22 December 2022 Afternoon Session Analysis

Canada Dollar lingered following mixed sentiment.

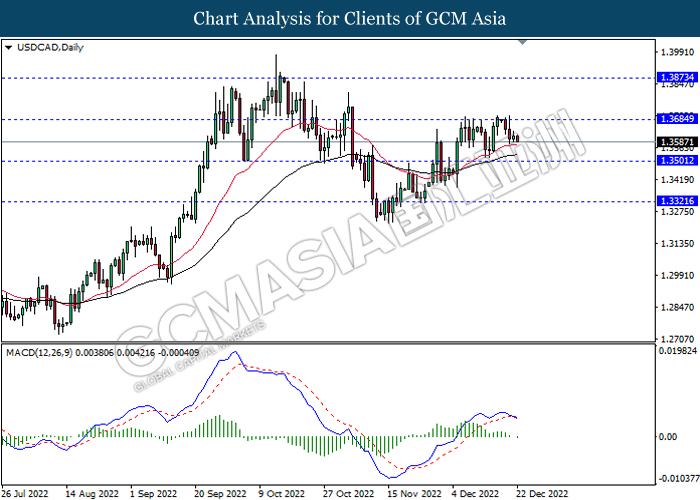

The USD/CAD, which widely traded by global investors hovered on yesterday following the mixing sentiment of market. According to Statistic Canada, the inflationary data that excluding food and energy price, Core Consumer Price Index in Canada has slipped in November, which notched down from the previous reading of 0.4% to 0.0%. With such backdrop, the Canada central bank would likely to scale back its rate hike pace, spurring bearish momentum toward Canada Dollar. Though, the losses of the pairing was limited over the upbeat US economic data. On the other hand, the EUR/USD edged down throughout Wednesday trading session after a dovish statement has been unleashed by ECB member. According to Reuters, the ECB board member Mario Centeno made his comments yesterday that the inflation in Eurozone was reaching its peak in the fourth quarter of 2022, which based on the data shown. Thus, it hinted that a lower interest rate might be raised in the next meeting. As of writing, the USD/CAD dropped by 0.11% to 1.3595, while EUR/USD rose by 0.28% to 1.0633.

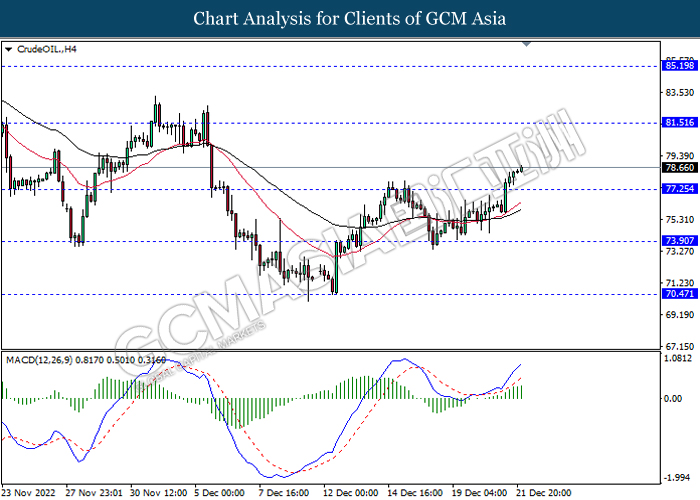

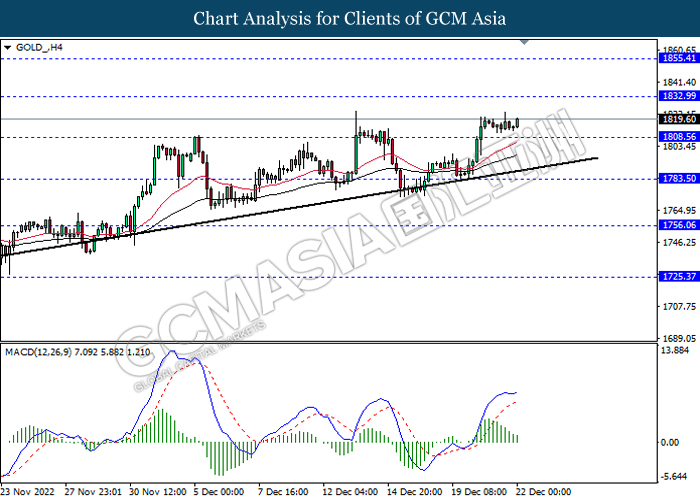

In the commodities market, the crude oil price appreciated by 0.41% to $78.60 per barrel as of writing following top oil importer China continued to relax safeguards on the COVID-19 front. On the other hand, the gold price rose by 0.15% to $1819.07 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) (Q3) | 2.4% | 2.4% | – |

| 21:30 | USD – GDP (QoQ) (Q3) | 2.9% | 2.9% | – |

| 21:30 | USD – Initial Jobless Claims | 211K | 222K | – |

Technical Analysis

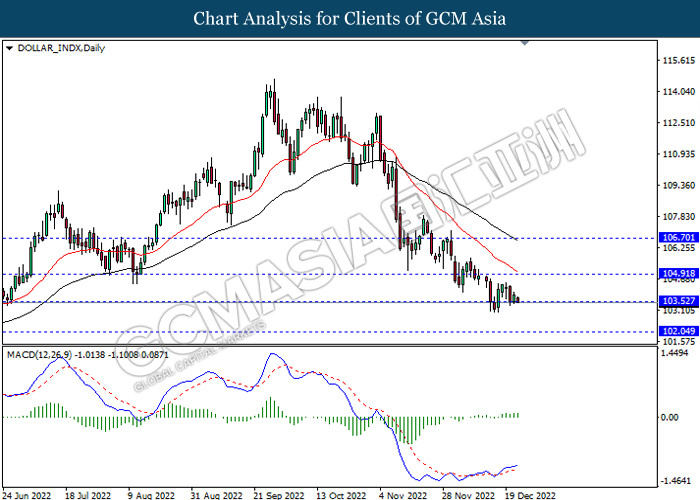

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

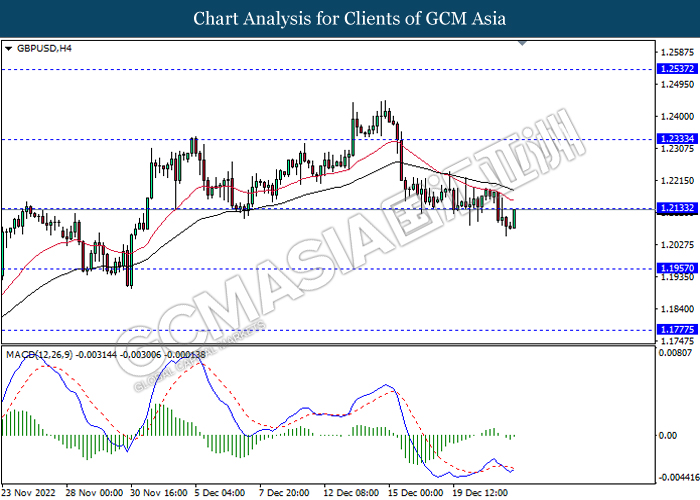

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

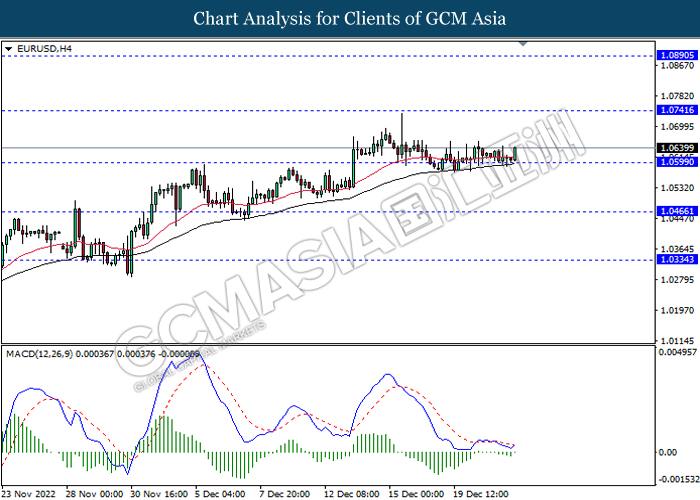

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

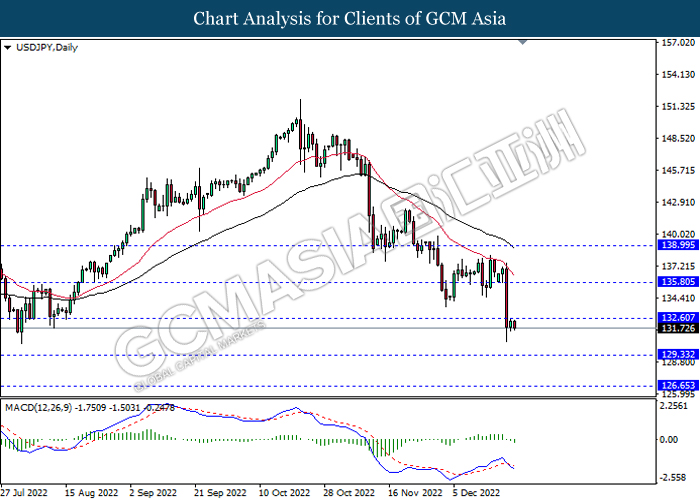

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

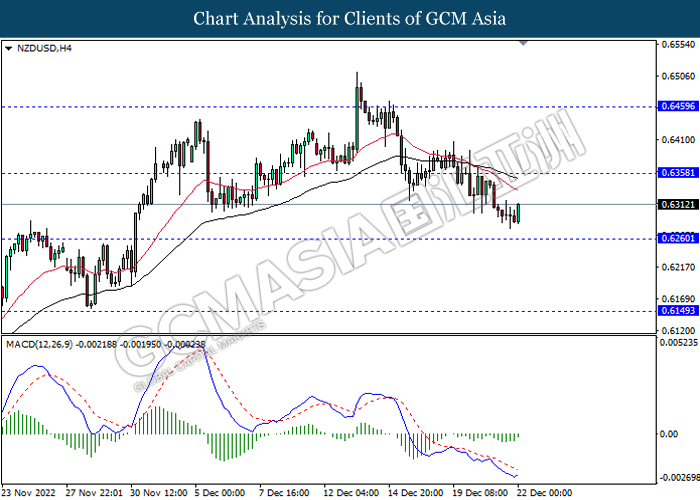

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1833.00, 1855.40

Support level: 1808.55, 1783.50