23 March 2022 Morning Session Analysis

US Dollar slumped as risk-on sentiment lingered in market.

The Dollar Index which traded against a basket of six major currencies retreated from its higher level as profit taking following market participants had digested the hawkish tone from US Federal Reserve Chair Jerome Powell. In fact, the rise in US equities market had also insinuated risk-on sentiment in the global financial market, which prompting investors to shift their portfolio toward riskier asset such as Pound Sterling. The banking sector in United States rebounded significantly as investors speculated the rate hike expectation from Fed as well as the economic recovery would likely to enhance the prospect for the banking sector. Besides, the retracement of oil price yesterday had sparked positive prospect toward the economic momentum in future, which spurring further bearish momentum on the safe-haven US Dollar. As of writing, the Dollar Index depreciated by 0.08% to 98.42.

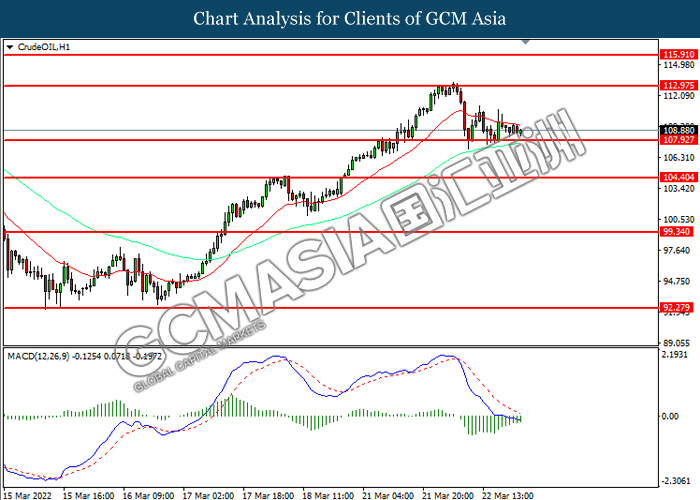

In the commodities market, the crude oil price depreciated by 0.04% to $110.75 per barrel as of writing following the European Union’s foreign ministers unable to reach consensus with regards of whether to impose sanctions on Russia’s energy sector over its invasion of Ukraine. On the other hand, the gold price slumped 0.01% to $1921.40 pre troy ounces as of writing amid risk-on sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE Gov Bailey Speaks

20:00 USD Fed Chair Powell Speaks

20:30 GBP Annual Budget Release

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Feb) | 5.50% | 5.90% | – |

| 22:00 | USD – New Home Sales (Feb) | 801K | 813K | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.345M | – | – |

Technical Analysis

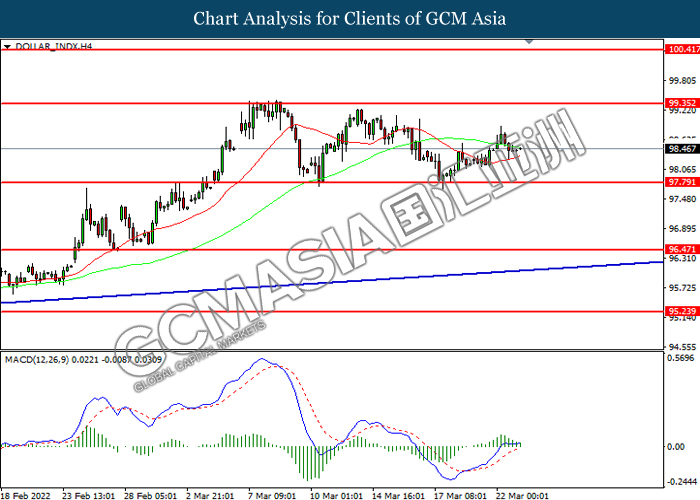

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

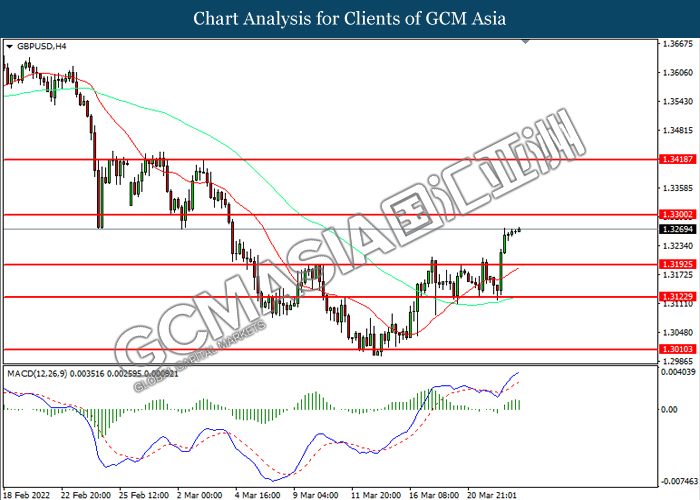

GBPUSD, H4: GBPUSD was traded higher while currently testing resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3300, 1.3420

Support level: 1.3195, 1.3125

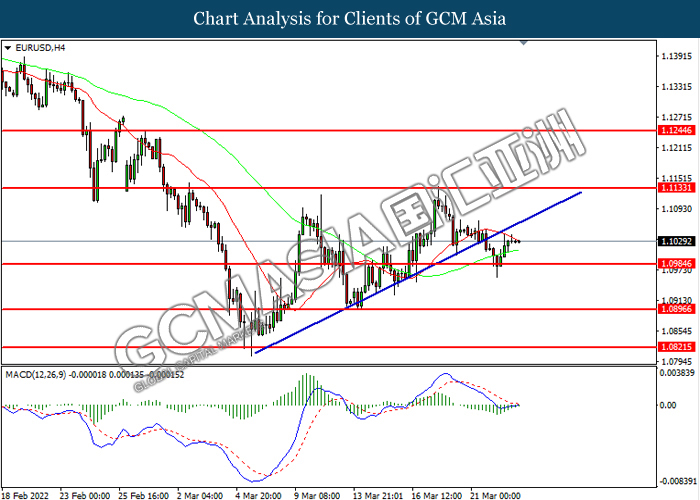

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

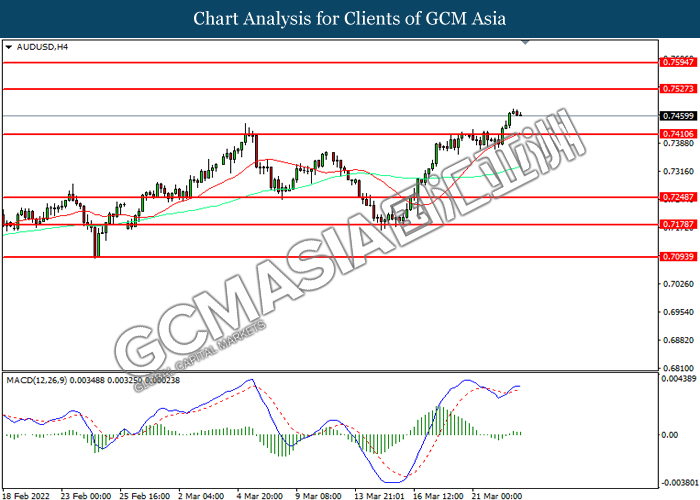

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

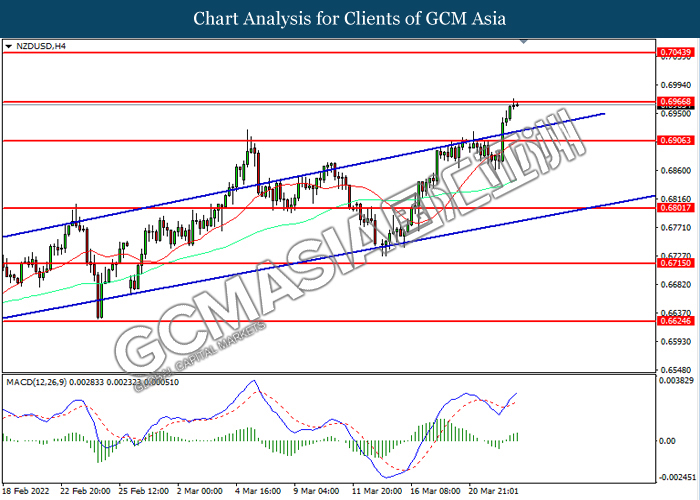

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after successfully breakout.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

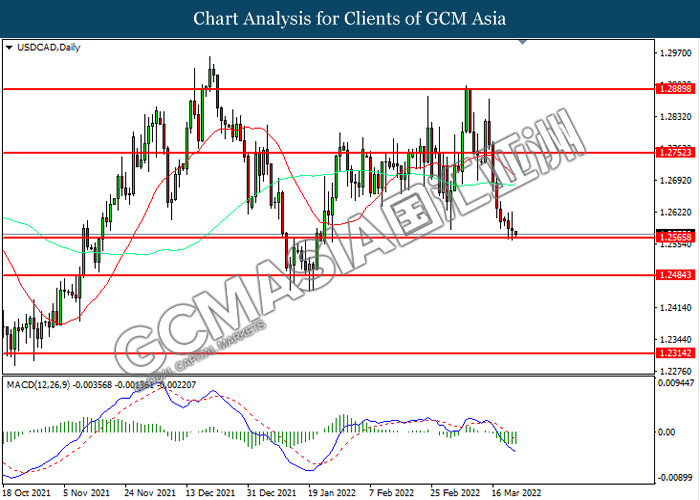

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2565, 1.2485

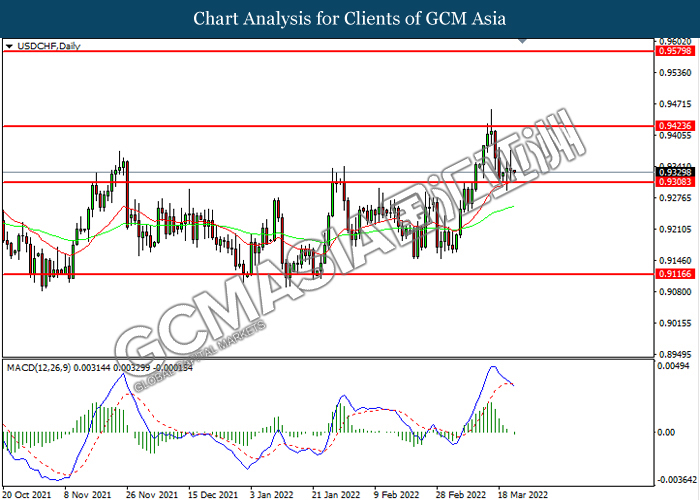

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 112.95, 115.90

Support level: 107.95, 104.40

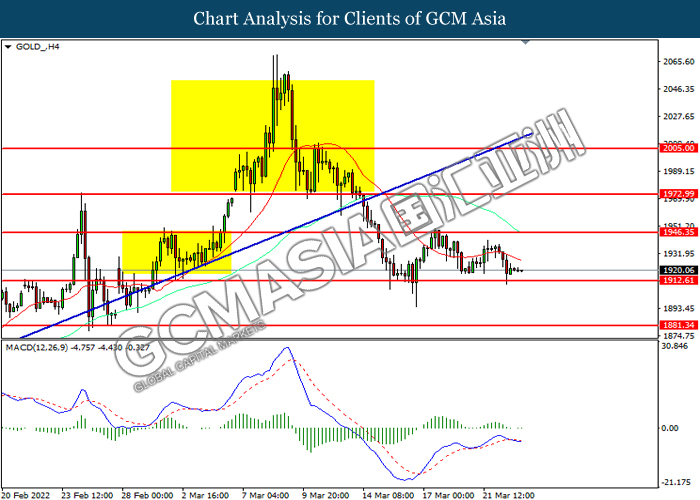

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35