22 June 2023 Morning Session Analysis

Greenback slumped despite Powell hawkish statement.

The dollar index, which was traded against a basket of six major currencies, reverted back to its downward trend as Powell testimony failed to satisfy the expectation of hawks. Yesterday, Federal Reserve Chair Jerome Powell testified before the House Financial Services Committee on as part of his semiannual report to both chambers of Congress. In the testimony, Jerome Powell highlighted that the inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go. With that, it signaled that more rate hikes or at least holding the rate at high level will be on the next meeting’s table. However, the hawkish comments from Powell did not hype up the market as the investors have been bracing for a continuous rate hike in the upcoming meeting. Nonetheless, the Fed are still data-dependent where their approaches could be changed if the inflation turns out to be getting closer to their long term target, said by Jerome Powell. Besides, he also reiterated that the household and businesses are also facing the headwinds which created by the stress in the financial sector. As of writing, the dollar index dropped -0.45% to 102.10.

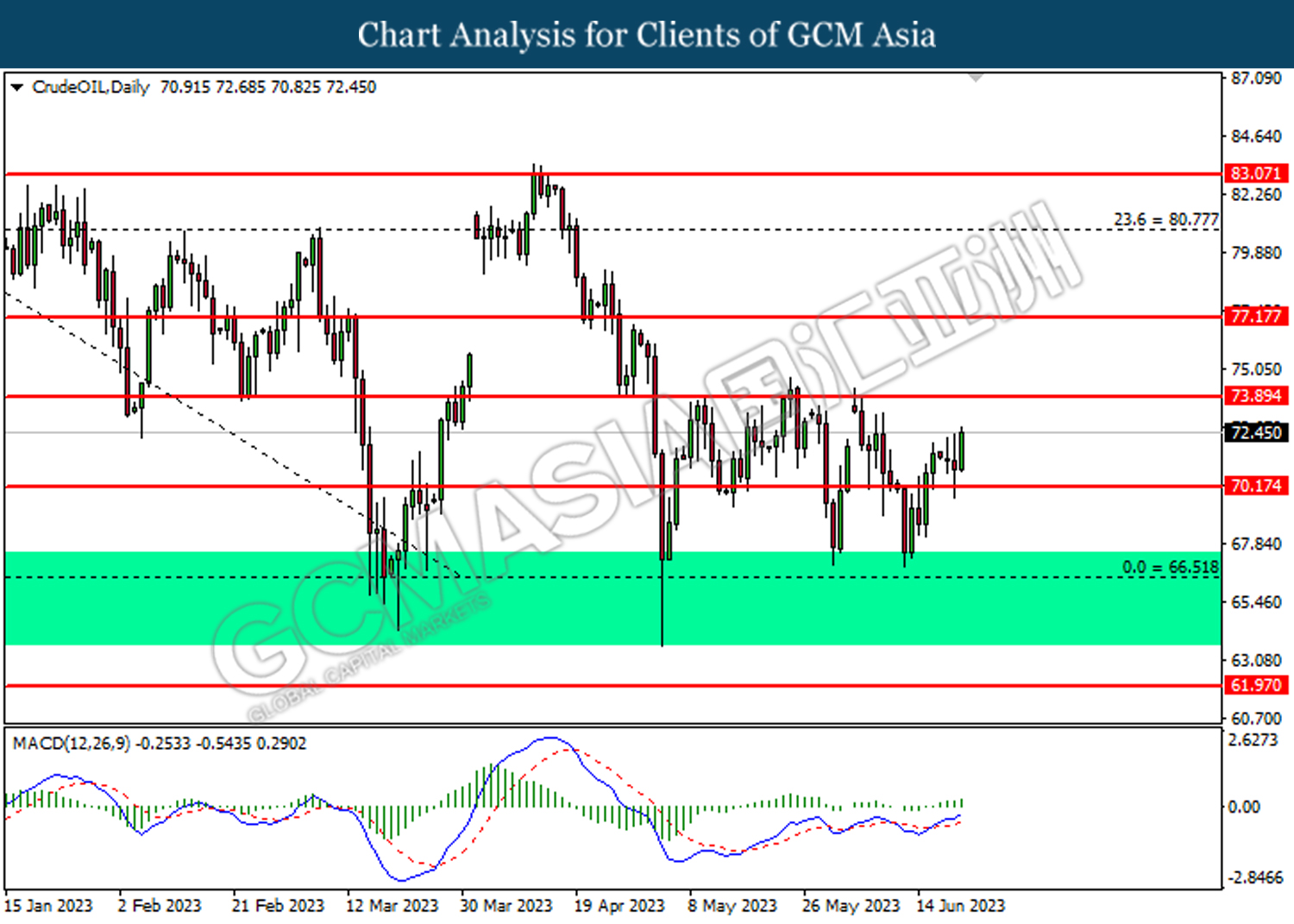

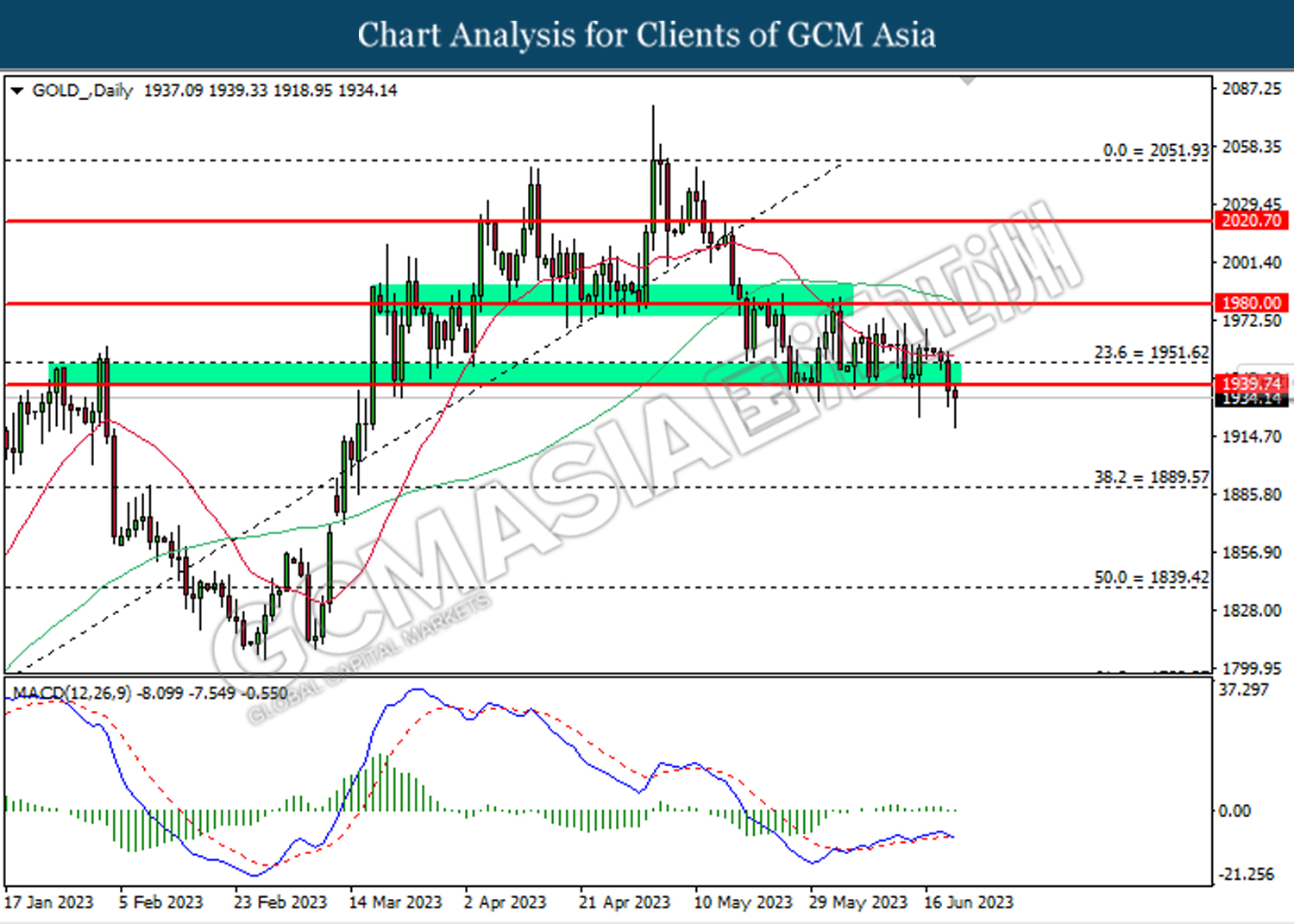

In the commodities market, crude oil prices up by 2.30% to $72.40 per barrel as the weakening of dollar index fueled stronger demand in the oil market. Besides, the gold prices edged up by 0.02% to $1933.10 per troy ounce as the less-hawkish remarks from Jerome Powell disappointed the market participants.

Today’s Holiday Market Close

Time Market Event

All Day CNY Dragon Boat Festival

Today’s Highlight Events

Time Market Event

16:00 CHF SNB Press Conference

20:00 GBP BOE Inflation Letter

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q2) | 1.50% | 1.75% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 4.50% | 4.75% | – |

| 20:30 | USD – Initial Jobless Claims | 262K | 260K | – |

| 22:00 | USD – Existing Home Sales (May) | 4.28M | 4.24M | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | 7.919M | 1.873M | – |

Technical Analysis

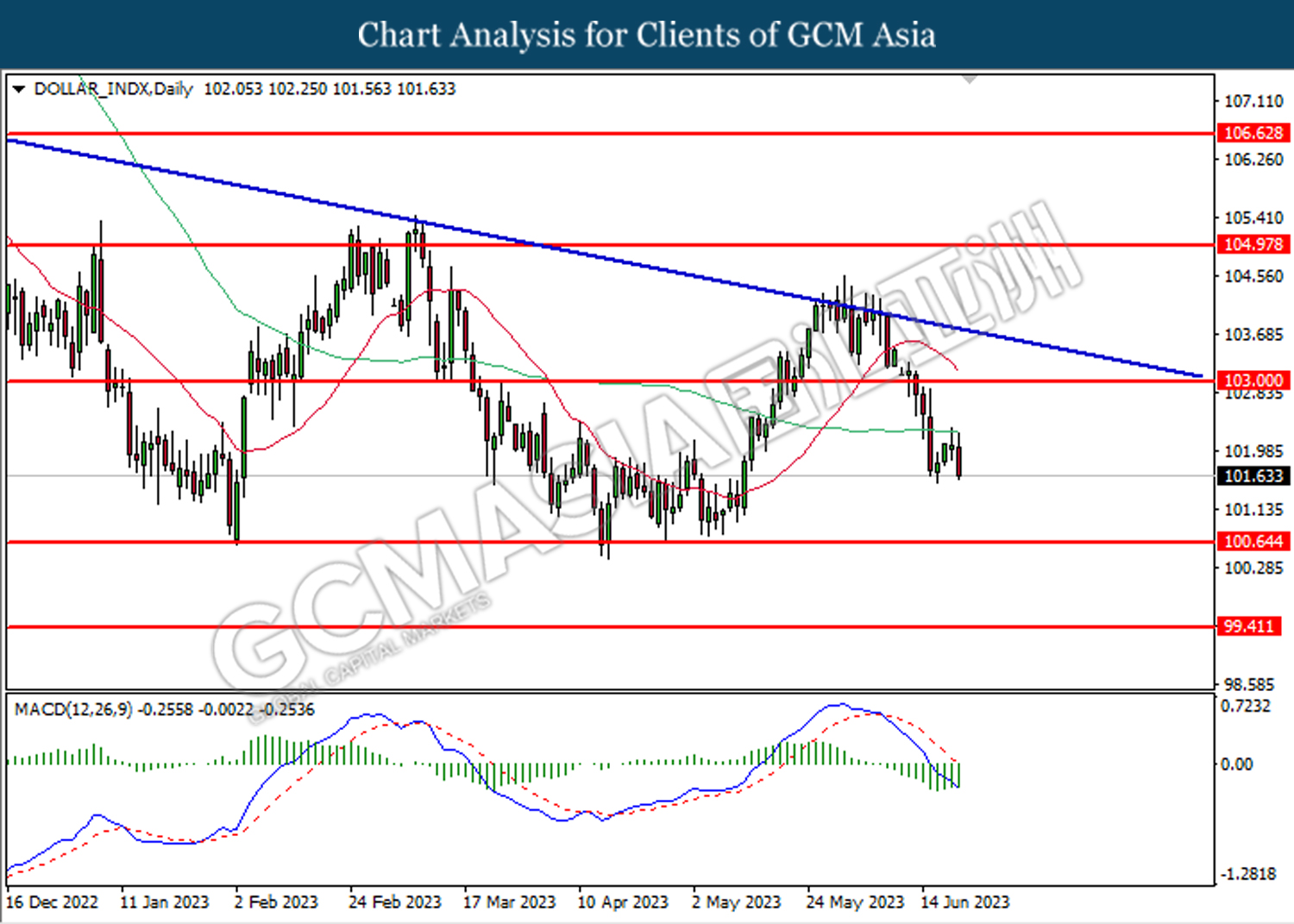

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

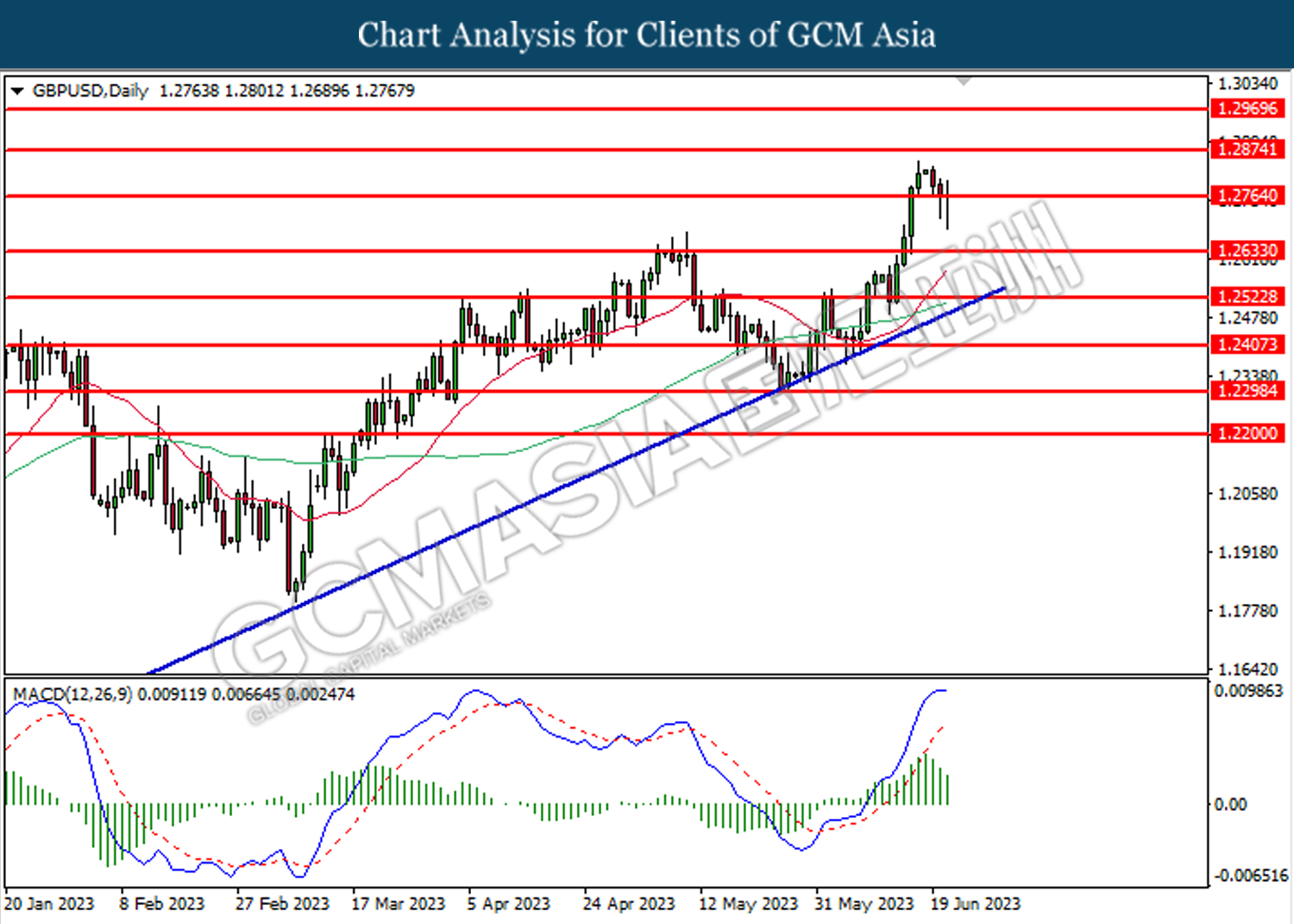

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2765. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2635, 1.2525

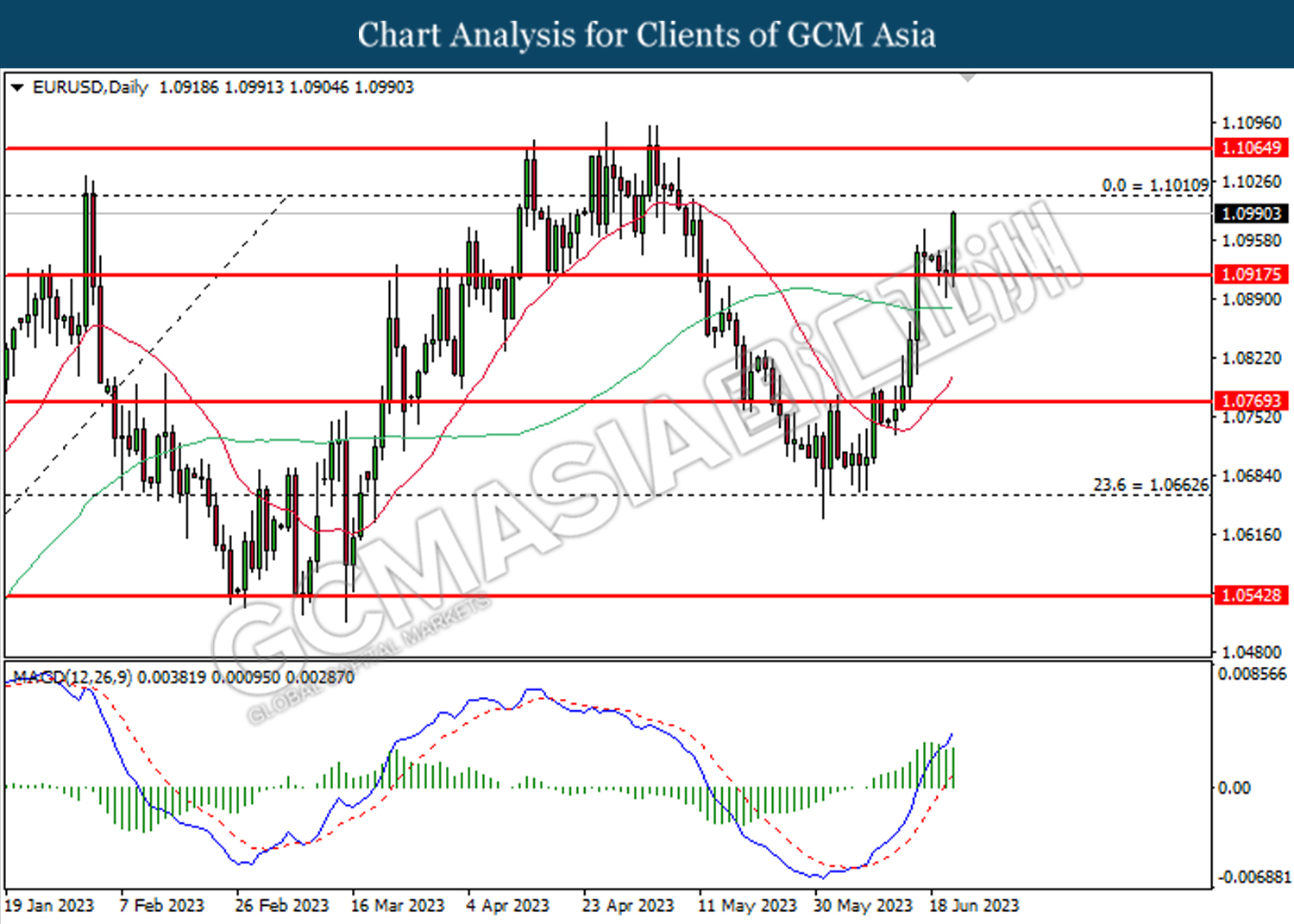

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0915. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

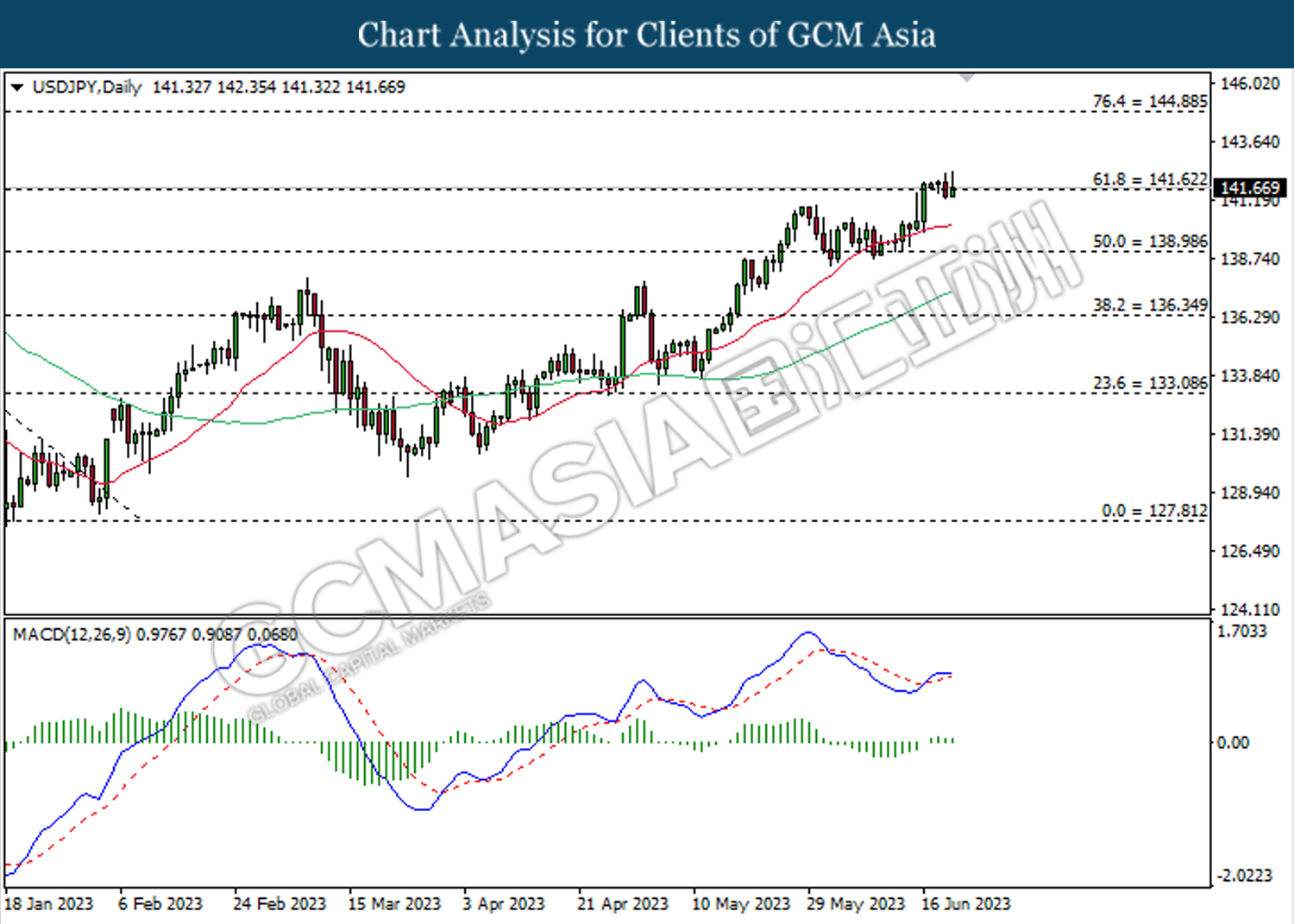

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

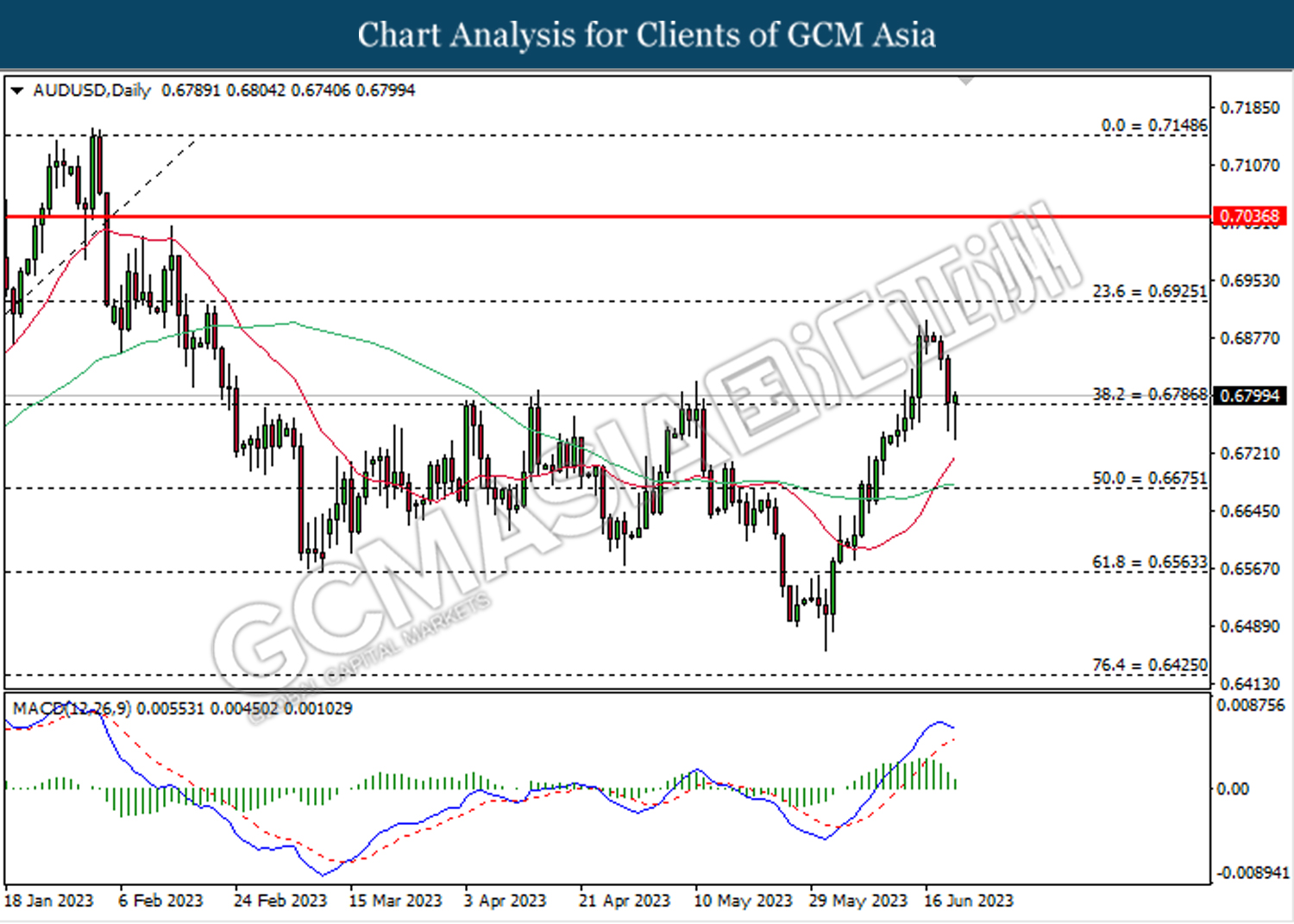

AUDUSD, Daily: AUDUSD was traded lower while currently testing support level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

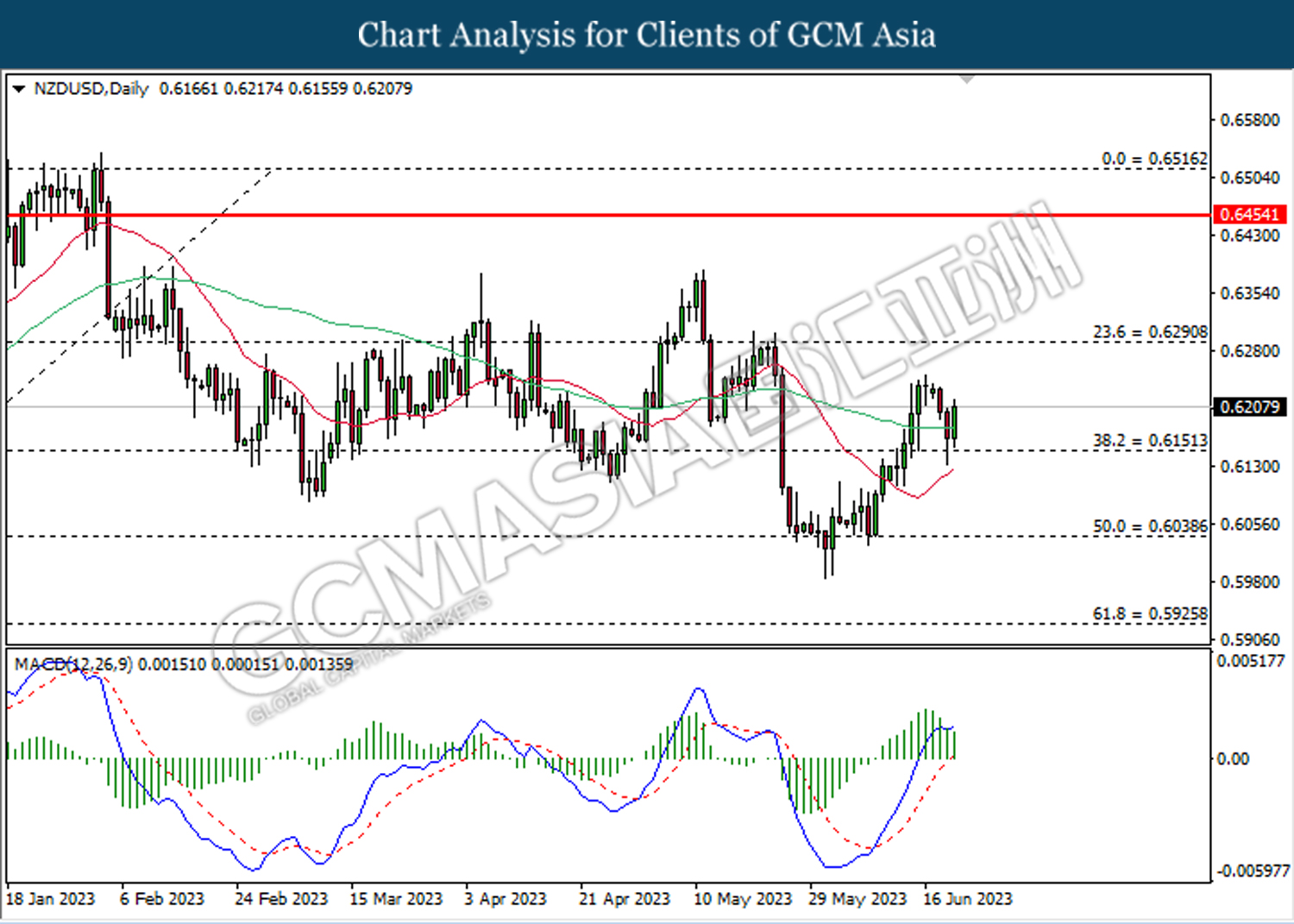

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

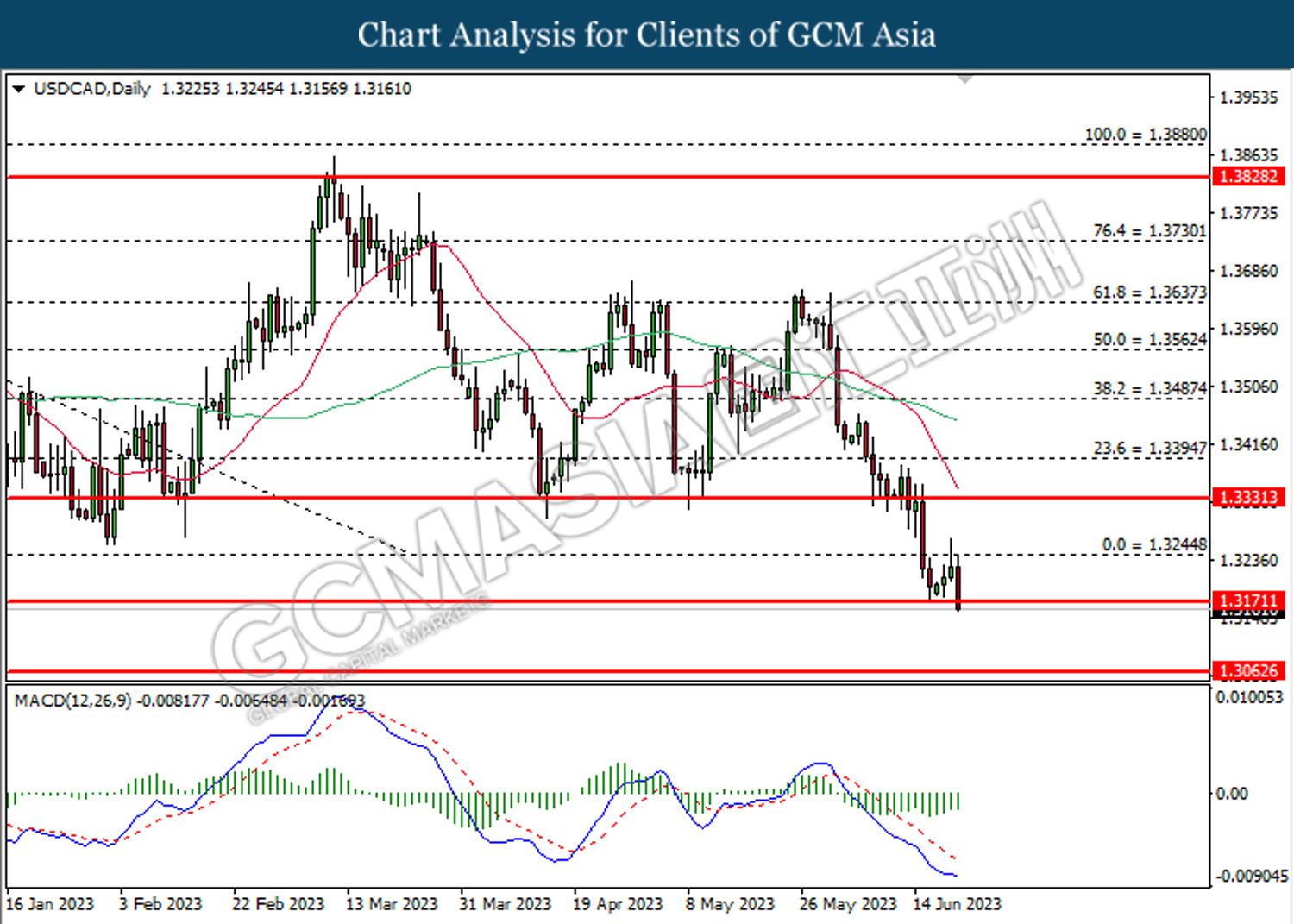

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3170. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3245, 1.3330

Support level: 1.3170, 1.3065

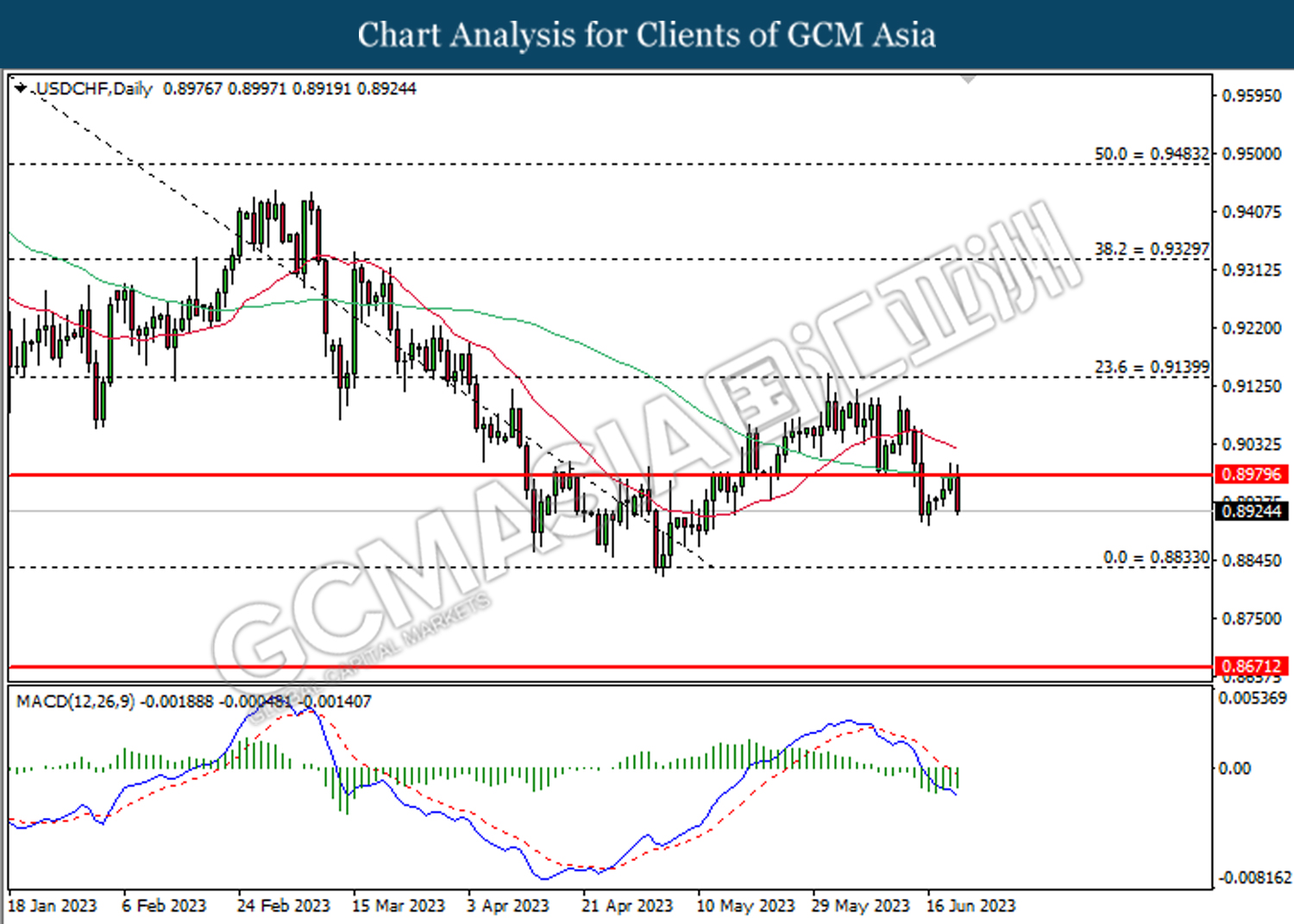

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8835.

Resistance level: 0.8980, 0.9140

Support level: 0.8835, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1939.75. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40