22 September 2022 Morning Session Analysis

US Dollar soared following rate hike decision from Fed.

The Dollar Index which traded against a basket of six major currencies surged significantly to a fresh two-decade recent high on Wednesday following the Federal Reserve increased their interest rates by three-quarters of a percentage point for the third consecutive time. Meanwhile, the Monetary Policy Committee (MPC) speculated further rate hike decision in future to stabilize the spiking number of inflation rate which stoked by supply constraints caused by the war between Russia and Ukraine and unexpectedly robust demand following the economic recovery. The MPC also claimed that the Fed could lift the rate by at least another 125-basis point by the end of 2022, to a range between 4.25% and 4.5%, according to Fed new projections. On the other hand, the safe-haven US Dollar extend its gains as rising tensions between Russian-Ukraine had sparked further risk-off sentiment in the global financial market. Yesterday, Russia’s President Vladimir Putin claimed that the Russia is willing to use nuclear weapons if Ukraine continues its offensive operations, according to the Guardian. As of writing, the Dollar Index appreciated by 1.00% to 111.05.

In the commodities market, the crude oil price depreciated by 0.25% to $82.75 per barrel as of writing. The oil market was edged lower last week amid the surge in US Dollar urged the non-US oil buyer to temporarily shy away from the black-commodity. The gold price appreciated by 0.27% to $1669.05 per troy ounces as of writing as the rising tensions between Russian-Ukraine, prompting investors to shift their portfolio into safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:30 JPY BoJ Press Conference

15:30 CHF SNB Monetary Policy Assessment

15:30 CHF SNB Press Conference

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q3) | -0.25% | 0.50% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Sep) | 1.75% | 2.25% | – |

| 20:30 | USD – Initial Jobless Claims | 213K | 218K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 111.20, 113.20

Support level: 107.95, 104.85

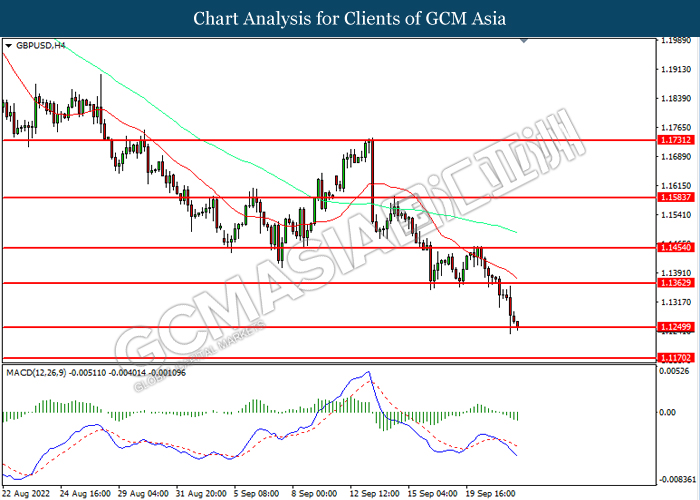

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.1365, 1.1455

Support level: 1.1250, 1.1170

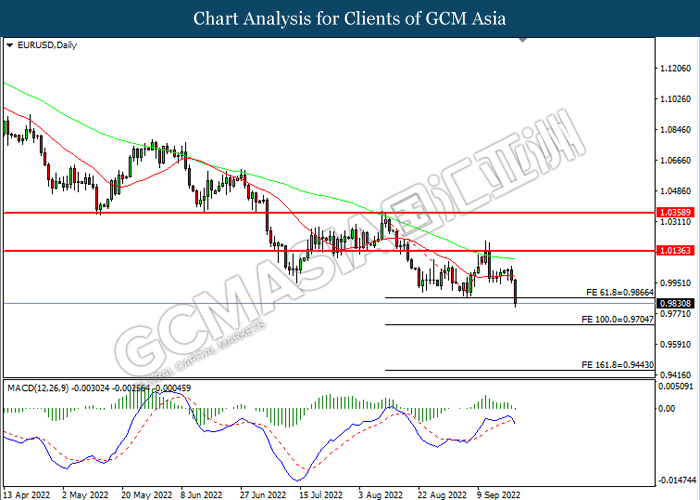

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9865, 1.0135

Support level: 0.9705, 0.9445

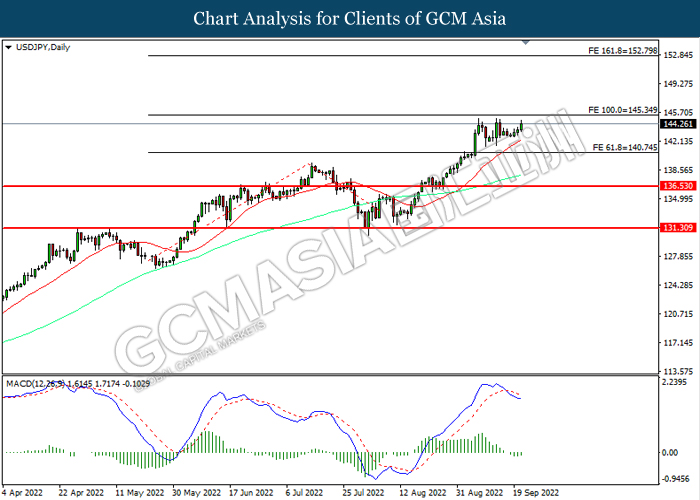

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

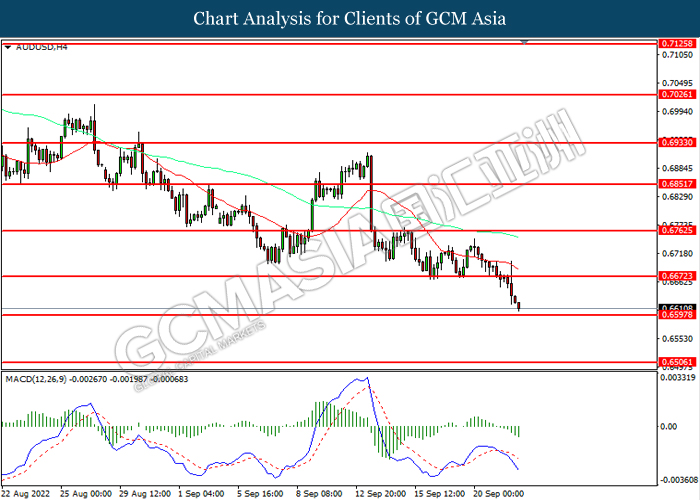

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6670, 0.6765

Support level: 0.6595, 0.6505

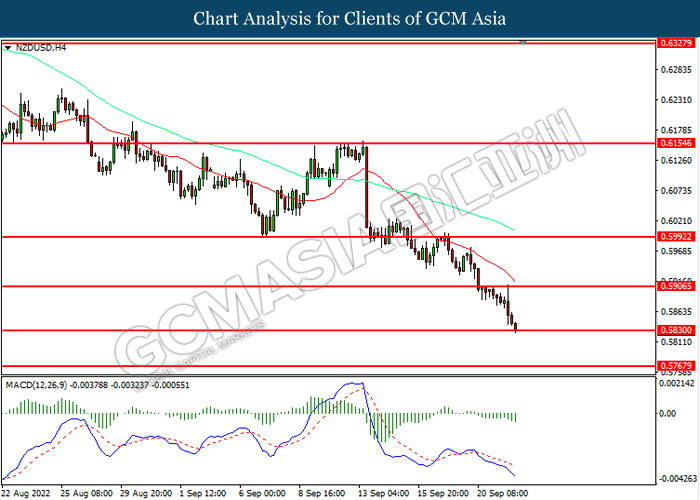

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.5905, 0.5990

Support level: 0.5830, 0.5765

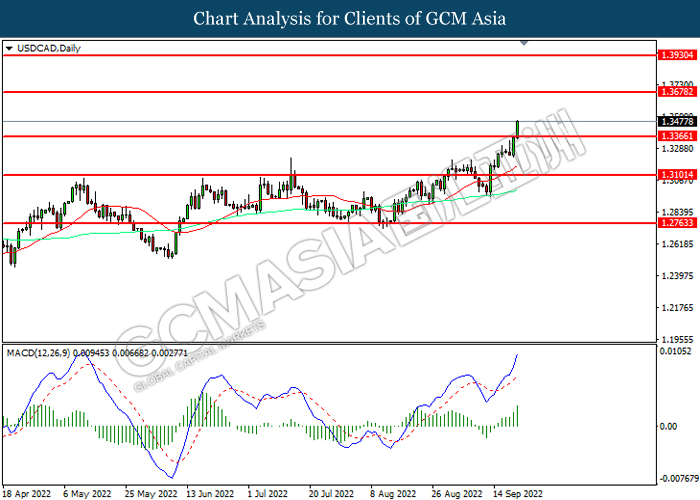

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.3680, 1.3930

Support level: 1.3365, 1.3100

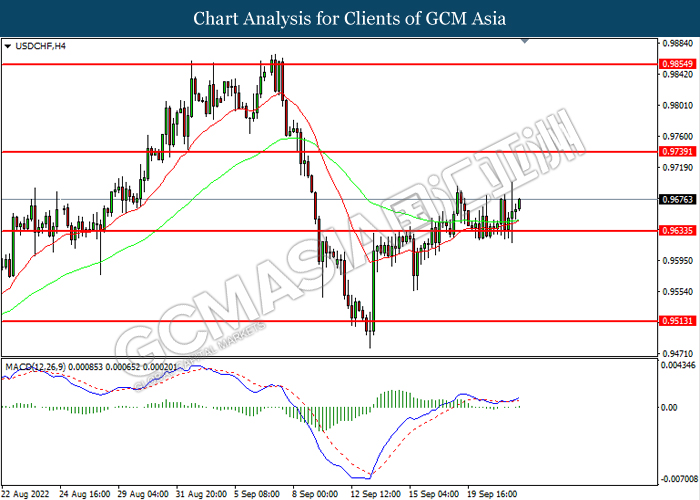

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9740, 0.9855

Support level: 0.9635, 0.9515

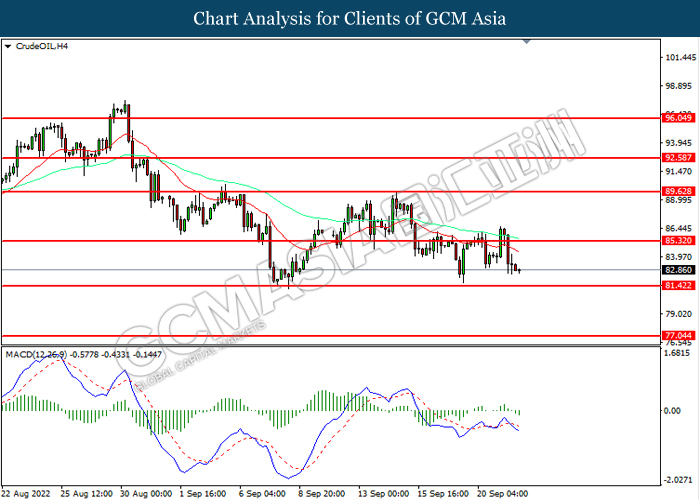

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 85.30, 89.65

Support level: 81.40, 77.05

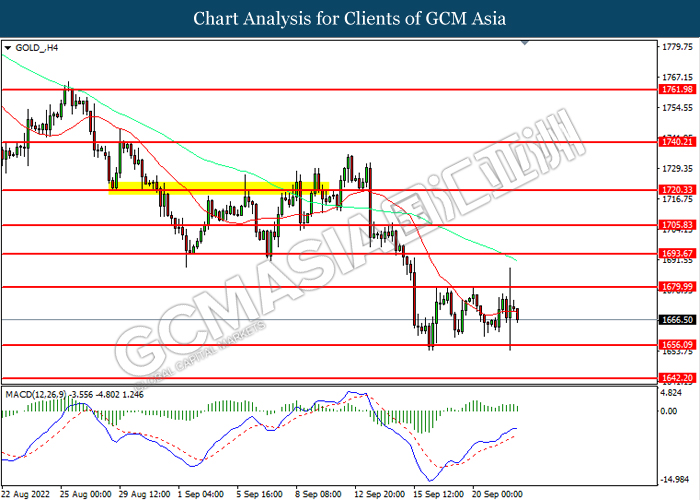

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1680.00, 1693.65

Support level: 1656.10, 1642.20