22 November 2021 Afternoon Session Analysis

Euro extend losses amid rising Covid fears, dovish ECB.

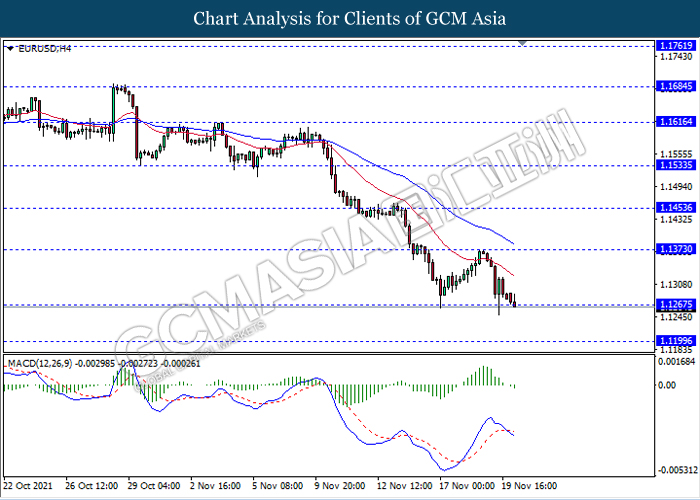

The Euro which traded against the dollar and other currency pairs have fell amid growing anxiety over rising Covid-19 infections in Europe. Following latest development, Europe has once again become the epicenter of the pandemic, accounting for half of global cases and death. Due to surging cases, Austria becomes the first country in Western Europe to reimpose a full COVID-19 lockdown from Monday. On top of that, Germany also facing record COVID-19 cases where the country reported 331,944 cases in the past week. A fourth wave of infections has plunged Germany, into a national emergency which Health Minister Jens Spahn warned that that vaccinations alone will not reduce case numbers. The increase in coronavirus cases in Germany has prompted the central government to ban individuals who have not received any vaccines into public places. On the other hand, dovish comments from ECB president Christine Lagarde also triggered further pressure for the pair. ECB President Christine Lagarde emphasized that the current economic conditions are still not enough for the central to consider raising interest rates. At the time of writing, EUR/USD fell 0.19% to 1.1266.

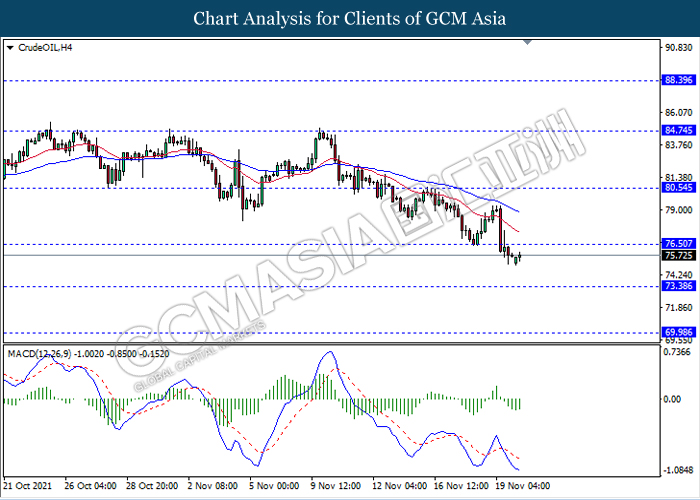

In the commodities market, crude oil price slip 0.10% to $75.65 as of writing amid concerns over weak demand and rising supply. According to Kyodo News, Japanese Prime Minister Fumio Kishida stated that they considered to release oil from their reserve to curb rising oil prices. In addition, the movement restriction announced by the European Union also affecting the demand prospect for crude oil. On the other hand, gold price also fell 0.09% to 1845.95 a troy ounce at the of writing following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Oct) | 54.1 | 54.1 | – |

| 23:00 | USD – Existing Home Sales (Oct) | 6.29M | 6.20M |

Technical Analysis

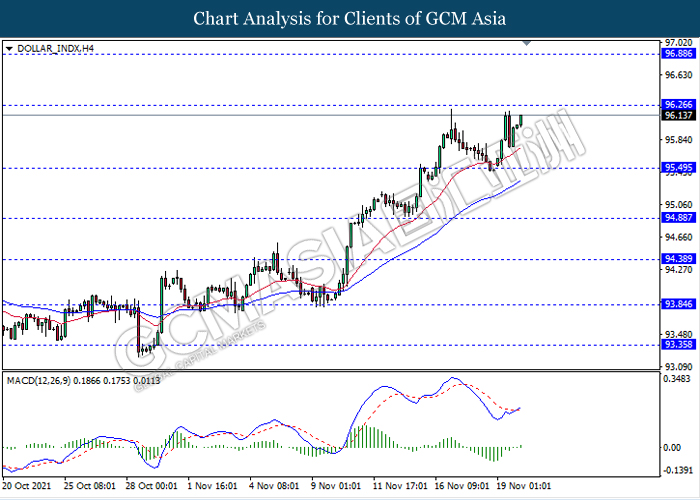

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing near the resistance level 96.25. MACD which illustrate bullish bias signal with the formation of golden cross suggest the dollar to extend its gains after it breaks above the resistance level.

Resistance level: 96.25, 96.90

Support level: 95.50, 94.90

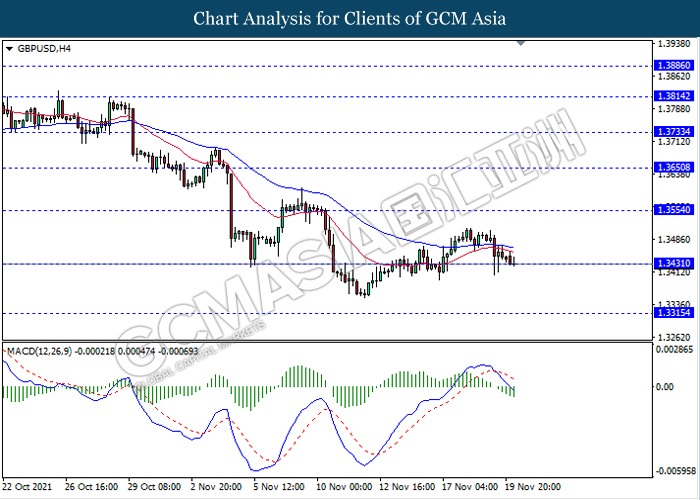

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level 1.3430. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend it losses after it breaks below the support level 1.3430.

Resistance level: 1.3555, 1.3650

Support level: 1.3430, 1.3315

EURUSD, H4: EURUSD was traded lower while currently testing the support level 1.1265. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.1375, 1.1455

Support level: 1.1265, 1.1200

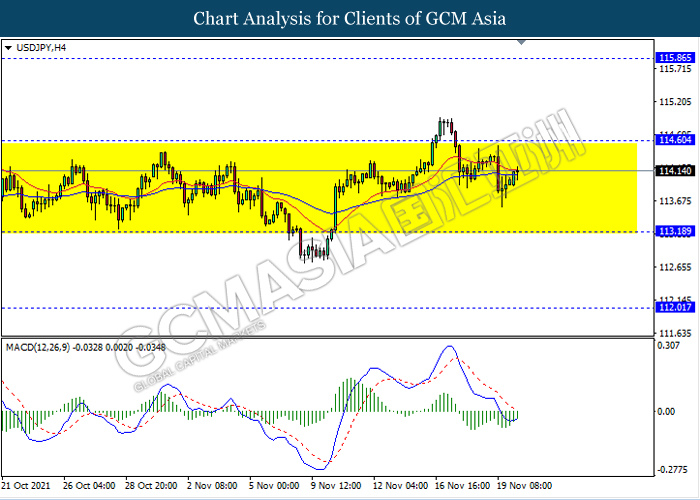

USDJPY, H4: USDJPY remain traded in a sideway channel. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher towards the resistance level 114.60.

Resistance level: 114.60, 115.85

Support level: 113.20, 112.00

AUDUSD, H4: AUDUSD was traded lower following recent breakout below the previous support level 0.7260. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to experience a short term technical correction back towards the level 0.7260.

Resistance level: 0.7260, 0.7365

Support level: 0.7175, 0.7105

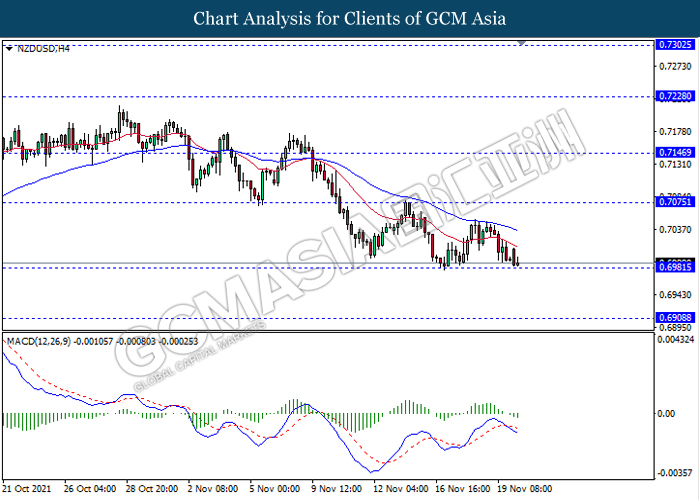

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6980. MACD which illustrate bearish momentums signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.7075, 0.7145

Support level: 0.6980, 0.6910

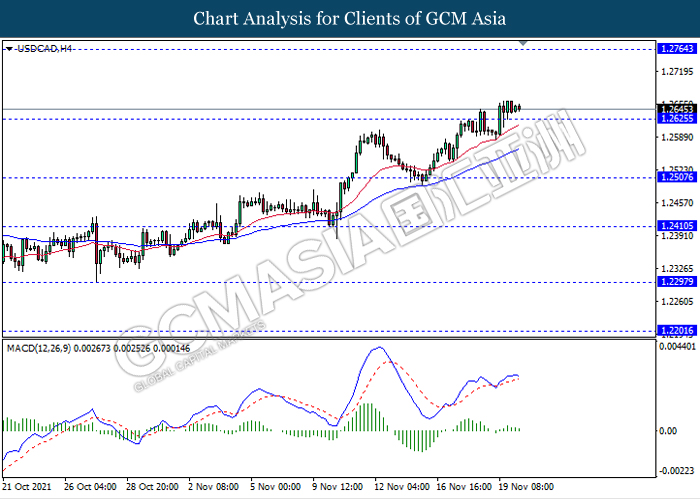

USDCAD, H4: USDCAD was traded flat near the support level 1.2625. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower after it breaks below the support level.

Resistance level: 1.2765, 1.2865

Support level: 1.2625, 1.2505

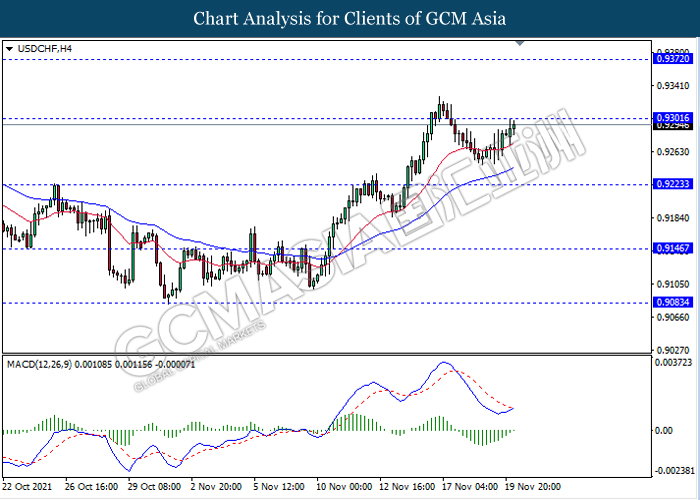

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level 0.9300. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.9300, 0.9370

Support level: 0.9225, 0.9145

CrudeOIL, H4: Crude oil price was traded lower following recent breakout below the previous support level 76.50. MACD which illustrate bearish momentum signal suggest the commodity to extend its losses towards the support level 73.40.

Resistance level: 76.50, 80.55

Support level: 73.40, 70.00

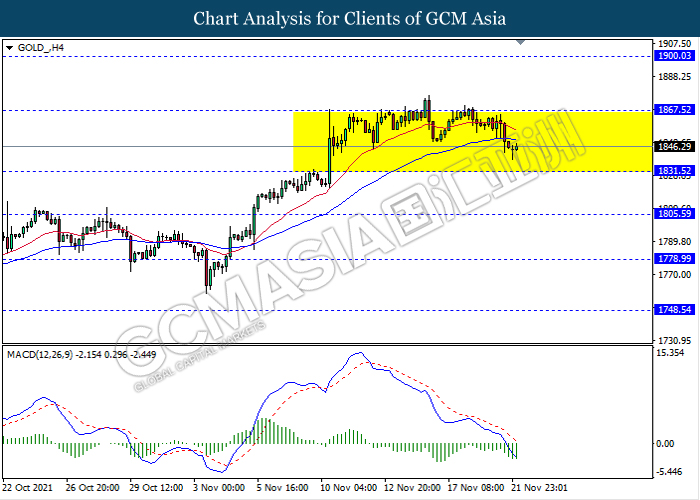

GOLD_, H4: Gold price remain traded flat in a sideway channel following recent retracement from the resistance level 1867.50. However, MACD which illustrate bearish bias signal suggest the commodity to be traded lower in short term towards the support level 1831.50.

Resistance level: 1867.50, 1900.05

Support level: 1831.50, 1805.60