23 March 2022 Afternoon Session Analysis

Pound surged amid hopes upon hike rate.

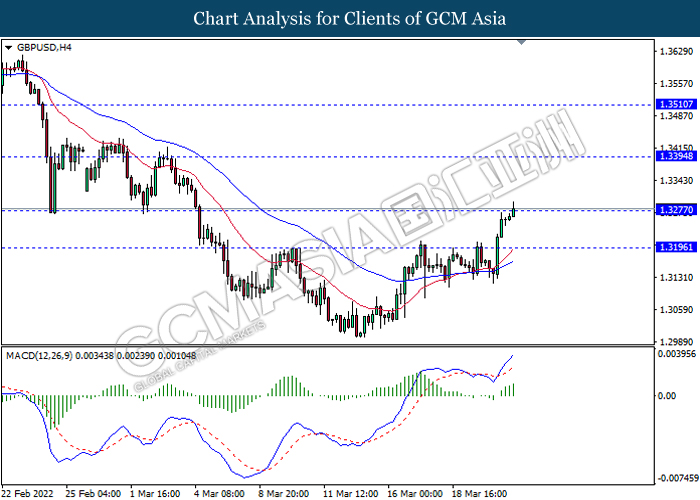

Pound started rebounding on Tuesday following sparking hopes of Bank of England rate hike upon inflation risk. According to Reuters, the Pound could mount a further recovery against US Dollar on Wednesday, and is poised for wild swings as data showing inflation remains red-hot could renew bets on Bank of England rate hikes. Commerzbank also appeared a speak that Bank of England would likely to hike rates by 50 basis points in March, but it signaled a modest tightening of interest rates over the coming months. The spike of commodities price such as crude oil would causing the import cost of companies to soar, indirectly leading to the hike inflation. The implementation of tightening monetary policy would likely to diminish money circulation in England market and leading to appreciation of Pound. It dialed up the market optimism on Pound and prompting investors to purchase Pound, spurring further bullish momentum on the pair. Investors should continue to scrutinize the latest updates with regards of Bank of England upon hike rate decision to gauge the likelihood movement of Pound. As of writing, GBPUSD appreciated by 0.18% to 1.3287.

In commodities market, crude oil price appreciated by 1.60% to $111.00 per barrel as of writing over the backdrop of EU considering to ban Russian oil. Besides, gold appreciated by 0.15% to $1924.40 per troy ounces as of writing as the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE Gov Bailey Speaks

20:00 USD Fed Chair Powell Speaks

20:30 GBP Annual Budget Release

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Feb) | 5.50% | 5.90% | – |

| 22:00 | USD – New Home Sales (Feb) | 801K | 813K | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.345M | – | – |

Technical Analysis

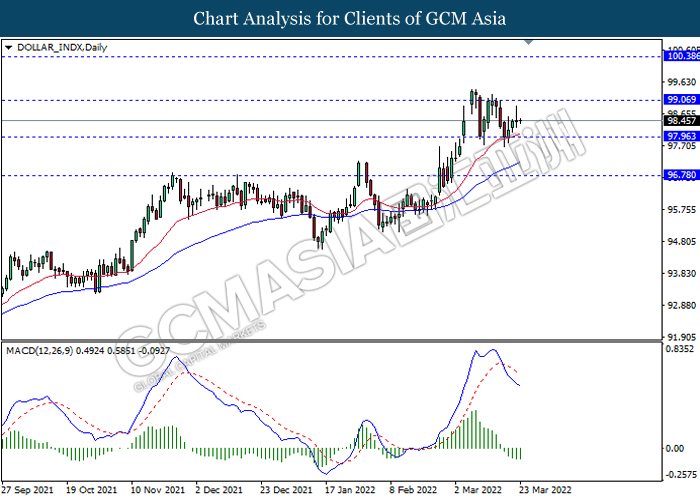

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 99.05, 100.40

Support level: 97.95, 96.80

GBPUSD, H4: GBPUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3395, 1.3510

Support level: 1.3275, 1.3195

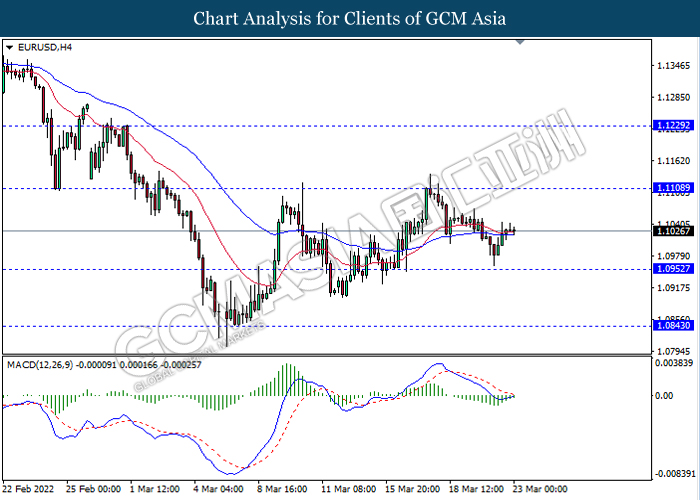

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.1110, 1.1230

Support level: 1.0950, 1.0845

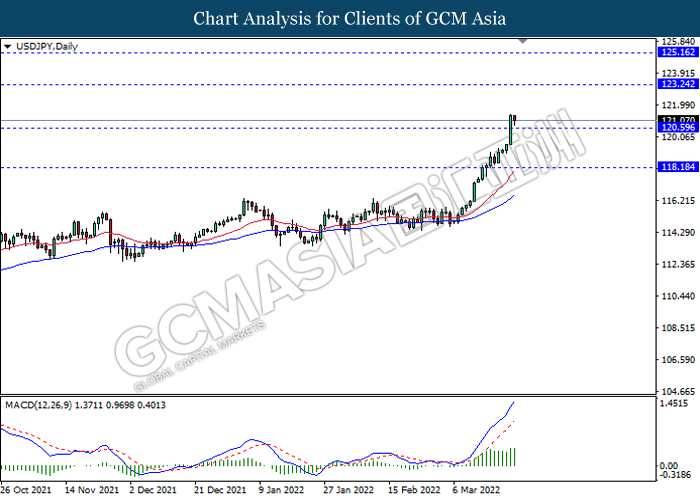

USDJPY, Daily: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.25, 125.15

Support level: 120.60, 118.20

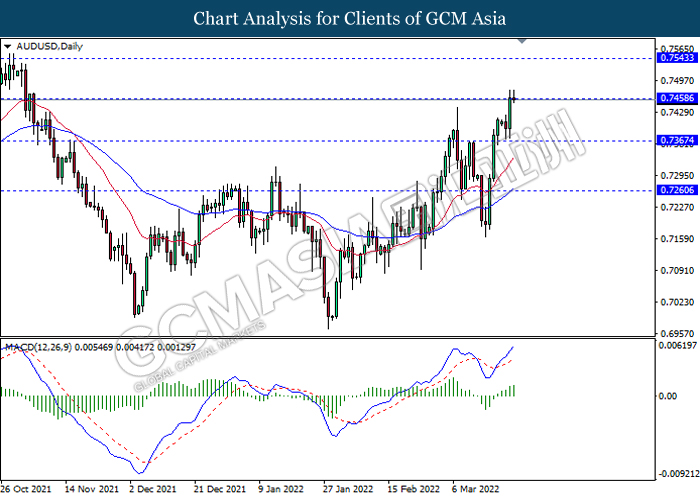

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7460, 0.7545

Support level: 0.7365, 0.7260

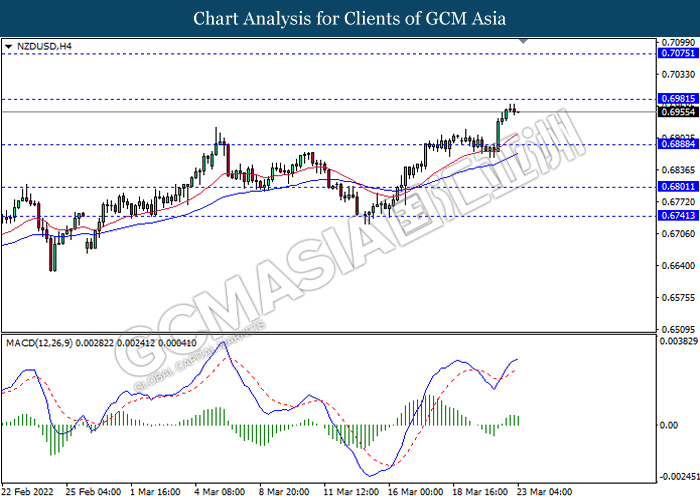

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

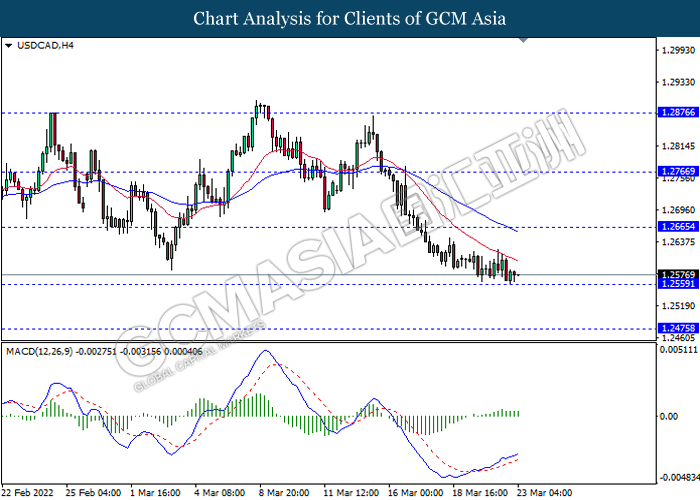

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2665, 1.2765

Support level: 1.2560, 1.2475

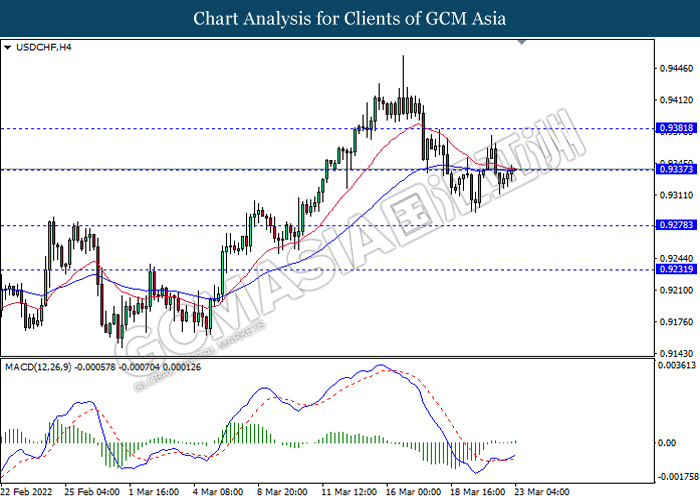

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9335, 0.9380

Support level: 0.9280, 0.9230

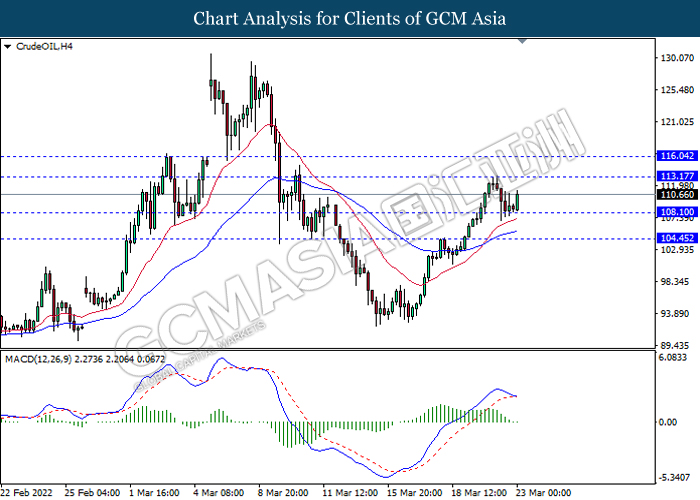

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 113.15, 116.05

Support level: 108.10, 104.45

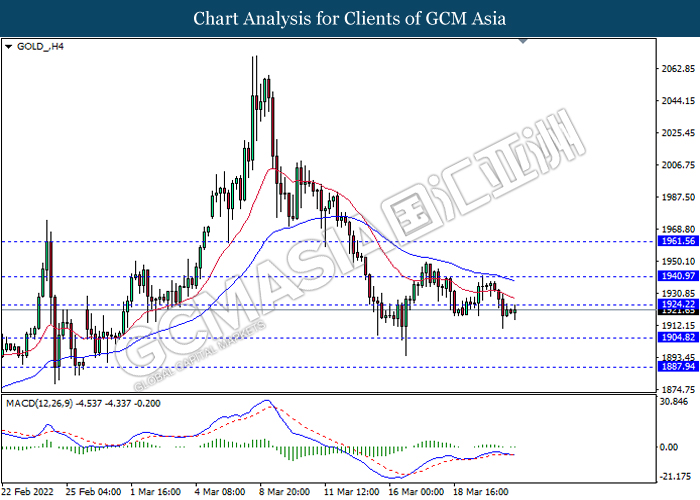

GOLD_, H4: Gold price was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1924.20, 1940.95

Support level: 1904.80, 1887.95