22 December 2022 Morning Session Analysis

US Dollar revived amid consumer confidence bounced back.

The dollar index, which traded against a basket of six major currencies, regained its luster over the past trading session as a positive economic data showed some recovery on the level of consumer confidence toward the nation’s economy. According to the Conference Board, the US CB Consumer Confidence data bounded sharply from the prior month reading’s 101.4 to 108.3, significantly higher than the consensus forecast at 101.0. The improvement of the consumer confidence was due to consumers’ more favorable view regarding the economy and jobs. With the data also hit the highest level since April 2022, it is also showing that the consumer’s willingness on higher spending will continue in the near-term future, at least the first quarter of 2023 despite the headwinds of inflation and rate hikes plan from the Federal Reserve. Moreover, the retracement of Japanese Yen has boosted the appeal of dollar index, whereby the slump in the Yen market was mainly due to profit taking activity after skyrocketing for more than 5.00%. As of writing, the dollar index rose 0.27% to 104.25.

In the commodities market, crude oil prices up by 2.80% to $78.25 per barrel as EIA reported crude oil inventory draw for the past one week. According to the EIA, US Crude Oil Stock dropped by -5.894M, while the consensus forecast was -1.657M. Besides, gold prices depreciated by -0.19% to $1814.30 per troy ounce amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (YoY) (Q3) | 2.4% | 2.4% | – |

| 21:30 | USD – GDP (QoQ) (Q3) | 2.9% | 2.9% | – |

| 21:30 | USD – Initial Jobless Claims | 211K | 222K | – |

Technical Analysis

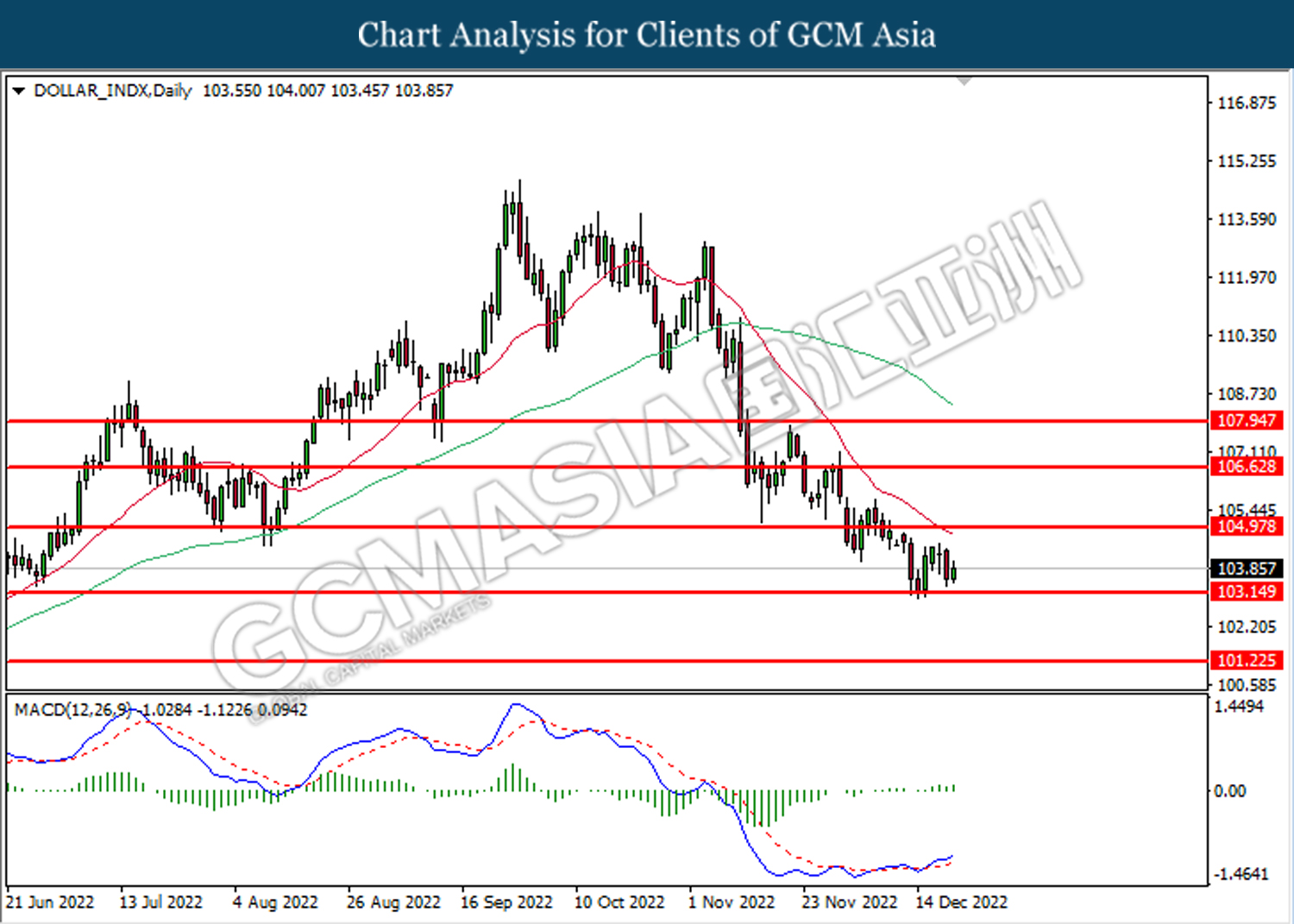

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

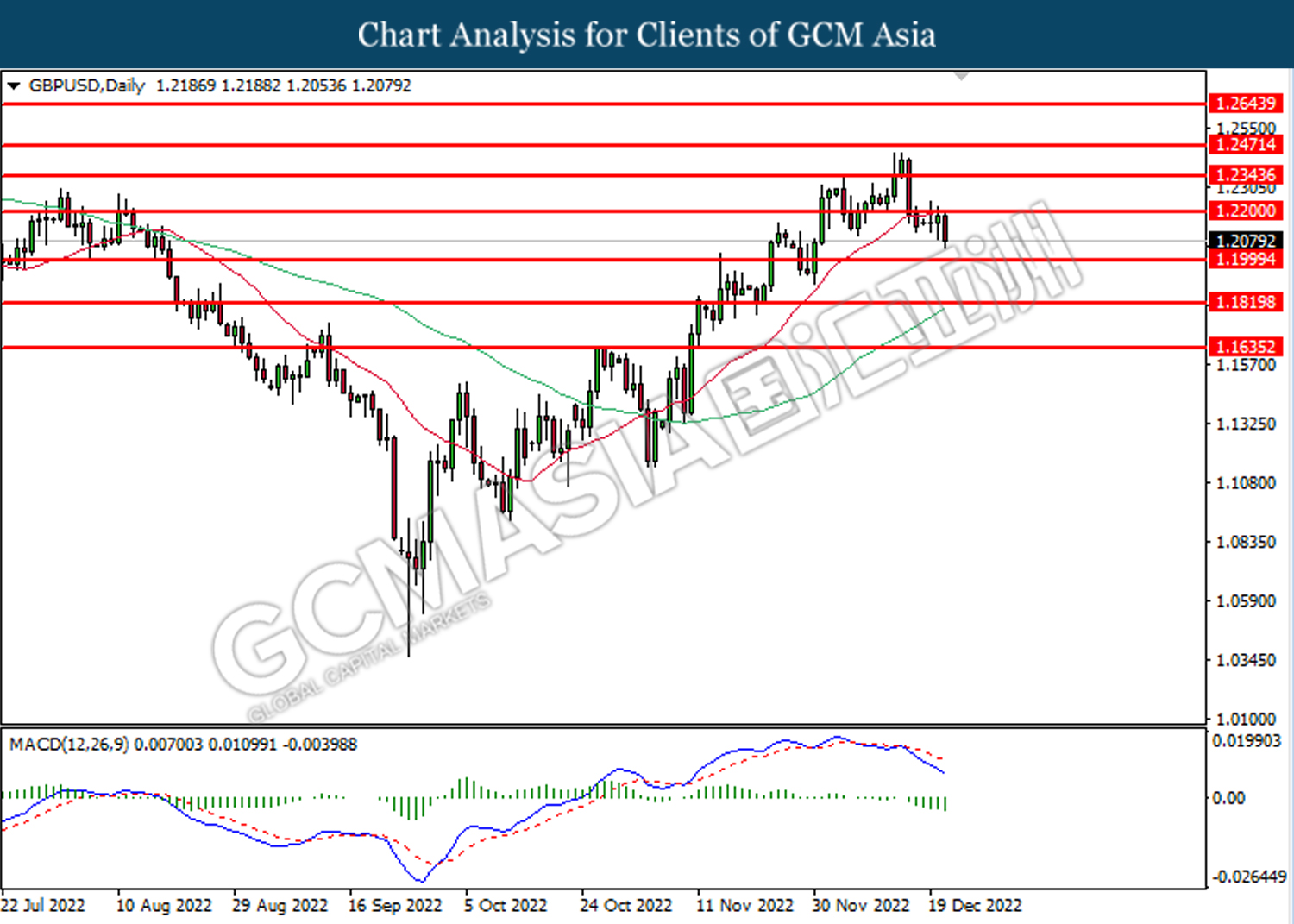

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the previous resistance level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2000.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

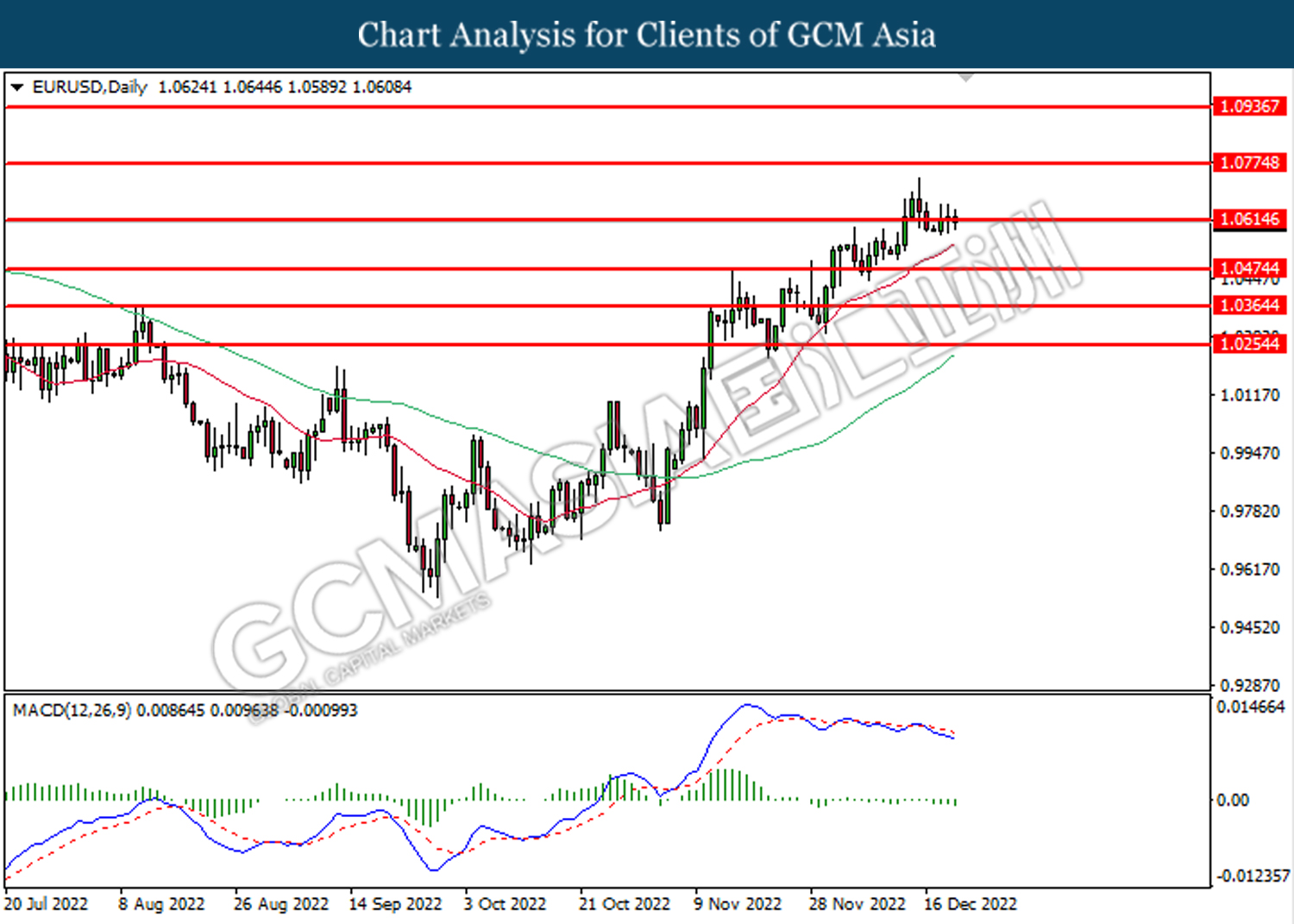

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0615. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

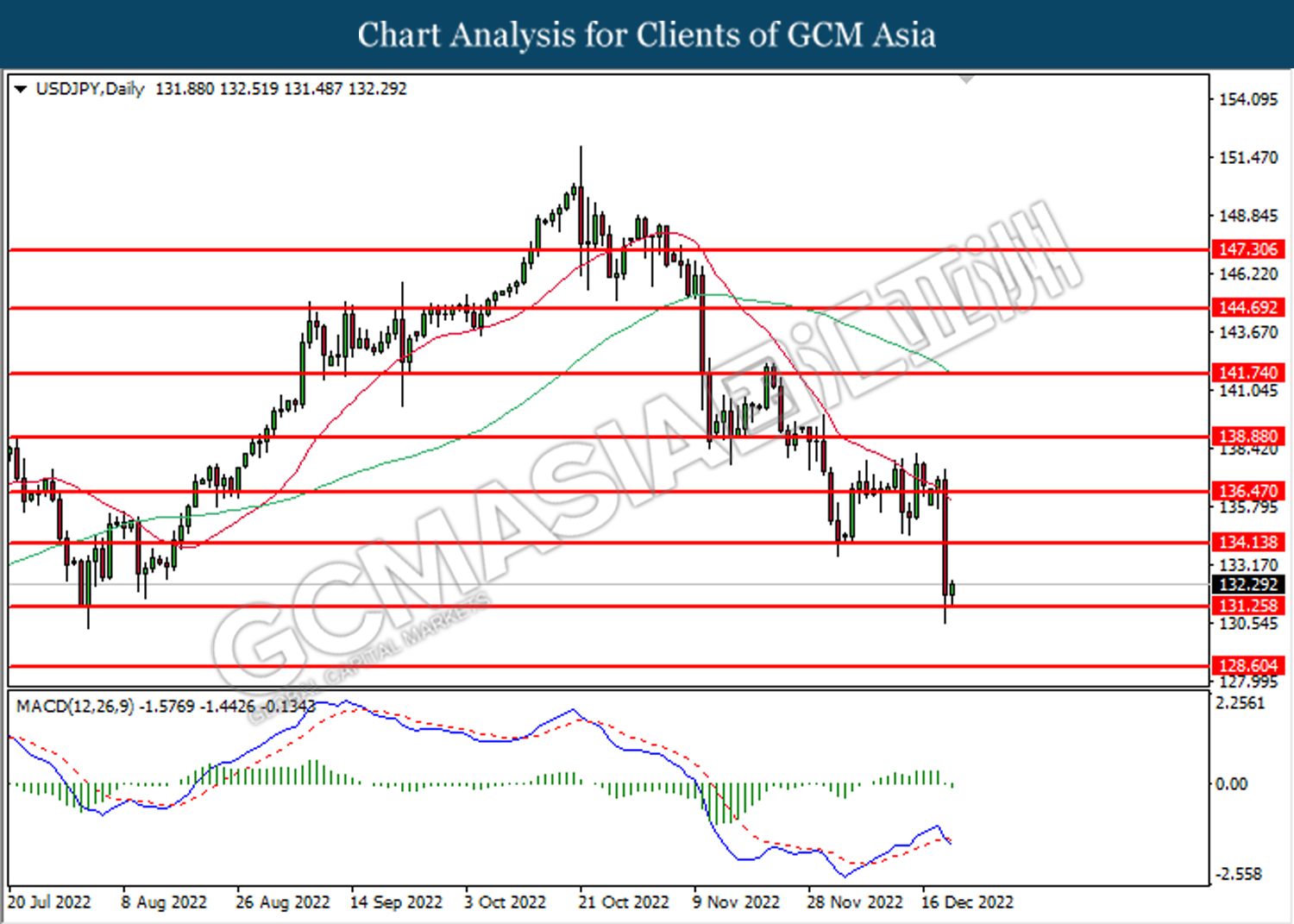

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

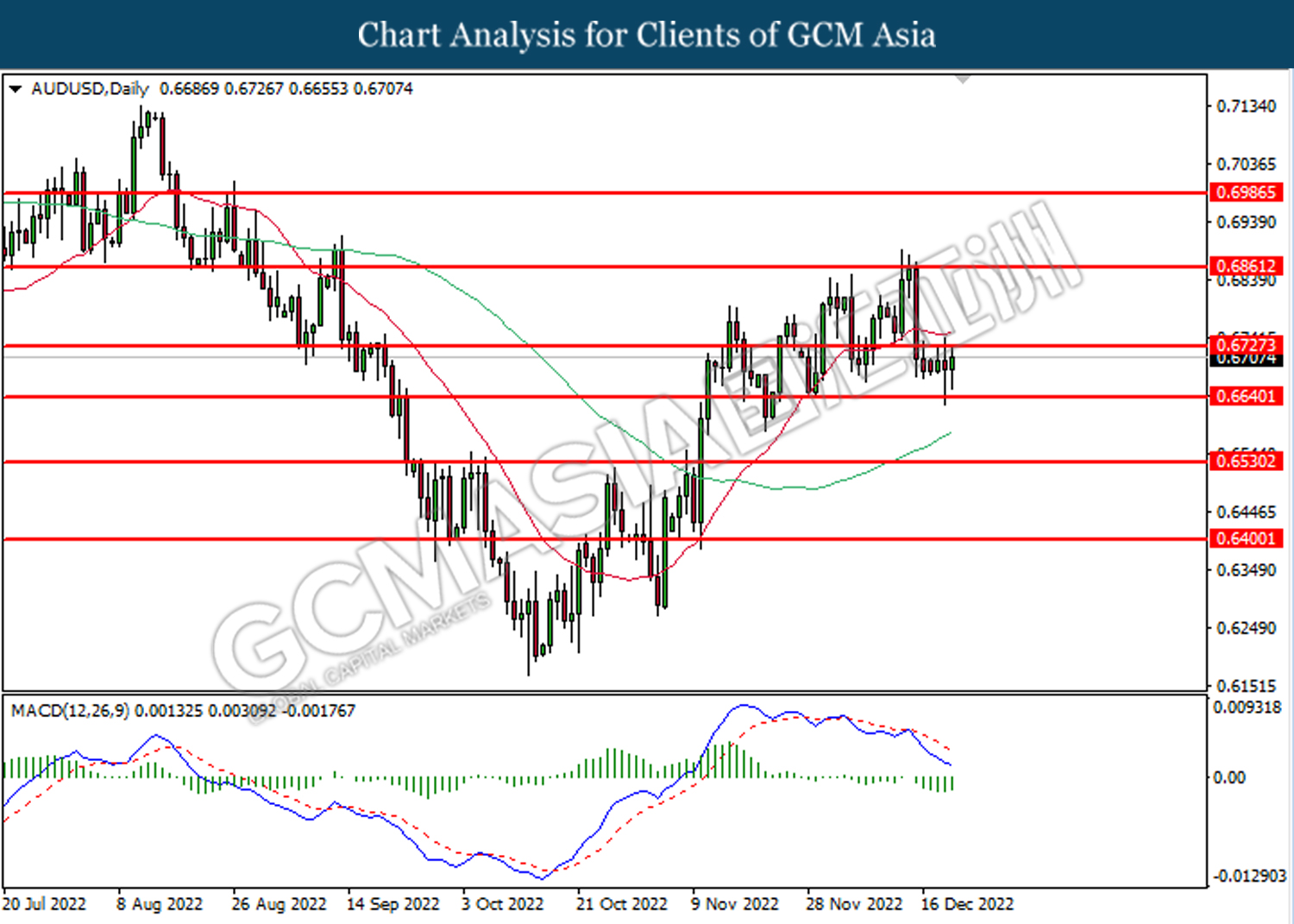

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

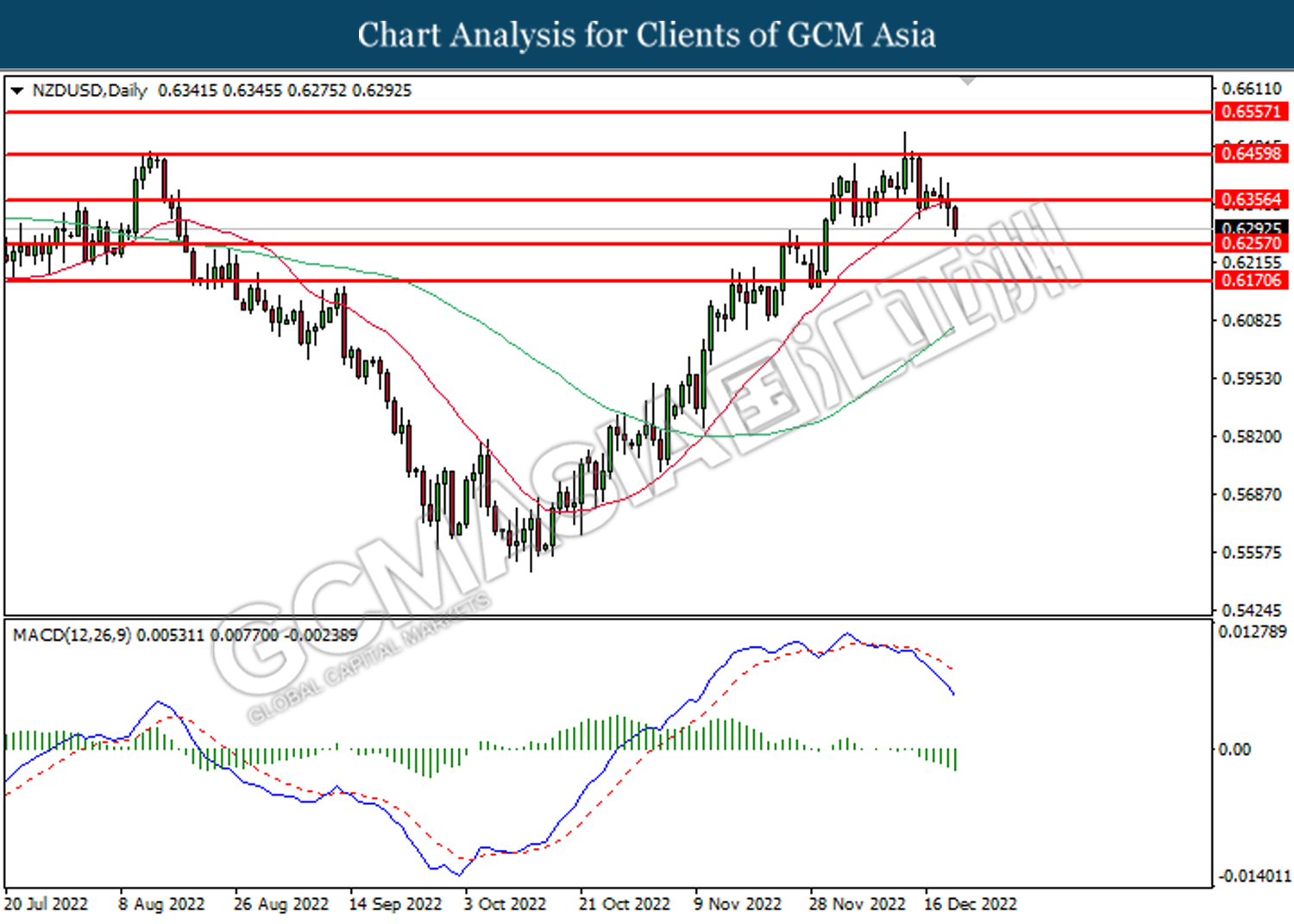

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

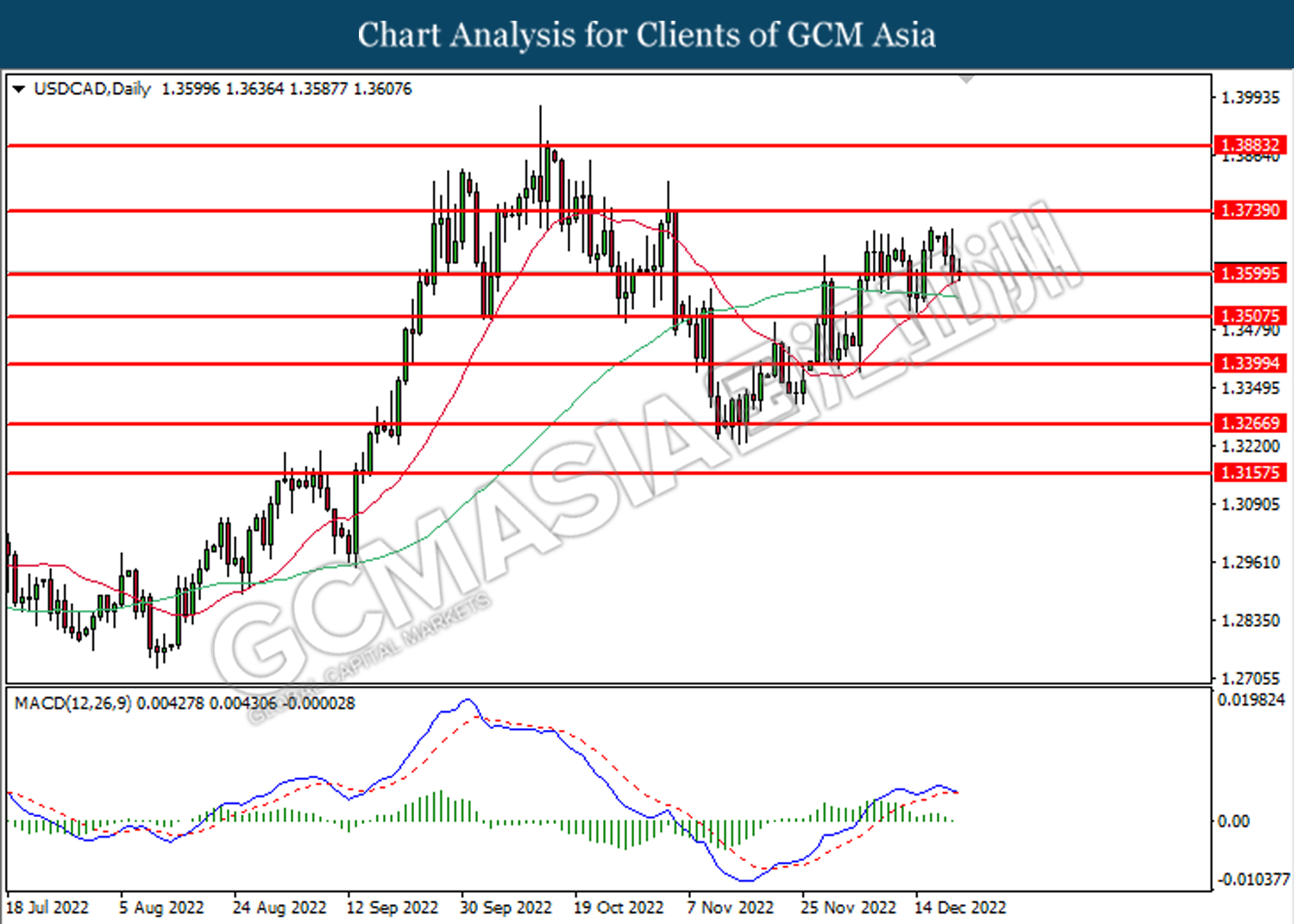

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

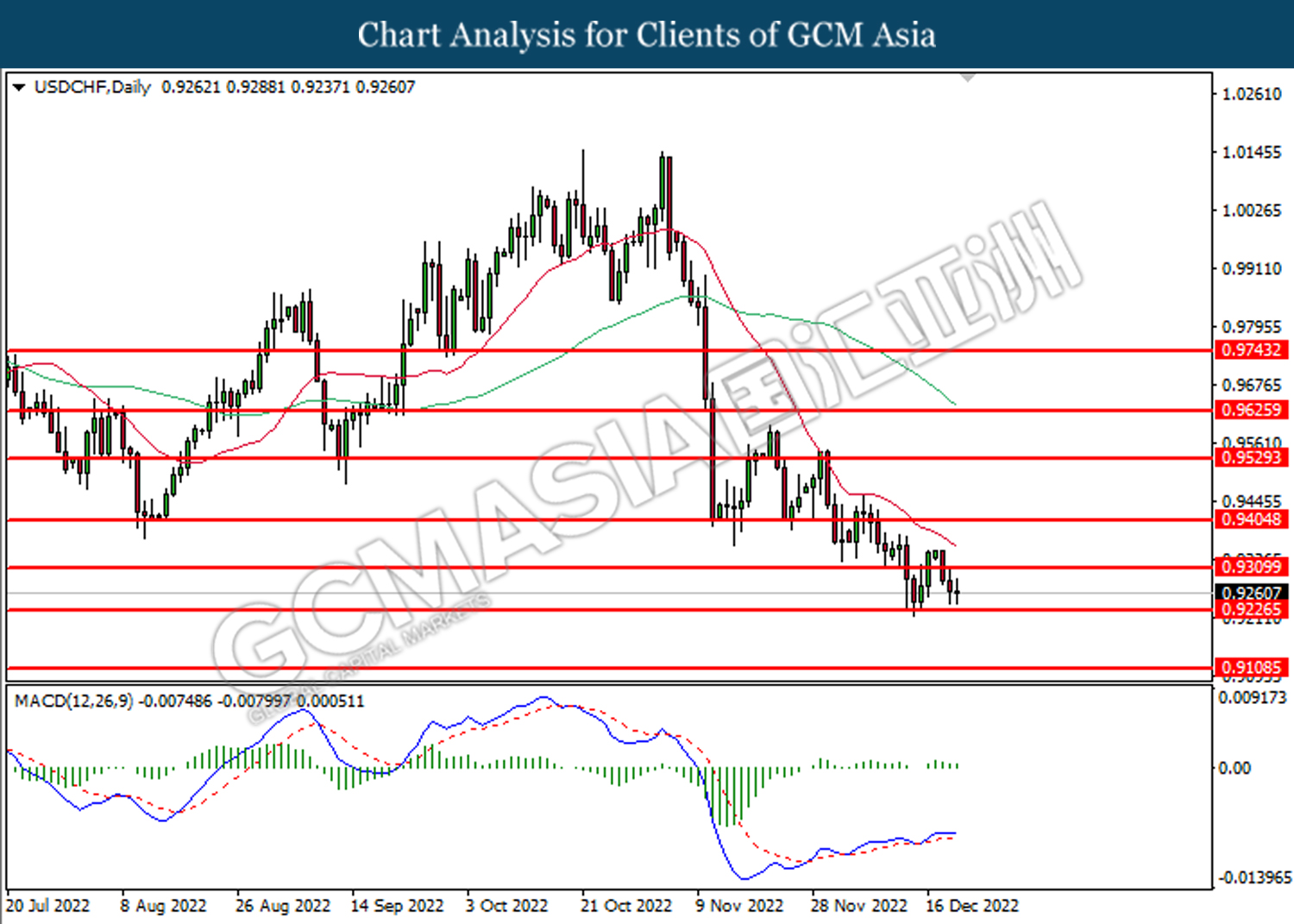

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

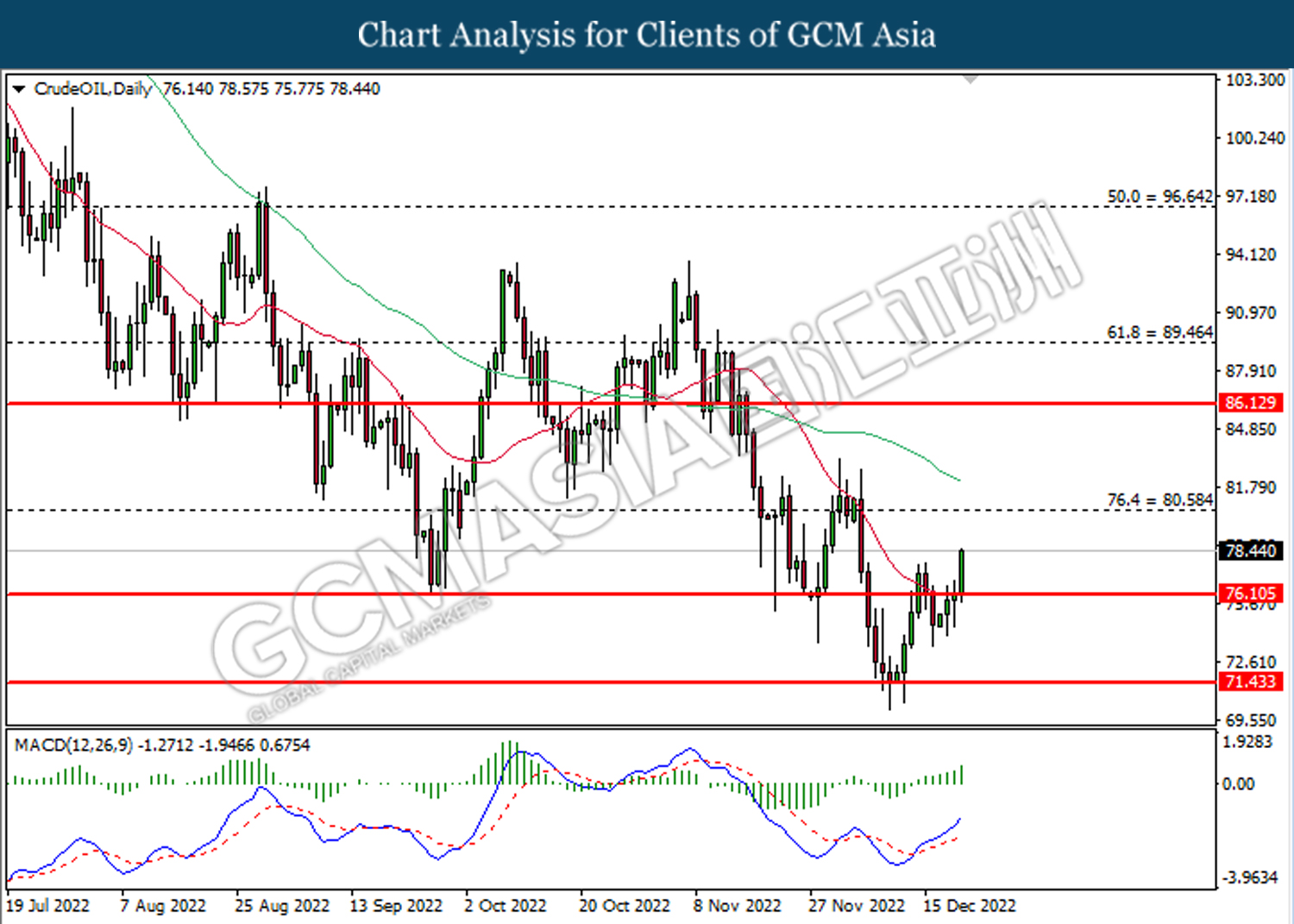

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 80.60.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

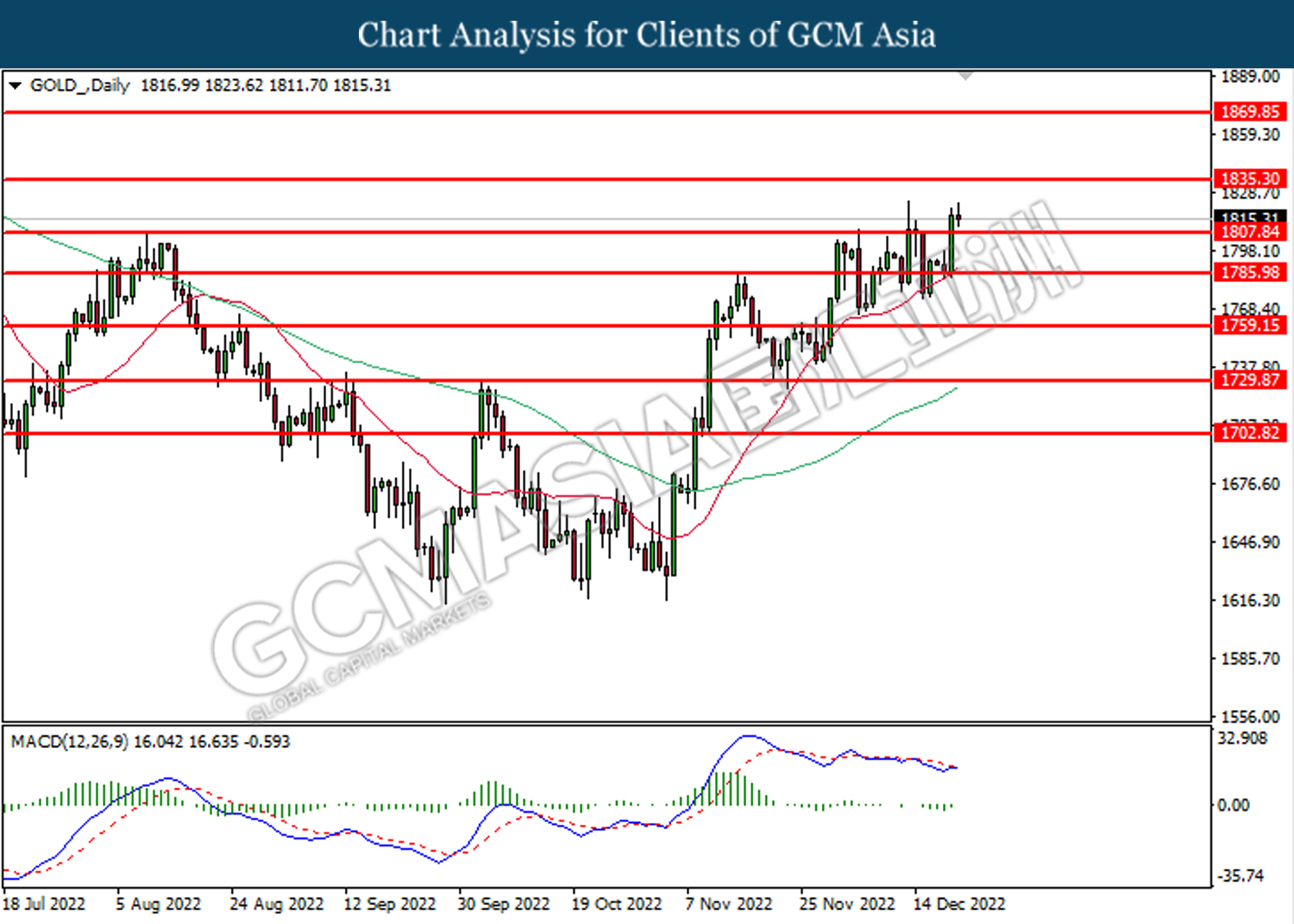

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1807.85. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1835.30.

Resistance level: 1835.30, 1869.85

Support level: 1807.85, 1786.00