23 June 2023 Afternoon Session Analysis

Sterling extended losses despite BoE’s unexpected tightening moves.

The Pound Sterling, which traded against the dollar index, extended its losses despite the Bank of England’s (BoE)’s unexpected tightening of its monetary policy. The Bank of England surprises markets by raising rates by 50 bps to 5.00% from 4.50%, but fails to lift sterling. A drop to 8.5% was forecast due to Wednesday’s inflation data but the actual reading was in line with the previous reading at a high of 8.7%. Following the BoE interest rate decision, the BoE’s Bailey issues a hawkish speech May inflation data leaves the central bank little choice but to hike rates by 50 bps. As a result, the GBP/USD skyrocketed towards its daily high before stabilizing at around 1.2770. However, the BoE’s tightening moves failed to cheer up the sterling as investors’ worries further rates hike will spark UK’s recession concerns. According to Mettis Link News, each percentage point increase in interest rate will increase borrowing costs of total markets adding around 20 billion pounds into the market. Since the UK debt exceeds the GDP of 100%, an additional increase in the interest rate will prompt the UK economy will enter into recession this year. Therefore, the GBPUSD is under selloff pressure by investors as pessimism hangs over the UK economy. As of writing, the GBPUSD edged lower by -0.27% to 1.2714.

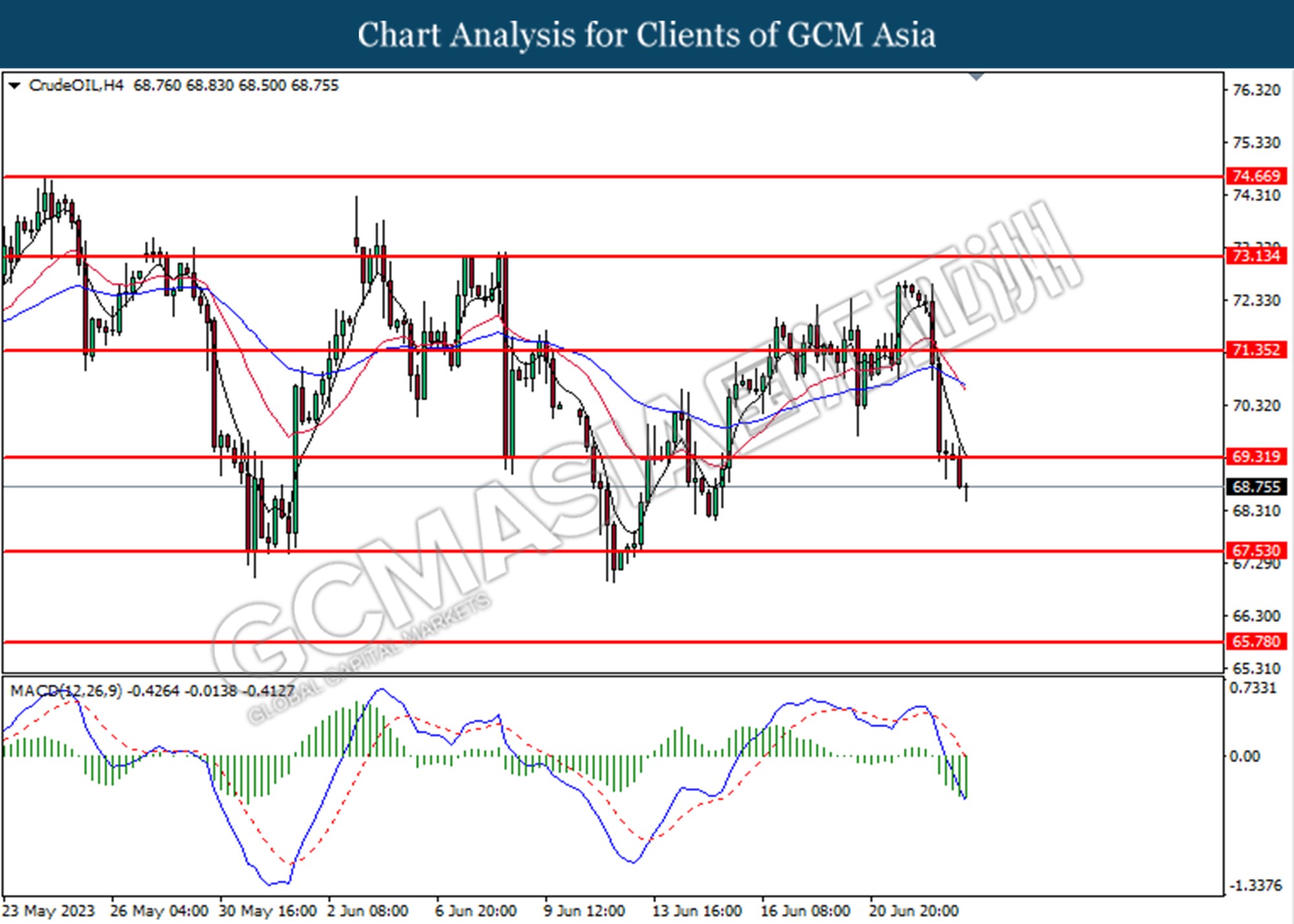

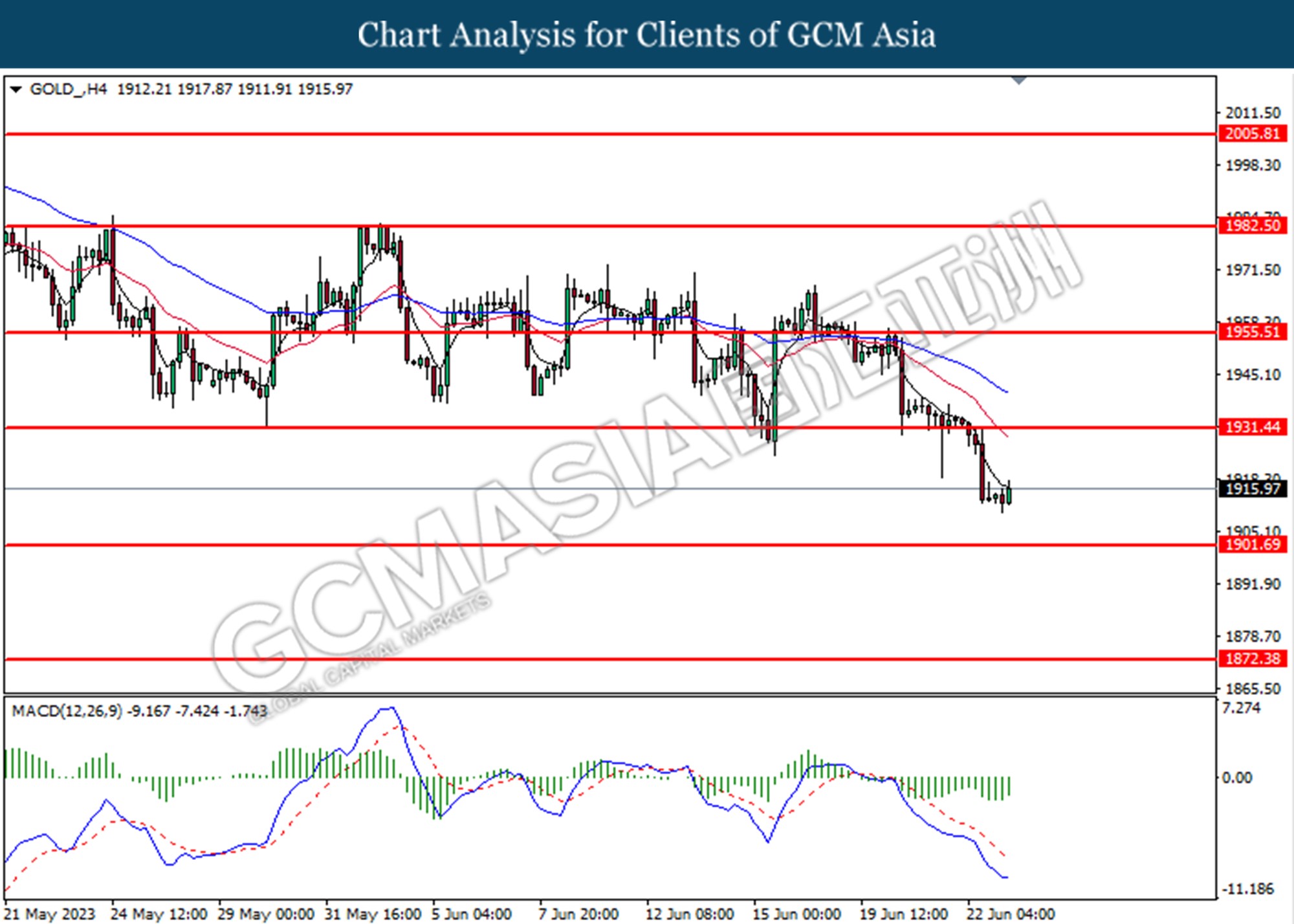

In the commodities market, crude oil prices extended losses by -1.05% to $68.78 per barrel as global demand concerns after major central banks lifted their interest rates. Besides, the gold prices dipped by -0.08% to $1912.30 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day CNY Dragon Boat Festival

Today’s Highlight Events

Time Market Event

16:00 CHF SNB Press Conference

20:00 GBP BOE Inflation Letter

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q2) | 1.50% | 1.75% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 4.50% | 4.75% | – |

| 20:30 | USD – Initial Jobless Claims | 262K | 260K | – |

| 22:00 | USD – Existing Home Sales (May) | 4.28M | 4.24M | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | 7.919M | 1.873M | – |

Technical Analysis

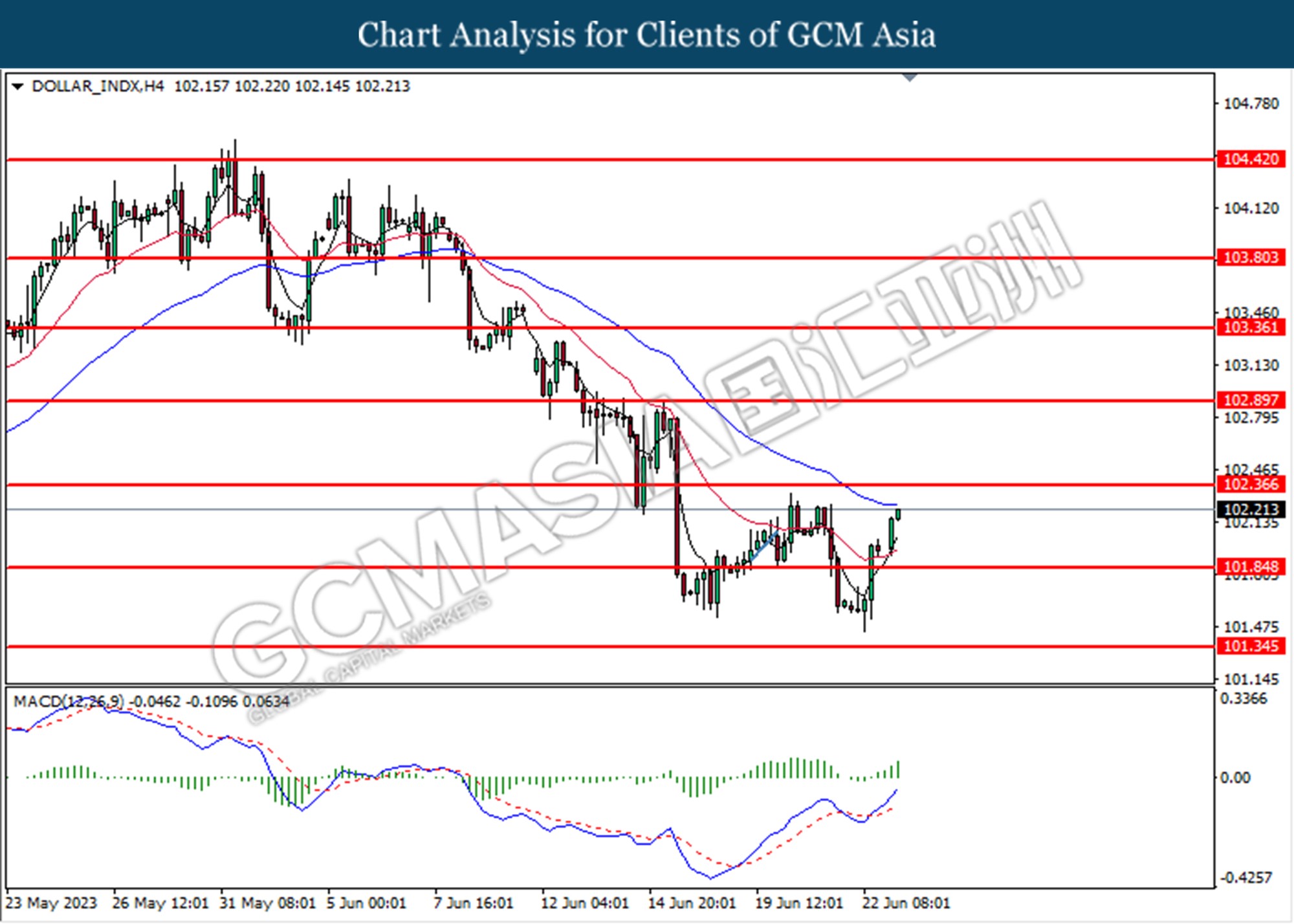

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from lower level. MACD which illustrated bullish momentum suggests the index extended its gains toward the resistance level at 102.35.

Resistance level: 102.35,102.90

Support level: 101.85, 101.35

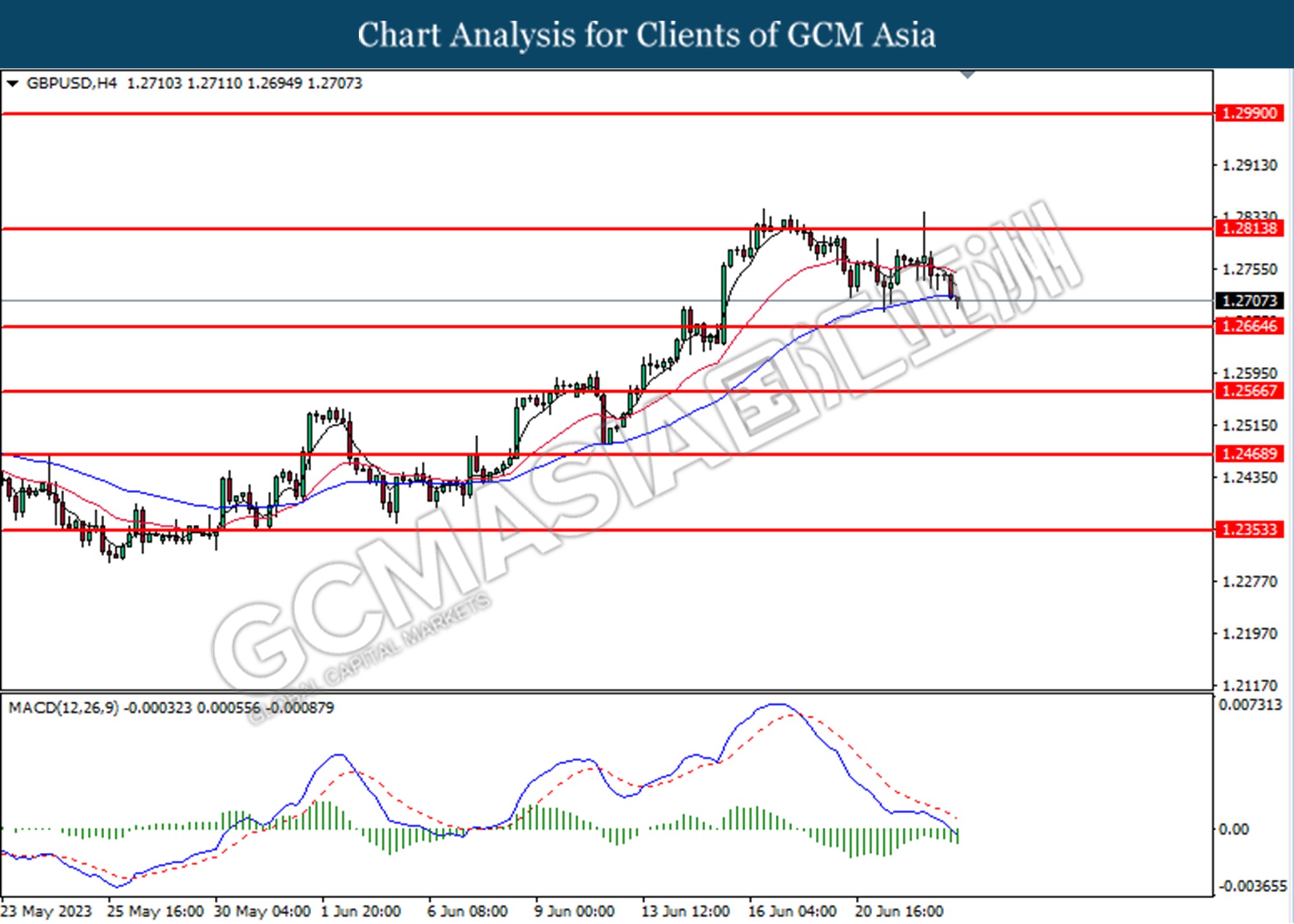

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 1.2665.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

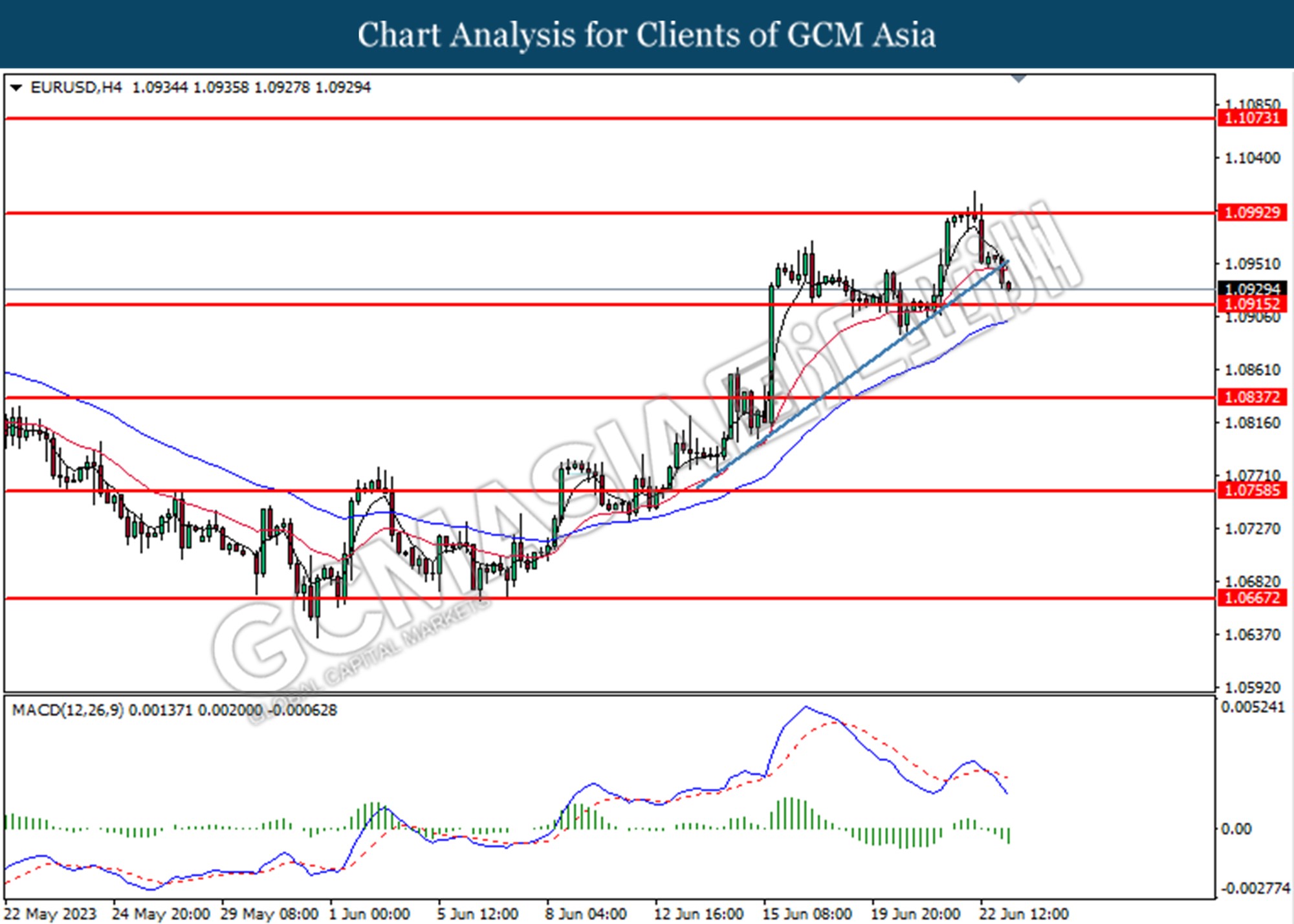

EURUSD, H4: EURUSD was traded lower following the prior retracement from below from the higher. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.0915.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

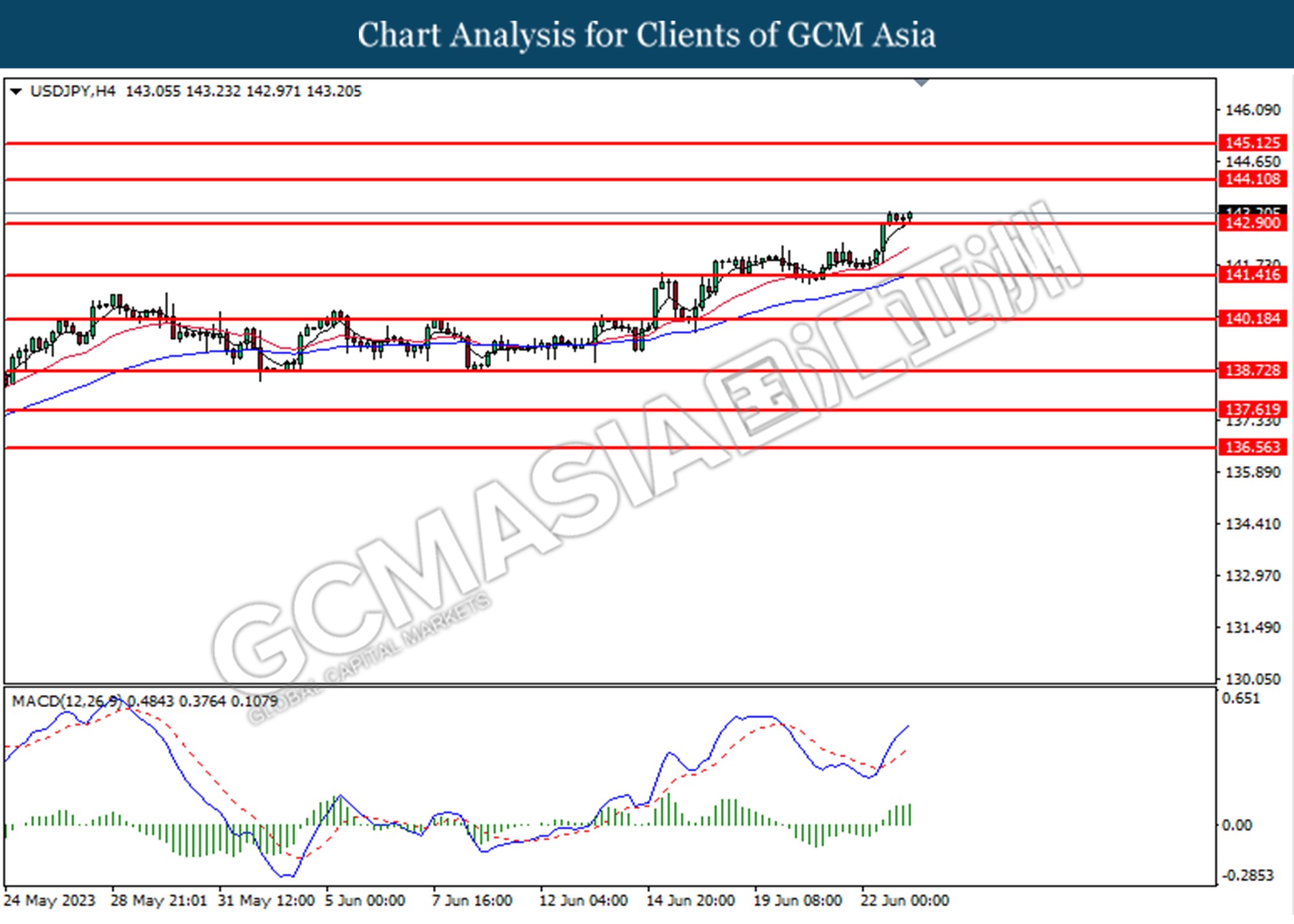

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 142.90. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 144.10, 145.10

Support level: 142.90, 141.40

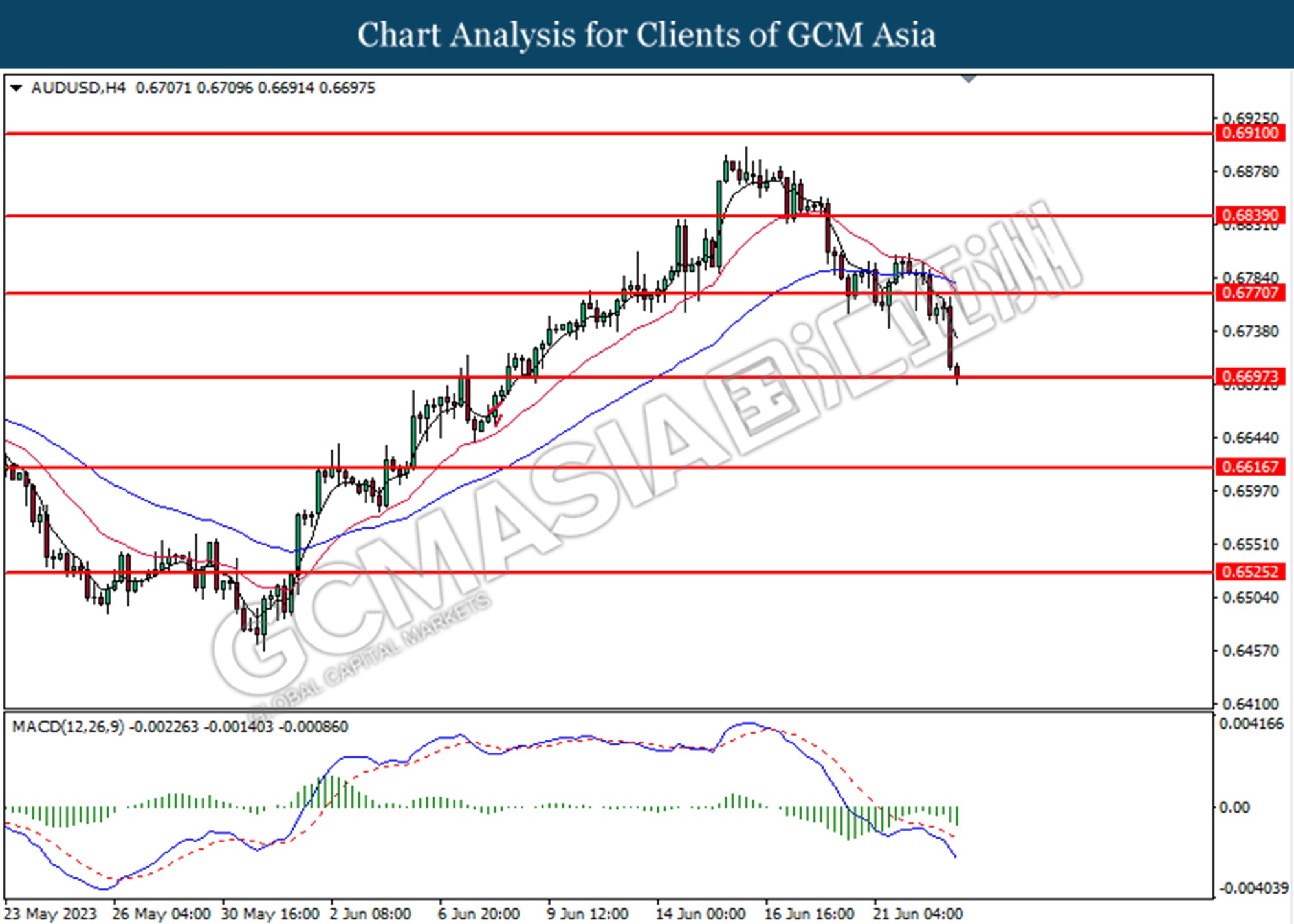

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6700. MACD which illustrated increasing bearish momentum suggests the pair extended its losses if successfully breaks below the support level.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

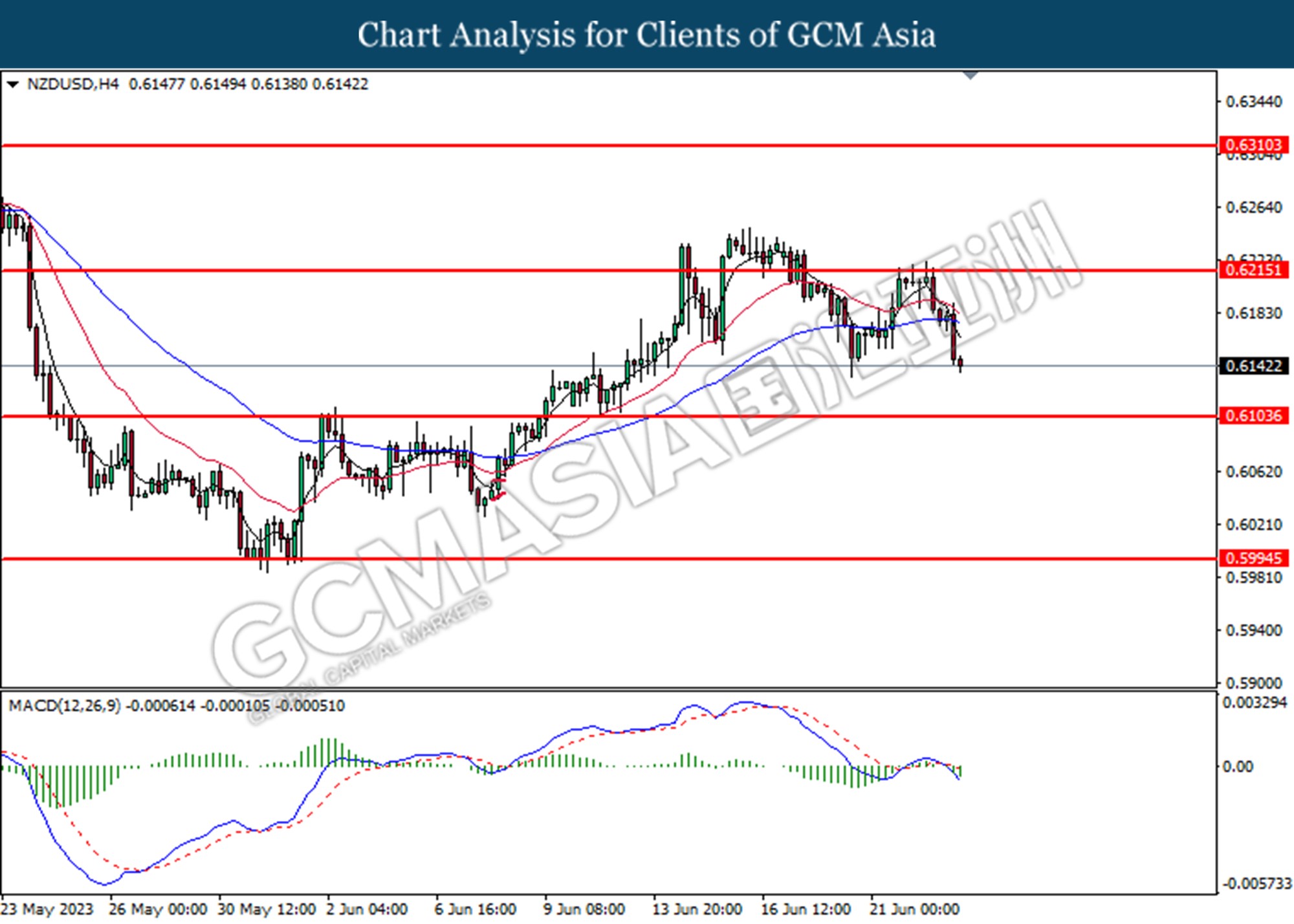

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6105

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

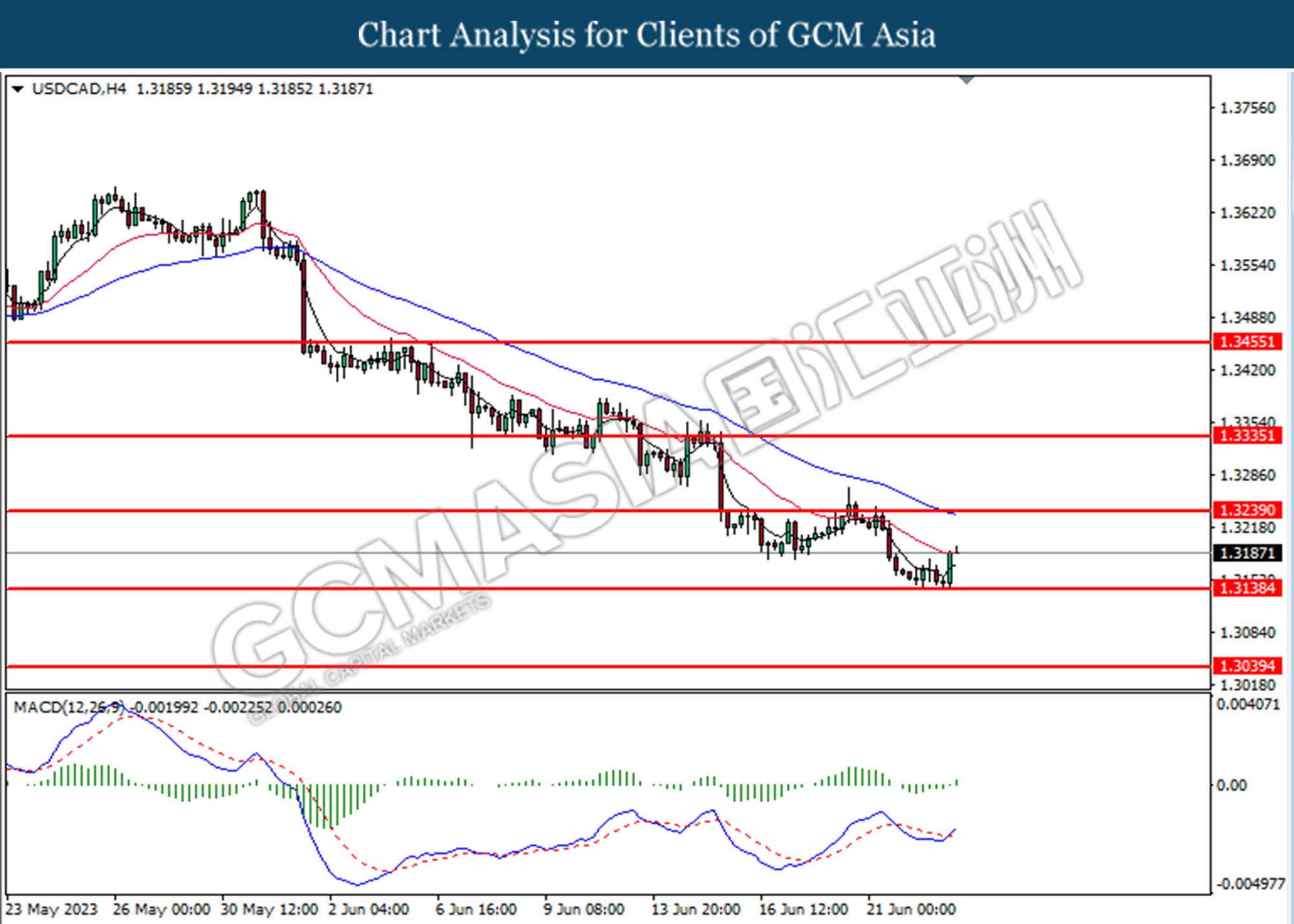

USDCAD, H4: USDCAD was traded higher following the prior rebound from the support level at 1.3140. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3240.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

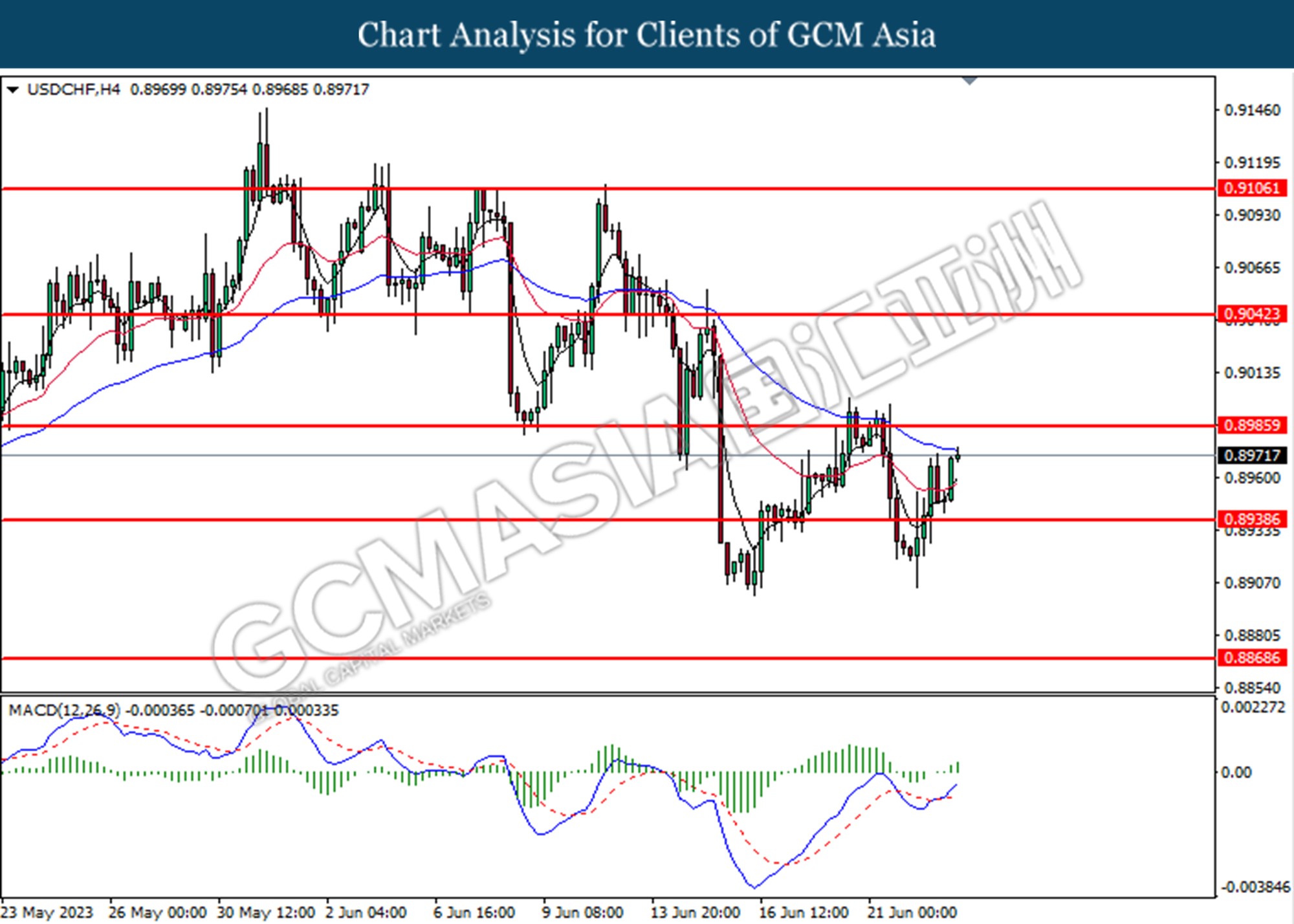

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.8985.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior breaks below from the prior support level at 69.30. MACD which illustrated increasing bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 69.30, 71.35

Support level: 67.55, 65.80

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 1931.45, 1955.50

Support level: 1901.70, 1872.40