22 February 2023 Afternoon Session Analysis

Sterling bulls spring to life after upbeat economic data released.

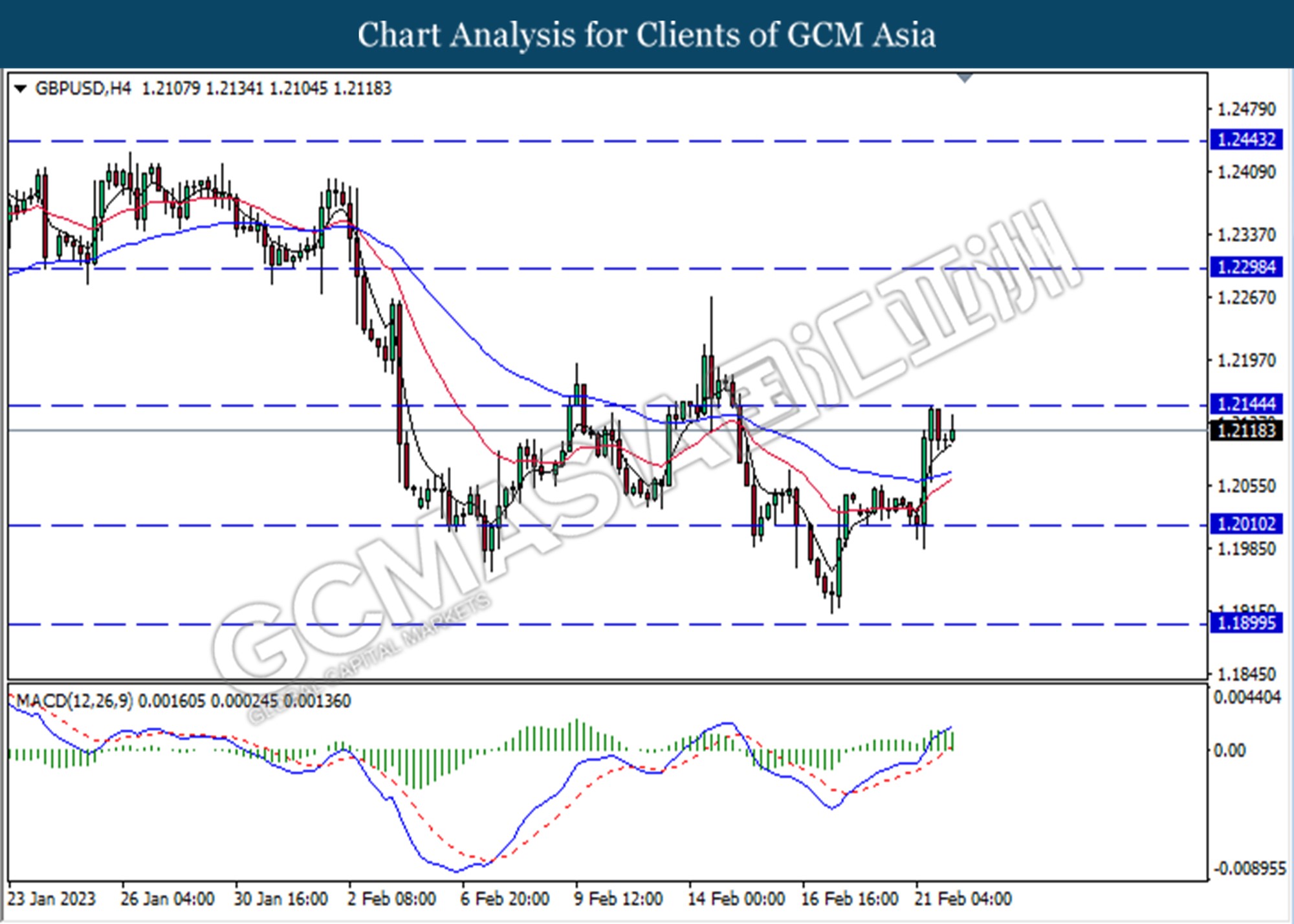

The GBP, one of the major currencies traded globally, has experienced a massive gain in recent trading sessions amid upbeat economic data announced. According to the data from Markit Economic, UK manufacturing PMI data grew by 2.2 points to the level of 49.2, while services PMI grew by 4.1 points to the level of 53.3. The overall Composite PMI stood at 53.0, which topped the market expectation at 49.0. The data results indicated that the UK economy has gotten rid from contraction as it reduced investors’ worries over the recession of the UK economy. With that, it increased investors’ expectations for a 25-basis point rate hike at the Bank of England’s (BOE) next meeting. Moreover, the UK unemployment rate for the last quarter hit the lowest level since 1974 at 3.5% providing BOE more room for rate hikes in the next monetary policy. As a result, investors increased bets on further BoE rate hikes after the optimistic economic data was released. As of writing, the GBP/USD rose by 0.07% to $1.2123.

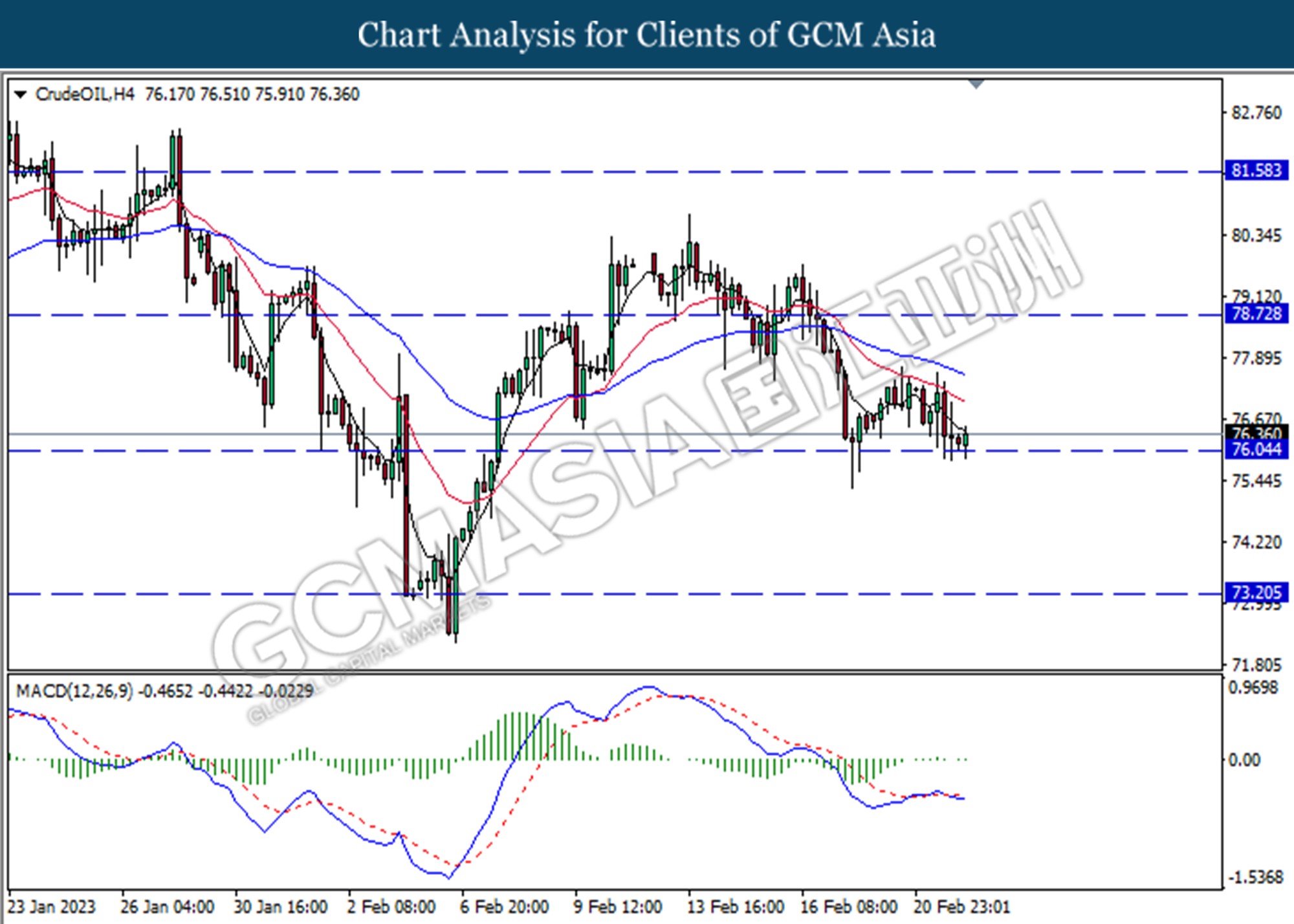

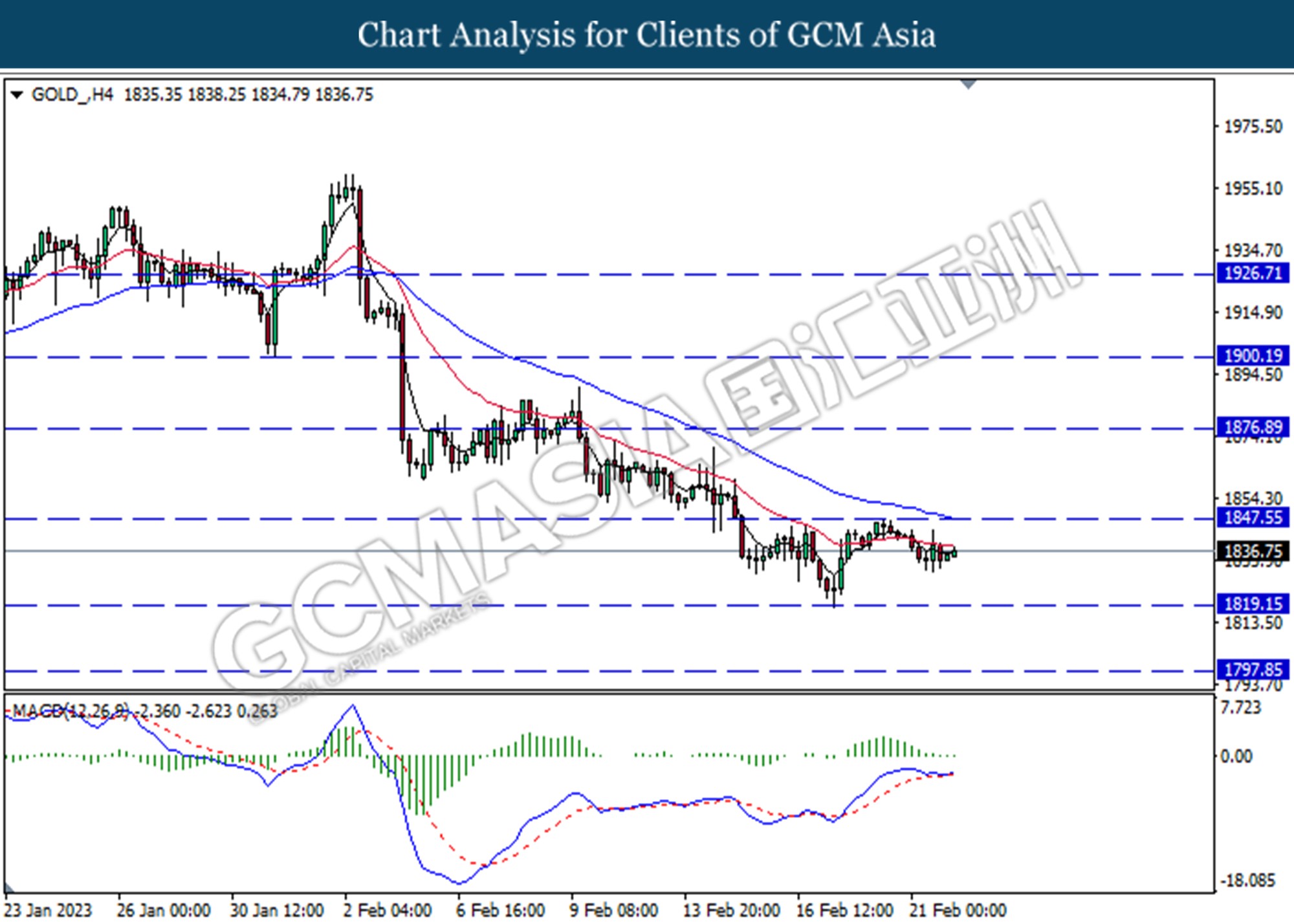

In the commodity market, the crude oil price edged up by 0.07% to $76.25 per barrel after a sharp drop in the prior session as the market awaited more cues from FED minutes. In addition, the gold price rose by 0.03% to $1835.09 per troy ounce as the investors sought safe-haven assets amid inflation concerns.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Feb) | 90.2 | 91.4 | – |

Technical Analysis

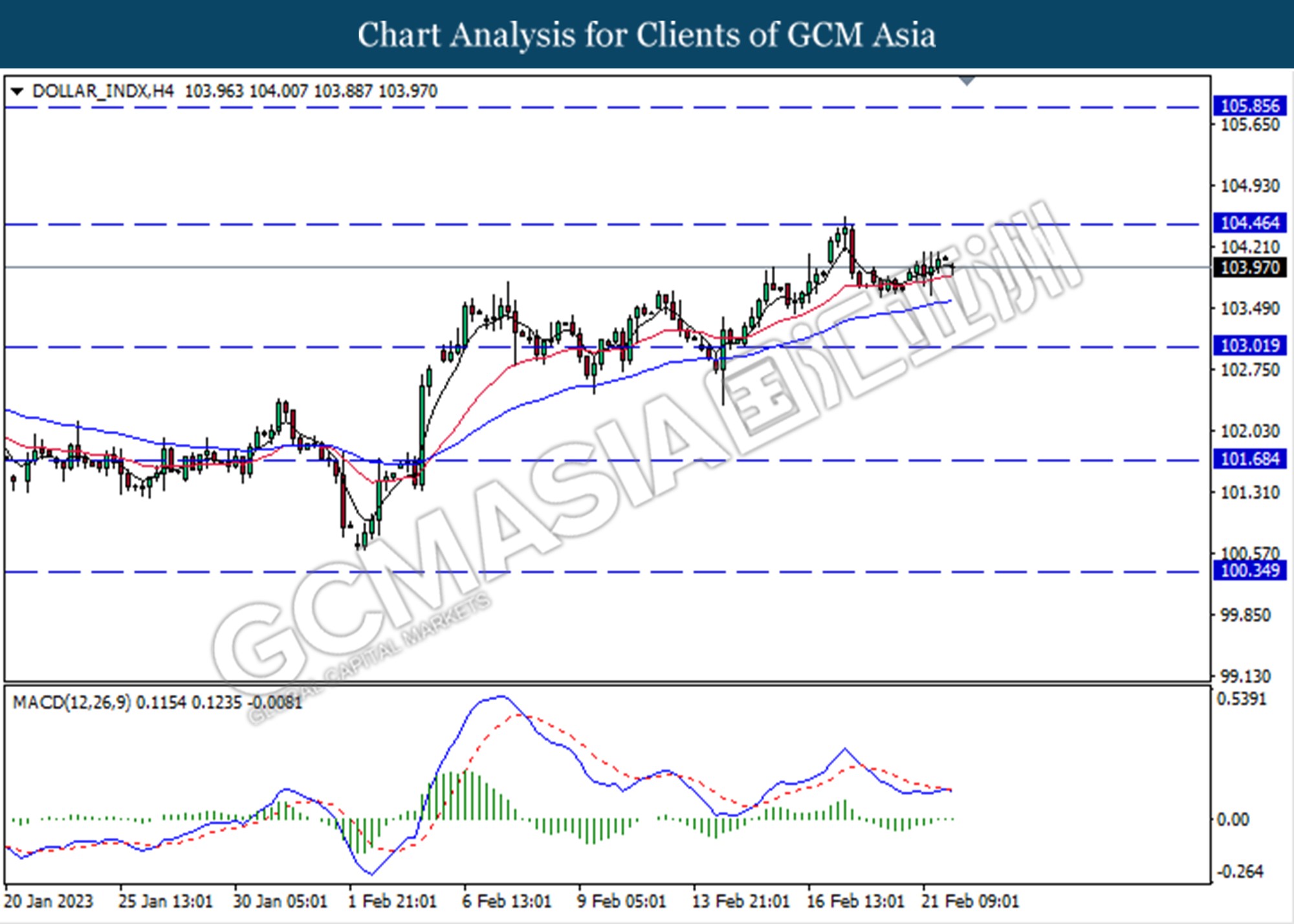

DOLLAR_INDX, H4: Dollar index was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the index to extend its losses toward the support level。

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lowest level. MACD which illustrated increasing bullish momentum suggests the pair to be extend its gains toward the resistance level at 1.2145

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

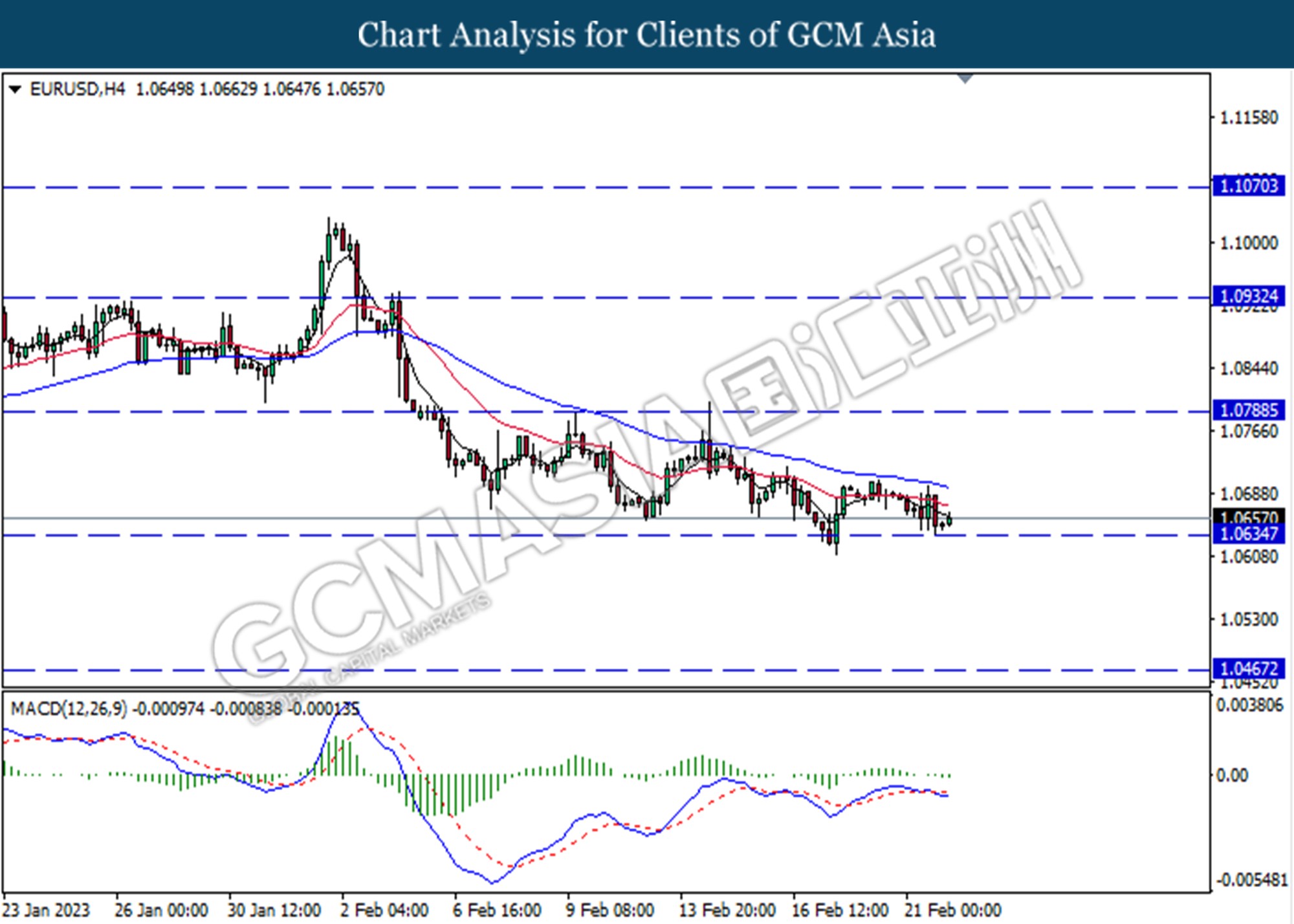

EURUSD, H4: EURUSD was traded higher following a prior rebound from the support level at 1.0635. However, MACD which illustrated bearish momentum suggests the pair to be traded lower as a technical correction.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0470

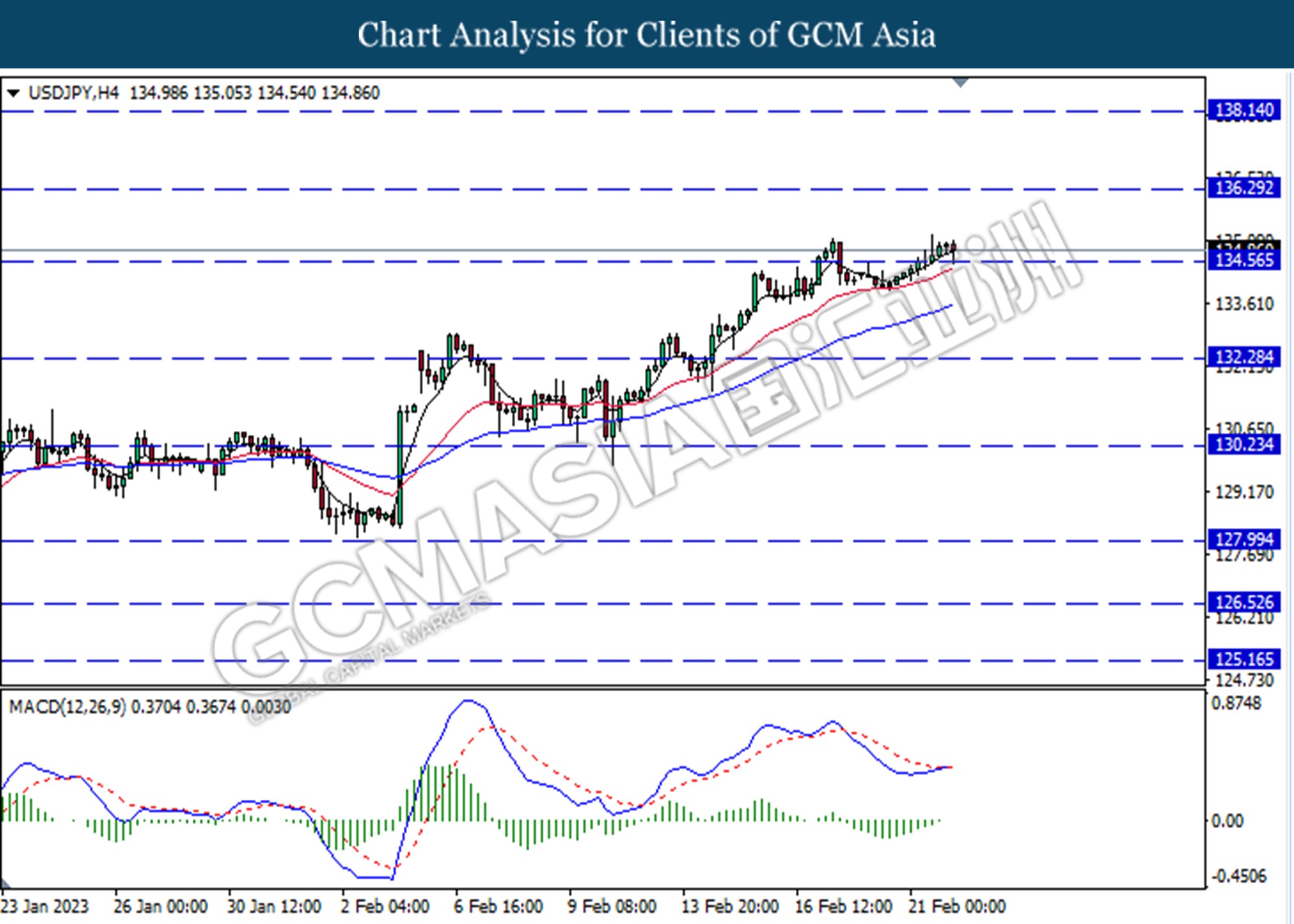

USDJPY, H4: USDJPY was traded higher following a prior break above the previous resistance level at 134.55. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains to the resistance level at 136.30

Resistance level: 136.30, 138.15

Support level: 130.25, 134.55

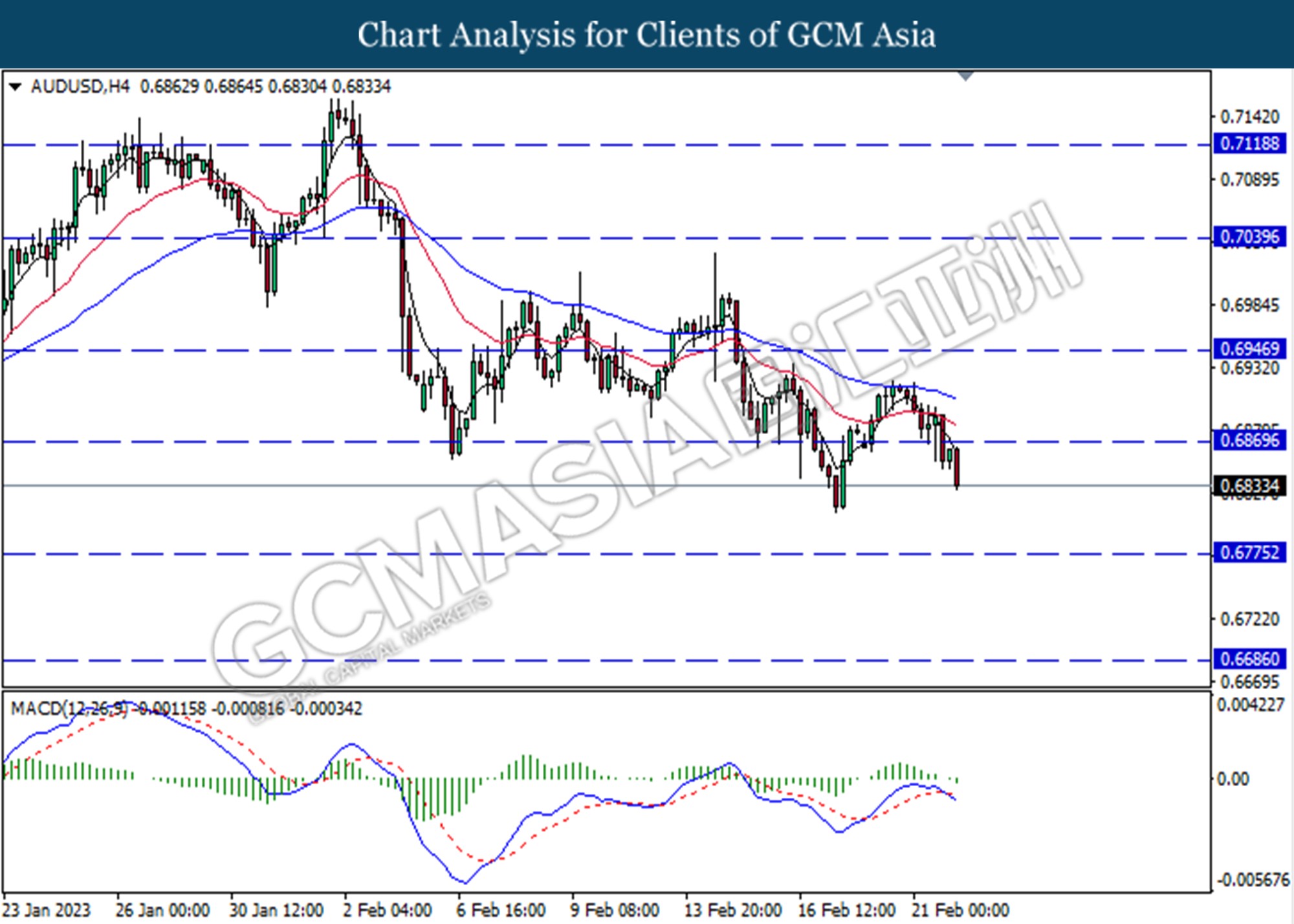

AUDUSD, H4: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6870. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6870, 0.6955

Support level: 0.6775, 0.6685

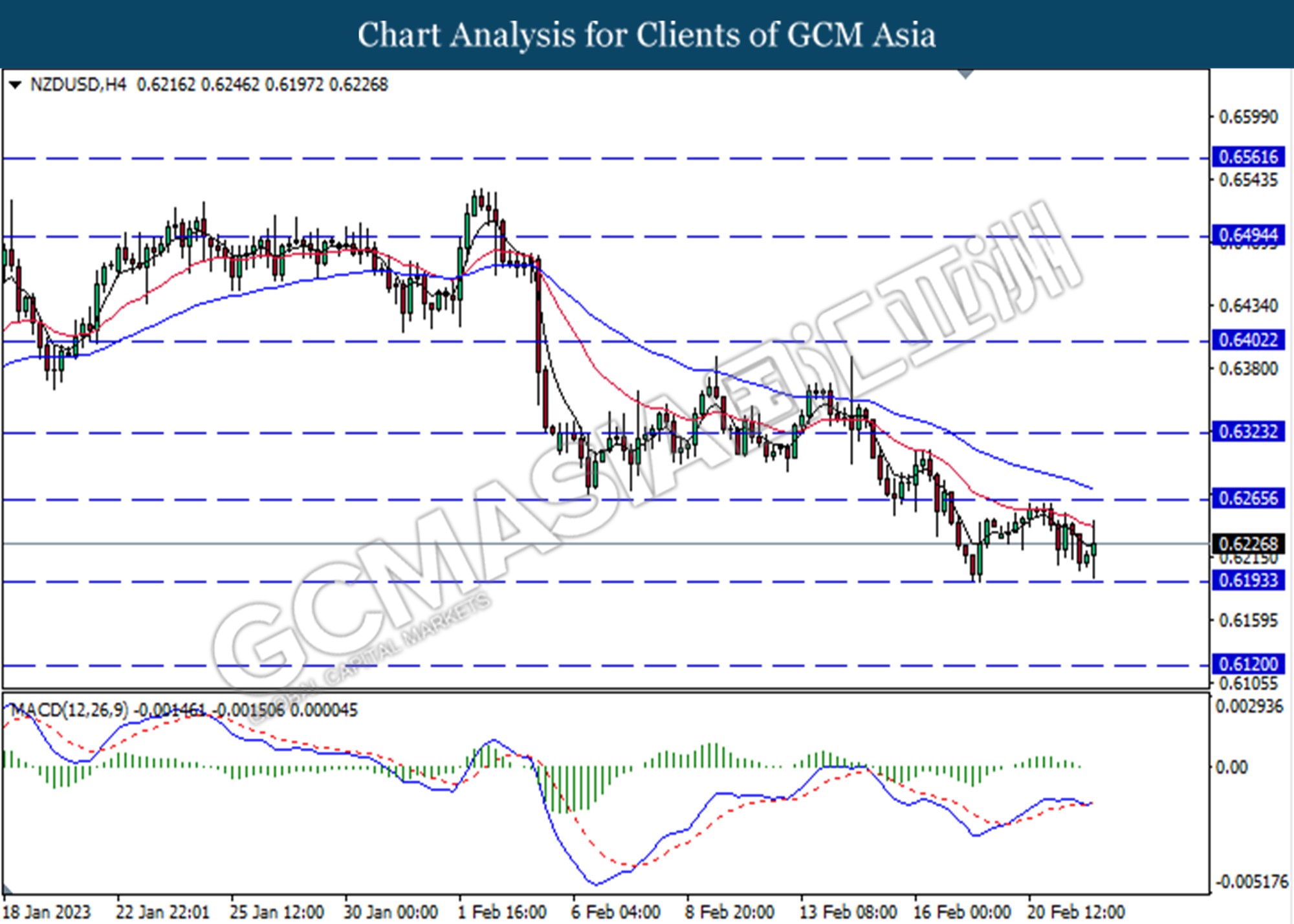

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the support level at 0.6195. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short-term.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

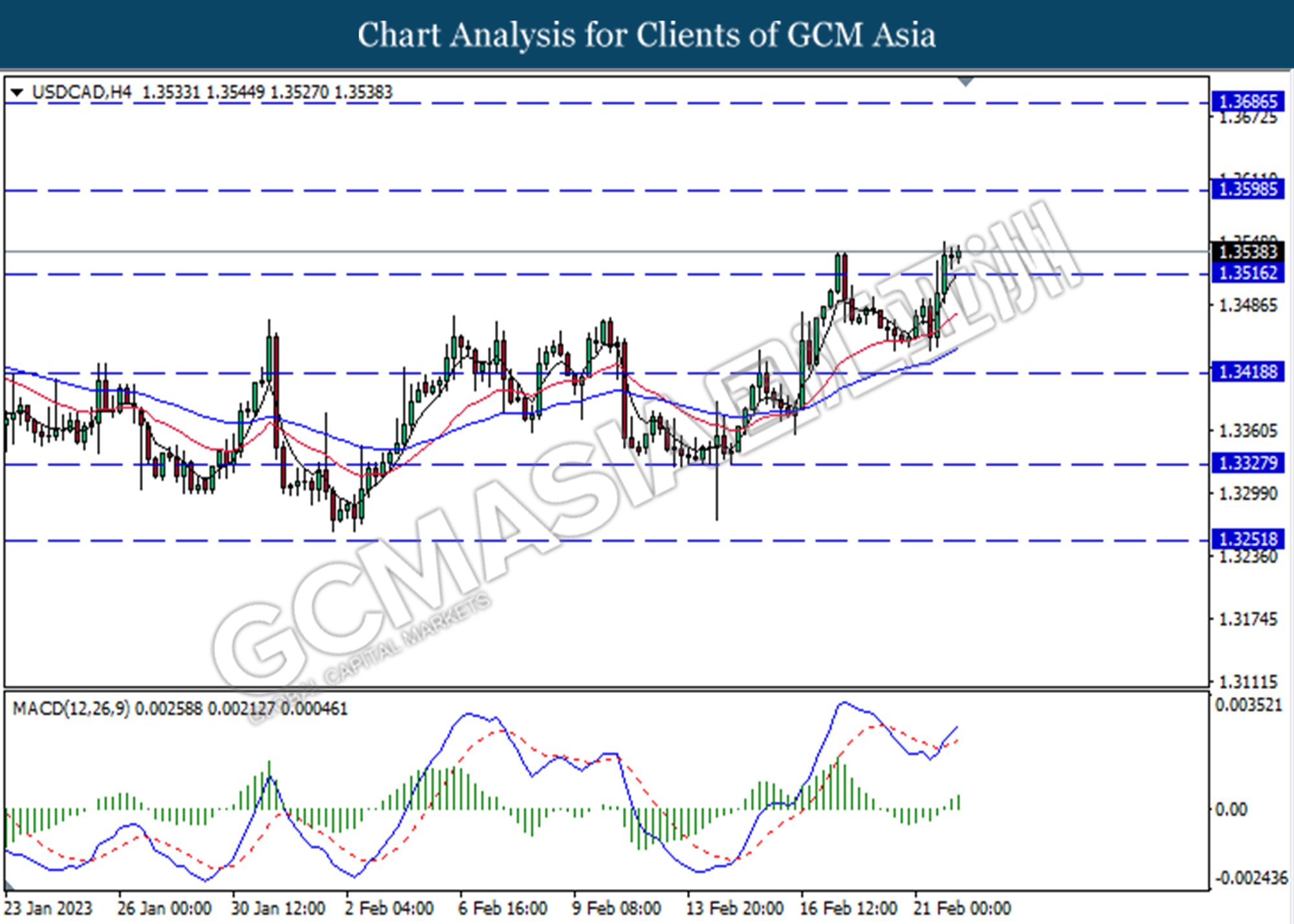

USDCAD, H4: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3515. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3560.

Resistance level: 1.3560, 1.3685

Support level: 1.3420, 1.3330

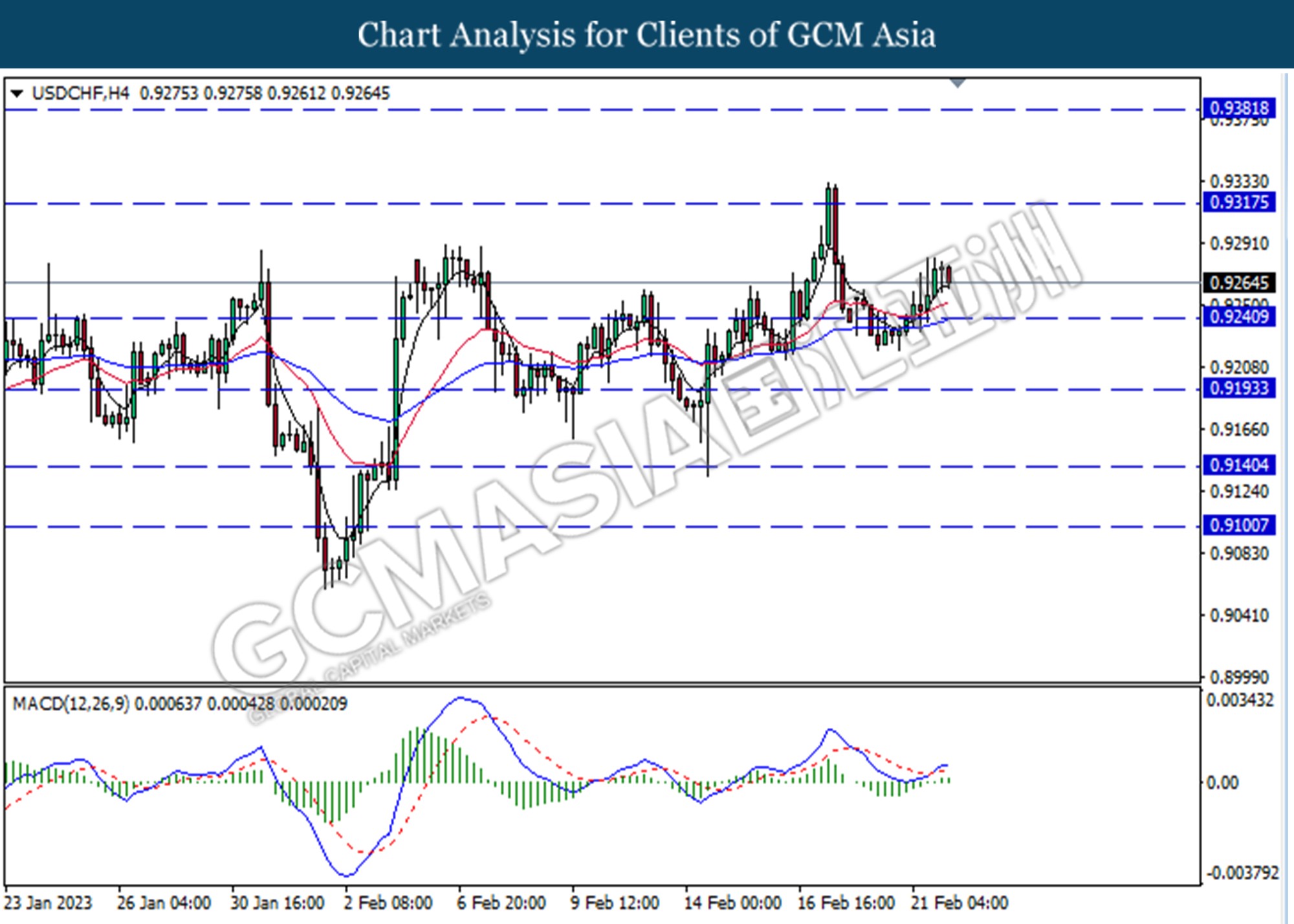

USDCHF, H4: USDCHF was traded lower following a prior retracement from a higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short-term.

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

CrudeOIL, H4: Crude oil price was traded higher following a rebound from the support level at 76.05. MACD which illustrated bullish momentum suggests the commodity to extend its gains toward the resistance level at 78.70.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded higher following a rebound from the lower level. However, MACD which illustrated decreasing bullish momentum suggests the commodity to undergo technical correction in the short term.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45