23 February 2022 Morning Session Analysis

US-Russia summit may be called off.

Demand for safe-haven asset remains high in the financial market following recent developments with regards to Russia and Ukraine tension. On yesterday, US Secretary Antony Blinken announced that he will not be meeting with Russia Foreign Minister Sergey Lavroy as scheduled. Following the announcement, White House stated that the summit in between both US and Russian president is rather unlikely, given the circumstances and recent events. However, White House declared that they are still open for discussion but it is not the right time as of recent. Previously, Russia President Vladimir Putin as signed a decree to recognize independence of two Ukrainian regions which are controlled by separatist. Following the decree, satellite images showed that Russia has mobilized its troops towards the two regions, sparking concern over an attack towards Ukraine at any point of time. As of writing, the dollar index was up 0.01% to 96.02.

In the commodities market, crude oil price was down by 0.03% to $91.51 per barrel as market participants waits for official inventory data from Energy Information Administration. On the other hand, gold price was traded flat at $1,898.53 a troy ounce while waiting for more signals with regards to Russia-Ukraine tensions.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 GBP Inflation Report Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Jan) | 5.00% | 5.10% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

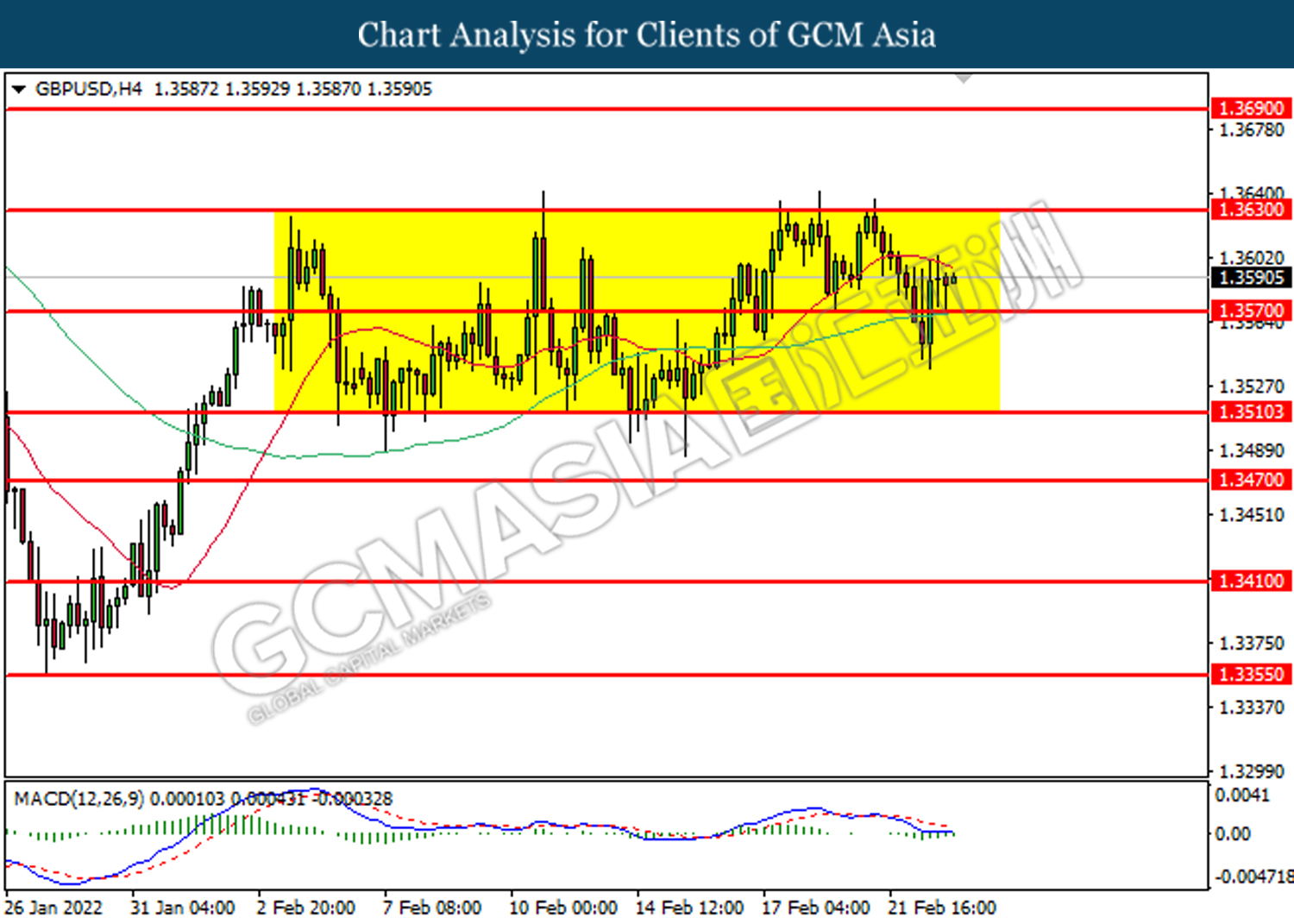

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

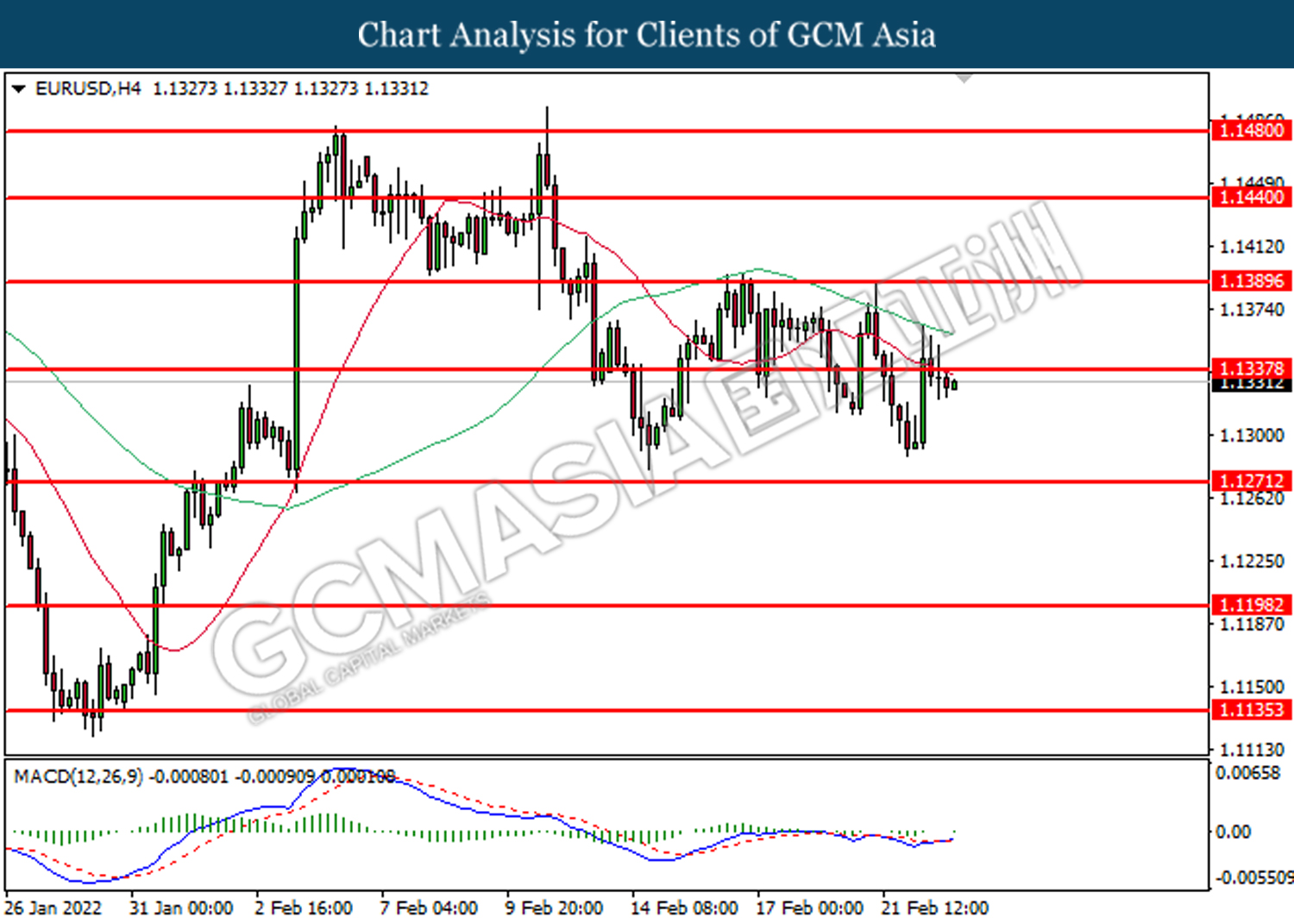

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1270, 1.1200

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which diminished illustrate bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

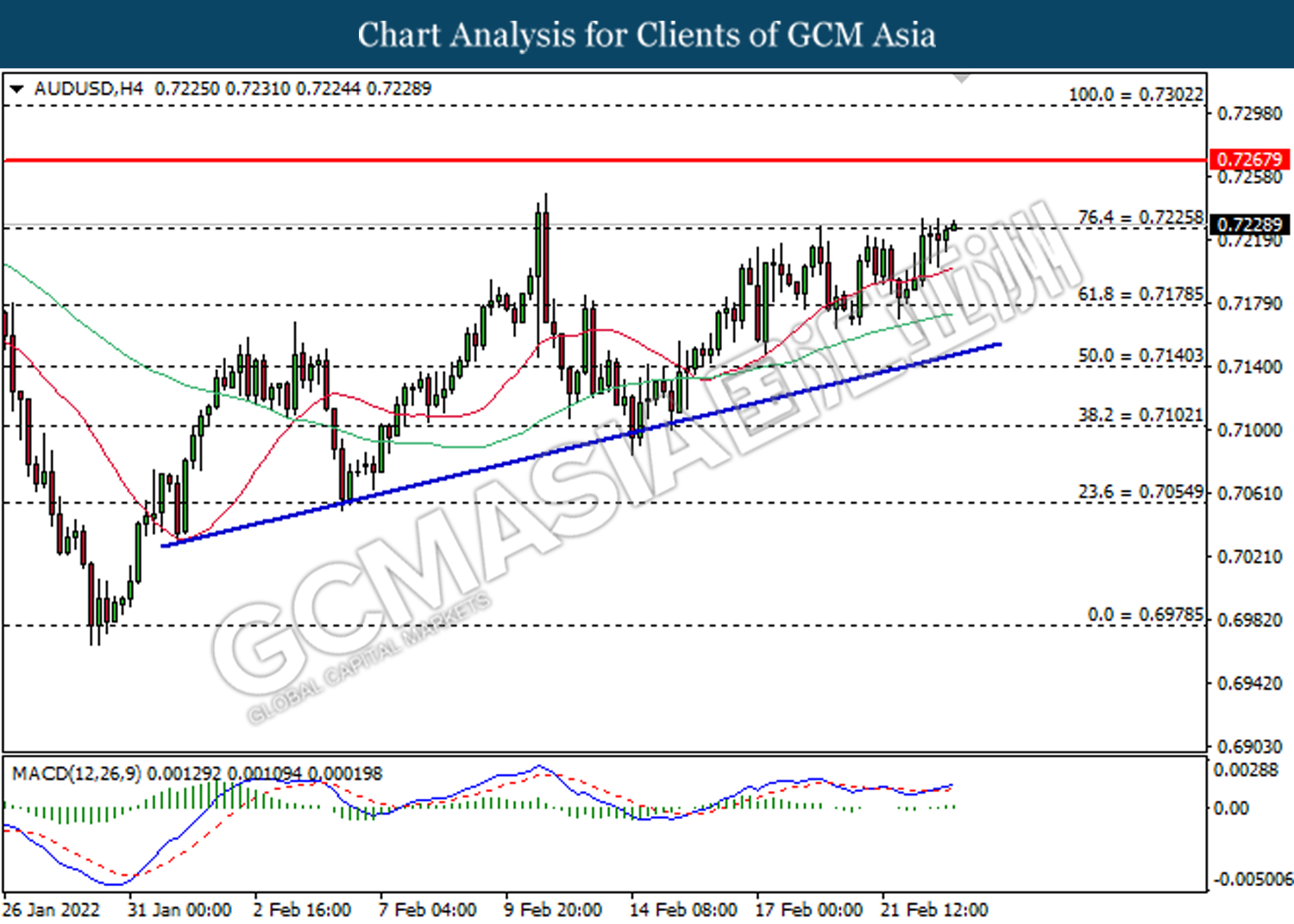

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7225, 0.7270

Support level: 0.7180, 0.7140

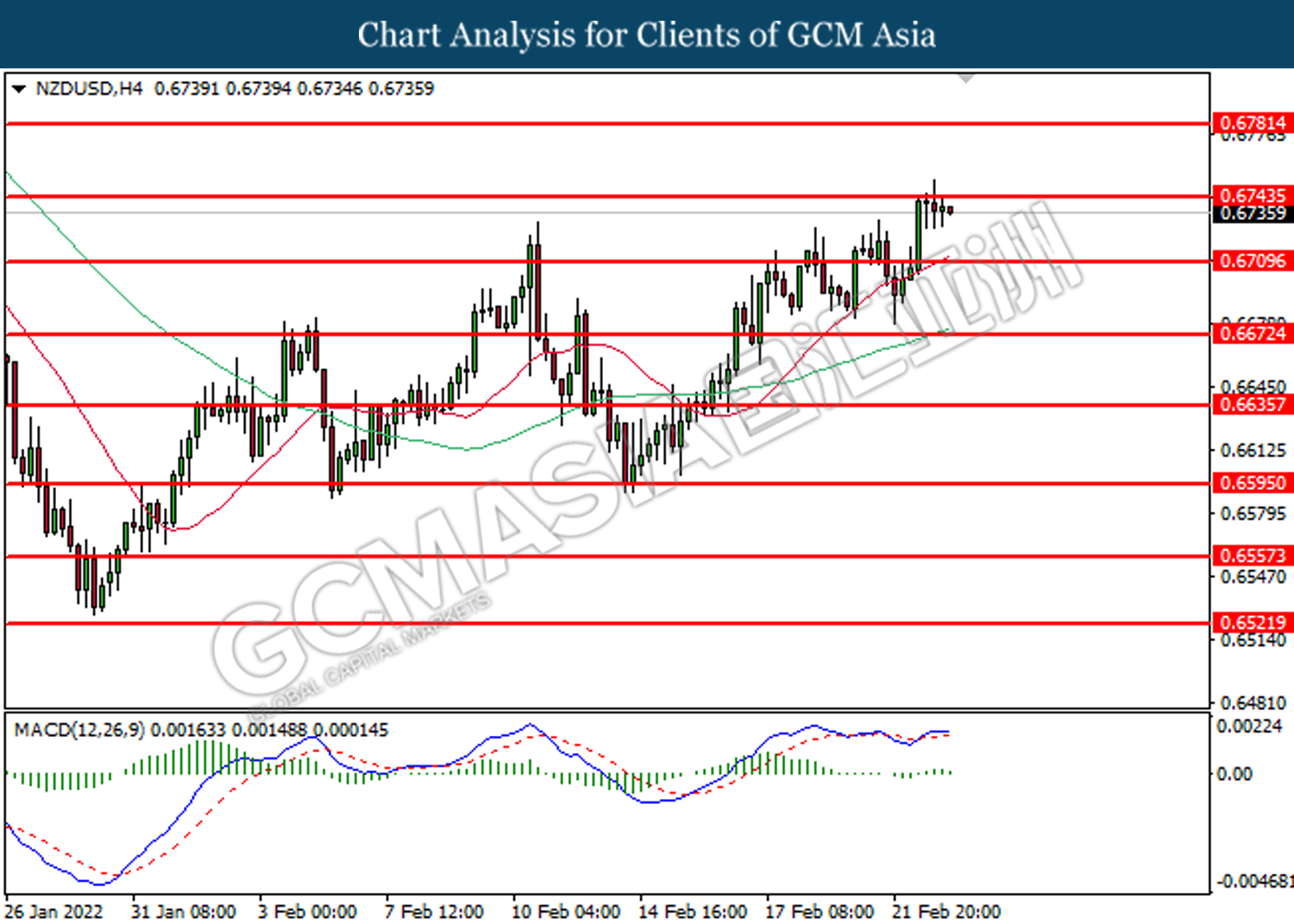

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6745, 0.6780

Support level: 0.6710, 0.6670

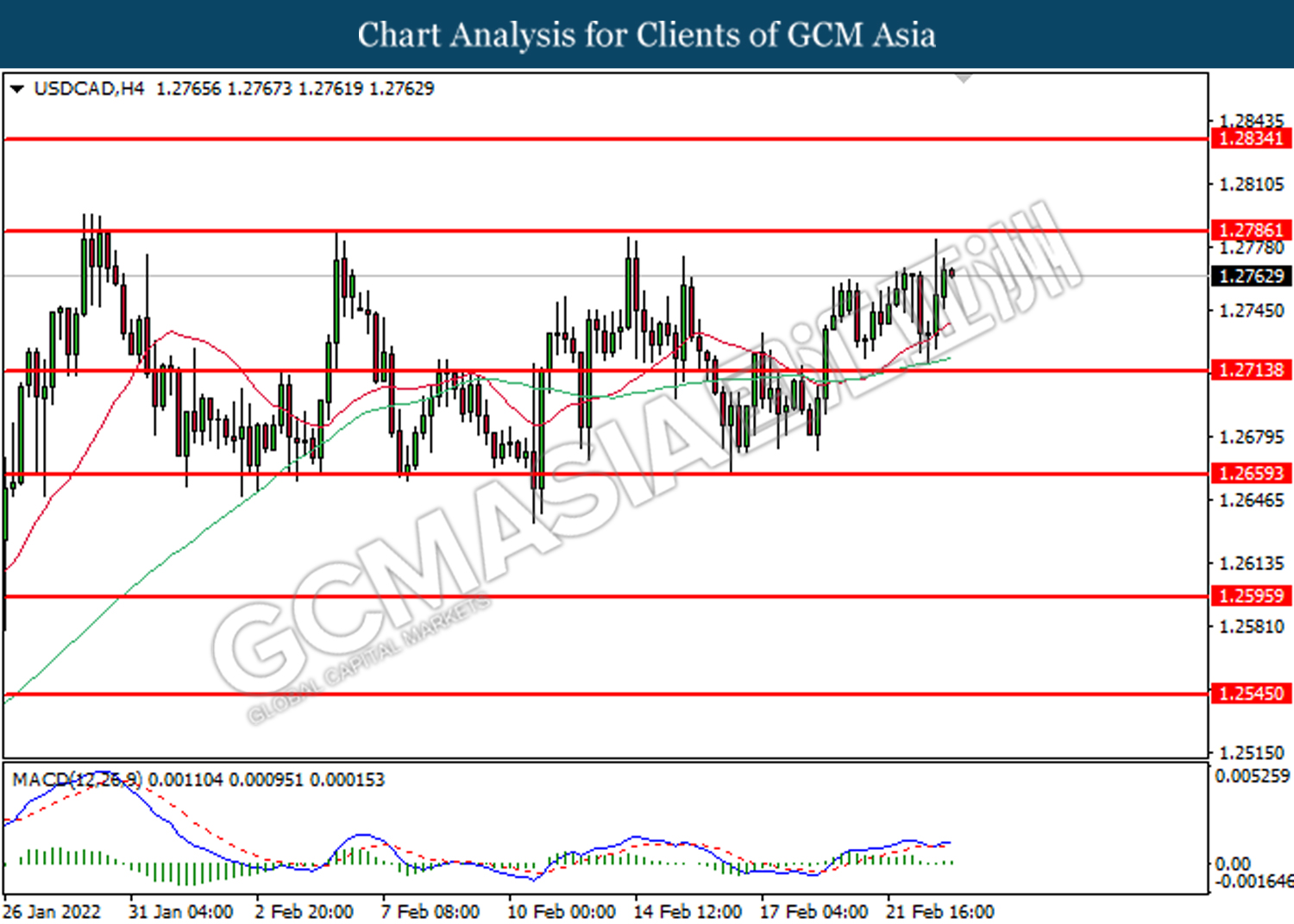

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

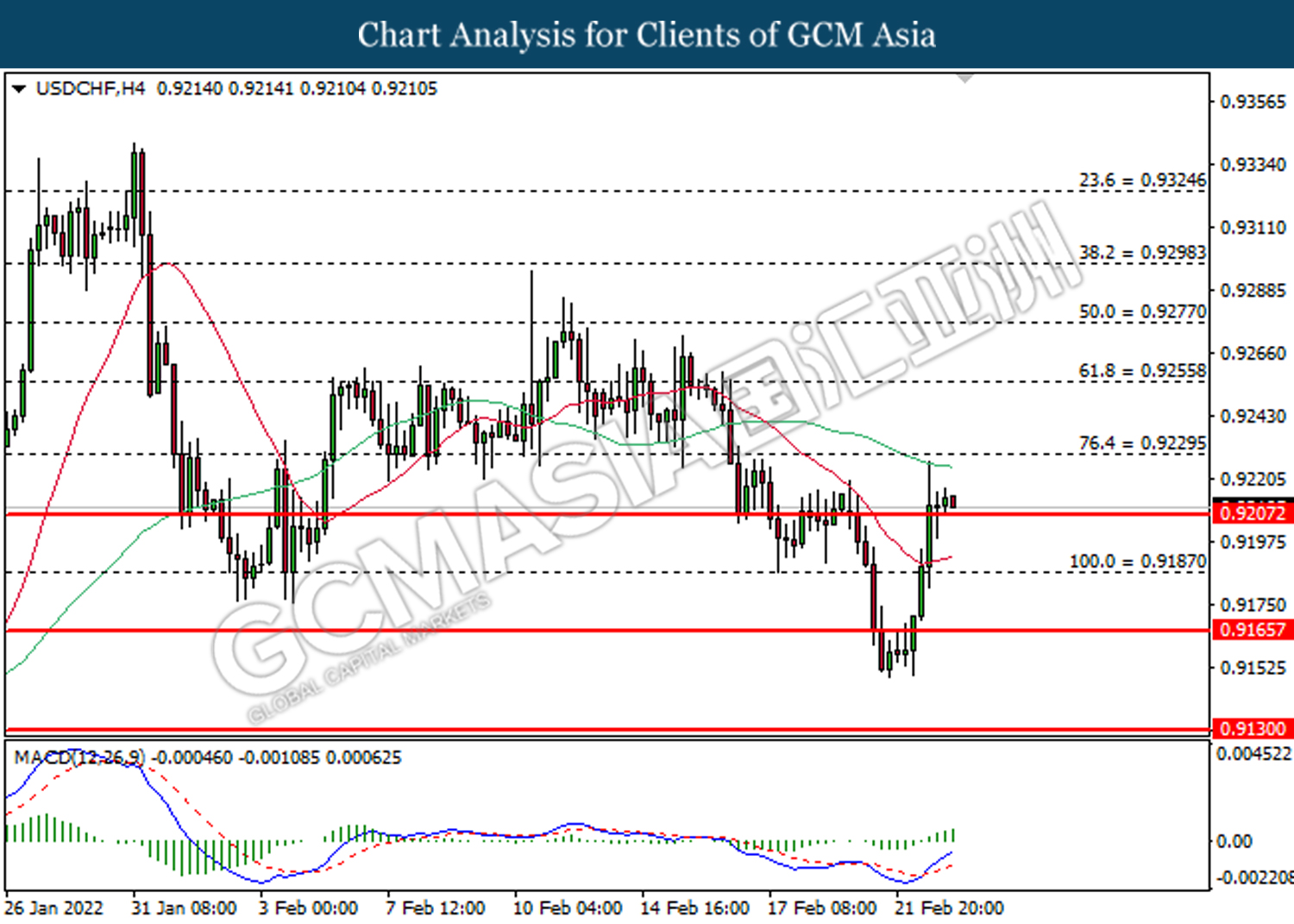

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9230, 0.9255

Support level: 0.9210, 0.9190

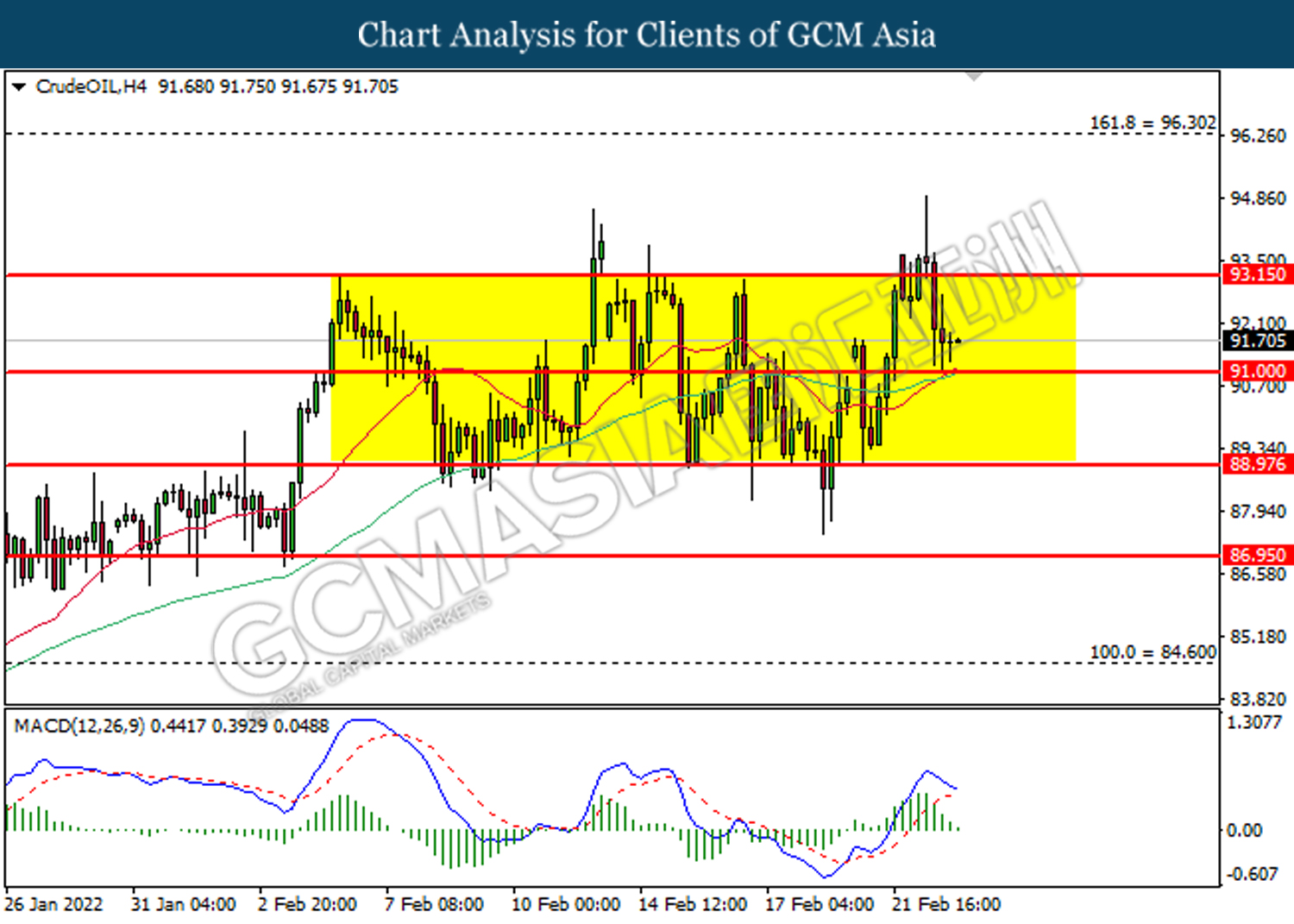

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.00

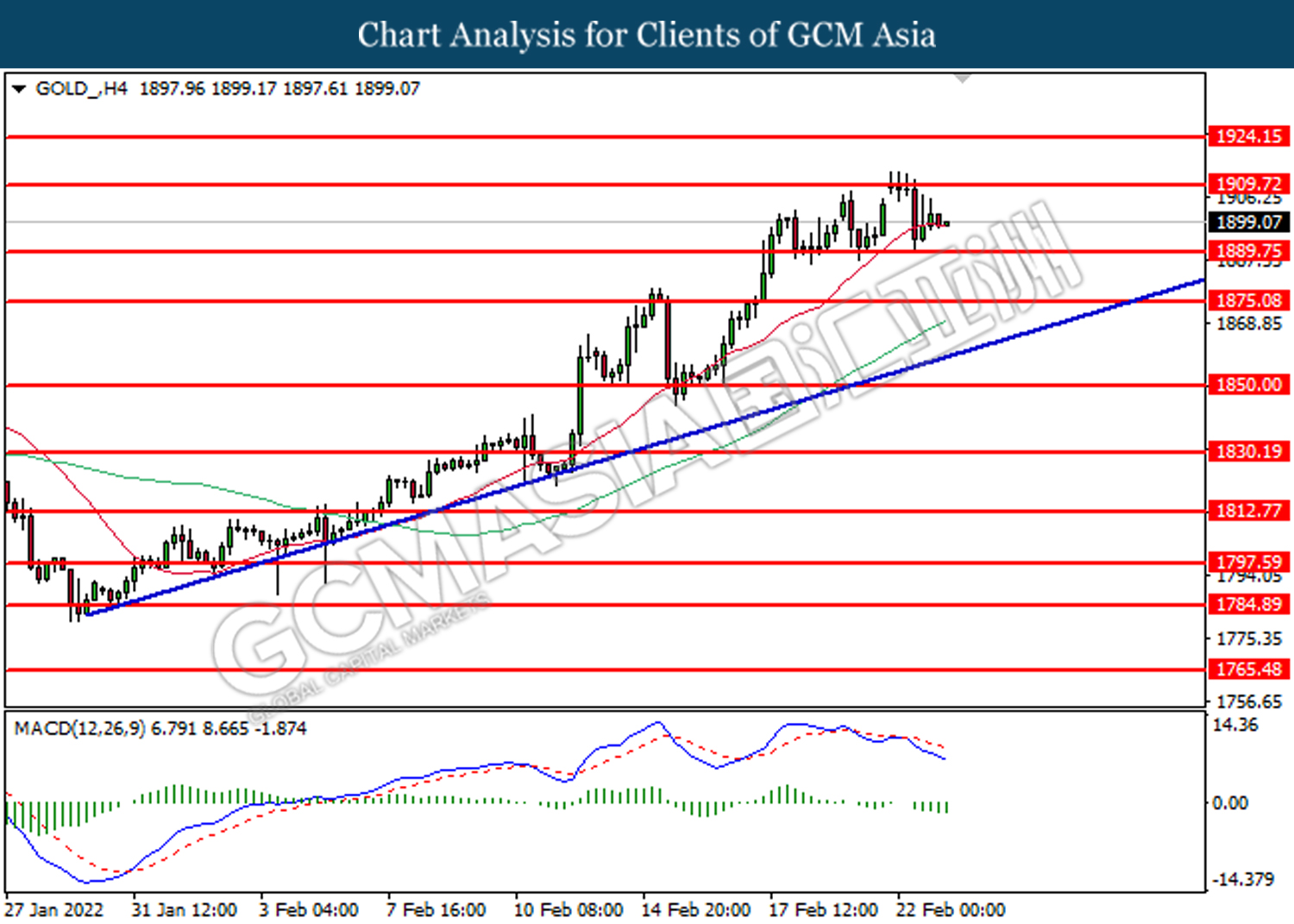

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 1909.70, 1924.15

Support level: 1889.75, 1875.10