22 March 2022 Afternoon Session Analysis

Euro beaten down following the surge of oil price.

The Euro extend its losses on Tuesday following of European Union to mull Russian oil embargo. According to Reuters, European Union governments will consider whether to impose an oil ban on Russia over its invasion of Ukraine as they gather this week with U.S. President Joe Biden for a series of summits designed to harden the West’s response to Moscow. Besides, the EU and allies have already imposed a panoply of measures against Russia, including freezing its central bank’s assets. Banning Russian oil would likely to diminish the oil circulation in the market, leading to the spike of crude oil price. Nonetheless, as EU mainly depends on Russia for imports of energy products, it would dial down the market optimism toward economic progression in Europe if EU ban Russian oil indeed. The surging oil price would also increase the import cost of companies, spurring further bearish momentum on the pair. Investors should continue to scrutinize the latest updates with regards of EU decision upon oil embargo on Russia to receive further trading signals. As of writing, Euro depreciated by 0.13% to 1.1000.

In commodities market, crude oil price appreciated by 2.53% to $112.75 per barrel as of writing over the backdrop of EU to mull Russian oil embargo. Besides, gold appreciated by 0.35% to $1936.30 per troy ounces as of writing under rising tensions of Russian-Ukraine conflict.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

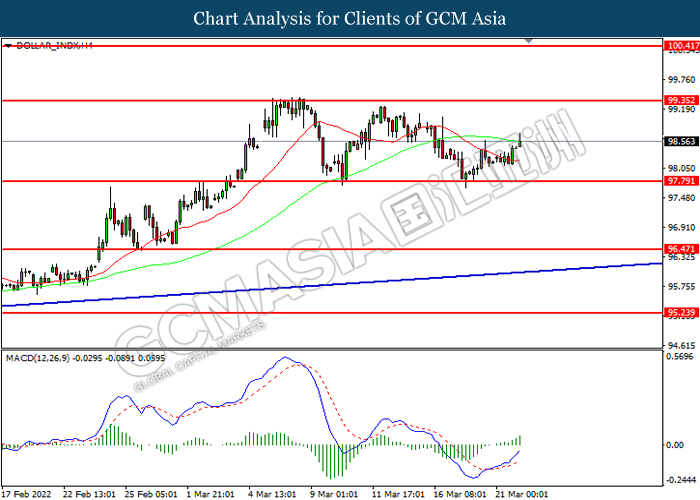

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

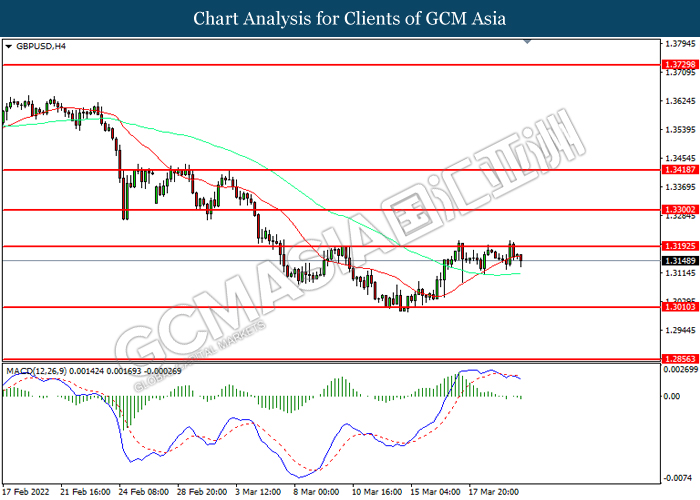

GBPUSD, H4: GBPUSD was traded higher while currently testing resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.3010, 1.2855

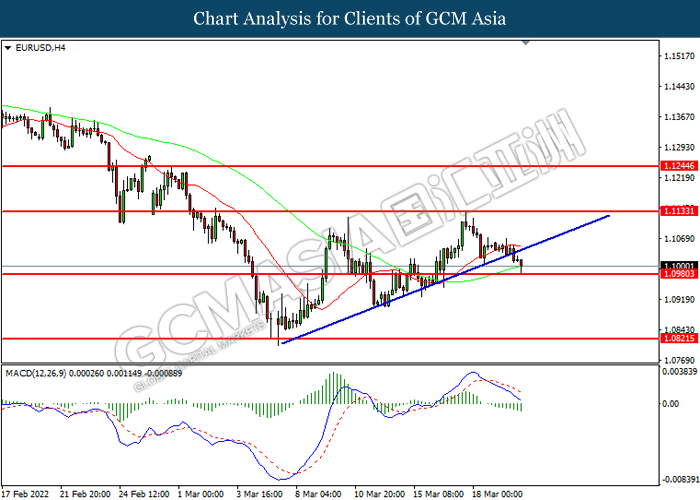

EURUSD, H4: EURUSD was traded lower while currently testing support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 119.90, 122.95

Support level: 116.15, 113.45

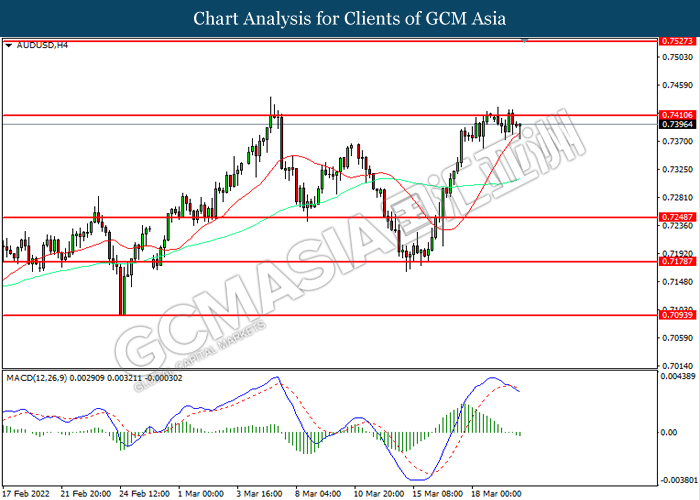

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

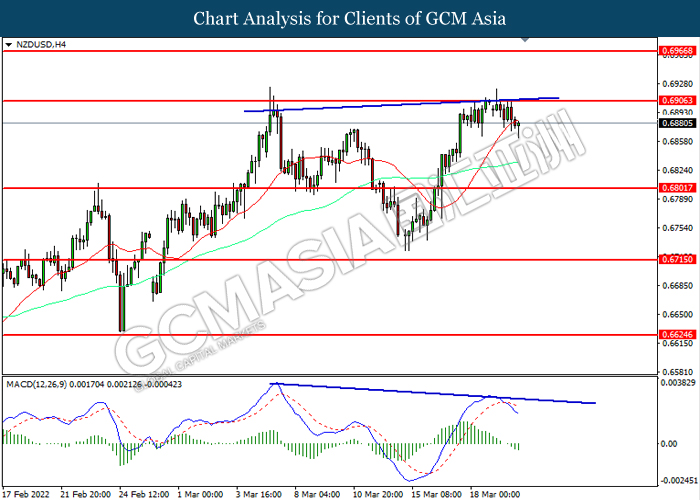

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6905, 0.6965

Support level: 0.6800, 0.6715

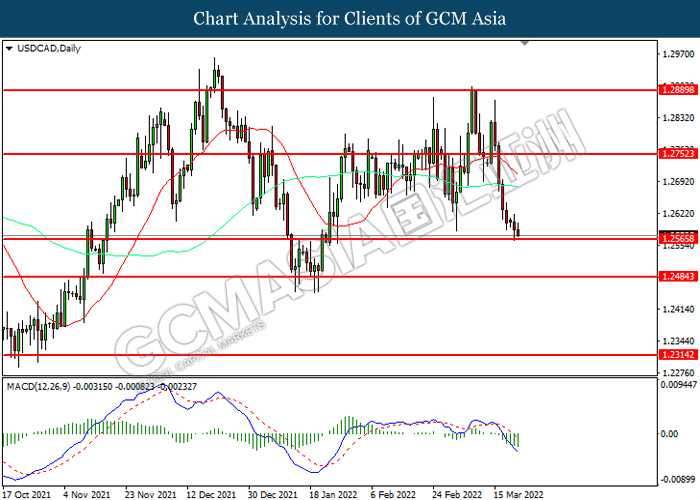

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2755, 1.2890

Support level: 1.2565, 1.2485

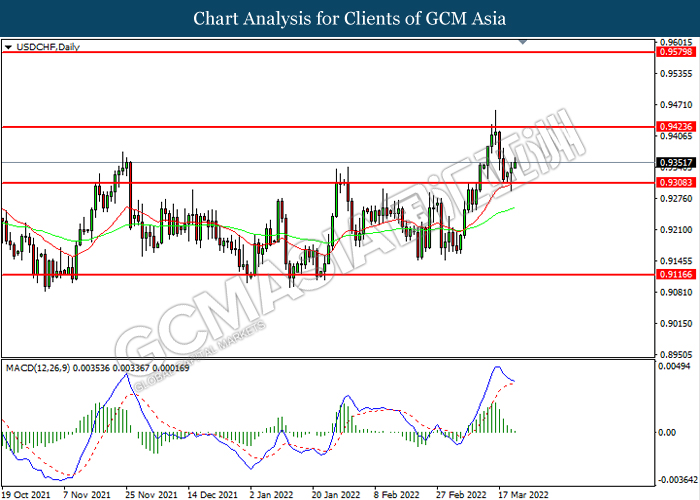

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

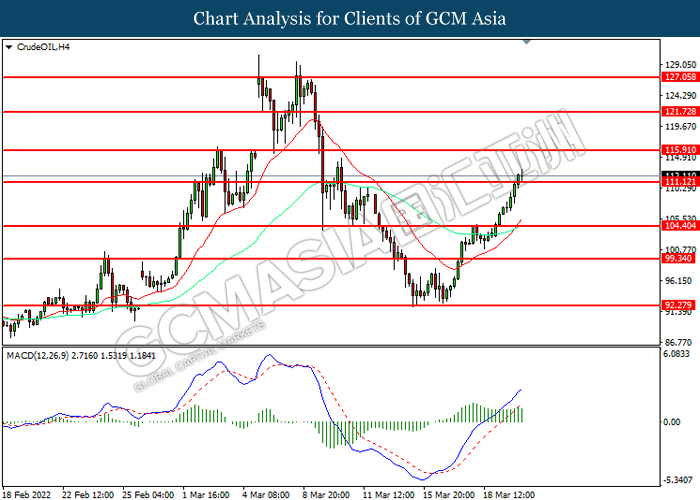

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 115.90, 121.75

Support level: 111.10, 104.40

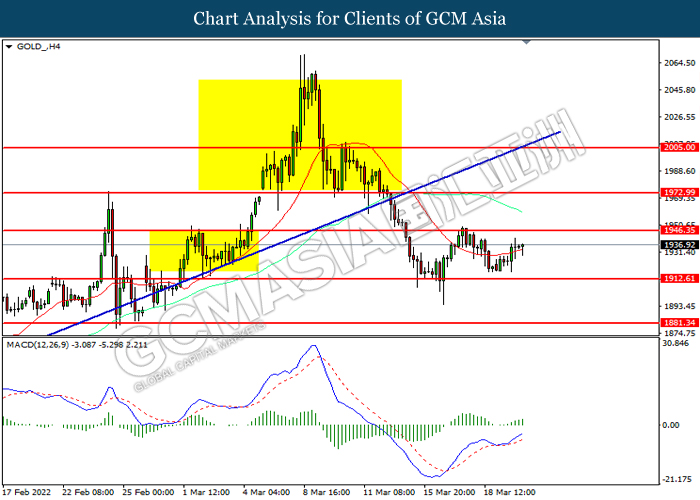

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35