22 April 2022 Morning Session Analysis

US Dollar surged as Fed unleashed hawkish tone.

The Dollar Index which traded against a basket of six major currencies rebounded from one-week low following the Federal Reserve Chair Jerome Powell unleashed his hawkish tone toward the economic progression in the United States. According to Reuters, Federal Reserve Chair Jerome Powell confirmed a 50-basis point of rate hike during the monetary policy meeting next month, including consecutive rate increases in the year of 2022. Fed funds futures have started to speculate a three straight 50 basis-point interest rate hikes starting with next month’s policy meeting. With inflation running roughly three times higher than the Fed’s target, it would prompt the Fed to be tightening the monetary policy in more aggressive ways to stabilize the inflation risk. As of writing, the Dollar Index appreciated by 0.24% to 100.65.

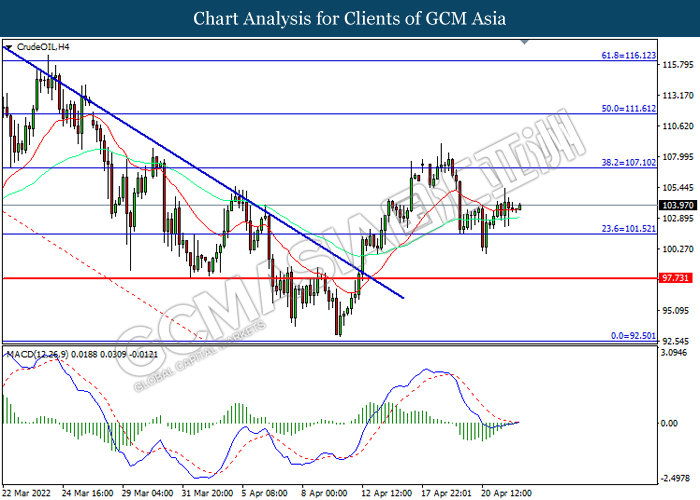

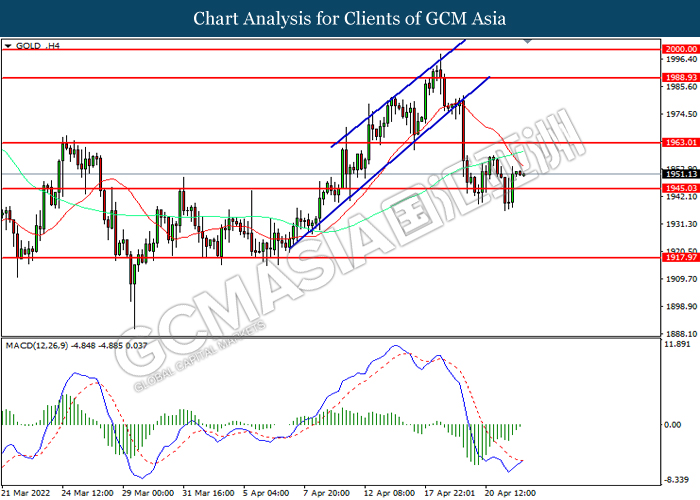

In the commodities market, the crude oil price surged by 0.03% to $103.48 per barrel as of writing. The oil market edged higher as market participants remained concerns that the European Union (EU) would likely to implement sanction on Russian oil supply. On the other hand, the gold price depreciated by 0.02% to $1951.00 per troy ounces amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 EUR ECB President Lagarde Speaks

22:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Mar) | -0.30% | -0.30% | – |

| 15:30 | EUR – German Manufacturing PMI (Apr) | 56.9 | 54.4 | – |

| 16:30 | GBP – Manufacturing PMI | 55.2 | – | – |

| 16:30 | GBP – Services PMI | 62.6 | – | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Feb) | 2.50% | 2.40% | – |

Technical Analysis

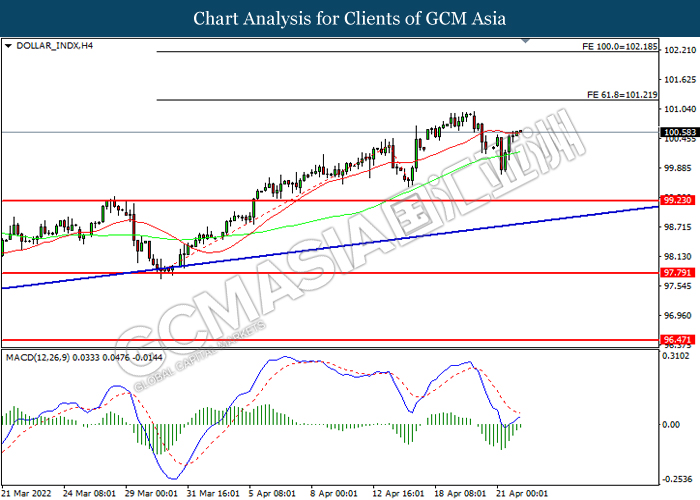

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 101.20, 102.20

Support level: 99.25, 97.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2995. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

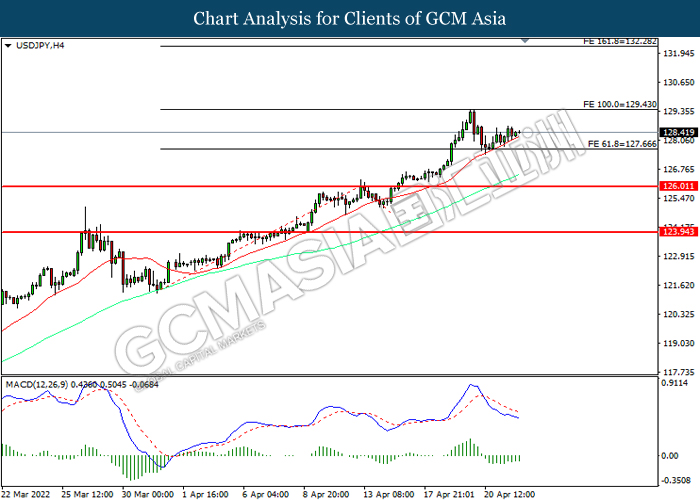

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 129.45, 132.30

Support level: 127.65, 126.00

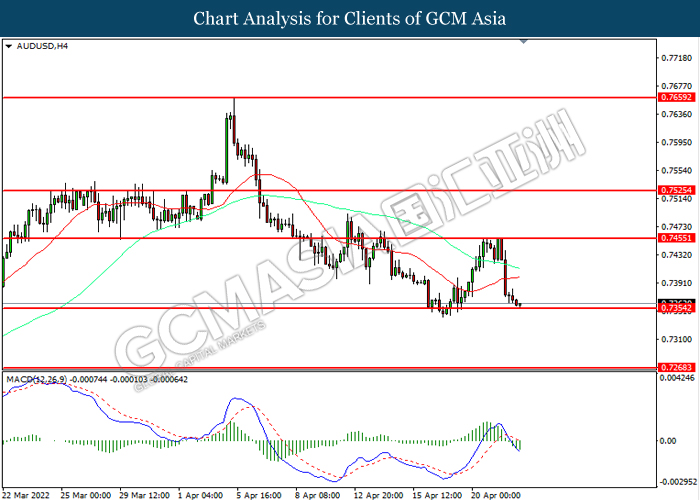

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7455, 0.7525

Support level: 0.7355, 0.7270

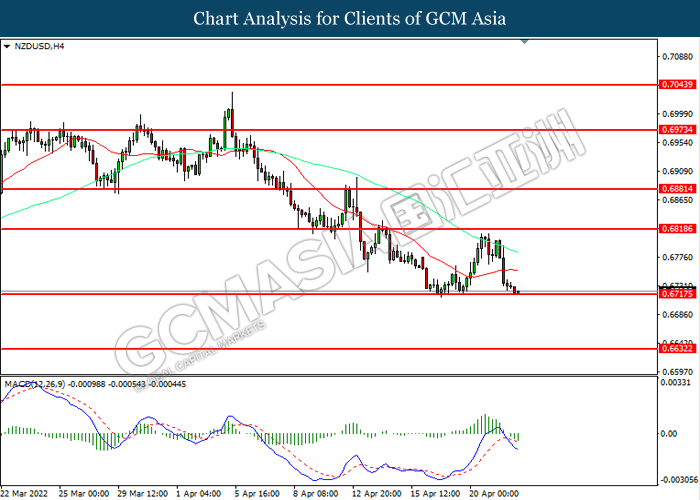

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6820, 0.6880

Support level: 0.6715, 0.6630

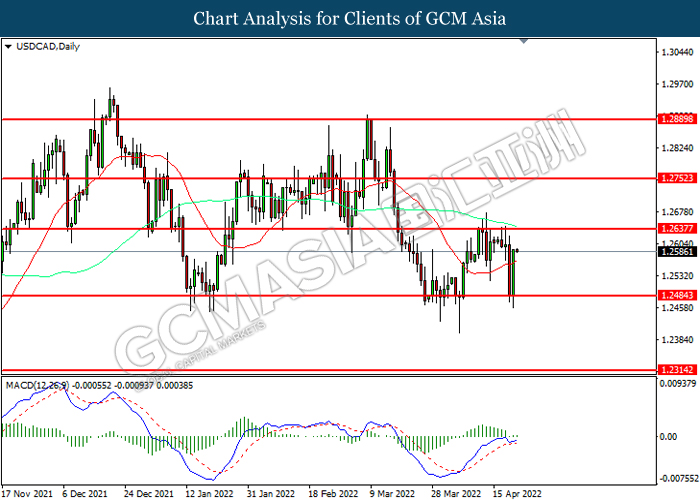

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

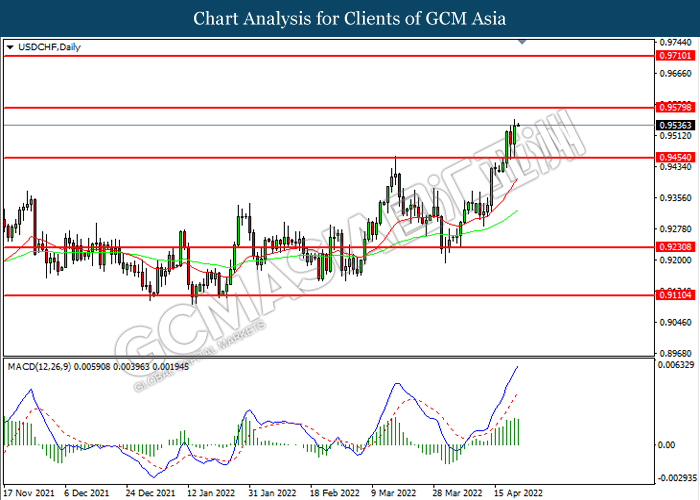

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1963.00, 1975.00

Support level: 1945.05, 1917.95