22 July 2022 Afternoon Session Analysis

Downbeat economic data beaten down the US Dollar.

The dollar index, which traded against a basket of six major currencies plunged following the release of a series of downbeat economic data. According to the Department of Labor, US Initial Jobless Claims came in at 251K, higher than the consensus forecast at 240K, showing the labor market in the US remain fragile. The higher-than-expected number of American filing for unemployment claims could be mainly attributed to the increasing number of employee layoff in most of the US giants. On the other hand, US Philadelphia Fed Manufacturing Index has also shown that the general business conditions in the manufacturing sector has deteriorated, where the actual reading came in at -12.3, far weaker than the consensus forecast at -2.5. A series of downbeat data prompted the investors to shift their capital from the dollar index to other appealing market. At this juncture, the market attentions have been gathered at the upcoming Fed meeting in order to gauge the further direction of the currency. As of writing, the dollar index dropped 0.07% to 106.85.

In the commodities market, the crude oil price up 0.79% to $97.55 a barrel as the depreciation of US dollar limited the losses of the crude oil, while the oil production capacity of OPEC+ has hit the maximum level. Besides, the gold prices eased by 0.16% to $1715.60 per troy ounce, while the dollar index edged up following a correction yesterday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jun) | -0.5% | -0.4% | – |

| 15:30 | EUR – German Manufacturing PMI (Jul | 52.0 | 51.0 | – |

| 16:30 | GBP – Composite PMI | 53.7 | – | – |

| 16:30 | GBP – Manufacturing PMI | 52.8 | – | – |

| 16:30 | GBP – Services PMI | 54.3 | – | – |

| 20:30 | CAD – Core Retail Sales (MoM) (May) | 1.3% | 0.6% | – |

Technical Analysis

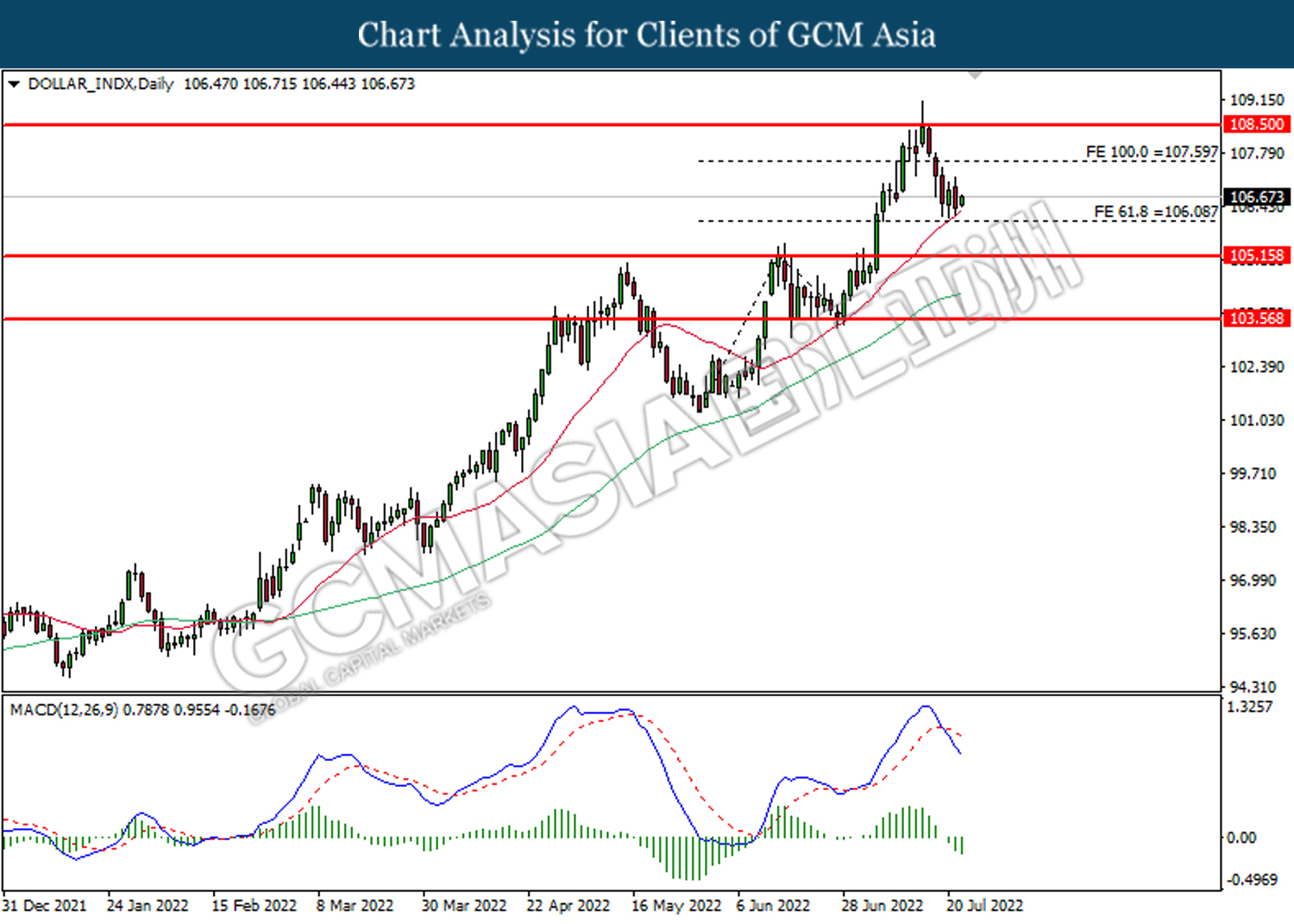

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 106.10. MACD which illustrated increasing bearish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 107.60, 108.50

Support level: 106.10, 105.15

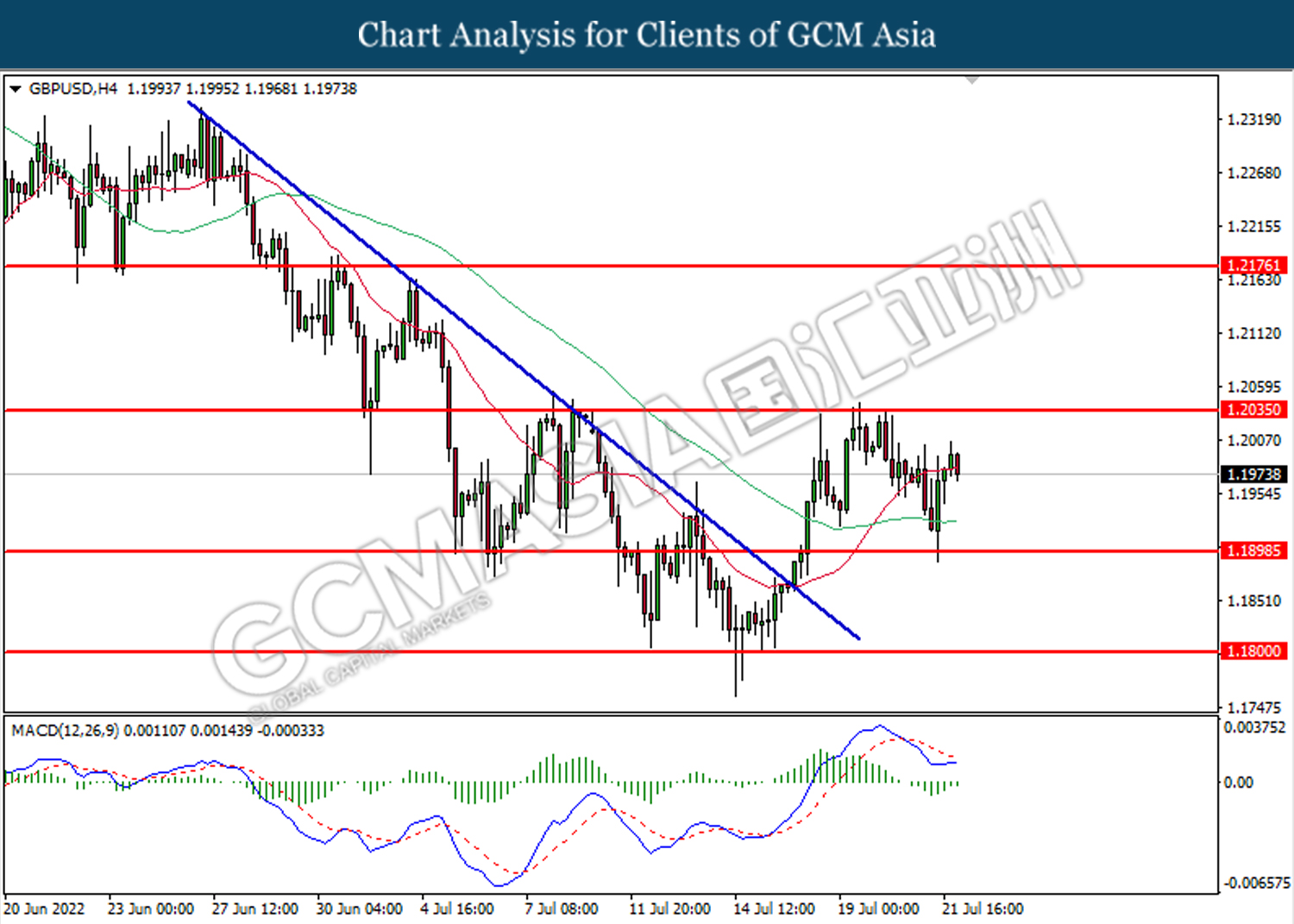

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.1900. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2035.

Resistance level: 1.2035, 1.2175

Support level: 1.1895, 1.1800

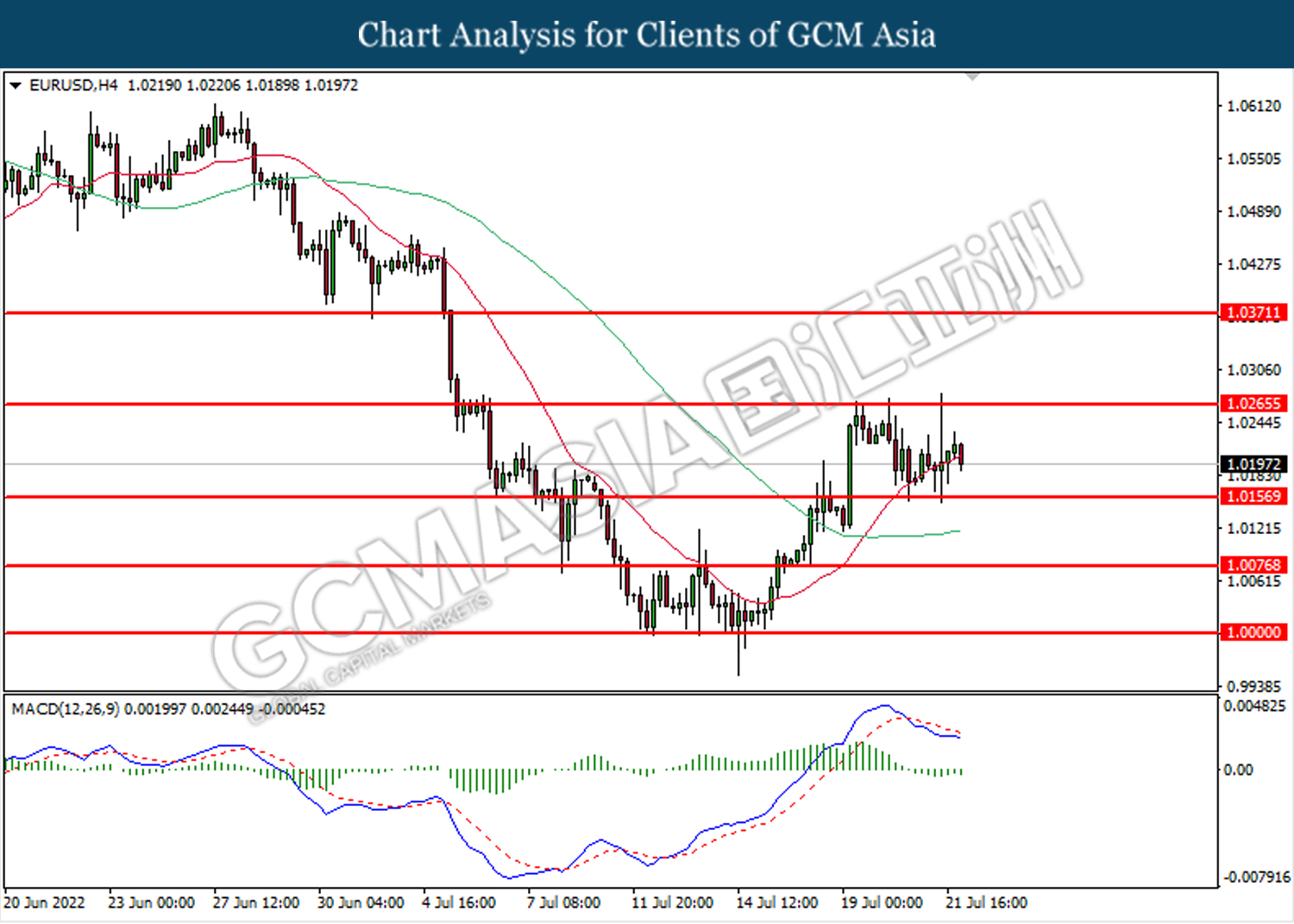

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.0155. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0170

Support level: 1.0155, 1.0075

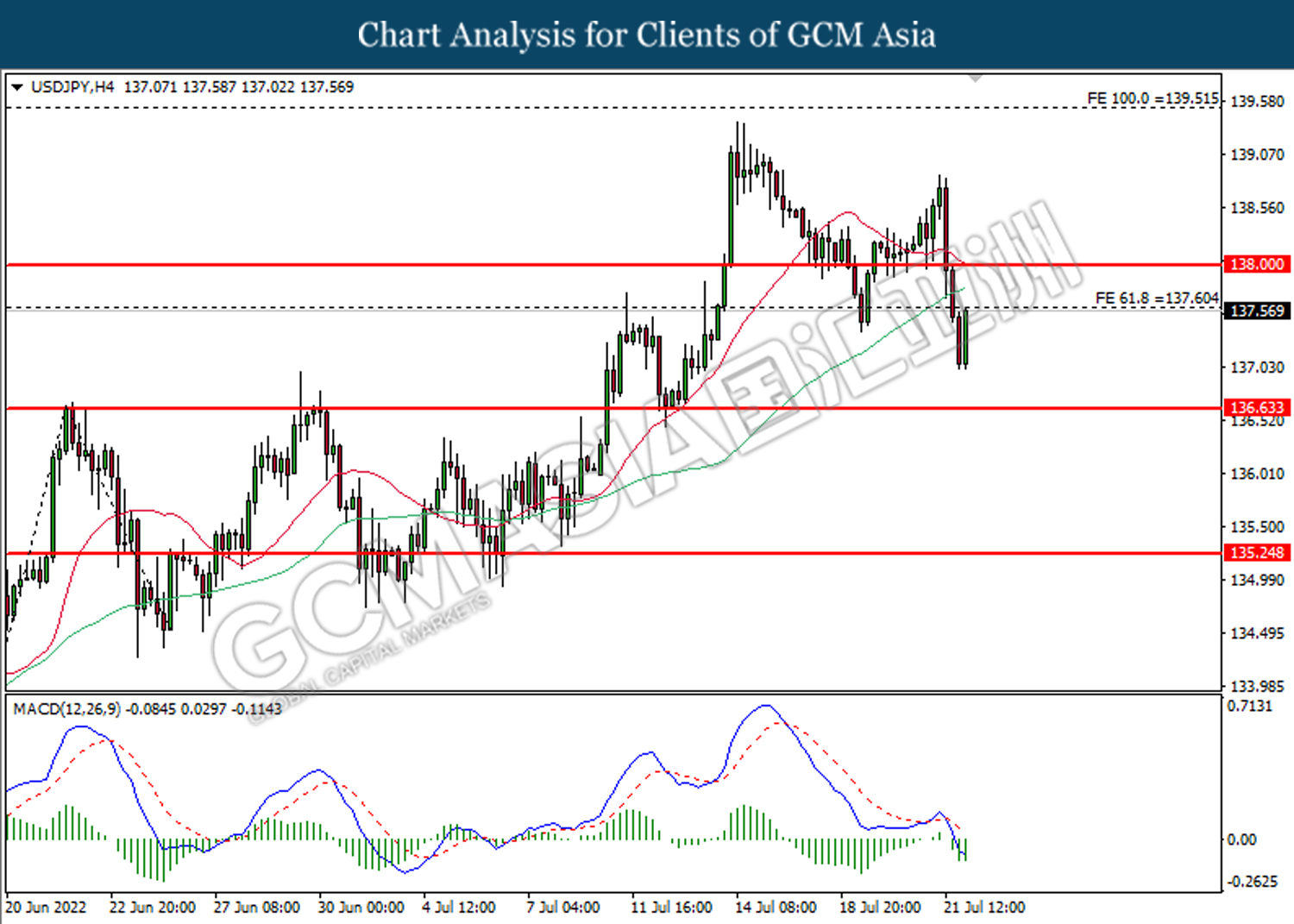

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 137.60. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 137.60, 138.00

Support level: 136.65, 135.25

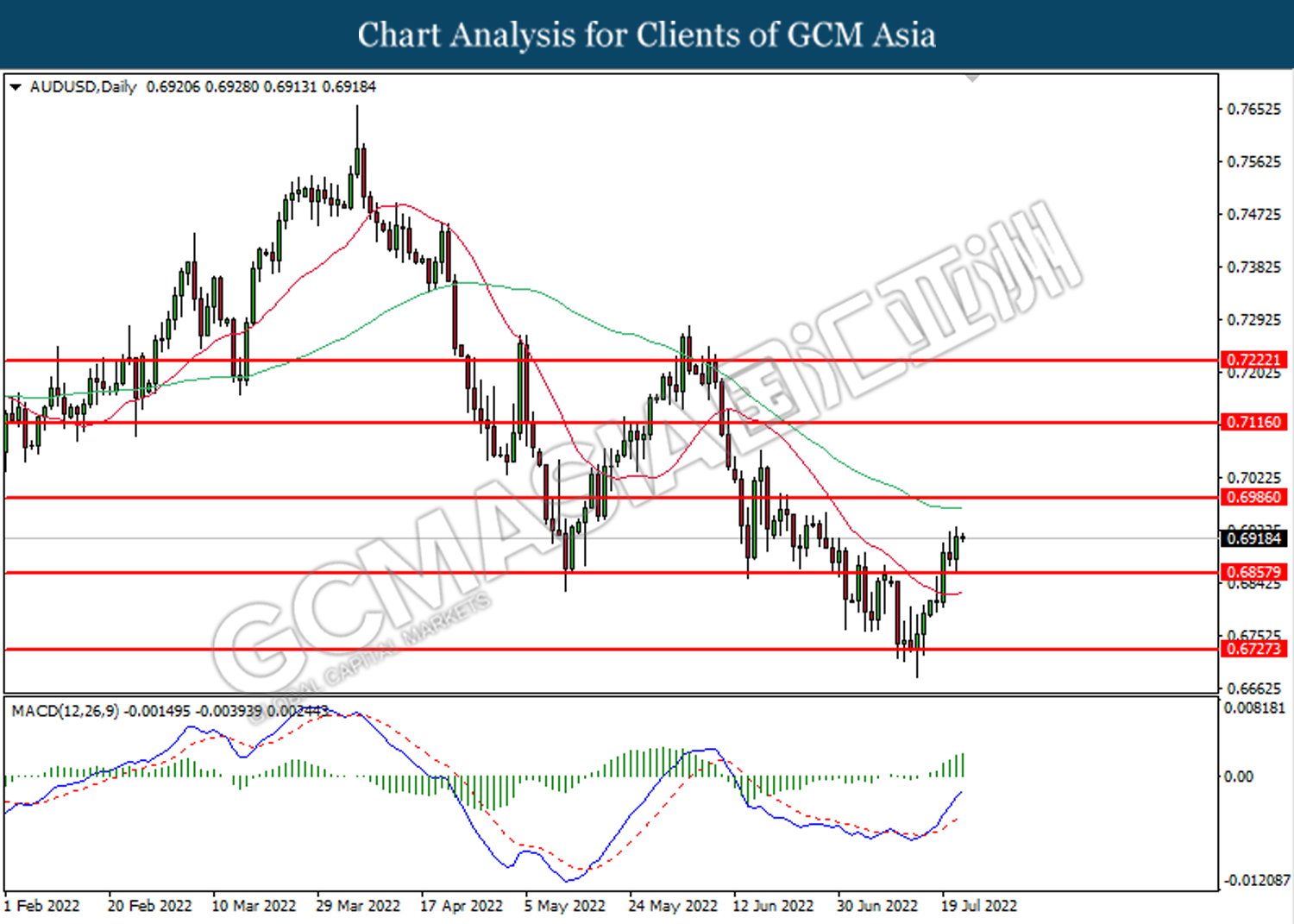

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6860. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

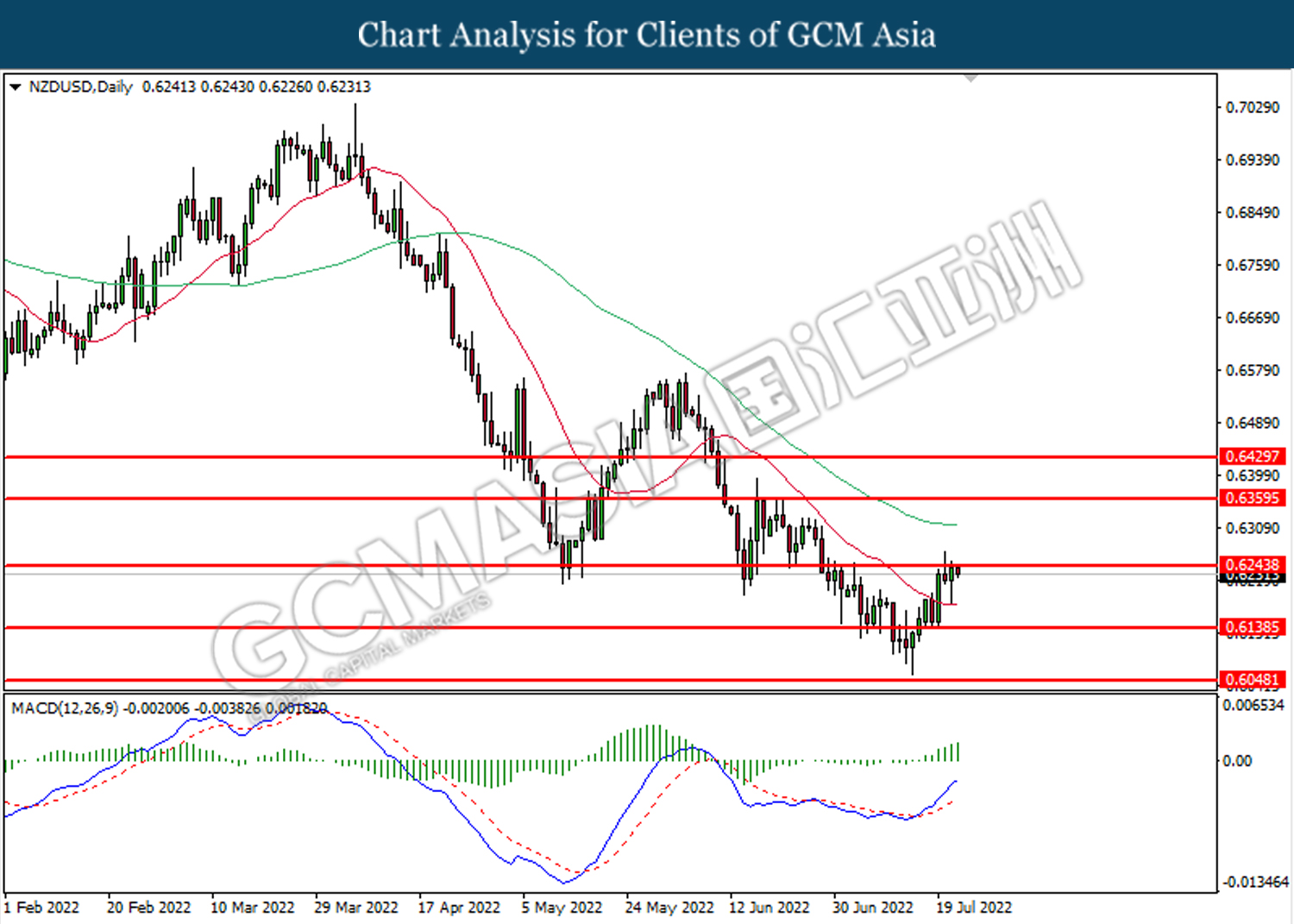

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

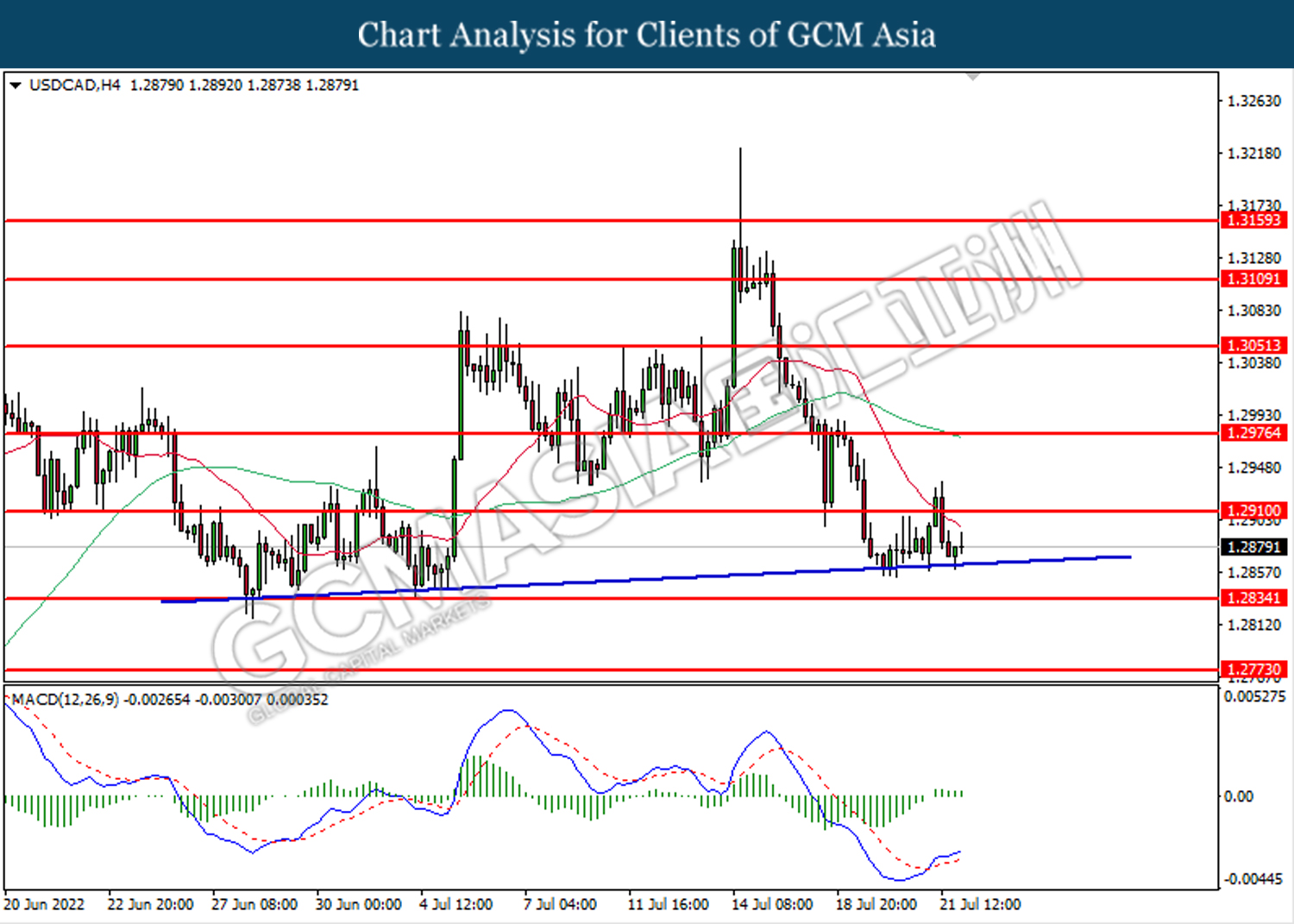

USDCAD, H4: USDCAD was traded higher following prior rebound from the upward trendline. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2910.

Resistance level: 1.2910, 1.2975

Support level: 1.2835, 1.2775

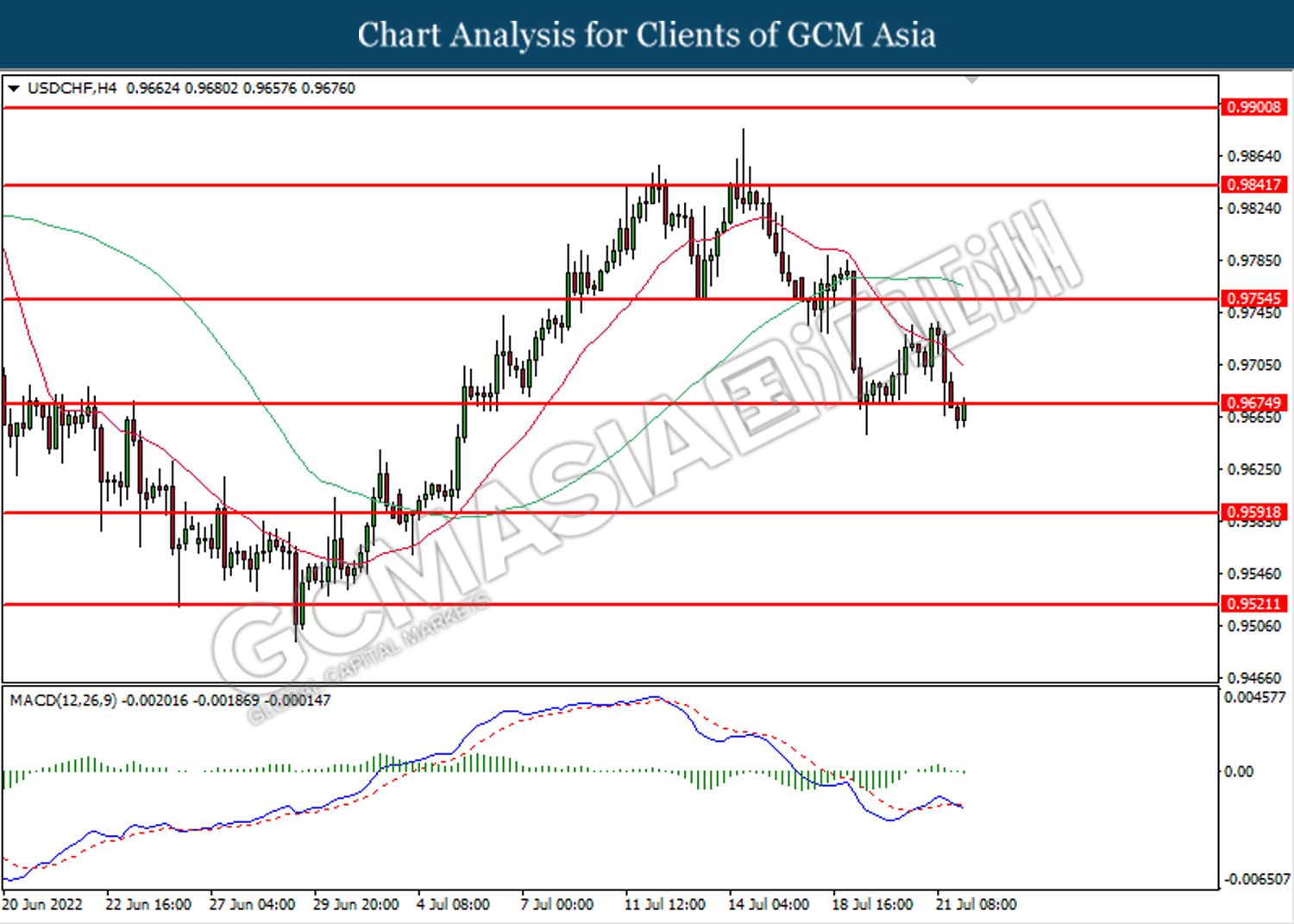

USDCHF, H4: USDCHF was traded higher while currently retesting the resistance level at 0.9675. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

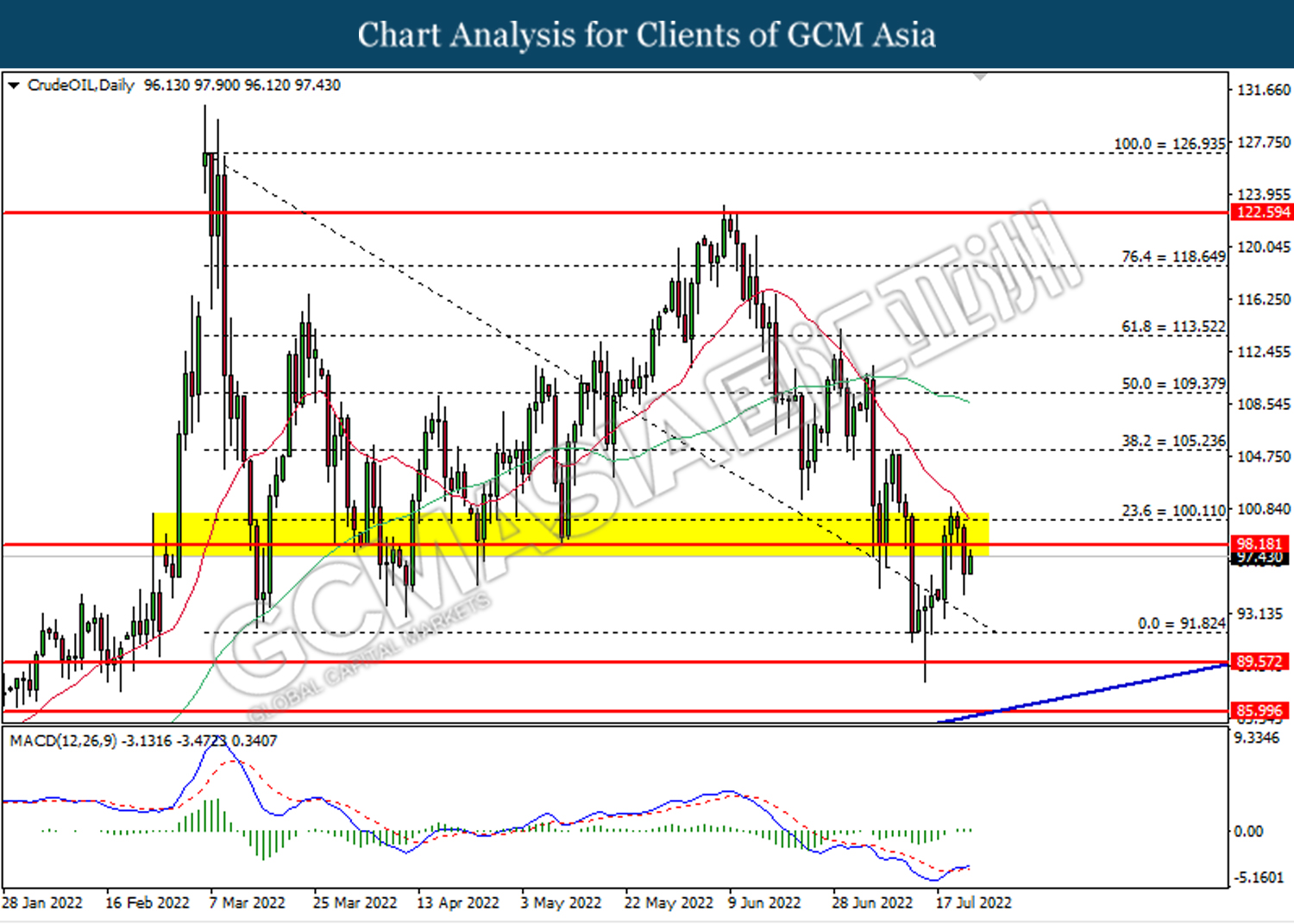

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the prior support level at 98.20. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1783.20

Support level: 1707.90, 1678.80