23 May 2022 Morning Session Analysis

US Dollar slumped amid the growing recession fears upon the United States.

The Dollar Index which traded against a basket of six major currencies retreated from its higher-level last week amid the growing concerns upon the stagflation risk in future. Recently, bankers and economists warned that the US economy would be heading toward recession in the next year as the mounting worries that the rising borrowing costs for consumers and business as well as the spiking inflation risk continue to weigh down the economic prospect in the United States. Meanwhile, the inflation rate, which remains near 40-year highs has become a challenge for the economy and the global central bank. Nonetheless, investors would continue to scrutinize the latest updates with regards of the Federal Reserve’s meeting minutes to receive further signal about the monetary policy decision from Fed. As of writing, the Dollar Index depreciated by 0.23% to 102.90.

In the commodities market, the crude oil price slumped 0.72% to $110.05 per barrel as of writing amid concerns upon the global economic recession continue to drag down the appeal of this black-commodity. On the other hand, the gold price appreciated by 0.03% to $1847.30 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German ifo Business Climate Index (May) | 91.8 | 91.4 | – |

Technical Analysis

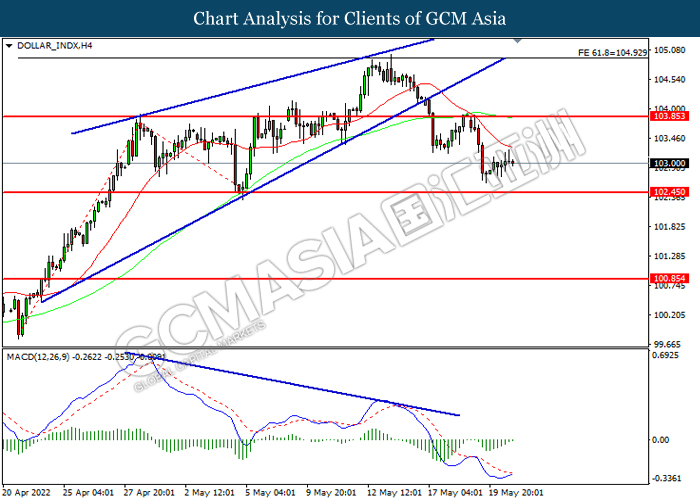

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 103.85, 104.95

Support level: 102.45, 100.85

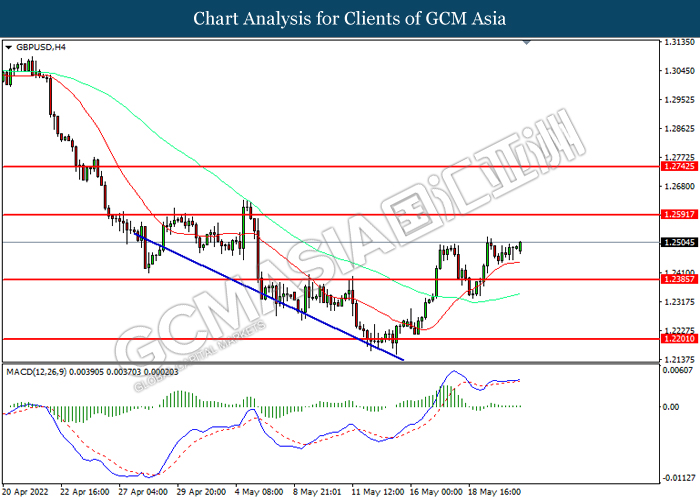

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2590, 1.2745

Support level: 1.2385, 1.2200

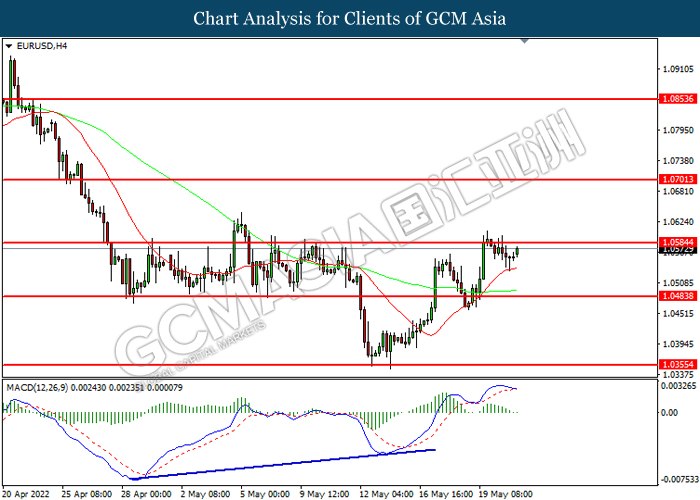

EURUSD, H4: EURUSD was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0585, 1.0700

Support level: 1.0485, 1.0355

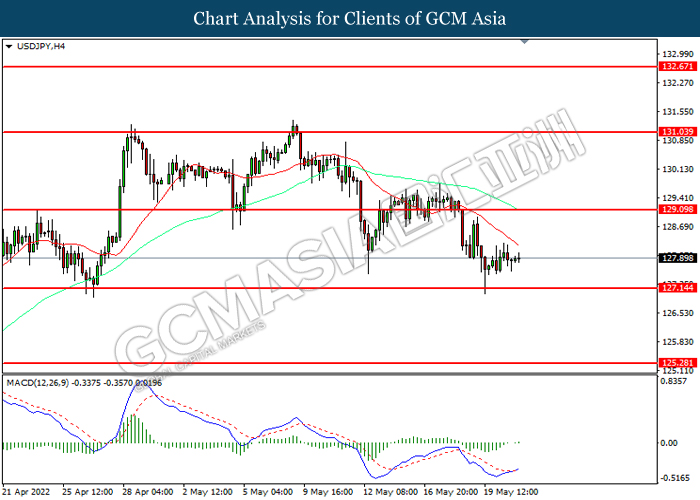

USDJPY, H4: USDJPY was traded within a range while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 129.10, 131.05

Support level: 127.15, 125.30

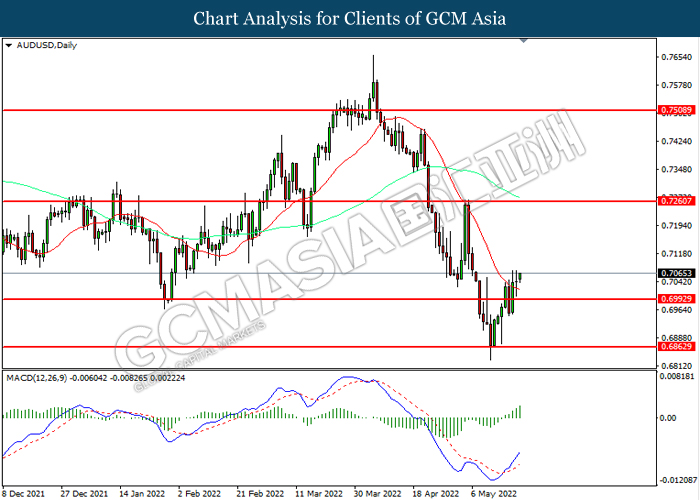

AUDUSD, Daily: AUDUSD was traded higher following prior breakout resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.7260, 0.7510

Support level: 0.6995, 0.6865

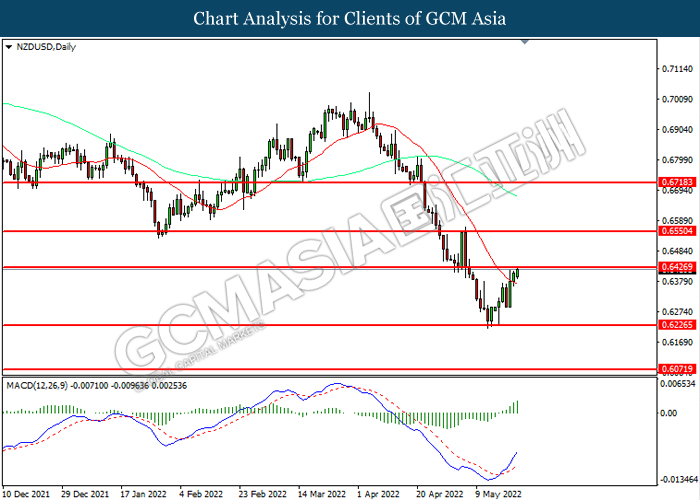

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout.

Resistance level: 0.6425, 0.6550

Support level: 0.6225, 0.6070

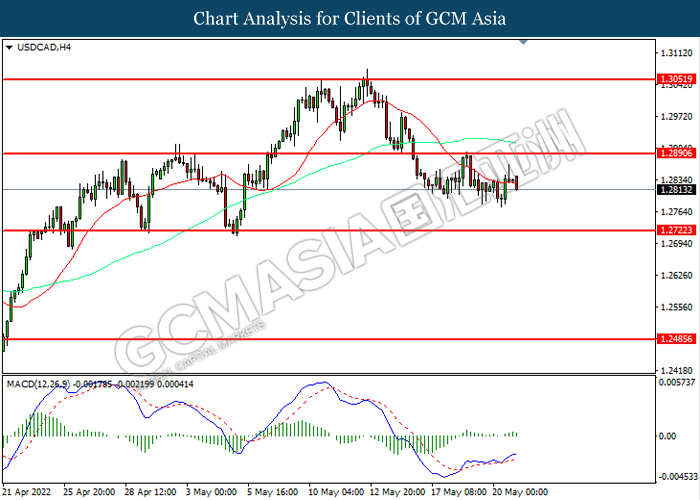

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend it losses.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2485

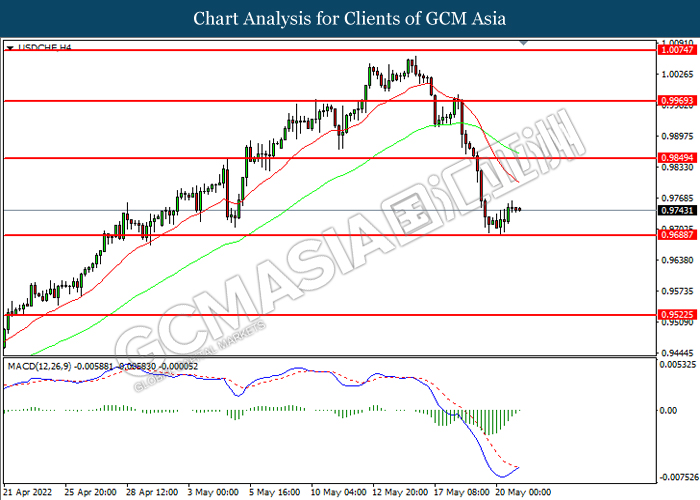

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9850, 0.9970

Support level: 0.9690, 0.9520

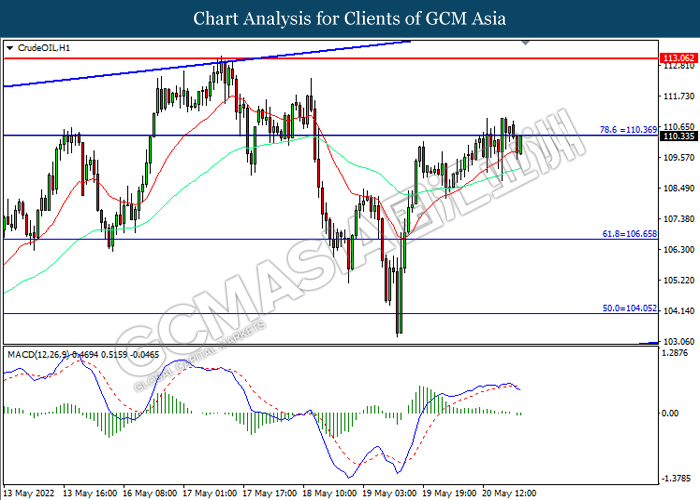

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated inceasing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 110.35, 113.05

Support level: 106.65, 104.05

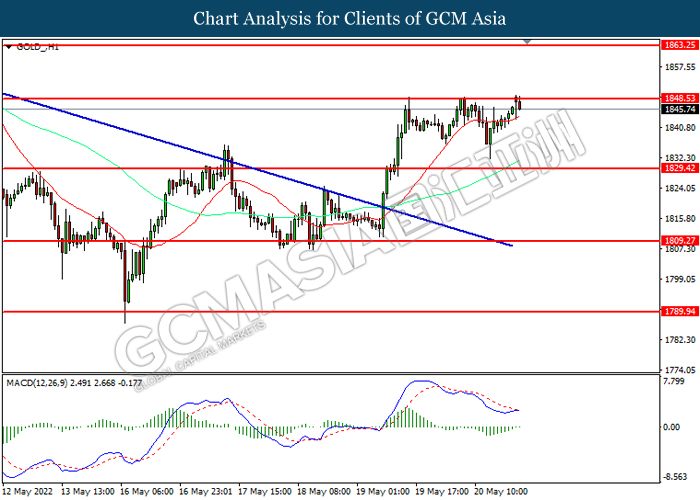

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum the extend its gains after breakout.

Resistance level: 1848.55, 1863.25

Support level: 1829.40, 1809.25