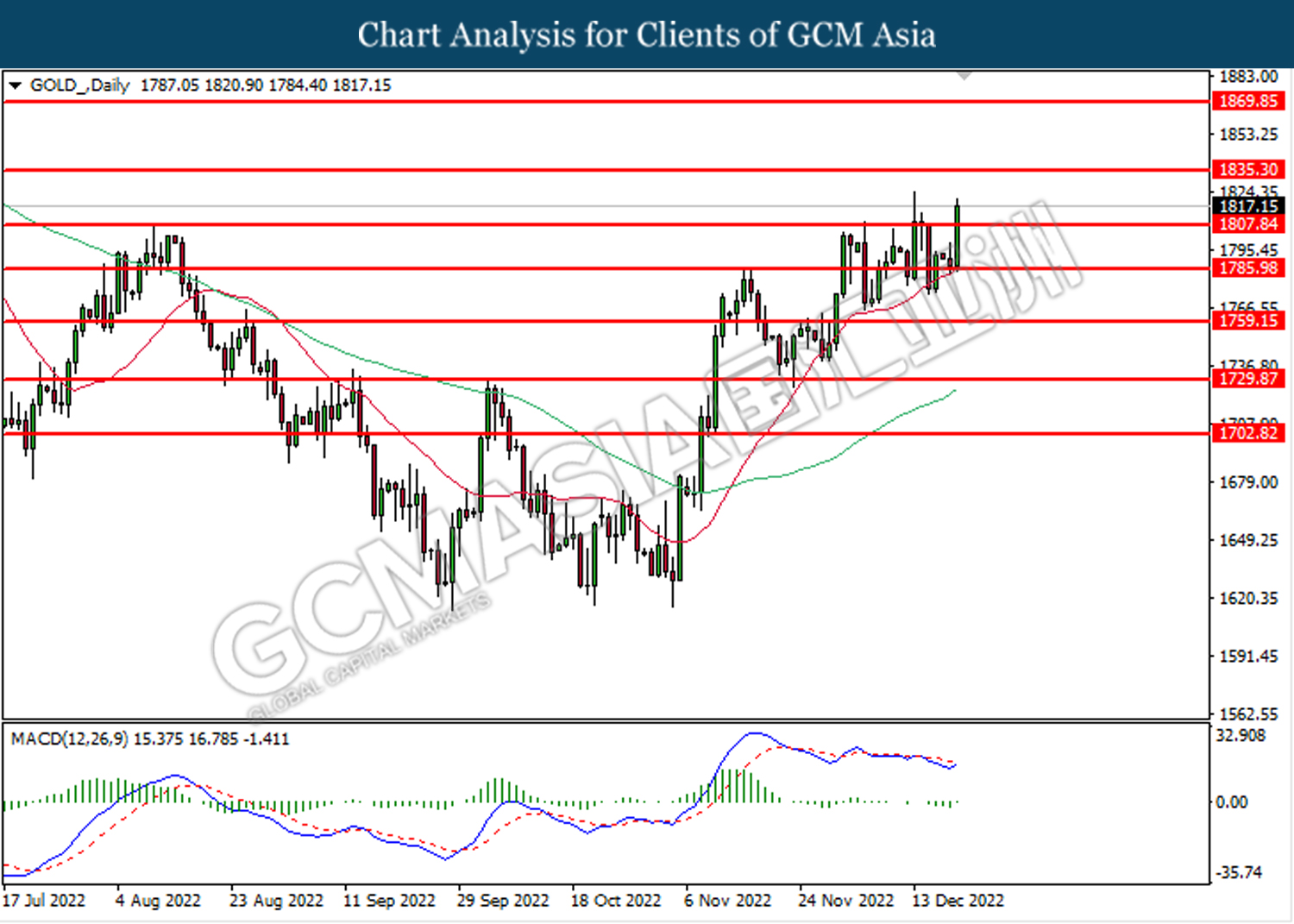

In the commodities market, crude oil prices up by 0.18% to $76.10 per barrel amid weakening of dollar index as well as the large draw in the US API Inventory data. Besides, gold prices depreciated by 0.01% to $1818.05 per troy ounce amid the weakening of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core CPI (MoM) (Nov) | 0.4% | – | – |

| 23:00 | USD – CB Consumer Confidence (Dec) | 100.2 | 101.0 | – |

| 23:00 | USD – Existing Home Sales (Nov) | 4.43M | 4.20M | – |

| 23:30 | CrudeOIL- Crude Oil Inventories | 10.231M | -1.657M | – |

Technical Analysis

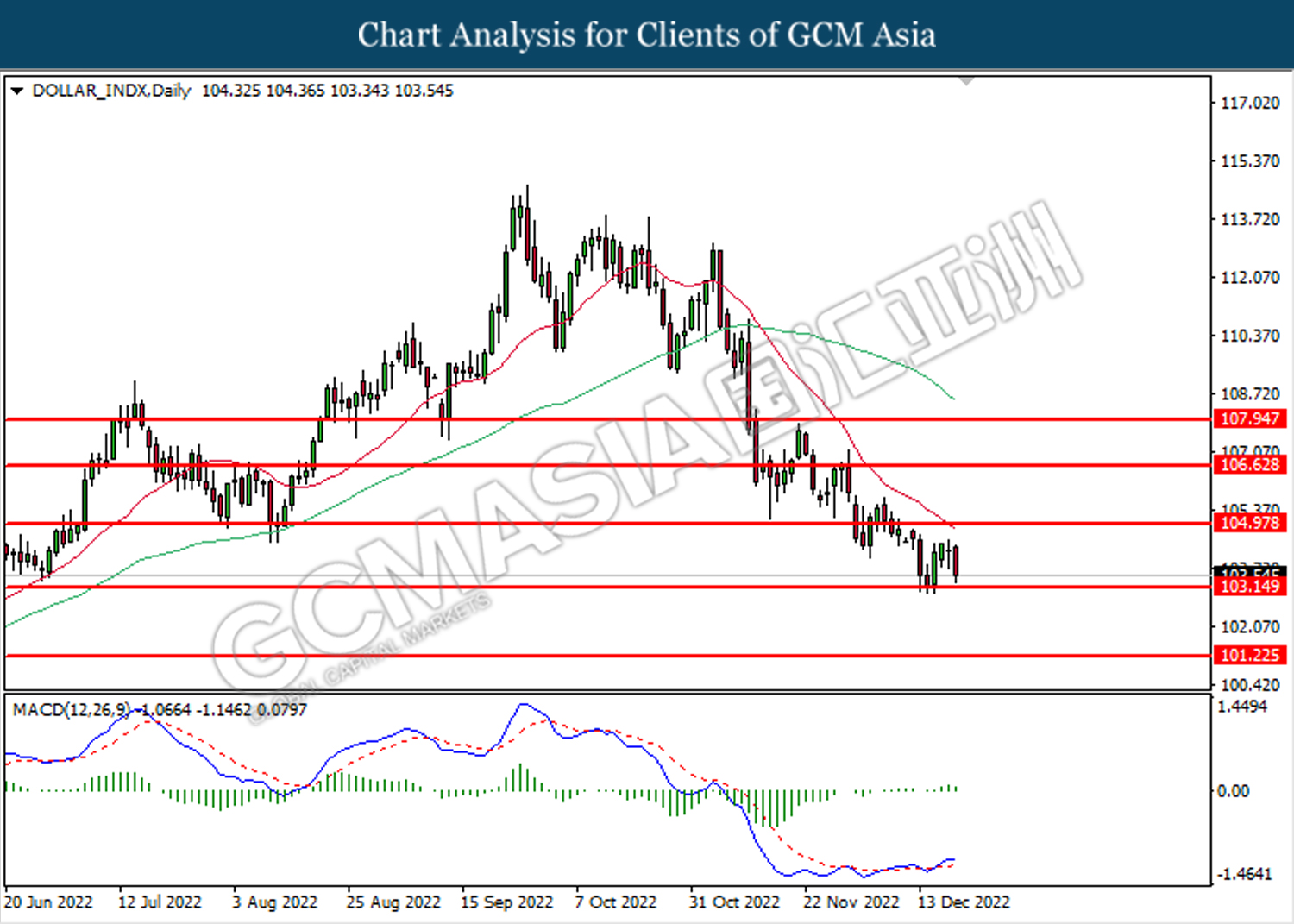

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

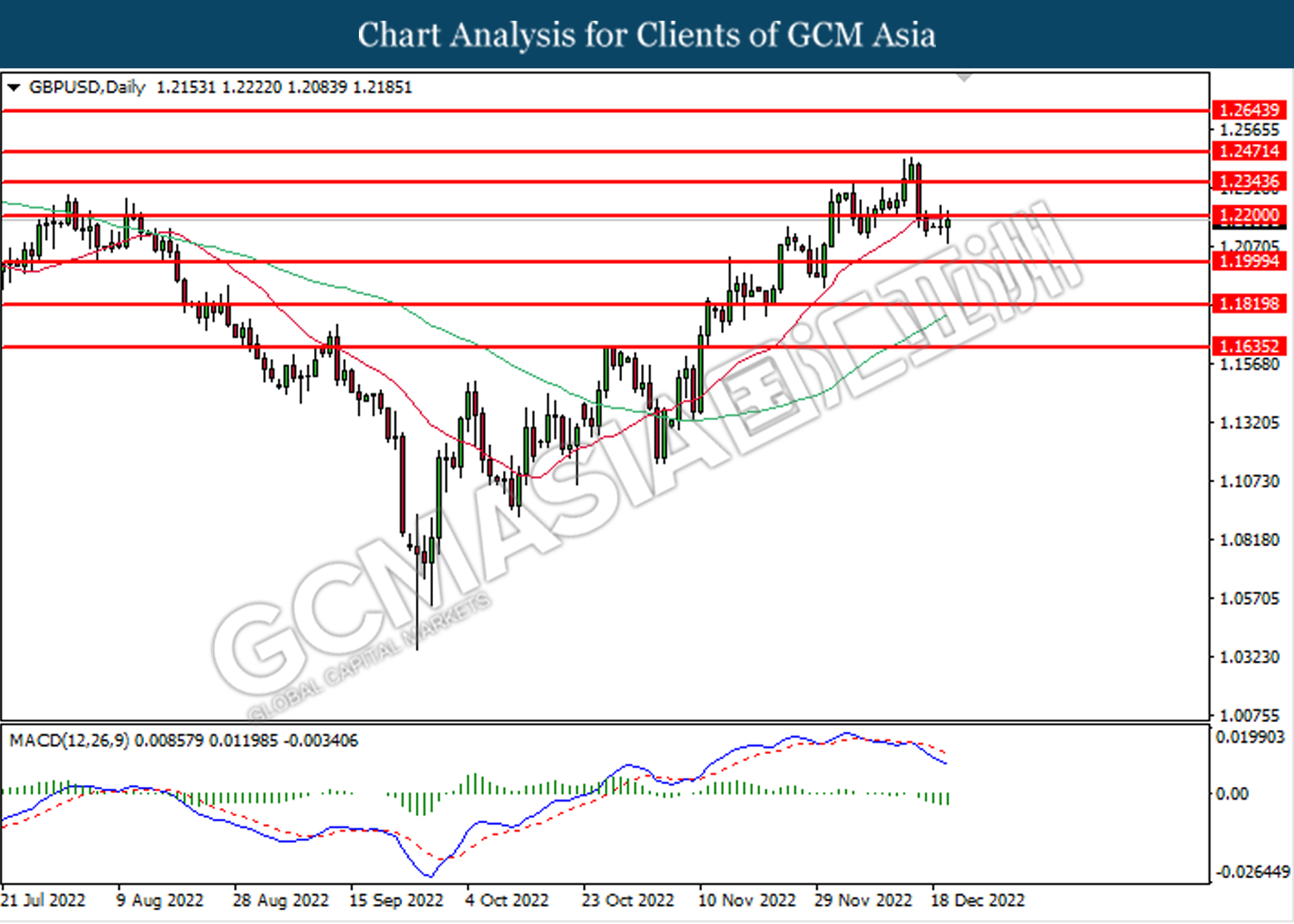

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

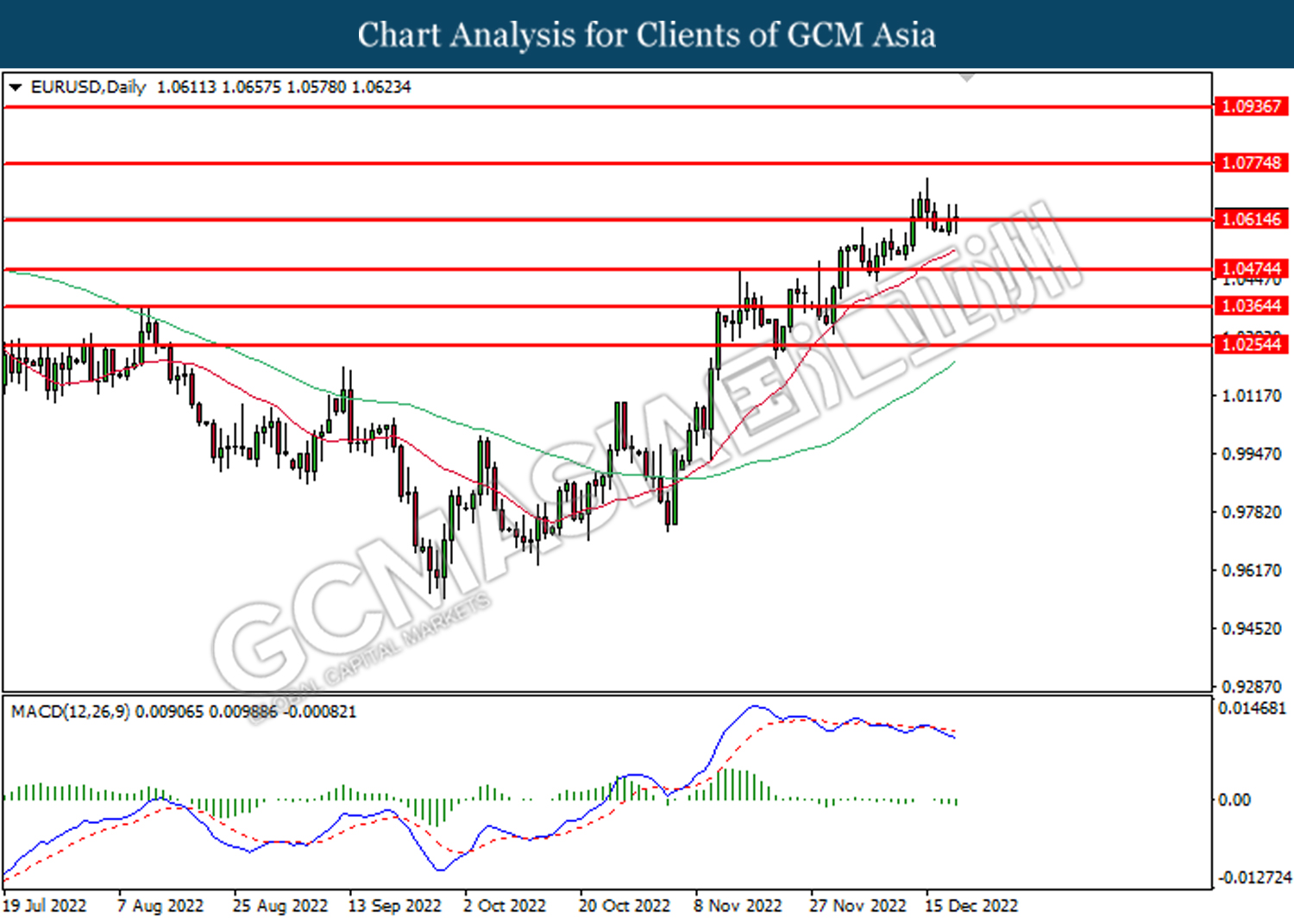

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0615. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

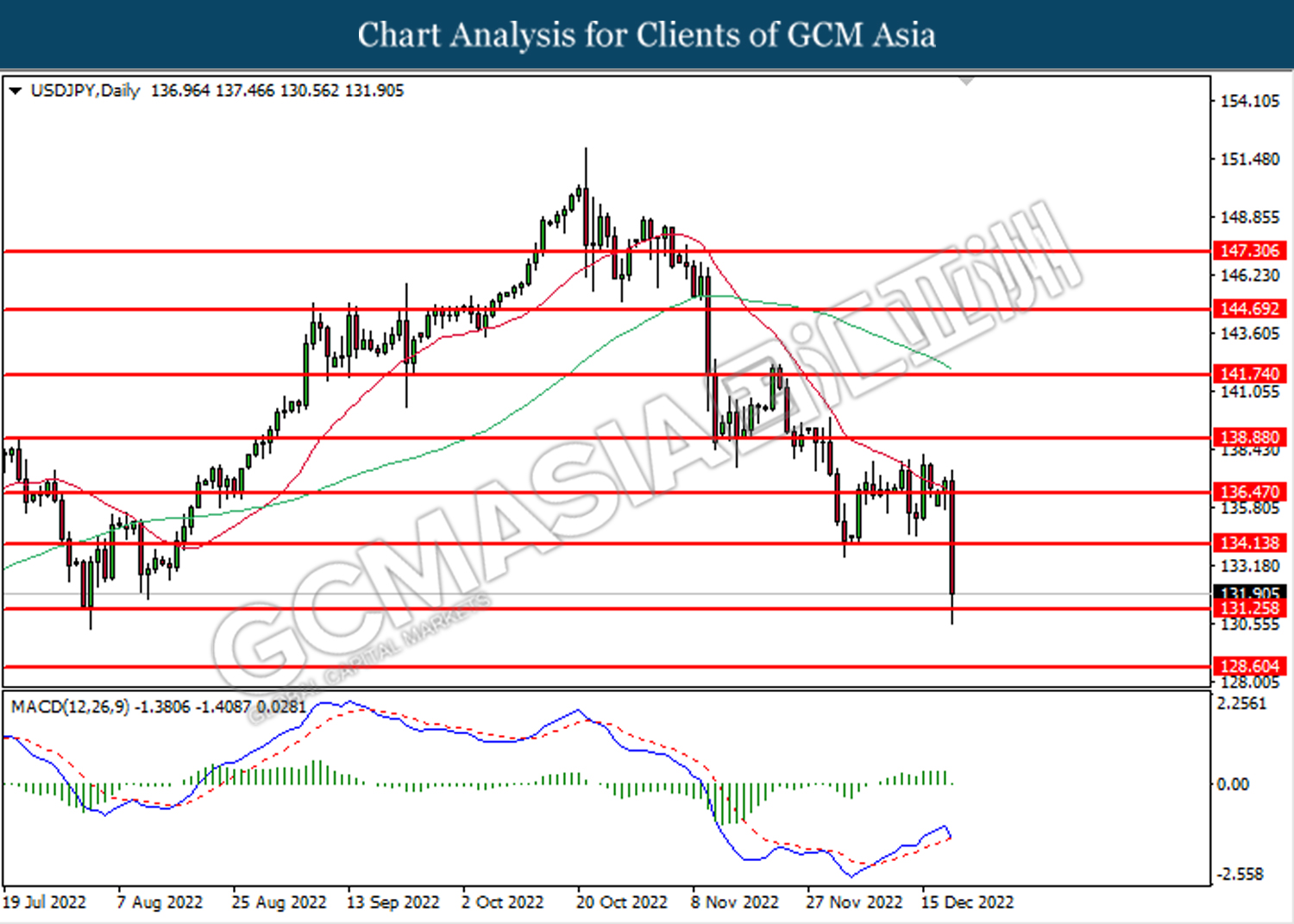

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

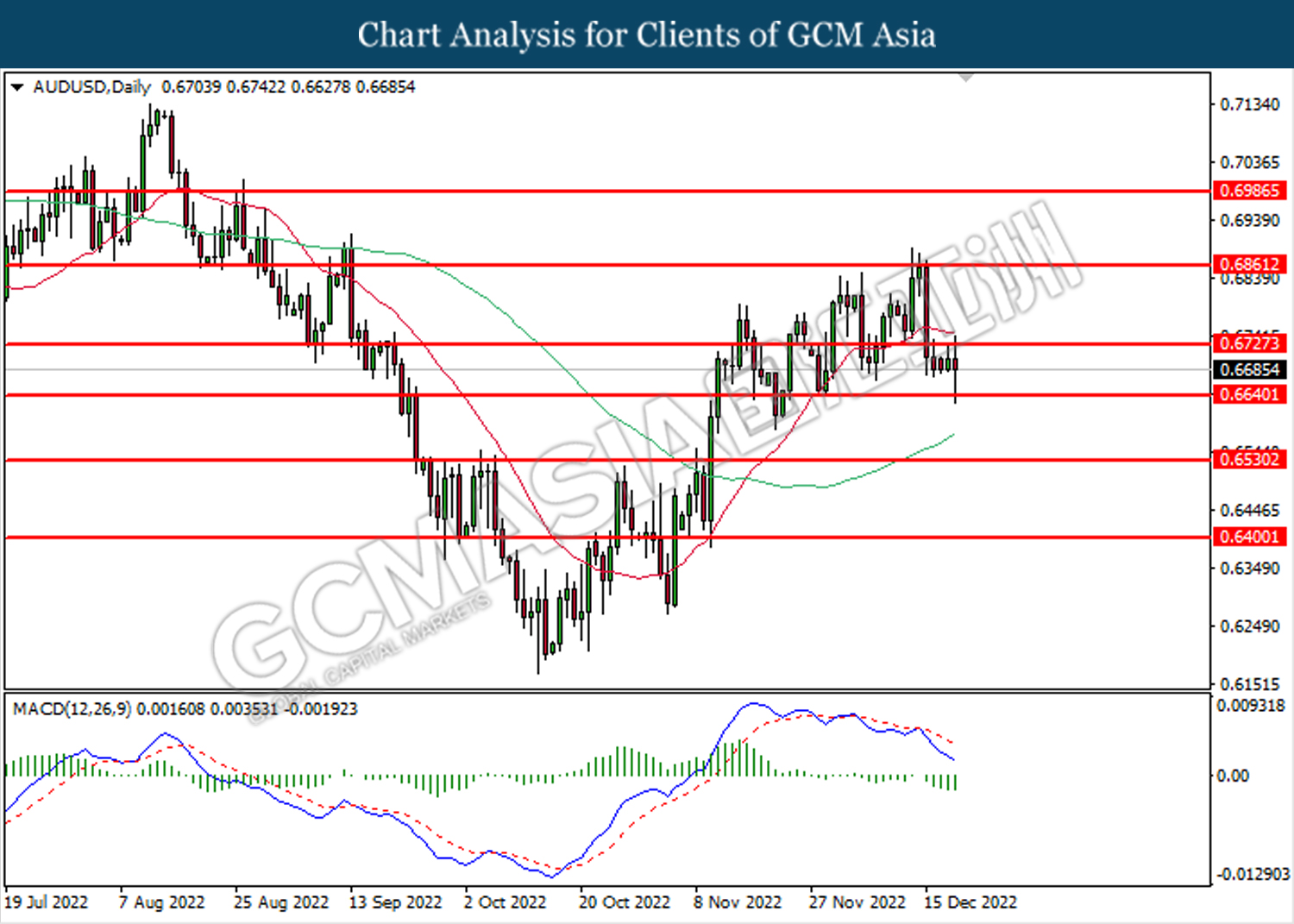

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6640. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

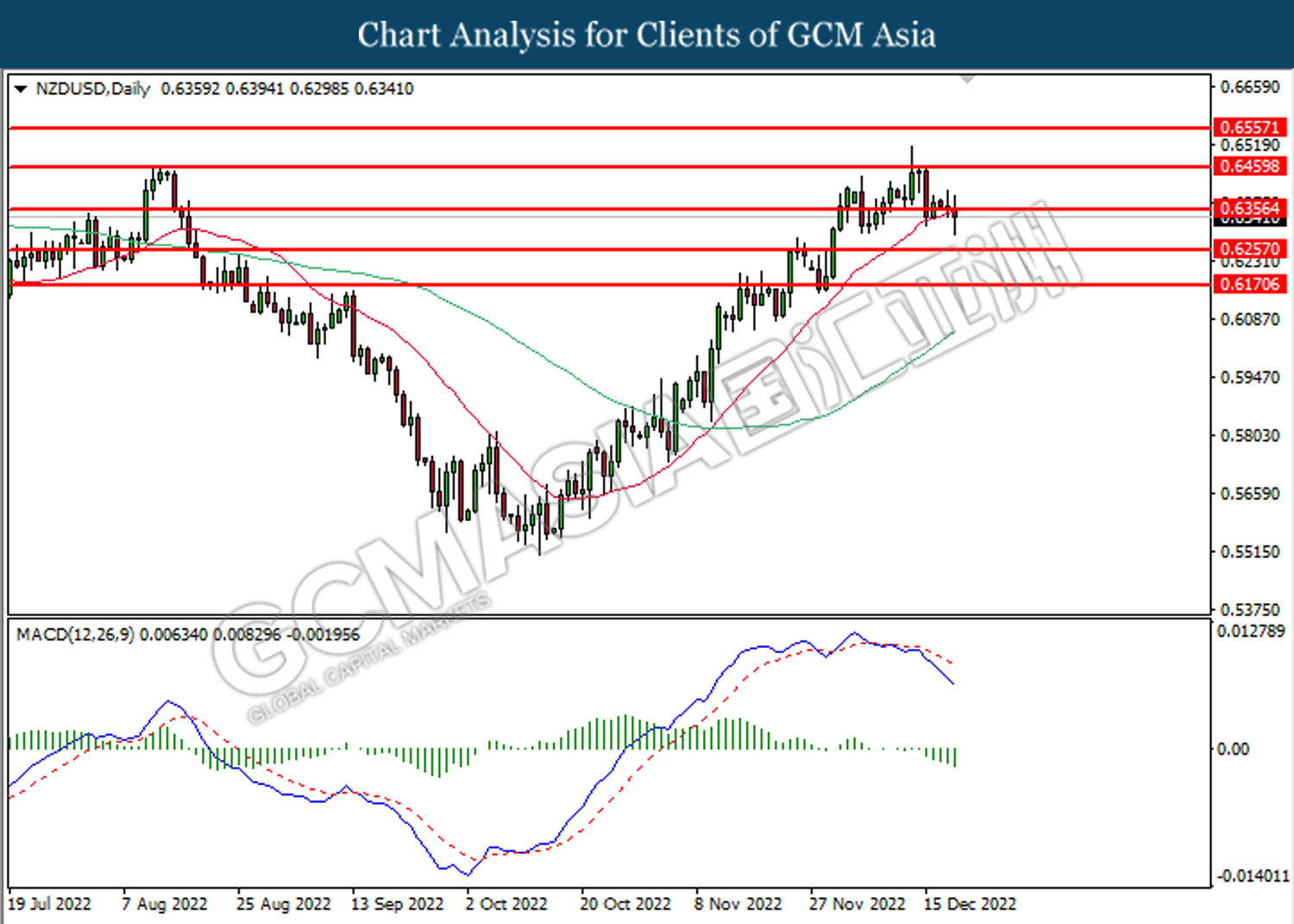

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

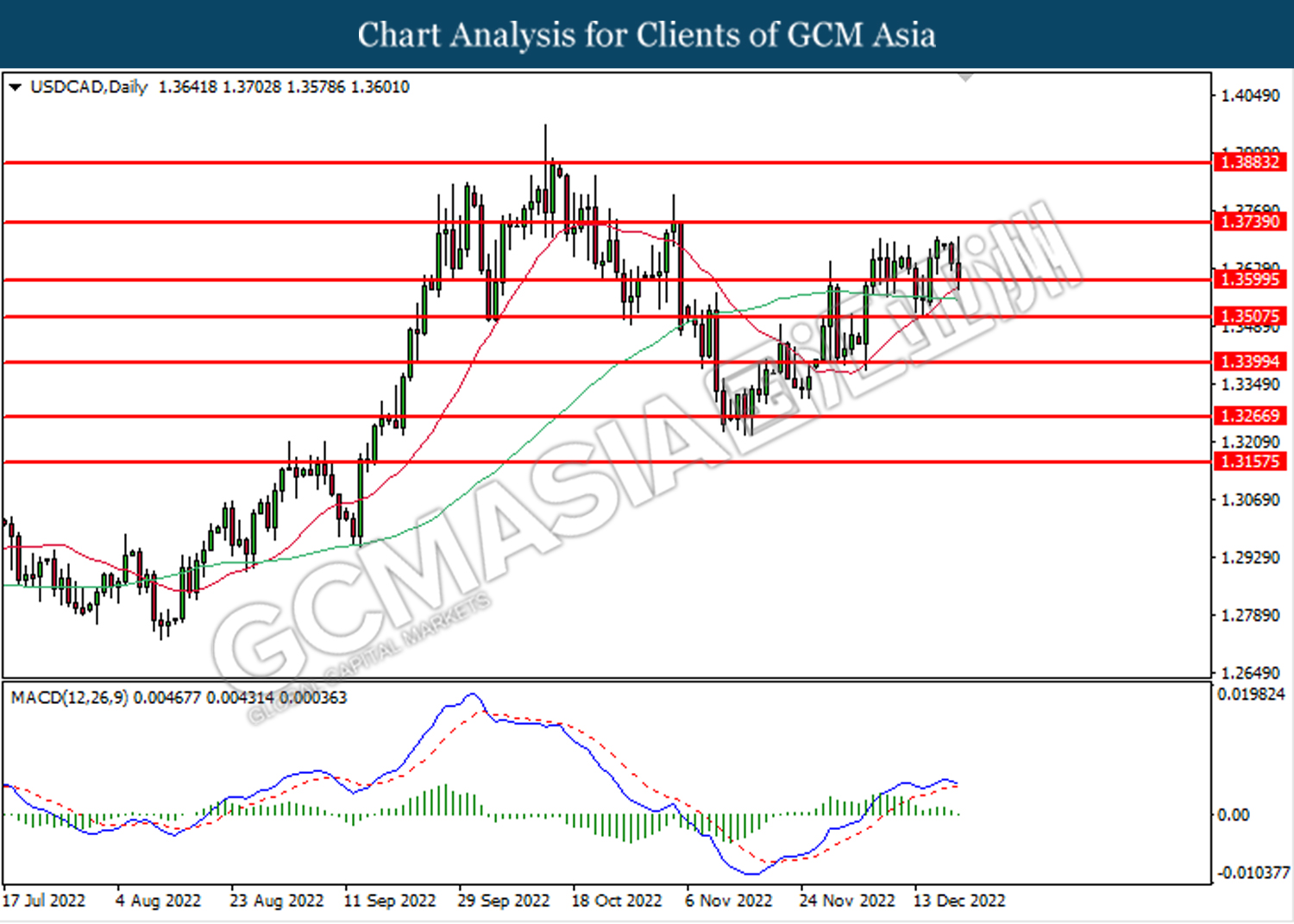

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

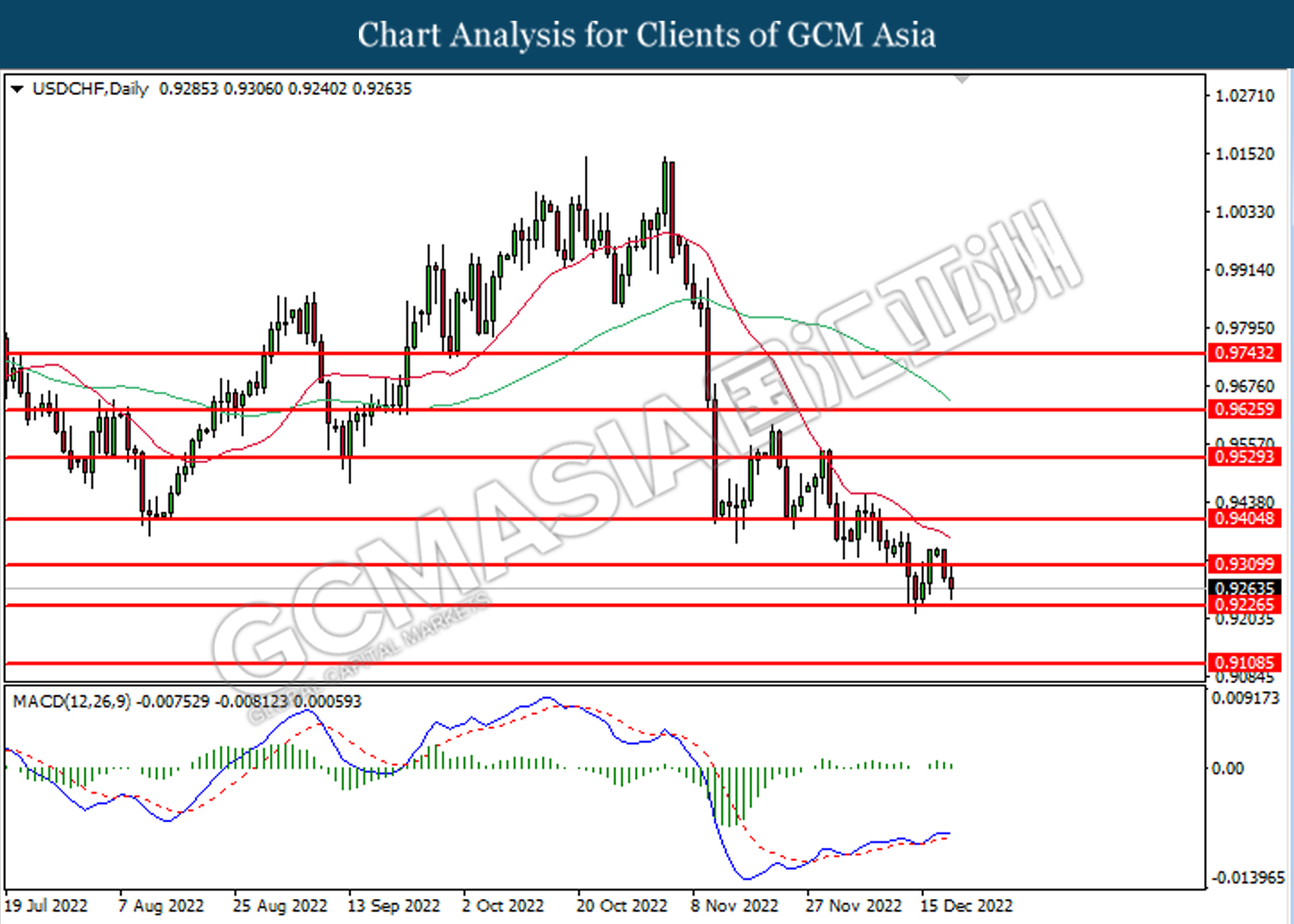

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 76.10, 80.60

Support level: 71.45, 69.05

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1807.85 MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1807.85.

Resistance level: 1807.85, 1835.30

Support level: 1786.00, 1759.15