23 June 2023 Morning Session Analysis

Dollar jumped amid persistent hawkish statement from Powell.

The dollar index, which was traded against a basket of six major currencies, bounced off after hitting the lowest level in 6 weeks as Federal Reserve Chairman Jerome Powell backed further U.S. interest rate hikes, albeit at a “cautious” pace, and a succession of central bank rate hikes raised concerns about the outlook for global growth. During the second day of testimony, Jerome Powell, expressed that the central bank would proceed with adjusting interest rates cautiously and gradually. When questioned about the possibility of rate cuts, Powell stated that they were not expected to occur in the near future. He emphasized that any rate cuts would require a period of confidence in seeing inflation decrease to the Federal Reserve’s target of 2%. On Thursday, recent U.S. data revealed that the number of individuals filing for state unemployment benefits for the first time remained at a 20-month high. This level has persisted for three consecutive weeks, indicating a potential early sign of a labor market that is experiencing a softening trend. According to the Census Bureau, the US Initial Jobless Claims came in at 264K, in line with the previous reading while slight higher than the consensus forecast at 260K. Despite, the downbeat data failed to drag the dollar market. As of writing, the dollar index rose 0.33% to 102.40.

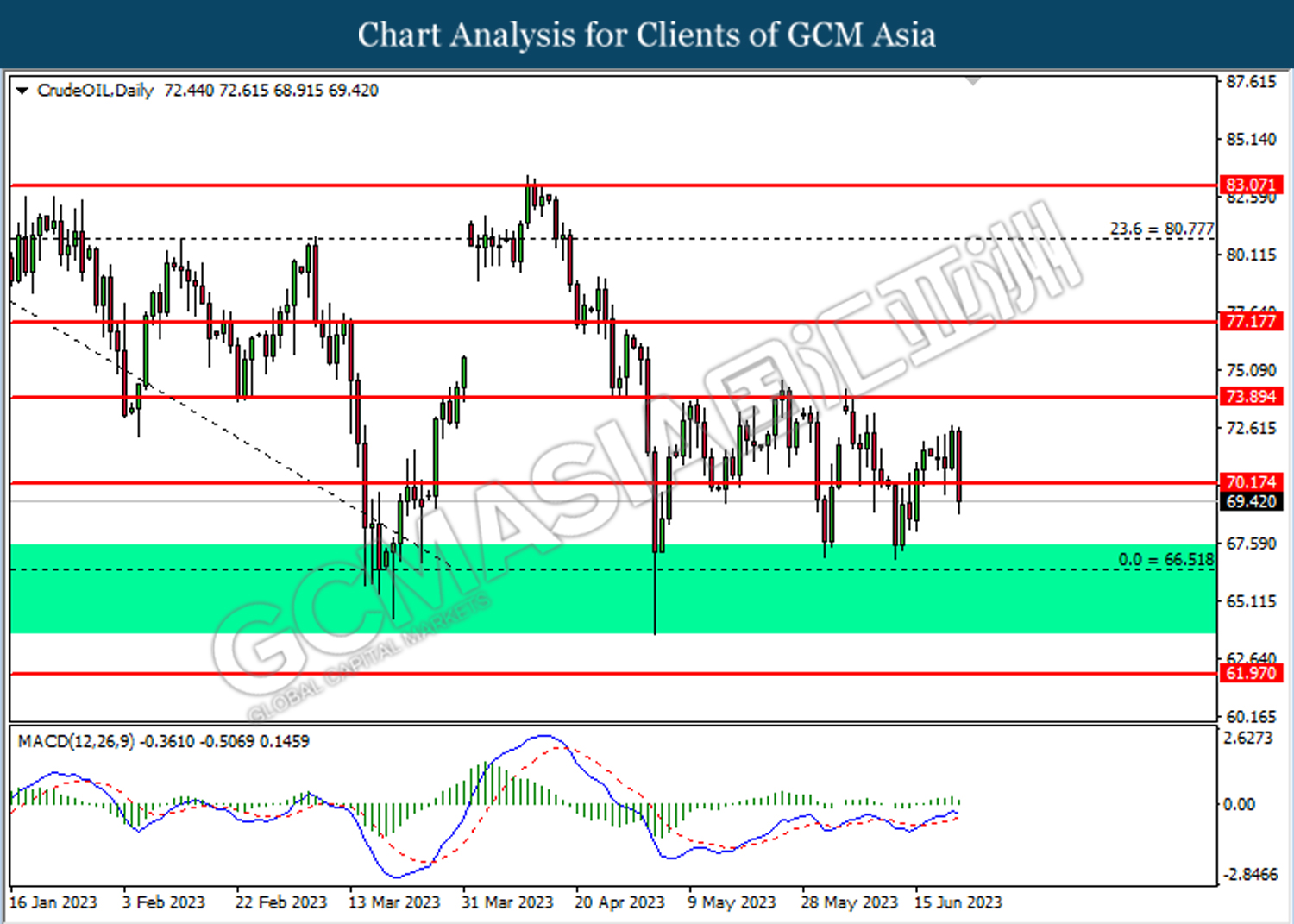

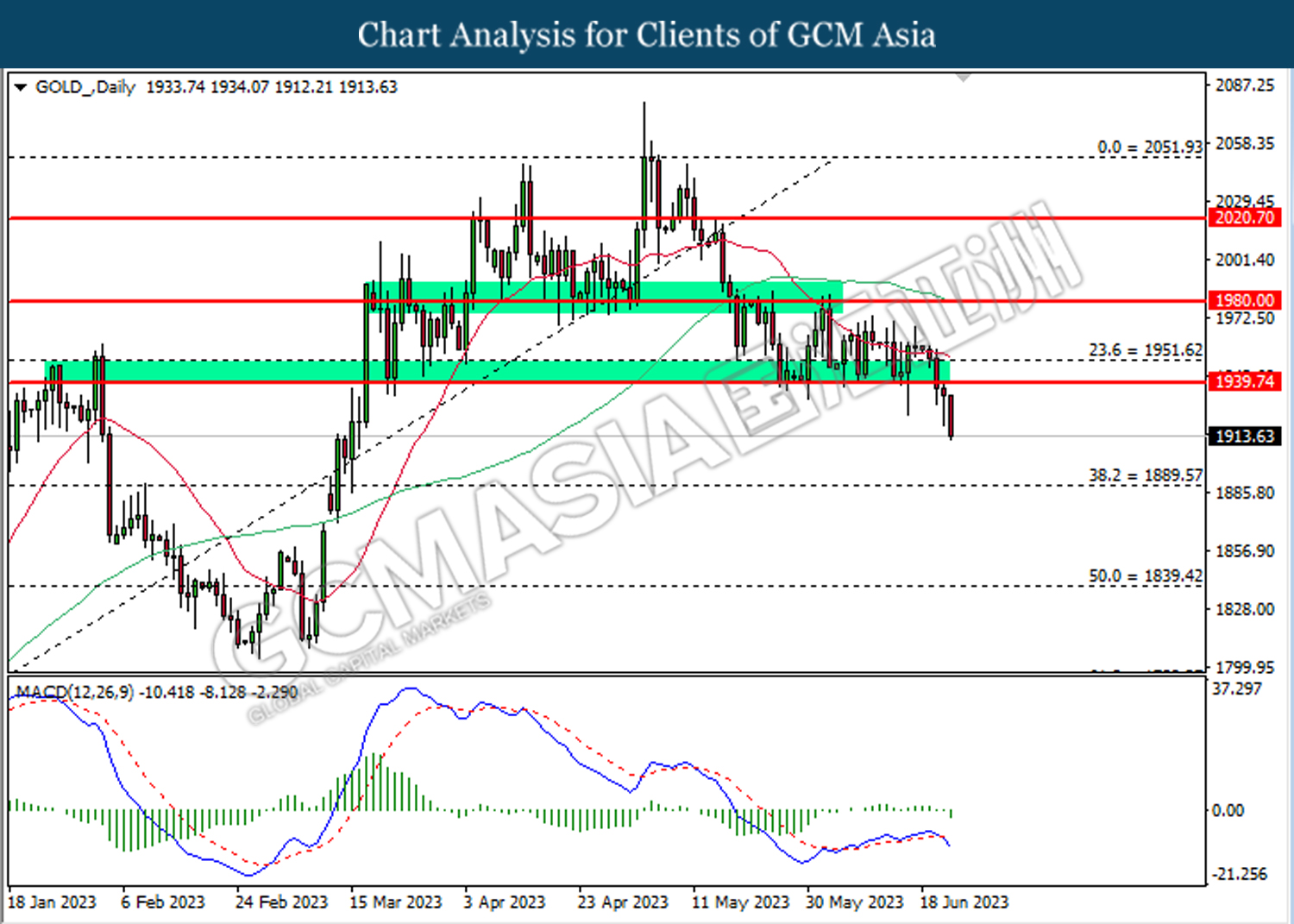

In the commodities market, crude oil prices was down by -0.03% to $69.40 per barrel as a slew of rate hikes From Bank Of England (BoE) and Swiss National Bank (SNB) darken the prospect of this black commodity. Besides, the gold prices edged down by -0.02% to $1913.75 per troy ounce as the aggressive rate hike comment from Jerome Powell lifted the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Jun) | 43.2 | 43.5 | – |

| 16:30 | GBP – Composite PMI | 54.0 | 53.7 | – |

| 16:30 | GBP – Manufacturing PMI | 47.1 | 46.8 | – |

| 16:30 | GBP – Services PMI | 55.2 | 54.7 | – |

| 21:45 | USD – Manufacturing PMI (Jun) | 48.4 | 48.3 | – |

| 21:45 | USD – S&P Global Composite PMI (Jun) | 54.3 | – | – |

| 21:45 | USD – Manufacturing PMI (Jun) | 54.9 | 54.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2765. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2635, 1.2525

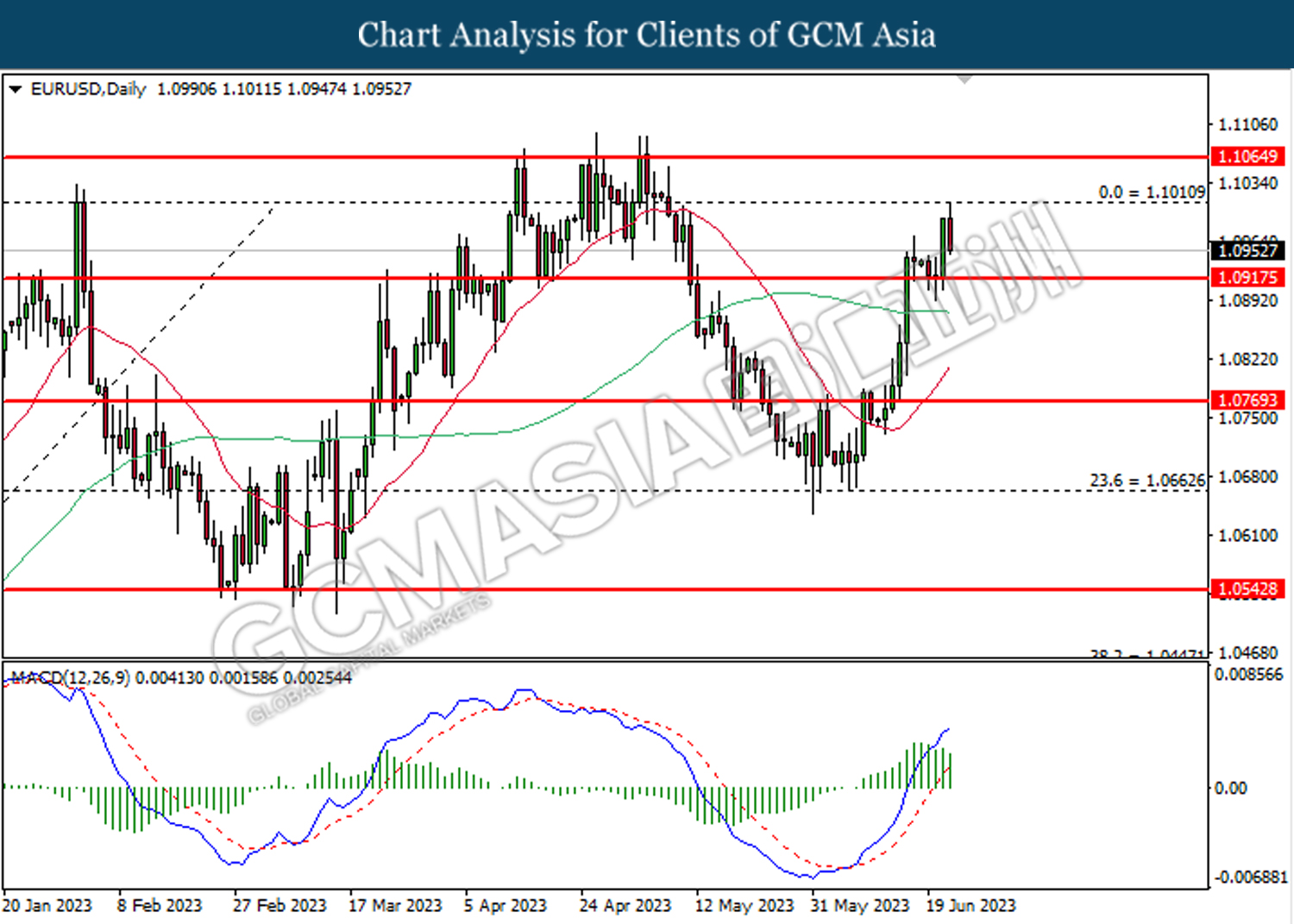

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0915. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

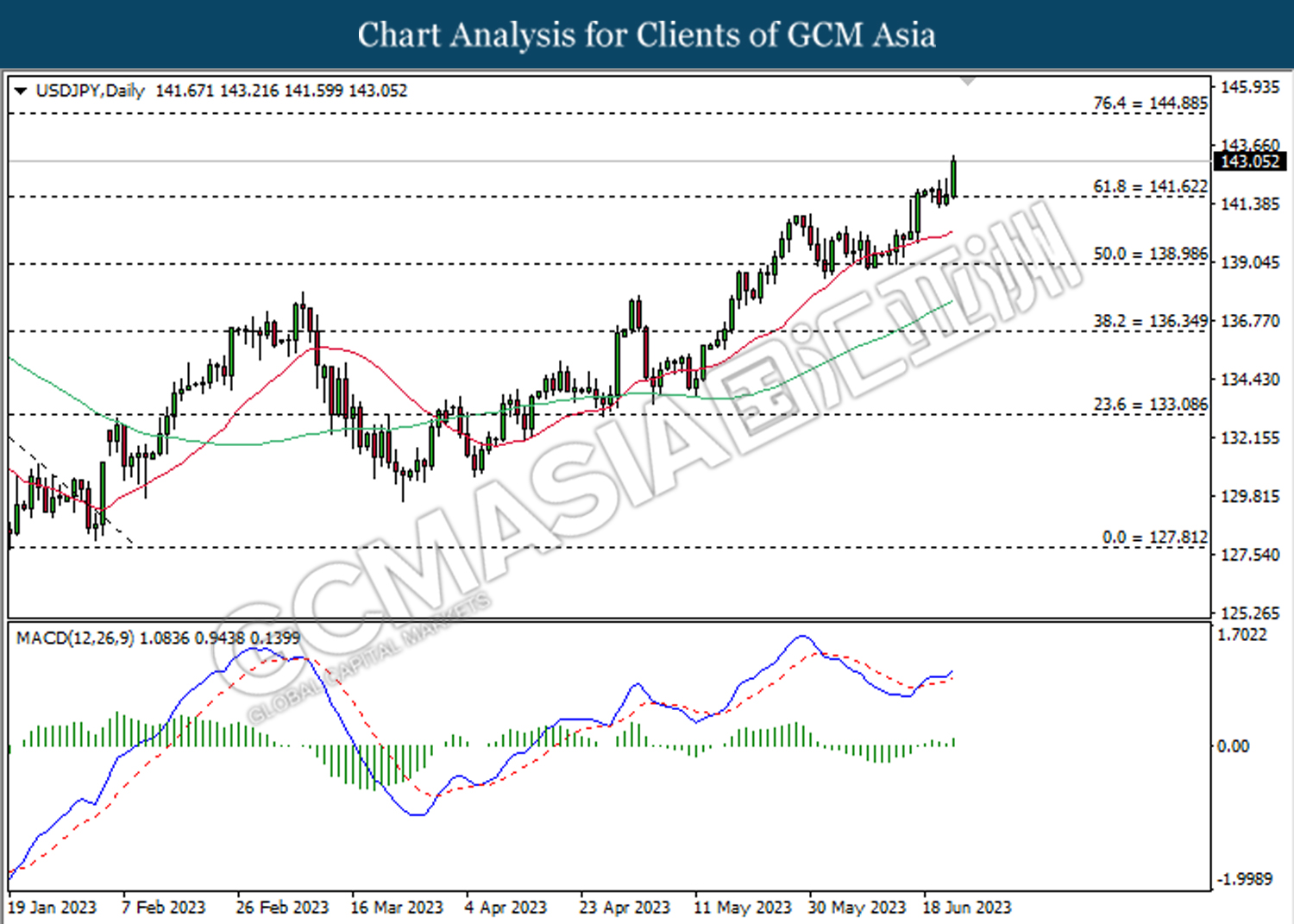

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

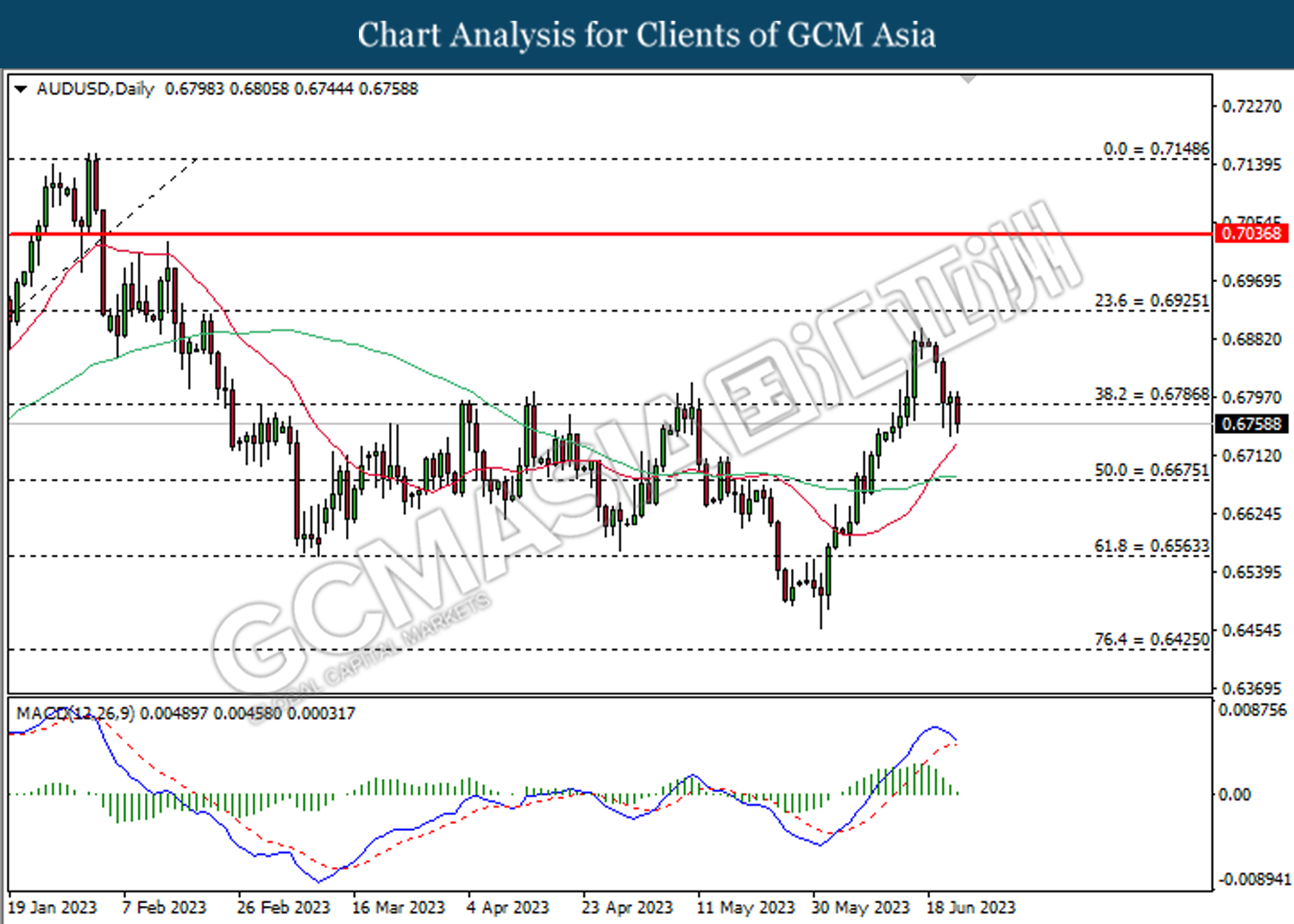

AUDUSD, Daily: AUDUSD was traded lower while currently testing support level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

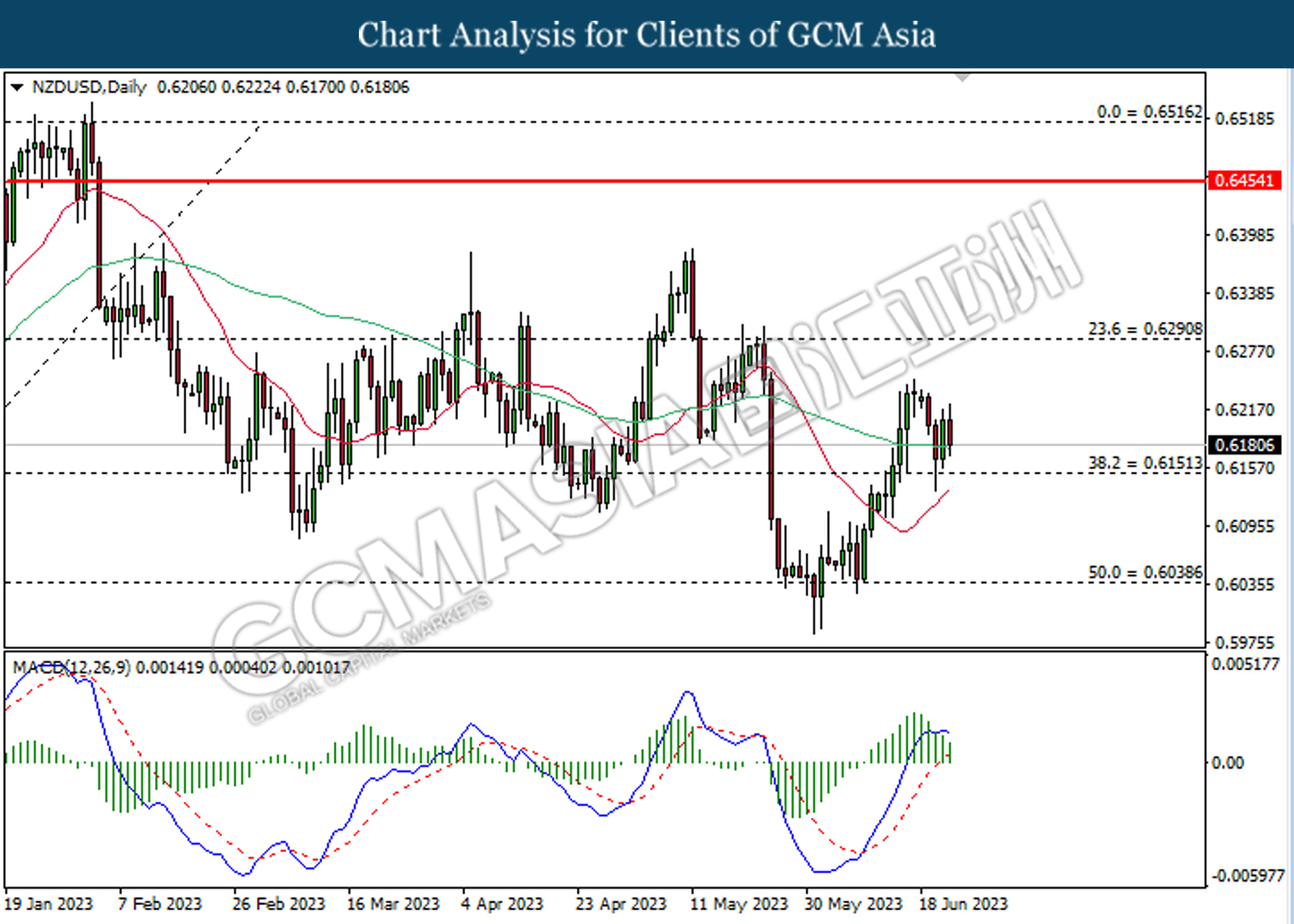

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

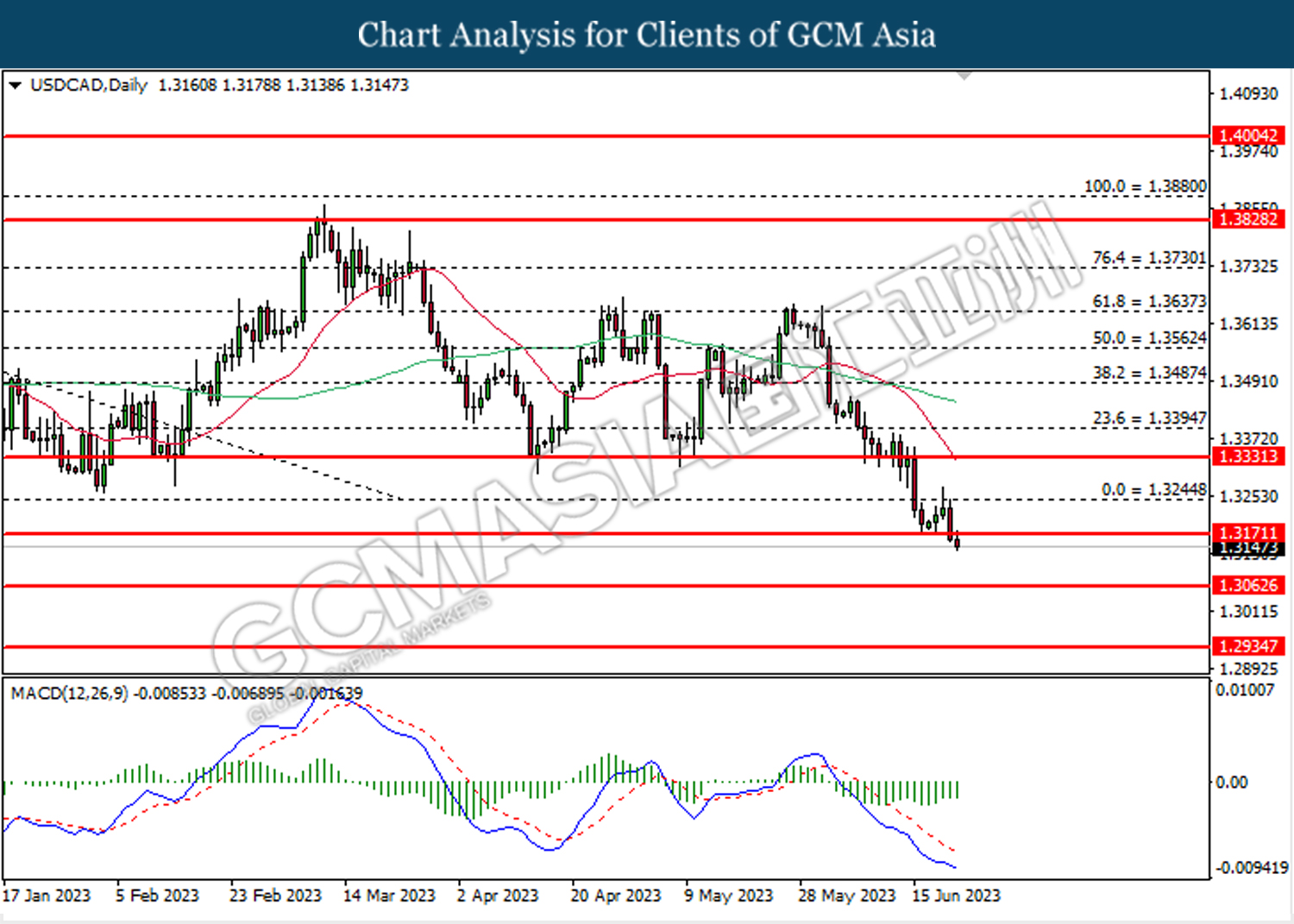

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3170. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3245, 1.3330

Support level: 1.3170, 1.3065

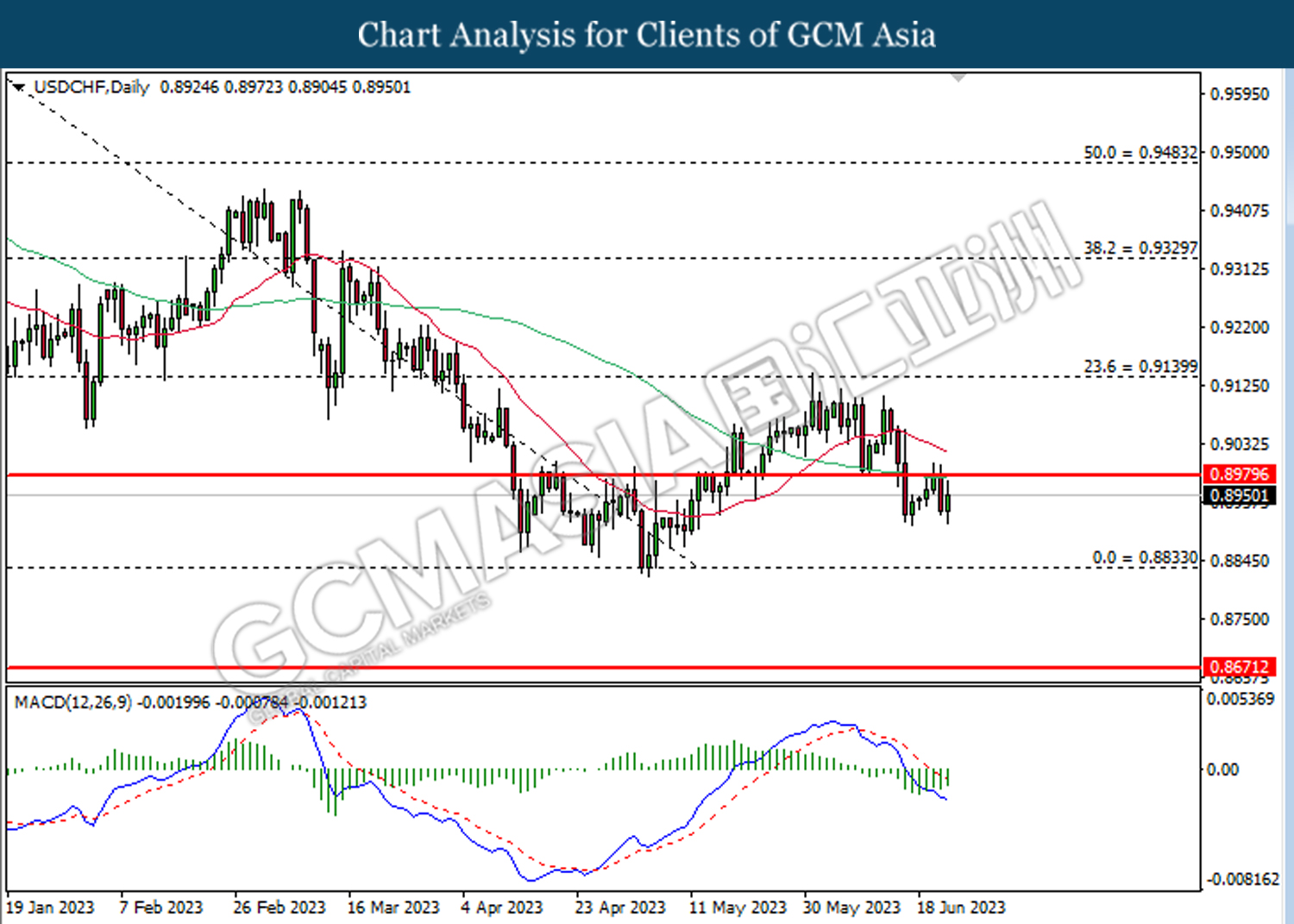

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8835.

Resistance level: 0.8980, 0.9140

Support level: 0.8835, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1939.75. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40