22 November 2022 Morning Session Analysis

Dollar soared on risk aversion.

The dollar index, which gauges its value against a basket of six major currencies, managed to regain its luster amid the heightening of market risk aversion. Recently, the big fuss that China is currently facing was the resurgence of Covid-19 cases. The global risk sentiment was dented following the rising of Covid-19 cases in China, as some major cities, such as Beijing, have implemented a semi-lockdown in order to curb the spread of the virus. Besides, other districts in China which, including Chaoyang, Dongcheng, Changping, and so on, also warned the residents to stay at home and reduce cross-district personnel flow. The resurgence of Covid-19 cases has cast doubt on hopes that the government could soon ease its restriction, the outlook of continuous economic recovery clouded with uncertainty. With such a backdrop, investors took a dim view of riskier currencies and shifted their capital toward safe haven currencies such as the dollar index. As of writing, the dollar index rose 0.82% to 107.80.

In the commodities market, the crude oil price jumped by 0.50% to $80.20 per barrel as Saudi Arabia denied the plan for oil production hike. Besides, the gold prices edged down by -0.75% to $1737.85 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core Retail Sales (MoM) (Sep) | 0.7% | -0.6% | – |

Technical Analysis

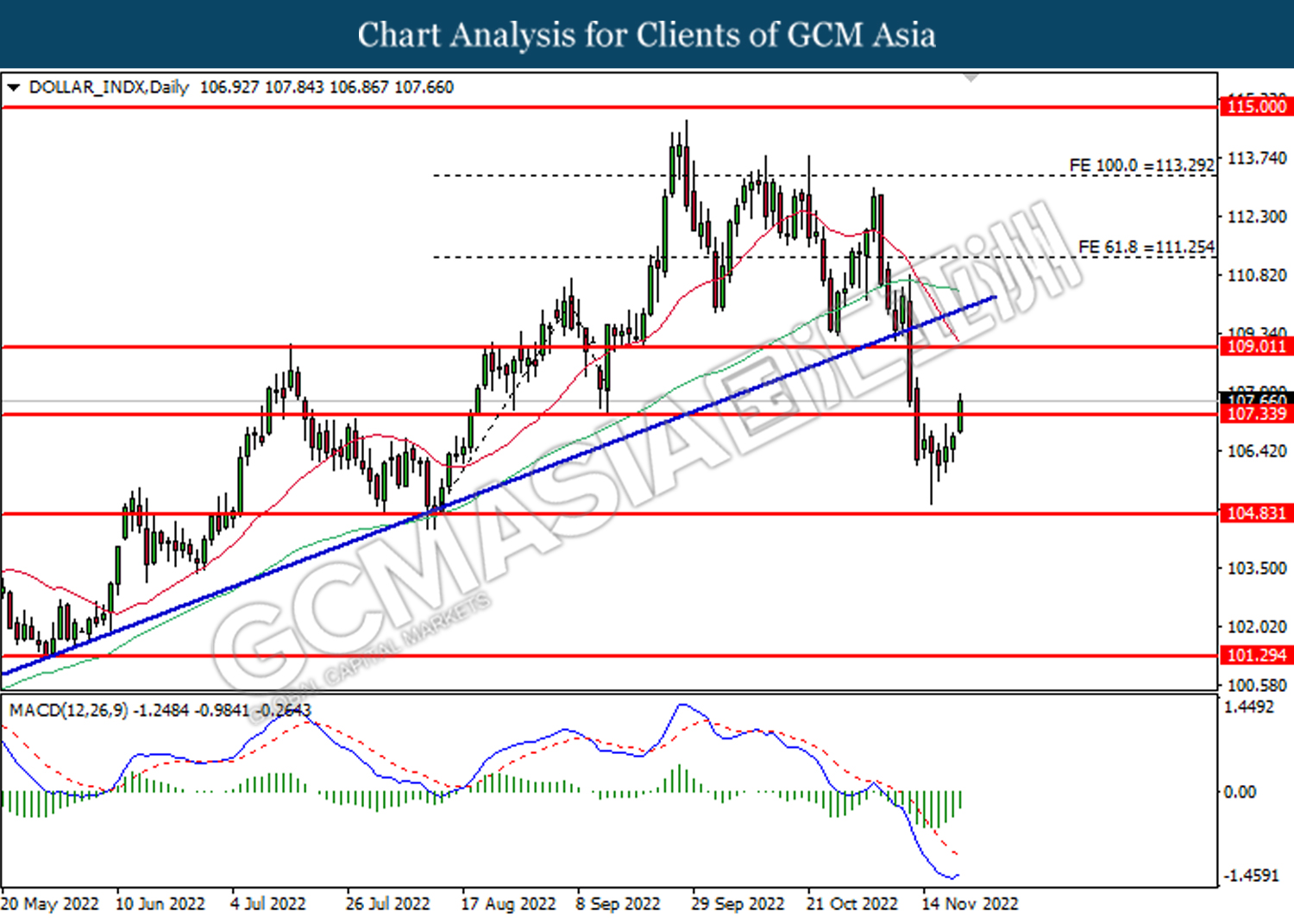

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 107.35. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

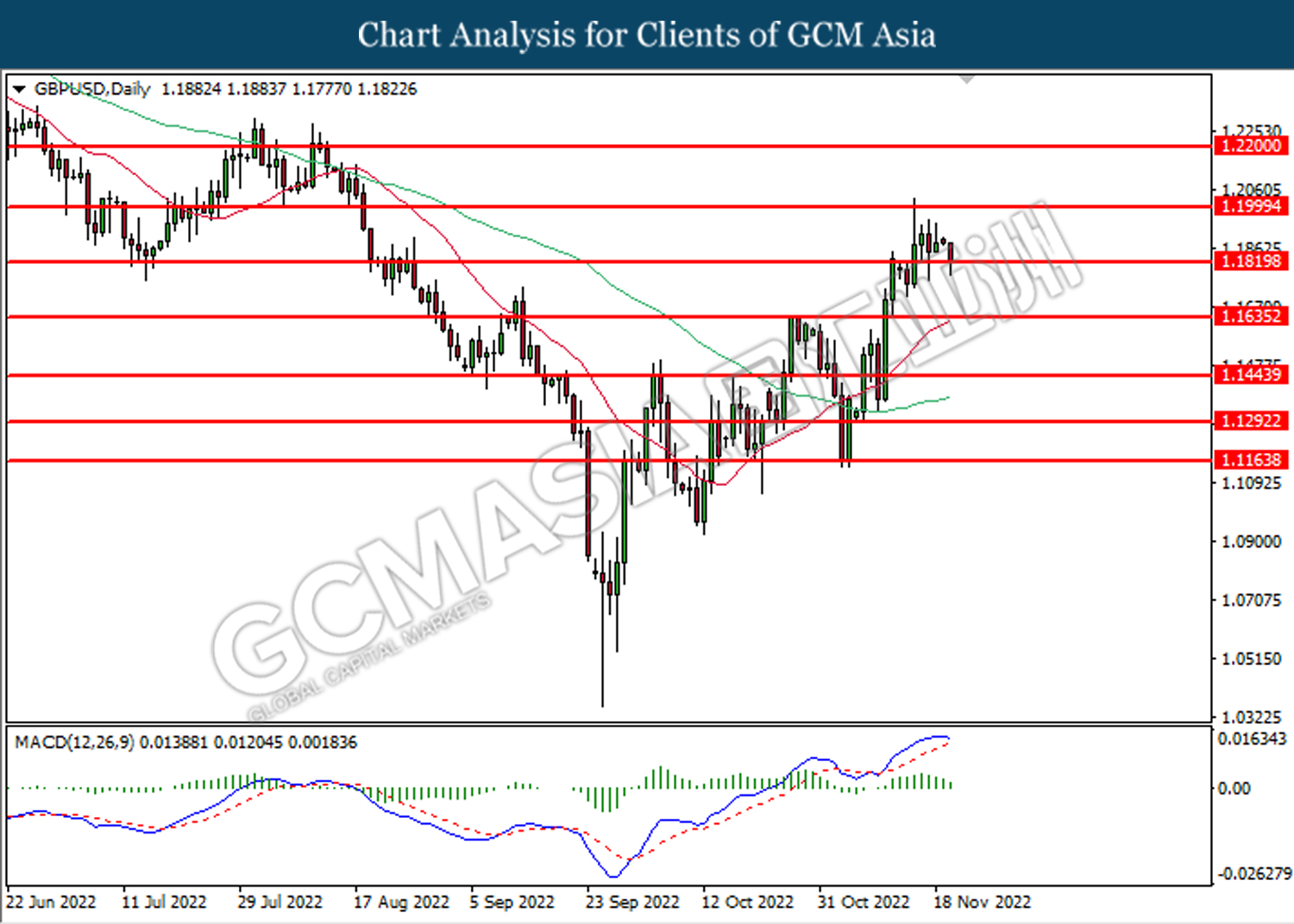

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1820. MACD which illustrated diminishing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

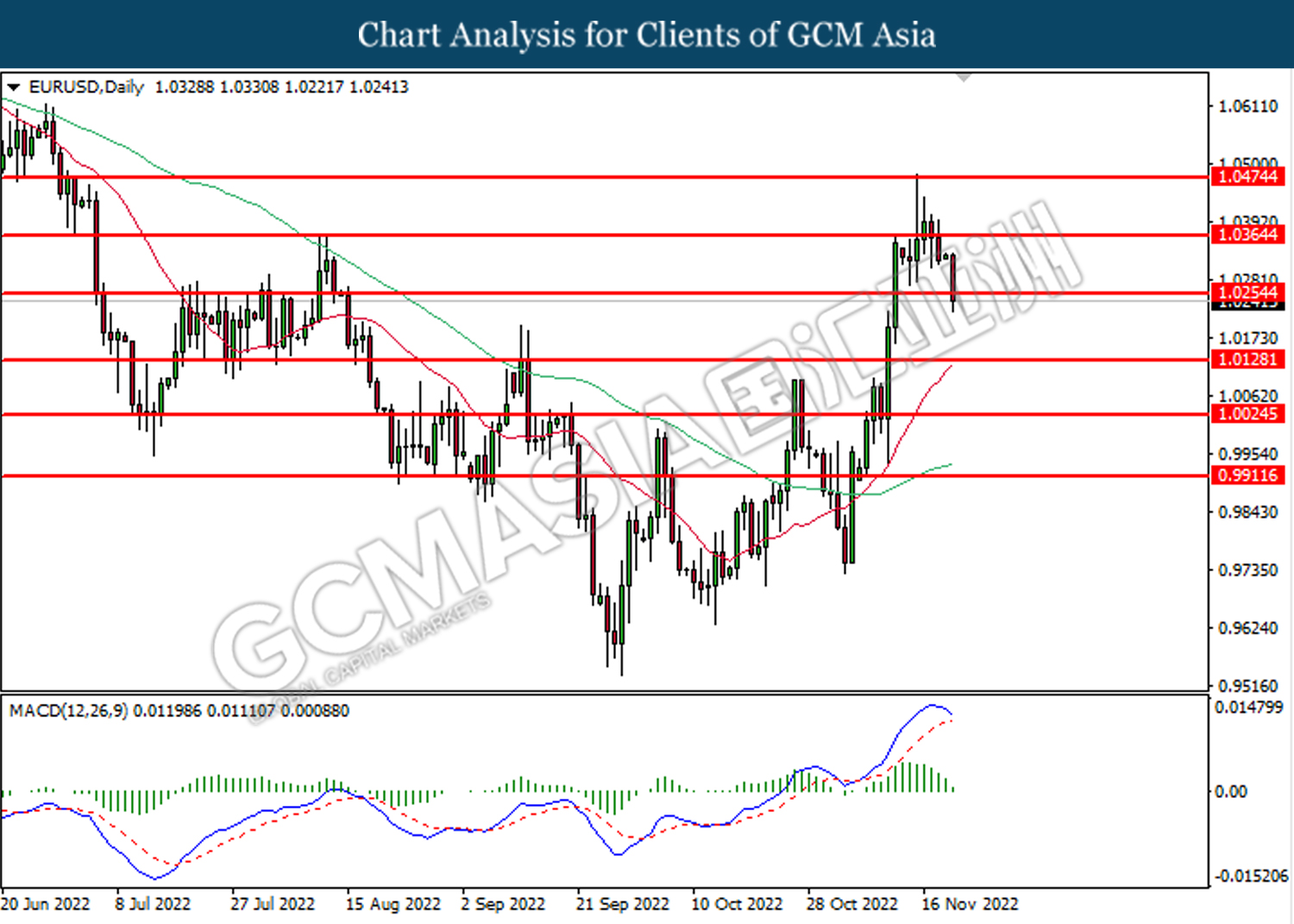

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0255. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

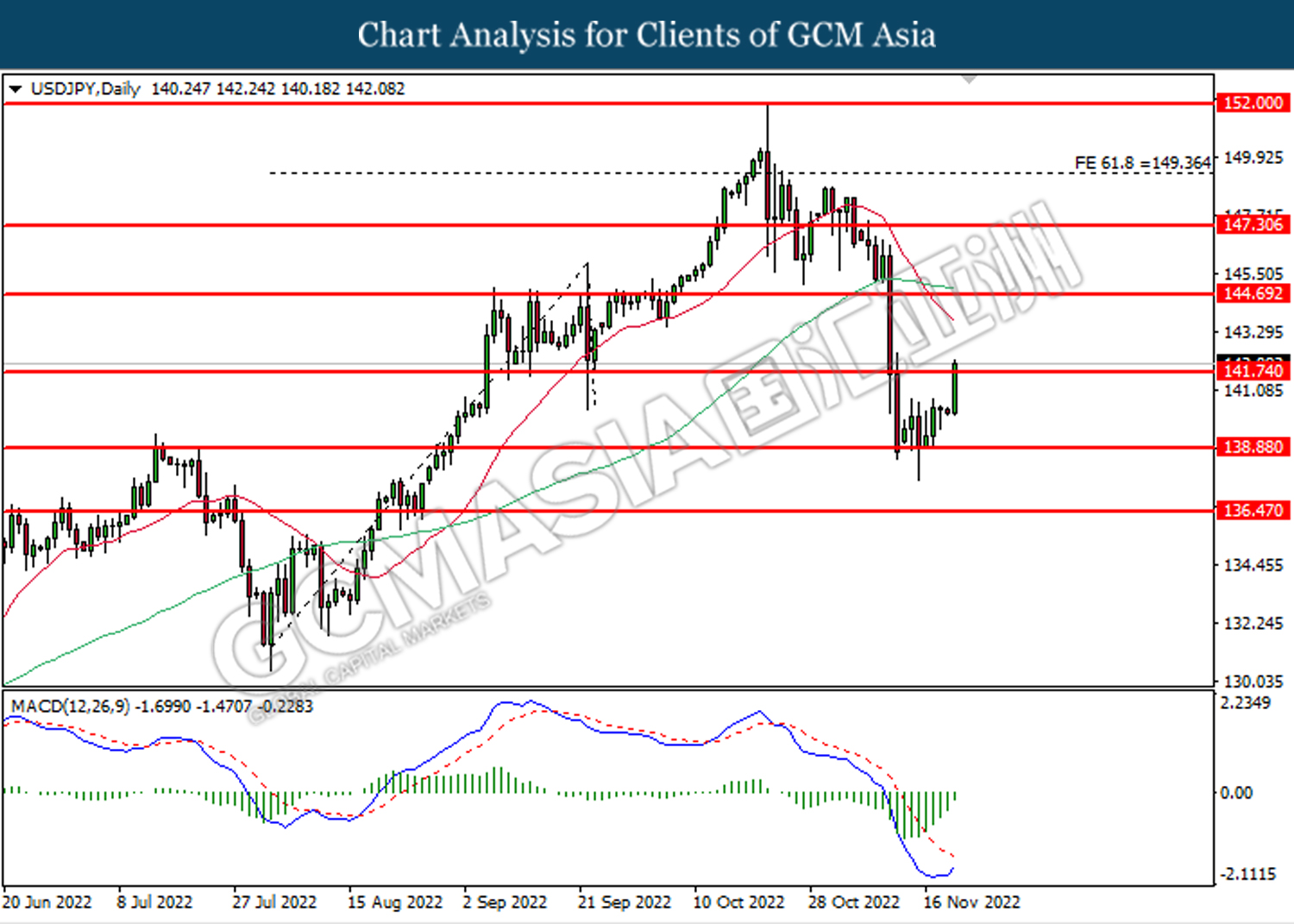

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.75. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

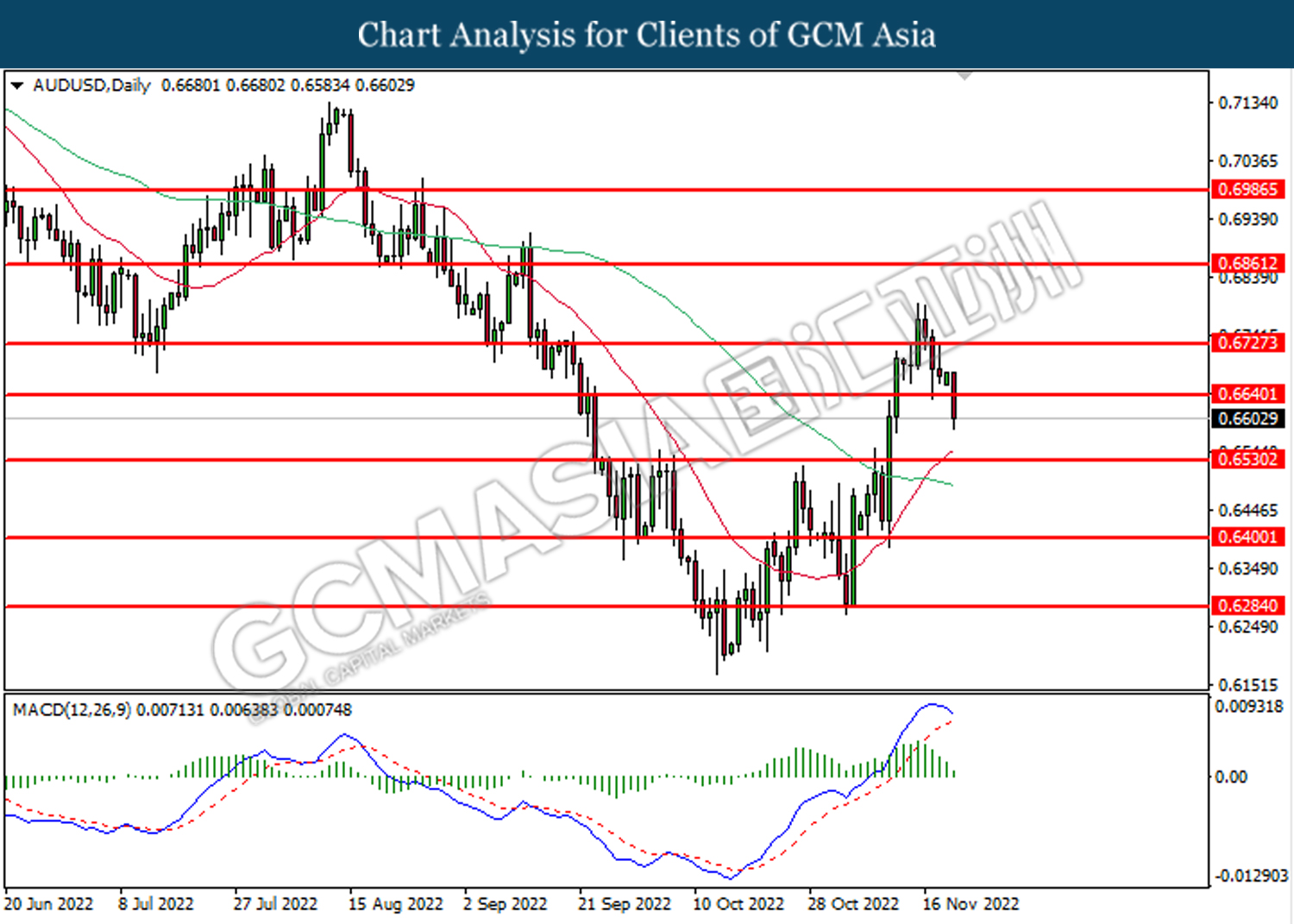

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6640. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

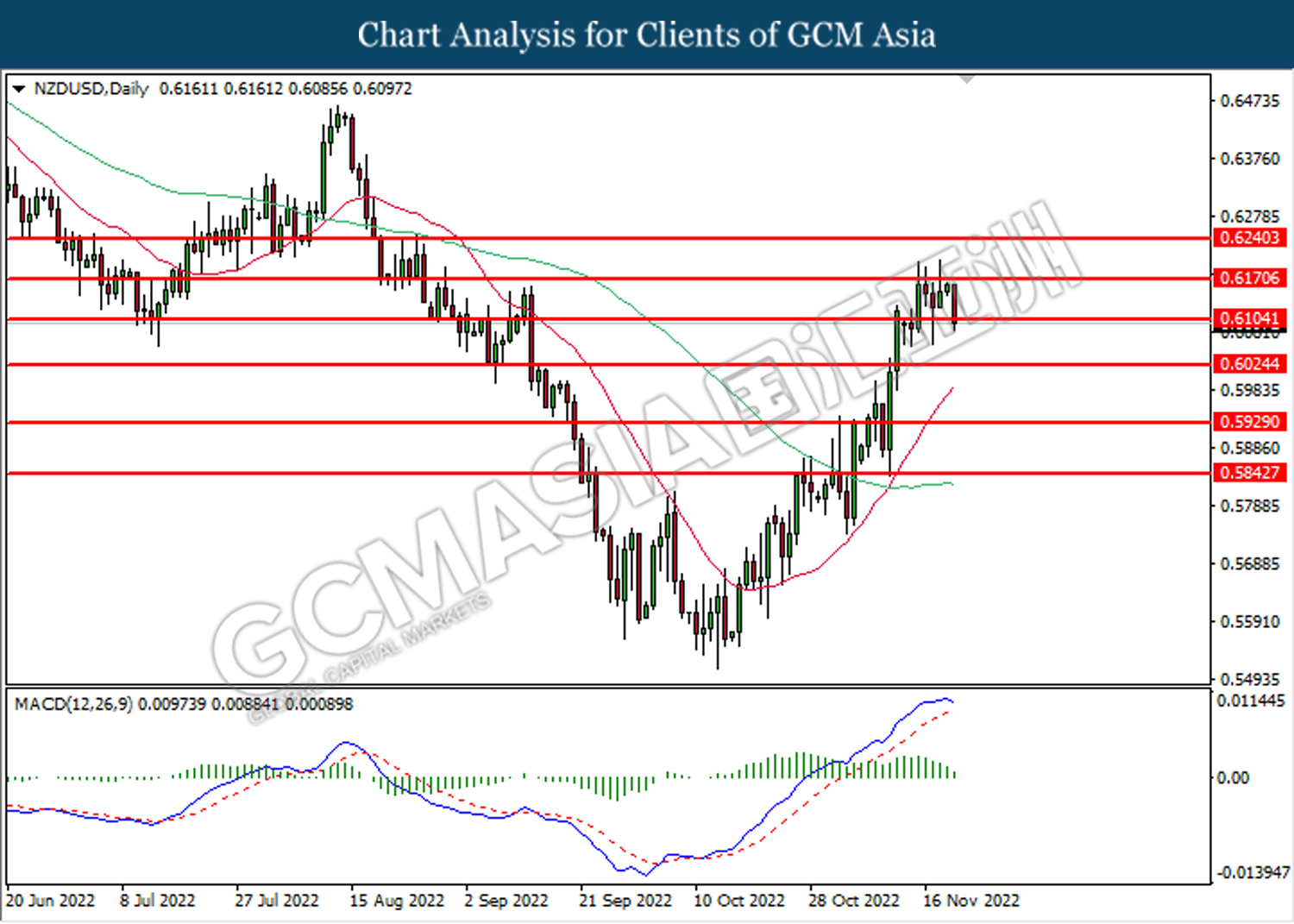

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6105. MACD which illustrated diminishing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6170, 0.6240

Support level: 0.6105, 0.6025

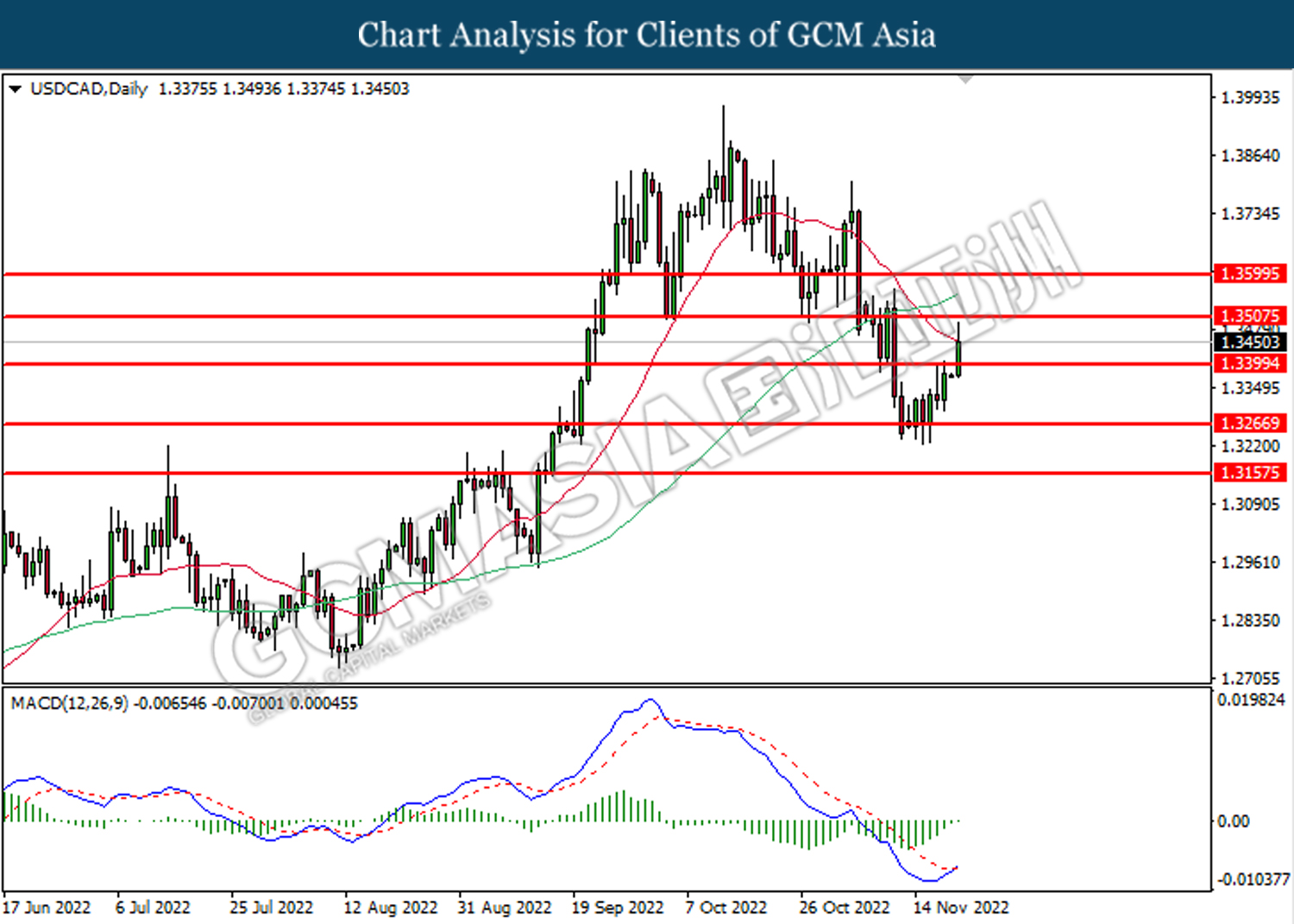

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3505. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

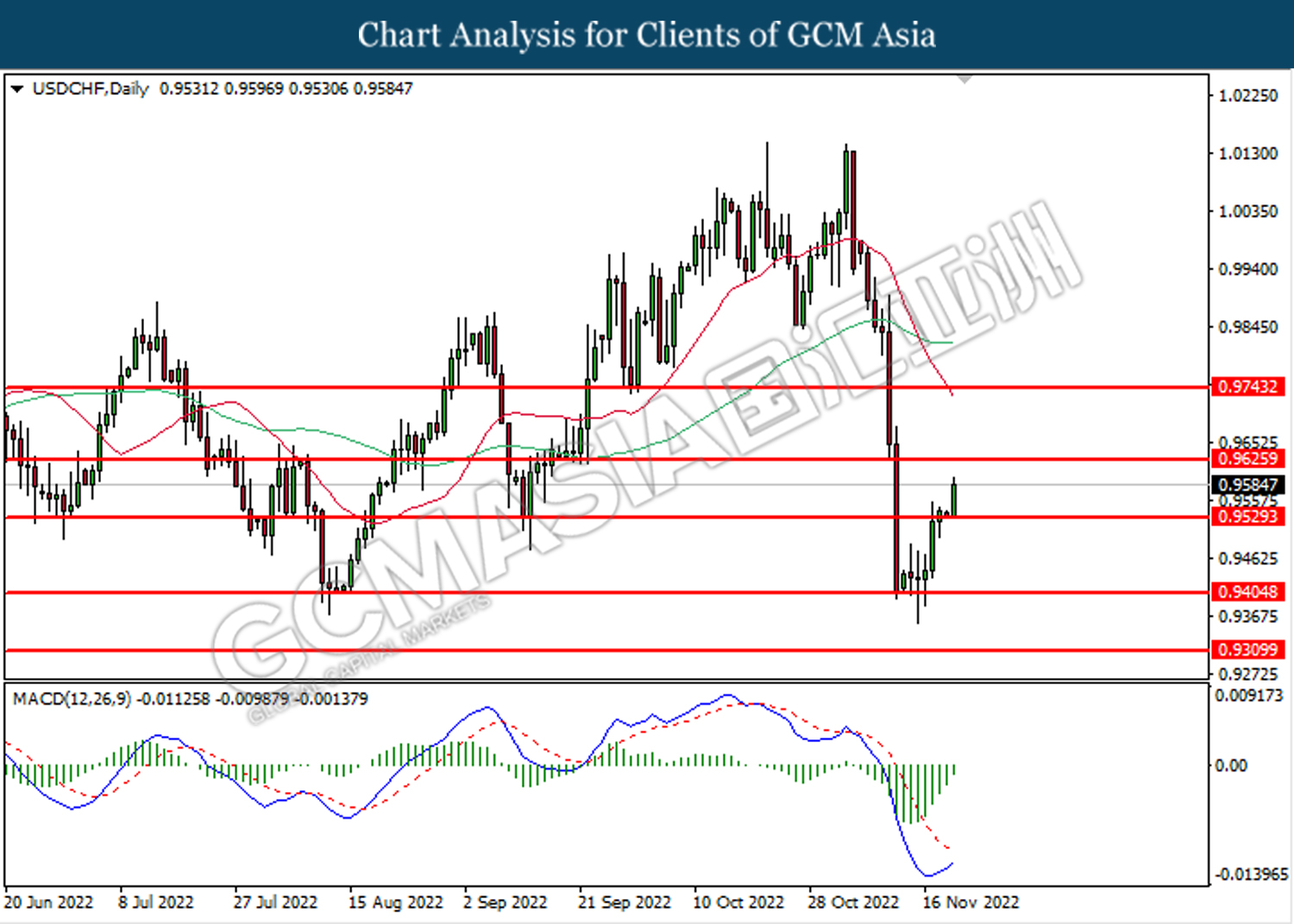

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9530. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9625.

Resistance level: 0.9625, 0.9745

Support level: 0.9530, 0.9405

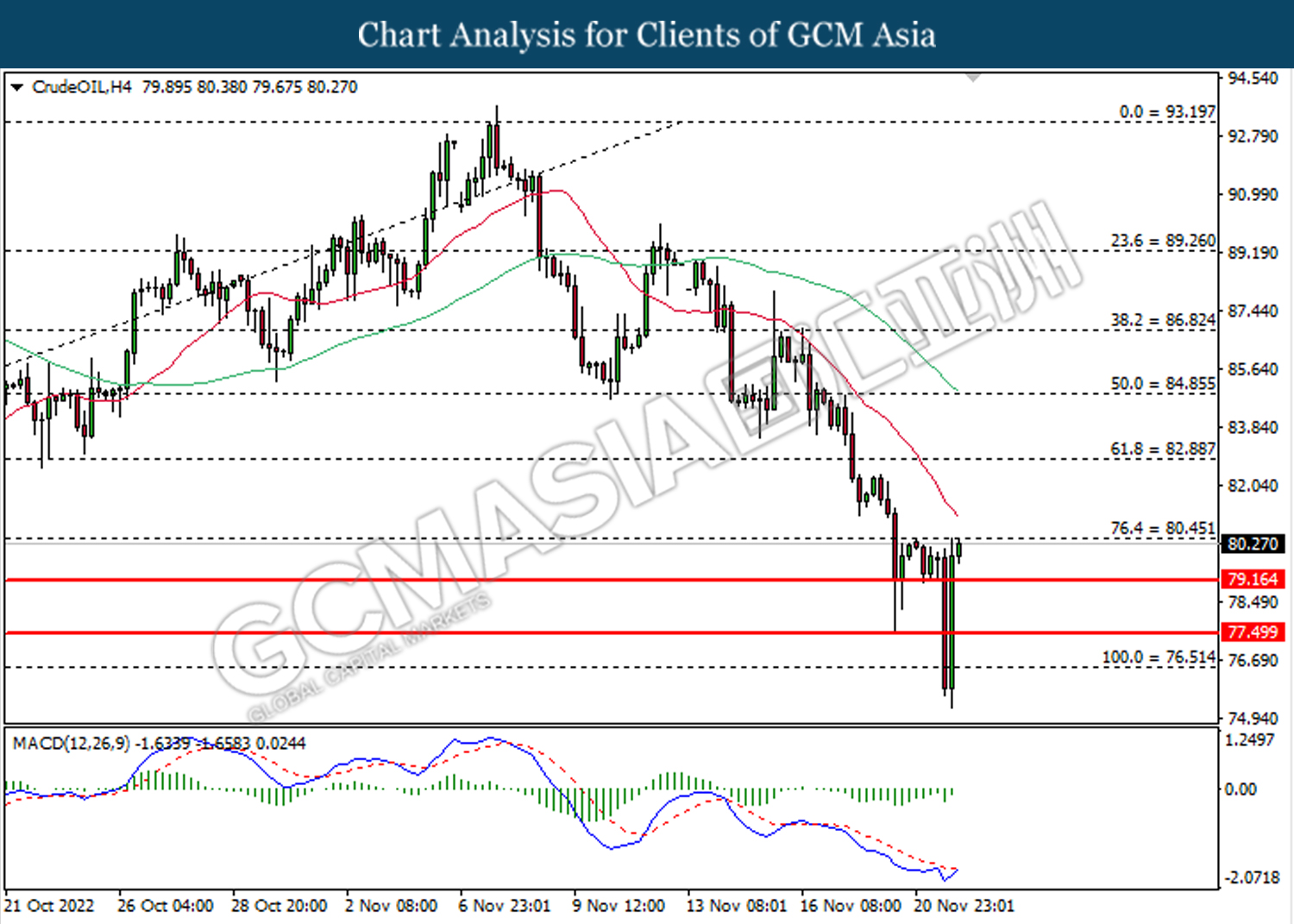

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 80.45. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.45, 82.90

Support level: 79.15, 77.50

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1766.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1726.15.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35