23 February 2023 Morning Session Analysis

US Dollar spiked after FOMC meeting minutes released.

The Dollar Index which traded against a basket of six major currencies rose significantly on Thursday following the Fed officials signaled further monetary policy tightening. Earlier of the day, Fed has unleashed its meeting minutes from the Fed’s Jan 31 to Feb 1 meeting. Fed approved a-quarter-of-percentage rate hike during the last meeting, whereby bringing its interest rate to 4.5% – 4.75%, due to the Federal Reserve Chairman Jerome Powell acknowledged that the inflationary risk was easing. However, some of the members were sticking to their guns as well as suggesting the central bank to hike further rates, and the reason drive them to do this is the inflation rate still well above the Fed’s 2% target. With that, the threat of inflation still remained. Since that meeting, Presidents James Bullard of St. Louis and Loretta Mester of Cleveland have said they were among the group that wanted the more aggressive move. On the other hand, the essential inflationary data, such as CPI and PPI were higher than market expectations, which adding the likelihood of aggressive rate hike implementation by Fed. As of writing, the Dollar Index raised by 0.34% to 104.46.

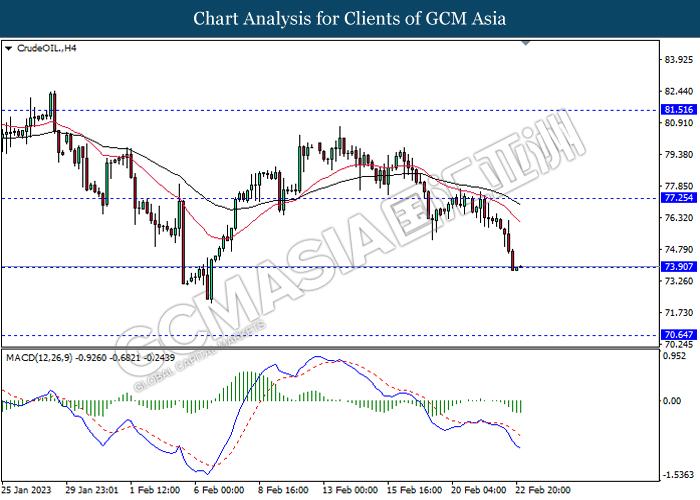

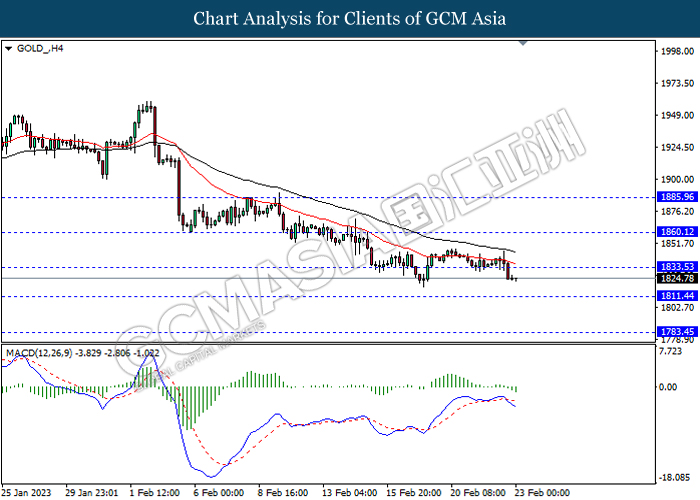

In the commodity market, the crude oil price rose by 0.12% to $73.94 per barrel as of writing after a sharp decline throughout the overnight trading session over the fresh fears against aggressive rate hike. In addition, the gold price depreciated by 0.03% to $1824.86 per troy ounce as of writing amid the appreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Jan) | 8.5% | 8.6% | – |

| 21:30 | USD – GDP (QoQ) (Q4) | 2.9% | 2.9% | – |

| 21:30 | USD – Initial Jobless Claims | 194K | 200K | – |

Technical Analysis

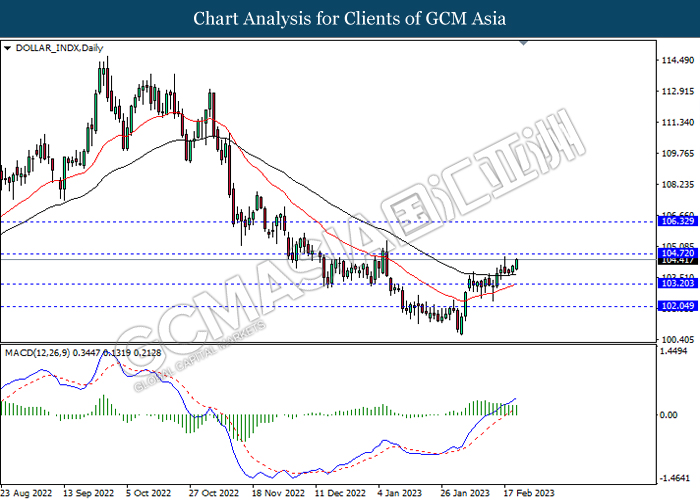

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

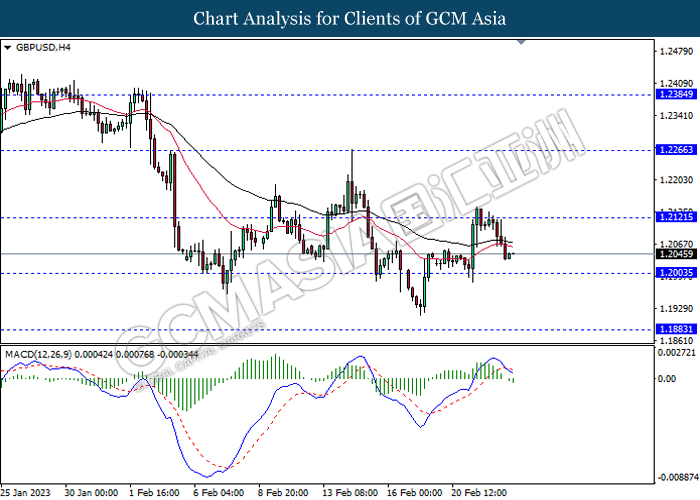

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

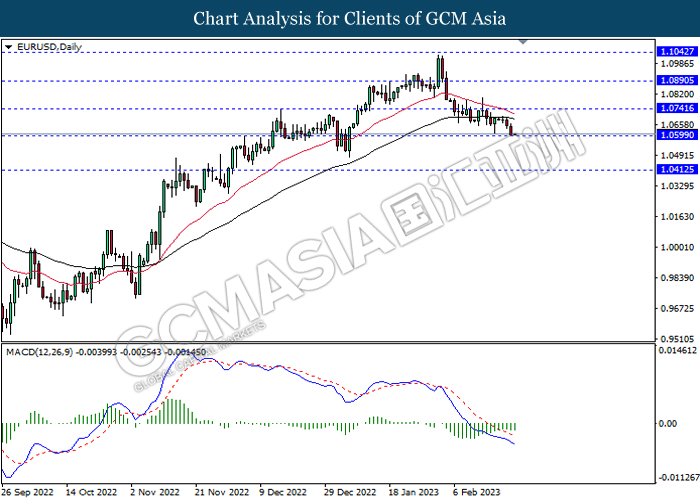

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

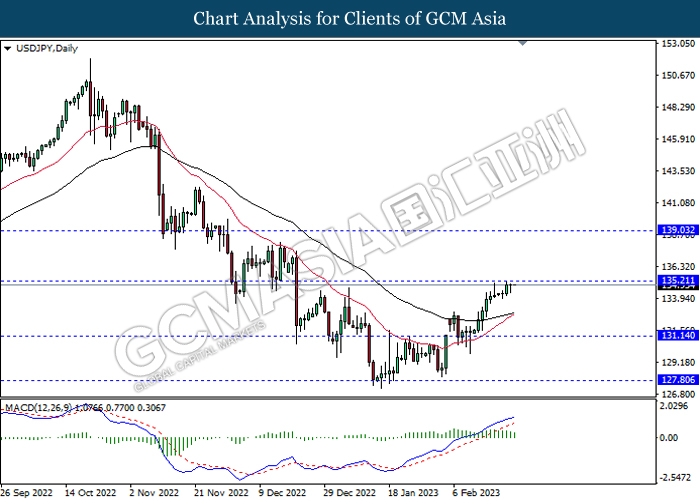

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

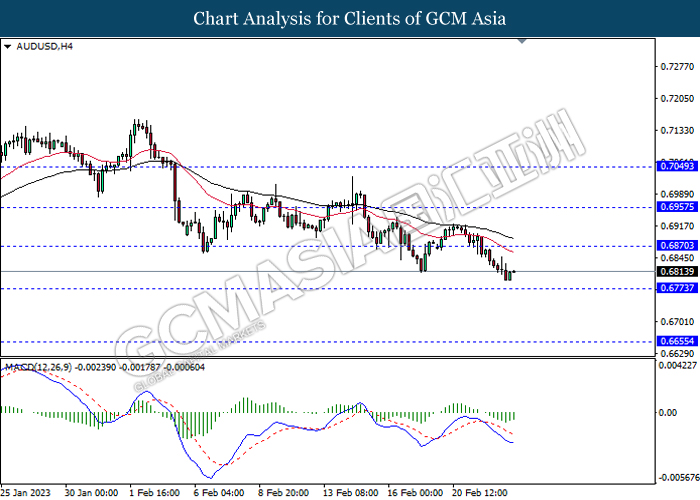

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6870, 0.6955

Support level: 0.6775, 0.6655

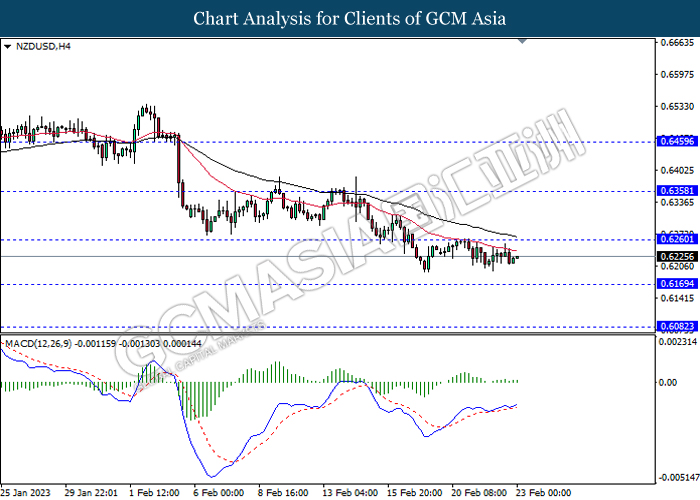

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

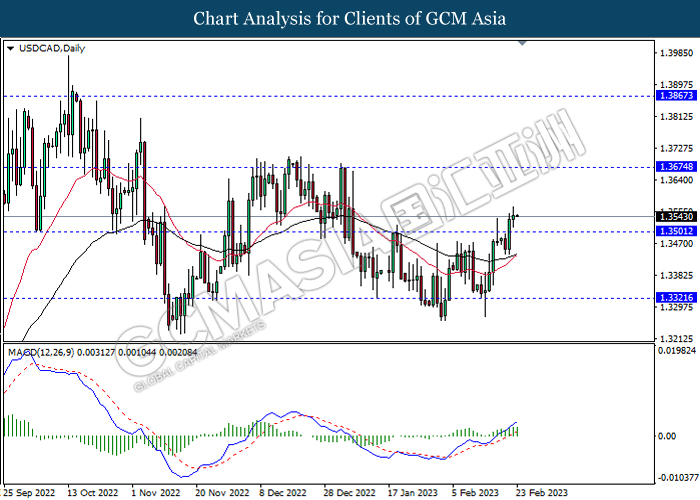

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3320

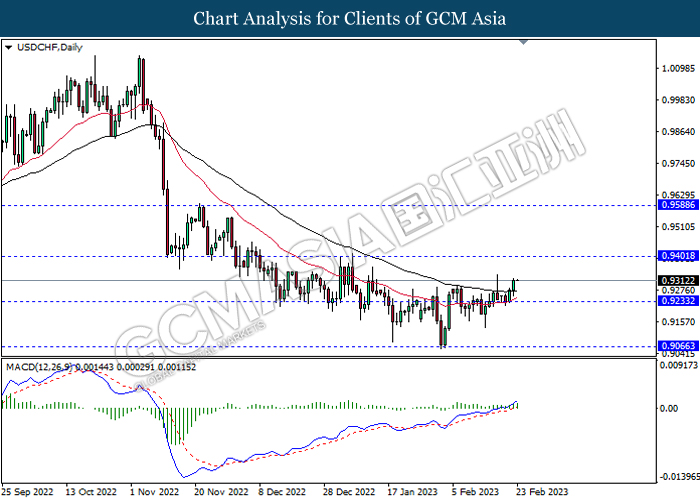

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be trade higher as technical correction.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1833.55, 1860.10

Support level: 1811.45, 1783.45