22 February 2019 Morning Session Analysis

Trade talk resumed, dollar remains steady despite weak data.

Dollar index measuring against a basket of six major currency pair remain steady on 96.00 level as trade talk have resumed between US and China. Despite the downbeat economic data released by US yesterday, dollar was able to shrug off the negative data while investors are eyeing on the progress of trade talk where both countries are trashing out structural agreements and trying to hash out a deal that could end the trade war. As the deadline for additional tariff on Chinese goods are due in a week, failure to reach an agreement will majorly benefit the US market with the additional tariff imposed, however the impact will disrupt global trade and the economy in the long-run. Dollar index was up by 0.14% to 96.45 as of writing. In other news, pair of AUD/USD edged higher by 0.18% to 0.7105 after plunging to a week’s low due to concerns of China’s ban on Australian coal imports. Being one of China’s major trading partner, the ban on Australian coal will drastically affect’s Australian economy. However, the single currency was able to recover part of its losses supported by upbeat central bank comments and strong job data. Focus will now be placed on the outcome of trade war where a deal will boost Asian market’s sentiment.

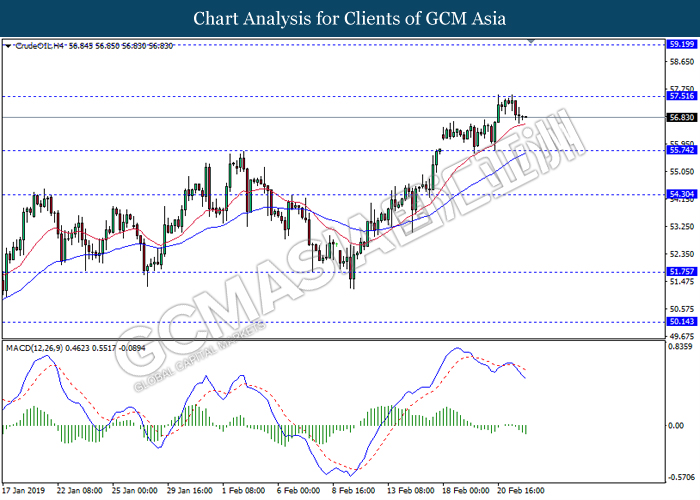

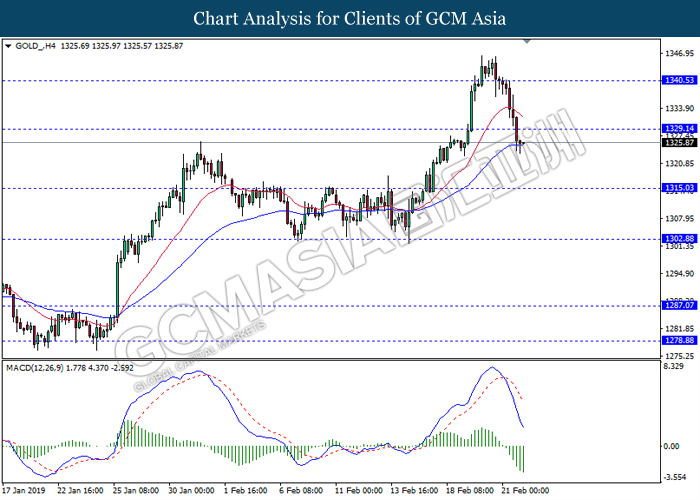

In the commodities market, crude oil price edged higher by 0.12% to $56.90 per barrel as of writing. The commodity was suffering retracement from its’ high levels following downbeat Crude Oil Inventories data. According to Energy Information Administration (EIA), crude production had increased up to 12 million bpd while weekly inventories increased to 3.672M, missing economist’s expectation of 3.080M. However, sentiment still remained strong for crude market following OPEC’s effort on production cut. Gold prices on the other hand was gaining by 0.18% to $1325.70 after retracing from its top-levels yesterday due to strengthened dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:30 EUR ECB President Draghi Speaks

00.00 (23rd) USD Fed Monetary Policy Report

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP | 0.0% | 0.0% | – |

| 17.00 | EUR – German Ifo Business Climate Index | 99.00 | 99.1 | – |

| 18.00 | EUR – CPI (YoY) (Jan) | 1.4% | 1.4% | – |

| 21.30 | Core Retail Sales (MoM) (Dec) | -0.6% | -0.5% | – |

| 02.00

(23rd) |

CrudeOIl – U.S. Baker Hughes Oil Rig Count | 857 | – | – |

Technical Analysis

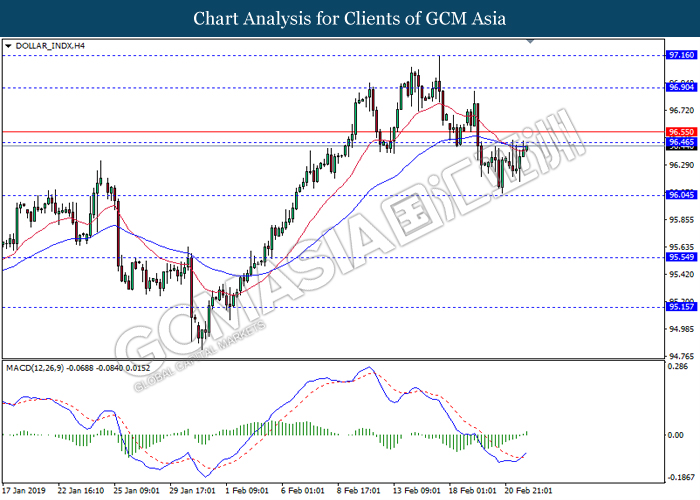

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level 96.45. MACD which illustrate bullish momentum with the formation of golden cross suggest the pair to extend its gains after It breaks above the resistance level.

Resistance level: 96.45, 96.90

Support level: 96.05, 95.55

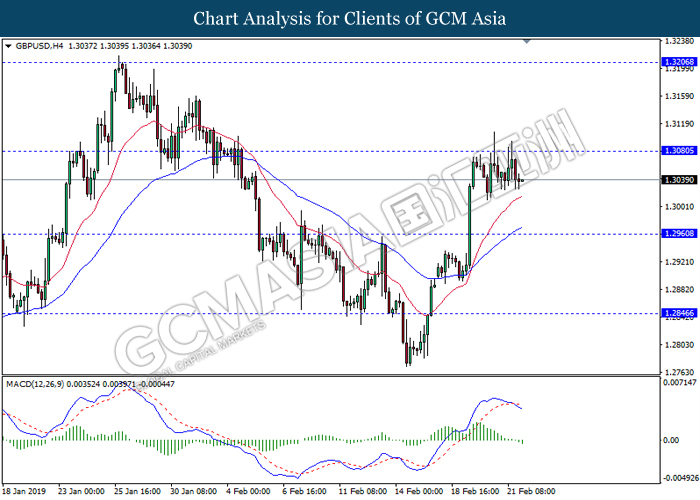

GBPUSD, H4: GBPUSD was traded flat following recent retracement from the resistance level 1.3080. MACD which illustrate bearish momentum with death cross formation suggest the pair to be traded lower towards the support level 1.2960.

Resistance level: 1.3080, 1.3205

Support level: 1.2960, 1.2845

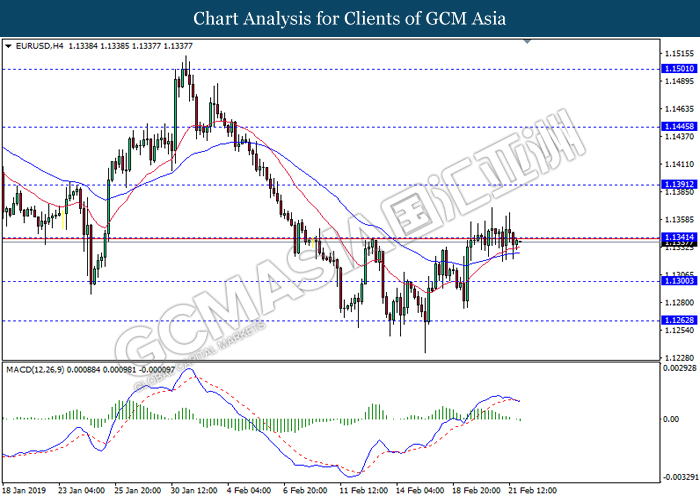

EURUSD, H4: EURUSD was traded flat while currently testing the support level 1.1340. However, MACD which illustrate bearish bias signal suggest the pair to be traded lower when it breaks back below the support level 1.1340.

Resistance level: 1.1390, 1.1445

Support level: 1.1340, 1.1300

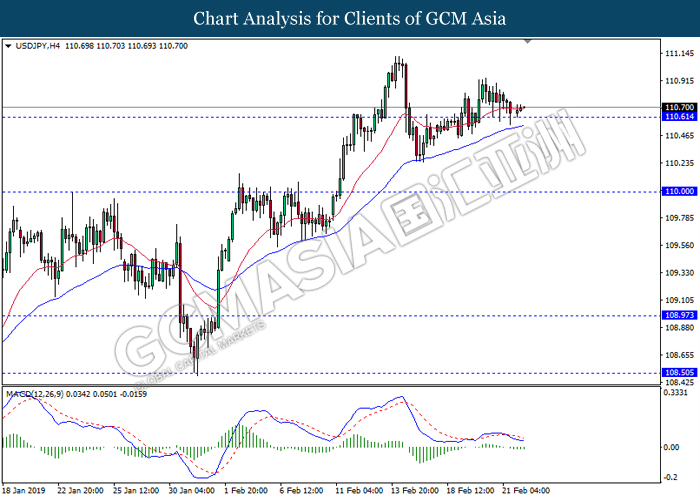

USDJPY, H4: USDJPY was traded lower while currently testing near the support level. MACD which illustrate bearish momentum suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 111.35, 112.20

Support level: 110.60, 110.00

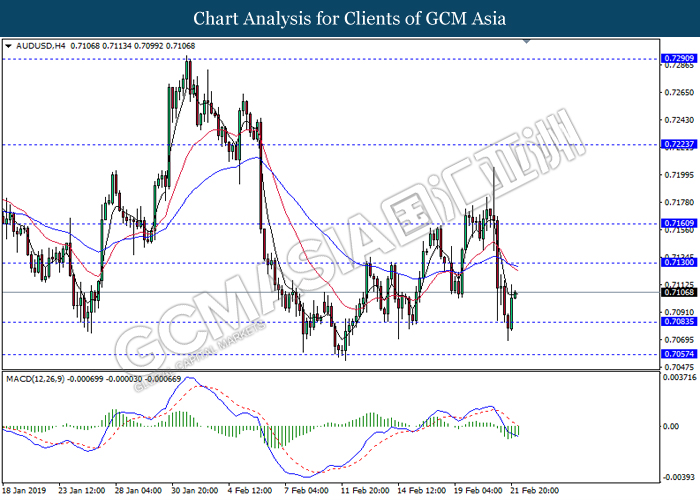

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level 0.7085. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 0.7130.

Resistance level: 0.7130, 0.7160

Support level: 0.7085, 0.7055

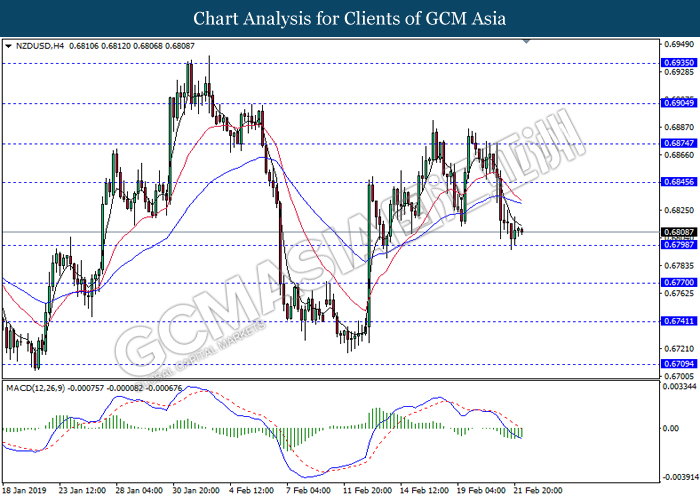

NZDUSD, H4: NZDUSD was traded higher following recent rebound from the support level 0.6800.MACD which illustrate bullish bias signal suggest the pair to extend its rebound towards the resistance level 0.6845.

Resistance level: 0.6845,0.6875

Support level: 0.6800, 0.6770

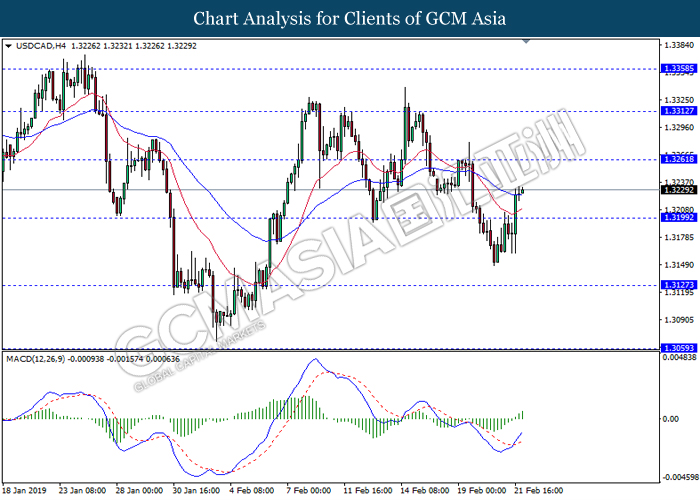

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level 1.3200. MACD which illustrate bullish momentum with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1.3260.

Resistance level: 1.3260, 1.3310

Support level: 1.3200, 1.3125

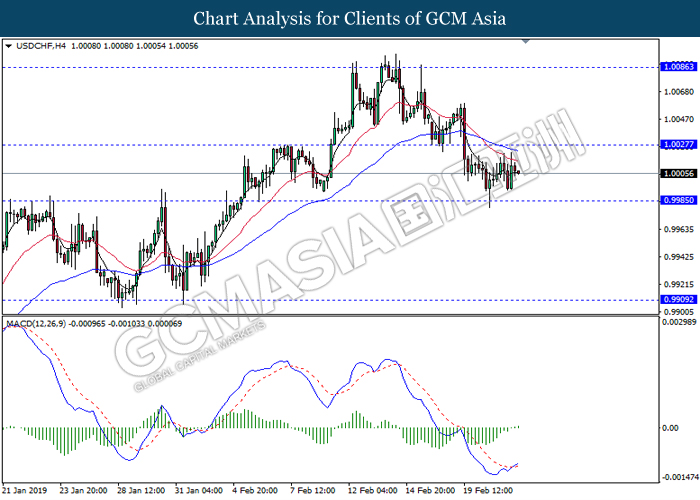

USDCHF, H4: USDCHF remain traded flat following prior recent rebound from its low level. However, MACD which illustrate bullish momentum with golden cross suggest the pair to be traded higher towards the resistance level 1.0025.

Resistance level: 1.0025, 1.0085

Support level: 0.9985, 0.9910

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level 57.50. MACD which illustrate bearish momentum with death cross formation suggest the commodity to extend its retracement towards the support level 55.75.

Resistance level: 57.50, 59.20

Support level: 55.75, 54.30

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level 1329.15. MACD which illustrate bearish momentum suggest the commodity to extend its losses towards the support level 1315.00.

Resistance level: 1329.15, 1340.55

Support level: 1315.00, 1302.90