22 August 2022 Morning Session Analysis

Dollar surged amid positive Fed rate hike forecast.

The dollar index, which gauges its value against a basket of six major currencies, extended its gains over the last Friday trading session as investors reckon that the Federal Reserve will keep raising the interest rates to cool down the overheating economy going forward. Following the release of the Fed’s meeting minutes, the likelihood of an upcoming Fed 75 basis point rate hike has increased from 31% to 47% as the Fed officials are seemingly more aggressive than the investor’s expectation. On the other side, Fed’s Barkin said that the Fed will do what it takes to return inflation to the long-term target of 2%. Besides, he also emphasized that the decline in the recent inflation figure was mainly due to volatile items, signalling that the overall inflationary pressures did not ease in a ‘healthy’ way in fact. At this point in time, the Fed is seen as having ample room for further rate hikes than other central banks which are more fragile. Nonetheless, the tightening path of the Federal Reserve would still be depended on the future economic condition in the US, where more rate hikes could be seen if the nation’s economy continues to suffer sky-high inflationary pressures. As of writing, the dollar index dropped -0.06% to 108.10.

In the commodities market, the crude oil price is down -0.39% to $89.35 a barrel after rising more than $3 per barrel as lacking positive news on the Iran-US nuclear deal issue. Besides, the gold prices depreciated by -0.02% to $1747.00 a troy ounce amid the dollar’s strengthening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

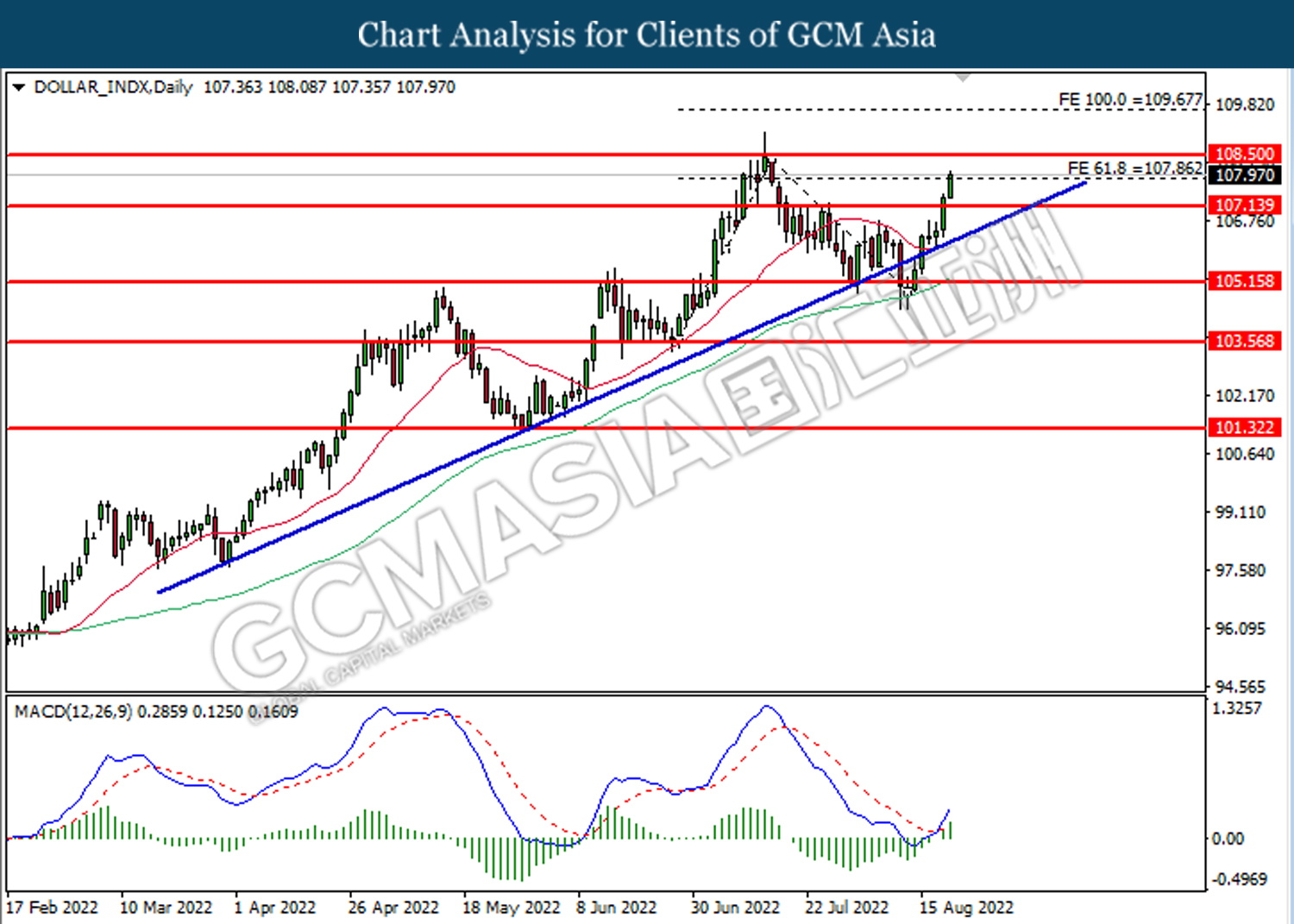

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 107.85. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 107.85, 108.50

Support level: 107.15, 105.15

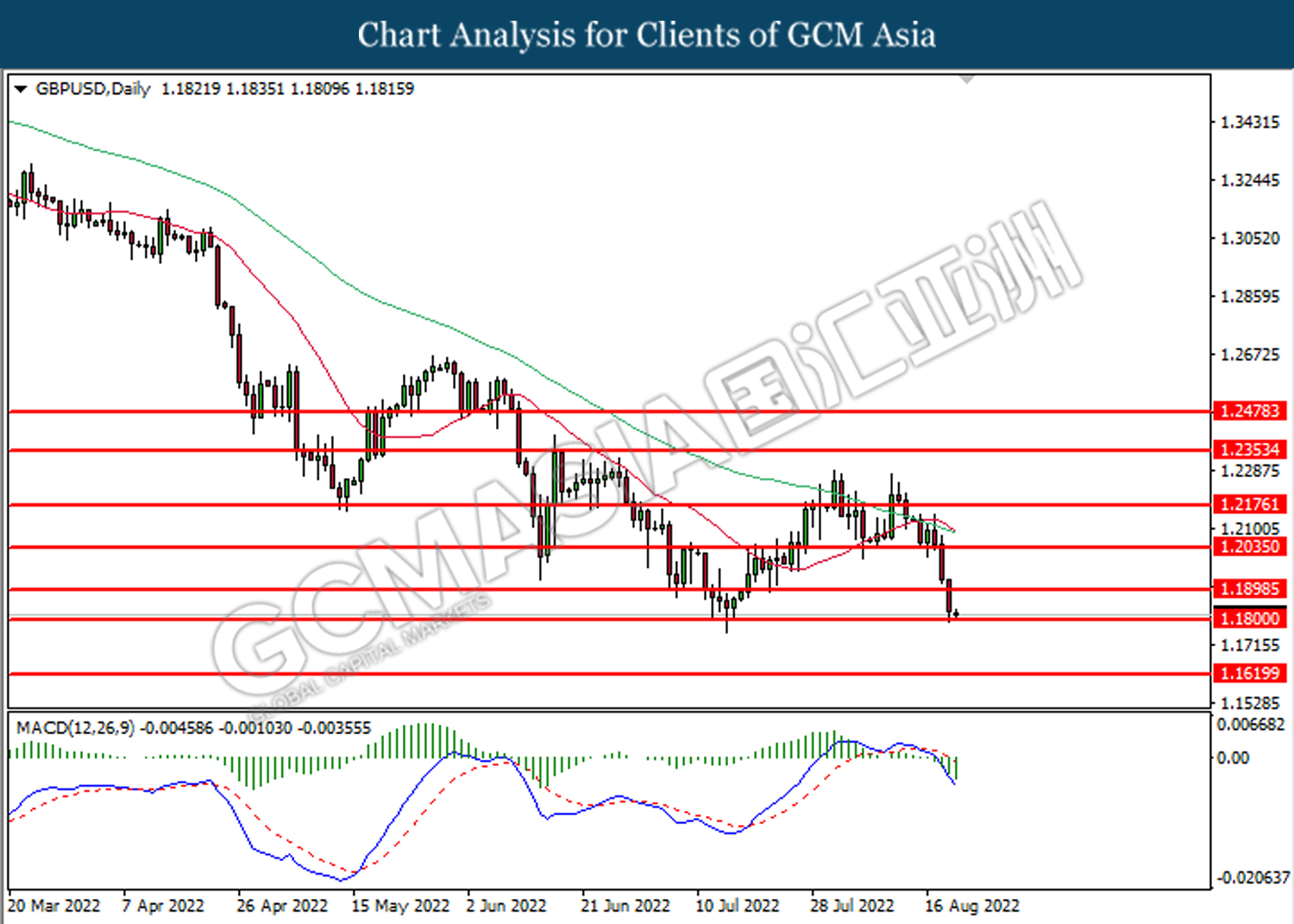

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1800. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1900, 1.2035

Support level: 1.1800, 1.1620

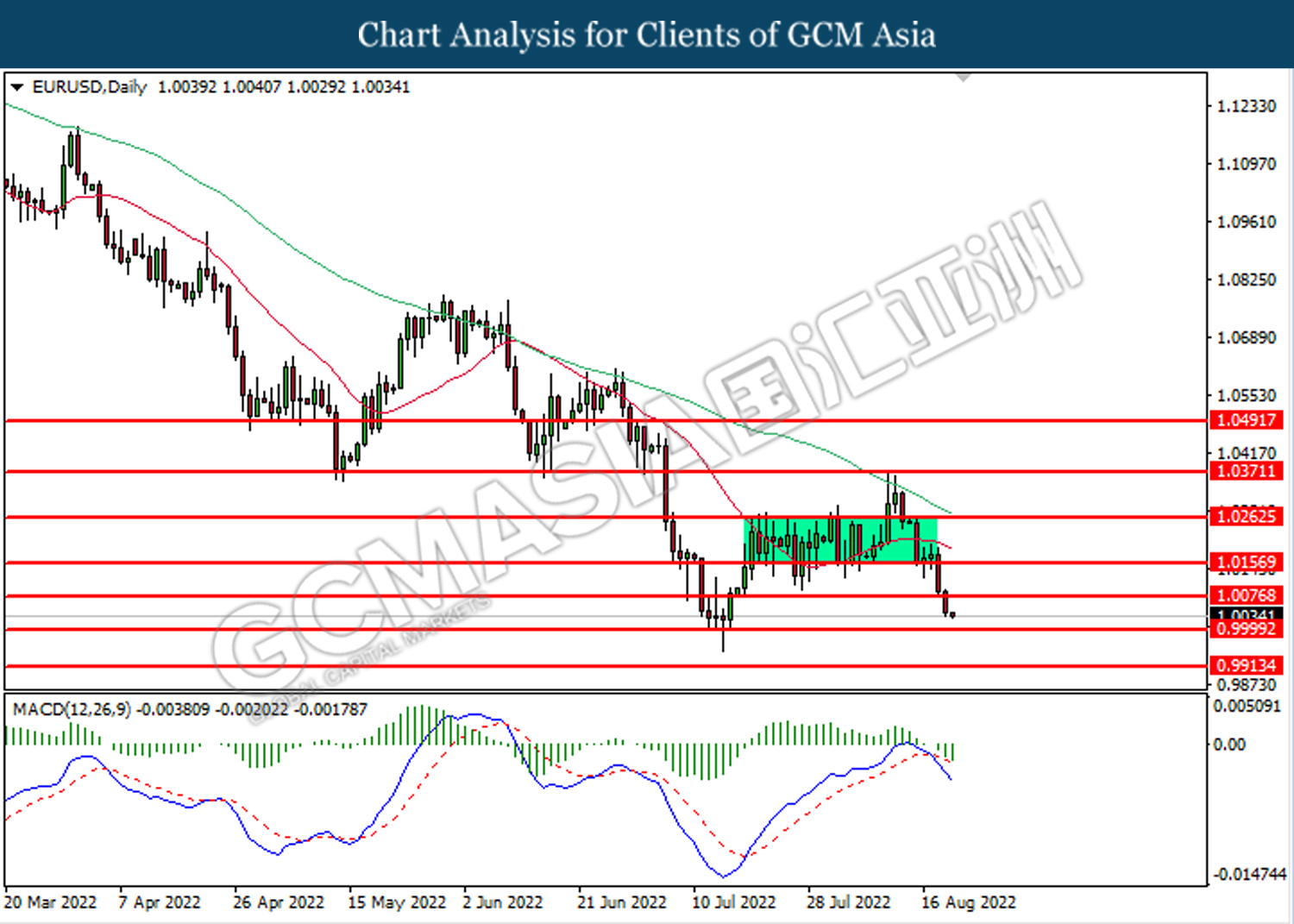

EURUSD, Daily: EURUSD was traded lower following prior breakout below the support level at 1.0075. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0000.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9915

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 136.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 138.00.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

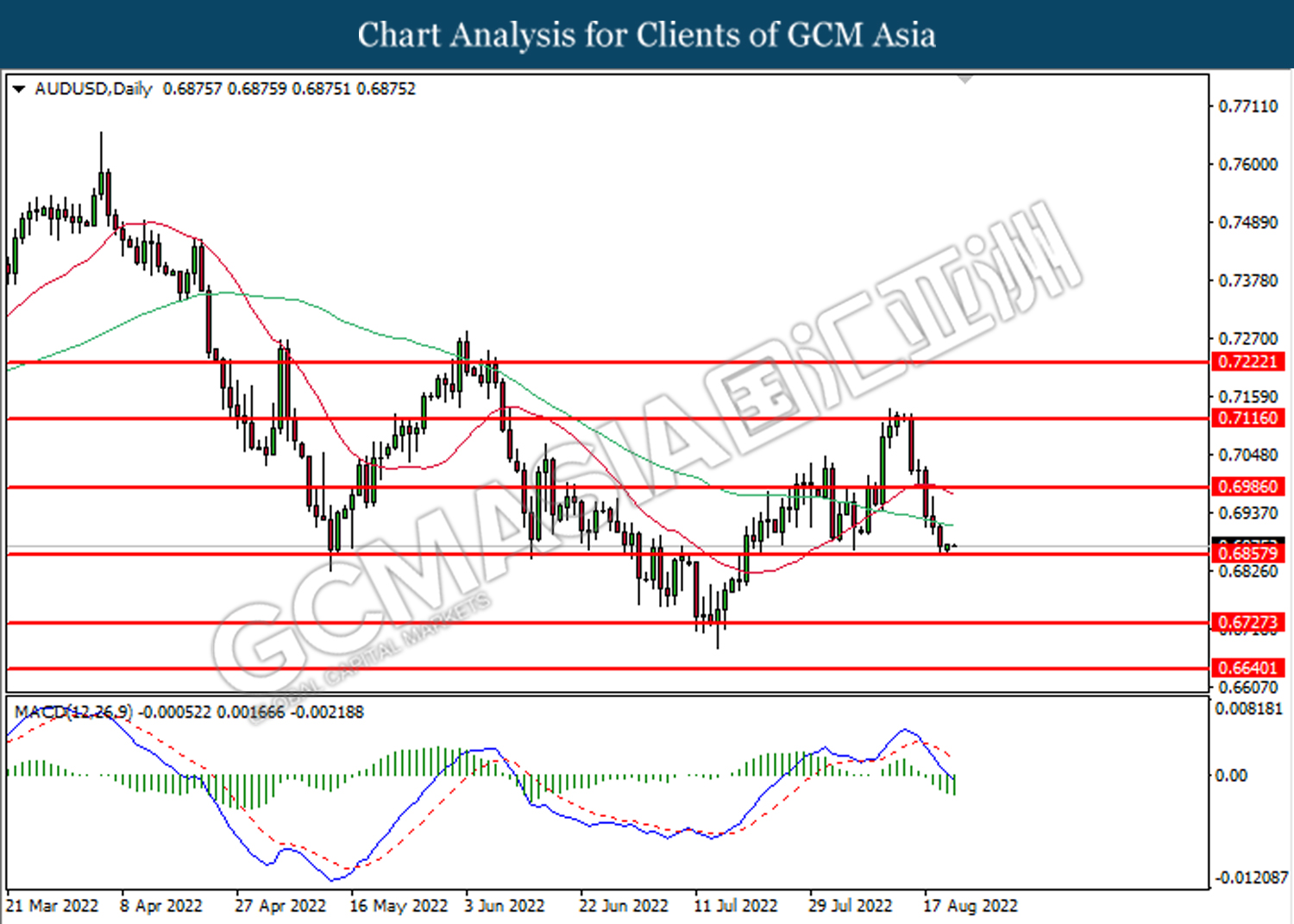

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6245. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6140.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

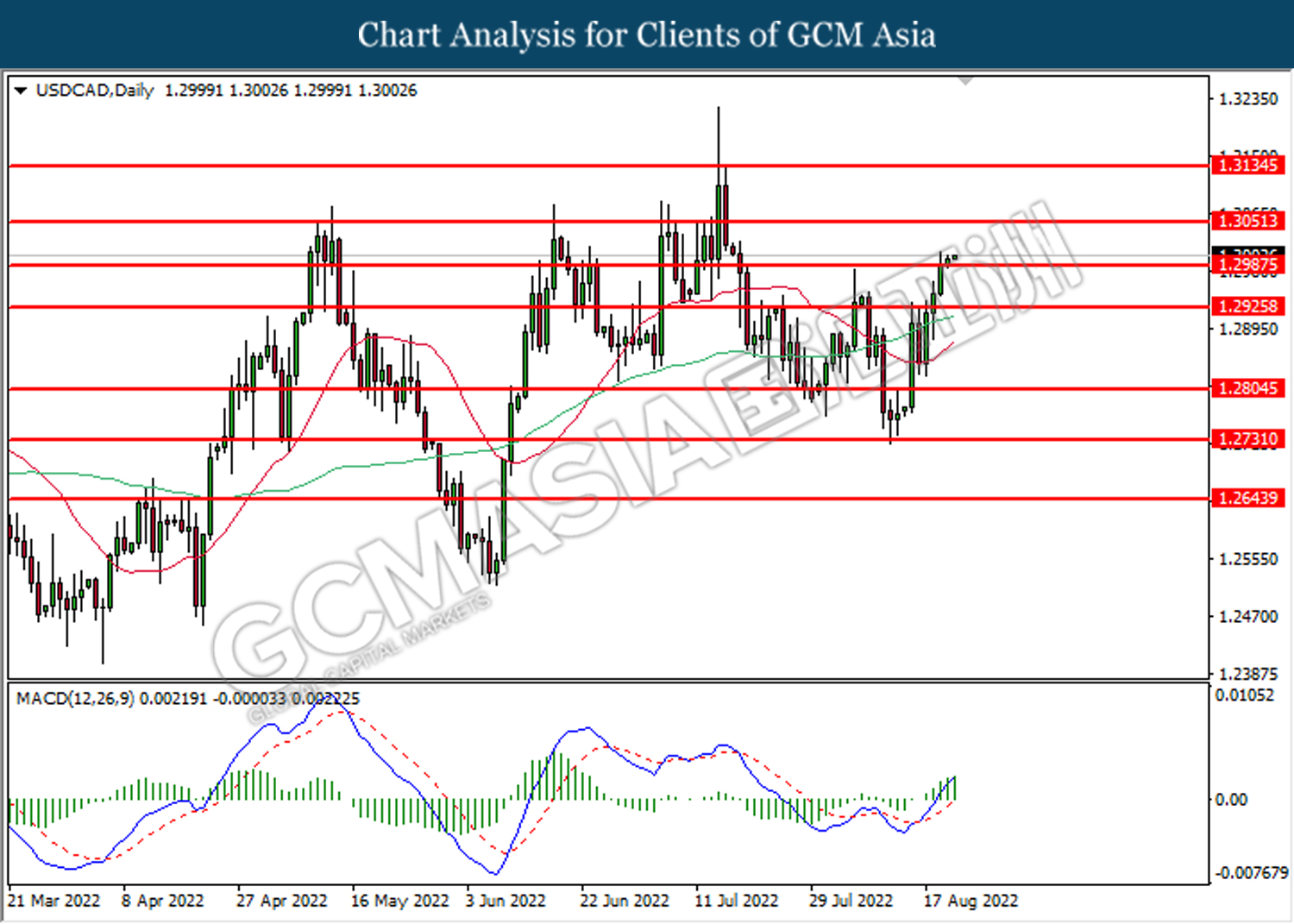

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2985. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3050.

Resistance level: 1.3050, 1.3135

Support level: 1.2985, 1.2925

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9590. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

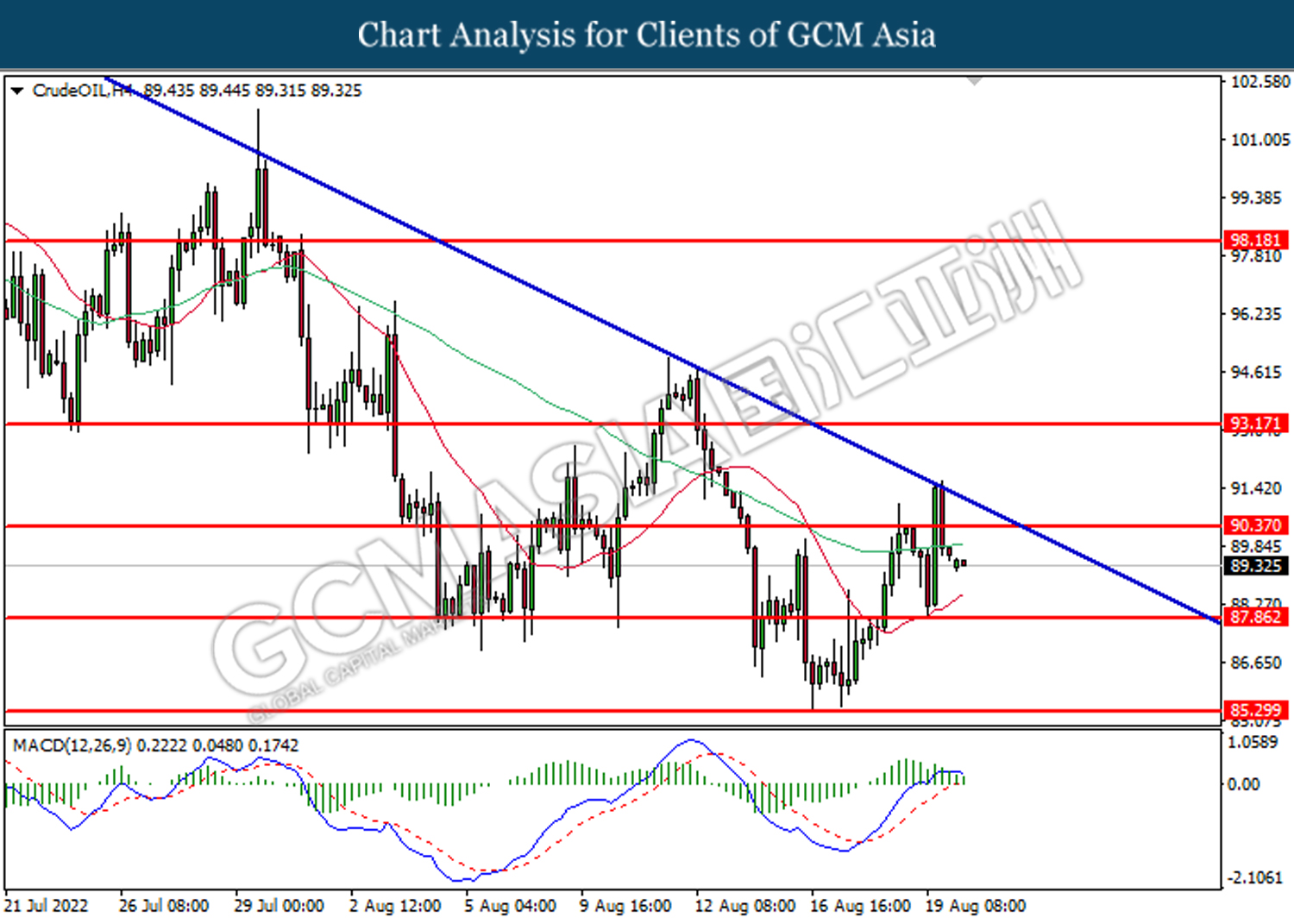

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 90.35. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 87.85.

Resistance level: 90.35, 93.15

Support level: 87.85, 85.30

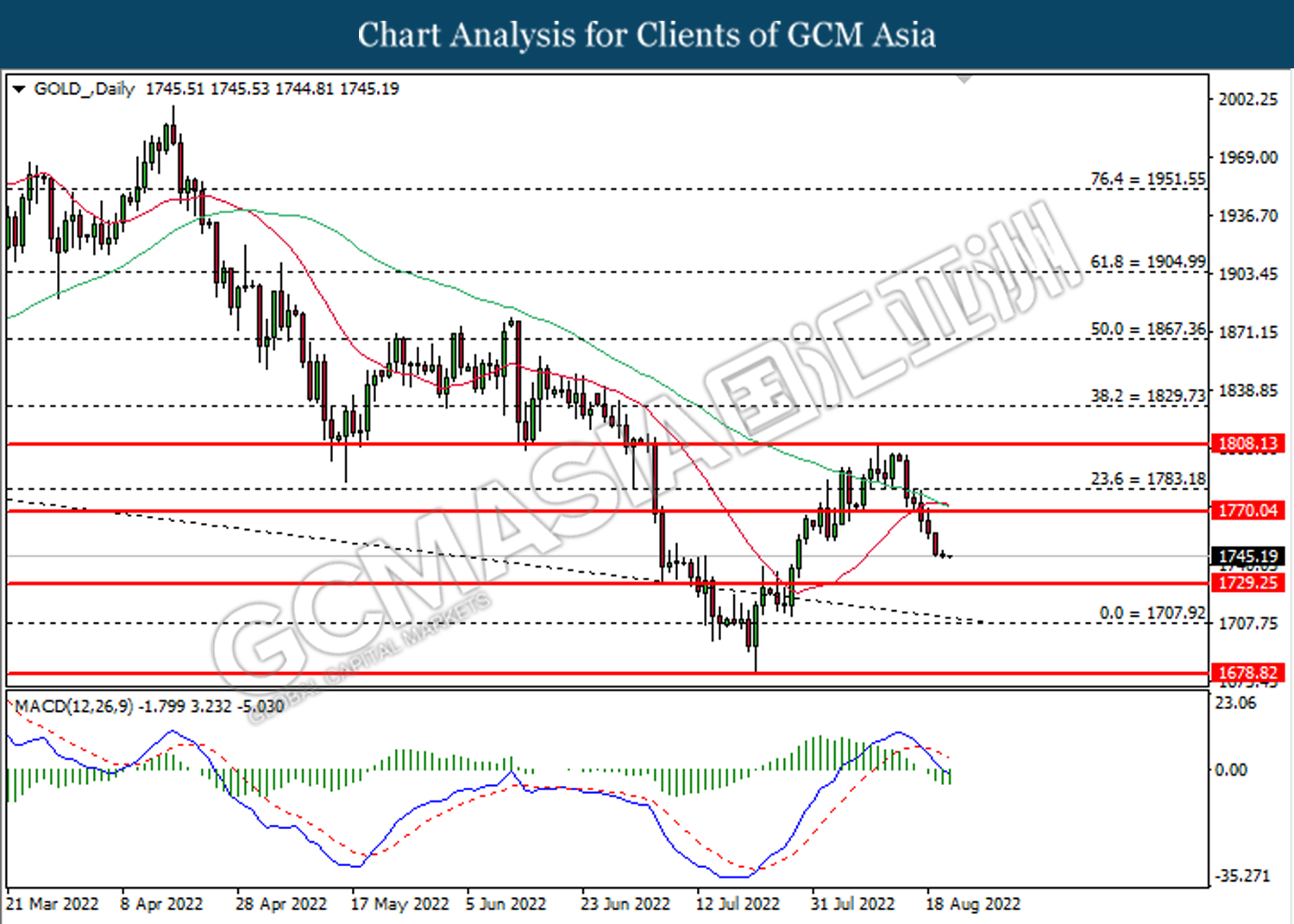

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1729.25.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90