23 May 2023 Morning Session Analysis

US dollar edged higher amid Bullard’s hawkish stance and progress in debt ceiling talk.

The dollar index, which was traded against a basket of six major currencies, managed to regain its luster last night as Bullard’s hawkish statement boosted the positive sentiment in the dollar market. The Federal Reserve Bank of St. Louis President James Bullard said that the US may need to raise interest rate by another 50 basis point in this year in order to successfully tame the inflation. The base case of hiking interest rate further was due to the rate of price increases has not come down ‘fast enough’, even the cash rate has been rising unstoppably since more than a year ago. However, the gains of the dollar were limited, as the debate of whether the US central bank will push pause on its tightening policy continued to swirl around the market. Last week, Fed Chairman Jerome Powell signaled that they do not need to raise rates as much as they initially expected amid the volatility in the banking sector. On the other side, the debt ceiling talks between Joe Biden and Republican made some progress but a bipartisan agreement is not on the table yet. After the recent discussion, Joe Biden was optimistic on sealing a deal while McCarthy revealed that they can find a common ground at the end of the day. As of writing, the dollar index rose 0.04% to 103.25.

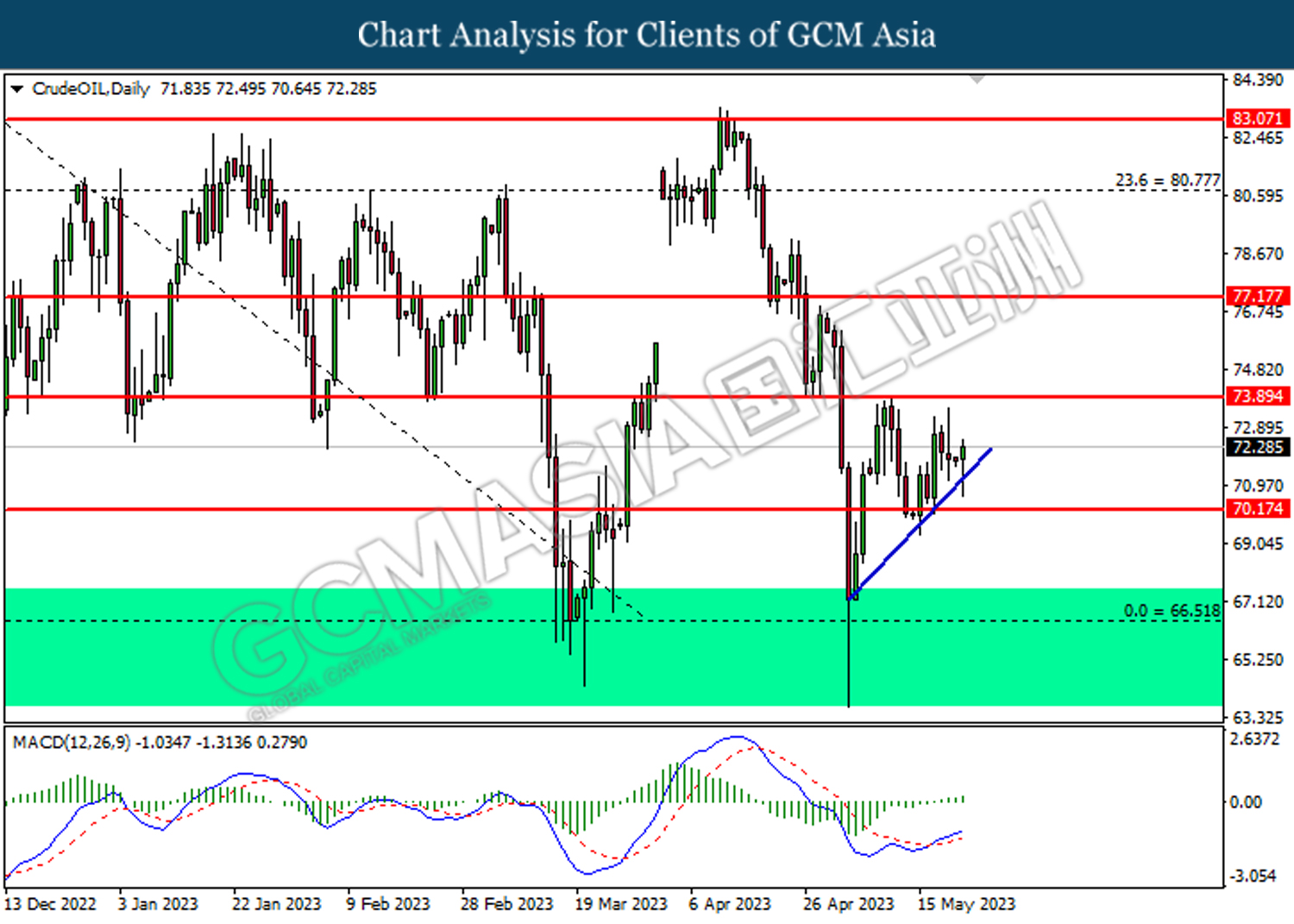

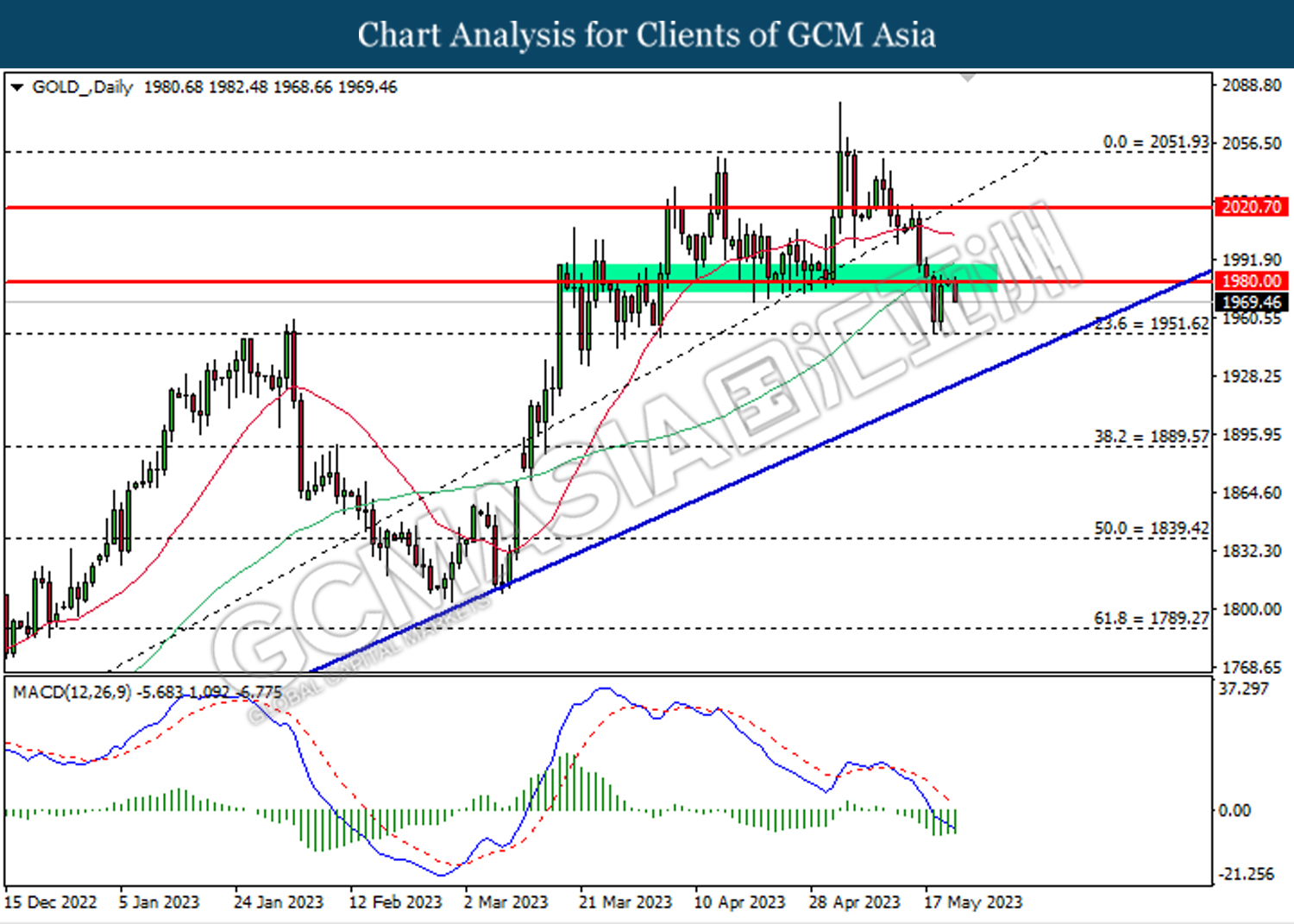

In the commodities market, crude oil prices were up by 0.15% to $72.30 per barrel as EIA expect a drop in OPEC oil production would moderately increase the oil price in the next few months. Besides, gold prices edged down by -0.03% to $1971.20 per troy ounce amid dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (May) | 44.5 | 45.0 | – |

| 16:30 | GBP – Composite PMI | 54.9 | 54.6 | – |

| 16:30 | GBP – Manufacturing PMI | 47.8 | 48.0 | – |

| 16:30 | GBP – Services PMI | 55.9 | 55.5 | – |

| 20:00 | USD – Building Permits | 1.430M | 1.416M | – |

| 21:45 | USD – Manufacturing PMI (May) | 50.2 | 50.0 | – |

| 21:45 | USD – Services PMI (May) | 53.6 | 52.6 | – |

| 22:00 | USD – New Home Sales (Apr) | 683K | 663K | – |

Technical Analysis

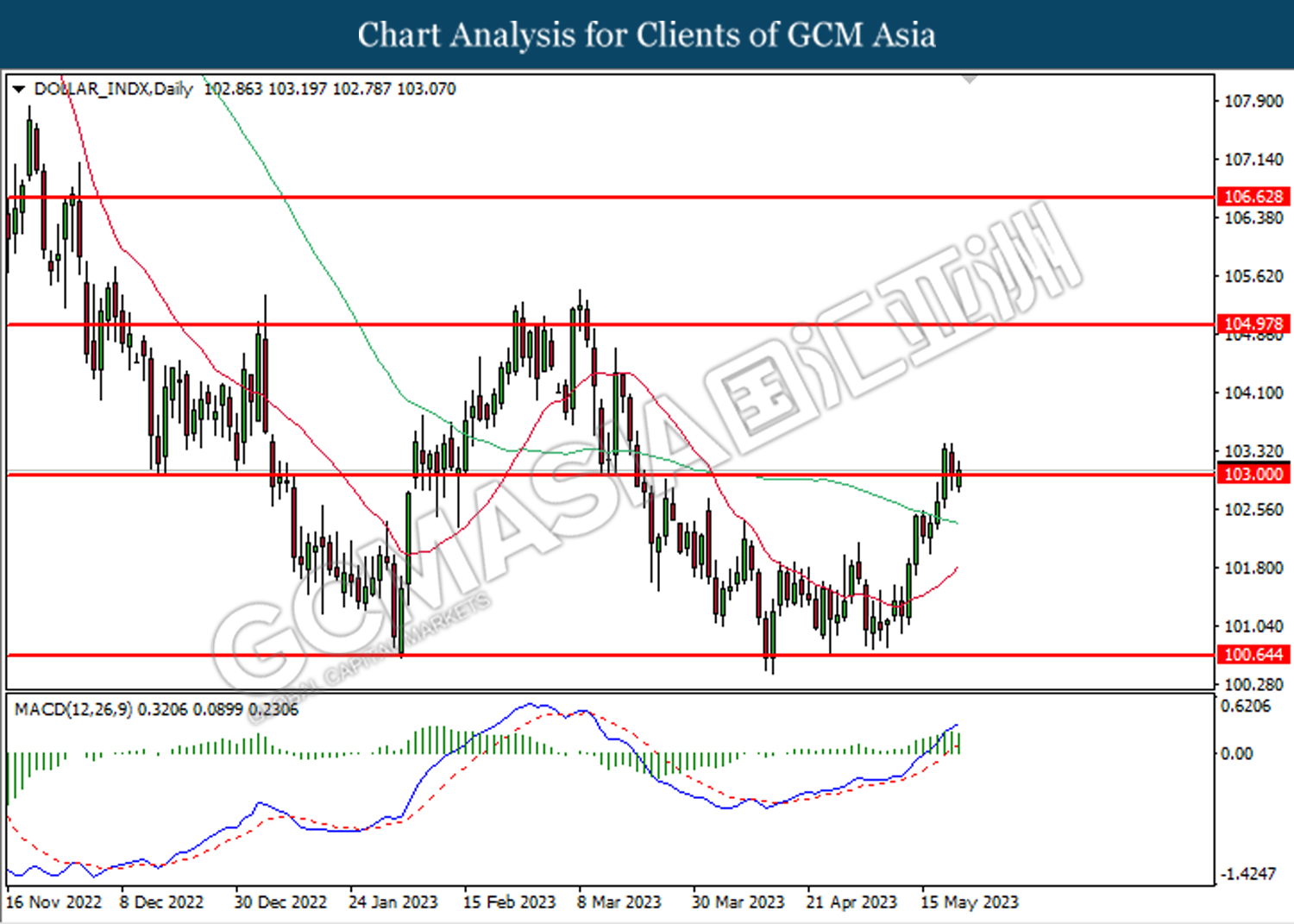

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

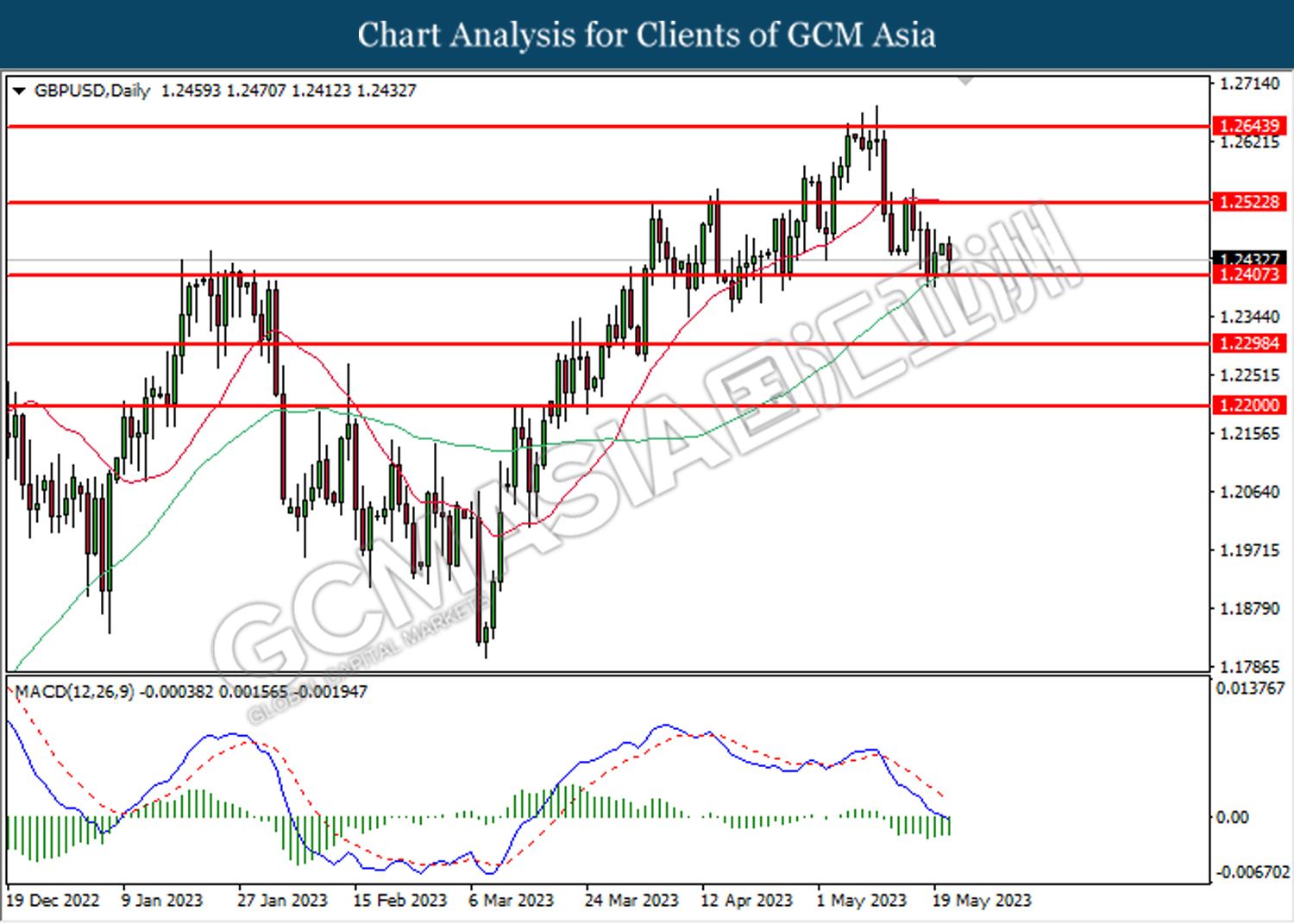

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2525.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

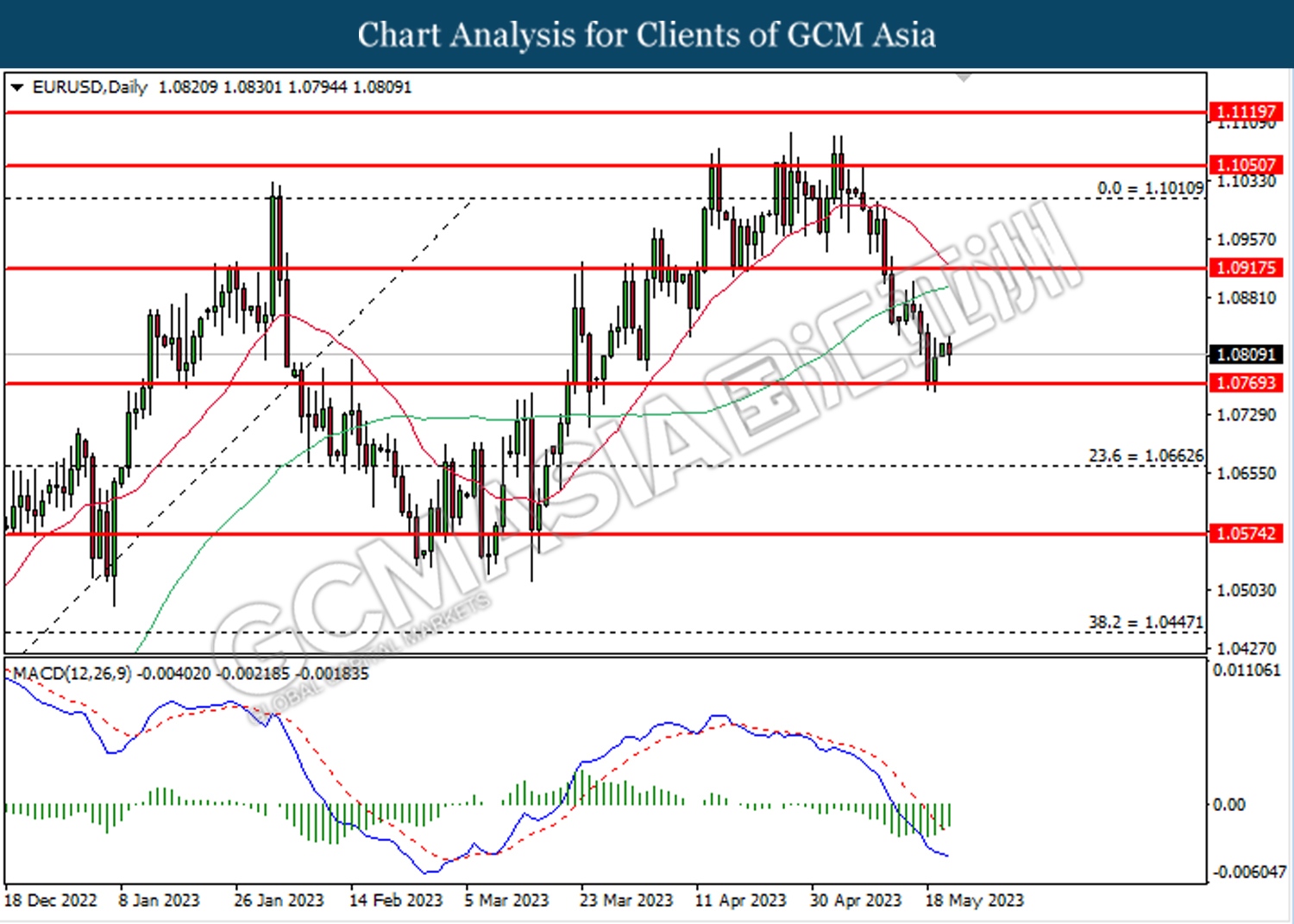

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0770. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

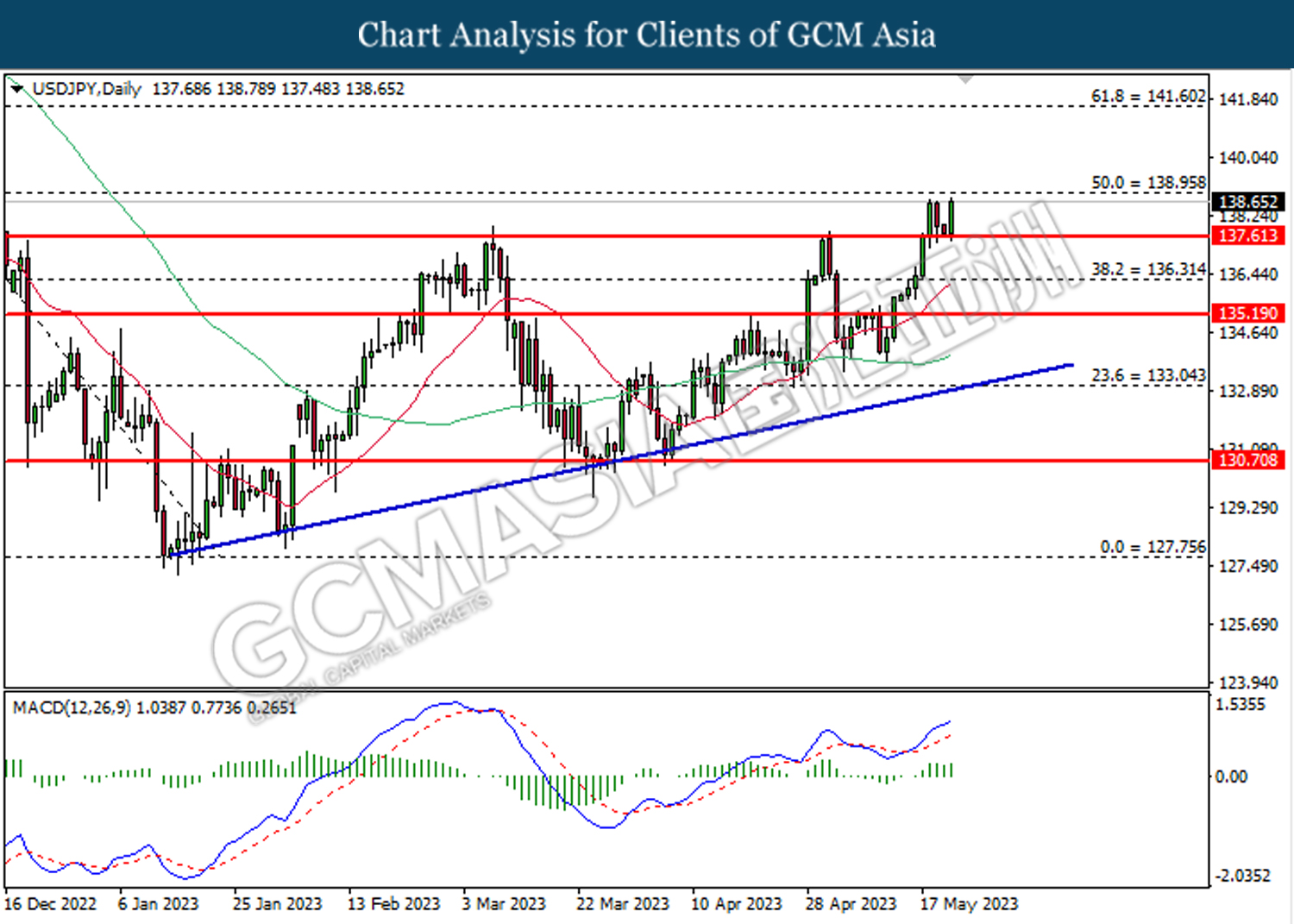

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 137.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 138.95.

Resistance level: 138.95, 141.60

Support level: 137.60, 136.30

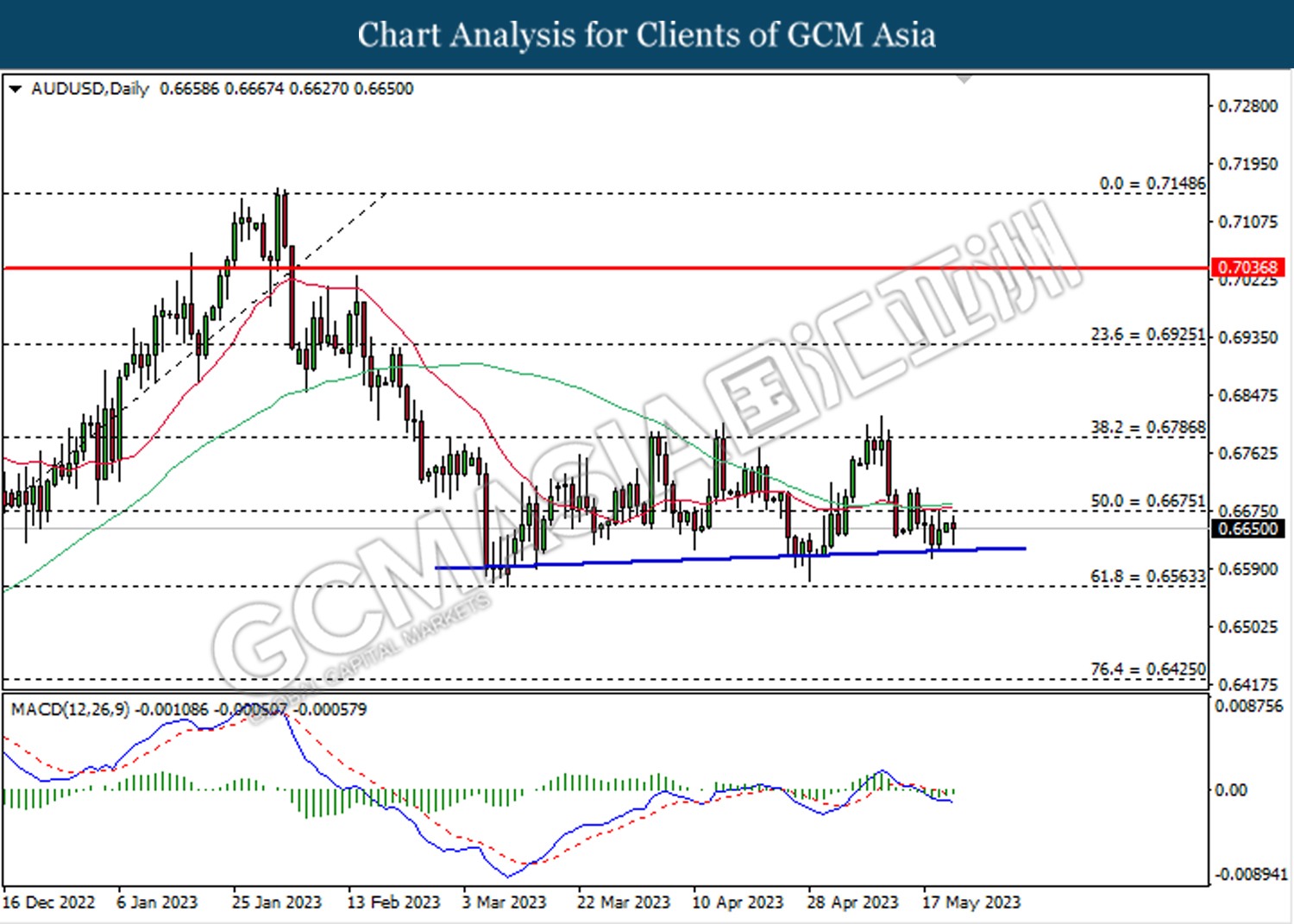

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

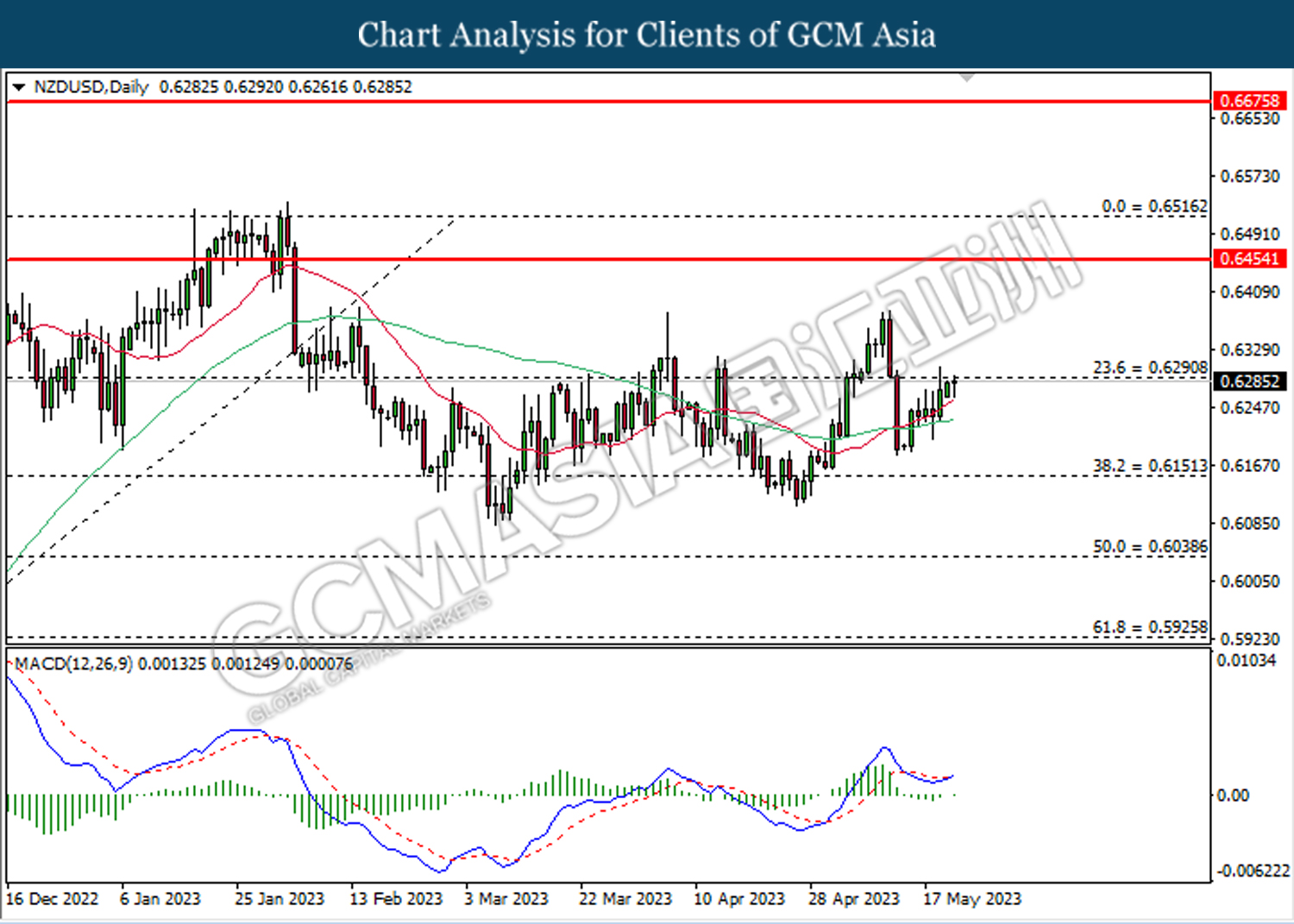

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

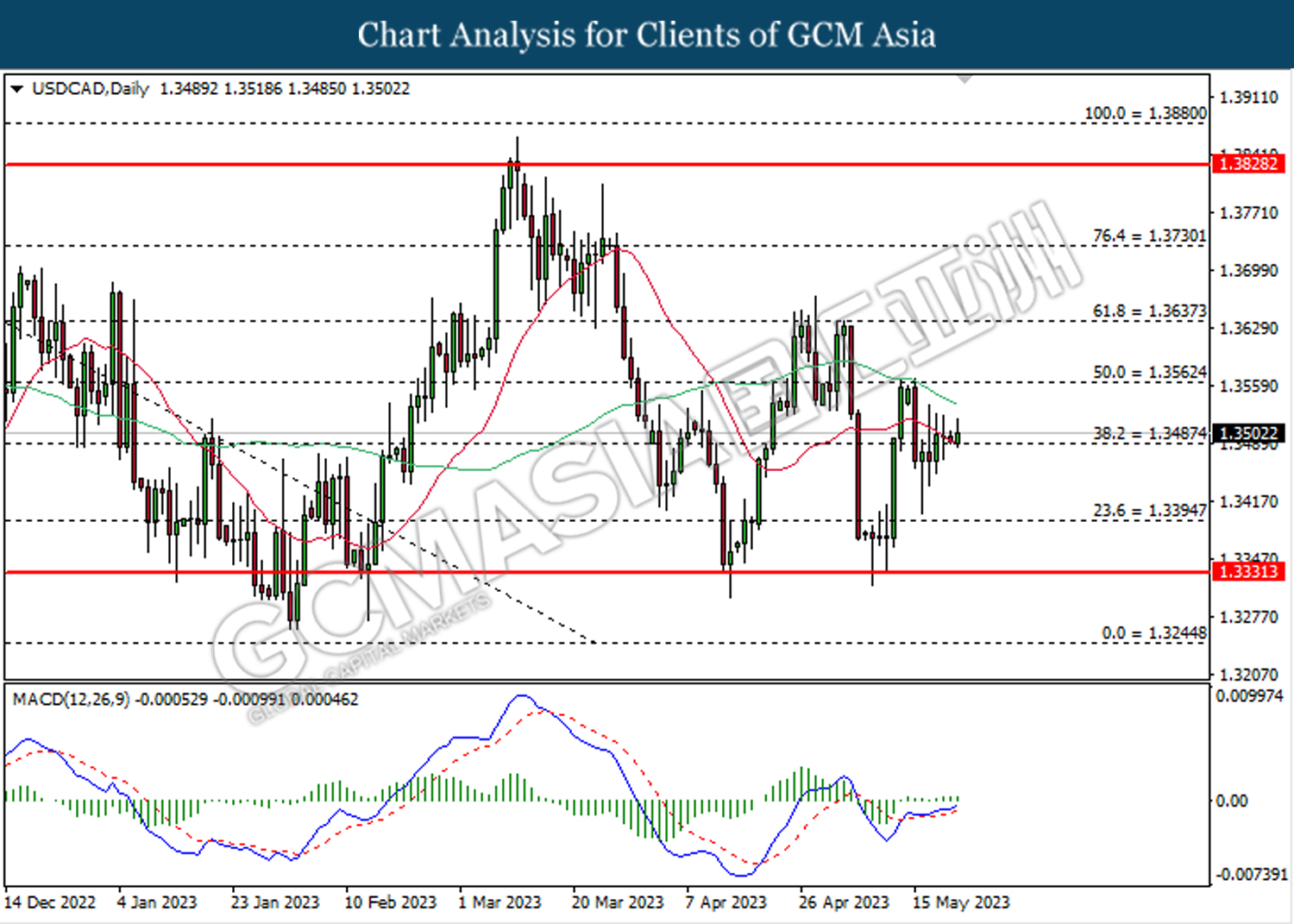

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3485. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

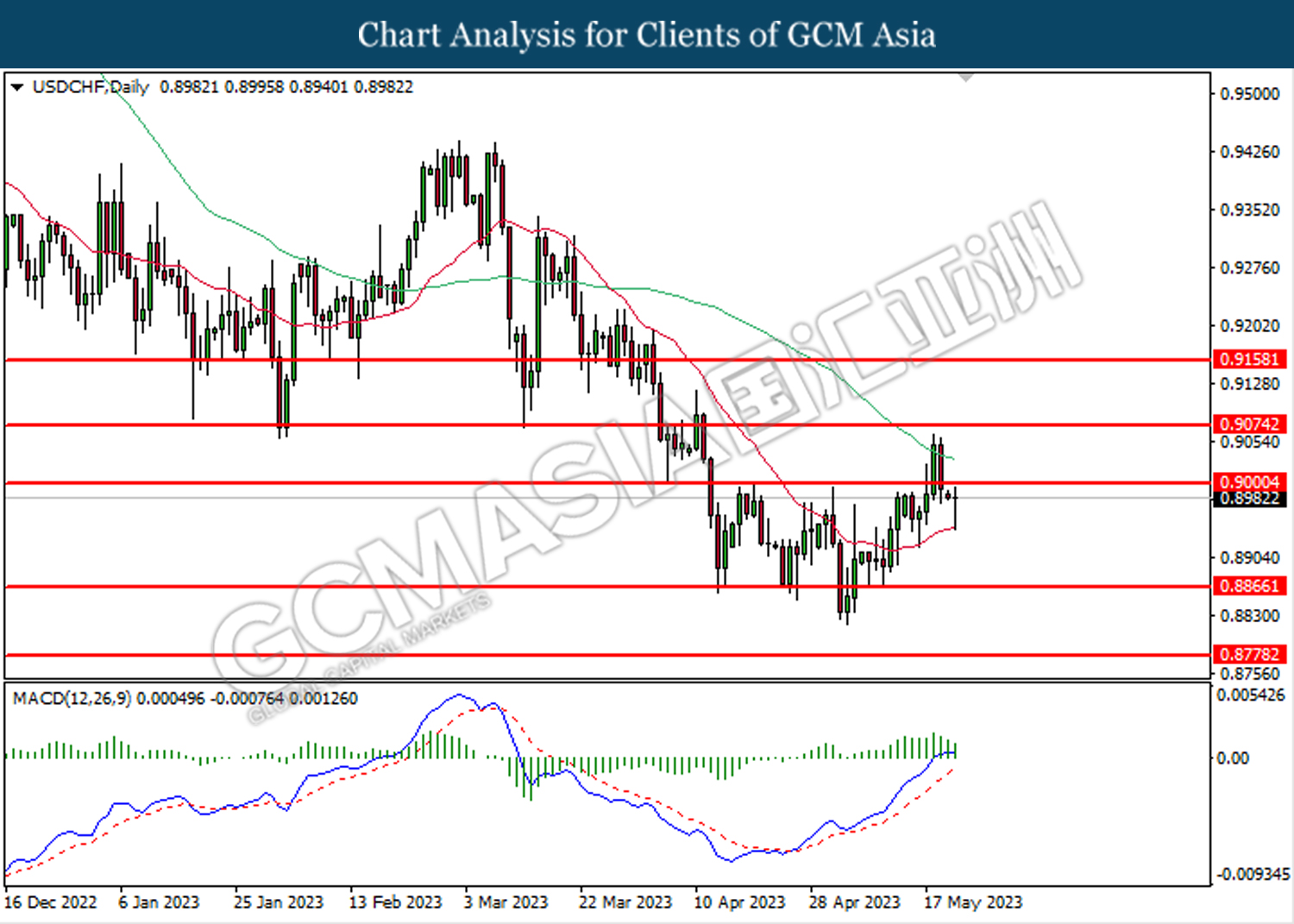

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.9000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the upward trend line. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1980.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1951.60.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55