23 August 2018 Daily Analysis

Dollar rebound from lows caused by political turmoil.

Index dollar has rebound from its lows after a sell-off that reacts to political turmoil that sparked on yesterday. According to the reports from CNBC, former US lawyer for President Donald Trump, Michael Cohen has pleaded guilty in New York court for break the campaign finance law with “candidate” and also added that his main goal is to influence the presidential election 2016. Speaking to the news agency, lawyer Lanny Davis and lawyer Michael Cohen have said that his client regretted what they had done with Donald Trump and stated that Cohan had information about the Russian conspiracy. Therefore, the market has reacted negatively towards the release of the news. The dollar index has recovered 0.15% to 95.19 as of writing. Meanwhile, USDCAD has gain 0.35% to 1.3041 following the release of Canada Retail Sales yesterday. According to Statistics Canada, retail sales has slumped -0.2% against market forecast of 0.1%. Thus, the reading has showed that the economy in Canada has slowdown which may affect the prospect for a rate hike, therefore weakening the Loonie.

In the commodity market, crude oil prices have rose 0.15% to $95.19 a barrel following the release of an upbeat Crude Oil Inventories yesterday. Energy Information Administration have reported that the crude inventories have unexpected drop 5.836m bpd, higher than market forecast which the reading only -1.497, thus boosting momentum for the commodity. On the other hand, gold prices have risen by 0.40% to $ 1192.25 per troy ounce following the dollar strength that is supported by the bullish investor sentiment provided by a long term expectation rate hike.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

10.45 AUD RBA Assist Boulton Speaks

19.30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15.30 | EUR – German Manufacturing PMI (Aug) | 56.9 | 56.5 | – |

| 16.00 | EUR – Manufacturing PMI (Aug) | 55.1 | 55.1 | – |

| 22.00 | USD – New Home Sales (Mom) (Jul) | 631K | 643K | – |

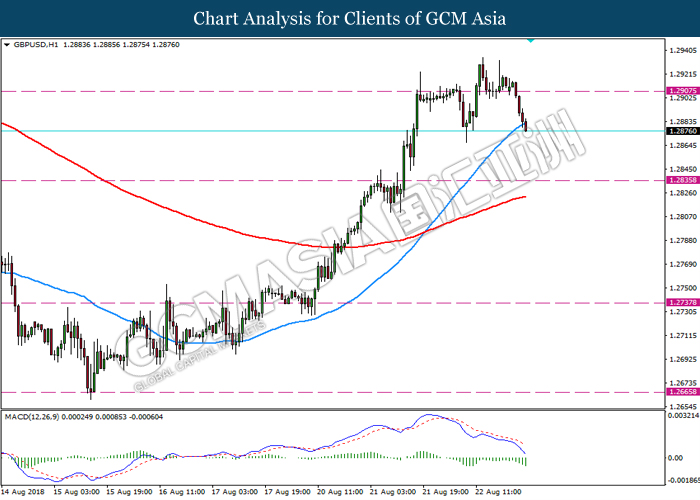

GBPUSD

GBPUSD, H1: GBPUSD was traded lower follow recent retracement from the resistance level 1.2905. Recent price action and MACD which illustrate bearish momentum signal suggest the pair to extend its losses towards the support level 1.2835.

Resistance level: 1.2905,1.2970

Support level: 1.2835, 1.2735

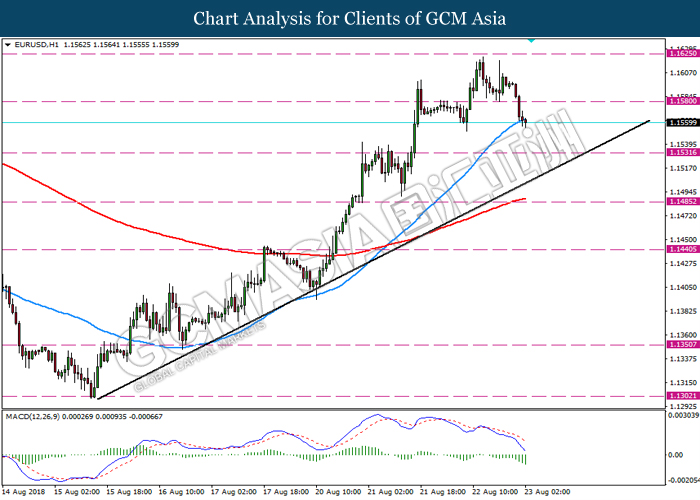

EURUSD

EURUSD, H1: EURUSD was traded lower following prior breakout below the previous support level 1.1580. Recent price action and MACD which illustrate persistent bearish bias suggest the pair to extend its losses towards the support level 1.1530.

Resistance level: 1.1580, 1.1625

Support level: 1.1530, 1.1485

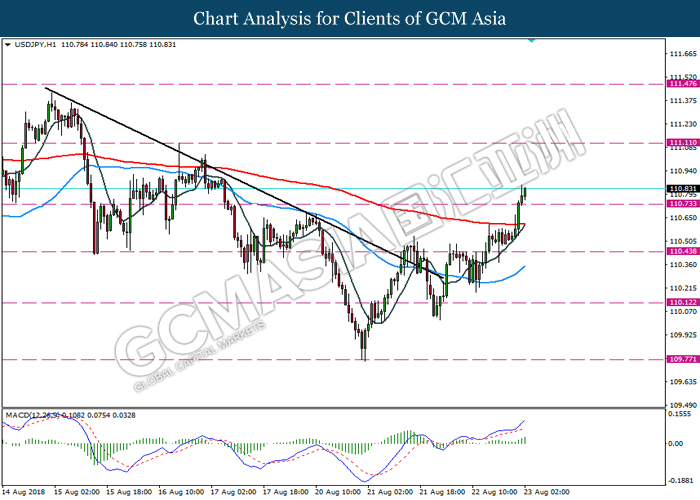

USDJPY

USDJPY, H1: USDJPY was traded higher following prior breakout above the resistance level 110.75. Recent price action and MACD which continue to illustrate ongoing bullish momentum suggest the pair extend its gains towards the resistance level 111.10.

Resistance level: 111.10, 111.45

Support level: 110.75, 110.45

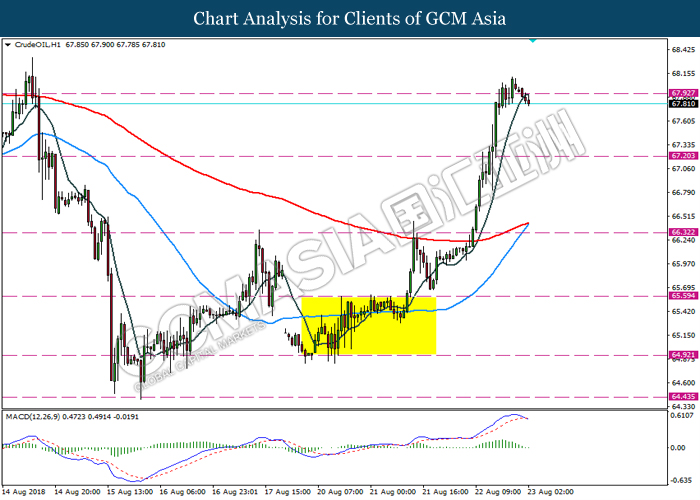

CrudeOIL

CrudeOIL, H1: The price of crude oil was traded lower following recent retracement from the resistance level 67.90. MACD which illustrate bearish signal with the starting formation of death cross suggest the commodity to extend its bearish momentum towards the support level 67.20.

Resistance level: 67.90, 68.75

Support level: 67.20, 66.30

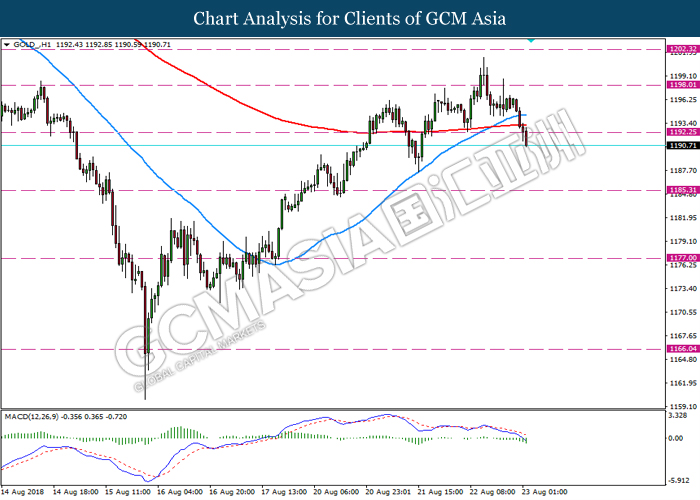

GOLD

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level 1192.00. Price action and MACD which illustrate bearish signal suggest the pair to extend its losses towards the support level 1185.00.

Resistance level: 1192.00, 1198.00

Support level: 1185.00, 1177.00