22 May 2023 Morning Session Analysis

US dollar plunged amid talk’s impasses and Powell dovish stance.

The dollar index, which was traded against a basket of six major currencies, retreated from its two-month high as a meeting between White House debt ceiling negotiators and House Speaker Kevin McCarthy ended Friday night with neither side able to say when they would meet face to face again. Last Friday, Mr. McCarthy requested a meeting with President Joe Biden on the debt ceiling, according to a person familiar with the matter. Speaking to reporters Sunday at the G7 summit in Japan, Biden said he would speak with McCarthy later in the day but declined to give further information ahead of the call. With that, the talk will only be resumed after Biden comes back from the G7 meeting. The setback dashed hopes that an agreement in principle could be reached earlier than expected. Besides, the unexpected dovish speech from Jerome Powell triggered huge selling pressures in the dollar market. Last Friday, Fed Chairman Jerome Powell said the recent turmoil in the banking sector is a warning sign for them, as further rate hikes might deteriorate the financial health across all sectors. Hence, the interest rate may not have to rise as much as expected to curb inflation, but future decisions on their monetary policy would be data-dependent as opposed to being a preset course. As of writing, the dollar index dropped -0.07% to 103.15.

In the commodities market, crude oil prices were down by -0.14% to $71.85 per barrel as debt limits talk faced a tumble, increasing the market worries over the risk of default which could hurt the oil demand. Besides, gold prices edged up by 0.02% to $1977.80 per troy ounce amid the dovish statement from Fed Chairman Jerome Powell.

Today’s Holiday Market Close

Time Market Event

All Day CAD Victoria Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

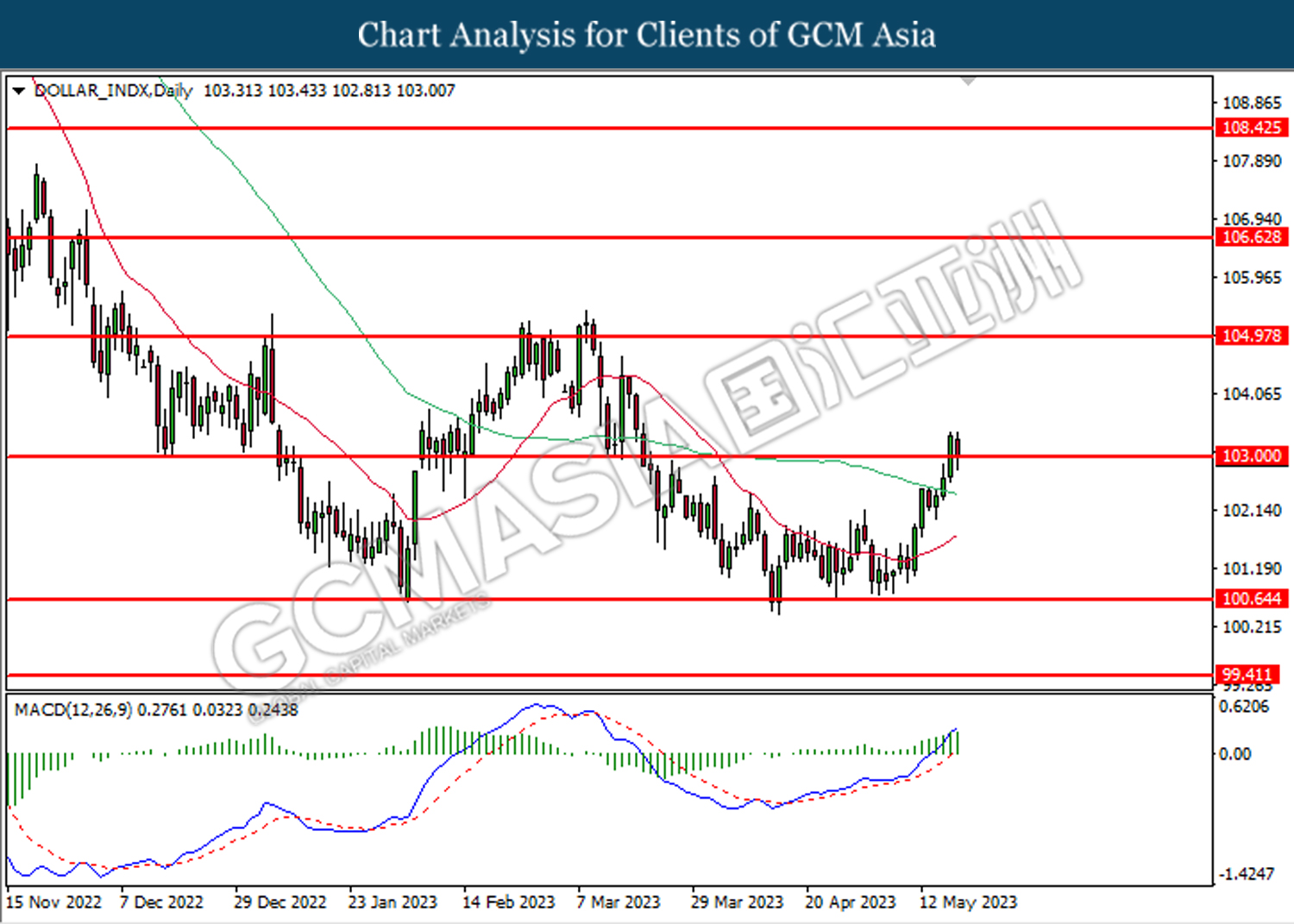

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

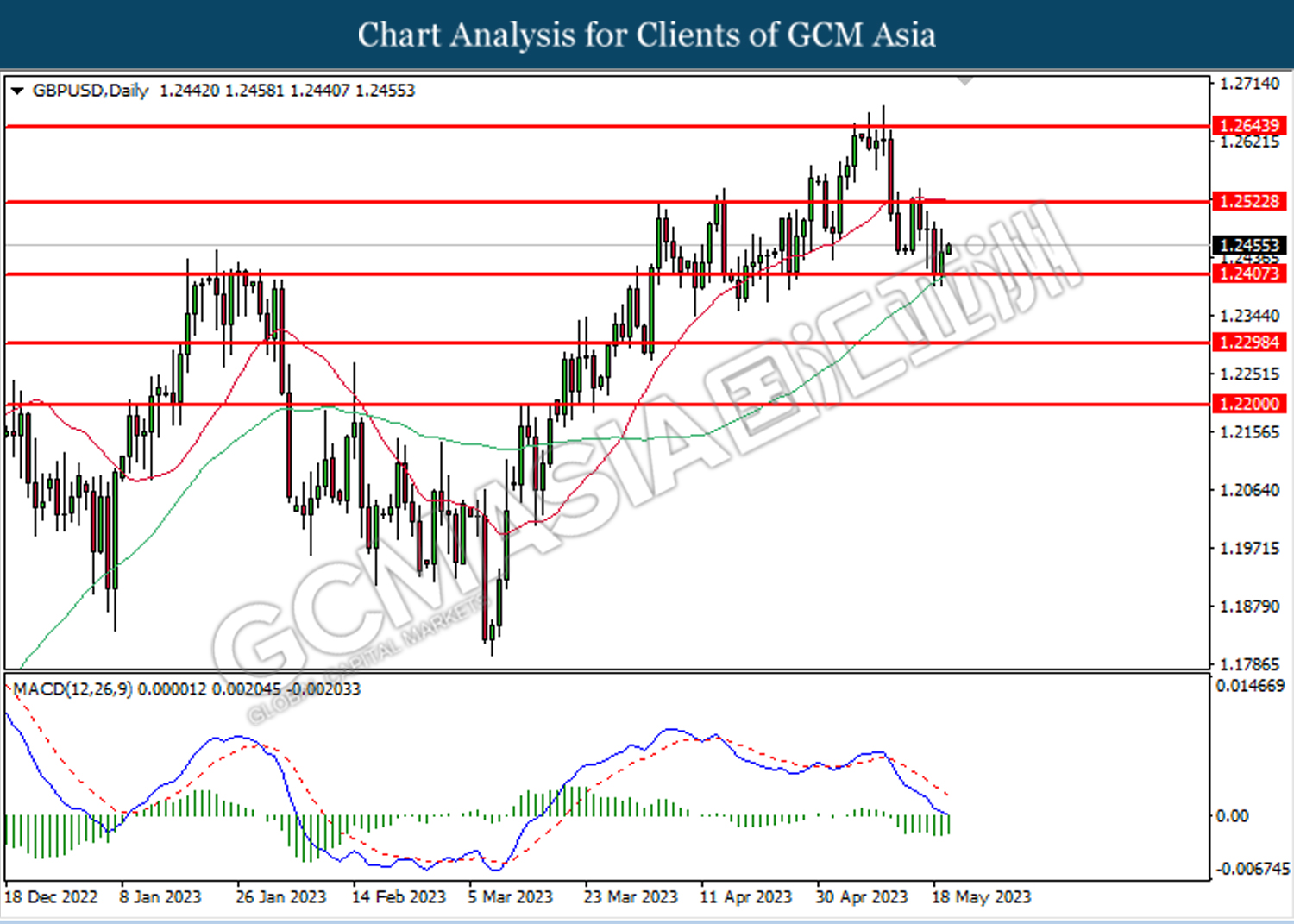

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2525.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

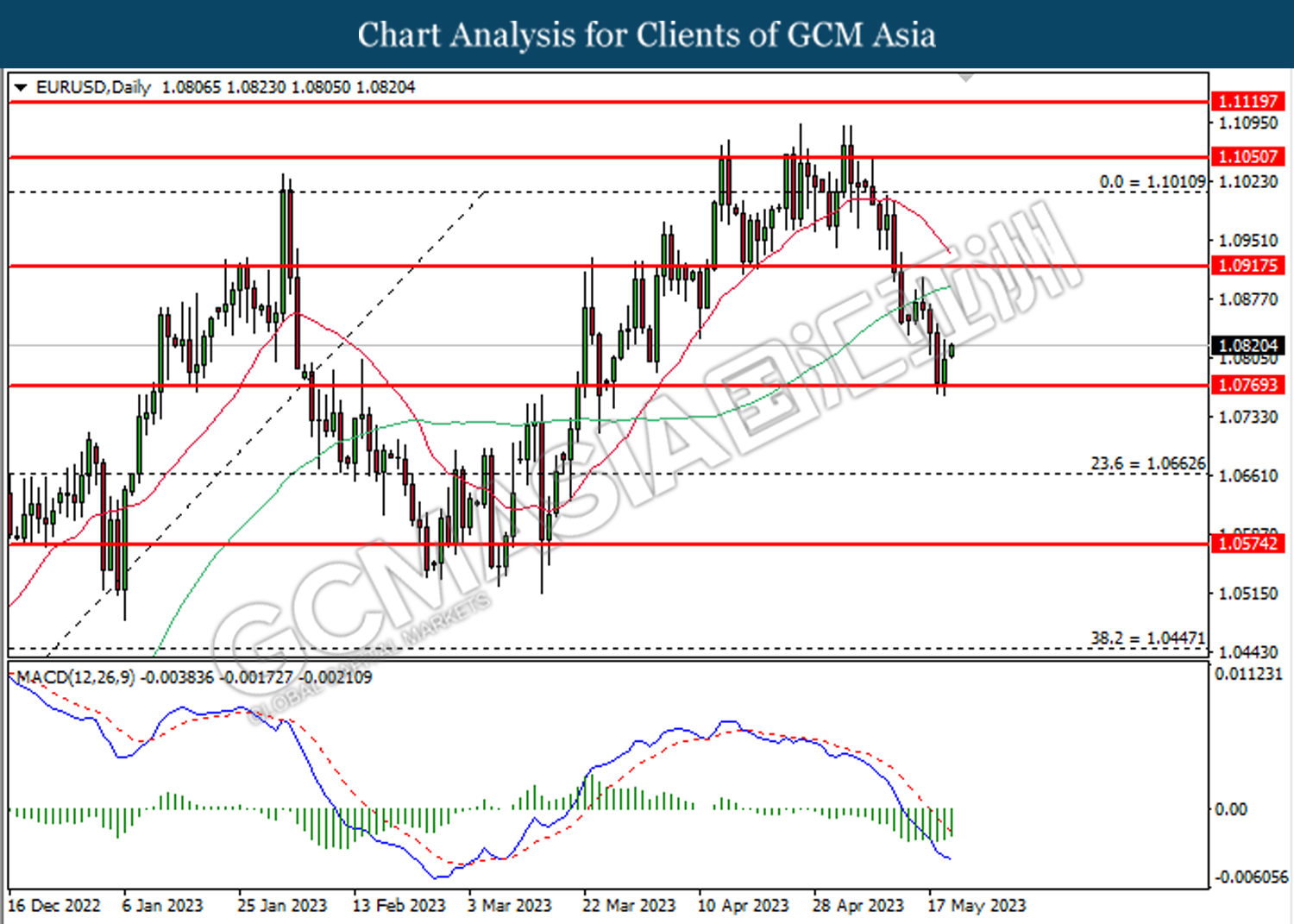

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0770. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

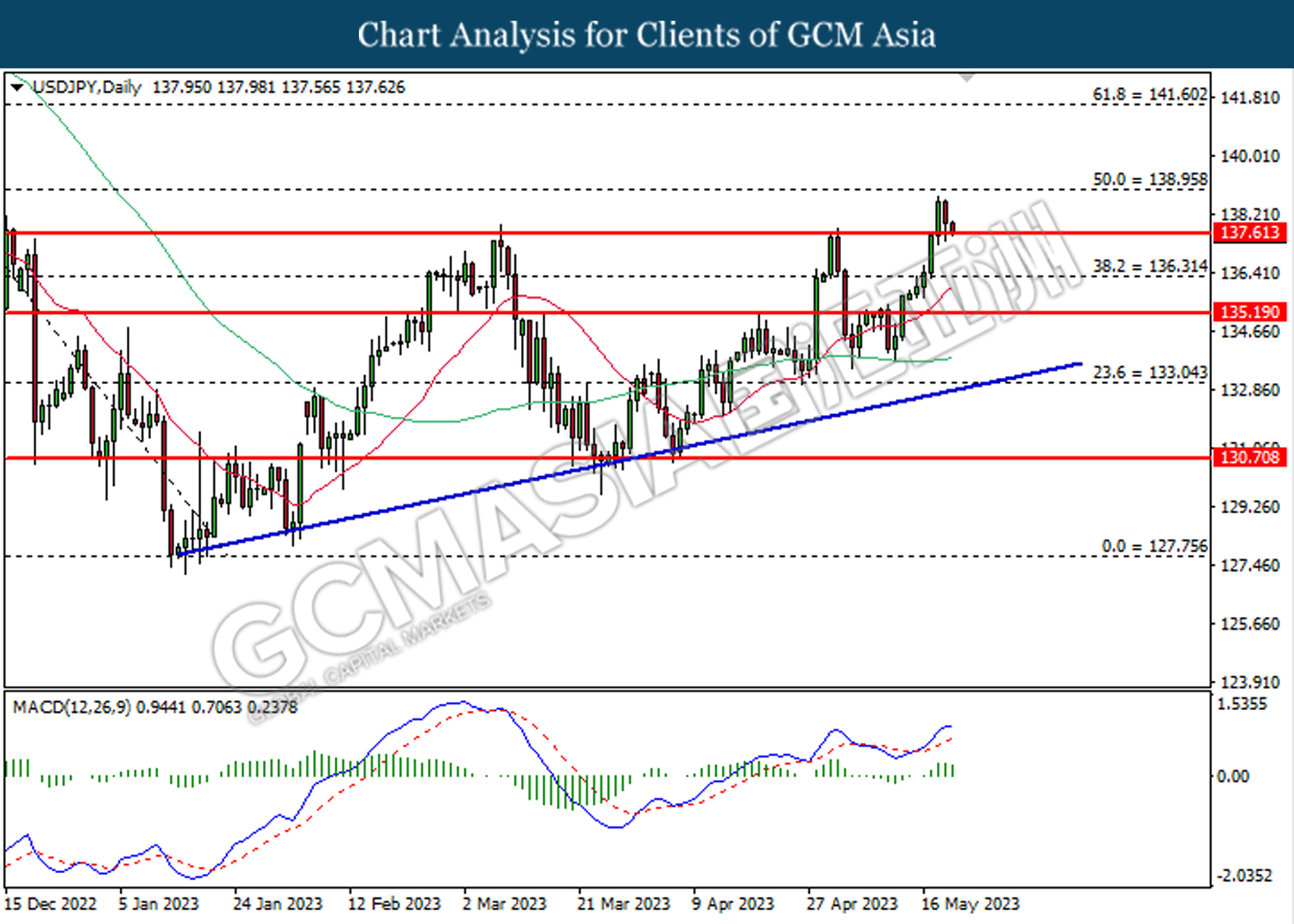

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 137.60. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 138.95, 141.60

Support level: 137.60, 136.30

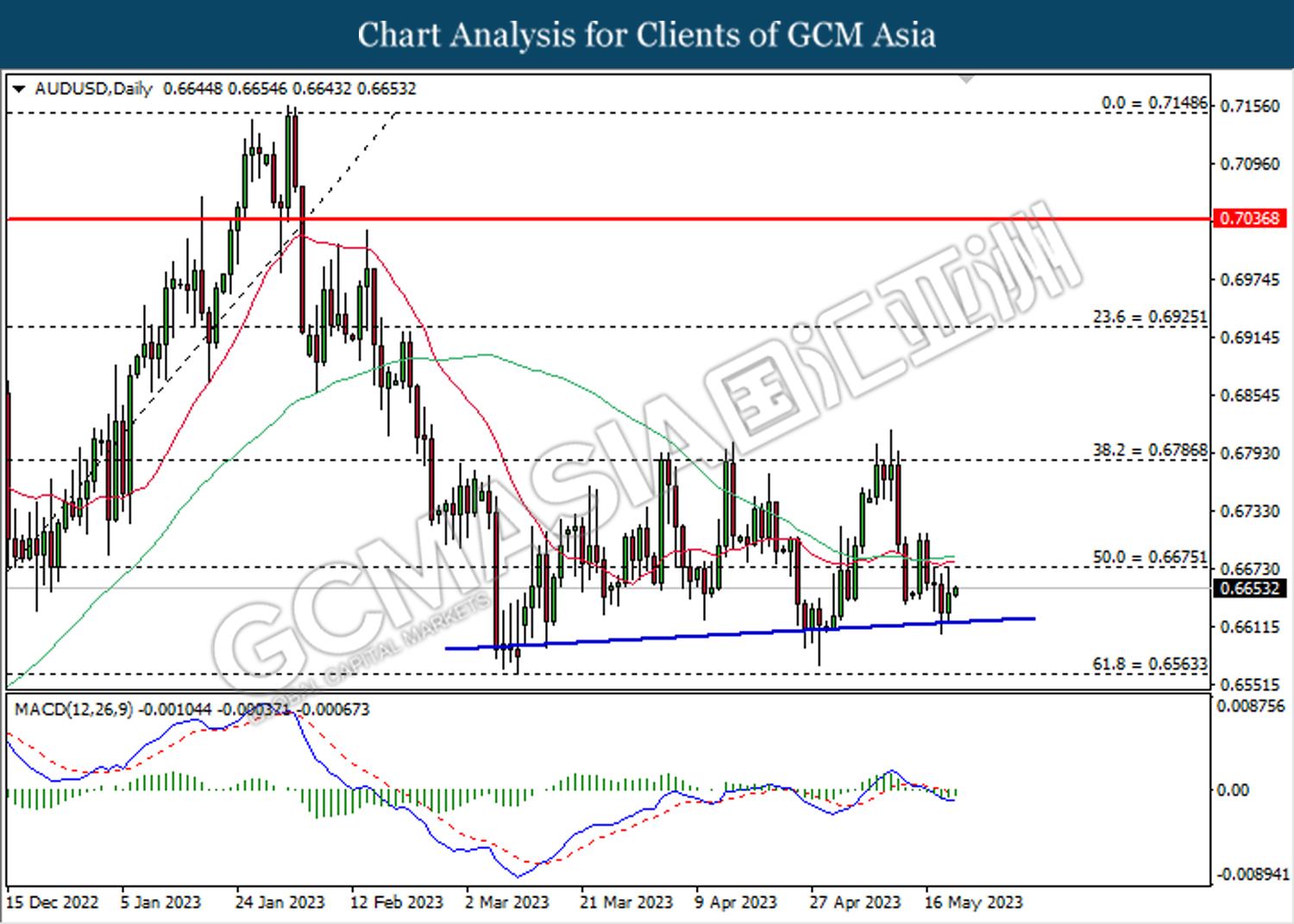

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

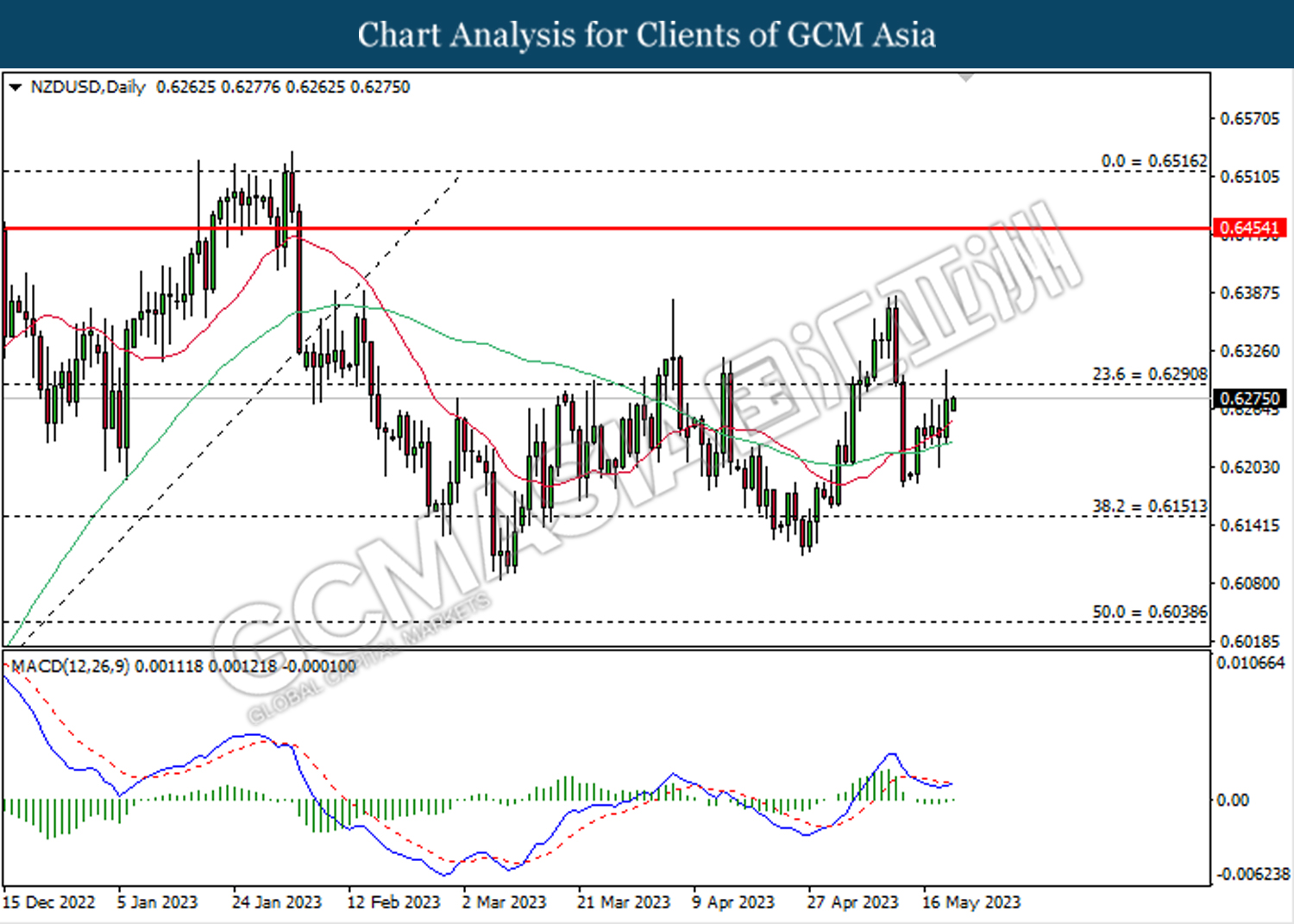

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

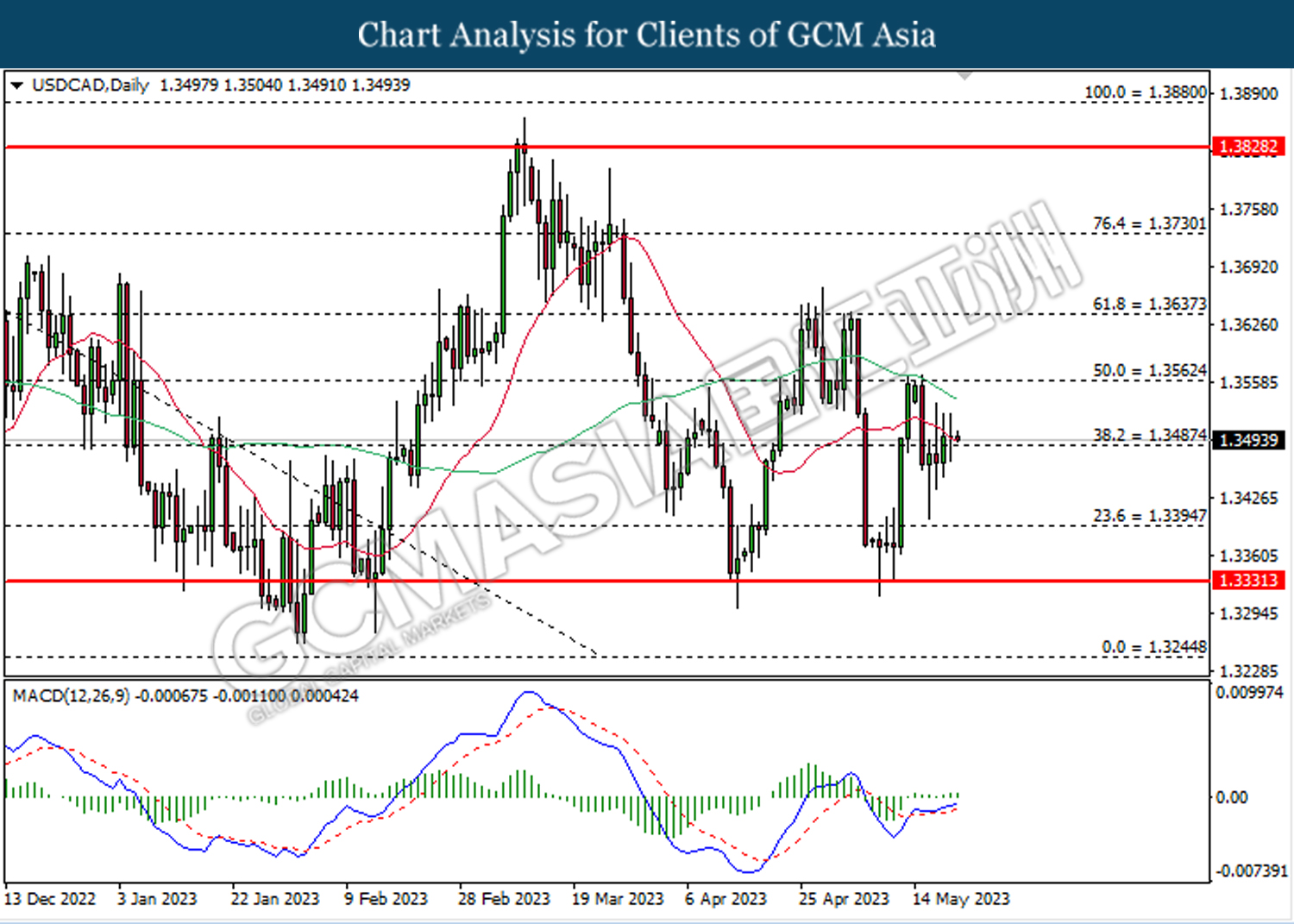

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3485. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.9000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 73.90. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

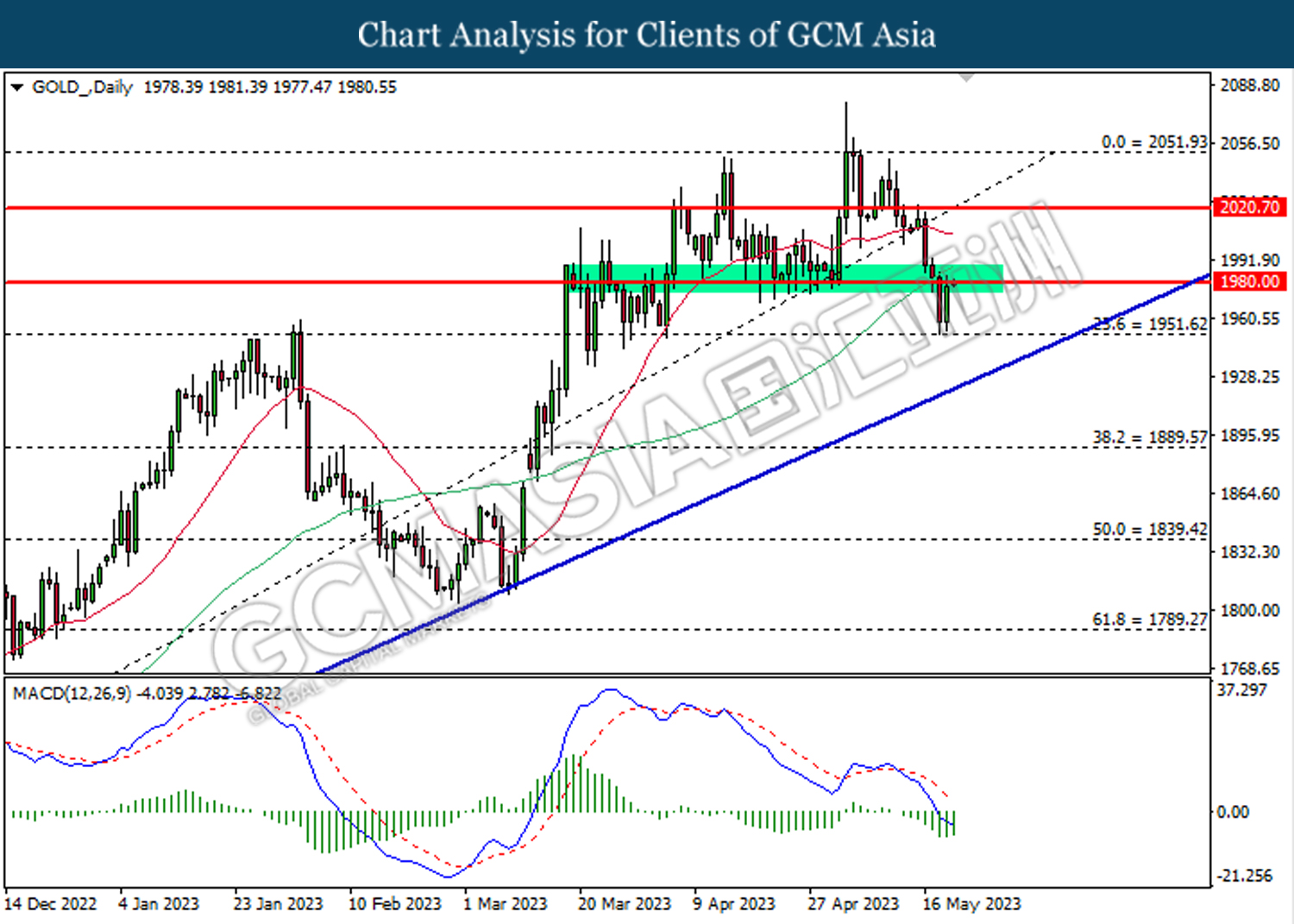

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1980.00. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55