23 May 2018 Daily Analysis

Dollar retraces ahead FOMC meeting minutes.

Dollar index was down 0.08% against a trade-weighted basket of major currencies to 93.40 as of writing following absence of economic catalysts while investors sold their long position on the Greenback ahead the release of FOMC meeting minutes due tomorrow morning (GMT+8). In spite of that, market still portrays optimistic sentiment towards the Fed to tighten its monetary policy in the coming meeting minutes due to recent rise in bond yields as well as healthy economic growth as displayed by most of the recent economic data. On the contrary, Euro suffered losses against the Greenback by 0.16% to $1.1780 following continuous political uncertainty in Italy and economic recession in the European zone.

In the commodities market, crude oil price fell 0.24% to $72.00 per barrel off its 3.5 year highs following prospect over the OPEC to increase its oil output next month after the former expressed its concerns over Iranian supply curb and falling Venezuelan output. Otherwise, gold price rose 0.14% to $1292.80 a troy ounce following recent retracement of the Greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 (Thu) USD FOMC Meeting Minutes

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q1) | 0.6% | 0.3% | – |

| 15:30 | EUR – German Manufacturing PMI (May) | 58.1 | 57.8 | – |

| 16:00 | EUR – Manufacturing PMI (May) | 56.2 | 56.0 | – |

| 16:00 | EUR – Markit Composite PMI (May) | 55.1 | 55.0 | – |

| 16:00 | EUR – Services PMI (May) | 54.7 | 54.7 | – |

| 16:30 | GBP – CPI (YoY) (Apr) | 2.5% | 2.5% | – |

| 22:00 | USD – New Home Sales (Apr) | 694K | 679K | – |

| 21:45 | USD – Manufacturing PMI (May) | 56.5 | 56.5 | – |

| 21:45 | USD – Markit Composite PMI (May) | 54.9 | – | – |

| 22:00 | USD – Services PMI (May) | 54.6 | 54.9 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.404M | -0.763M | – |

| 22:30 | CrudeOIL – Gasoline Inventories | -3.790M | -1.421M | – |

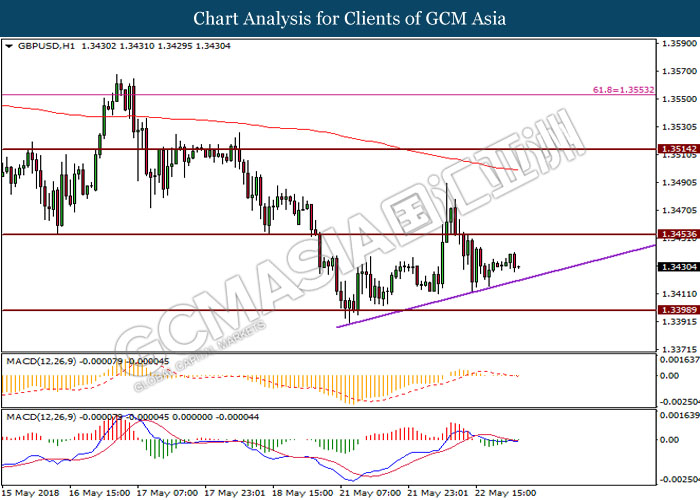

GBPUSD

GBPUSD, H1: GBPUSD was traded lower prior breaking support level at 1.3450. MACD signal line that portrays weakness of bullish momentum would suggest the pair to extend its losses if breakout at the trend line of ascending triangle is successful.

Resistance level: 1.3450, 1.3510

Support level: 1.3400, 1.3330

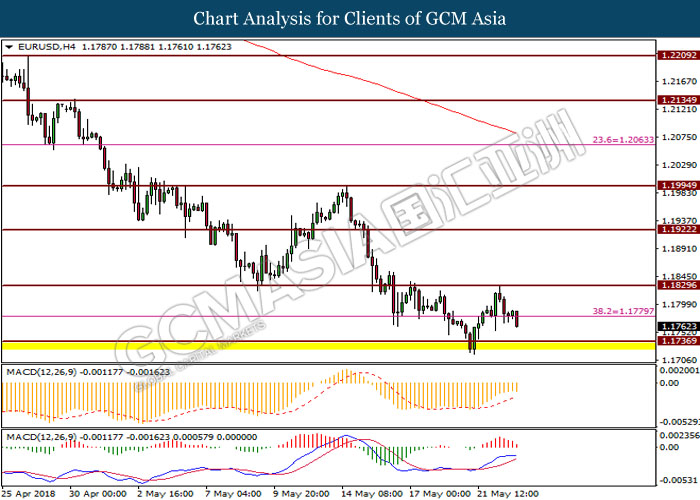

EURUSD

EURUSD, H4: EURUSD was traded lower after retracement from resistance level at 1.1830. MACD signal line that is about to form a death-cross would suggest the pair to extend its losses if it successfully closes candlestick below the 38.2 Fibonacci level.

Resistance level: 1.1780, 1.1830

Support level: 1.1740, 1.1680

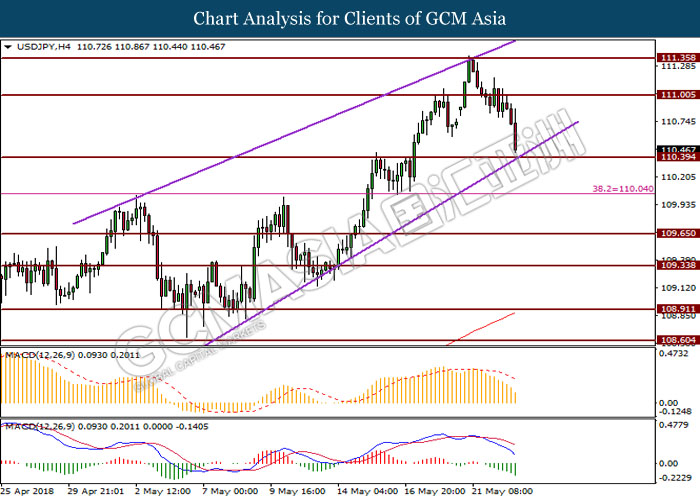

USDJPY

USDJPY, H4: USDJPY was traded lower after breaking support level at 111.00. MACD signal line that portrays continuous downside momentum would suggest the pair to extend its losses towards the support level at 110.40.

Resistance level: 111.00, 111.40

Support level: 110.40, 110.00

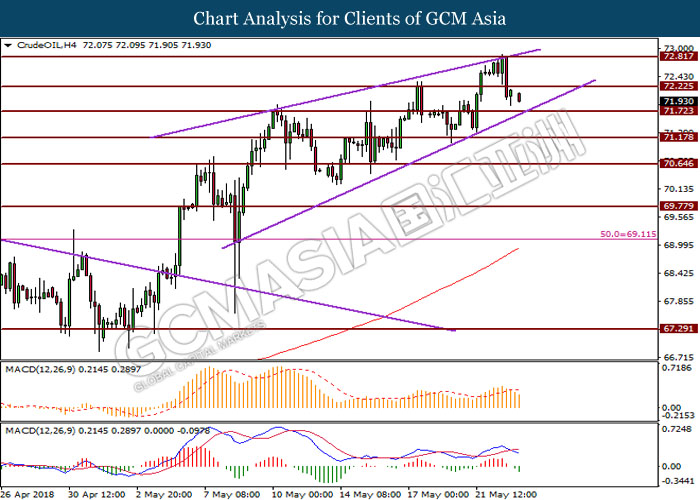

CrudeOIL

CrudeOIL, H4: Crude oil price was traded lower after breaking support level at 72.20. Death-cross as displayed by MACD signal line would suggest the commodity price to extend its losses towards the support level at 71.70.

Resistance level: 72.20, 72.80

Support level: 71.70, 71.20

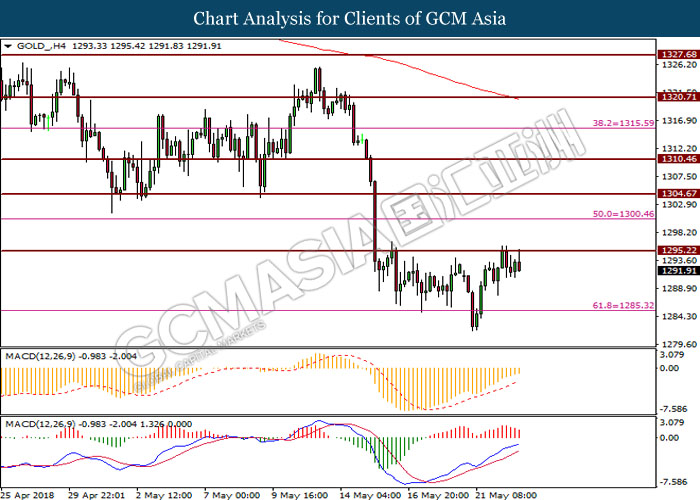

GOLD

GOLD_, H4: Gold price was traded lower prior retracement from resistance level at 1295.20. MACD signal line that is about to form a death-cross would suggest the safe-haven asset price to extend its losses if candlestick successfully closes below its previous low.

Resistance level: 1295.20, 1300.40

Support level: 1285.30, 1275.90