22 August 2019 Afternoon Session Analysis

Dollar steady after minute meeting release.

Greenback which measures its value against a basket of six major currency pairs was steady above 98.00 level following the release of FOMC Meeting Minutes. The Minutes showed that majority policymakers viewed the recent rate cut as just a mid-cycle adjustment towards risks of an economic slowdown and trade war concerns but not the beginning of a series of rate cuts. However, due to growing concerns of global economic recession, members of FOMC were able to agree that forward guidance and QE might not be enough to sustain the recession, and hinted that the Fed is still open to further rate cuts if necessary. On the other hand, US President Donald Trump had continuously bashed Fed’s Chairman Jerome Powell, stating that talks with China are going well but the only problem faced by the US now is Fed policy action and its Chairman for not cutting rates aggressively. Market participants will now focus on the Jackson Hole Symposium this Friday where Jerome Powell is expected to provide clearer signal on their policy guidance while investors currently park their investment into safe-haven Yen. As of writing, dollar index ticked lower by 0.04% to 98.10 while pair of USD/JPY fell 0.16% to 106.43.

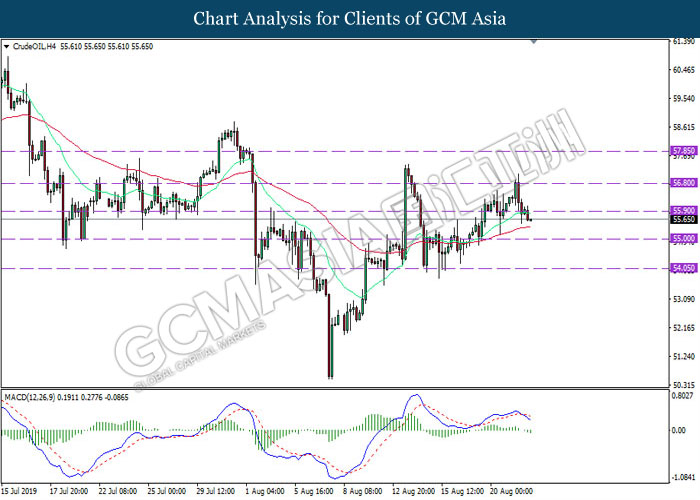

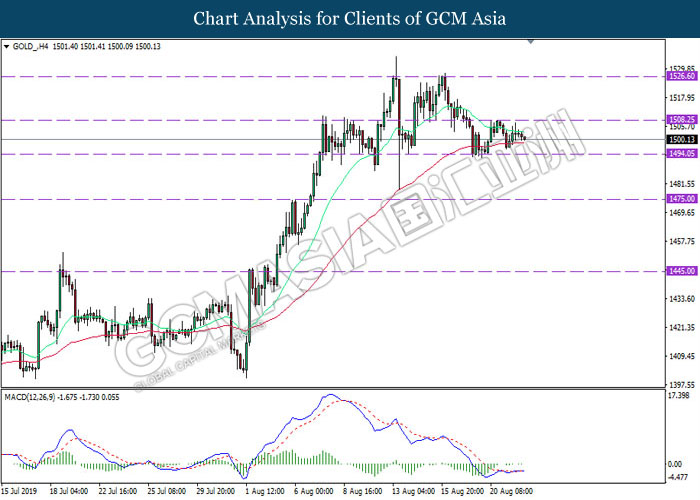

In the commodities market, crude oil price fell by 0.29% to $55.70 per barrel. Oil prices was earlier supported by bullish inventory data reported by the EIA. However, gains on the commodity were limited as economic slowdown continues to weigh on global demand. Investors will focus on further sentiment such as trade developments to further gauge oil price movement. Otherwise, gold price was traded lower by 0.04% to $1,501.70 a troy ounce while market participants waits for further signals from this Friday annual central banks meeting.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Aug) | 43.2 | 43.0 | – |

| 20:30 | USD – Initial Jobless Claims | 220K | 216K | – |

| 21:45 | USD – Services PMI (Aug) | 53.0 | 52.9 | – |

Technical Analysis

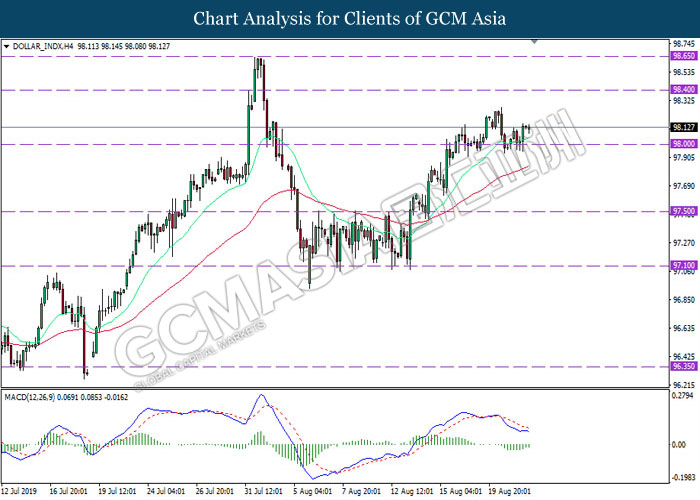

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level 98.00. MACD which illustrate diminishing bearish momentum suggest index to extend its rebound towards the resistance level 98.40.

Resistance level: 98.40, 98.65

Support level: 98.00, 97.50

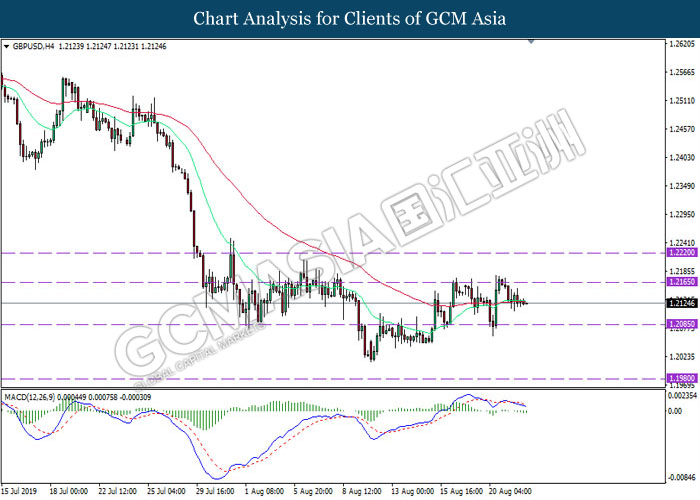

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level 1.2165. MACD which display bearish momentum with the formation of death cross suggest the pair to extend its losses towards the support level 1.2085.

Resistance level: 1.2165, 1.2220

Support level: 1.2085, 1.1980

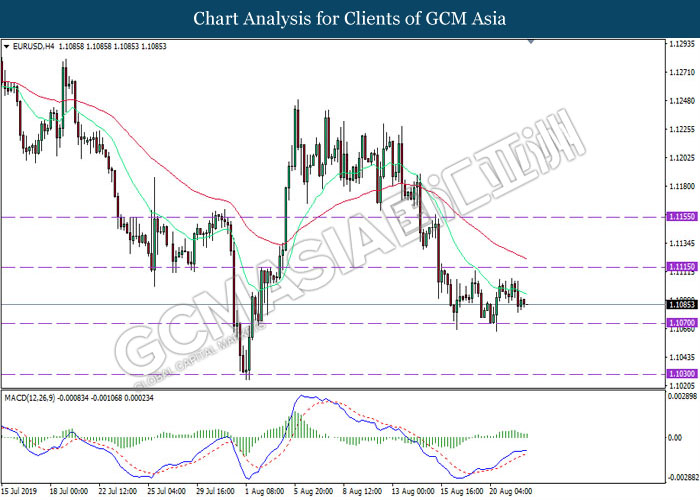

EURUSD, H4: EURUSD was traded lower following prior retracement from its top-level. MACD which display diminishing bullish momentum suggest the pair to extend its retracement towards the support level 1.1070.

Resistance level: 1.1115, 1.1155

Support level: 1.1070, 1.1030

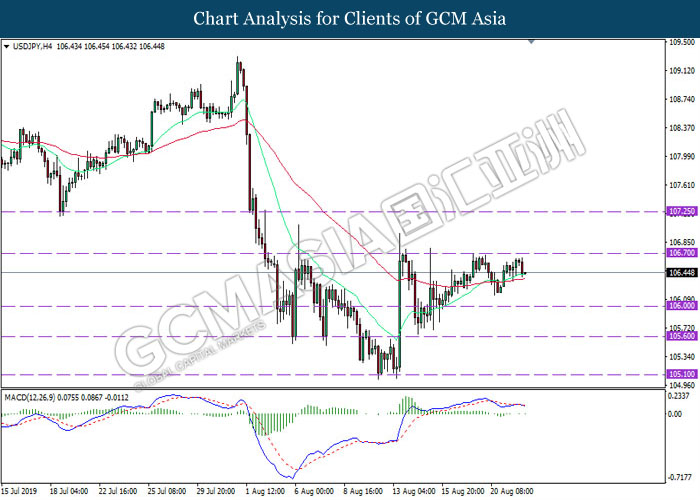

USDJPY, H4: USDJPY was traded lower while currently testing near the 60-MA line (red). MACD which illustrate bearish bias signal suggest the pair to extend its losses after successfully breaking below the 60-MA line.

Resistance level: 106.70, 107.25

Support level: 106.00, 105.60

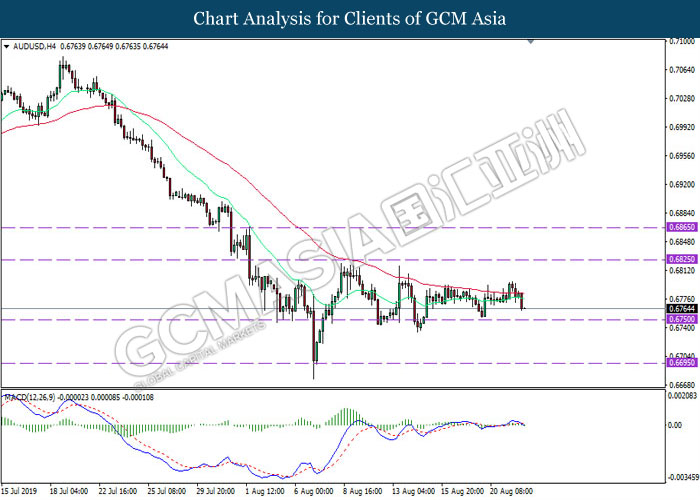

AUDUSD, H4: AUDUSD was traded lower while currently testing near the support level 0.6750. MACD which display bearish momentum with the formation of death cross suggest the pair to extend its losses after successfully breaking below the support level.

Resistance level: 0.6825, 0.6865

Support level: 0.6750, 0.6695

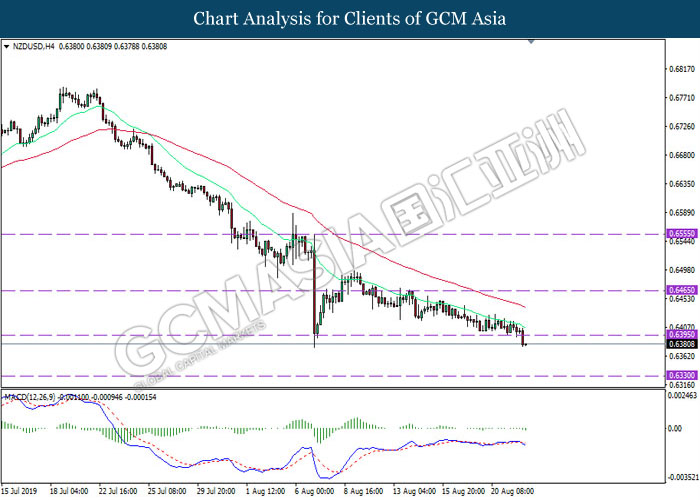

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level 0.6395. MACD which display bearish bias signal suggest the pair to extend its losses towards the support level 0.6330.

Resistance level: 0.6395, 0.6465

Support level: 0.6330, 0.6270

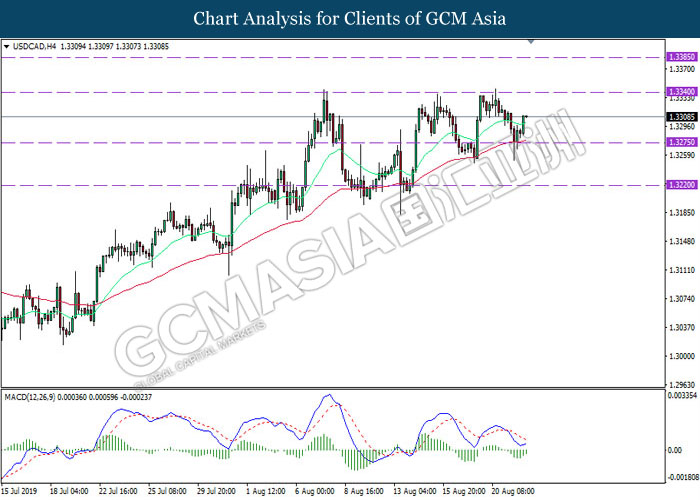

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level 1.3275. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.3340.

Resistance level: 1.3340, 1.3385

Support level: 1.3275, 1.3220

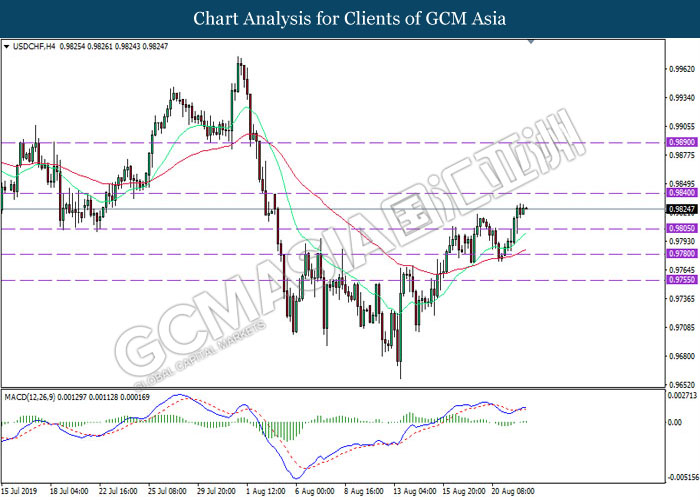

USDCHF, H4: USDCHF was traded higher while currently testing near the resistance level 0.9840. MACD which display bullish momentum suggest the pair to extend its gains after successfully breaking above the resistance level.

Resistance level: 0.9840, 0.9890

Support level: 0.9805, 0.9780

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below previous support level 55.90. MACD which display bearish momentum with the formation of death cross suggest the commodity to extend its losses towards the support level 55.00.

Resistance level: 55.90, 56.80

Support level: 55.00, 54.05

GOLD_, H4: Gold price remains traded flat above the support level 1494.05. Due to lack of signal and momentum from the MACD, a breakout below or rebound from the support level is required to obtain further confirmation before entering the market.

Resistance level: 1508.25, 1526.60

Support level: 1494.05, 1475.00