22 May 2023 Afternoon Session Analysis

The Loonie fluctuated after retails sales softened.

The CAD/USD trade continued to be volatile on Friday after retail sales deteriorated but the losses were offset by a pullback in the U.S. dollar. The retail sale data in March rose to -1.4% MoM in March from -0.2% in Feb, in line with market expectations. Core retails sales which excluded gasoline stations, fuel vendors, motor vehicle, and parts dealers increased by 0.3%, above the market expectations by -0.8%. Further details of publications revealed that the retail sales in 5 of the 9 subsectors, accounting for 55.5% of retail traded fallen. The figure was driven by lower motor vehicle and parts dealers sales at -4.4%, and 3.9% at gasoline stations and fuel vendors. The retail sales suggest expectations for interest rates paused for the Bank of Canada as consumer spending slowed. Besides, the Canadian dollar weakened against its counterpart as oil prices fell and Bank of Canada (BoC) Governor Makclem resists validating rate hikes bet by investors. Macklem said that the April inflation increase in the first in 10 months was an anomaly and insisted on his view that inflation will continue to fall. The Loonie falls as Governor’s dovish comments knock investors out of favor. However, the losses of the Canadian dollar were offset by the pullback of the greenback. Fed Governor Powell said that tightening credit conditions due to stresses in the banking sector. The Fed might not need to raise its policy rates to achieve its 2% targets. As a result, the pair of USDCAD continues to be volatile and traded up by 0.04% to 1.3511.

In the commodities market, crude oil prices were tickled down by -1.38% to $70.70 per barrel as investors remain cautious ahead of debt ceiling talks. Besides, gold prices traded down by -0.18% to $1974.15 per troy ounce amid strengthening in the dollar index.

Today’s Holiday Market Close

Time Market Event

All Day CAD Victoria Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breakout below from the previous support level at 103.00. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level.

Resistance level: 103.00, 103.75

Support level: 101.90, 100.80

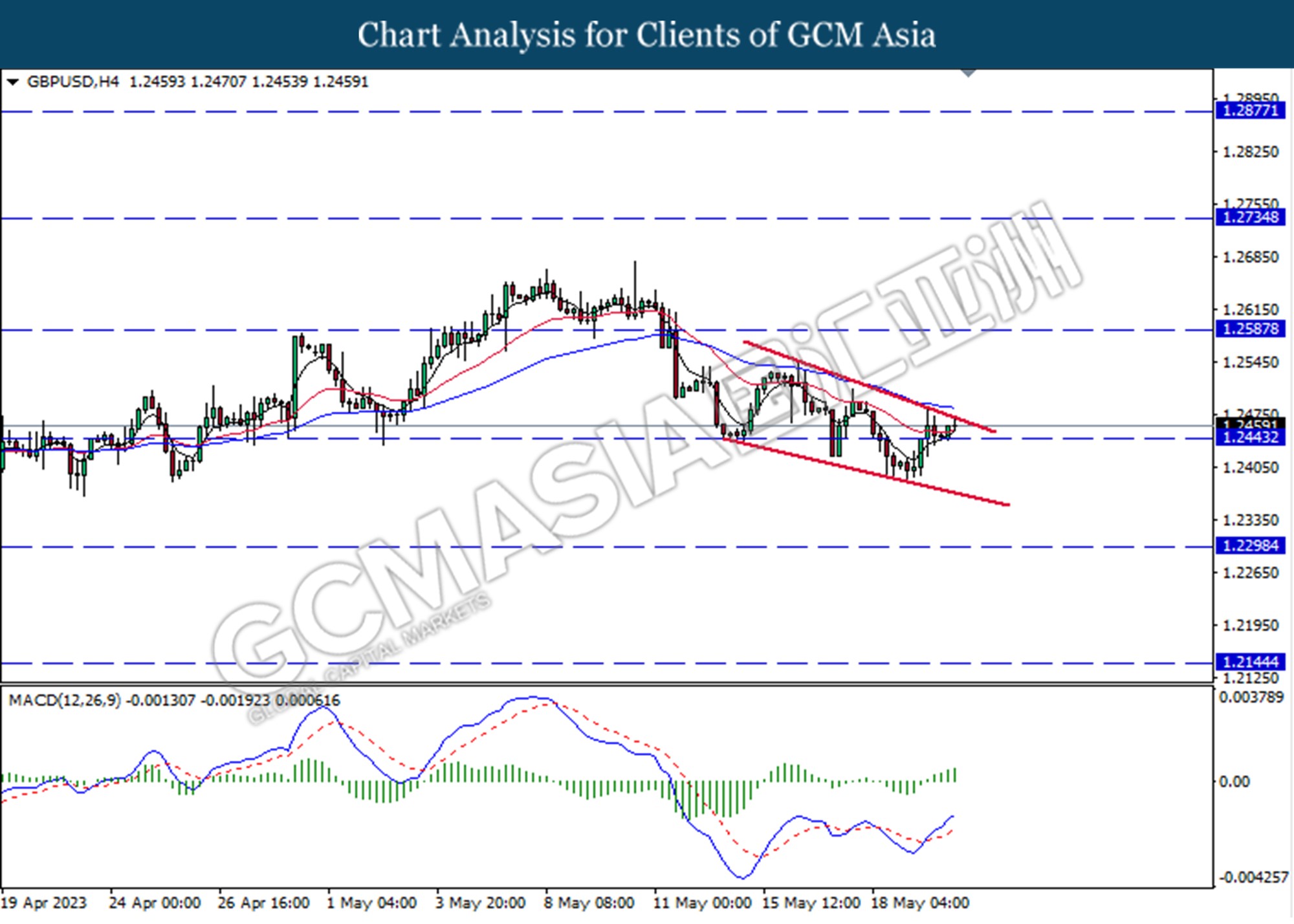

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2445. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

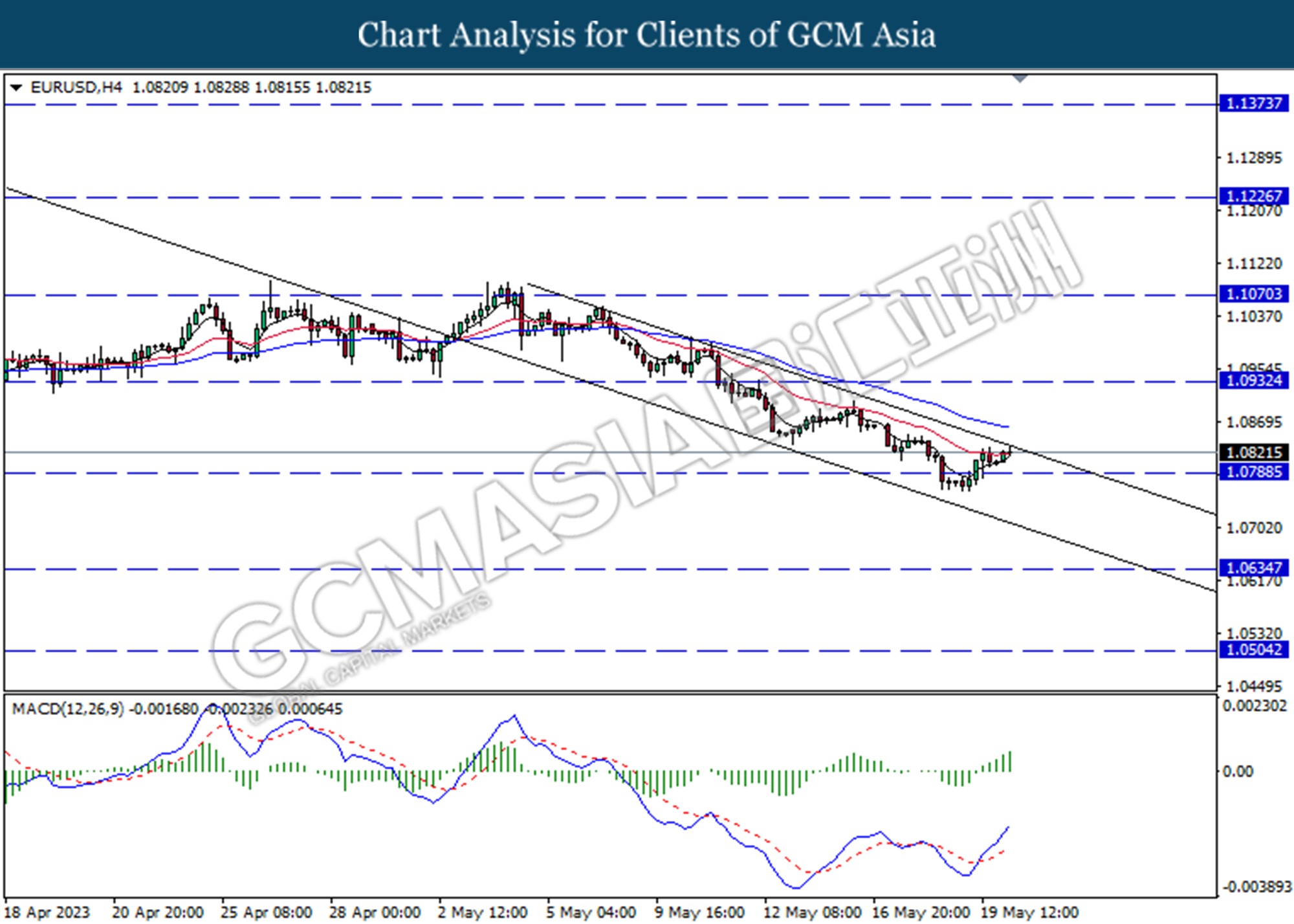

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

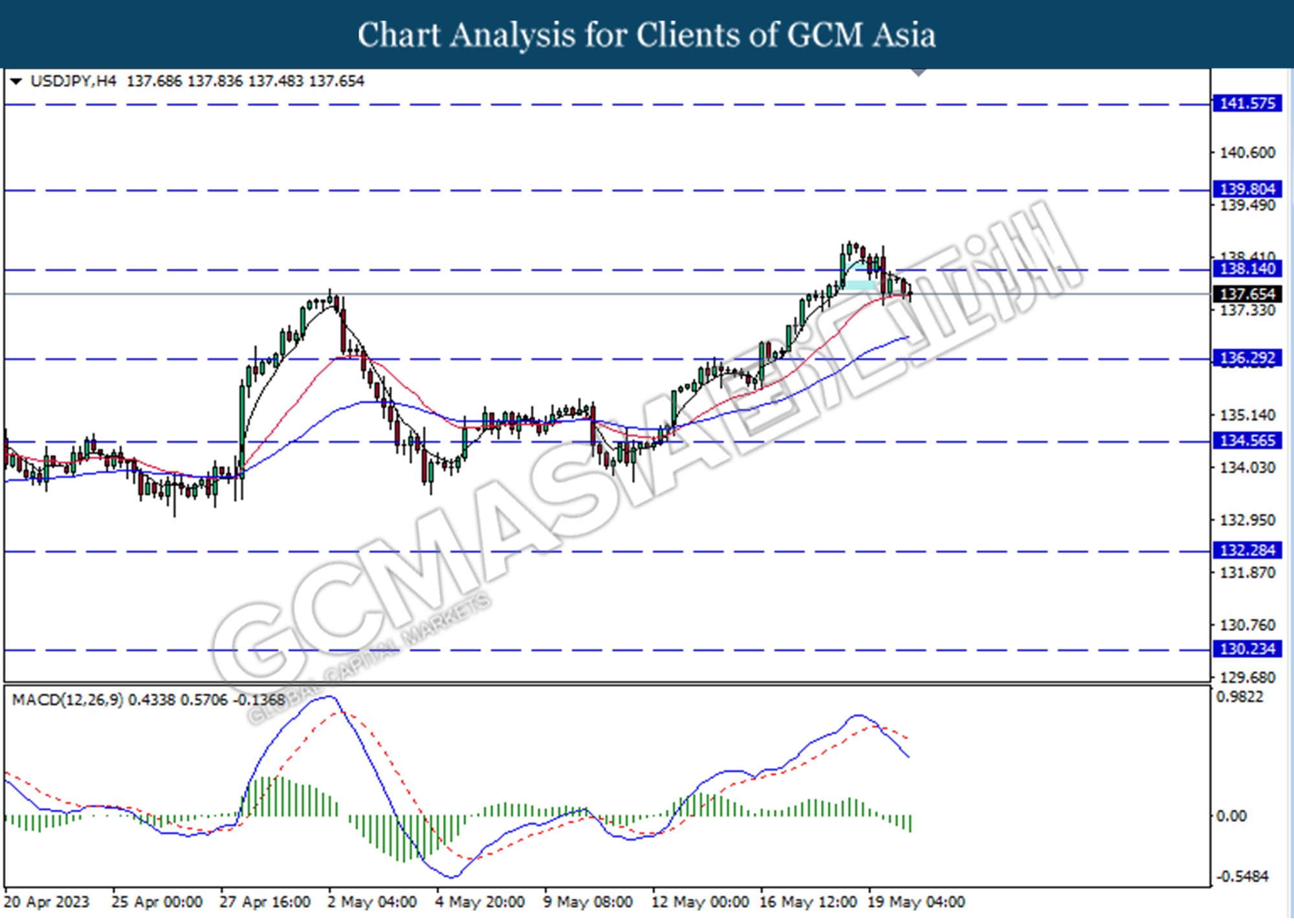

USDJPY, H4: USDJPY was traded lower following the prior breaks below the previous support level at 138.15. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 138.15, 139.80

Support level: 136.30, 134.55

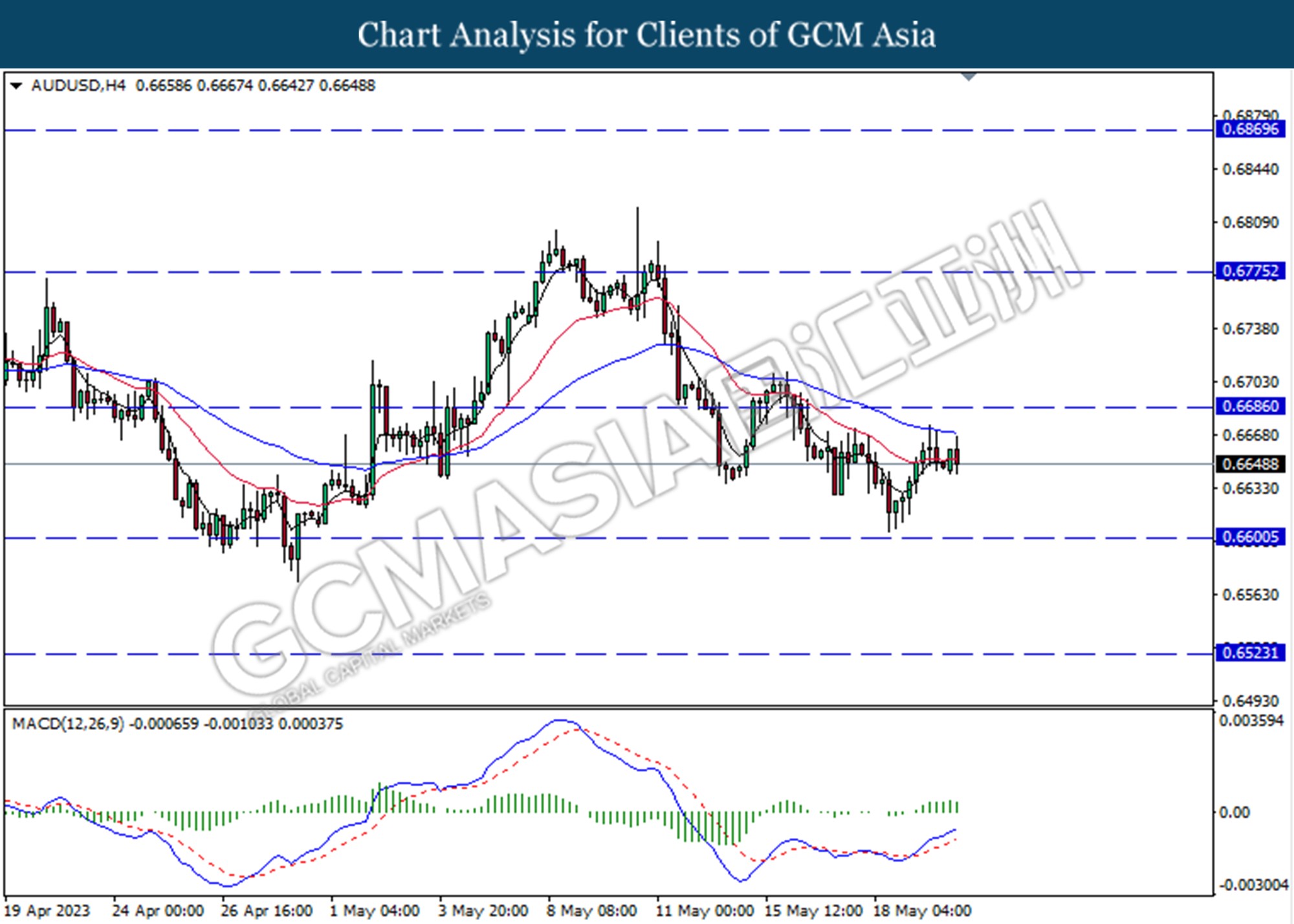

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

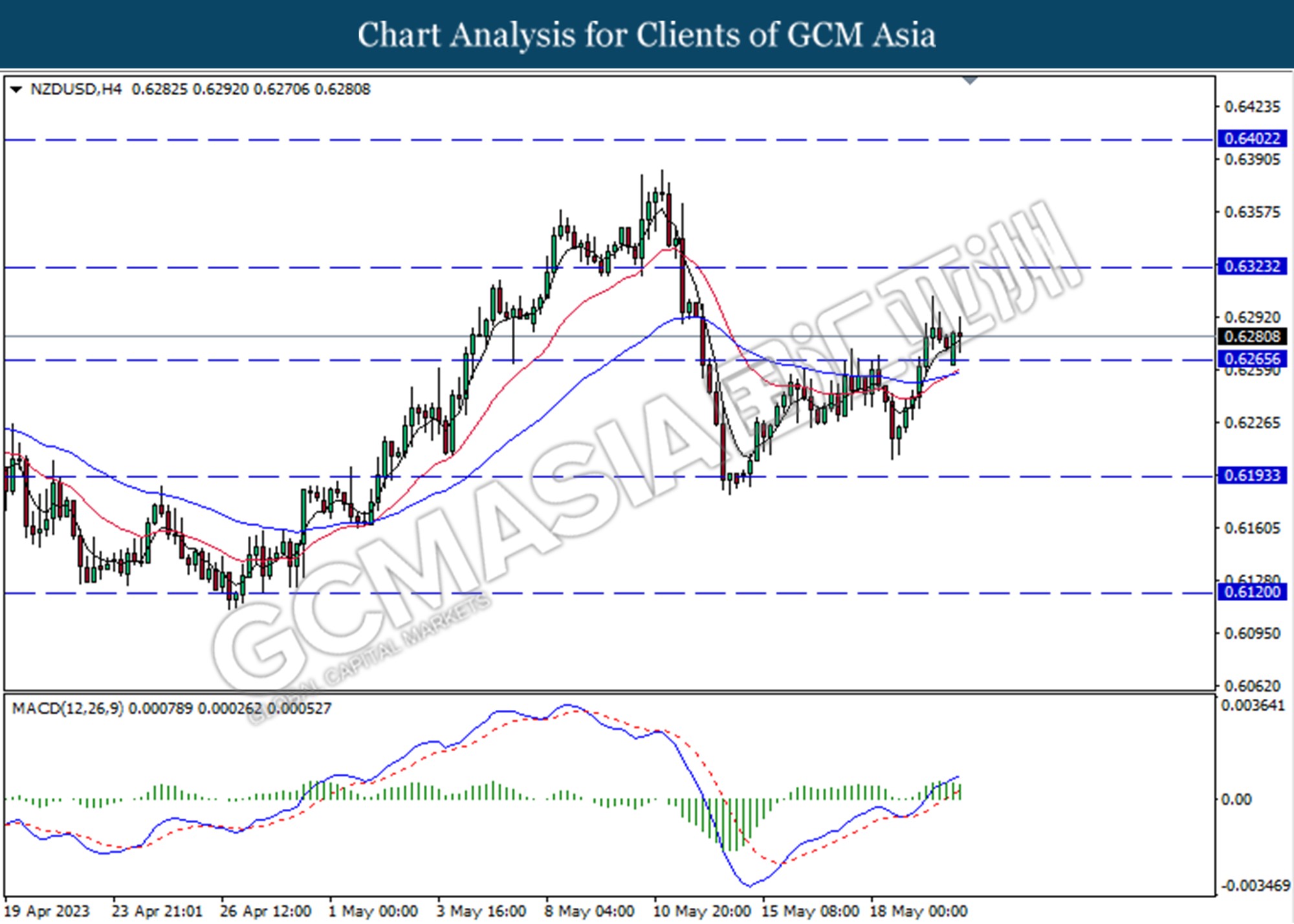

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bullish momentum suggests the pair extended losses toward the support level at 0.6265.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

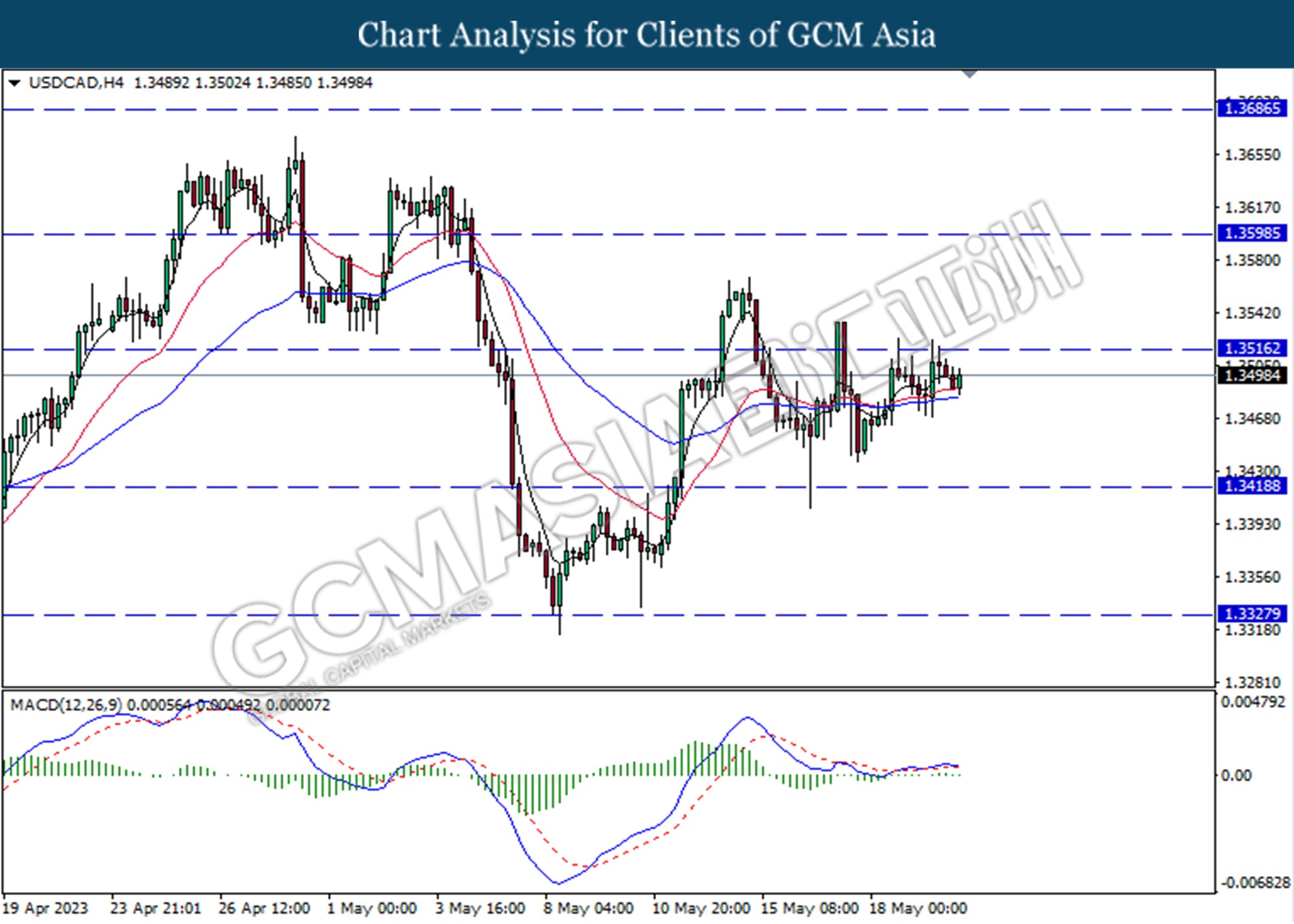

USDCAD, H4: USDCAD was traded lower following the prior retracement from the resistance level at 1.3515. MACD which illustrated bullish momentum suggests the pair undergo technical correction in a short term.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

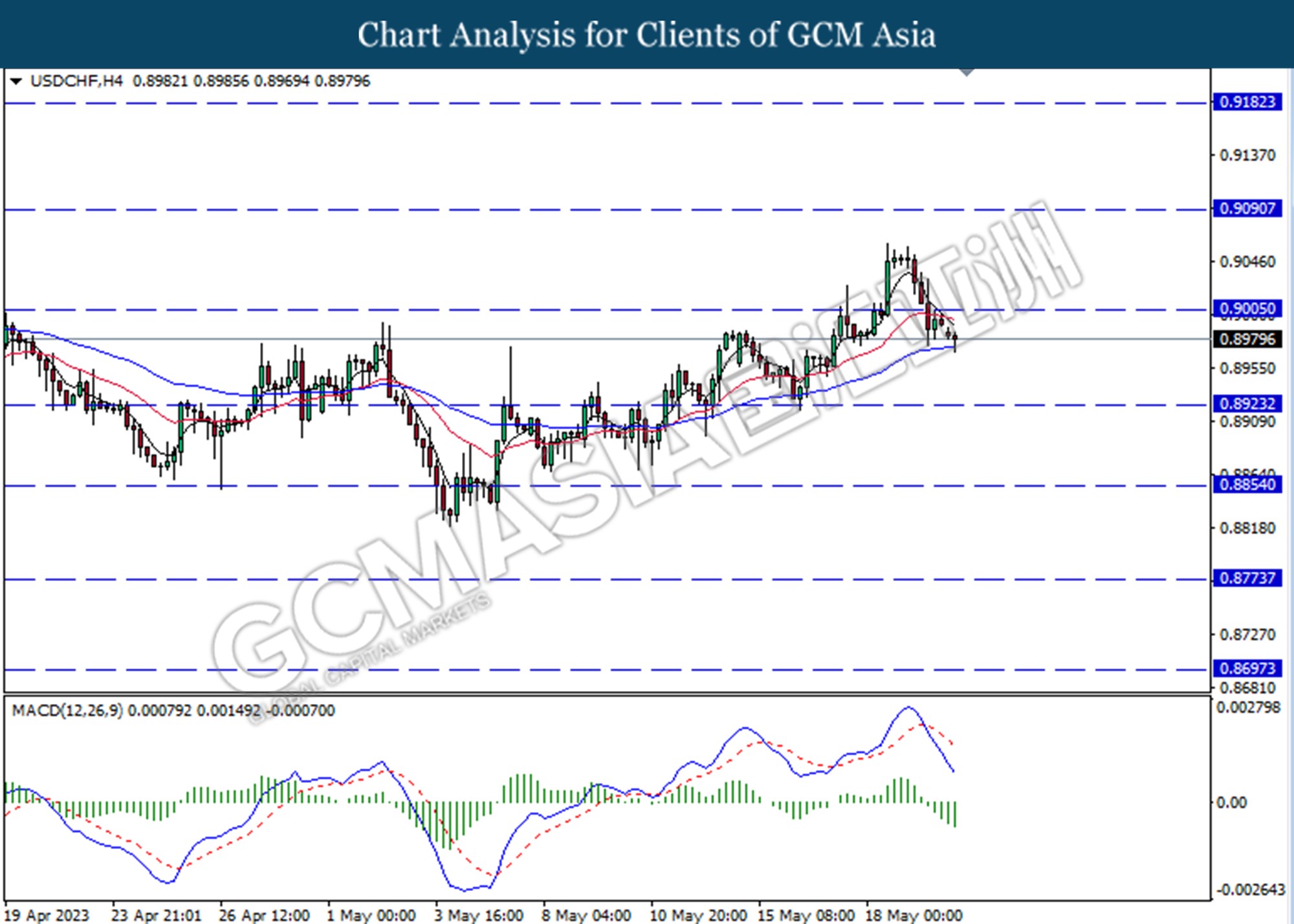

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.9005. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

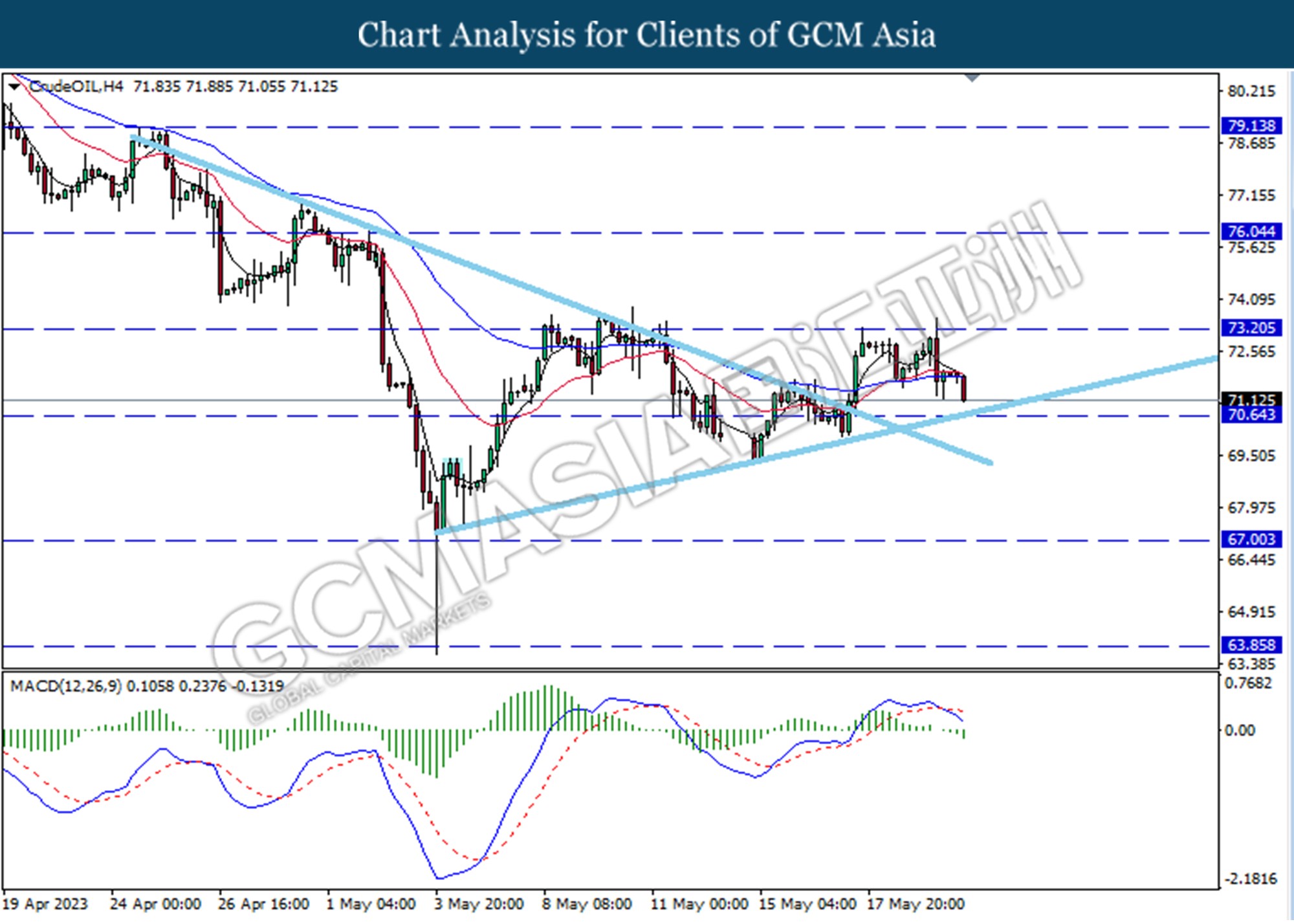

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the resistance level at 73.20. MACD which illustrated increasing bearish momentum suggests the commodity extended losses toward the support level at 70.65.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

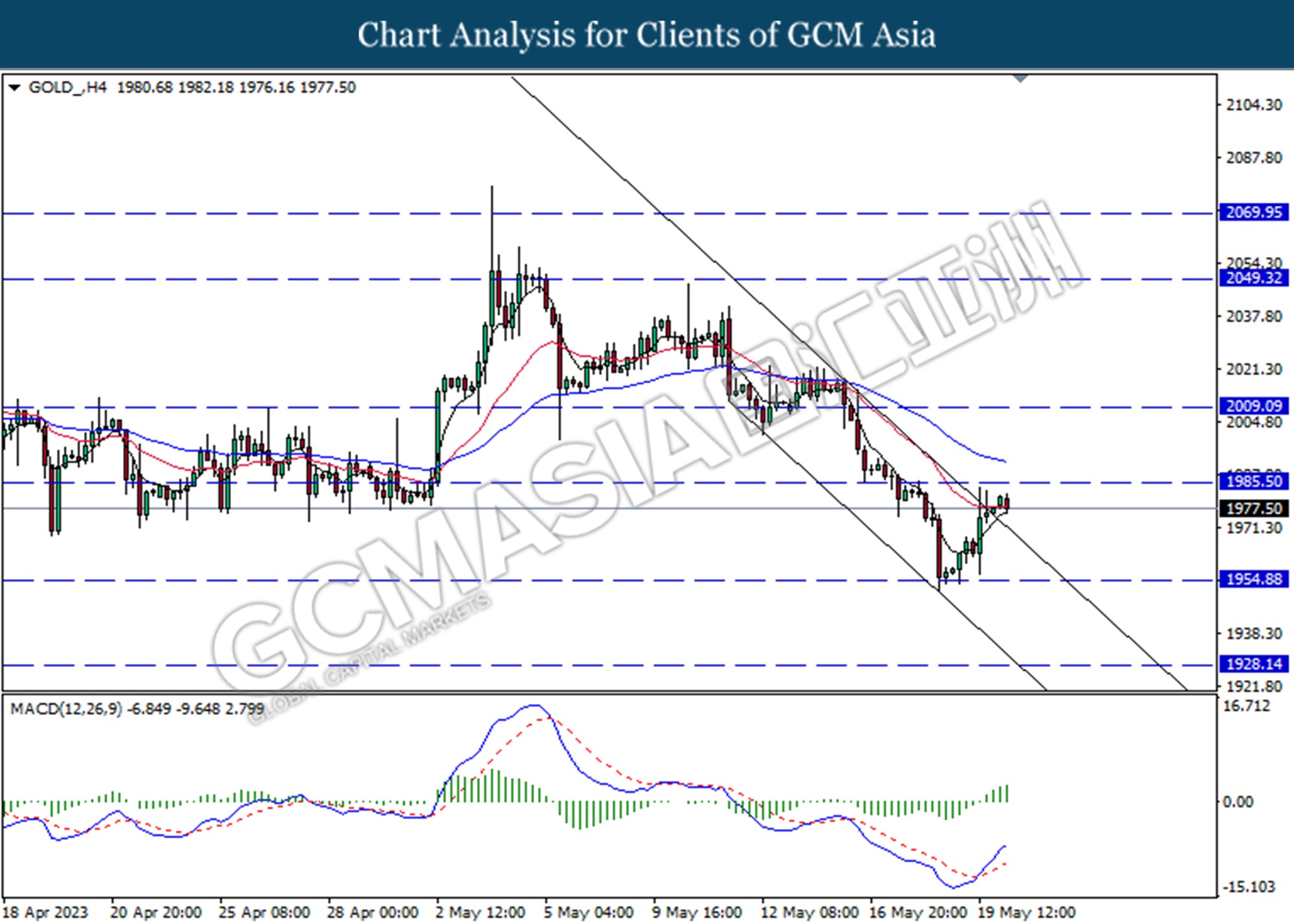

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1954.90. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 1985.50.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15